The Carlota Perez Framework

I was reading William’s post on the potential crash in the Bitcoin sector this morning and I thought of Carlota Perez. Longtime readers of this blog will know that I am a huge fan of Carlota’s work, her research around technology revolutions and financial capital, and her book about all of that.

In 2011, I got to interview her on stage at the Web 2.0 expo, which was one of the highlights of my career.

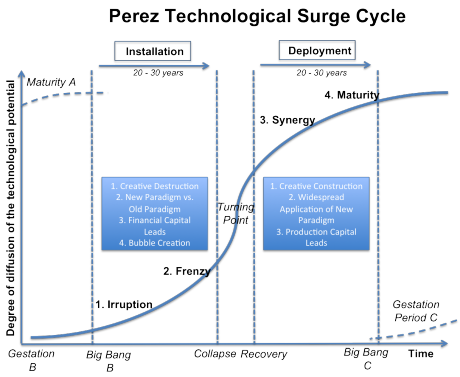

For those that are not familiar with Carlota’s work, she studied all of the major technological revolutions since the industrial revolution and how they were impacted by and how they impacted the capital markets. What she found was that there are two phases of every technological revolution, the installation phase when the technology comes into the market and the infrastructure is built (rails for the railroads, assembly lines for the cars, server and network infrastructure for the internet) and the deployment phase when the technology is broadly adopted by society (the development of the western part of the US in the railroad era, the creation of suburbs, shopping malls, and fast food in the auto era, and the adoption of iPhones, Facebook, and ridesharing in the internet/mobile era).

And the “turning point” between the two phases is almost always marked by a financial crash and recovery. See the chart below from Carlota’s book:

I’m not going to guess if we’ve seen the “collapse phase” of the Bitcoin technological revolution, or if we are in it, or if it is coming. But if Bitcoin and Blockchain is going to be a meaningful technological revolution, and I think it will be, then we are going to move from the installation phase to the deployment phase at some point and there will be a major financial break point that happens along the way.

What is less clear to me is whether this “collapse” will be seen in the price of Bitcoin, the health of the overall Bitcoin and Blockchain sector and the companies in it, or possibly the broader capital markets (VC, public equity, etc). It seems to me that the first is very likely, the second is also likely, and the third is less likely.

In any case, as my friend Tom Evslin like to say “nothing great has ever been accomplished without irrational exuberance”. And the Carlota Perez corollary to that is “nothing important happens without crashes”.

And the lesson I’ve learned in my career is to invest into the post crash cycle. When you do that, and do it intelligently, you are rewarded greatly.

Comments (Archived):

Smacks of William Blake–“nothing great has ever been accomplished without irrational exuberance”.

Tom is awesome

well, if some learnings come from making mistakes, mistakes aren’t visible until they are made.

To me the most important thing is to have a theory or thesis on why you think you are making the right choice. Doesn’t mean that everyone will agree with you but at least you aren’t just “laughing and throwing caution to the wind”. Which I personally really hate.This is one of the things that I love about reading whatever Fred says at AVC. I don’t always (or even typically) agree with him but I firmly believe that he absolutely and obviously gives thought and basis to the decisions that he makes.

And some learnings require much bigger mistakes than others. Hence the irrational exuberance component. And the concept of hedging bets.

Or the bardTo sleep, perchance to Dream; Aye, there’s the rub,For in that sleep of death, what dreams may come,….Thought,And enterprises of great pitch and moment,If dreams are not “irrational exuberance bourne out of death on the wings of hope” then Hamlet got it hopelessly wrong when soliloquising (no not a word) !

Nice!I realize from mulling over your comment) that most of my professional successes have been creating market exhuberance and identifying brands,..and cashing in on them at the peak of market cycle.Every morning that I learn a new view of my own thinking is a good one.I thank you!

Wow – in a train station waiting for a night journey to Essen in Germany . Bit chilly but inner warmth emerges as you just paid me in full for the minor effort of engaging . Thank YOU for provoking the thought !

Great post Fred. What are your thoughts on the adoption of cryptocurrencies in developing countries, where access to internet remains a challenge? Or do you expect these currencies to remain concentrated in the developed countries for the foreseeable future?

I think phones are the answer

Meaningful application uses other than just buying stuff too.

I live in Argentina, a developing country (whatever it means), and indeed cryptocurrencies don’t solve any additional issue that can’t be solved by other means. There are a lot of people mixing the concept of cryptocurrencies with economic restrictions but there easier ways to overcome these restrictions.Particularly in Argentina, what happened was the creation of a cutting edge bitcoin scene. People who are at the top of the technical community, including Sergio the security auditor of the Bitcoin Core and the team behind BitPay Copay.

I’m not sure I understand your comment. In the first paragraph you said there are easier ways to overcome economic restrictions than with cryptocurrencies, but in the second paragraph you talk about the creation of a cutting edge bitcoin scene.I would think that in Argentina bitcoin as a value store could be a useful hedge against inflation. Weren’t people holding large amounts of USD cash and investing in foreign real estate to get around the currency restrictions of swapping out the Argentine peso?

Your first paragraph is right, these are two different things. There is a correlation between them but, for example, Sergio was involved on “esoteric” cryptographic protocols before bitcoins appeared, and Argentinians has been prominent in the computer security field in the region.I would think that in Argentina bitcoin as a value store could be a useful hedge against inflation. Weren’t people holding large amounts of USD cash and investing in foreign real estate to get around the currency restrictions of swapping out the Argentine peso?Yes, I think you answered your own question. Why use bitcoins when you can have USD?

In the first paragraph you said there are easier ways to overcome economic restrictions than with cryptocurrencies, but in the second paragraph you talk about the creation of a cutting edge bitcoin scene.Yes, these are two different things. There is some correlation but the engineering side of cryptocurrencies is related to the computer security scene that predated bitcoin.I would think that in Argentina bitcoin as a value store could be a useful hedge against inflation. Weren’t people holding large amounts of USD cash and investing in foreign real estate to get around the currency restrictions of swapping out the Argentine peso?I think you answered your own question. People use USD for saving, they don’t need bitcoins for this purpose.

Holding large amounts of USD cash seems fairly risky as well, especially when it comes to security and logistics. Obviously price fluctuations in bitcoins don’t make it a stable value store just yet, but it could be at some point.Even if it isn’t used as the actual value store, you could use bitcoins (or any cryptocurrency) to purchase USD without having to hold physical currency. That would seem to be the ideal solution in the short term, since you would mostly eliminate the security risk of that cash as well as the risk of bitcoin price fluctuations.I guess my point (which we may agree on) is that it’s worth exploring cryptocurrencies as a transaction tool and possibly a value store, particularly in countries where local regulations make it difficult to buy foreign assets.

Holding large amounts of USD cash seems fairly risky as well, especially when it comes to security and logistics.This is a cultural issue. Historically people with USD can take advantage of crisis and big devaluations. People with good financial advice use the same financial instruments used everywhere.I guess my point (which we may agree on) is that it’s worth exploring cryptocurrencies as a transaction tool and possibly a value store, particularly in countries where local regulations make it difficult to buy foreign assets.Yes, for the long term, but currently there are cultural biases that make cryptocurrencies use marginal.

And the lesson I’ve learned in my career is to invest into the post crash cycle. When you do that, and do it intelligently, you are rewarded greatly.Trump’s version of this used to be that when he bought a building after some crash or price depression “all the risk has already been taken out” (or something like that).

Possible cycle acceleration of 4-6x

I’m not going to guess if we’ve seen the “collapse phase” of the Bitcoin technological revolution, or if we are in it, or if it is coming.Assumption is that the outcome is known. Carlota only studied things that ended up happening not things that never happened. Bitcoin isn’t ready for monday morning quarterbacking.Separatey, I gotta tell you that I don’t buy into most of this. I think it’s easy to fit a set of events into a theory when numbers, timelines and outcomes can be easily massaged and you are preaching to people that don’t have as good of a grasp on the underlying data as the author does.In any case, as my friend Tom Evslin like to say “nothing great has ever been accomplished without irrational exuberance”.I agree with Tom. You need people with that mania edge (not rational sticks in the mud such as my self).I remember going through that mania phase in my early 20’s when I would come up with ideas and thought that they all were good and possible and that I could pull them off.

Cool idea. I will have to read her book. I am reminded of another fact I learned from a macroeconomist. True revolutions take about 30 years to be realized in an economy. Printing press, rail, electricity etc. It literally takes a new generation growing up with it to optimize it. Perez work seems to give a nice canvas to interpret that generational change.Bitcoin is one massive innovation we are seeing today. Sensors, automation, artificial intelligence are others. Papering different industries with these innovations will most certainly cause boom and bust cycles. Watch what happens to a public industry like education.Broader macro busts like we had in 2000 and 2008 won’t be caused by investment. It will most likely be caused by bad government monetary or fiscal policy.

It literally takes a new generation growing up with it to optimize it.All of those things happened pre-internet availability of information and ideas. No question that the timeline will be shortened for any change going forward and not constrained in the same way, regardless of the generational “governor”.For example the advent of TV in terms of spreading ideas and homogenizing the nation more quickly is fairly well know. Prior to that newsprint.[1] Context, “bus governor” http://en.wikipedia.org/wik…

TeeVee started when? 1928 was the first network in the US. It wasn’t until 30 years later when people realized it’s true capability. The internet browser was when? The initial adoption of small handheld technology with a screen was either, iPod, or smart phone. We are a long way from seeing the true optimization of the technology.

Not sure how that relates to what I said. Not to mention that there is a difference between when something is “invented” when it is commercially available at a “reasonable” price and therefore becomes widely adopted in some fashion. Once again you can make the timelines say anything you want by fudging the numbers.Fax machines are a good example.http://en.wikipedia.org/wik…Scottish inventor Alexander Bain worked on chemical mechanical fax type devices and in 1846 was able to reproduce graphic signs in laboratory experiments. He received patent 9745 on May 27, 1843 for his “Electric Printing Telegraph.”[6] Frederick Bakewell made several improvements on Bain’s design and demonstrated a telefax machine.I remember exactly in the 80’s (not sure the date) when we got our first fax machine. I also remember very clearly how quickly all the businesses that we dealt with got fax machines. (Was very iphone-ish in a way). I also remember Fedex’s failed zapmailhttp://en.wikipedia.org/wik…So in other words in 1984 Fedex made a big investment based on the then current cost of fax machines (in other words 1984 or 1983 when they began on this idea let’s say) and quickly (within a few years) got out of the business because their customers could then afford fax machines. The initial adoption of small handheld technology with a screen was either, iPod, or smart phone.Depends what you mean by that. In the 90’s I used a Newton clone to access the internet and my servers remotely from wherever I was in the world. Worked on a radio frequency network called “ardis” http://en.wikipedia.org/wik… I could either visit a web page that I setup or I could send an email and the server would kick back to me (by email) the answer to the handheld device.At the time it seemed like it was going to be a big deal. Decided not to bet on it (had gotten info on the developers program) which was good because it was never widely adopted and actually quite expensive at the time.

Quibble if you want. I think your assertion that this innovation will go faster is incorrect.

Yeah I agree that innovation is generally much quicker overall now, largely because the time for information (and people) to communicate and go between places is radically reduced. Sort of a play on Thomas Friedman’s “hot flat and crowded” (haven’t read the whole book.. but just the theory I am referring to)

Well I think there is a natural point of diminishing returns whenever humans are involved. The pace of technological change can double every two years if it likes, but humans ability to accept, deal with, and get on board with change probably isn’t moving at the same clip. At least I hope not.

“True revolutions take about 30 years to be realized in an economy.”So true. Kahneman and Tversky published their work on Behavioral Economics in the early 1970s. In the late 2000s, technology implemented it in the form of heuristics and A/B testing.Meanwhile, the iPad was an idea in the 1970s (Alan Kay’s DynaBook).

Awesome post. I love this.

History in the making. We will reflect back on this someday and wish we knew now what we know then.

When I wrote that post, part of me was wishing for us to see “big bad things” to happen so that people see what’s “not possible”, and realize where to draw the lines. (ties with your point on post-crash fog clearing)Specifically, I’m a little worried about the cryptocurrency-driven crowd-sales that are happening in the Bitcoin/Blockchain ecosystem. There is little accountability, transparency and governance standards, and that sector is vulnerable in my opinion.I’m pretty sure that the VC-Tech ecosystem is pretty resilient for now, and is a distant 3rd for a potential hiccup.Paraphrasing Andreas Antonopolous, he said “Even if Bitcoin goes to zero, we have the blockchain to boot-up other crypto-currencies.” So, crypto-currencies and the blockchain are here to stay.

A lot of the altcoin crowdsales are dangerously close to, or even squarely within, the definition of a securities offering. As such, many are quite clearly illegal under well-established law in the US. We’ve only seen a few, very gentle, enforcement actions from the SEC so far. This is not b/c there’s a lack of new law to deal with bitcoin-related securities. It’s a matter of enforcement resources (limited) and priorities (focused).Issuers could possibly restrict bitcoin-related securities offerings to comply with an available exemption at federal and state levels (though none do, as far as I’m aware). However, if the crypto token being issued is freely transferable, then you’d still have rampant violations of restrictions on secondary transfers. No way could you prevent unregistered secondary sales without re-instituting centralized control on transfers, or linking personal identity to the token — in which case, there’s no point in using bitcoin.I like your suggestion for rules to avoid getting caught on the wrong side of irrational exuberance. Perhaps it could be even shorter:- Only sell digital tokens that are redeemable for products and services- Only pre-sell tokens for products/services that are already implemented (at least in proof of concept form)- Never hold money on behalf of others

Good points. So far, they are skirting around it by saying these are not securities, and there are no promises for returns. In reality, they are like a big Kickstarter campaign, with the added possibility of benefiting from a potential value appreciation, or lose it all.

Bitcoin (the original) is not a security. However, the line gets blurry in altcoin land. I’m sure most ponzi schemers also disclaim future performance, etc., if only b/c faux regulatory language sounds more authentic to the mark.

I still can’t figure out how to post a comment to your article without registering. Why don’t you hire a programmer to fix that? You can get them cheap!

I have Disqus enabled on my blog, same as here. Were you having an issue with that? Please let me know if so, with a screen shot that would be helpful. wmougayar AT Gmail. Thank you.

Sent! As you can see in the pic there is no “I’d rather post as quest” check box.

Yes, Disqus is broken, introduces needless friction, not solving a problem, just getting in way. Used to post via Twitter, that is now broken too. Bernard the guest

You smartly avoided delving into predictions and judgements on when/where but I’m going to give it a shot: If you ask me the bitcoin price crash has already happened. There are a certain number of people that simply will not sell BTC under any circumstances – unless the protocol is shown to be truly broken. For these folks it’s one part understanding the potential and one part ideological (some might say irrational). I believe that anybody that doesn’t truly understand the potential or hasn’t the ideological stance has already gotten washed out. I do think the startup space is getting overheated and probably due for a correction – even if they lead the charge in driving adoption. It would seem to me that any revenue model setup by the startup space will be undercut by fully decentralized blockchain tech. Some really interesting, fully decentralized solutions coming down the pike but the most interesting ones, I believe, are decentralized exchanges and assets that maintain one-to-one with the dollar.

Fred – this is great. You are a value investor

i try to be. not easy in VC though

Wonderful mind. She’s in my top five people I would love to have a meal with.Curious if she and you feel this scenario will be accelerated with mobile adoption so hyper accelerated already or it will be the same decades of pain as in past revolutions.

i think things are accelerating right now for a host of reasons, but mobile is probably at the top of the list

Is Carlota Perez’s study around adoption of technologies only in developed markets? With the smartphone evolution, and “Deployment” across the globe (with disparate maturity cycles and socio-economic adoption of evolving tech), perhaps this is something that is subject to change? Systemic cycles that grip evolved economies might not be applicable to developing countries where the bulk of growth in the next 20 years will come from – e.g. India butterflied over the PC / Wired Line deployment phase, missed all those crashes and flew into the Mobile Age.So maybe the crash in BTC has nothing to do with economies without a history (Some countries opened up / scaling in GDP in last 15 years)

Bitcoin isn’t a currency, though.And blockchain as a technology hasn’t proven its value over traditional means, assuming those traditional means are managed a certain way.You may be rewarded greatly for perpetuating Bitcoin, of course.I’ve still not heard an answer or good response to that if Bitcoin was a real currency – then if someone would pay USD for it, then that USD would be destroyed – not pocketed.Any good answer there?

In agreement with you. Almost by definition a currency has to be backed by a state (government body). And let me assure you I can see absolutely no state giving up their monetary and fiscal authority to a decentralized “bitcoin currency”. And before the “gold is a currency” folks pop up, make sure you understand the great depression and the Bretton woods monetary system from 1946-1971 before stating that it worked as a currency.

It’s funny because the Roman empire was built with gold as a currency.

Not sure the angle your comment was meant to take.. but either way it shows why gold IS NOT a viable currency 2,000 years after the roman empire (or 1600 after its fall if you really want to quibble) The reason gold was used back the (and other precious metals etc) is there was no information sharing. Now there is nearly ubiquitious information so we can know if the US govt. decided to devalue the dollar by 75% in a day, that information would be known. Back then it could take a DECADE for information to get passed from one side of the empire (and easily months for even close cities). Since gold couldn’t be faked easily it was a good “store” of value. Now a days gold simply has carrying costs.. but no underlying value. I haven’t taken the time to fully flesh this out.. but I hope this makes sense why gold being useful really up until 75 years ago shows definitely why it would never be relevant with modern communications and the trust / information factor which paper and digital money can be more easily used for (the digital issue with bitcoin is its not backed by a govt. and an economy..)

I don’t see why a currency should be backed by a govt. In my point of view it’s a fallacy. I once done some translation work and been paid with bitcoin, then bought something with them. No governments involved and thus, it worked. Why? Because independent and neutral accounting systems can perfectly work without govts. Govts are only good at evaluating their currencies.

All currencies are inherenerently worthless by themselves (all bitcoin is, is some bytes on a server), and all the US dollar is paper (and same really with gold. The bitcoin only has value because you can buy certain things (food, shelter, clothing etc.). How do you express the value of bitcoin? You say how many dollars it will buy you. The value behind the dollar is all the real estate, infrastructure, intellectual capital, land, food, military might etc. that the US represents. So the only way that bitcoin itself will be a store of value is if society excepts bitcoin as being backed by all those “real” / non financial assets. I am not sure if that makes sense or not. One thought that crossed my mind on again why techies love bitcoin is essentially if it ever took precedence over the dollar then it will probably need to signify an end or at least great decline of nation states. I just don’t think that is very likely, and ultimately a currency value is derived based on the assets / potential of a country, which as of now all countries are managed by their govt. who regulate the currency. Again, if you don’t like govt bitcoin sounds even more appealing.. but hard to imagine the dissolution of the nation state model for our country over my lifetime (50+ years hopefully 🙂 )

https://medium.com/@ntmoney… I think Fred is invested in Coinbase right? Either way, this article proves my point that this guy has no clue what money is really about (which is funny because his article is about how others don’t know ;)). One of his main points is how money has to be scarce.. which is incorrect. It simply has to be a fair / effective means to distribute assets and value throughout society, with lower transaction costs vs. bartering. His scarcity misunderstanding is almost exclusively shows he / bitcoin folks are making digital “gold”. Not enough time to dissect further.. but this was hugely clarifying to me on really solidifying that bitcoin advocates are simply looking at the world in a fundamentally flawed way. Sure they are good humans.. but not good at making a business (probably over the top.. and happy to talk to th articles author.. but yeah.. they don’t get it)

If Carlota is right, then I think the following are interesting questions:- In a new innovation cycle, when in the installation-crash-deployment flow do, on average, the eventual winners first appear? When do they really start to take off? How long does it take?- What are the benefits to jumping in during installation vs. during the crash vs, during the deployment phase? How much do those benefits matter to the eventual winners?Sounds like you have your own partial answer here:”The lesson I’ve learned in my career is to invest into the post crash cycle. When you do that, and do it intelligently, you are rewarded greatly.”But that also means that when you say…”I’m not going to guess if we’ve seen the “collapse phase” of the Bitcoin technological revolution, or if we are in it, or if it is coming.”… you’re either being coy with your readers, or you’re actively avoiding something.Which begs an answer to the very question you said you won’t take guesses at. :-)So, where in the cycle are we with bitcoin?

The cycle for Bitcoin is at development stage, building the casino.

“casino”

think often eventual winners survive the crash – in a pseudo-darwinian reality pre-crash there is abundant resources, the crash weeds out the time-wasters (who hold others back and damage the entire eco-system), those who survive (or pheonix) are tougher and more aligned with reality.Spotting these people is relatively easy – they are less marketing puffery and more bold vision

Interesting Qs – they also hint at how $ is not only type of investment happening or required to go from installation to deployment. Beyond the usual blowhards there is a type of equity owner in technological advancement that isn’t (and maybe can’t) be motivated by money, think Werner Koch and email encryption ( http://www.propublica.org/a… )

I love that chart, particularly bc it helps explain the famous Gates quote:”We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten.”http://www.rocrastination.c…

How is this curve different from the Gartner Hype Cycle? http://en.m.wikipedia.org/w… The Perez S Curve seems like a cumulative version of the Hype Cycle, but without the obvious dip in the “Trough of Dillilutionment”. That dip is where we appear to be for Bitcoin. The $1,000/coin peak was the first wave of excitement. The question now is what the system looks like as it advances out of the dip, and how long that will take. 2015? 2016? or a yet-invented improvement in 2020?

I’d say that Perez Cycle is a more “optimistic” way to present the same concept as Gartner Cycle deos. The “Turning point” with it’s collapse and recovery seems to overlap with the “Trough of Disillusionment”, but for some unknown reason the Perez Cycle presents it in less “dramatic” form – the graph line still goes up, despite the crisis.

Is there any record of what are the highest values transactions made with bitcoin? How much of your personal wealth would you keep in bitcoin? There is a big difference between willingness to pay for a taxi ride with bitcoin and trusting yours and your family’s financial security exclusively in bitcoin. Often when I read about bitcoin I have the feeling that most people who have an interest in it are overlooking people’s intimate relationship with money. A job in a customer service dept in a bank would give you a view. Money physicality has been partially handed over to the physical existence of financial institutions. There will probably be another platform for transactions in the future, but not bitcoin unless the trust issue is overcome. You may say a lot of money is just numbers on a computer screen even today, but people don’t perceive it like this and that perception is all that matters.

Perhaps we are seeing this in the energy revolution which is very much being driven by technological innovation.

People seem to have a strong adverse reaction to Bitcoin, more so than other disruptive ideas. Like they’re rooting against it. Why? Paid hitchhiking, fine. Vulture lending, no problem. Disappearing kiddie porn texts, ok. Yet the public just hates on Bitcoin…why is that?

It’s the trust issue. Vultures, at least hypothetically, can be chased.. disappearing texts are.. a temporary game that some, but not all play. Money is serious, The most serious thing there is. It isn’t strong adverse reaction as much as lack of adoption.

“the installation phase when the technology comes into the market and the infrastructure is built ” :http://techcrunch.com/2015/…

Interesting – I am seeing this in our branch of the IoTBefore Crisis of confidenceSmart-,metering was sold as a panacea for all ills. The public were told that simply installing a display device in the home could save 15% of fuel bills. Few realised that the trial participants had self-selected and were eco-nut outliers.Post Crisis of confidenceNow data histories are becoming lengthy enough to show credible empiric evidence. BI tools exist and the data handling is trivial.Value propositions that make a difference are beginning to emerge, and usefully the charlatans and fruit-loops have been starved out by the tough transition.So I had not read of Carlota and will make it my business to now – Thanks Fred

Maybe the currency aspect of the tech gets sacrificed to the market gods. It’s a fair deal too. Move on from there, clean slate and less baggage

Thanks for sharing – I was not aware of this research looks fascinating. My guess is we should focus on the blockchain as the technology since individual products likely get swept away by the wave.

I can see how this could apply in my industry as well…