The Profit and Loss Statement

Today on MBA Mondays we are going to talk about one of the most important things in business, the profit and loss statement (also known as the P&L).

Picking up from the accounting post last week, there are two kinds of accounting entries; those that describe money coming into and out of your business, and money that is contained in your business. The P&L deals with the first category.

A profit and loss statement is a report of the changes in the income and expense accounts over a set period of time. The most common periods of time are months, quarters, and years, although you can produce a P&L report for any period.

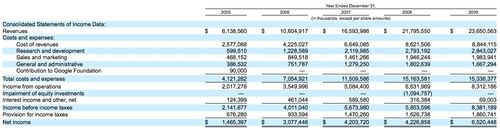

Here is a profit and loss statement for the past four years for Google. I got it from their annual report (10k). I know it is too small on this page to read, but if you click on the image, it will load much larger in a new tab.

The top line of profit and loss statements is revenue (that's why you'll often hear revenue referred to as "the top line"). Revenue is the total amount of money you've earned coming into your business over a set period of time. It is NOT the total amount of cash coming into your business. Cash can come into your business for a variety of reasons, like financings, advance payments for services to be rendered in the future, payments of invoices sent months ago.

There is a very important, but highly technical, concept called revenue recognition. Revenue recognition determines how much revenue you will put on your accounting statements in a specific time period. For a startup company, revenue recognition is not normally difficult. If you sell something, your revenue is the price at which you sold the item and it is recognized in the period in which the item was sold. If you sell advertising, revenue is the price at which you sold the advertising and it is recognized in the period in which the advertising actually ran on your media property. If you provide a subscription service, your revenue in any period will be the amount of the subscription that was provided in that period.

This leads to another important concept called "accrual accounting." When many people start keeping books, they simply record cash received for services rendered as revenue. And they record the bills they pay as expenses. This is called "cash accounting" and is the way most of us keep our personal books and records. But a business is not supposed to keep books this way. It is supposed to use the concept of accrual accounting.

Let's say you hire a contract developer to build your iPhone app. And your deal with him is you'll pay him $30,000 to deliver it to you. And let's say it takes him three months to build it. At the end of the three months you pay him the $30,000. In cash accounting, in month three you would record an expense of $30,000. But in accrual accounting, each month you'd record an expense of $10,000 and because you aren't actually paying the developer the cash yet, you charge the $10,000 each month to a balance sheet account called Accrued Expenses. Then when you pay the bill, you don't touch the P&L, its simply a balance sheet entry that reduces Cash and reduces Accrued Expenses by $30,000.

The point of accrual accounting is to perfectly match the revenues and expenses to the time period in which they actually happen, not when the payments are made or received.

With that in mind, let's look at the second part of the P&L, the expense section. In the Google P&L above, expenses are broken out into several categories; cost of revenues, R&D, sales and marketing, and general and administration. You'll note that in 2005, there was also a contribution to the Google Foundation, but that only happened once, in 2005.

The presentation Google uses is quite common. One difference you will often see is the cost of revenues applied directly against the revenues and a calculation of a net amount of revenues minus cost of revenues, which is called gross margin. I prefer that gross margin be broken out as it is a really important number. Some businesses have very high costs of revenue and very low gross margins. And example would be a retailer, particularly a low price retailer. The gross margins of a discount retailer could be as low as 25%.

Google's gross margin in 2009 was roughly $14.9bn (revenue of $23.7bn minus cost of revenues of $8.8bn). The way gross margin is most often shown is as a percent of revenues so in 2009 Google's gross margin was 63% (14.9bn divided by 23.7). I prefer to invest in high gross margin businesses because they have a lot of money left after making a sale to pay for the other costs of the business, thereby providing resources to grow the business without needing more financing. It is also much easier to get a high gross margin business profitable.

The other reason to break out "cost of revenues" is that it will most likely increase with revenues whereas the other expenses may not. The non cost of revenues expenses are sometimes referred to as "overhead". They are the costs of operating the business even if you have no revenue. They are also sometimes referred to as the "fixed costs" of the business. But in a startup, they are hardly fixed. These expenses, in Google's categorization scheme, are R&D, sales and marketing, and general/admin. In layman's terms, they are the costs of making the product, the costs of selling the product, and the cost of running the business.

The most interesting line in the P&L to me is the next one, "Income From Operations" also known as "Operating Income." Income From Operations is equal to revenue minus expenses. If "Income From Operations" is a positive number, then your base business is profitable. If it is a negative number, you are losing money. This is a critical number because if you are making money, you can grow your business without needing help from anyone else. Your business is sustainable. If you are not making money, you will need to finance your business in some way to keep it going. Your business is unsustainable on its own.

The line items after "Income From Operations" are the additional expenses that aren't directly related to your core business. They include interest income (from your cash balances), interest expense (from any debt the business has), and taxes owed (federal, state, local, and possibly international). These expenses are important because they are real costs of the business. But I don't pay as much attention to them because interest income and expense can be changed by making changes to the balance sheet and taxes are generally only paid when a business is profitable. When you deduct the interest and taxes from Income From Operations, you get to the final number on the P&L, called Net Income.

I started this post off by saying that the P&L is "one of the most important things in business." I am serious about that. Every business needs to look at its P&L regularly and I am a big fan of sharing the P&L with the entire company. It is a simple snapshot of the health of a business.

I like to look at a "trended P&L" most of all. The Google P&L that I showed above is a "trended P&L" in that it shows the trends in revenues, expenses, and profits over five years. For startup companies, I prefer to look at a trended P&L of monthly statements, usually over a twelve month period. That presentation shows how revenues are increasing (hopefully) and how expenses are increasing (hopefully less than revenues). The trended monthly P&L is a great way to look at a business and see what is going on financially.

I'll end this post with a nod to everyone who commented last week that numbers don't tell you everything about a business. That is very true. A P&L can only tell you so much about a business. It won't tell you if the product is good and getting better. It won't tell you how the morale of the company is. It won't tell you if the management team is executing well. And it won't tell you if the company has the right long term strategy. Actually it will tell you all of that but after it is too late to do anything about it. So as important as the P&L is, it is only one data point you can use in analyzing a business. It's a good place to start. But you have to get beyond the numbers if you really want to know what is going on.

Comments (Archived):

Great info here. Last week, you recommended Quickbooks for general small business accounting. Would you recommend making P&Ls from Quickbooks? Or making them by hand in a spreadsheet?

I don’t believe in doing any reporting work outside of the accounting system. The reporting capability in quickbooks is flexible enough to do whatever you need to do

I’d disagree there are some great excel plug-in’s for some accounting systems which allow you to have far greater flexibility over the type of analysis and reporting you can do with an accounting system standard report writer.

The true answer lies in the middle.QuickBooks is a great accounting system for small to medium companies, and is as powerful as you need for the most part. However, when it comes to creating a realistic set of projections that must account for a number of input channels – there are better tools (mostly Excel plug-ins) out there for this purpose.

Examples of these Excel plugins?

Further to my comments made in the accounting post, I am still totally of the opinion that a plain old spreadsheet does its job well enough for a start-up.I once worked in a successful start-up that ran its entire accounting function from Excel until it reached $500k revenues and 20 employees, before transitioning to “proper” accounting software that it still uses to run a $10M business today. Mind you, this is a manufacturing business with multiple products and customers from all over the world.Any dollar saved in admin expenses (i.e. Quickbooks subscription) could be a dollar spent in customer acquisition and / or making payroll.Just make sure that whoever punching those numbers into a spreadsheet is responsible, awake, and doesn’t have fat fingers like I do.

Good thoughts on that. I currently use a free, web-based accounting tool (Outright) that I like a lot for its simplicity. At the moment, their P&L reporting isn’t as detailed as Fred’s Google example (I just submitted a feature request to them), but Outright’s tax reporting features are pretty good (at least for my needs).I think a combination of Outright and Google Spreadsheets would work, but I’m eager to see Fred’s upcoming posts on balance sheets and cashflow statements, to evaluate whether our current tools are up to the task.I agree about the cost savings being important. At the same time, I don’t want to disregard the importance of efficiently using my time, and the dangers of misinterpreting my own data. Either way, the core point is understanding what the status of the finances are, and how they’re going. I’m thankful for Fred’s MBA Mondays posts. It’s nuts-and-bolts stuff that few startup blogs cover.

Juicy post, appreciate the time that went into it (not just an elliptical glider one). My handy dandy spreadsheet will get a whole lot smarter. Emailed this one to my VM paperwork label in gmail.Side note: disqus fails to load on my mobile (over 3G) quite often. Loads ok with wifi. This may cost you some comments from mobile people who are less patient.

Two good comments from Mark, and two reax:(1) “Elliptical Glider Post”. That’s a good one. Soon we’ll have to call them “Elliptical Glider iPad Posts”, or EGIPPs.(2) Agree on the DISQUS comments via mobile. Really tedious and heavy. I’d comment 5x more if it were faster on the go. By the end of the day, with a heavy comment load, it’s not tenable. At the start of the day I’m tempted to say something quick & dorky to trigger the email alerts for the convo: “Wow! P&Ls! Love ’em! Especially when the P’s are really big!”I’m sure one of you fab technos will instruct me to configure my settings differently. I welcome that! I wasn’t able to get to optimal in the 5 minutes I allotted. I’m a busy girl. 🙂

The disqus on mobile question is something that the team has been working on. They believe mobile engagement has to be lighter weight to work well

as a u.s. based vc, do you require international portfolio companies to use gaap? im just curious how gaap vs. ifrs would impact portfolio valuations because things like R&D can be capitalized as opposed to expensed, etc.

i’m happy to live with any accounting convention that is in place as long as someone takes the time to explain the differences to me

We oughta get all your MBA Mondays off a link / button at the top of your page.

that’s a good suggestioni’ll make it happen

I like the idea of sharing the financials with everyone else in the company but I’m not convinced it’s always the way to go, particularly in the start up situation. As much as when you hire people in a start up you can tell them that it’s a higher than average risk company I still think people like their security. I’m not so sure there are many technical/scientific employees who can handle being shown a cash over time remaining graph when funds are running low without thinking it might be time to jump ship. Particularly in the current economic climate.

that is true but you don’t have to show the balance sheet (which is thesubject of next week’s post)

Looking forward to the balance sheet (and its directly related cousin, the Cash Flow Statement) post(s). I agree that the P&L is a great tool for transparency with the ranks. Understanding cash flow and remaining months of cash is vitally important for early-stage start ups.It’s great that you’re opening up these accounting basics to your crowd. Understanding how the financials flow is important for managers running companies. Interested to know from your experience how many technical founders were intimately familiar with this before you invested and how many had to pick up on the in’s and out’s as part of their own personal development while running the co.

mostly the latter. it’s one of the things we can do to help them develop.

I agree Zack for any start up, understanding cash flow, tracking it and performing sensitivity analysis on how you currently use/are going to use the cash is absolutely vital.

Here’s my problem. If you aren’t going to show people all financials B/S P&L Cash Flow then you should show them none of them. (You can show sales, etc)And here’s why. It doesn’t work in the bad times and it doesn’t work in the good times. Because if you don’t see them all you can’t understand the interactions.If I’ve personally guaranteed the line of credit took a small salary and guaranteed the lease when the company becomes really profitable and I’m rewarded……people forget the tough times and focus in on the good times.

Nothing causes panic like ignorance.

It’s a difficult one Glen (apologies) up to a point I’d agree with you. I been in start ups that have chosen to share and not to share financial information and I’m still undecided.

I remember following up with the (part-time) CFO of a start-up where I worked about the delay in reimbursing my T&E. He admitted they delayed it so they could make payroll. I respected his honesty, at least.

If you’re worried about the implications of transparency the solution to that is more transparency. In this case you’d show the numbers but also take the time to explain to the team what they mean and what the implications for the health of the business are, particularly to people like engineers who aren’t as well-versed in managing a P&L.

Fred, one small nit – in your explanation of Google’s gross margin in 2009, I think you pulled the cost of revenues from 2008…You made a comment that I’d love to see you expand into a separate post – which is you feel P&L should be shared with the entire company. This is one of the more emotionally charged discussions I’ve been in at startups – I happen to agree with you, but I haven’t been around many partners/VC’s who agree. What do you think of a discussion regarding employee disclosure? What should and should not be shared, and how deep in the organization (I’m thinking startup, so no worries about 5 levels of management – 2-3 would do the trick – Exec Team, Management, Employees).

thanks for the catch scott. i did the math right but used the wrong numberin the text. i fixed it. it’s interesting to note that cost of revenues onlyincreased from $8.6bn to $8.8bn year over year from 08 to 09 while revenuewent from $21.8bn to $23.7bn. hmmm?i am a big fan of transparency and lots of it. i know that many don’t agree.but i think you have to be honest with your team and give them the same infoyou are operating with. there are limits. individual’s comp (includingequity grants) would be a bit too far to go in my opinion.

I noticed that too, which is why I thought you had done the math incorrectly, but turned out to just be grabbing the different year… talk about a license to print money!ok, so I’m glad you like transparency, I was beginning to think I was on an Island on that topic… I have a hard time with the “people won’t know what to do with the numbers you are presenting, or they’ll share it with inappropriate people when they are laid off”. It goes back to the trust issue between employer and employee that you and Mark Suster blogged about last week. So, it seems like you and I feel that the employer and employee should and can be trusted, but most others disagree. I do agree that personal information should not be shared (or more appropriately is up to the individual to decide, but on the whole inappropriate to discuss), but corporate information is fair game. Public companies have to disclose to everyone (including competitors) so why wouldn’t a private company want the people on their own team to know (AND understand) what the numbers mean? Employees at startups are smart or they wouldn’t be there – so sharing bad news (e.g. a bad quarter) or really bad news (we’re almost out of cash) is much better than trying to keep it secret – they’ll know things are bad, just not the details, and they’ll be pretty upset when you drop the bomb on them with no warning. If you really want everybody in the same boat, tell them what’s coming over the next wave… and the loyalty and honesty you’ll get back will only help you make the business even better.

I love these posts Fred. Just so we can distribute the P&L, we have to each everyone at RF how to read it. We’ll probably just link to these posts from our intranet.One question. You have been a strong advocate for taking financial statements seriously; absent fraud, I tend to be someone who wants to spend as little as possible on G&A. In the early days it’s easy to agree to hire a contract bookkeeper, and much later a full-time accountant. But what’s your take on when a company needs a CFO? Is it only when the company is contemplating an IPO, or earlier?

i like a VP Finance when you get to real revenues and significant headcount,i’d say $5mm in annual revs and 50 or more people.a CFO is a very big step. i think you can go a long way with a VP Finance.it’s ideal if your VP Finance can grow into a CFOthe big difference between a VP Finance and a CFO is in their ability to bea true business partner with you.

What are your thoughts on part-time CFOs? An OTCBB company I own a few shares of — a company that’s profitable and is on track for $20 million+ in revenues this year — appears to have a part time CFO, who is also a 10% owner of the company and a director. They don’t advertise that he’s a part-time CFO, but I deduced this because he still has his own accounting firm, and that’s where you can reach him.

The whole issue w/ a CFO is does he/she have a “controller” who is overseeing the real accounting burden and what is the job description of the CFO.If you break down the total financial function (accounting, treasury, benefits, cash management, insurance, regulatory reporting, etc) and allocate the jobs correctly, a damn good controller and an experienced part-time CFO can handle things well.The important thing is to ensure that everybody knows what sacrifices are being made because the CFO is part time.The other big variable is does the CFO really know what a CFO does or is supposed to do?

In staffing a start up from an accounting perspective, it is important to provide a “progressive” level of staffing. I usually see this progression as follows:scraps of paperyour older sister who worked in accountingoutside bookkeeperoutside CPAinside bookkeeperinside accountantcontrollervp-finance <<< a title which creates great confusion in corporations and I prefer not to use as it implies a corporate officer. I prefer controller.CFOThe nexst issue is the quality of the software. I like QuikBooks for its breadth, flexibility and acceptance. There is absolutely nothing wrong w/ using Excel plug ins for analysis, budgeting and forecasting.In buying chaotic businesses (which are always the very best bargains), I almost never even look at “their” numbers preferring to just take their checkbook for the last 2-3 years and have a temp enter the whole mess into QuikBooks and preparing new financial statements from scratch.It is really just that easy.

that’s a pretty typical progression JLMthanks for laying it out there for everyone

Excellent tiered financial support

mba mondays make opening google reader a serious danger to my productivity. well done and thanks!

I have no problem sharing gross profit with everyone in the company. But sharing the entire income statement in a small company may enable people to figure out how much salary they’re earning versus their colleagues and boss. Not a good idea in my opinion.

Another great post, as usual, Fred. In addition to your excellent points, may also be worthwhile pointing out that accrual accounting concepts differ from industry to industry. For instance, revenue recognition practices for companies in software services will be very different from that of cleantech manufacturing. Would be worthwhile for a startup team to check in with their CPA on what is most applicable for their business.On a separate note, on trended P&Ls, I would also have touched on the difference between historical and forecast trends, how important it is for a startup team to ensure that they are able to tie back their forecast numbers with historical performance, explain “hockey sticks” and to use sensible optimism with projecting their expected future performance of their business. Ultimately forecast P&Ls are the most basic starting point for the valuation of a business in a financing round.

i wasn’t thinking about forward projectionscomparing them to historical results is only useful if they are reasonable projections

I love the idea of sharing the P&L with the rest of the company. It is a great way to bring people in the same page and you can help to move strategies forward. If the employees understand why some steps are taken they are more willing to give you the benefit of the doubt. It can help build consensus in your most important decisions.Doing this in a private or startup company is not very wise. How do you suggest doing something similar without giving away valuable intelligence?Off topic; Fred, Your book suggestion of the “The Blue Sweater” was very inspiring. I will host an online book discussion for anyone who want to read it and be part of the conversation. If interested I will be hosting it at: http://www.forefrontschool.com/Dis…Thanks, Camilo

The MBA Mondays is a great idea, Fred. Collected together, they’d make a great little book (“The Fred Wilson MBA”) – the kind of book Portfolio does well.

you have to end the posts to do a book

Not suggesting you stop the posts. Keep ’em coming! Just a thought about a book.

I know. But a book has an ending. I don’t like that idea

You’re right and it’s not interactive. The community is lost, even if book groups form around the book.Although I like how Seth Godin manages it: his books seem to be an ongoing conversation, with each other and the audience. They also build from the blog to ebook to hardcover (and his presentations) and back to the blog. But that’s part of the whole package of his brand.

Yeah. He does it brilliantly. But he started with books

I agree. I’ve often wanted to comment/discuss (DISQUS?) on Seth’s blog and books but the outlet is not there. The net result is unrealized participation.

You could hire an editor/coauthor to help pull it all together.

Its not the effort I am concerned about its the end product, physical, with a beginning and an end. I don’t that like that form of packaging

Appreciate the post and perspective. How about some commentary on the diversification of revenue?…either from multiple products or a wide base of customers?

Why exactly do you want to match to time with accrual accounting rather than cash in to cash out?How does time play in here? That seems to be a very important concept going on, and I am not sure why?

ShanaC,Let’s say you are a company who has sold a large item for 10 million dollars, for delivery in 2 years. You get paid that 10 million dollars right now, but you don’t deliver the product for 2 years. You can not show revenue right now, as you have not earned that revenue. Instead, it is a liability, called unearned revenue. Once you earn that revenue, you recognize the income, deduct the liability, and the increase the asset/equity portion of your balance sheet. Once you have earned the revenue, it goes as income on your IS

Alright. Much better.

awesome responsei love the community taking over and finishing the work i started

Hi ShanaI can’t really explain it more simply than Fred stated:”The point of accrual accounting is to perfectly match the revenues and expenses to the time period in which they actually happen, not when the payments are made or received”When you look at a financial statement they are for a certain period. So statutory accounts here in the UK are usually (but not always) for an annual period. Therefore you want to make sure that you have represented the revenues and expenses correctly for that period. So you might incur a cost in one financial year and pay for it in another financial year and you want to make sure you account for the expense in the year that it is incurred.Hope that hasn’t confused you more!

alright, I think I got it now. Next question- what happens to the cash asit is still on hand?

The cash stays with you in your bank account but shows up on your balance sheet as both an asset “cash in bank – $10 million” AND liability “unearned revenue – $10 million” – thus the double entry accounting.You can physically do whatever you want with the cash you have on hand but on your books, it constantly reminds you that the $10 million really belongs to someone else until you’ve delivered all your goods. So you should probably keep a good reserve to pay those money back in case the deal didn’t pan out as planned.

Got it. Much better

balance sheet is coming next week. stay tuned!

Thank you!

Fred, excellent post as always. Thank you.In thinking of the P&L (income statement) it is always important to know that it is part of a coherent whole and is only one chapter in the accounting books and records of any enterprise.In discussing the issue of cash v accrual accounting methodology — and let me say immediately that accrual is the only GAAP acceptable approach — it is comforting to know that there is an easy and predictable methodology to see where things are and intellectually compare what is accrued with what is paid.An automated accounting system, like QuikBooks which is simple as pie and you will love it, will also produce transaction journals.These transaction journals can include an accounts payable journal, an accounts receivable journal, a cash disbursements journal, a cash receipts journal and, of course, you can automate your check register in Quik Books.The reason I mention this is because you can take a quick look at your accounts payable journal and compare it to your cash disbursements journal and double-check it with your check register and you have a complete view of what you have accrued v what you have actually paid for.Sometimes cash managment is nothing more than making payments when you are able to make them. This quick comparision of what you owe v what you have paid for is really the fundamental difference between cash and accrual accounting.

The other reason to break out “cost of revenues” is that it will most likely increase with revenues whereas the other expenses may not. The non cost of revenues expenses are sometimes referred to as “overhead”. They are the costs of operating the business even if you have no revenue. They are also sometimes referred to as the “fixed costs” of the business. But in a startup, they are hardly fixed. These expenses, in Google’s categorization scheme, are R&D, sales and marketing, and general/admin. In layman’s terms, they are the costs of making the product, the costs of selling the product, and the cost of running the business.Wouldn’t it be nice if financial statements were more precise about the difference between fixed and variable costs? To anticipate discussion of the balance sheet, the ordering of balance sheet accounts by liquidity is a similar convention that is too fuzzy in practice to be reliable for anybody reading a single set of financial statement. Only multiple consecutive (or what you call “trended”) financial statements bring out the information needed to quantitatively understand the relative rates of change in the accounts.But does that need to be true? Now that accounting information is recorded digitally, all it takes is a simple algorithm to convert a stream of journal entries into additional — quantitative — information about the relative rates of change in various accounts.We don’t need to rely on the discretion of accountants anymore in distinguishing between fixed and variable costs, or between low and high liquidity balance sheet accounts. We could include an additional number with each account that indicates what percent of the total account value turned over within a given period.Notice how adding that single number would make some common types of accounting fraud (such as the much publicized Repo 105 fraud at Lehman) much more difficult. You can’t hide a massive liability from the balance sheets by moving it off and on between periods.Accounting rules are more in need of engineering than any other aspect of our financial system, on my view. All of the financial regulations, SarbOx, anything else we do to prevent fraud — these amount to nothing so long as the accounting rules are too complex for the ordinary investor to understand what the numbers mean.

so true

#avcmbam – I remember one thing that helped me really conceptualize P&Ls as opposed to just memorizing line items was the logic baked into the way they’re sequenced as you go from top to bottom. Found it useful to think of it as: ‘ok so I get paid; with that i first have to pay my suppliers and employees; then my lenders; then the IRS; and then whatever’s left is for the shareholders or is reinvested in the company.’Could even take a step further to account for cost of equity: http://www.investopedia.com…, but probably a bit much for the 101 course.

Nice mental map. Thanks for sharing ro

hi ro gupta become my nearer friend close

pls contact me now

Would it actually be recommended for startups to follow their P&L so religiously on a monthly basis or rather have some other parameters which are actually monitoring their performance and impact in the target market; as well as their cash flow of course. Debated further at http://bit.ly/bx0DQz

Both. You can’t manage by the p&l alone

I would go out on a limb and say that most business owners have no idea how to read a P/L statement.They use their accountants for one of two purposes. Either to tell them how much they owe in taxes or to create a set of financial statements so they can forward it on to their bank / lender or sugar daddy.I would also say that most accountants do not go the extra step, and offer ideas, or thoughts they had, when compiling the numbers. Countless of times after sharing an idea with an accountant, they will they say, Oh, I thought of that a couple of months ago when I was compiling your numbers.Controllers & CFO’s, who are suppose to be the in house accountants end up being glorified bookkeepers and when they have an idea it is rejected as coming from a “bean counter”.CEO’s should be forced to review their P&L & BS in detail every month. I would say, that CEO’s should be presented with a P&L that does not show “the bottom line” and a BS that does not show “net equity” and have them work though it line by line until they come up with the result. This should show them, how the details affect the bottom line. They will be amazed at the information contained in a detailed financial statement. CEO’s need to realize, the answer is not always to increase sales.Yoni Wagschal

Accrued expenses 😉