The NY Times' Freemium Strategy

I was very pleased to see yesterday that the NY Times has made the decision to adopt the FT's subscription model over some of the other options they had. I wrote the following last summer and thought it would be useful to reblog it today:

————–

Monetize The Audience, Not The Content

There's a lot of discussion out there about how online content should be monetized.

In particular, the newspaper industry is doing a lot of soul searching for the right revenue model. For many publications, particularly legacy publications with higher cost models, advertising alone isn't covering the nut.

Let's leave out the discussion of the print side of these businesses for this discussion. I think most papers would be better off without the print business but I also understand why many won't walk away from a print based product just yet.

For those content owners with a cost model that can't be covered with advertising alone, subscriptions seem like the obvious choice. And yet, for most, subscriptions have not worked very well.

The worst examples of subscription services are those that break the content up into free and paid. It's as if some content is worth more than other content. I think that is the wrong idea most of the time, and especially in news and news related content.

I like the subscription model the FT has been using for some time now. I may get the exact details wrong but its the idea that's important anyway. You can visit the ft.com domain something like nine times per month for free. They cookie you and when you stop by the tenth time in a month, they ask you to pay. And many do.

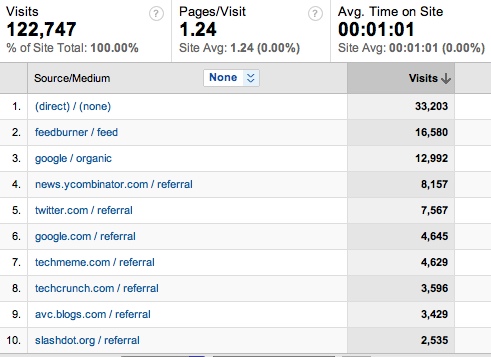

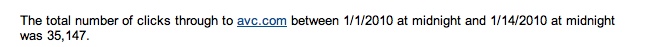

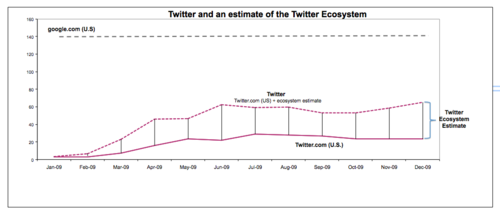

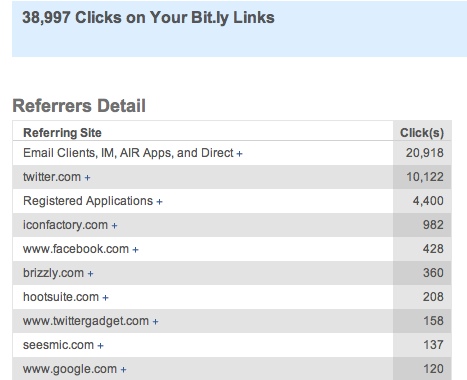

This model recognizes a few fundamental facts about the internet. First, you need to make your content available for search engines and social media linking. That drives as much as half or more of the visits these days. And if you have an ad model at all, and most newspapers do, then you need those visits and that audience.

Its also true that the 'drive by' visits will bring new audiences, some of whom will become loyal and ultimately paid audience members.

The other thing I like about the FT's model is that its an elegant implementation of freemium![]() . The best freemium models allow anyone to use the service for free and then convert the most serious/frequent/power users to paying customers.

. The best freemium models allow anyone to use the service for free and then convert the most serious/frequent/power users to paying customers.

Apparently the NY Times has been surveying its readers in an effort to find the right subscription model. I hope they'll ask them about the FT's model. Its simple to understand and my guess is most will like it.

If they roll it out, I'll gladly sign up because I visit the NY Times at least ten times a month and I would like to help pay the costs of the people who create it.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c3114b6a-fd12-4d02-9627-a83babc96546)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=fc5fee0c-8e94-46ab-a287-3789b73b863e)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d63f464e-0412-4fe1-a0b4-7073eaa23038)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=ebcf49ac-1826-45a2-89dc-310562852649)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=5b782ba0-7ea2-4051-92b2-8c803ec8ec74)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=aaabb823-b4c2-42c0-b569-759624207500)