What VCs Are Worrying About

A survey of VCs by Polachi Inc. has been making the rounds of the internet the past couple days. I was asked to participate in this survey but did not (not for any reason in particular).

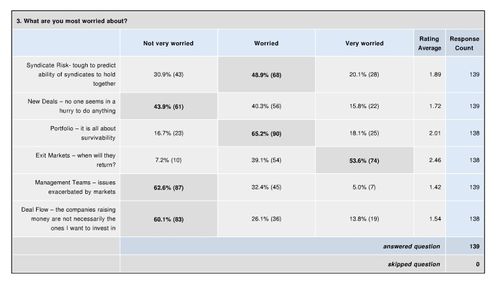

I looked over the results (click on that link above to see them) and this slide caught my attention:

Surprise, VCs are not worried about deal flow and the management teams they work with, are a bit worried about their portfolio, and are a lot worried about exits.

We've talked about this issue endlessly here on this blog and elsewhere. The problem with the VC industry is that there is too much money in it, too many portfolio companies, weak venture firms, and a tepid exit environment.

There is no lack of good opportunities, no lack of talent (both entrepreneurial and management).

Nothing is wrong with the VC business and the startup ecosystem that a few years of weak fundraising can't fix. And I think we are seeing that and will continue to see it.

But the headlines like VCs Losing Confidence in “Broken” Industry overstate the issues in my mind. The VC business is not broken. Some of the participants in it are.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=c7c33782-097d-4691-8b4b-56f8d173cf67)

Comments (Archived):

Approximately half of the participants are “broken”…which is a lot.

Isn’t this whole issue just good old “overcapacity in a down cycle sends the weakest to the wall” stuff? Its playing all over town right now 🙂

i think so alan

I agree – in the US the asset cycle (ebb and flow of VC funds) and the macro cycle have hit a period of correlation which is leading people to over pessimistic interpretation of the data. As you say weak funds will come out of the market and then things will right themselves. This takes time though – one of the weird characteristics of the VC market is that bad firms take a long time to die.In Europe by contrast we are at the bottom of the asset cycle and to my mind there is clearly too little money in the market. Getting this message through to LPs at a time when they are trying to avoid risk can be hard work though.

then we’d better get over there and start investing some more!!

Absolutely! 😉

Fred,Thanks for the link, but I think you’re missing the reason for my headline. The “losing confidence” referred to a result in which a majority of VCs are less confident in the VC industry today than they were 6 months ago (which would have been post-Lehman, post-election).I agree with you on some of the remedies but, if we’re beginning to see those implemented (particularly weak fundraising), why the decrease of faith? May I suggest a different paradigm for your conclusion: “The VC business is broken. Some of its participants are not.”

that works dan.it’s the broken part that i take exception toi’ve been in this business for 23 years this summer and i don’t think its broken at all

Maybe the issue is definition of “business.”I recently asked Brad Feld (during a conference panel) about whether the VC “industry” was sustainable if 10-year median returns were negative or, at best, lower than checking account interest rates. He replied that he didn’t care, because VC needn’t have become an “industry” or “asset class” in the first place. Instead, VC could/should simply be an “investment activity” with far fewer participants acting far more independently.So perhaps when I say business, I mean “industry.” And when you say business, you mean “investment activity.” Or perhaps not…

I mean the business of supplying entrepreneurs with capital. I don’t care if its an industry or not. I think its best as a cottage industry though

Dan,Maybe you mean Capitalism is broken, as every industry goes through good times and bad. Take the auto industry for example: individual players are broken, but no doubt the industry will survive, principally, because VC’s will fund the next generation of participants.Maybe you mean VC current business model is broken, as potential exits are fewer and far between, but this obstacle is nothing changes to the term sheet can’t fix.What I’d like to know is how many VC’s are looking to invest in self sustaining companies with a clear/logical path to profitability? (Something akin to long term buy and hold Warren Buffet style)?

At least one that I know of 🙂

What’s interesting from the numbers is the following:Fundability disconnect. 60% say that the companies/sectors raising cash are not the ones that they are seeking to invest in. Does this disconnect always exist in the system?End Game disconnect: 54% are worried about the exit markets and when they will return. Does the very nature of the fund cycle time force VC’s to worry about exits long before they can actually nurture their investments/companies into growth companies? I am comparing this to the difference between the “buildup” and “breakthrough” stage concept from the book “Good to Great” by Jim Collins? Do fund cycles force exits just as companies are reaching the breakthrough stage?

that may well be the case deepak. i am currently working on three investments that were made in 1999 and all three are doing well. venture capital requires a lot of patience

Isn’t that chart stating the obvious?I mean…VCs are worried about their ventures exiting, and surprisingly not too worried about finding new deals? Anyone would think VCs were measured on exits and that they were also the most popular people in any entrepreneurial meet up. 🙂

I was gonna say that (in fact I had written it) but I thought better of it. Its totally true

what is a scenario when a VC is panicking about deal flow? You’d have to be rather infamous for no one to approach you for $$$…I kinda thought maybe if you had no cash for new deals, but I guess you’d be panicking about why your LP’s didn’t love you, rather than why you couldn’t get new deals…

The primary market is never ‘closed’ – you just don’t get many IPOs when buyer’s and seller’s views on valuations don’t converge.In pessimistic times, buyers are less likely to give sellers the benefit of the doubt wrt future growth and/or ability to monetize.The current IPO malaise is as much to do with dippy web revenue models than anything else.

Dippy?

From Webster’s 2020 edition:——————————————Dippy: Adjective; foolish, not smartExample usage: In the first decade of the new millennium a number of web companies decided to boost their market share, and achieve what their investors called ‘traction’, by giving away their products for free. This tactic proved remarkably effective, and these companies rapidly found themselves with a large and very happy user base. Finally, when all their unenlightened competitors were bust and people became accustomed to everything on the internet being free, these companies looked at each other and realized they’d been very dippy indeed.

That’s very cynical. I don’t see it that way at all

I appreciate it might be bad form to criticize the free web on the same blog where the term ‘freemium’ was originally coined, but, as you yourself said in a past comment, ‘we are allowed to disagree’ – and, anyway, conversations in which everyone concurs are rarely very interesting.No offence (sic) intended.

Of course we should disagree and debate. My objection was being called dippy 🙂

Woah Fred – I never called you dippy, I just suggested the free web was dippy.Notwithstanding I’m Bobby Nobody, I’ve got enormous respect for what you’ve achieved – and more importantly – the manner in which you achieved it. Not many successful people conduct their business so transparently, and have scaled the heights without making so few (apparent) enemies. Total Respect.And I actually believe your investment thesis makes complete sense: in the land of blind revenue models, one-eyed freemium is most definitely king.I just happen to believe the future lies with usage-billing, and I say as much not so much to talk up my own book, but in the spirit of open debate – which I have learned in large part here on this very blog.

Got it. I thought the dippy comment was aimed at our investment strategy which is very much the free web

Not wishing to speak for David but I assume the ‘dippy’ reference is in relation to rather simplistic/naive monetization models based solely/primarily on ad-links, etc.David?If so, I agree.

I agree with your assessment, Fred. On the subject of what VCs are worried about… we’re still seeing great deal flow, but I’m wondering if the steep downturn in the Fall put a temporary kink in the hose. In other words, did the quick and heavy downturn in the economy discourage some group of potential entrepreneurs from getting started on a new biz – and will we see that effect downstream (i.e. in Q4-09 or Q1-10)?

It’s one thing to intellectually acknowledge that there will be a multi-year winnowing period in VC. But now that we’re in the middle of it, doesn’t it make sense that the significant proportion suffering from what Fred calls weak fundraising are now of the view that the “model is broken”? It’s far more palatable for those who are getting worked out of the system to declare the game broken.

Further to your point, Eric – the “broken” question is nothing if not vague in its various interpretive possibilities. One may say the industry is broken b/c they can’t raise another fund. Another may say it’s broken b/c exit markets are closed. We see above in the comments that Fred and Dan had different ideas in their heads about what constitutes broken. Without a meaningful definition of the term in use, does it really matter what everyone thinks?On a side note, Fred – it’s fascinating to see the stream of retweets and responses via Twitter in the Reaction section below. Props to the Disqus guys for putting this together and a way to visualize what you’ve been talking about recently re: power of passed links.

Yeah, its finally working right. It took the disqus guys some time to get it right

fred, when do you think the “few years of weak fundraising” will end? Will we be back on the upswing by the beginning of 2011?also, i imagine you didn’t want to participate in an “anonymous” survey because you’ve seen what happens with those names lately 🙂

I wasn’t worried about that. It just didn’t seem that useful as a source of infoI think the downturn in fundraising may be permanent. The industry can’t handle 25bn to 30bn per year

Couldn’t agree more. I’m constantly astonished by the disconnect between VCs’ actual business cycle and some decision making of its participants. With investment horizons of 3-7 years it is futile, and irrelevant, to look at current exit markets. The “concern”s of the industry should be what market opportunities will develop over this time frame, which deals are sourced and found to tap them, and which teams are assembled to execute and build companies around these opportunities.Capital markets will come (and go). When is always beyond anyone’s guess (two sharp cycles in past decade do not seem to teach anyone this lesson). Obsessing about it misses the point. The industry attracts many people who want to make a quick buck. Things happen short-term sometimes, but they usually happen to people who think long term. The good and consistent investors are those who want to stay in the business long term with a perspective of layering up long-term quality investments across all cycles.

Hopefully this will display as me-Good advice about patience.

I must be doing something wrong. You speak of too much money and too many firms, but it is still so difficult to get on anybody’s radar screen.I believe there are great opportunities and great talent (biased :)), but it still feels like a ‘good ole boys club’ as far as circulating those ideas. It’s still very much who you know.So, some of this weekness and fear may be because VCs aren’t working hard enough to uncover the best opportunities, wherever/whomever they may be, and are content to settle for the easiest/familiar opportunities.

tell me a bit about your business Rajjr. you’ve gotten on my radar screen.

can i email you?

Yes. There’s a contact me button on the upper right of this blog

Fred,You argue there is “no lack of good opportunities, [and] no lack of talent.” Yet you believe there is an oversupply of capital? How does this make sense? If there are good investment options relative to the rest of the market that suggests an undersupply of capital.If the strongest concerns are with exit markets, that means VC exit strategies are not aligned with market realities. In the presence of good investment options, that is evidence of historically poor investment decisions, and/or poor execution by funded companies. As a the founder of a small bootstrapped business I find it hard to sympathize. Not every business needs to be on life support. Why are people funding those that do?

there’s an oversupply of capital because VCs want to pile too much money into companies that are already funded and me too competitors.

I agree that there is an oversupply of capital chasing the same types of companies/verticals/valuations/etc…and from this perspective I think you’re right that it’s the participants, not the “business”, that is broken.But I don’t agree that the “business of supplying capital to entrepreneurs” cannot support $25bn/yr. That basically implies that there is a $$ cap on our ability as a society to productively innovate and disrupt the status quo. I don’t know if such a $$-based cap exists theoretically, but I strongly believe that we are nowhere near it. Just think of all the problems that have not yet been solved…We are oversupplied with $3M Series A rounds for follow-on competitors in the saturated vertical-du-jour, but who’s to say that we couldn’t productively put $25bn/year (or $50bn?) to use if the “VC business” itself started thinking outside the lines and stopped chasing its own tail? (not directed at you or USV who are clearly among the leaders, not the lemmings, in the current model)

Its happening in places like clean tech but the jury is out on that sectors ability to deliver the returns that investors expect30bn per year coming in requires 100bn per year in exits. That’s not easy to deliver no matter what you invest in

You know, that speaks of a business that is scared, very scared, of something more fundamental:As much as I hate sounding like Barak Obama- there afraid of some unsettling change that is happening underneath the industry.As much as I hate to say it- unless you are doing something that requires a lot of capital startup (and those levels are now dropping madly, especially wth the internet)-How badly will you need a VC, or lots of money in general? Money is very scary right now because as information starts very publicly equaling money, and information starts returning to the commons faster than it did previously, while hard cash starts dissapearing from the public eye and inflation versus computing costs wrecks havoc on what we think a lot of start-up costs are:Who really knows what it takes to start a business? Not me. No one really knows fully yet how the great internet experiment will unfold in all of its glory. I can see how pessimism for an exit strategy will occur as the full force of W2.0 starts to hit full face.

Aside from the IPO-related exit which has dried out, can you comment if “acquisition” as an exit method is on the up and what are the multiple metrics there? Aren’t several start-ups building products and markets that matter to bigger players?

The M&A market has been in the doldrums for the past year or so. I expect to see it come back along with the IPO market

everyone should be worried. i think VCs are in a somewhat unique spot and may have the most to lose, as illiquid, dollar-denominated, negative cash flow investments (as many US-based startups are) are in trouble and in my opinion should have “economic insurance” policies in place. but as the vast majority of economists who saw this crisis coming agree, it is only just beginning. only the truth can set us free, but that will become more apparent over the next couple years, in case it is not already.of course, like tyler durden told us, it is only after you’ve lost everything that you’re free to do anything. so rejoice, venture capitalists, because this crisis will set you free to do anything — including rebuilding capital markets, solving monetary policy problems, restoring capitalism, and disrupting the whole global finance industry.

kidmercury, maybe a little sulfuric acid poured over the back of the hand will do the trick. Nontheless the concept of capitalism doesn’t exist without venture capitalists.

that’s what the new school “capitalists” say. old timers like me long for the days when capitalism wasn’t equated with investors who endorsed fascist government policies, but rather when capitalism was equated with sound money and limited government.too bad venture capitalists have sold out to big government instead of keepin’ it real and sticking up for capitalism. tyler would not be pleased.

🙂 Palahniuk

I’m a little out of my element here when I participate in financing discussions.One approach I’ve been curious about is whether VC’s could change from an equity-appreciation play to a cashflow play. If exit markets are thought to be gone with respect to the salad-days of 1999-era, then perhaps there’s an opportunity (albeit smaller) to structure investment deals on a dividends-from-cashflow standpoint.Has anyone taken such an approach? Seems like it could be a potential fit for Y-Combinator type small-seed investment funds. But, it’d probably be hard to “move-the-needle” in terms of getting enough cash into play for it to make sense for many large funds.

This is strategy is one that growth funds can occasionally play successfully, assuming the investment has enough cash flow and the investor holds the company for long enough. However, a dividend based returns model does not work for most early stage investors. The time horizon + risk/return profile is too poor – still incurring all the risk and time of getting a business off the ground to a self-sustaining point plus the generally small amount of capital that can be pulled out of a business w/o damaging its ability to continue to be self-sustaining.

Chris,I believe the reason VC’s don’t take a dividend approach as their investment dollars are meant to be growth capital. By taking a portion of the cash-flow you’re in essence limiting the hockey-stick (in theory) growth that a portfolio company should be having. You may say, well what about when they’re 100M + revenue companies but can’t go public? The fact of the matter is that the landscape is littered with high revenue companies who are still throwing off cash in their business cycle, just look at all the press FB is getting about not being CF+. The only real way for a VC to achieve the necessary returns to offset the losers (read bankrupt) companies in a portfolio and make money for its LP’s is through a large and meaninful exit, not the slow drip of dividend returns.Hope that helps.

I think that would be very challenging for the early stage venture fund model which is based on investors comitting capital in the first five years and getting paid back 2-3x in years five through tenThat said, there could be funds raised to take out the early stage VCs once the businesses reach cash flow positive and designed to generate a yield as opposed to a multiple

I think there are many more great entrepreneurial opportunities out there that don’t get funded. There needs to be a shift to smaller bite size investments in early stage companies, but VCs don’t like that model because they don’t earn enough management fee, and making investment decisions in concept stage companies is much more difficult than looking at a graph that goes up and to the right. An exceptional VC would be happy to invest smaller chunks and only earn a huge living if their companies succeed. Unfortunately, the solution here is making humans less greedy, which is probably tough 🙂

I recently learnt about True Ventures (www.trueventures.com) and they seem to have figured this out pretty well — starting with seed stage investments and going all the way up to Series B/C for the winners. This way True Ventures doesn’t suffer the dilution that regular angel investors/seed funds do.

True didn’t invent that model. We’ve been doing that at USV since 2004

I agree with you. Great comment

haha thats classic!’that idea is a load of dippy bollox.’

Fred,Do you think the percentage very worried about their exit is based on investor impatience, the type of industry (internet, cleantech, software), or just the participant?I agree that some VCs are broken, it actually saddens me that some I have spoken with can care less about the management team and product. They are more worried about taking 51% ownership right off the bat, completely crushing the entrepreneurial drive. Without great VCs, how can we keep leading the world in innovation?

I think worrying about the exit is just a constant part of the VC psyche and is not likely to go away even in boom times

Exit markets are coming soon. I promise ;)How many businesses survive to them though is another question.

That’s where patient and confident capital partners come into the equation

Fred, I’m curious to the concern of lack of exits. It seems to me that exits correlate directly to the perceived return. I struggle to see how an exit is any different than M&A. M&A seems to be rather healthy. Certainly not at as robust as previous times, but clearly not in the toilet. If a company has real discernible, measurable value then an exit exists.Is it fair to say the concern around exists is a result of poor investments, particularly in Web 2.0 companies who rely on ad revenue or have no revenue at all. Without a strong revenue model and cash flow it would be difficult to exit in a pessimistic economy.It seems to me the concern around exits is a result of investments in companies unable to establish a strong business model and a good balance sheet. Am I missing something here?

I think you are reading too much into it. The IPO market has been all but closed to VCs for a decade and M&A has been weak for the past 18 monthsThat’s what you are seeing

at risk of sounding like a broken record, when are we going to stop talking about the lack of IPOs as if that is an act of god or nature or something? the lack of IPos may be exacerabted by SOX etc., but at root it is simply a lack of buyers of new public issues.and why are there no buyers? because a) buyers were taken to the cleaners by VC backed new issues in the tech bubble of the late 1990s, and b) there is little or no demand — current VC portfolio companies do not inspire confidence amongst investment bankers and institutional investorsand if there is indeed little or no demand for existing portfolio companies, the question begged is, why not? because the portfolio companies are awesome performers with huge exciting near term future prospects (the typical preconditions for an IPO) but buyers are just plain dumb and cant see that? or because protfolio companies will make weak or failed public entities, and buyers would rather spend their time and capital elsewhere?and if its the latter, how and why did that situation come into being?oversupply of VC and too huge failure-proof management fees

I’ll bet you a nice dinner in nyc or boston that we’ll get a healthy IPO market before the end of 2010 and that public market investors will want our best portfolio companies (our means the VC industry)

Qualified “OK its a bet”Caveats:How do we measure what constitutes a “healthy” IPO market?In a heartbeat I acknowledge there are vc portfolio companies today that will be public in next 18 monthsBut even if 36 IPOs happen in next 18 months that would only constitute a miniscule fraction of portfolios and capital invested being harvested as returnsAnd the number of vc gps collecting carried interest (the true indication of health of asset class) will still be next to zeroSo where do we set the “healthy” bar?

Market value of IPOs between now and 12/31/10?

hmm. maybe. but only as a relative number – time weighted and compared to invested dollars value of vc portfolios (e.g. IRR)?maybe better to not distinguish between IPO and M&A – its the overall dearth of “exits” everyone is worried about. so how about we try to determine whether vc asset class earns its “bonus” in next 18 months- how many vc funds will generate carried interest pay for gp’s? for the last decade nearly zero gp’s have earned carried interest from funds invested at least 3-5 years (your own suggested time frame). how many businesses would continue to employ people who fail to earn their bonus year after year after yera?

I’m not interested in that. It won’t earn its bonus anyway. My bet is about the IPO market coming back, plain and simple

Ok, what’s the threshold or definition? (Btw I guess you are agreeing that the IPO market can come back but that VC asset class may still not produce carried interest?)

Yes. But it will make a difference. There are some good firms with good portfolios out there that would be well served with a return of the IPO marketAs for our bet, I’d prefer something simple. Let’s go back over the past 20 years and calculate the avg number of VC backed IPOs per yearMy bet is we’ll see that number or more in 2010

That sounds good — caveat, I need to see what the average is, and howskewed it is etc, but I like your thinking

I agree with the IPO component. It has definately dried up.Would be curious to see a comparison of exits between companies generating strong revenue and cash flow vs. Web 2.0 or other companies with no or little revenue and negative cashflow.Are the exit opportunities equally weak?//keenan

As a non-VC, I would probably agree with your assessment that there are too many people in the venture business with too much money chasing after too many crappy deals. But if that is true, I do fear that as the number of players contract, the entrepreneurs end up with crappier terms on their deals, simply because it’s harder to find competition to fund them and therefore they have less leverage. VCs become more powerful than they already are, and deal “standards” start moving upriver in favor of the VC. Entrepreneurs would have to seek alternative funding to retain favorable deal terms, or we’ll see more companies started by repeat entrepreneurs who can bankroll their own startup.

Maybe. If the best VCs survive, that’s not likely to happen

Fred, thou dost protest too much, I thinkWith $30-$35 billion in venture funding being invested every year, there is no question at all that the business or industry or whtever we call it, is broken — there is simply NFW venture returns can be achieved on that much dough.over supply of capital (last 10 years and continuing) leads to bubble/excess (now, way too many startups funded with little or no hope of venture returns) leads to wrenching reversion to mean (soon?)so all the hand wringing and chatter about the “bad exit environment” is a red herring at best. such is true, but such is not an independent phenonemon (eg the result of sarbanes oxley.) no, the “bad exit enviornment” is a direct reflection of the oversupply of capital — exist aren’t really exist, they are sales of venture to other buyers (the public markets or M&A). those prospective buyers aren’t stupid and won’t buy the capital-oversupply-stuffed garbage in most VCs portfoliosalso, in the midst of all this brokenness, VC general partners have insulate dthemselves from feeling any of the effects of poor markets — they continue to collect massive unwarranted non-correlated management fees – $0.20 of every dollar invested by LPs — so they have no incentive to help push the business into health. no, they have every incentive to continue the self-destructive behavior of raising more and more funds, despite truly poor performance by the asset class

All true and you know I agree with you. But I just don’t see this in as dire straits as you

Amen, Steve. Thou speakest truth to power. Want to see the VC industry right size quickly? Reset the compensation structure for VC partners. Eliminate management fees and move to a comp model that mirrors the start up model; ie., base salary plus equity bonus for overperformance (where LPs determine bonus milestones, thresholds and payouts).Adopt this compensation structure and I guarantee you half of VC partners would leave industry within 3 months. It’s truly appalling that VC partners continue to live the life of Riley with no risk and only upside while their “industry” burns to the ground right in front of their eyes. Maybe we should hand out violins to all these Nero inspired VCs.

Still would not work without exit opportunities. Getting in to the deal is easy. VC getting paid what they do – is between them and their investors – we just need more exit vechiles – then let the market sort out the real winners.

I agree with you both. But its a market. Somehow the terms you are railing about (rightfully) are getting set by the market

Don’t agree. It is inherit in the industry that 80% of venture backed firms will not return a dime to their investors. It is built into the model (risk) – much like stock out costs or the OK level of rat droppings in our food supply. Markets, investors and consumers are fickle – they change daily and thus, the shoot gun approach to venture investing.I would like to see more exit avenues. I want to see these companies succeed. Most IPOs or M&A infuse these companies with the capital they need to fully commercialize and enter the main stream – forget about who makes money off of them. We need these products and we need companies that create jobs and build wealth. And, as I see it, the exit is the only real way to make it happen. How much has Google improved and grown since its IPO? Would it be the company it is today with venture backing and its IPO?Try not to focus on what people make (I am sure that there are people who think you make too much for what you do) – but try to focus more on the greater good. Without venture capital – I truly believe that many of the products and services we take for granted in our daily lives would not be possible – and those people who make it happen should be compensated.Just my thoughts

You completely miss the pointProfessional investors should be compensated mostly based on successful investing. That does not happen in VC.

Actually it does steve. When a VC fund works, the majority of the comp is success basedWhat pisses you off is the compensation for the unsuccessful investors!

Yes indeed. And that way way way too many of them are unsuccessful butthere’s seemingly no penalty. Bad – tragic – for entrepreneurs andinnovation – sucking all the oxygen out of the atmosphere

Why don’t you get into the business steve and start a fund where there is no mgmt fee, all carry, you’ve got your own capital at risk, and you do 80/20 deals with entrepreneursYou could single handedly save the business. I don’t quite have the guts for it myself and I also have partners who aren’t as “out there’ as I amI think it could work

I do that every day, Fred — its called angel investingZero management fees. My own capital at risk. Sometimes its 80/20, most ofthe times its not remotely that good.The business need not go withoiut management fees. The business hsould dropmanagement fees to 1% — or even better submit operating budgets (gasp!) –and management fees should only get paid for first 3 years of the fund,maybe first 5. Increase carry to 25%.Imagine what the typical VC would say if an entrepreneur or CEO suggestedthat they get guaranteed high salary for 7 years minimum, with no penaltyfor failing to ever achieve bonus.

I like your attitude but that rat dropping comment was tough to take!

Fred,You’ve probably read Gian’s eCommerce spending report: http://blog.comscore.com/20…I wonder how many VC’s are aware of the beating eCommerce is taking in the 45+ demo, and if that concerns them / plays a role in their decisions as of late.-David

I haven’t read it but I will now

Great – eager to hear your thoughts! Does VC industry need disruption? Seems worthy of a full post!

Fred, what’s your take on this article in Business Week?http://www.businessweek.com…There are several top tier firms like yours that make great bets and make a real difference in fostering and supporting great innovation, but seem like there’s an oversupply of firms, many moving up the risk curve, and perhaps sitting fat and happy on management fees. is it time for market forces to clear away the waste, and is there a model that cuts out the VC as middleman?

i agree with Vivek’s article and have written most of what he says at one time or another here at AVC. the last thing the VC industry needs is government assistance.

I’d suggest that the main challenge is that we have become disconnected from what people want/need (2 very different drivers, of course).So many investments/developments are for ‘us’ it is little wonder there is a general malaise.

These seem to be real concerns – but, what is the VC industry going to do about it? Are they to watch other firms fail? Are they looking for new ways to exit? Would love to hear your opinions on alternative exit strategies.Nearly a decade ago while I was in Grad school, I had the privilege to meet and hear Ralph Shaw (from Shaw Ventures in Portland, OR). I asked him a similar question as the IPO window seemed closed at the time. I figure he would give some comments on M&A. No, he got mad and stated that IPOs are they look for.It seems that everything in this world goes in cycles. IPO windows open and close – M&A gets strong then declines. But, there must be some way to exit when the traditional methods are non-existent?Would love to hear your opinions on what could constitute as alternative exits.

I am a big fan of secondary private markets. Google AVC secondary markets and you’ll find a bunch of posts I’ve written (hopefully)I don’t think IPOs are appropriate exits for the vast majority of venture backed companies. Maybe the top ten or twenty percent of our investments will make good public companies

Btw, I think it is highly amusing and ironic to watch the VC industry twist into a pretzel to explain why the Internet and new technologies are disrupting – nay demolishing — every business model and industry… except their ownIts as if VC industry is saying, Creative destruction? By all means, its the lifeblood of our modern society… just not in my own office and business. The exact same model we have always used, for generations now, need never change; historical and existing power structures and financial models never become obsolete in our businessThe “innovators dilemma” attitude that VCs view with disdain in every other industry (eg news publishing, music and video distribution, office automation, travel and hospitality etc etc) somehow doesn’t apply to their own…….?

Of course it does steve. Were just debating what the new model is. Its like the auto business or the mortgage business. Ppl are still going to need cars and homes, but the way they are developed and sold will change. Same with VC

Sure I am aware of much discussion about the trade. But besides you and a select few others (thank you) I never hear anyone in the trade talk about changing fees and carry and comp (other than to raise them) so pls send me links anytime you run across this discussion

I like it when I hear bold talk in this tough economy: “Nothing is wrong with the VC business and the startup ecosystem that a few years of weak fundraising can’t fix.”

This is excellent article. And these problems have several aspects. One is that many good companies and entrepreneurs are without funding. Another problem is that many investors who put many into VC funds are not happy, because ROI is zero or very low and the costs of VC are high. This indicates that the market is not effective.When we decided to set up Grow VC (www.growvc.com) we talked a lot, how it is possible that VC’s always look for new innovative business models, but they still have the same model in VC business as 20 years ago. We came outside VC industry, so it was natural for us to challenge the models. But it has been surprising that several experienced VC partners have now said that same to me in private discussions. They also think that new models for VC business are really needed.I see we really need more effective and transparent market for early phase funding, i.e. how different kind of investors and companies can find each other, and also make it much more cost effective. VC’s have invested a lot of money in companies that bring openness, communities and transparency to their industries. But do we need the same in VC industry? Can it be so that a few VC managers can really make all decisions, which companies can make a significant breakthrough?

All great examples charlie. You and Gloria are right. We need more of this kind of capital