Whither Netflix?

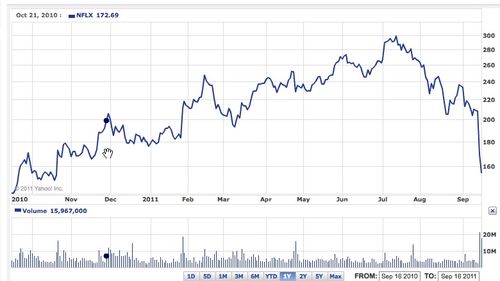

When you see a stock chart like this you have to wonder, what the hell is going on?

Netflix has been one of the hottest stocks out there, rising from $50/share in Feb 2010 to $300/share in July of 2011. That's six times your money in 18 months. And now the stock has given back well over half of those gains in two months and that freefall in the past week seems particularly scary.

But as Dan Frommer points out in this excellent post on Splatf, the street may be overreacting to Netflix's downward guidance. Netflix has pulled off one of the most amazing customer transitions I've seen. They used a dominant position in the physical distribution of DVDs to build a dominant position in the streaming business. That's damn hard to do and it is something you rarely see because it is difficult for most companies to cannibalize a highly profitable franchise.

But that transition isn't always easy and right now, consumers are abandoning DVDs more quickly than they are adopting streaming. And Netflix' recent price increases haven't helped.

But let's go back to Dan's post. Look at this slide:

Netflix told the street that they are now expecting 1mm less subscribers by the end of this year. That's a big miss. But as Dan points out, 80% of that miss is coming from the DVD side of the house. By the end of this year, if the current guidance is correct, Netflix will have 21.8mm streaming customers. That's a huge customer base for the next important film and TV distribution format.

Netflix will produce about $500mm a year of EBTIDA based on a "back of the envelope" calculation I did using Google Finance. With a market cap that is now down to about $8bn, the stock now trades at 16xEBITDA. That's a lot better than 32xEBITDA where it was two months ago.

I don't own Netflix. I don't own any public stocks in my own account these days and haven't since I closed out positions I bought (and blogged about) during the market meltdown in 2008. I do have some managed models on Covestor and some hedge fund interests. They may own Netflix, but I'm not aware of it and if they do, my exposure to Netflix would be minimal. I am not going to go out and buy Netflix after writing this post.

But I do think what we are witnessing here is the speculative forces coming out of a stock in reaction to some bad news. My instinct is that Netflix is still the company to beat in premium streaming video and that they are building a killer franchise in the next important distribution system for film and television shows. And thanks to some excellent analysis by Dan, we can see why that is so.

Comments (Archived):

in the casino known as the stock market, run by algorithms, a company’s fundamentals have almost nothing to do with stock price …

when that is true, either on the upside or the downside, there is opportunity to make money

Do you think there isn’t enough value investing left in the market?

I probably own Netflix in my mutual funds since mutual fund managers seem to lose their minds when they get my money, so I’m going to inherit all your disclaimers. Though anyone who would follow *my* stock advice is clearly nuts.I will say that I am a subscriber to Netflix, Hulu, Pandora, Spotify, etc.. and I worry about all of them. Because they middleman the content but don’t own it. They don’t even really own me. If Netflix/Hulu don’t have the show I want to watch, I just go to USA.com (sadly, I am addicted to second tier comedy/action/drama shows with unknown actors – I think of them as startups if it helps.)If I could forego the subscription fees and easily use network/indy_cable stuff on my TV, I would. I’d much rather have a subscription to TCM than netflix. -XC

i am a customer of many of those services too. i like them. they make my life easier. i don’t want to work to consume content. i just want to search and watch

Completely agree. What I see happening is that the content owners are getting smarter about slicing/dicing availability to maximize their revenue, which is restricting my ability to just go to one place and watch stuff.So now I have to go to various websites or wait a few months to watch a show. Bleh. Soon I’ll have a dozen subscriptions to watch what I want – it’ll be like an a-la-carte cable TV bill. And I don’t even watch much TV or very often compared to the rest of my family. The gyrations they have to go through….-XC

It may be long term hurting them – there is always someone who pushes out a torrent as soon as a tv show airs. It makes these other services less valuable if you need to watch something right now

This was going to be my question – you don’t own Netflix stock, but do you use the service? What bothers me most about their price hike is that their streaming library is very limited – so I need other options anyway, which doesn’t make the price hike 60%, but more like 200% when you add in all the other services I need to get *just* streaming of content. If you add in the physical DVD service (which we are still using for now because you just can’t get a lot of current content via streaming), then it’s even more.I’m seriously considering dropping Netflix altogether and going with Amazon + Redbox – we just don’t have time to watch that many movies, so streaming Amazon and hitting up the local redbox for $1 DVD’s when we can’t find what we want via streaming would do… it’s not as convenient as I’d like, but what Netflix is showing now is not nearly adequate enough, and I don’t see them getting there in the next 12 months.

yeah, the price hike was premature it seems

It was a folly of errors, Fred. First they introduced a new “1 disc plus streaming option” that a lot of people took them up on (myself included) that effectively lowered your price if you gave a bias to being a streaming customer. But then they separated the services and brought a price hike that was higher than what it was before they lowered it. They artificially made the delta more extreme and it showed a lack of direction and decisiveness that made people feel manipulated and undervalued. Now breaking streaming from DVD into separate companies, in my view, is the beginning of the end if they stay on this course.

How many movies/tv shows would you need to see for it to be worth it for you to come back

Not sure – and this is entirely unscientific, but typically a day in our household goes like “hey we finally have 2 hours together as a family to chill out – let’s watch a movie… what do you want to watch?” And probably 80% of the time, what we want is not available on Netflix streaming. So, we’ll add it to our DVD queue (which grows and never shrinks because we hardly ever watch DVD’s anymore!), and then “settle” for something else. I’ve been checking out Amazon videos, most of what we have been wishing for is available there, which led me to my Amazon + Redbox scenario – we haven’t tried it yet though.One other note – our movie desires range from oldies, to stuff that was popular when I was a kid (we all watched Terminator together last weekend, it was a blast), and current stuff. So it’s not all one genre….

I’m the same. I see this as a managing the catalog effectively issue. We’re not sinking the money into making streaming worthwhile when it comes to catalog management (especially depending on the variances of value of each part of the catalog)

exactly this re netflix: a tiny percentage of the dvd queue items for 8yo are avail in streamingtalk about the longtail

I’ve seen a lot of my friends go to Redbox since the Netflix price hikes were announced.Just a data point.

I find myself using Clicker.com more and more these day. I wish I could just search Netflix but they are still missing a lot of content.

copyright violation posts to youtube serve a lot of that market; not avail on streaming on netflix … faster than ordering the dvd

You raise the big question.Distribution isn’t a lock on anything over time. No-one owns us except by choice. Thank you to the internet!But, either the world is a coherent, self managed, interconnection of niches or content brands (like HBO) and/or there is value in the aggregator and we are happy to pay for ease and access and curation.Right now, for me (like you it seems) it’s a hybird aggregator model. My sense is that this will be status quo for the next wave.

In a streaming model, we don’t own anything. How do you measure the cost of giving someone potential access to what they don’t use?

Not sure I understand this Shana.

We don’t own the catalog. Netflix and the media companies do. It is expensive to write all these programs to store the catalog online, search through it, personalize, especially when there is tons of material I am never (and lots of other people) will never watch.What is the cost of creating such a system

Don’t know about cost, but there is a lot of value in curation, access and ease of use. I’ll be glad to pay for those forever.

And remember why Reid started this business in this first place – he had a recommendation algorithm that needed a business model. That engine has provided a great deal of value to me and mine over then years. Can producers offer that value across content they didnt create and don’t control? Aggregators will have to.

@MarilynCraig:disqus Does it hold enough value over the long term that it can’t be replicated at the price level you currently are paying for? Are there enough people who agree with you long term to cover the cost? Right now the answer is yes, but long term….

I think she means what value is there, that you readily have available a large database of whatever (movies in this case)? The value at one service compared to another I guess?The value potential has to really come if one provider has a better deal than others and has the same, which therefore potentially gets passed onto the consumer in their fees (because assumingly they can be charged less).But won’t content owners keep giving good deals to others? It just means more money – the only way to feel safe / secure is that they a) give you exclusive rights, or b) everyone licensed is at minimum charged what you’re charged. And how the content owners distribute and charge for the content would matter too.

Thnx. A bit dense today.Writing a post about a Jura Trousseau from last nite and following this string is an exercise in mental diversity.

i’m trying to do a prezi on the fragmentation of online marketing and i’m having the same problemhttp://prezi.com/omgasr4l9m…i’ve only got one slide done!

Not only is there no cost to this, it’s a benefit. The psychological benefit in a consumer’s mind of having access to unlimited X, even if they only use X-2, is worth way more than paying for the increased amount of X to ensure you have adequate resources to pay for the possible usage of the service. I’d guess by a rather large factor as well.In other words, the increased bandwidth costs to serve the increased userbase brought on by offering unlimited access is more than offset by the increased subscription revenue generated by those who barely use the service but pay full price.

That’s not netflix’s prerogative though. That’s the ISPs

access vs ownership: spotify

It should work as an aggregator, if they are the place for producers to flank the death dance of current PPv channel.

In my opinion, Netflix is still like a startup, while they may have figured out what seems like a great service offering they still need to figure out better ways to monetize it better. They maybe at the top but its one of its kind with no direct competing service yet. I think the market is overreacting given that Netflix would still be cheaper compared to DVD, on-demand, cable.

Dan says that Netflix needs to convince Hollywood to add the big titles. Netflix’ recommendation engine has actually changed my viewing pattern away from block buster titles that thrive on stars and big budget advertising to the long tail of movies and documentaries.But maybe that’s me, and not the other 22m viewers.

Yep — Saw a doc on origami that was fantastic i wouldn’t have otherwise seen and watched all episodes of MadMen and Damages. Problem is it’s just not enough and I still want to see the blockbusters (which i would personally be willing to pay more for)

You probably right, long tail is not enough. Still I encourage you, try foreign language films.

I’ve been talking about this with a lot of people lately.Blockbuster went into receivership in Canada so we collectively have little choice but to figure out a streaming solution. Here’s the problem – the solutions aren’t ready for us yet. – Sure we have Netflix but choice is a joke. (i can only watch so many docs each week) and cable co throttles fer sure- I tried the Sony service through our BlueRay player which took forever to set up only to have it crash in the middle- Cable Co. PPV service sucks (always crashes)- Connecting my computer to the TV is fine but iTunes downloads not streams (you have 3 hrs to download X)- No one i know who has Apple TV loves it- Illegal streaming quality sucks so that’s a no for us (we love high def for a reason) === I WANT MY LOCAL VIDEO STORE BACK! Company that solves this first – easy, great UX, streams without crashing will win huge

I hear you. We’re in the same boat here. Also, high bandwidth plans in Canada still suck.

Vote me for Prime Minister in future and I’ll make telecommunications fixed cost and transfer the cost of jobs to something more useful than tech support, such as preventative/proactive healthcare jobs…

Can’t speak to the Canadian experience, can’t say that all is perfect, can’t say that anything connected to the internet is fault free, but…as a movie aficionado, life is a dream compared to what it was.Video stores be gone 😉 I have one and it is the internet. Remember when the only way to buy a book was the bookstore or find something out, the library. Oy!Growing pains like getting in shape has stuff that hurts. I’ll take it.Leigh–3 hours to download something on iTunes through or not Apple TV for a rental. That’s your connection.

get the highest speed avail so must be throttling from the Cable co….Where do you end up getting your content from? (of course service prob. not avail to us but thought i’d ask 🙂

Realize I was not sensitive to my friends north of the 49th parallel. Sorry.I use most all of the content services and still play around with both Apple TV and my Boxee box as conduits. I’m a bit of a geek and used to blog on this area.But even with all this, I still get around one DVD through Netflix a week. Be glad when I don’t need to do that but happy that I can get most of what I want.

but you like Apple TV. May have to go there. I already give Apple so much money I hate to give them more. Just wait until Apple comes out with an actual TV. Then i’m in trouble.

Apple understands the mass market. You need to decide if that is you. They defined the second screen experience to date pretty much.Re: the advantage to them and the benefit to the consumer of owning the big chunk of glass in our living rooms, I don’t know.(But I’m a Boxee fan from way back and they still get social in this segment better than anyone.)

Apple 3D – People will buy it. Apple will know how to make people want it.

Agree. Check your connection….apple tv for me: movie playing in 3 minutes

I hope video stores always exist. They’re a lovely part of culture.Sure, if you have a wife/girlfriend/partner and a really busy life then video from the internet is nice. But ever done dinner and a movie, or dinner and rent a movie and head on back to home to cuddle up on couch and watch? Yes yes, you could still do the dinner and a Netflix movie.. but browsing can be fun.We really need to prevent these social locations from disappearing including the bookstore.Edit: This is going to turn into a blog post for me.. so checkout http://mattamyers.tumblr.com over the next day (maybe two? It’s Sunday – gimme a break!)

Agreed. I just think maybe they shouldn’t be storing the media. Maybe they should have scannable cards, which you can credit back to your computer.

That feels a bit silly but I understand what you mean. The formats of them will need to change a bit.I wrongly assumed at one point that Blockbuster video was going to do at least something similar to the ideas I had regarding adapting to online competition – but they definitely didn’t do anything at all.

they might still be in business if they did. they sidelined themselves.

Hmmm….Don’t agree that I can’t get cosy (or don’t) over a streamed movie at home. Video stores are gone and my enjoyment through easy access grows as choices become greater.But as someone who grew up on vinyl music and my dad had an antiquarian book biz on the side, I understand what you are saying.I jump into shops that sell old vinyl on impulse and browse the handful of specialty book shops in NYC but this is more about a sensitivity to the format and presentation. I don’t feel that way about movies. And I had massive collections of video disks and DVDs and happy to have them gone.But that’s just me. Each to their own.

Hm. I don’t think I outright said it’s not possible to get cosy streaming a movie at home – I guess I’m just trying to hold onto the nostalgia of going to a movie store with a date and selecting a movie.

Of course 😉

maybe better video/dvd stores, highly curated, niche/special interest.higher end and niche seems to be the future of print, the new vinyl; maybe video/dvd too

i believe that your experience in canada is worse than what we experience in the US. that sucks and should be fixed

Telco’s & Cable Co’s suck in Canada. It goes downhill from there. They are still more interested in milking users rather than providing value for service.

That is so true it hurts!

Kingston, where I live, has Classic Video. Amazing little place. I believe they hold the record for #2 most DVDs in Canada for a video store? They’re a fairly small location – just compact. They don’t have a billion copies of everything either. Maybe you’ve been before?

No – haven’t been to Kingston in a while but i have a lot of friends who live there – sounds like the Video store i worked at in high school – videophile. We were the first video store that i knew of who had the electronic check out system. I used to have weekly themes – Bette Davis for instance watching every one of her movies – and then slowly became her to the customers as the week went on giving them the ol’ bug eyes…..hum…maybe i’m just being sentimental about video stores!~

Sentimental – Me too.. I have fond memories of them. I think everyone in the future should be able to have fond memories of them.

Don’t you have $1.49 DVD vending machine @ your local Safeway?

omg i’m feeling like i live in a third world country! no Safeway and no vending machine!

Leigh…just about every convenience store in Toronto can rent you a DVD movie for $4-5. And their selections aren’t bad.

no we watch A LOT of movies William – it’s the thing with having an under 3 yr old bc we rarely go out and never watch movies in the theatre – so stores wouldn’t have enough selection. Probably some of the downtown niche stores would work – the one in Kensington but I work too much so don’t have time to make the stop between work and home…..

You know about http://www.zip.ca ? Mail + Kiosks + Streaming. I’m going to give them a shot.

If you go downtown check out these guys, they have a great selection of movie that’ll make your stop worthwhile http://www.baystreetvideo.com/. Btw, a note on Netflix in Canada, there are a lot of good movies that you get to stream in Canada that are available on DVD-only in the States. This is one http://www.imdb.com/title/t…

Convenience stores don’t have much ambience to them…

Time to move to Alberta – couldn’t resist!

Soon to have a big client in Calgary. I”m sure i’ll be there often. Can’t wait for Calgary in December!

Thank God we have no Safeway. Loblaws is enough here. (Safeway is in BC). What do you get to rent for $1.49? Planet of Apes when it first came out?

Geared to families. Don’t use it personally, ( we don’t own a working DVD player – all iPAd & DVr) a neighbour swears by it.

Go to usvideo.ca and sign up for $5/month.Congrats! You now have access to the world’s streaming library. Including US Netflix, Hulu, BBC iPlayer, etc.And if you’re any bit technical (sounds like you are) head over to bintube.com and sign up for $11/month package. That lets you access newsgroups and their client is absolutely phenomenal – it allows streaming of video while downloading it. In fact I can get speeds so fast that I can stream Blu-Ray quality 1080p video near instantly.Obviously bandwidth is a concern so make sure you’re not on Rogers and move to Teksavvy for no bandwidth caps.There you go. For under about $70/month you now have access to literally every piece of media under the sun, in essentially instant OnDemand.

These are great links Omar! Thanks for sharing. So, the price of Internet freedom in Canada is $5/month. Not a bad deal, but still would have liked it to be free if it wasn’t from the legal gatekeepers.

Until they get shutdown by said legal gatekeepers..

I’ve been running it for over 4 months now. Because it’s a paid service they have a lot of incentive to keep it running. So when someone closes a loophole usvideo has it fixed within a day or so.

Not sure what fix can be applied to a judge giving authorities power to shutter down.

usvideo.ca re-directs to http://www.unblock-us.com/ . Is that right?

Yup, same company.

ME, GRIMLOCK, HAS APPLE TV.YOU KNOW GRIMLOCK.GRIMLOCK LOVES APPLE TV.

Hey GRIMLOCK!I just bought myself a nifty new #NOEAT list t-shirt. Can’t wait for it to arrive.You’re a legend my friend.-Robert

i have this grimlock t-shirt. i wore it for the first time this weekend http://fredwilson.vc/post/9…

IT BEST SHIRT ENDORSEMENT EVER!SHOULD BE UNIFORM FOR ALL VCS.

i hope VCs never understand itotherwise i’ll have competition

HOORAY!IF SHIRTS WORK OUT, DO REAL PRINT RUN, SELL HIGHER QUALITY AT REASONABLE PRICE.ZAZZLE JUST MVC TO PROVE MARKET.

I think I am naming this post: The price of transition.watching netflix is like watching a media company detante. They know they need netflix to stem the blood loss to their media portfolios from torrenting. (same goes with pandora, and spotify, and itunes). They know that parts of the distribution costs are now taken out of the equitation, so that they save money.At the same time, because distribution costs drop while the price of making media remains somewhat the same (if not a bit more expensive once we disinclude inflation and hedonics), pricing costs for an individual piece of media seems to be difficult to do (how many people watch citizen kane a month? does that make it less valuable or more valuable than the most recent disney flick?). New school ad buying only makes the catalog more complicated to value. (if I show my low impression thing with a high cost ad, because despite low impressions, it has a high quality audience, what does that mean for its worth? Should I make more media things like that, or should I try to gather an audience, even if the ad I get with the new audience won’t be worth as much)So everyone sits in a dark smokey rooms and discusses while not doing enough to bring media into the future.Meanwhile, its coming. Pro Publica just won the Pulitzer, you know….

Your comment reminds me of the definition of disruption as “Making what used to cost $10, 10X cheaper”. (paraphrase)

Helping the big kids get more lunch money is easy.Stealing the big kids lunch money………The rubber is hitting the road for Netflix. Will the studios decide that they. Can afford to tick off their traditional media distributors? That’s the volatility factor here.And it’s a fair doubting point, IMO.

So was detante. The Soviet Union did fall, though I am sitting here today wondering if the process weakened us.It depends on how the traditional media distributors behave. They’re giving wild signals (apps on one hand, blocking stuff on the other). This is a big question for me, what is supposed to happen next?

They are dying dinosaurs. They will stagger & veer. Another volatility factor.Hulu – who seem fantastically managed – has the same macro issue. They are dancing w dying dinosaurs ( networks ).

Very well written. It is a matter of control… or maybe disrupting what is viewed.

NFLX biggest issue for me right now is content. There are some really good things (Mad Men, the plethora of docs) but there is a real lack of premium content. I would, and I think most folks would, pay extra for first release content. Therein lies the problem. Hollywood is so flaky it is next to impossible to lock up that content so NFLX lives in eternal limbo. Unless the studios were to start a service, I don’t know that anyone will come up with the perfect solution. Content remains king.

Have to wonder if the market knows something we don’t. Netflix took a fairly drastic action in changing their pricing structure for the long term health of the company given the rapid switch from DVD to streaming. That it resulted in a cut to projected subscribers is hardly unexpected. To have such a downward slide, concerns me that possibly streaming licensing is getting more difficult and more expensive than anyone anticipated. Really that is what Netflix comes down to. If they can secure those rights at costs that allow them to maintain their prices, they become a blue chip internet media company. But if those licenses start running away from them, they could see real trouble.

hmm you may be onto something steveif licensing costs go way up, then ebitda won’t be $500mm and growing but i’m not sure the film studios can hold out forever

Fred, I really hope you’re right re: the film studios.What worries me for netflix is offering starz 10x the fee as their last contract and starz turning it down.

Starz will regret not taking that deal. They are a middleman. Netflix will eventually make its deals directly with studios.

STARS MAKES OWN SERIES TOO. NOT ALWAYS THE MIDDLE MAN.

STUDIOS NOT HOLDING OUT. STUDIOS CREATING COMPETING PRODUCTS.IDEA IS NOT GO TO NETFLIX. GO TO HBO, STARZ, TIME WARNER, ETC. PAY EACH SUBSCRIPTION FEE TO STREAM MOVIES.THAT BAD FOR CONSUMER, BUT VERY GOOD FOR STUDIOS.

I love you fake grimlock

I’m his adopted son.. and proud of it!

And your mother would be?

@donnawhite:disqus HIM MOTHER? ME NOT SAYING NOTHING, NO PROOF, AND HER SWEAR SHE BURN NEGATIVES!

@FakeGrimlock:disqus In that case, I’m glad he inherited your looks.

ME LOVE ME TOO.

As usual, you nailed it @FAKEGRIMLOCK:disqus. That being said, if NetFlix was smart, they’d play their role as a hub to the maximum and broker those distinct relationships as add-ons to a base subscription model.That was the corner cable operators turned eons ago and I can’t believe NETFLIX doesn’t see it.

EVERYONE THINK THEM CAN DO WITHOUT AGGREGATOR, FORCE BAZAAR MODEL ON CONSUMERS INSTEAD OF BUFFET.BUT CONSUMERS WANT BUFFET. US SEE IF CONTENT COMPANIES FAIL FAST ENOUGH TO REALIZE THIS IN TIME.

that’s my bet with boxee. that you’ll need a service between the content and the device to aggregate. of course apple and google understand that opportunity as well.

Hence the MMI purchase by google?

EVERYONE UNDERSTAND THIS OPPORTUNITY. ALL PLANNING ON CUTTING OWN DEALS, FORCE CONSUMERS TO GET SEPARATE SUBSCRIPTIONS.HBO ALREADY DO, EVERYONE READY FOR CUT SLICE OF PIE FROM CONSUMER’S WALLET.

i don’t understand why they don’t do a starz deal that is licensed per subscriber.the original starz deal was a flat rate and that worked out great for netflix because they had huge subscriber growth over the term of the deal. now starz seems to be holding out on negotiating a new flat rate because who knows how many subscribers netflix will have in the future.seems like a per subscriber deal would align the interests better and its more like how cable channels are licensed anyway

I was bullish on NETFLIX until Sunday night when Reed Hastings put out the announce that they are breaking the company up into two business units and the physical DVD operation will re-branded “Qwikster.”I thought it was a joke at first.This is a bonehead move so many ways over… not the least of which is they will no longer be the one-stop-shop they used to be. Each library is incomplete on its own. Their only value in the short term is having both libraries combined. Plus in terms of community, all search, queues, reviews/recommendations, ratings, etc. are no longer going to be integrated. THAT’s why Wall Street is suddenly so bearish on NETFLIX.This is positively self-destructive.

Smells like panic.

Netflix/Qwikster or Wall Street?

Netflix. I think they’ve confused their value proposition (range and quality of content) with the method of delivery.

Wonder what you think of Mark Suster’s post on this?http://bit.ly/ogOvAoMy comment went into the black hole of @disqus:disqus which probably matters very little in the scheme of things, but basically, I think Mark is onto something.Hey, do you know Mark given that you are in the same general neighborhood?

mark is awesome

You should know.BTW, I’m thinking it’s uncanny the timing of your post on Netflix and his almost immediate well-thought-out, lengthy response to the announcement. Hmmm…

Yeah, they’re swimming with sharks for sure.They depend on highly oligopolistic content providers upstream for content.They depend on monopoly ISPs downstream to distribute it.They face potential competitors like Amazon, Hulu, Google, Blockbuster/Dish streaming.None of those are particularly averse to taking full advantage of their market position.Insider purchases 0, sales > $100m.Great service, not necessarily a great business long term.

They have increased the price of DVD subscribers and still have ppl opting for that service. The streaming customers drop can be attributed to a knee jerk reaction, it should increase in the coming months. At the end of the day they will book a higher net profit. Shouldn’t you be advising your readers to buy netflix?

i don’t want to advise anyone on buying public stocks.

Subtle?

The stock price drop reflects the reality of uncertainties around Netflix’s model as it stands today. Netflix will need some kind of strategic partnership or acquisition to assure their growth. They were brave to dive first into the streaming business, and therefore got the first arrow of an industry segment that is changing rapidly. I believe that users want to stream more than just movies to their TVs, smartphones and PCs, so why don’t they add other products, for example? There are other friction elements between them and users, namely the ISP’s/Tel Co’s and/or cable Co’s that provide the Internet service to the homes. They are not making things easier. Plus, serious competition from Amazon+Redbox, Coinstar and DishNetwork getting into it. Motley Fool put it well “The rub here is that no streaming service will ever have access to everything that’s available on disc, something that became perfectly clear when Starz revealed two weeks ago that it would not be renewing its Netflix deal.” And I’ve seen headlines alluding that Netflix risks being the next RIM…ouch.

i don’t think netflix suffers from what RIMM suffers fromin fact, they are taking almost exact opposite approaches to the market

I was going by this where some good points were made: Is Netflix the Next Research in Motion?http://wallstcheatsheet.com…But I agree that Netflix chances of changing and adapting are much higher that the complacency we have seen with RIM.

I’m still wondering why Netflix and other streaming services aren’t pushing harder their international expansion… For a company valued this high and not even operating worldwide yet it’s still quite impressive.I’m guessing the stock would be less subject to what’s currently happening in the US to Netflix if they already had a clear international strategy (I mean consumer readable as in: coming to France in 3months for instance).Another bigger step back than the licensing deals is the data cap issue with ISPs. It’s by far the number one problem for netflix imo…

They launched in Brazil in Sept. with plans to expand to 43 countries throughout South America.

well no signs of netflix coming to France anytime soon sadly =(then if even that doesn’t help it, I must say I’m clueless…

You have great cafes though!!

Where we rebuild the world everyday sipping a glass of wine =)Edit: not sure you’ll get the expression, but we have a saying here: “refaire le monde” which is like a conversation talking about everything and nothing about very various subjects that end up in a very lenghty conversation hence the world part. The litteral translation is “to re-do the world.”

International expansion is probably not very cost and time efficient – they would have to negotiate content rights for each country individually, and given the power dynamics of rights holders in each geography that could prove problematic

US movies sell well all over the world sometimes doing better outside the US.

yeah, but the licensing is a nightmare, an MGM movie in the US might be distributed by europacorp here for instance, meaning you’d had to renegotiate anyway.It would help a great deal if all forms of license and copyrights were dealt in a open data foundation/NGO worldwide.

Agreed, and in each country, content rights holders of each source and Netflix may have different economic incentives – e.g. in countries without unlimited data plans (like Australia), a Netflix like service is not as viable, which means that its harder to meet rights holders’s income expectations.

That is entirely due to the complex world of rights clearing. Unfortunately, the old rules of rights organizations are prohibitive to launching a truly global service.The only way to do it right now is to run effectively separate regional “stores” like Apple does with iTunes for each distinct domicile of rights.Plus, in the case of Netflix, they have their hands full just trying to stock their virtual shelves with media rights clearing just to hold the edge they’ve historically enjoyed in their home market of the USA.Your vision is the right vision but the intellectual property process behind the scenes is woefully behind the times.

Could not agree more. What is the saying? When others are fearful?We no longer have over the air or satellite, survive only on streaming. And we live in a rural area so the kids and the grown ups fight over bandwidth. (Who is streaming? Knock it off, Mom is trying to watch something!)Netflix is built into every device we have – Roku, Xbox and Apple TV. Yes, choice is not great, but getting better all the time.Sold most of my NFLX on the way up, now buying some back…

as JLM would say “well played”

LOL – i’m usually telling my 15 yr old to stop with her Mangas. Naruto and Bleach are likely the culprit to my bandwidth woes

So you have a 15 y.o. and one under 3? Oh, my dear! I thought the 10 y.o. to 16 y.o. range was head spinning.

tell me about it 🙂

WHERE ANGELS FEAR TO TREAD…USUALLY HAS SWEET LOOT.

Netflix got first move advantage, but they will have to defend market shares against the likes of Amazon, Apple, and possibly Google (if they buy Hulu), so content providers will have more outlets, and eventually squeeze netflix out of deals.The internet has been a huge disrupter of middle-men. And netflix is a middlemen between video-content, and consumer. So it’s likely margins will continue to slide, and earnings pressure will increase. Unlike Amazon, Apple, and Google, whose core competencies are in other markets, and streaming video content is a value-add, video-content is netflix bread & butter. So the other big three can allow the pricing model to trend to the point where marginal cost = marginal profit, but it will ruin netflix

wow. this is an excellent outline of the bear case. well done.

Exactly what I was saying as well. They’ve got to change from their monolithic business model. Head winds are coming at them.

not to take offense at your bear case, which i like very muchi think netflix has done a wonderful job of getting onto every major device, platform, OSthe others have notso i’d prefer to use netflix at any price over the others because i’m confident i can get it where/when i need itof course, the others can do that. but apple won’t (i think). google should. and amazon should but hasn’t yet.

Amazon tablets will likely allow Amazon Premium movies to be streamed. Apple tablets/Itunes/tv refresh will facilitate further video streaming. Google tv /Android tablet refresh predicated on new content deals in the near future. Netflix is dependent on Apple & Google for its distribution. Again it is playing middle men for the big three. It’s not a role you want to be in.

The big three control markets (hardware, search, retail), which are in the hundred of billions. They are looking for new markets to territorize, and add value, to increase their market cap.Netflix controls a much smaller market (video rental). It will be very hard for them to push back against the big three, since the big three can push down the pricing model, so that netflix’s marginal profit approaches marginal cost. Apple has done this to the music industry. .99 songs. Amazon has done this to the publishing industry. 9.99 e-books. So it’s likely they will do it in the video space.

but will people buy? I rather just go to netflix than buy movies. And spotify and pandora did take hold here, despite neither group being in the “buying” category

you are making an incredibly convincing casewhat stocks do you like?i’m not buying them (as I outlined in my post) but i am curiousi like the way you think

I mainly invest in the natural resource sector (base metals, met coal, potash, uranium, oil, precious metal), from the structural shifts underway in the emerging markets (BRIC). The main thesis is the vast population movement from rural to urban centers, and an increasing middle class in these countries. This movement from agrarian to modern industrial mode of production, necessitates huge natural inputs to develop infrastructure (electricity grid, housing material, roads, etc) to increase productiveity.

Good macro theme

Although the natural resource trade is at risk, due to the high probability of a global recession, since it’s still uncertain if the BRICS economy have decoupled from US/Euro. But we avoid a recession the trade will be good until 2015, when new mines come online, and offset some supply problems. However long term prices for natural resources should be buoyant, given the low USD, and a zero interest environment, as capital may flow into hard assets as a hedge to fiat currencies.

Exactly what I was trying to say. Head winds are coming to Netflix. They have to face them or change direction.

Great points – but you missed one or two (or I missed them when going through all the comments). In addition to Apple, Google and Amazon, potential Netflix competitors also include Comcast Xfinity and other offerings from Cable companies, Verizon and others. Most studios also own numerous TV channels and are reliant on cable for a large amount of revenue – of course in the case of NBC-Universal, a studio is owned by a cable company. The more successful Netflix is in driving cord cutting and the deeper its content, the more at risk this cable revenue is for the Studios. My friends in media tell me that in the US, this is the greatest threat to Netflix, once the cable companies and studios focus on maximizing revenue across all distribution windows – including streaming, it is very easy to rationalize the decision to squeeze out the distributors that deliver the lowest total revenue across all windows (especially when existing revenue is at risk). This is even more so when one of the competing distributors (Comcast Xfinity to Netflix) owns one of your key suppliers (NBC-Universal) and the product at hand is intellectual property and, individually, not replaceable. This of course is in addition to the fact that Google, Amazon and Apple are also competing and willing to drive marginal profit to = marginal cost.Of course, elsewhere it is different. Here in Asia, for a $250 one time fee, I can buy this box http://www.asiabox.my/?page…. I have been looking at it, it pulls in the vast majority of movies, TV series and other video productions produced in at least 10 major markets (including US) for the last 5 to 10 years. A different type of challenge…

I still haven’t found a better deal on watching commercial free content.I see Netflix as the DropBox of online streaming. Sure Amazon, Apple, Google, and cable companies appear perfectly positioned to compete, but none of the larger businesses care enough about One Thing to cut significantly into DropBox’s success. Netflix has no choice but to keep pushing and pulling the streaming industry in its wake.I’m long Netflix.

Bobby – they don’t license direct from studios? If this is so, they are toast.

So what do you think the role of Cable Co’s will be – say Cox or Comcast/Xfinity?

Lots of bear thinking on Netflix it seems http://portal.eqentia.com/s…

How far do you think discussions have gotten internally at apple about buying netflix? (seems like they would be a fit) … and I am certain you can’t comment but would have loved to be a fly on the wall as the word twitter was discussed in the same sentence as acquisition.

i have no clue about either

This should be the core pitch to studios, by Netflix. Goog & App are using you as loss leaders. We will charge more, provide better experience (somehow) & care more. Because we have to!

Yep, this is my take too. Love the company, love the culture and I can’t fault them for making the price adjustment.But ultimately, all the leverage lies in having content. Content is what made Hulu’s growth curve possible. And right now, the networks and studios don’t need Netflix more than Netflix needs them.Which is unlike the record labels + Apple situation of yesteryear.

I don’t see netflix as a video-content provider, they’re a software company. The content will just become a factor of production (with no additional margin). Movies are already commoditized to the point of free via BitTorrent.Software has eaten music with Spotify, and the percentage of software vs music will increase.It’s the netflix software, with it’s additional functionality, convenience, portability, queue, recommendation engine etc that will differentiate it and give it pricing power. To summarize: software is media.

wordhttp://www.avc.com/a_vc/201…

But how long before the software differentiator that netflix has gets neutralized/commoditized by goog/amzn/appl/comcast/othersTo me the bigger differentiator for netflix or any web based service is the user behavior and usage data that the service accumulates about the user which a competitor does not have and hence would struggle to provide the level of customization that the user is accustomed to using the incumbent service.Thoughts?

But how long before the software differentiator that netflix has gets neutralized/commoditized by goog/amzn/appl/comcast/othersnetflix needs to differentiate in a direction that the other companies can’t or won’t go:- data can be used to help with this differentiation- IP/patents can help with this differentiation: http://ir.netflix.com/relea…- specialization can help with this differentiation. not having to compromise on strategic direction or product features etc- securing key intellectual capital can help when creating this differentiationTo me the bigger differentiator for netflix or any web based service is the user behavior and usage data that the service accumulates about the user which a competitor does not have and hence would struggle to provide the level of customization that the user is accustomed to using the incumbent service.I agree, data is a powerful competitive advantage. Data can be used for product decisions, customization, improving engagement with the product, improve marketing functions, improving efficiencies. And all of these things can be done in a data-driven manner vs hunches.During the first industrial revolution energy was a differentiating factor of production; before electricity became a utility. And whoever harnessed the most energy tended to win. Now information is a differentiating factor of production. Energy and information can both be represented as work. Energy is the amount of work it takes to transform matter from one state to another (in the production of products etc), and information is the amount of intellectual work needed to distinguish between a set of possibilities (that is, better than picking at random).

hmm . dear netflix and showtime .. i’d pay extra right now to have showtime available via netflix.

Great analysis and meta picture of the battle

The biggest problem with Netflix’s price increase is that it was a)large and b)lump sum. Had they gradually increased the price for the DVD portion they could have kept half of the fleeing customers AND made more money. In this case ripping the bandage off was NOT the right move. That said, they are still the option to beat in streaming but they’ve also drawn a lot of attention to themselves from the content owners who are considering jumping in the biz (doesn’t work too well, look at hulu) or worried about pissing off their cash cow (cable/directv). Starz just walked away from a LOT of money from Netflix, a 10x increase, because they worry that pissing off cable will cost them more money than they gain. I think moving forward that those decisions by the content owners will be the real determining factor on whether Netflix does well or not.

I don’t often comment on Fred’s excellent blog, but let me add this to the discussion.I don’t use NFLX and have had no desire to.I have Verizon Fios with more than enough channels and movies.If there is something else I want to watch, I get a $1 rental from Redbox or Blockbuster.I don’t own the stock.I had been short NFLX at higher levels.I don’t really “get” the fascination w/ NFLX. Unless as a substitute for having pay cable TV to save money. Why pay for both ? Also as my Fios is bundled TV, Internet & Phone (and maybe eventually cell phone), I would think that Verizon and the cable companies (& perhaps AAPL & AMZN) will eventually run NFLX out of business (except I guess for those that have no need for bundles) so long as price competition continues to commoditze these services.NFLX doesn’t offer me much (or any) value add from what I already get.

thanks for commenting. maybe you’ll share your thoughts with us more in the future

Nobody seems to mention all the user content (reviews & ratings). They are great discovery tools just AMZN has for most of everything else except for video. They will give NFLX some sort of defense against getting disintermediated.

This should be the core pitch to studios, by Netflix. Goog & App are using you as loss leaders. We will charge more, provide better experience (somehow) & care more. Because we have to!

I think Netflix is weakening their bargaining postition with the studios by dumping their DVD subscribers. Studios could not prevent Netflix from renting DVDs, Netflix would use that strength to negotiate online content.

Netflix’s refusal to develop a PPV model locks it out of the premium market and certain segments, while its price increase at least temporarily limits its growth in its core segments – and that is why it is suffering a loss of confidence from investors. I wouldn’t buy Netflix stock not because its user base won’t increase – it will. Just that the growth will be hampered and confined to a large but limited audience that watches a lot of movies and willing to wait longer for new releases. It just might be reality setting in – a reality Netflix saw before the market.Netflix didn’t have much of a choice. Plus as pay-per-view rates go up it this might only be a case of sticker shock. And if I were Netflix, I am not sure I’d develop a PPV either considering how much competition there is in the space. The guys at Netflix are pretty smart. They are the ones who killed the video store, and focusing on being the dominant player on streaming and discouraging anyone from entering that space is a sound if not sexy strategy.

Let’s wait and see what happens when the Starz content goes away next month. That’s where most of the newer movies came from. Otherwise their content is like a bad video store selection. No thanks!!!

Very interesting post, and it has made me think….I wonder if this is not a strategy problem and an evolving society issue.1. netflix gave a solution to a problem that every one wanted, but the pricing was not in line with what they needed. So they decided to charge more. While we were getting the service for free, and we wanted it we did not like the change. Strategically, I see all these free/reduced services and wonder how they are going to introduce a costing structure without alienating. Tell me five years ago, if someone would have explained Netflix to you and said it would cost less than $20, would you not have said sign me up? Because they started by giving it away and then charged, it ticked everyone off. Services with pricing be damned!2. We want everything for free, and we complain about the service. Our society wants everything free and we try to build businesses around this. I admit I am not that smart because I do not understand how these businesses have a go at it without revenues, I personally applaud Netflix for the increase in pricing because if they want to continue they have to make money. When they make money they can include more services and different shows. It has to work that way, it can not bank on limited revenues to expand services.

I don’t understand your reference to “free.” I’ve always paid for Netflix.

I have always paid and happy to do so, love their product. I was talking about all the free services across the web. I believe this is a problem long term for businesses, free or cheap at first and then try to find a way to create revenue later.

People have always paid for better. The question with streaming is: what is standard? It is it far from settled. When it is, then a premium service can evolve.

We don’t want everything for free, we just don’t want to pay middlemen a pound of flesh. The true value lies in the content, it is that simple.

word

Content agreements to do a technology trial (which are the ones that are ending now) are not indicative of what long term content costs will be. The ISP and CDN shoes are yet to drop.

Agreed. Prediction: An M&A is brewing for Netflix, either as an M or an A.

Certainly more feasible now than it was on July 13 when the stock was at $300/share.

Well…it depends if they are acquiring or being acquired 🙂

Time for apple to buy Netflix. …

If the rumours are true Starz declined to do a deal at $300m, or at around $300m/22m/12 = $1.14 per subscriber per month. Given what it costs to add Starz to a cable subscription it doesn’t seem likely any cable providers would be getting anywhere near those terms.To my mind Netflix is synonymous with low cost, which was fine when they were shipping DVDs in the post, but as a fully fledged competitor? Now they’ve got to strike deals with an industry that eats its young. I don’t think this is really about their subscriber forecast, but that they’re unproven all over again.

NFLX is in a very scary place right now.The DVD business was always at worst going to be break even. They know what their maximum exposure is (you can’t get more than 8 discs/month on a 1 at a time plan and you have to work it to get 8). Streaming they have no idea what their maximum exposure is. Take it to the extreme and say all tv viewing become NFLX on demand. That is ~225 hours of streaming a month/household. There’s no way the subscription charge covers the CDN bill for that.

Actually, I’ve heard cost per GB estimates which are rather low–on the order of $0.015 per GB. If we assume 1GB/hr streaming, 225 hours would only cost $3.38. I think this article really misses out on the potential impact of the dropped Starz deal. Netflix’s streaming content is about to get a whole lot worse. I also would be far from surprised if their streaming subscriber numbers drop sharply as people realize what’s available and can’t supplement with DVD rentals.

It’s more complicated than that.All CDNs are not created equal. There are other costs associated with digital distribution.There’s also no first sale doctrine. NFLX has no real idea of what the steady state costs of the streaming business are. Expect content tiers. Expect usage tiers.

Isn’t the root of the problem here the broken content production model? Instead of having a lot of independent content producers, out of which it would be possible to make a real vibrant market, we have a lot middlemen studios who add little value and hold back the future.

i’m hoping that as Kickstarter scales we can start to solve that issue

meaning? kickstarter as a marketplace for indepenants alongside their funding focus?

meaning kickstarter as a place for directors/producers to go get the funding to make the movie

next step is helping pple see them – lots of indy films get made but indy film people will tell you, distribution, getting into theatres for longer than a week or two is very difficult. They need a place for pple to watch them. Would be interesting if Kickstarter did that…..hum………

How about on a connected big screen in your family room?

See the forest thru the trees per @fredwilson:disqus

There is where an aggregrated site for niche productions would come in handy

IndieGoGo has been doing this for some time now. They started out as a crowdfunding source for independent producers and have built a solid base in this area.

they are tiny compared to kickstarter. a gnat.

Fred, I’ll have to check out kickstarter. I’ve heard good things about them. I am partial though to IndieGoGo in part of their connection to Chicago and they have a female co-founder. I like to support other female entrepreneurs’ businesses.

i like to support businesses that win

I hear ya. I too like to support winning companies, and although IndieGoGo is small in comparison to KickStarter, I don’t think that will always be the case. They are expanding beyond independent film makers.The crowdfunding space has gotten crowded, but given how many people seek funding for various reasons other than to start a business, I do think there’s room for everyone. GiveForward, a Chicago crowdfunding company for healthcare costs, is one example. Are they as big as KickStarter? No. But are they making a difference for those who use them? Yes. Sometimes it’s not all about the money, but also about the good you do for society. *sigh*

you do good for society by being able to bring real money to needy causes. i’ve been on the board of donorschoose for a number of years now. when i got involved they were much smaller. they are now big enough that they are self sustaining.if you can’t reach scale, you can’t really sustain yourself and then you can’t help others

Love going back and forth with you on this Prof. Wilson ;). The point, counter point you offer is one of the reasons I love your blog. It’s a great place to hear different perspectives on a number of topics. The biggest difference between crowdfunding sites are their fees and if you receive money you raise even if you don’t meet your goal. These difference may make a difference to you the fundraiser. Yes, all businesses need to scale in order to succeed. But businesses who doesn’t build social good into their culture early on, won’t all of a sudden focus on this down the road. Finally, research has shown that those who give in small amounts consistently throughout their life often donate more over time than those who donate big amounts at inconsistent points in time.As much fun as it’s been debating this though, I’d rather turn the conversation back to this really fascinating look at the future of video and how a business could potentially succeed in this area. There are some great insights offered in your post and the comments that get the wheels in my head turning. So thank you to you and your readers!

good points. i do believe backers are much more comfortable with the “you only contribute if the project meets its goal” model. i think that is why kickstarter has blown away everyone else in the space

If you want Matt Damon your budget is busted, marketing and stars are where the costs are.

that was in reply to a conversation about indie films

KICKSTARTER IS FUTURE FOR ALL MEDIA/ART.

from your mouth to gods ears

ME TALK TO HIM AFTER TOMORROW STANDUP, WHEN HIM EXPLAIN WHY HIM TEAM BEHIND 40 STORY POINTS THIS SPRINT.

The content producers and their cable/satellite bagmen will inevitably be dragged into the future kicking and screaming.It is going to be messy – keep your hands in your pocket and stand back!

THIS FUTURE IS COMING. CURRENT PLAYERS ARE BUILDING WALLS AGAINST IT AS FAST AS THEM CAN.

One thing to consider… Up to 25% of their streaming subscribers, at any time, are “free 90 day trial” subs. Additionally, there are a large number of younger subs who “share” subscriptions – one account, many users. The service is far easier to “steal” than standard cable service. All to say, there’s a softness to their projections.

The surprising loss of subs prolly isn’t sufficient on its own to explain the price drop. I see this as a replay of 2004: Netflix had run strong for 16 months straight up, they had increasing content cost concerns and a lock on the market and raised prices 10%, subs left at a higher rate than expected, Blockbuster entered with a competing plan priced aggressively, Amazon threatened entry, and Netflix then lowered prices 20%. Over that time the stock went from 39->9 and took 5 years to pass 39 again.These themes replay again. Starz (And other things) suggests higher content prices. Netflix has raised prices. BlockbusterDish are announcing their streaming service next week. Amazon is launching a loss leader tablet rumored to come with Amazon Prime which includes free streaming. Could Netflix say mea culpa and lower prices again? In 2004 that basically wiped out all profits.

I think it’s hard to call the last 2 trading days anything but an over-reaction. I put my money where my mouth is and bought into NFLX from my Roth.I don’t as a rule invest in high-risk securities in my Roth or 401K but this looks like a good deal to me and I’m willing to hold for years if that’s what it takes to see value here, but I personally doubt it will take that long.I bought initially on Thursday at $169 and doubled my position on Friday when it hit $157.

People are on here talking about M&A for Netflix. Not sure how feasible that would be. But if there was a partner, would it be something like Sony, or a games company? could Netflix partner with EA to stream video games, by the way? I am just wondering.

Netflix succeeded because they took advantage of first-sale doctrine, used DVD rentals online to acquire a ton of users, and used cash and user reach to acquire a ton of long-tail content. They then struck a killer deal with Starz to sublicense movies, allegedly based on an omission in Starz’ contracts that allowed them to do so, and used that and other content deals to grow incredibly quickly. Now many of these contracts have expired, Hollywood has caught up, and the Netflix experiment is under pressure.What happened? Netflix was unable to renew the Starz deal. To renew other incumbent deals (including a valuable Sony deal) that had elapsed because they had too many users, they had to double their prices and shed users. Spencer Wang at Credit Suisse downgraded the entire cable TV industry and warned content to “Just Say No” to Netflix. Cable, at its $70 a month, has been buying up a bunch of on demand content and working to out-Netflix Netflix.So why has Netflix been collapsing in shareholder value? Netflix has price-sensitive users. Prices have been going up but the content has stayed the same. The cable industry can reproduce and exceed their content without breaking a sweat. Above all, the channel conflict faced by content is intensifying and Netflix is too young to have system lock-in with content.

Nick,I found your comment, along with CapCube’s and MarilynCraig very interesting. I agree that the end of the contract with Starz and the price increase related to the renegotiation of deals will have a great impact in the company. Content is key, even for price-conscious households and if content becomes limited, I am afraid the business will be in danger. This, I think, is the major problem Netflix is facing and what may explain the drop in share value.Having said this, as whatever competitor picks up the Starz content, will have to pay for it and, given that Netflix has the largest customer base over which to amortize costs, it will be more difficult for any other company to cover those costs. Maybe The Big Three, with their deep pockets, can subsidize content while their bases grow but most companies cannot. I don’t look forward to seeing Netflix lose out in this war and see competition in this space reduced…I see CapCube’s point of view around bundled services and I do think that there is a market for that but many people no longer have a land-line phone – so one of the elements of the bundle may not be as relevant – and also many other are looking to lower their monthly entertainment bill without losing quality. I have not had cable for a long time but, back in the day, I always felt I was paying too much for content.This unbundling seems to be the model that works for MarilynCraig and, I think, will be the most widely adopted in the future. I totally agree with her as well regarding aggregation. Most of us probably want to go to a single place to reach all of our preferred content. I certainly hope that each producer of content does not go down the route of setting up its own storefront. That would be, from my perspective, amajor step back in convenience.

Not taking about the fundamentals, but from a pure technical trading perspective the best way to trade a share at 32xEBITDA is to sell it. It actually moved 10x over the last 3 years and on the weekly charts the stock was overbought and a correction was due.The volumes are still high , would buy it around 100-120 range or if we see a bounce from 140+ levels.

I’ve always thought a technical perspective is a good compliment to a fundamental analysis. Thanks for providing that

I know a retail broker doing just that. Making better than market by 8%, for about 7 years now.Of course, when the market is off 60%…….

Regular lurker, but passionate about this topic…I have been a Netflix subscriber and fan from the very beginning. Our household turned off the cable and got rid of our TV in 1996. Since then it’s been nothing but PC/iDevice/Xbox watching, mostly thru Netflix (I think we were one of the first 100 subscribers). We pretty much stopped getting DVDs years ago. We were on a test plan that mimics their new pricing model – 1 DVD and all the streaming we can eat. Here are some comments from a focus group of 2:- Cosy browsing: We do a lot of browsing on Netflix. My husband and I have spent entire data nights curled up picking a movie. Never watched anything but previews and loved it. (Maybe this says something about our decision-making processes 🙂 – Other options: We also use Amazon and iTunes. But, potentially because of my historywith Netflix, that is always where I go first. The tyranny of the installed base. And if I remember right, Netflix was on the Xbox before Zune really got established there. – Hulu: my husband and I were discussing this topic yesterday, and he thinks that Hulu will win out. I need to do more research as a consumer. Every time I’ve gone there in the past, I haven’t been able to find what I want. And they don’t do a very good job of the message for Hulu Plus – difficult to find out what my ten bucks will get me if I add that on top of my Netflix bill. – Last point on choice, maybe it’s just my tastes and watching patterns (I’m usually behind, see most of the “first runs” on airplanes anyway), but I never lack for finding something to watch on Netflix. – Netflix on the iDevices was seamless right from the beginning. Amazon is flash. Dead on arrival.My biggest concern came, not with the price changes, but with Starz pulling out. That was a competitive advantage for Netflix early on, and it was not good to see them go. I do think the content producers are moving more and more toward “owning” their own”retail.” It will be very interesting to see how this plays out over time. It is a classic question that producers have been asking since the days of the Silk Road – how do I make the most money: by putting up my own storefront and supporting that effort, or selling to someoneelse who already has the building and people to sell my stuff? Am I a producer or a merchant or both? As a consumer, I hate trawling the web looking for the show I want to watch and want someone to aggregate for me…are there enough like me to make it a more efficient model to have a “middleman?”And I agree, Amazon and Google will be better middlemen than Netflix or Hulu. This is just one of several product lines for them.

Some good points and questions, Marilyn. I’m with you on aggregation, but I’d take it a step further to curation. At least for this stage of life when time is precious and I’d rather sit down with a few choices and spend the time watching than choosing. Netflix helps with that through suggestions and the reviews. A Pandora for film! Is there such a thing?Lately, I’ve found myself taking a look at Amazon more. For some reason, Hulu is not doing it for me, but my teenage son loves it.

You’re right – movie discovery has been crying out for innovation. Time is precious, and “wrong” choices are more costly than with music. On Pandora, you can always skip something you don’t like. Watching a movie requires more time and attention than listening to music. Also, most of the time, the value of a great “new” story is usually much higher than a great story we already know, whereas we are much more inclined to repeat-listen to songs we like. (Though I am always up for watching The Big Lebowski another time!)

Yeah, if I spend time watching a movie that turns out to be a loser, I feel cheated. Limited time to begin with and high value placed on the experience. I love film.

One of the really interesting things about the web is it makes good quality middlemen a very efficient business model. However, if you add lots of middlemen, unlike a bazaar where you can price shop, things can get tricky as to what to spend.Otherwise, great post (and you should comment more 🙂 )

MANY LINES TO FUTURE CONVERGE IN NETFLIX.END GAME IS CROWDFUND MEDIA, SELL DIRECTLY TO CONSUMERS.(HINT: THAT GOOD IDEA FOR STARTUP)GAP BETWEEN THERE AND NOW WIDE. AND FULL OF POWERFUL INDUSTRY NOT INTERESTED IN DYING.

Even companies that just do straight up crowdfunding are turning to crowdfunding themselves to create content for themselves.

Last part true…..first part, not so much.Future is contraction of entertainment supply chain. Financial risk, production talent, etc., all compressed into self distribution model. What that looks like is really hard to tell.Way tougher in TV & Movies than books or nonfiction. Old adage in Hollywood: ‘it is really hard to even make a bad movie!’ Not too many people can create really good TV or movies. Lots of people can make bad TV & movies.

REMOVE ALL MIDDLEMEN = LOWER COSTLOWER COST = LESS PURCHASE REQUIRED TO REACH PROFIT+TARGET NICHE = EASIER TO MAKE GOOD ENOUGH MOVIERESULT:MANY SMALL, HIGHLY TARGETED MOVIES THAT MAKE PROFIT FROM SMALLER NUMBER OF PEOPLE.HUGE BLOCKBUSTER BECOME ACCIDENTAL SURPRISE, NOT EXPECTED OUTCOME.

Another ‘who sees forest thru trees’…

removal of all middlemen= low P/E multiples in equity marjets (stock markets are a representation of middlemen taking their cuts)! Lets go disruption!!

Expand your view a little. @FakeGrimlock:disqus is right about middlemen thinking more current, yet the bigger picture shows something disruptive. It isn’t so much having to produce concept, story board, editing and so on with $$ backing. The solution is to interconnect the viewers.The big $$ will fight that. But the consumer will begin to feel their power.At this point, we unfortunately have a talent pool without much talent living with rehashed concepts from years back ranging from Oprah’s real problem over to something like Real Housewives being something that is too poor to even list its faults.In the end, it is a matter of bringing the viewers together and you plant the seed of a different tree.

My guess is the vast majority of consumers only want to consume, not produce ( see Twitter stats or # of AVC lurkers…..)

You are right. It is a matter of it becoming easier. AVC has lurkers? 😉

Dave, I like the “…you plant the seed of a different tree.”The trouble with innovation, is that sometimes we get so wrapped up in the promise we lose sight of the real.I spent a very late night with a group of coders and designers and I laid out my social media plan to them and all I heard was “cool” and “awesome” and every time I heard one of those two words I would ask, “can you translate that into number of tee shirts sold?”The internet is awesome, but you still have to develop moats and exploit barriers to entry if you are going to sell anything on the web.I always wondered how successful would Facebook be if it actually charged a monthly fee for service.

I do have experience in the media world, including the producing of commercials (my taping goes beyond music world) and selling of television programs.A lot of folks were mesmerized over the ability to buy a half/full hour on television. To get around that is a different tree where viewers are participating without paying for that privilige out of their own pocket at that moment. The tech and knowlege therewith will be happening.It offers a different marketing.

Hey Dad –I honestly think YouTube is going to do the crowdfunded media. They’ve taken a few steps to help content creators improve quality of their content.if they’re not, they should buy me out (in the future) – and hire me to guide it all.. I want to help fix the world like them, so really it’s meant to be..

Grimlock, do I have a Series A pitch for you…

ME, GRIMLOCK, HAVE ONE DOLLAR AND 15 CENTS FOR YOU!THAT AT LEAST 3 TIMES MORE THAN NEED FOR GOOD STARTUP.NO ONE SAY GRIMLOCK NOT GENEROUS… AND LIVE.

Grimlock is certainly generous – look at all his free advice. Maybe we do a deal. How would VCs react to GRIMLOCK on our board of advisors?

PROBABLY RUN SCREAMING. IT STORY OF GRIMLOCK’S LIFE.

I’ve always suspected (never studied this to see if it was true) that studios and production companies saw a problem:Problem –> millions upon millions of potential fans out there who love music (sidenote: today is the 30th anniversary of the year Simon & Garfunkel played in front of 500k people in Central Park).But they solved the problem this way: Create a distribution system that locks people into only the content that we can deliver them, They did not think of a content distribution model that allowed for user’s to control how, iff and when they received content, or, even most importantly, who they would consider an artist. Stephen Murray and Ryan Dadd are good friends, and they are working with a client of mine, so there is some personal and professional interest here, but I have been pretty impressed with their model for content production and distribution. It is friend-selected, community approved and community distributed: http://revimage.com/

WHY IS LINK TO USELESS WEBSITE? THEM FORGOT TO FINISH MAKE IT?

I think so. It’s part of the New Wave of New Media, I guess.

LESS IS MORE… UNLESS IT JUST LESS.

Netflix got a great deal on their initial streaming content. Now with looming increases in the cost of content they had to up their price. The market reaction is simple economics with higher subscription rice leading to lower growth and probably lower margins. That does not kill the company, just lowers valuation.

I am not sure about the great future of Netflix.All their success was possible because in the physical DVD rental era they did not have to ask any content owner or any studio about permission. They could simply buy rental DVDs at a higher price and optimize logistics, product, recommendations and customer service.With streaming they have entered a different game. They suddenly need temporarily limited license agreements for every single movie title, for every single territory. And in contrast to the music industry being hit by apple’s itunes in 2002-2004, the movie industry still makes good money in home entertainment and is not yet depending on Netflix money. The studios do not want a scenario again (after what happened in music), where some new kid on the block (not producing content) destroys their pricing or bundling model. I think that is the reason why they keep content from Netflix at the moment. That is the reason why Netflix streaming seems to be dried out.For me it makes total sense that the Netflix stock price went down. It might be that their sheer size and customers’ satisfaction – and their balance sheet is yet not big enough to win the content game after all. It might be that they got the timing wrong. And the studios still feel so strong that they withdraw their content.And without content the Netflix magic soufflé of a kick ass product, great recommendation and amazing customer service might as well collapse completely.

It is a good point, but Netflix is getting so large that if they are able to get studios to give them content exclusively for a few years they could become the equivalent of ESPN. They have the most subscribers so they can theoretically pay the most, thus creating a virtuous circle where they get the best content, grow the fastest, etc. It won’t be easy for them by any means but if anyone has the right culture and CEO to pull this off it is them

the studios should not give anyone exclusivesthe music industry effectively gave apple an exclusive on mp3 and it hurt them badlythey are fixing that with their streaming licensesthe studios should learn from thatdo not make kings. kill the kings.

Stocks, particularly ones trading with high multiples, can fall a lot faster than they rise. Another reason to consider hedging them opportunistically. There were a number of opportunities to hedge relatively inexpensively, when volatility was low, from April to early July.Hedging has gotten more expensive recently though. This post gives an example of how hedging costs have spiked in the last few months, and also shows the recent (high) cost of hedging Netflix.

Fred, all is, the kids are still complaining about the $6 increase in fees or whatever. You should see my son’s Facebook page, still bitching and bitching endlessly about this way after the fact. So, maybe that’s it.

yes, the price increase was ill timed

Headlines – “Netflix raises prices 60%”. Reality, Netflix raises prices $7.Gimme a break, this whole thing is a play by the shortsWake up people

I canceled my netflix account.They rose the prices ‘just because’. That isn’t cool.

I don’t know what’s going to happen to Netflix’s stock price in the near term. Long term, I think their business is in trouble.I’ve been using Netflix on-and-off since 2001. I recently signed back up when Netflix launched streaming on the Wii. It’s really a great interface and user experience (much better than I get on my wi-fi enabled Sony DVD). But I feel like Netflix is running out of content I want to see. There are still movies I want to see, but they’re mostly new releases, available only on DVD, and after they’ve been on Redbox (a US kiosk service).Who is Netflix’s competition? I think it’s the content owners. For example, HBO. They’ve got great new app–HBO Go for iOS, Android, and browser. I use it on iPhone, and it’s an even better experience than Netflix. Really slick. As an HBO subscriber, I get streaming access to every show HBO’s ever produced (Sopranos, Deadwood, The Wire, as well as current series, the day after they’ve aired). I also get a bunch of movies–probably what HBO is airing at the time. The biggest downside is I’m watching on an iPhone, as opposed to on my TV.I read recently on Mac Rumors that NBC, TBS, and TNT are working on similar apps for iPad (http://www.macrumors.com/20…. If the content owners can go straight to the end user, why do they need Netflix?If I was going to invest in Netflix, I’d want them to have strategic competitive advantage, and a big moat to protect that advantage. I don’t think Netflix has that moat–I think they have a head start.What would make me bullish on Netflix? Netflix signing deals to offer new releases on streaming the same day they’re available to Redbox (kiosks) or to Cable pay-per-view. Is that unrealistic? Probably. I just don’t know how unrealistic.If I was the movie studio, I’d consider building my own content delivery app. Maybe that’s Netlfix’s silver lining, providing the technology backbone for content owners who want to go straight to the end user, cutting out all other middle-men. But that may not justify an $8 billion valuation.

recommendation engine and installed user base? Do I need another app to watch very similar content, especially if I don’t know what that content will be like?

I haven’t used the recommendation engine, so I can’t comment on its value. Do you use it a lot? How successful is it at recommending moves you like?

It is very good at discovery of new content and avoiding terrible movies. For new content: My kids discovered Mighty Machines, a 10 year old Canadian series about huge machines. I’ve watched several foreign Samurai films that were amazing, that I never would have discovered. For avoiding terrible movies: every major actor seems to have done some terrible stuff. I can’t think of any examples right now, but if it has 2 stars, you can be pretty sure it was awful.

Maybe I’ll check the feature out. I do from time to time look at Netflix’s “Top 10 Picks for Dan”. The problem generally isn’t that it’s movies I don’t want to see–it’s that I’ve already seen the movies. I’m probably a bad use case for the rec. engine b/c I’ve seen a lot of movies.