As I read this post in the WSJ about the changing nature of VC funding of consumer web companies, I thought that we may be looking at the symptoms and not the disease. As the WSJ notes, VC funding of consumer web and mobile companies is down 42% in this first nine months of 2012 (vs the first nine months of 2011). And the big falloff is not in seed rounds, which are still getting done, but in follow-on rounds, which are not.

So what has changed in the past couple years? A lot, actually.

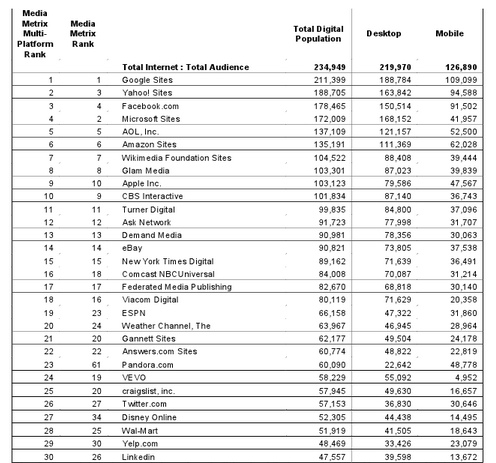

1) the consumer web has matured. we are almost 20 years into the consumer web and we have large platforms that are starting to suck up a lot of the oxygen. google, facebook/instagram, amazon, microsoft, apple, twitter, ebay, yahoo, AOL, craigslist, wordpress, linkedin together make up a huge amount of the time spent online, particularly in the english speaking world. there are still occasional new entrants into this list and departures too. tumblr and pinterest have risen a lot in the past couple years while myspace has declined. but consumer behaviors are starting to ossify on the web and it is harder than ever to build a large audience from a standing start.

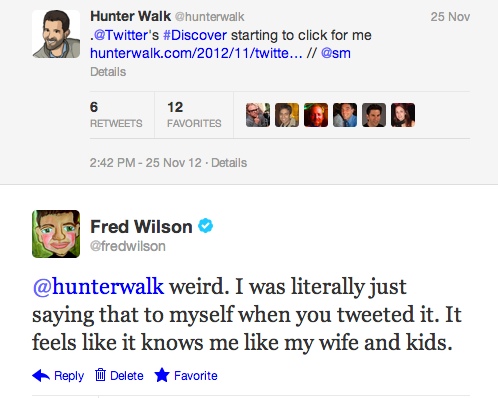

2) the consumer is moving from desktop/web to mobile/app. we've talked about this transition ad nauseam on this blog. it is the single biggest megatrend in the consumer internet space right now. most new consumer internet startups need to build for iOS, Android, and web at the same time. it is making the startup more expensive and time consuming. distribution is much harder on mobile than web and we see a lot of mobile first startups getting stuck in the transition from successful product to large user base. strong product market fit is no longer enough to get to a large user base. you need to master the "download app, use app, keep using app, put it on your home screen" flow and that is a hard one to master.

3) the momentum/late stage investors have moved from consumer to enterprise. there is a large pool of money in the venture capital asset class that is opportunistic, momentum driven, and thesis agnostic. this pool is driven largely by the public markets. this pool of capital was "all in" on consumer web/social web in the 2009-2011 time frame. it drove a lot of activity throughout the venture capital markets because each layer of the VC stack (angel, seed, Srs A, Srs B, Srs C, etc) needs to be aware of what the next layer up wants to fund. when the momentum/late stage wanted web/social, the layers below gave them web/social. now that the momentum/late stage wants enterprise, we should expect the layers below to give them enterprise.

The combination of these three factors is making it harder for consumer internet companies (web and mobile) to get funding. But the first two factors are also making it harder for consumer internet companies (web and mobile) to breakout which is more and more a prerequisite for funding. As venture portfolios fill up with promising companies with solid products that are struggling to breakout, the VCs will naturally be drawn ever more to the companies that are in fact breaking out. It is a pernicious cycle and we see it playing out very clearly in the consumer internet space these days.

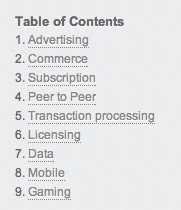

What does that mean for USV? Well not that much actually. We are thesis driven to the core. We believe in what we believe in, for good or bad. And that is large networks of engaged users that have the power to disrupt big markets. We are investing at the fastest rate right now in the history of our firm. We are doing a lot of Srs A and Srs B rounds right now because that is where we see the biggest vaccum in the market. We have not done a real seed or angel round in quite a while. But that doesn't mean we wouldn't and our next investment could well be a seed or angel round.

But we are a small firm. We put out maybe $40mm to $50mm per year across all of our core funds, across initial investments and follow-ons. That is a tiny fraction of the venture capital market. We are small on purpose. We don't want to be the market. We want to invest in a tiny slice of the early stage ecosystem where our thesis collides with great teams and unique and differentiated products.

All that said, these three trends are impacting our portfolio. We have fifty portfolio companies, with the vast majority in the consumer internet space. We encouraged our portfolio companies to raise a lot of capital in 2011 and many did. But even so, we are seeing fundraising challenges everywhere, even in our very best portfolio companies. We are also seeing many of the youngest companies in the portoflio, those started after the summer of 2010, struggling with the breakout challeneges I mentioned earlier in this post. We are patient investors and believe in our portfolio companies and the teams we have funded. We are seeing patience being rewarded, particularly in the mobile market. But it is a tougher time for early stage consumer internet companies than I have seen since the 2001-2004 time frame. And I think we are still in the early innings of this more challenging environment.

So things have changed. As they always do in tech. Those who adapt to the changing dynamics, who see the openings that were not there before and slice through them, will succeed. But the wind that has been at our back for 7-8 years in consumer internet is no longer there. It's tougher sledding and will likely continue so for some time to come.