Yesterday’s discussion was fantastic. Days like that are where the USV community really shines.

David argued that data is the new oil, not software. There’s a lot of validity in that comment.

Kirk pointed out that ISPs are the pipelines of the digital revolution and I liked that.

And TR followed Kirk with this observation:

Oil in all its various forms (software)

Pipeline/delivery (networking/access)

Infrastructure/Drilling Equipment (hardware)

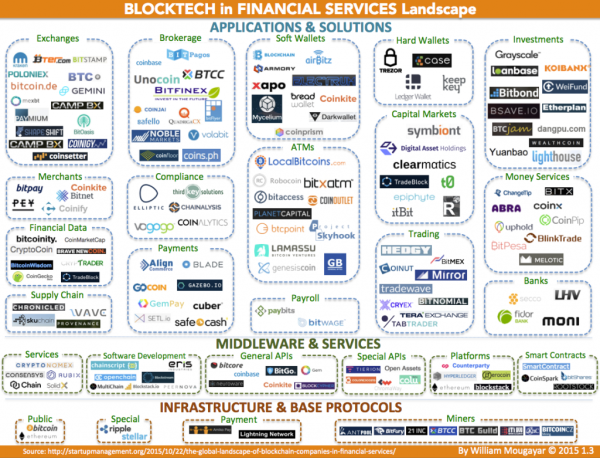

What they were all discussing is the tech stack and where the value is.

A simple version of the tech stack of the information revolution would look something like this:

Data

Applications (software)

Infrastructure (software)

Hardware

Access

At USV, we have invested mostly in the top three layers, and most actively in layers four and five (Applications and Data), but we are increasingly drawn to Access and Infrastructure (software).

But, as I tried to point out in the Dentist Office Software Story, software alone is a commodity. You need data to provide defensibility and differentiation. And so most of USV’s investments have been companies that combine software and data to provide a solution to the market that we believe is defensible, usually via network effects which are a data driven phenomenon.

So why would we move down the stack to Infrastructure (software) and Access? Well there are data driven network effects in those layers too if you know where to look for them. And, increasingly, we are finding them there and finding them at prices that make a lot more sense to us too.

So, in summary, I agree with David that software alone is not the new oil. But neither is the entire tech stack. That’s why I moved away from the phrase “tech is the new oil” that I used in the comments the day before. I also don’t think data alone is the new oil.

The new oil is going to be found in various places in the tech stack where software and data come together to produce a service that has high operating leverage at scale and is defensible by the network effects that the data provides. That’s a mouthful. Software is the new oil sounds a lot better. But the mouthful is more accurate.