Some Things To Be Thankful For This Year

1) The economic meltdown/panic of 2008 is largely over. The economy is still weak but markets are functioning and buyers are buying and sellers are selling.

2) The FCC has submitted a proposal for rulemaking on net neutrality.

3) Android looks to be a winner and will give the iPhone a much needed competitor to keep Apple honest.

4) Bing is showing some signs of life and may give Google a much needed competitor to keep them honest (this one may be wishful thinking).

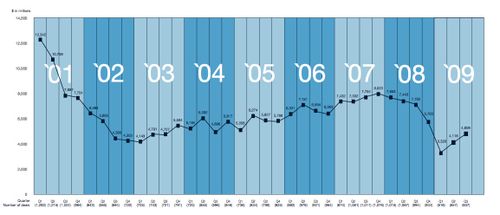

5) Venture Capital investing is bouncing back:

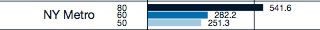

6) The NY Metro venture investing market is bouncing back even more sharply:

7) Programs like Y Combinator, Techstars, Seedcamp, etc are expanding all over the country and now the world, turning out newly minted entrepreneurs by the thousands.

8) A secondary market for founder stock, employee stock, and angel and early stage investor’s shares is emerging, offering the possibility of a third way to get liquid on startup investments.

9) The NASDAQ’s Internet Index is up 128% over the past year suggesting that wall street loves the internet sector again. Can a vibrant Internet IPO market be far away?

10) It’s thanksgiving day, a day to forget all of this stuff and spend it cooking, eating, watching football, and hanging with good friends and family. That’s what I plan to do and I hope all of you do too.

Note: The charts on venture investing in this post come from the PWC Money Tree survey for Q3 2009.

Comments (Archived):

Bing just might give Google a run – especially now that Google is front loading all its searches with sponsored links. Understandable yet annoying. Happy Thanksgiving Fred.

Thanks to you, Fred, for introducing me to some great music this past year and for sharing your thoughts so openly with the AVC community. Happy Thanksgiving to you and your family.

the feeling is mutual. i think you’ve tipped me off to more great music thani have you david

That’s debatable 🙂 And let’s keep this up next year!

The signs are good. Roll on, 2010.Have a great day!PS, I believe that on this day the collective watching of ‘Planes, Trains and Automobiles’ should be mandatory … 😉

that’s such a great movie!

Those aren’t pillows!

Time to add that to the Netflix list, thanks Carl for the reminder.

Pleasure, Mark – it is a timeless classic – enjoy!PS, make sure you have the Kleenex at the ready – darn film always gets me trying to restrain any too obvious signs of my (happy) blubbing towards the end. My wife always finds that most amusing and cues me in at the same time, every time we watch it! 😉

Fred,I’ve been reading your blog for about a year now, but because I’m neither an investor nor an entrepreneur I’ve refrained from muddying the waters in your comments.But this post seems like an appropriate occasion to chime in. Thank you for writing so openly, honestly and insightfully — your perspective has broadened my own purchase on the world considerably.Or put differently, thanks for cultivating a blog (and community) that represents the internet at its best.

i love the first time commenters!!thanks Chris, both for your kind words and your participation

Please chime in more Chris. Looking back at my own comments you’d be hard pressed to see any “clear water”, just a bunch of fun mud 🙂

Wow, Fred and Mark, thanks for the encouragement. Yet more reason why this is such a great site. 🙂

The more we read and respond, the happier Fred becomes. He’s a community titan.

Feel free to come any time…I’m just a student, you can hang with me.

Amen to all of that Fred! I just feel #1 is a bit too optimisitic. I think we’re still in an economic trough and will be for some time. But, hey, I’m grateful for that! In times like these it is the worst and the best time to launch. Only the real gold nuggets thrive, the rest die out very quickly. There are NUMEROUS benefits to this global recession. Let’s not forget this is an opportunity for change.All my best- HAPPY THANKSGIVING NYC!

Fred, where do you see that secondary market (that you mention at point 8)?

well there are markets like second market and others that are attempting toorganize this market but most of the selling is happening privately rightnow

oh boy, we’re probably going to get lots of happy, optimistic comments in this thread. allow me to counter:1. lol, the meltdown is just getting started. what caused has not been solved, all that has happened is the crooks stole more, and everyone else is either afraid or unaware. fortunately, scams can only last for so long, as we are in the process of finding out.2. net neutrality benefits certain people, like web apps investors. lol, i am glad your colleague brad acknowledged this in the recent debate. all these people are acting like net neutrality is power to the people, i tend to think it is the opposite. at the very least i think it is morally subjective.3. okay i am always up for dissing crapple so i am grateful for this one. good call, boss!5-9. american finance faces the dollar crisis, as all american finance busniesses are dependent upon a stable dollar. this is why other countries dont have the robust economies, because the currency is undermined from the start. this system is coming to an end, but the economic/financial system that comes after this one collapses will pave the way for a new world order characterized by stable monetary policy, free energy, responsible and efficient government, and most importantly, a network of blog stars leveraging open source technology to deliver the truth that sets us free.and that’s something definitely worth being grateful for!

That’s it KidMercury, you’re getting a virtual thanksgiving BEAR HUG!I think you’re overly optimistic about the ability for global financial and social change, and overly pessimistic about our current systems chances.Much like your prediction for the fall of wikipedia (I think the wave protocol is coming for them), I suspect the agents of change will come from within. We are those agents. Let’s shake things up and see what collaborative and diverse view of value emerges.

lol, happy thanksgiving to you too!much of the rate of social change depends upon the rate at which the existing system collapses. if we have a long drawn out collapse, in which the US dollar remains the economic keystone of the world, we could just slowly wither away over the next decade. imagine a world where DJIA is at 20,000 but gas prices are $7.50 a gallon. at some point the dollar is going to give, unless something steps in and turns it around. all the incentives the people who can affect this situation have are towards the current structure, so i don’t think real change can happen internally.IMHO people are the same everywhere, no one is going to get politically active when they are being well fed and enjoying life. but take away their money and they’ll be in the streets protesting like madmen/women. and that’s if their civilized. the uncivilized, of whom there are always many in a society that has allowed itself to devolve towards tyranny, will resort to rioting, theft, and that type of stuff.but i suspect the timing will be quite perfect, and the virtual economy will be robust enough just as the dollar is collapsing, thus allowing for a somewhat seamless transition into the new world order. at which point we can throw ourselves a free energy/free speech/sound money party at our local blog star’s place (fred, dave winer, etc) and let the good times roll!

No revolution ever got started on a full stomach!While I am not quite as pessismistic as you on the future of the dollar — don’t get me wrong I just don’t think gold or another currency is going to be any better — I am very, very, very concerned about the future.Strong foundations do not fail because of a single crack, today unfortunately we seem to have a great number of cracks — intersecting cracks — and the fixes are not fixing anything. Worse still, we appear to be running out of glue.In addition, we appear unwilling to truly measure the magnitude of the cracks. While we kid ourselves that unemployment is 10.2%, we all know that the methodology employed does not include folks with little part time jobs, folks who have exhausted their unemployment benefits, folks who have stopped looking for a job and the myriad of current and impending college grads. To say nothing of the “under employed”.I suspect that the real rate of unemployment is about 17-18%. Imagine that, 1 out of 6 of our countrymen are out of work. It is even worse when we begin to dissect things along state, industry and ethnic lines.I fear we are getting to a tipping point from which we may take a decade to recover.I still have complete and absolute faith in the American work ethic and the strength of American business and innovation but we desperately need leadership which is able to say — “unleash the hounds of what we know really works.”

JLM, your straight talk is as good as pumpkin pie. It’s time for the hounds.

Nail on head, JLM. Yet, there are plenty (very) of ‘comfortable’ (and under-performing) people around, yet the status-quo will be sustained. It’s in the interest of the ‘few’ – as ever the all-mighty ‘few’ – that decree that is how it should be. In Britain we have numerous banks bailed-out by the state, AKA known as ‘us’ mugs the tax-payers (as per you chaps) to the tune of billions, necessitated largely due to their own short-term greed and incompetence yet each bank has many execs – still – on salaries of 1+ million GBP, PA – and that’s before bonuses. It’s a funny old world. No values any more, it seems. Which is why it is so cool here – it’s all about creating, producing and making/creating wealth along the way.It’s one of the many reasons why Kid’ is so cool and oh-so relevant here. You are cathartic, Kid’. Keep Going For It. We’re listening.Many of us, me included, are pretty tired – no, exhausted – at raging against the machine – be it politics, class (very British, and sadly still very relevant crap), religion, creed, etc. So, we just roll over and rant now and then in mediums such as this. That suits ‘them’. We have a release. Basic life is hard enough for many of us, without trying to tackle the injustices that have prevailed for so long in our ‘Western’ – Civilised? – World.Anyway, get back to your turkey, folks – and enjoy!

Rage against the machine!Count me amongst those whose rage is growing and whose tolerance is slowing!

IMHO the real question is how much enslavement the US people will put up with. a few years ago $2 a gallon gas was considered unthinkable, now it is viewed as a good deal. meanwhile goldman bonuses are of course soaring throughout this crisis their personnel helped create via their division in the US government. i think this system will continue until1. it changes internally. this would be marked by a sharp decrease in government spending, most notably demilitarization. i find this to be extremely unlikely given the factors that would be required to make this happen, and the incentives and psychology of those ultimately in charge. 2. people abandoning the dollar to start their own currencies. economic warfare. 3. dollar self-destruction. ultimately the dollar is a fiat currency, one of belief. so if people are willing to believe in it forever, even when it is worthless, then we could see $10 gallon gas, 20%+ unemployment, soaring homelessness, soaring stock prices (not matched by soaring earnings, so P/E will be through the roof), and if people are willing to regard this as fair, appropriate, and patriotic, than that is what it will be.

The concept of a percentage of our population being “enslaved” is perfectly correct. We have created and grown a dependent class whose livelihood is delivered by the sweat of better men but whose manhood is rendered impotent by the very concept of entitlement.The faux class warfare which was created by the AIG/Wall Street feigned outrage has already run its course with the same class ending up on top.A few scores got settled. A few companies were ceremoniously thrown onto the gas fire log funeral pyre but in general they still got to keep all they had won and to borrow the government’s checkbook.It proves one thing beyond all doubt — all politicians will ultimately serve the hand of those who feed their ambitions.The current administration is Wall Street’s bitch.

its sickening. and so glaringly obvious that i fail to understand why the populous does nothing.

Like many things, it’s the quality and makeup of the leadership.Compare the Founding Fathers to our current President, Majority Leader and Speaker of the House.The Three Stooges (for a second I was contemplating being civil but then I thought WTF, it’s Saturday isn’t it?) are operating a system of governance created by better folks.Our President (a charming, handsome, photogenic, smart as a whip, well educated, well spoken, American Dream life story, perhaps even, sometimes, rightly intentioned) is woefully lacking in experience, naive in the ways of competing national interests, an uncomfortable executive and embraces a leftward leaning governing philosophy which is anathema to that of the Founders.Our Majority Leader carries his baton from a state whose core values are gambling, prostitution and belly busting buffets.Our Speaker of the House is a wild eyed liberal from arguably the most liberal acreage in the land and the spawn of a crooked Mayor and Congressman.If we were freezing to death on the side of a mountain awaiting dawn, would we not want to be lead by someone who was at least minimally acquainted with starting a fire?Not someone who had seen a fire once upon a time. Not someone who had a staff member who had started a fire. But someone who actually knew how to start a damn fire themselves and could inspire our confidence because they were a damn FIRE STARTER!Therein lies the problem, we need jobs and nobody in the leadership has ever created a damn job. Oh, they can throw money at things like there is no tom’w but they cannot create jobs.We need to start a damn firestorm of jobs!

humming ‘the prodigy’ along to this post.

yatzee.well said.but i, like you – have alot to be thankful for today – and she happens to be taking a nap next to me on the couch – and her future is in our hands.So yes – major problems ahead – but the solutions are most worth fighting for – here in the US

I don’t like to put my money into banks. I like to put it in the hands of entrepreneurs who create jobs. My wife and I talked last night to a friend who is going to start a bodega. We’ll be investing in that too. Should create a few more jobs I suspect

Fred, First of all…wishing you and your family a Happy Thanksgiving.I have been an avid reader of your blog for a long time and have learned much here. While it is difficult to tell from the PwC sourced chart in #5 above, exactly what the “bounce back” is…I respectfully disagree. The VC industry (like others) is changing, I think for the present time it is very much broken. There are certainly some exceptions but to see a slight uptick at the moment I feel is more of an anomaly rather than a resurgence to where the industry once was. I fully agree that entrepreneurs in the thousands (#7) are newly minted through this economy however that in of itself is causing the VC (and PE) industry to change. If this industry does not “re-model” itself, it will never comeback stronger. A better focus on operations, hand-in-hand guidance, and less deals that are made more valuable (yes I know it sounds like Jerry McGuire) is what should happen. This will produce better returns for investors and further encourage the entrepreneurs that can change our world. We look at this every day and have seen truly remarkable absorption of this thinking (www.solideacapital.com)Be happy to discuss further. Again, thanks for all the insight and have a wonderful holiday.

Howdy Randall, I wrote up a far out idea on crowd sourced venture funding. Basically taking a covestor type of approach to open up the door to smaller investors who can spread their risk. The actual support of the venture capitalist is connected to a massive poolof people that want to support entrepreneurship but can’t do so at the Angel/VC level on their own.I don’t want to buy stocks in big corporations who already have large revenue, I want to invest in super lean startups but don’t have enough liquid to do so in the current framework.Here’s a link. You can see in the comments some folks have already built this type of structure.

In the meantime, Mark, why not invest in some upstarts on the OTC Bulletin Board?. There’s some crap there, but also some real companies, a couple of which I’ve mentioned on my blog recently. It’s sort of like a poor man’s version of venture capital investing. These companies may be publicly traded, but many of them are leaner, less capitalized, and less publicized than many venture-backed companies. And there are entrepreneurs doing some amazing things at some of these companies.

You are on the money.I run an OTC-BB company for exactly some of the reasons you have enunciated. Myself and one other investor own 70% of the company.The business is simply a vehicle to execute a very calm, well-planned roll up, consolidation strategy while transforming an outmoded, poorly managed, ancient marketing perspective business in an arcane, niche industry into a “modern” well run, analytically driven, customer centric marketing business.It generates a 30% return on capital while being a very simple multi-unit, multi-state operating business.I love businesses in which the scale is created by simplly operating multiple units. This is the genius of McDonald’s.

You bring up another feature I like about some OTC BB companies: big founder/insider ownership. My current top holding is similar to your company in that the CEO owns about 60% of the company while his CFO owns another 10%. When the CEO pays himself a modest salary and owns most of the company, his interests are far better aligned with those of his outside investors than that of a typical large company CEO. What’s the symbol for your company?

LTFD.OB [email protected]

Thanks. Sent you an e-mail last night.

This approach is not a lot different than the real estate syndication business which had its time before the 1986 Tax Act which changed the character of taxation of real estate “losses” — primarily accelerated depreciation and interest expense.This industy raised a ton of money and then the predictable scumbags ruined it all by their greedy focus on immediate returns on an asset class which had a 50-100 year physical life.They laid on syndication fees, asset management fees, property management fees, fees, fees, fees, fees and then carried interests. They choked the golden goose even before she had squatted to lay the first damn golden egg.The world is still awash with money — a lot of it the cat on the hot stove type money just now. Money will flow to any prospect which creates bit of order out of chaos and which removes the normal size driven institutional barriers.An interesting niche may be the small insurance companies whose size does not allow it to efficiently allocate money to venture capital but whose inclination otherwise is to participate. This is simply an institutional syndicate rather than an accredited investor syndicate.

Thanks for giving this year Fred, and everyone at AVC. We have the best mix of optimism/realism, capitalism/socialism, and science/art (notice the lack of bias ;)).This community is the rocket fuel behind my inspiration and quest for value creation.THANK YOU.

Well said, Mark – ditto! Plus, how refreshing and inspiring that the dialogue/banter is conducted in such a civil and often witty, personable manner. Such decorum makes a nice change from the tone evident within so many blogs and the like out there. Long may it continue!

Happy Turkey day! This sounds like a New Years post almost as much as it does a Thanksgiving one. Very excited to see how 2010 will be. But in the meantime, going to enjoy some deep fried Turkey. Happy holidays to everyone!

Thanks for avc.com Fred and also thanks to everyone who participates here, including those who read and listen. This blog community is invaluable.avc.com is the Internet’s playbook and just a great place to hang out and get inspired.

for me most of all

Awesome stuff Fred. Have a great thanksgiving!

“avc.com is the Internet’s playbook and just a great place to hang out and get inspired.” Amen Brooks.Fred, just one point regarding the IPO market. We’ve seen quite a few Tech-related S1’s filing the past few weeks, but unfortunately these deals (Calix, Sensata, Fabrinet etc.) are not of the highest quality. While these sectors are not directly related to the Internet space, I fear that the most valuable Internet properties that have been awaiting a solid IPO window for years now will have to wait awhile longer as these deals are likely to trade poorly. It could be another couple years until the equity market is ready to reward the best of class in the new media space with appropriate valuations…

maybe investors will see through the poor quality and treat themappropriately

Great post, Fred – particularly interested in #8, the “third path” to liquidity for early stage investments, and wondering if you’ve come across the idea of “royalty based finance” for tech startups. It’s an idea we (Founders’ Co-op) are excited about for the same reason (high-IRR liquidity w/o requiring a liquidity event) but it doesn’t seem to have crossed over just yet.

I tried that once early in my career on a software deal in the late 80s/early 90s. It didn’t work out to well

Today I am personally filled with an abundance of thanksgiving for all that I have received and the luck which has guided my life. Mostly for the luck — the unending luck. The undeserved luck. If I died today, I have lived a life far beyond my wildest expectations.In a few minutes, I will enjoy a lavish Thanksgiving dinner with my family gathered in luxurious surroundings and then this evening we will watch the Longhorns pound the snot out of the Aggies (sorry, Aggies, I still love you, but you have to take sides). The Longhorns will win the National Championship, Colt McCoy will win the Heisman, there will be some order on earth as it is in Texas! [OK, let me have my fantasies, but it COULD happen!]In spite of my many blessings, I am filled with ennui. It is a hollowness at my very core and it brings tears to my eyes.Burned into my brain is the experience so many years ago of Thanksgiving dinners I enjoyed in peace and in war while in the Army. I remember the trouble I went to personally to ensure that all of my troops received a HOT meal complete with all the trimmings. For three of those six Thanksgivings, I was overseas and Thanksgiving meant a bit more as it was a connection to a home where we all longed to be. I was really just a kid but I had important responsibilities — Mother’s sons — entrusted to me and I tried to do my best to deserve their service.Somewhere in Afghanistan is a young Lieutenant similiarly ensuring that his men are fed a hot Thanksgiving dinner. He is, as I was, scared by the horror of his war but trying to the very best he can for his men on Thanksgiving.I am thankful that our Nation still produces such men and I wish him and his men Happy Thanksgiving and Godspeed. All that we hope to do with our lives is paid for by the blood of such men who protect our freedoms every day including on Thanksgiving.God bless to all and Happy Thanksgiving!

If anyone is moved by JLM’s comment to lend a hand in some way, consider Spirit of America, which happens to have been founded by a tech entrepreneur, Jim Hake.

We can’t thank those who sacrifice life and limb enough. But we can recognize and respect them. Thanks JLM for the reminder .

Well said JLM. Thank you

jlm thanks for the reminder…may everyone be really safe this thanksgiving, or at least safe enough that while they eat turkey they feel safe enough to eat it.

Jeff,I don’t know if you tried to send me that long e-mail yesterday, but in case you did, I thought I’d leave you a note here that I didn’t receive it.Best,Dave

“Can a vibrant Internet IPO market be far away?”Not until we get at least some some minor reform of Sarbannes-Oxley. Until then, exits will continue to be strongly tilted to M&A.

SOx is one of the greatest head fakes in the history of the world. It has created a duplicate regulatory environment to the SEC — the Public Company Accounting Oversight Board. In fact, it was initially staffed by all the #2s in the SEC.Nothing in SOx or SEC regulation for that matter is something that a well run company would not want to do and similiarly there is not a single rule that a lawless company would hesitate to violate.The criminalization of certain things such as the requirement for a company’s SEC counsel to report the company in the event of a substantive violation — a violation of the long standing attorney-client privilege theory and practice — is just plain goofy.No small part of the regulation of public companies (e.g. the requirement for independent Boardmembers and the composition of the audit committee) is totally redundant with the requirements for a public listing on any exchange.You have exchange rules, SEC rules and SOx all of which provide the same requirements as to how you have to tie your shoes and yet we still have the same level of securities fraud, cheating, insider trading, etc.The problem is not just the rules, it is the enforcement. Guys like Bernie Madoff are not going to follow the rules under any circumstances.This is why I have consistently called for public execution (beheading) on the steps of the NYSE for transgressors. It should be done on the first day of each quarter and should be sponsored by major corporations. Broadcast on cable.

I’m thankful for having good online and in person friends. Been an interesting week for needing them (So I am really thankful for that)I do sort of wish that investment chart was less sharp in in its growth curve. That sort of wigs me out.On the risk to safe scale, Venture is on the pretty damn risky side pure chocalate side, and US Treasurys on the Eat Your Green Vegetables Safe Side. Treasuries don’t feel that way, they feel risky, and it also feels like there is too much money that should be flowing through the system that ins’t because of TARP. It has to go somewhere eventually…I’m not one of those people who think money goes poof and disappears. You can kill a good, even a soft good, not money. Money after all is just information, some agreement of worth or value.I’d like to see that curve smoother because it reminds me that information has to go somewhere, and its going, and a slightly slower, smoother gorwth would be easier to handle on the populace (perople often forget how hard new technology is to handle). If venture continues rising that way, it’s a sigh that we’re really unsure about how we feel about the treasuries in the short run (which is wierd, and I hope they settle it out) and a sign that we are about to have another major technological change, since those come in waves. It seems those are happening more frequently. Further, they’re harder fore the average (even the not so average) person to keep up with.And that’s the scary part. Not that I want a recession, but I wish there was a little more time for people who won’t have a chance to hack education of this stuff before they fall behind. Long term, that’s bad. And it causes social changes that may or may not be what we want.*sigh* Just a bit neutral…

If you follow the actual ratings and numbers, there is an argument to be made that WalMart debt is more secure and safer than US Treasuries. It is priced so from time to time.I think it’s the management. LOL

I don’t like the idea of corporate debt/equity being a flight to quality. It speaks too much of not enough seperations of power.Granrted Venture is probably among the tiniest of fractions of the market, but in a way, as an instrument, it has the power to be extremely explosive. Really well placed TNT. And I’m wondering because I really do believe that money is also just a belief about the good/service as anything else, that it is a font of information, WTF are people thinking? Venture is not a place you go to quality. Especially since many people still talk as this is a time of upheaval (I’m keeping my cards close on this one), what should this tell me…why would they fly to venture? Are their parallels to other financial funds and instruments? (beyond the market stabilizing, that I know) And how do I check?Such a sharp rise…So noticeable…

It is good to have Android on everyone’s radar now to keep Apple honest like you mentioned Fred. I find it hard to believe it took this long to get a REAL competitor for the iPhone but better late than never. I wonder if Google really wants to be an iPhone killer or if they have other much bigger ideas longer-term about how to fold it into their other products and services?!

Not so sure I agree with #1, but today isn’t a day to quibble about that. Re #4, I’ve done a tiny bit to help by opening a small account with Microsoft adCenter (i.e., Bing’s version of Adwords). FWIW, I found the process to be easier than Adwords, and Microsoft even lets you call a live support person — and an American one at that (at least in my case) — if you have any questions.Happy Thanksgiving everybody.

Have a great thanksgiving. But just an – obvious – thought about your first one. The financial crisis has clearly abated but for so many people there is no end in sight to unemployment or underemployment. Here in NYC we’ve got the financial community resurgent yet again but so many in the creative disciplines without work or working for wages that they cannot live on in a city where finance has – over the past decade – set the price of living. As a society we face a problem with an increasing polarization between the haves and have nots and it’s not just about education level or coasts vs the rest or blue collar vs white collar.

The “real” numbers are frightening.We have 16MM out of work not including any illegal immigrants looking for work.We have 9.3MM “involuntary part time workers”.We have 2.4MM unemployed who are no longer looking for work of which 0.8MM have given up completely.We have almost an entire college graduating class (2009) which has been unable to find jobs and we will have another in about 6 months who will be trying to claw over the previous class.Do the math yourself and it looks to me like we have almost 30MM Americans looking for permanent work.As this fact sets in, note that we are currently LOSING jobs and many of those part time jobs will disappear on 26 Dec 2009.Whatever was supposed to happen with the Stimulus to create jobs has not worked. And now the Congress contemplates a similar effort called “job creation” as if that is a new objective and was not the fundamental objective of the Stimulus.It is time to go back to tried and true tax code manipulation to create jobs.

Strongly agreed. Note that NY State just increased our payroll tax. We are a small business pre-revenue and pre-profit; how is increasing our payroll tax going to help create jobs?

This is called “choking the baby in the cradle” and is what happens when the administration has a bias toward taxing everything and I mean everything.In fact, you should be paying nothing and the company given an opportunity to take root, blossom and flourish. We need to create the mechanisms which will create jobs not increase taxes.Why is it even debatable that governments cannot raise taxes during a recession? I do not expect “uncommon” sense but I do pray for a bit of “common” sense.Just don’t get a Botox injection. LOL

Completely agree. I’m torn over your comment about taxation as a way to redistribute wealth. I clearly agree that a company like ours should have no taxes – it’s insane to think we have to use high priced equity capital to pay the government their taxes. But so long as the government increases its spending – and governments left and right seem unable to do anything else – the money has to come from somewhere. As a society we do create tax based incentives for certain behavior. Home ownership and debt are behaviors we incent through taxes. We don’t create positive tax incentives for people to become doctors (no reduced rate of income tax on an M.D.’s pay). Should we make value judgments like this with taxes? Small entrepreneurial companies should not be taxed? Teachers and Doctors should not be taxed? Financial institutions should be taxed at a higher rate. It strikes me as an easy decision to make in the short run after all, don’t we need smart people to be teachers more than we need them to be traders but a dangerous slippery slope of the government making value judgments through its tax power. Of course, the government already makes lots of these decisions already. Tax abatements for some and not for others, no tax on mortgage interest etc. What do you think?

The simple truth of the matter is that tax policy does in fact direct changes in the economy and serve to create jobs, INCREASE tax revenue and to invigorate investment.While today, this is identified as a Republican initiative, in fact, John F Kennedy was perhaps the most courageous tax cutter.Tax revenues go UP when tax rates go down. When capital gains rates are lowered, locked up profits are unlocked resulting in a net increase in tax revenues. More importantly capital begins to flow within the economy and whatever multiplier effect is applied to the unleashed cash flow works its magic.Again, this is the voice and governance of JFK in addition to Ronald Reagan and others.The Clinton era economic largess was created by the last vestiges of the Reagan low hanging fruit spurring the economy and the initial impact of the Gingrich tight fisted spending controlling Congress.Revenue was still going up as expenditures were simply being “controlled” — the rate of growth being dampened. God forbid, the Congress actually diminish spending.Dwight D Eisenhower delivered 8 balanced budgets while extricating the US from the Korean War, building the American nuclear arsenal and initiating the US highway system. Of course, he was a guy who knew how to run a beauracracy, how to demand accountability from his staff and how to frame and make important decisions.What do you think DDE would say about the handwringing of committing two divisons to Afghanistan? He made bigger decisions before breakfast.

Further to your question about incentives, in my view therein lies the dilemma. The current administration intends to make war against the slice of American thought, enterprise and creativity which actually creates jobs — knows how to create jobs — by attempting to send them the bill for each and every liberal initiative they enact.You cannot make war against the job creating slice of America while simultaneously expecting to cajole jobs out of them. It is naive and silly.On the other hand, if the administration were simply to stop taxing all corporations less than 5 years old, all corporations employing less than 50 persons while simultaneously slapping the SBA with GM bailout money — the jobs would multiply like wildfire.This administration, on one hand, pretends to punish Wall Street while handing the steering wheel to a bunch of Goldman alumni, while on the other hand being unwilling to consider any tried and true job creation mechanism because it would somehow allow some guy to make a buck.The government does much to create targeted outcomes — the Ft Hood shooter was provided with an undergrad, medical school, medical residency, psychiatric residency through his early 30s before the Army came calling saying they wanted him to go to work. Approximately 15 years of free schooling.When he did go to work, he was paid as a Major ($92K/year plus $16K quarters and food) and then wanted to get out of the Army.How many jobs could have been created if that money was used to educate air conditioning repair men and computer networkers?Government does pick and create the winners — and losers these days.

I agree.

Here’s a kicker for you. Employers – no matter how small or large – have to pay for COBRA for 18 months after the termination of an employee. How do you avoid this? You don’t give employees health care in the first place – make them freelancers instead. How’s that for a perverse incentive.

Ok, I am going to do a little victory lap here…..Black Swans do not drift in, they are delivered by a cruise missile in the middle of the night, holidays, or on the weekend.http://oahutrading.blogspot…http://oahutrading.blogspot…http://oahutrading.blogspot…http://oahutrading.blogspot…As America tryptophans out and wakes up weary tomorrow, with half a trading day to “panic out with”, this could be very interesting. Looks like nearly “perfect timing” by our financial overlords. Lots of Turkeys (aka Lemmings) getting cooked today.

“No revolution ever got started on a full stomach!”Perfect! I gotta quote you on that.Thanks.

Hunger of all types — intellectual, financial, educational, political — is what fuels changes in the individual and the masses.That is why socialism does not work. That is why the redistribution of wealth as a governing philosophy, as a “painless panacea” for the masses, is so dangerous. It quenches the motivation for hard work and excellence which is provided by the basic hunger for a better life.The manner in which one quenches that hunger is vitally important. That is why a stolen watermelon tastes so much better than a store bought one. It has the added flavor of the derring do necessary to obtain it — the struggle.Entrepreneurial zeal is simply the watermelon thief’s risk taking channelled into a legitimate endeavor. And that is why success is so tasty.

You got that right! Happy Thanksgiving. I hope you have a great year.

i tend to agree – the meltdown is just getting started – i just came through Dubai – watch on monday. The meltdown is systemic – until new constructs evolve in all manner of markets, we are a slower version of the black night in monty pythons holy grail – the legs came off lat year – arms are coming off shortly and we are still sitting about thinking we can bite.The problems are deeply systemic – and sadly wont be going away.acknoledgment and applause for JLMs eloquence for those in harms way aside – i fear they defend a deeply flawed system in desperate need of drastic change.

The great beneficiary of bad times is………………geography.Most people have a shaky understanding of exactly where Dubai is. Just wait 30 days and folks will be able to point it out with their eyes blindfolded.Interestingly enough, the magnitude of the problem — at first report — is “only” $80bn hardly even a problem by Tim Geitner’s standards these days.I think we will see a short list of troubled countries becoming longer and longer. I understand one can buy Iceland for a comparative pittance.

Happy Thanksgiving, Fred. Great list.Another thing I would add to the list is social networks are gonna take Web to another level. I had a kick-off meeting of my Chinese Y-Combinator, named appWorks Ventures, in Taipei the other day and 100+ showed up. The rise of Facebook here and how it’s making starting a web company this much easier is a great thing that’s happened in the past year and we’re seeing interests in entrepreneurship going up again.

Yes. Its very powerful

Thank you for bringing up the good news! I really like number 10. Great blog.Gellert

Worse still we sit on the precipice of an energy crisis — the supply will be dampened by the upcoming crisis with Iranian, bet the farm on that — and nuclear power does not even have a seat at the table.Nuclear power would create immediate good quality construction jobs followed on by high quality operations jobs and would divert enormous sums of money currently being exported to the Middle East back into the US economy.I am not so brave to suggest that nuclear power is even the solution, I am only suggesting it is allowed to be added to the conversation. Please.Almost 90% of all power in France is generated by nuclear power plants. Please, let’s at least be as advanced in our thinking as the French.

USA has def jumped shark. if i could afford it or make it plausible, i would peace out of here. i’m still actually thinking about moving to the bahamas or something, something not too far from the US and a place where no one is doing anything so the thugs will focus their opportunities elsewhere. the falling dollar will lead to higher oil prices (since tons of oil is imported), the speculators will come in and “help the market find its efficient price” (aka bid it up with all the money the fed printed and gave to them), then oil prices are too high, govt steps in with the “solution” of price controls, nixon’s price controls in the ’70s will be cited as “evidence” this works…of course, it doesn’t, it only creates shortages and black markets, which will further fuel not our automobiles, but rather the decline of our society. the good news is that eventually, once the people have been thoroughly robbed and have decided they have had enough, and once greed and hubris of the criminals results in their inevitable self-destruction, we’ll be set free. then we can all all chill out and have a good time. although i’m not sure if i’ll have anything to talk about! 😀

“Nuclear power would create immediate good quality construction jobs followed on by high quality operations jobs…”This would have been a much better focus of stimulus funds than policies designed to temporarily and unsustainably boost the spending of over-levered consumers.”…and would divert enormous sums of money currently being exported to the Middle East back into the US economy.”And don’t forget all that money being exported to Canada, which sells us oil at market prices and then buys our prescription drugs at cost plus.

I think we have no choice but to invest in nuclear in the short term

Frankly I consider this such “low hanging fruit”, a “two-fer” of jobs and energy as to be incredulous that the “save and create” jobs crew would not be all over it.I fear it betrays a bit of the Yucca Flats squishy environmental concerns.While nuclear power plants are expensive they are not nearly as expensive as paying out AIG’s counterparty obligations.The other thing is that from a political perspective they are a great “spoils system” cherry as they can be granted to States whose electoral behavior is pleasing to the administration as well as being a bandaid for States (e.g. Michigan) which are really suffering.It defies third grade logic as to why this has not been embraced.

You guys sure know how to throw cold water on a nice optimistic post!

its in the process of jumping the shark for sure. And the government is powerless to do anything. As JLM pointed out – truly uncoupling special interest from government is the only hope left before this democratic and free market economy is so peverted and distorted that it black holes itself.this senate candidate Pagliuca (the former VC) (up here in boston) is running on this very paradox – its caught my interest.

Actually I think your optimism is well founded but like many things it must be tested by the view from the other side of the mirror. Optimism can exist in the midst of an otherwise troubling time.One of the best features of the salon you have created is that smart people can enunciate opposite views in a courteous and engaging manner. Many things in life require us to be optimistic, to fashion a goal, to carefully assess the downside and risks and then to gleefully jump off the diving board hoping nobody moves the water during the trip.Don’t let the bastards get you down.