The Value Of An Engineering Degree

Six years ago, in the summer of 2008, NYU and Polytechnic University came together to create NYU Poly, NYU’s engineering school in downtown Brooklyn. When I saw the news, I called NYU President John Sexton and asked for a meeting. He agreed and I went down to Washington Square to meet with him. I told him he had just acquired a jewel, but a jewel that had fallen on hard times. I told him he needed to invest in bringing that jewel back to it’s former luster and that if he did, it would be an incredible thing for NYU, for Poly, for Brooklyn, and for NYC. In typical John Sexton fashion, he got up, gave me a big smile and a big hug, and said “I will do it but I need your help”. And that is how I found myself on the board of NYU Poly and NYU.

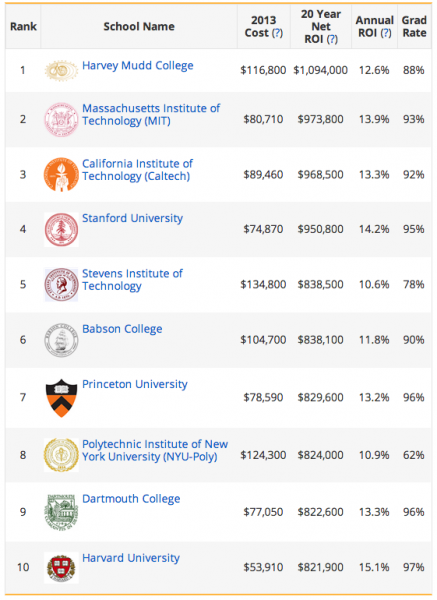

Here’s the thing I know. Engineering schools and engineering degrees are the most valuable degrees you can issue in higher ed. Here is the data:

You might be surprised to see Stevens Institute and NYU Poly on that list. But I am not. NYC is starved for the kind of technical, quantitative, and analytical minds that engineering schools generate. Combine a big urban center with a top engineering school and you have a recipe to print money. And you have a recipe to change lives. Many of the kids who go to NYU Poly are from immigrant families and are graduates of the NYC public school system. They are smart and work hard. And with an engineering degree and a big city like NYC, they can earn more in a year than their parents earn combined.

The value of a diploma is set by the marketplace, by the laws of supply and demand. There are more technical jobs open than qualified candidates to fill them. It is the one bright spot in an otherwise bleak employment picture. We need to be investing in our engineering schools and we need to be investing in a K-12 education that gets our children ready to go to these schools.

When I am not working at USV and/or hanging out with friends and family, I am working on this problem. It is an important one. I plan to post more on this topic in the coming weeks. I have been looking at enrollment data and we are seeing some really interesting things. It is very encouraging and exciting to me.