Employee Equity: Dilution

Last week I kicked off my MBA Mondays series on Employee Equity. Today I am going to talk about one of the most important things you need to understand about employee equity; it is likely to be diluted over time.

When you start a company, you and your founders own 100% of the company. That is usually in the form of founders stock. If you never raise any outside capital and you never give any stock away to employees or others, then you can keep all of that equity for yourself. It happens a lot in small businesses. But in high growth tech companies like the kind I work with, it is very rare to see the founders keep 100% of the business.

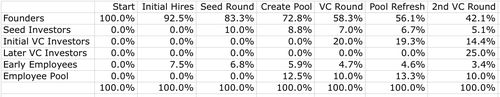

The typical dilution path for founders and other holders of employee equity goes like this:

1) Founders start company and own 100% of the business in founders stock

2) Founders issue 5-10% of the company to the early employees they hire. This can be done in options but is often done in the form of restricted stock. Sometimes they even use "founders stock" for these hires. Let's use 7.5% for our rolling dilution calculation. At this point the founders own 92.5% of the company and the employees own 7.5%.

3) A seed/angel round is done. These early investors acquire 5-20% of the business in return for supplying seed capital. Let' use 10% for our rolling dilution calcuation. Now the founders own 83.25% of the company (92.5% times 90%), the employees own 6.75% (7.5% times 90%), and the investors own 10%.

4) A venture round is done. The VCs negotiate for 20% of the company and require an option pool of 10% after the investment be established and put into the "pre money valuation". That means the dilution from the option pool is taken before the VC investment. There are two diluting events going on here. Let's walk through them both.

When the 10% option pool is set up, everyone is diluted 12.5% because the option pool has to be 10% after the investment so it is 12.5% before the investment. So the founders now own 72.8% (83.25% times 87.5%), the seed investors own 8.75% (10% times 87.5%), and the employees now own 18.4% (6.8% times 87.5% plus 12.5%).

When the VC investment closes, everyone is diluted 20%. So the founders now own 58.3% (72.8% times 80%), the seed investors own 7% (8.75% times 80%), the VCs own 20%, and the employees own 14.7% (18.4% times 80%). Of that 14.7%, the new pool represents 10%.

5) Another venture round is done with an option pool refresh to keep the option pool at 10%. See the spreadsheet below to see how the dilution works in this round (and all previous rounds). By the time that the second VC round is done, the founders have been diluted from 100% to 42.1%, the early employees have been diluted from 7.5% to 3.4%, and the seed investors have been diluted from 10% to 5.1%.

I've uploaded this spreadsheet to google docs so all of you can look at it and play with it. If anyone finds any errors in it, please let me know and I'll fix them.

This rolling dilution calculation is just an example. If you have diluted more than that, don't get upset. Most founders end up with less than 42% after rounds of financing and employee grants. The point of this exercise is not to lock down onto some magic formula. Every company will be different. It is simply to lay out how dilution works for everyone in the cap table.

Here is the bottom line. If you are the first shareholder, you will take the most dilution. The earlier you join and invest in the company, the more you will be diluted. Dilution is a fact of life as a shareholder in a startup. Even after the company becomes profitable and there is no more financing related dilution, you will get diluted by ongoing option pool refreshes and M&A activity.

When you are issued employee equity, be prepared for dilution. It is not a bad thing. It is a normal part of the value creation exercise that a startup is. But you need to understand it and be comfortable with it. I hope this post has helped with that.

Comments (Archived):

That scenario you described is playing almost like a book in our case. It’s one of the most straightforward aspects of a startup.Any guidelines on who you should/shouldn’t share the stock table with?

Rather have a small piece of a big-ass money pie than an entire pie of hot air…

Well then you sir certainly don’t like hot air! 🙂

What about autonomy and business direction?How much are you in the drivers seat of a company when you own only 10-15%.Mark Zuckerberg’s an uber product guy with 25%ish of Facebook, and an interesting case study in company leadership. How about Mark Pincus, he may have a similar percentage of Zynga.

What matters in that case isn’t % ownership, but who controls the board.

Ah, the mythical 12 headed hydra where one curries favor.

Ha! Sounds about right.I’m glad I only have one VC.

Ha! Sounds about right.I’m glad I only have one VC.

sorry – this, unfortrunately, is wrongits neither % ownership nor board controlrather its who controls the preferred stock and what rights does the preferred stock have?

Hey… I was just talking pie.You’ll have to ask Fred what the right trade-off is between size of pie andwhether you can eat it or shove it in someone’s face. 😉

Who doesn’t love pie?

communists.

had a business consultant once pitch me for undilutable stock as remuneration. told him to go jump…Curious if anyone’s seen those kind of agreements play out. Seems a pretty sweet deal if you can get someone to agree to it. (ongoing cap table calculations must be a nightmare)

When it is too good to be true, just have to walk away holding your nose tight.Those kinds of deals are made by fly by night operators.I wonder if Google founders ended up with a similar dilution path. If I am correct they got to hold on to 28% between the two of them.I also feel sometimes founders and other early employees hold out for more, and I think that is a greedy attitude as it is better to have a small share of a growing company than a large share of a stagnating company.

They are toxic and are ultimately unworkable. Stay very far away

They are toxic and are ultimately unworkable. Stay very far away

If you start a business – go through an angel round and two real venture rounds and still own 42% of the company – you are doing pretty well – and you have compensated your fellow employees through the option pool as well. All in the employees own 55% here. Pretty good.

Ten years ago this table would have looked very different. This isobtainable now. But you need to get traction early on and execute close toflawlessly to do it

What seemed most out of whack to me was the seed investors. Usually they want a much bigger share of the company in my experience.

have to disagree with fred here, at least by degrees — the spreadsheet he posits is a rare case, still, i think

As an employee: pay no attention to the absolute numbers of shares granted, only the percentage. Founders sometimes like to put crazy big numbers in offer letters by issuing a vast number of shares.Even if such a company is wildly successful, there will be a reverse split before IPO.

Having a large number of shares is almost a recruiting requirement in the Bay Area now. No matter how much you tell people to focus on percentage ownership – their emotional reaction is to focus on the absolute number of shares. I can’t count the number of times I have had this conversation. Me: We are going to offer you x numbers of shares which currently equates to x% of the company. Candidate: But my wife, girlfriend, 3rd cousin – got X shares from company x or Company X offered me X shares. Me: What percentage of the company is that? Candidate: I didn’t ask or They didn’t want to discuss that with me. Now admittedly you don’t see this much with people who have worked in start-ups before. But in about 12 years of recruiting folks at all levels for my startups – I have seen this mindset in 80% of the folks who have never done a startup before. Unless they came from banking or some other industry with a deep understanding of equity. Of course then you have to deal with unreasonable %age expectations – No Mr. Biz Dev candidate – you can’t have 20% of the company on a 1 year vest even if you did see John Doerr in your gym last year. For an exec I treat focusing on the total number as a disqualifier. But for ICs I will typically try and step them through the math, but many otherwise talented folks seem to be innumerate enough, that even if they get it intellectually, viscerally they are going to have a hard time focusing on the percentages and not the total number. Interesting observation from a recruiter friend. She has found that a pool of about 20 MM shares seems to be the number of shares you need to allocate to keep people happy with their number AND stick to reasonable percentages for particular positions when you are starting out.

Early employees seem to take a huge hit here. Let’s say you hire three people early on at the 7.5% total you posit. With dilution, etc., that’s 1% of the company by the time your shares vest four years out. And those four years come with reduced salaries and a ton of risk — if you work for, say, Wesabe for four years as a non-founding early employee, there’s no exit, no reputational gain outside of the entrepreneurial world, and potentially a reputational hit within it. That’s a bad thing, and I wonder if the upside is enough to make it acceptable.So let’s look at a good outcomes: * Mint’s sale to Intuit for $170MM. Ignore the further dilution from the C-round, and they walk away with $1.7MM. * Associated Content to Yahoo, $90MM. Again, a C-round. $900k each.And neither of these take into consideration the liquidation preference of investors. It seems like there should be horror stories of early employees of startups which had tiny exits, but honestly, I don’t recall seeing any. Why’s that?

You don’t see the stories because the alternative is working as a coder for HP or Dell for 4 years at $120K per year in salary and some benefits. End of 4 years you have taken home just under $500K – and you keep $350K of that after tax.Most of these exits – even if they are small – are better than the alternative.And in the meantime – people feel they are much more part of a team – they are doing meaningful work (to them) – hopefully in an area they love – and have much more chance of moving up in food chain the next time around.None of this is really available in a colossus – there, it is just a job.

+1

Yeah, but why not instead start a hobby which could have similarmarginal upside but allow you to keep your job?The potential grand slam exit for an early startup employee istypically overstated dramatically.

If someone likes working a BigCo job better because they can take less risk and be home early and have a hobby — more power to them. Not everyone needs to do the same things in life.Most people who work in startups, and in my experience almost all of those who succeed, don’t do it for the money (certainly not the salary), they do it because it they can “make a dent in the universe”, have a ton of fun, work their ass off on something they love which is solving a real problem, show up at work in flip-flops at 11 as long as they get stuff done, etc.The stock and the exits are scorekeeping and icing on the cake.

Spot on Dan… completely agree that the math for early employees is often entirely uninspiring. I think that 1% ownership is fair for employees 1-4, but employee 5-10 are looking at even less. I spent nearly four years on the management team of a successful venture-backed startup (came in around employee #10). We sold the business (doing ~$20M in revenue) to another private company that subsequently went public (Convio). The outcome for me sounds great on my resume and I wouldn’t trade the experience for anything, but it will net me a bit more than enough to pay off my graduate school loads. Certainly not a life changing monetary experience.

“Certainly not a life changing monetary experience.”Your life is not yet over (well I hope so). And it will turn out to be a life changing experience on many levels not just monetary. You made it to the pay window and you have drunk deeply from the elixir of life.One of the very best things that ever happened to me was getting screwed out of a $2MM payday. Not a subtle, delicate, complex matter — an old fashioned “I’m not going to pay you, go sue me” kind of matter. A real disillusionment and a great lesson.Best thing that every happened to me.I took a 4 month European vacation, got in the best physical shape of my life, fell more deeply in love with my wife and life, came home — tanned, rested and ready — and went into business for myself.You are now locked and loaded — poised — for great things. On the strength of your description and your avatar alone, I would buy stock in you right now, sight unseen.Go bite the ass off a bear. Figuratively speaking, mind you.

Forgot to say — guy who screwed me?He went broke in a huge way.Karma

Interesting how life – or karma – has a way of telling “you gorn and dun wrung there sunshine!” as it clearly did to the guy who screwed you JLM. My wife/biz partner closed a deal for a client that would have netted him a huge pay-day along with several years of very profitable renewable contract work for his business which, in turn, would have led to gaining further substantial business for him in due course. Subsequently, when we billed, he reneged on the deal and failed to pay her what she was due under contract. The entity that had placed the order with the client, upon learning what he had done, withdrew the order stating, amongst other factors, that they had made the deal in the first place based upon the expected good-faith and integrity of the client which they subsequently felt was revealed to be none-existent. Upon realizing his mistake, client calls to make a “dinner date” with my wife in attempt to make an alternate much reduced offer of compensation and have her renegotiate the deal for him but still refused to honor the original agreement. Our bill for services rendered was mere 1% chump change in comparison to what the client would have initially earned if he had honored his agreement. Some people just do not get it!

Of course he didThose who make money by taking from others don’t make good business peopleThose who make money by generating wealth for everyone are heroes On Oct 4, 2010 10:12 AM, “Disqus” <>

JLM – appreciate the reply and the kind words and I’ll keep it mind next time I’m in the market for capital ; ) I am entirely appreciative of the experience and definitely see it as transformative in ways outside of money (I went on to co-found another company and now am on the management team of yet another venture-backed company). All great life experiences. Definitely not arguing with anyone here who extols all of the other virtues of working in the early stage world as I love it… its the only world I know! That said, I just think people should go eyes wide open on the compensation side and understand what they are getting into.

In life, we never really get what we deserve, we get what we negotiate.You now know the secret and are armed and dangerous.Go to the Chester Karass Negotiating Seminar — life changing and worth it in automobile repairs alone. LOLMoney means nothing. When you stop focusing on it, you make a lot of it.Entrepreneurs get paid in a different currency.

Knowledge, reputation and satisfaction of seeing the impact of your handiwork are just a few of the extra-financial payoffs. What other forms of currency do entrepreneurs get paid with?

You will thereafter only be eating what YOU have killed, you will not eat another man’s bread and you will always know when the times comes that you CAN survive on your own wit and wisdom and go where few men have gone — the untracked wilderness of total independence.You will have the unbridled confidence of knowing when you and the bear came face to face, you bit the ass off the bear and the bear went home hungry and with a sore butt.Having done it once, regardless how many times you fail thereafter, you will know the taste of blood and you will be a killer.When you are lying alone in bed with only your own thoughts, you will smile knowingly because you banged the prom queen and her boyfriend never knew it.For the rest of time when that bitch fate looks your way, she will wink and blow you a kiss.And once having done it, you can never go back. And you will love it.

If anyone else had told me the positive outcome of an event would be biting a bears ass and sleeping with another man’s woman I’d call him crazy, but not you sir.You have a talent for metaphors.

A lot of people crumble under that experience. Finding a way to find that initiative in candidates would be a powerful thing for a startup.Thank you for sharing.

I think people undervalue non-monetary gains quite a lot. My guess with early employees that are judiciously hired and learn from experience is that they gain a lot of the same things that founders do: leadership skills. Very hard to teach in BigCo- which is why the work is considered rewarding in the first place.

We definitely undervalue the non-monetary aspects. But that’s a sharp, double-edged sword.

Most sharp things are worth checking into- you don’t chop vegetables except with a very sharp knife- it isn’t safe- why would you employ yourself in any other way?

Well said.You know one of the companies I started achieved an ok exit. Financially, f you took your money off the table it was great (he did), if you let it ride (I did) it sucked.The network that was built and the fun we had was INSANE. I guarantee if there is a tech company I have a hook into it from a former employee that I personally hired.He views it as one of the most fun times of his life (so do I). We had a company beach house with ISDN lines hooked up to the office in the early nineties. We worked from 6am to 10pm with a workout room and hit the beach starting noon on Friday and got back Monday morning, we worked hard partied harder. What a great time!Some people including his wife who was the third co-founder view it as a failure. What a damn shame. I can’t imagine trading the time for my fraternity brothers that spent the time on Wall Street and made a ton more than we did STFW. What path would I rather have traveled??? I know.

Of course, this IS what sells lottery tickets, no?

Ha!

I was thinking about moving up in the food chain, unless you’re on the ground floor of a big winner you may walk away with better experience at being a VP of engineering. If you really want to build companies, there’s no better opportunity to learn than founding. As an employee of a bigco (survived on layoff round) I can appreciate all the up side of a startup – fulfilling work that matters. I assume (perhaps in error) that working at a startup (not necessarily one you found, that’s a given) means it’s your one thing. From the outside looking in, no side projects grow into an independent venture unless you’re one of the founders. These guys seem to jump into new startups at will and still walk away with some equity.

And those early employees still earn salaries- probably not as much as with a big company but…

Unfortunately sometimes the ramifications go on longer than that. You take a pay cut to go to the startup, swing for the bleachers, but you fail. Ok, fine, dust yourself off and go on to the next thing.The next thing might include working for a big company for a while. The Big Company may graciously offer to match your salary from the startup. Wonderful.

A million bucks at the pay window for something you did not start or takesevere risk and financial hardship on is a great outcome On Oct 4, 2010 8:16 AM, “Disqus” <>

Amen.

Agreed, but I think a million bucks is a very generous estimate of what most of those early employees will walk away with.

In our portfolio, I believe at least a third of our investments will makethe early non founder employees millionairesEven on a risk adjusted basis, you want to be an early employee in one ofour portfolio companies

You don’t have to guess, no?What % of your many investments over the many years achieved this?

I’ve been too busy lately steveThis would take some work to compile

Nobody has ever gone broke taking a profit.

No doubt, but it’s also an incredibly unlikely outcome. It’s much more likely that you’ll end up spending four year working for a company no one has ever head of (and doesn’t even exist any more!) having made 25% less than what you’d make at a boring company. It’s also very likely that the company will have a success exit, insofar as the founder/investors are concerned, but you end up at break-even or thereabouts.I think the ramifications of this are larger than you’d expect.

Having been there and done just that – and it was anything but boring while it lasted – the ramifications are, after the disappointment has worn off, that its just another facet of life’s great panoply of experiences from which we pick ourselves up, dust ourselves down and start all over again a little wiser, a lot more experienced, much more mature and even more determined next time around.

Honestly, I’d say these early employees are lucky. I wouldn’t give non vesting, pre-financing stock to someone who’s going to be an employee and not full co-founder who I can trust to work their ass off and not bail after six months.

I wasn’t suggesting non-vesting, for what it’s worth.

Dan…your math/analysis is pretty good. I was an early employee of Associated Content with a promise of 2% founders equity at the time, post series B. A handful of employees who vested over 4 yrs probably cleared 900k. Most (like me w. only 2 yrs vested) got much less — but it is hardly life changing money in any case.On the other hand, I hardly regret working for AC. A very interesting company that changed the landscape of the content business. Working for a start-up is fun — even one that fails. I was paid very fairly even w/o the equity consideration — in most cases, if you are post series A, you can get paid at a market rate that is comparable to a non-startup salary.Early in my career I sold a start-up (accept.com) to Amazon as the founder– with around 3-4% of the company at exit. In both the AC case and the other one, the money never quite felt *real* — it was too sudden and too strange — like a night’s winnings in Vegas.Having failed a few times since– losing feels the same way…You take your chances, you gamble, sometimes your lose. Others may be able to internalize their start-up exits more rationally, but speaking for myself the “real” part was always the work, the people, and the vision. The money is all to hypothetical to get worked up over, either positively or negatively.

“Early in my career I sold a start-up (accept.com) to Amazon as the founder– with around 3-4%”I bet there’s a great story behind that one Andrew. Would love to hear it, got it blogged up anywhere?

I don’t know how long my confidentiality agreement on that one was supposed to last.

http://www.salon.com/techno…Here’s what one reporter made of it…

Got it.

This is great but you need to emphasise the other side – build in value at each round. Otherwise it looks more like washout rounds. Dilution of a much larger value at each round makes everyone happy! Also people leaving early lose most of their stock – but that is for next week. So important as many people hope to get shares, drop out and leave others to do the hard yards – but then don’t we all!

All good points. I hope to address all of them in the coming weeks

I think this the key underlying principle that Fred doesn’t address in this post- you’re not going through all those rounds unless the overall valuation is rising. I look forward to that post.I’ve been through a liquidation event where the options didn’t make me rich but the experience was priceless. You simply can’t understand how it works on both a business and a visceral level until you go through it. No regrets!

So true. Until you have been there it does not make sense. Such fun when it goes well; such despair is the flip side. It is not fair!!

All so true including that life is not fair: Life does not offer to be “fair” though and to expect “fair” is to be constantly confronting further disillusionment and living with unrealistic expectations.

Next weekI want to lay all of this out slowly so everyone can grok it

Excellent Post. This is exactly what i was looking for over the weekend to read up on. Thanks for that.

Thanks for the post. 🙂 all I can say is…42% after the B round? *swoon* I think I’m in love!Actually I do have one other question. It seems like the first handful of employees, who are probably getting single digit percentages in their grants, suffer dilution almost as bad as the founders but with a much smaller potential upside since they start at 1-5, not 100. At first blush it looks almost like the risk/reward tradeoff is worst for being employee #1. Founders will have huge equity. Later employees will come in with a lot less risk, more money in the pot for “grownup” salaries, and their shares are much less likely to be severely diluted. Do you have a take on that?

That’s a good question, I think a couple of things would make up for that: (i) although the first employees are getting only 1-5%, which is small in comparison to the founders, it is still a bigger %age grant than later employees in the same situation would get (in later stages, there are typically many more employees splitting up that available option pool, and it’s not uncommon to see option grants of 0.0025%, etc. to front line employees), (ii) the exercise price on the early options (if they are options) is lower, (in fact, they will be nominal if the company is a home run), whereas employees brought on at a later stage have exercise prices closer and closer to the value of the common stock at exit, so the net return per option will be less for later grants, and (iii) if the early stage employees are still around & valuable to the company through later rounds, they’ll often get refreshed, so they’ll be part of the later employee grants as well (same may be true for particularly valuable founders).So that, even with the observation you make, being in early is far, far better if the company continues to create value along the path to exit. I hope that makes some sense.

It does Ken, thanks.Plus for some early employees (I’m thinking of Nathan Marz Lead Engineer and first employee of BackType) it’s an amazing learning experience and a great way to build up a solid rep.

The term ‘dilution’ is probably one of the vaguest in finance. It means different things to different people.Some people take it simply to mean percentage ownership, whilst others regard it as value per share.The distinction is important. Your percentage ownership can go down, but the value of each share (and hence the value of your stake) can go up.I would argue that most ‘up rounds’ are not dilutive to early investors.

Brilliant observation. Keep score w/ $$$s not shares.Small slice, big pie >>> big slice, small pie.

I have a much finer appreciation for the process, thanks Fred.This paints the picture for the info I was guessing at in an earlier comment last Monday. Curious if this dilution turns into down rounds for early employees if they can cash out or buy back in.

Good stuff.Maybe it’s obvious, but I think you should explicitly mention the fact that, unless there’s a down round or a recap or something like that, each of these events, though it dilutes your _relative_ share of the company, should make you richer _absolutely_ since it increases the total value of the company.The founders (and early employees and seed investors) should welcome the dilution because their 42.1% is going to be worth a lot more money than the 100% they had at the start.You say of dilution “Well, that’s life.” But actually, if the startup moves forward, you should welcome it, because it means the startup is getting more valuable, so you’re getting richer (unless something fishy happens like a recap or something).

It’s definitely not obvious. I regularly give the dilution speech to founders of all shapes and sizes. I finally just wrote a blog post on it some time ago: http://rickcolosimo.com/200…

Great topic, great explanation, great thought provoking discussion.My following comments are directed to entrepreneurs and CEOs and Board members:You have hit on one of the things which I think is critical to the relationship between an employer and an employee — compensation.Small companies have a tendency to use overly simplistic approaches — they go right to the equity cookie jar — rather than a balanced approach of cash compensation, benefits, short term incentive comp and long term incentive comp.Because many companies do not have a lot of cash, they tend to trade the equity like it is dope — a guaranteed high and universally attractive to everybody. Employees have a tendency to think it always works and do not “risk adjust” their comp plan.Everybody would turn out a bit better — particularly founders and investors — if they would design a plan which does not rely so heavily on equity.Value the full cost of the ENTIRE comp package annually and make sure that you are weighting things in such a manner that the employees are getting what they indicate they want.The spreadsheet that Fred provides is perfect but it should be part of an overall analysis of your total comp cost both to run the company effectively and also to ensure the employee knows the value of comp package.I would like to draw particular attention to incentive comp — both short term and long term <<< they ARE different — performance hurdles. It is silly not to make incentive comp an “incentive” with specific, measurable, attainable, realistic and temporal constraints.If the value of the equity is dependent upon a level of performance — revenue, customer counts, profits, etc — make the incentives attainable when the performance is attained. Pay for play = pay for performance.I would also counsel particular attention to vesting periods and the ability to re-acquire an employees stock options or stock. I favor vesting periods which are consistent with the level of performance or are simply performance constrained. Again, make the rewards attainable, well, when the rewards are attained.Comp plans have to be thoughtful, just a notch more complex than getting a bunch of stock options and capable of aligning incentives, performance and value.Nobody goes to the pay window until everybody goes to the pay window.Last note, when presenting “value” spreadsheets over time, it is always useful to note the perceived value of a share and all the attendant liquidation preferences. Get it down to $$$.

“Nobody goes to the pay window until everybody goes to the pay window.”I think we can all agree that wide pay windows are desirable, as long as there’s enough bags of money to go around. *update* definition for enough bags of money is break even survival money plus the occasional guilty pleasureOff topic but related to wide pay windows:I was hashing out a startup idea this morning with many early employees, all working in unison for nothing more than ownership shares at first. Then growing into salaries as revenues kick up. Are founding team sizes restricted to a few because of leadership challenges? Requirements on early salaries? Or the need to slowly grow into a bigger company?

“make the incentives attainable when the performance is attained”So when benchmarks are reached?

Oui

As echoed elsewhere in the comments dilution is not always bad. It is very tough, sometimes, to explain to founders that 30% of a bigger pie is better than 40% of a smaller pie. If each fund raise is accretive then the $ slice gets bigger as the % slice gets smaller. In a similar way I have seen companies not want to reverse-split stock as they feel that their employees would feel worse with fewer shares. Another example of where logic and emotion are in conflict.

Sometimes the obvious needs re-stating for clarity.I once traded a guy college scholarships for his three sons for 5% of a deal. This was his idea, not mine. I tried to talk him out of it and even offered to loan him the money.In the short term, he was totally focused on the college costs and was prepared to sacrifice the long term upside for peace of mind.The 5% was worth about $7MM a few years later when the pay window cracked open.Funny thing is that to this day, he is still happy.

He valued liquidity and you gave it to him. It allowed him to focus on what was most important to him. The elements of a good deal is when both get what they need and neither feels hard done by.

Agreed and that is why comp plans have to be hand made to be most effective. I could detect a step up in this guy’s performance when HIS problem had been solved.BTW, the guy had worked for me in an enterprise and done very well.Then worked for two deals which both went under and were time consuming; and, was working for me in a new enterprise and did very well.He was not a huge believer in either the Tooth Fairly or equity at that time.So, you are completely correct — he got what HE believed in and what HE wanted. A great lesson.

Interesting, my definition of a fair deal is when both parties feel hard done by.I suppose it works like algebra: the deal is fair when emotions on both sides cancel each other out.

As an almost irrelevant aside — the going in returns amongst small business acquisitions today are almost obscene given the lack of liquidity in the small business arena.If you have a bit of cash lying about, it is possible to buy 50% + returns. There is no small business debt capital available in America.I signed a contract today to purchase a going concern which shows a 60%+ going in return and the ability to tack on another 5-10% through merger efficiencies. Of course, it is an all cash deal.I almost feel sorry for anybody who has to sell these days.

The phrase “cash is king” should be tattooed on entrepreneur’s foreheads.Many long-term viable businesses fail to make it through their first big cash crunch.Which means many visionaries are forced to sell their dreams for 10cents on the dollar.

Are you looking at these purchases as long term buy n holds or rather as an opportunity to consolidate some high return small businesses into a larger entity and a much larger exit?I was looking at doing something similar in Australia a few years back but the market valuations got out of hand very quickly as the property boom took over and everyone had easy access to money.

Reminds me off the Cisco guy whose new kitchen cost him millions in the stock options his wife made him sell to pay for it! before the metoric rise in their valuation!

This is a great read. Definitely something I should’ve read before watching The Social Network. There’s a huge disconnect between the real percentage Mark Zuckerberg owns in the movie and in real life and I wanted to know why he owns so little (~25%). FYI, the movie made the math easy for the general audience to comprehend and gave Zuckerberg 51%, thus implying majority of the company.

Haven’t seen the movie, but I think that Facebook has had many rounds. And in some of them the amount of money has been quite big because the company was burning money very fast. If investors bring a lot to the table (piles of cash) they should get away with a lot also (equity).

the first person to get a tattoo of JLM’s latest wisdom nugget gets super-props.”Nobody goes to the pay window until everybody goes to the pay window” – JLM October 2010

I like this other one of his from today:”In life, we never really get what we deserve, we get what we negotiate.” -JLM http://bit.ly/9sHtQ2

It does appear uninspiring for the employees. That being said, I think more attention needs to be paid to the value of the money coming in and what it, plus execution does to the value of the company. The old adage, 50% of something is better than 100% of nothing. If the early employees start with 10% of 500k then get diluted to 1% of 500M then they are doing OK. The key here is to watch and pay attention to the value of the company in relationship to money coming in and the value it creates. If done correctly, despite dilution, everyone should be making more. If not, somethings wrong and it’s time to think things through. I don’t think companies do enough to help people understand the impact to their shares during these events. Not just dilution, but the value of the share post money evaluation.

Fred’s posts and the comments that follow are the single best course imaginable on start-up finance and the start-up zeitgeist. This post is a great example. For years this kind of information was simply not available except in war stories which inevitably get embellished over time.Seriously, reading this blog over the past few years has been a real eye-opener. If you are doing a start-up it would be worthwhile to go back and start reading, including the comment stream. Better than that MBA- take the MBA money and fund yourself!

It’s as if you wrote this post just for me !Everything just gets clearer and clearer mondays after mondays =)

Would love to see typical option %’s given to initial 50 employees (and how these % ‘s differ for sr programmers, prod mgrs, designers, etc).

As a founder, your single bigest dilution source is more co-founders who may or may not be better added as employees. Early on it is really tempting to pad a founding team. When (not if) you pivot a niche skill co-founder is hard to get rid of, if they’re an employee it is much easier.Fred’s scenario with 2 co-founders is a very different outcome for the founding team than Fred’s scenario with 4 co-founders.

OR the industry moves towards loans. Dilution is only a “fact of life” with respect to equity investments. A debt Series B round by a bank produces zero dilution.AND let’s be clear that dilution is indeed a bad thing (for founders). It is certainly not part of the value creation. It’s a value transfer.

?? Dilution is great if it leads to an increase in value – ask the founders of Google and many other successful angel/VC funded companies, including my own minor success. You cannot blame lack of value creation on investors and employees which is why the founders win the most. If not, and value is static or goes down, it is a tough learning process. A debt series is not a round – a round involves dilution – it is normal trading which all companies try to do. Negative cash flow companies such as the ones in which Fred invests (at least in the early days) will not be able to raise debt unless there are personal or other guarantees. Dilution is great for the right companies in the right industries with the right entrepreneurs – served me very well and it was wonderful when everyone in the company did well when we exited. Good luck to them all. It is good to share and good to grow fast. Someone said that over 10,000 employees did well at Microsoft. How many in your company?

Unless you are pretty high up the food chain in an early stage start up I don’t think as an employee you should worry too much about the number or value of your options but focus on the overall package.Don’t be seduced by talk of the huge potential value that your options have in lieu of salary because chances are they are worth nothing.I’m not saying that as a founder/CEO you shouldn’t big up the options that you are offering of course, it’s just that from an employees perspective obtaining great experience and further opportunity is probably where you will derive most benefit from working in a VC backed start up.

Agree, but the problem is that those early employees are very near of the founders.Many people don’t care if the CEO of the huge company they work for earns a lot (or they care but they can’t compare their work with his directly because they are far away). But in a startup the founders are probably sharing that late night pizza with those early employees. They go through a lot of things together. So those employees feel they are as part of it as the founders. And they feel they deserve as much as them. That is not necessarily true (founders usually risked much more… and founded the company!), but sometimes perceptions are more important than the thruth.

The people with whom you struggle in the present are folks who you can re-assemble in subsequent enterprises in the future.I have had the luxury of working with some of the same guys in a number of subsequent deals. It is hugely rewarding and very, very efficient.I just can’t figure out how they age so much while I seem to hold static? LOL

Next week, maybe talk about what can happen to the share you own when the company is sold or merged with other company. What also you should do if you think the position you now won’t survive when the company is sold?

I am probably extremely naive in these matters, but how can someone reduce my share without my consent? If I am granted a 10% of the business, how can the owner of the other 90% come in and say, “guess what? you now own only 7% because I just made a deal and gave away your other 3%”?

You are not granted a 10% of a business, you are granted a 10% of the equity at a given time. If the equity increases and you keep the same amount of it in absolute terms, your percentage decreases. Those new investors bring money (or other assets), so the total equity is bigger.

Ok it took me a while to understand this too.Ignore the numbers for a momentsImagine you got a magic pizza pie. It is the world’s best tasting pizza pie. It normally can be cut into 8 pieces, like a standard pizza pie.Someone give’s you a slice of the magic pizza pie. Great. You chomp down, and it tastes, amazing.20 people show up because they heard you have an amazing pizza pie. Now, if this were a normal pizza pie, you would have to cut the slices thinner in order to share it, but because it is a magic pizza pie, it just expands and makes more slices of pizza, all the same size. Now everyone has a slice of amazing pizza.So great.As the baker, you get to take more pizza than average people who show up because you made the pizza. You want to show off the amazing pizza. The guy you hire to market, he gets some, but not as much.That’s equity. Each share is one thing. Dilution is making the pizza bigger, it doesn’t make any share less share like (or any of the slices less slice like). However, just like if you give out too much magical pizza, you might end up making the magic of equity all that much less magical, which is why spreading too much equity/pizza is a bad idea.As for percentages- yes this gets me too. Google is misbeheaving, there use to be a feature that would allow you to copy the exact same chart to your own google docs so you could fudge with the numbers. (That’s good). Most people forget that percentages are a kind of fraction, and it is much much easier to look at the numbers wonkily sideways and multiply fractions in your head because your gradeschool teacher probably drilled you more in fractions than percentages. (uhh Fred, this may be on your end, if you can set it up so I can copy it and play around with the chart in google docs….)When in doubt, write it on paper. I’ll admit to still doing that after all these years because it helps with recall. I’m human.

“Dilution is making the pizza bigger”. No. The increase in the value of the business between rounds makes the business more valuable (if all goes well) and your now smaller share (after the round and dilution) more valuable. If no increase in value, you end up with a smaller share which has a lower valuation and at worst are “washed out”. So the magic pizza has to grow in size between each rounds which is why you keeping adding the ingredients of more money and more people at each round – if all goes well. So each thinner slice of the much larger magic pizza is bigger and tastes so much better and one day you can sell it someone else who wants to eat the pizza or keep it until it grows and grows…..Guess Fred will cover in the weeks to come.

I was thinking the following:A slice is a slice is a slice, a share is a share is a share. Even thoughtechnically there is such thing as a reverse stock split. For the sake ofexplaining this, that makes life complicated, there is a reason schoolsexplain division after multiplication when it comes to fractions.technically you’re right, the slices would have to get “thinner” for thesake of argument because this is a magic pizza and not a business pizza(we’re not talking about why this happens) they’ll change shape, but themass will stay the same.I had a teacher once that said if you can’t explain it in such a way thatmakes sense to say a 4th grader, you are doing it in a too complicated way. The fractions side of percentages (where is all of this stuff going and whyis this being diluted) is explainable by magic pizza. They use pizza in myclassroom growing up (I miss that). The business side is another question.

Hopefully the mass of the whole pizza and the mass of your slice goes up and up and up even though the angle of the cut goes down and down and down…. Such fun to share an ever growing pizza but not so easy to keep cooking it which is why you need to keep adding the ingredients and mixing in the new money and new people… Not quite sure how you do this continuously with a pizza but guess you need to bake a new one at each dilution event and hopefully need a larger kitchen and larger pizza oven and good team work to keep the pizza del.icio.us and worth saving (oops! sorry for that).

You have to look at your stock agreement, but if you have typical employee stock options, you are not a shareholder and do not have rights as a shareholder, i.e., no vote. The voting shareholders decide by vote to increase shares and/or sell shares to investors.Employees with small % of shares rarely have a say in corporate transactions like share issuance or M&A, either because they have no vote, or the shareholders represented by the board already have a voting majority and can make those decisions without consulting non-BOD employees.

What about IPOs? I haven’t been involved in one, but I understand that you can sell existing shares or issue new ones –with the subsequent dilution–, or a combination of both. Is that right? As JLM would say… pay window!

Fred, this is a very nice piece and it has turn the light on on a very important issue. I bootstrapped my startup about 2yrs ago and we gained traction, this time around we want to scale so we approach an investor on convertible note funding (this is the best for them as they are yet to understand consumer internet business in my country, Nigeria) we about to close that deal now. But with our performance we are begining to get interest from VCs but we may not be able to close the deal for the next 2months (we just started talking). So, given that we need funding to scale, we want this loan badly so, getting this convertible note is inevitable for us. Going forward, if we get the funding, should we pay out the note from the fund or in another case if the investor now wish to convert before the due time, how best do we deal with the dilution.Also, our employees are more or less on a part-time bases, and we plan to give then options (since we aint paying them salary yet) how best do you deal with this kind of scenario, dilution, % etc?as an aside; disqus is hell when using opera mini on mobile, I found it very difficult to comment. always refreshing and losing already type comment. Guess you invested in the startup, you can tell them to look into it. tnx

I think this is great and I’d love to see (perhaps in forthcoming MBA mondays?) how dilution impacts employee compensation, and also the company’s market value.On the latter, especially interesting and educative, I believe, it would be to learn what’s a VC’s view of a “well-dilluted” company, and what could be possible dillution scenarios that some VCs may be reluctant to get into.

Good, clear explanation of this. Perhaps this would be a worthy topic for a separate MBA Mondays post, but the continued dilution due to options grants after a company becomes profitable (and even after it goes public) can be a cause of concern for equity investors. If a company needs to raise capital to become profitable, dilution is a legitimate price to pay for that. But should dilution be necessary to attract and retain employees once a company is profitable?With public companies, at least, this can drift into an agency conflict where senior managers liberally award themselves options grants.

I do not understand why if you are profitable you should get diluted by ongoing option pool refreshes? If the business is off the ground and in the black why give employees options and keep the pool supplied while diluting everyone else? It seems very strange at that point.

what’re the chances that tomorrow’s post is about Twitter?edit: probably under 50%, but still worth saying just in case I’m right. heh.

Great topic as usual. As a quick contribution you may like my work on equity dilution on http://www.startup-book.com… and many additional examples if you use the tag equity in my blog. My experience though is that founders are usually more diluted, founders keepign 10-20% of the company (but this maybe be an old model!) and it is not always due to the VCs only, but also the ESOP which may grow as high as 20, sometimes 30%. A critical issue I experienced also in the past is that the stock value of early employees has real value only if the company is really successful, not just nicely successful. Do you agree?

Dilution is pretty meaningless – from a practical point of view valuation growth is what matters.

Fred–great post, really helped me get a handle on dilution! Thought I’d add some additional formulas to steps 4 and 5 so readers can make the model dynamic for their own purposes:Step 4: To arrive at the 12.5% option pool, divide the target option pool by one minus the VC Round dilution>> 10%/(100%-20%)Step 5: Since the option pool is being increased, not diluted, add 3.3% to the existing 10% ownership per the formula below:> (target option pool ownership post VC 2nd Round divided by one minus 2nd Round VC dilution) minus target option pool ownership post VC 2nd Round>> (10%/(100%-25%))-10% = 3.3%Step 5: Then, instead of simply multiplying all non-option pool tranche holders by (100%-3.3%) like in the other steps (which would result in >100% total ownership), multiply the other tranches by one minus (3.3% divided by one minus the target ownership post VC 2nd Round). This is because the option pool is not being diluted during this ’round’.>> 100%-(3.3%/(100%-10%)) = 96.3%My points above are definitely more complicated than they’re worth, which is justifiability why you avoided the subtlety and hard-coded in the google doc.

How does this math work?” When the 10% option pool is set up, everyone is diluted 12.5% because the option pool has to be 10% after the investment so it is 12.5% before the investment. “

Today as part of my secondary business I met a guy from Texas who received 8% of a company in options that last ten years!! Ten years. That software company how has $10M in revenue and is profitable. Seeing this analysis — that market expectation is 42% ownership remaining after the founders have raised capital –reinforces my conception that Silicon Alley & Valley are very founder friendly, to the right founder. I wonder what this analysis looks like in other parts of the country. I wonder what this analysis would look like in 1991.

Again, how did this math work? Please help…”When the 10% option pool is set up, everyone is diluted 12.5% because the option pool has to be 10% after the investment so it is 12.5% before the investment” Thanks much in advance

Dilution in terms of ownership percentage is an incomplete analysis, because there is hopefully massive accretion in the value of the ownership stake as the business grows and good people join the team. The quality of the personnel brought to the team will help determine he value accretion, and great people cost a lot of money. That said, anybody who has been in charge of people knows that titles are a form of cheap equity!

Btw, I am always surprised how tax insensitive founders and employees are. The time to prepare for the massive 50% tax bite (which matches your dilution analysis, and on which there is no return whatsoever) is at the get-go, even though there is more complicated structures and more difficult explanations to employees.

Thanks! That was very helpful 🙂

My problem with employee dilution is I would see (and this is personal experience) the company get diluted, and then the favored upper executives get new grants on top of it while the staff that actually did the work got screwed. I’ve been told that it was because I was working for (quote) “douchbags”, but it is still all too common.

+1, this is EXACTLY right.

I’m with you, I’m having trouble understanding where this additional 2.5% is coming from…