What Happened In 2015

Last year in my What Just Happened post, I said:

the social media phase of the Internet ended

I think we can go further than that now and say that sometime in the past year or two the consumer internet/social/mobile gold rush ended.

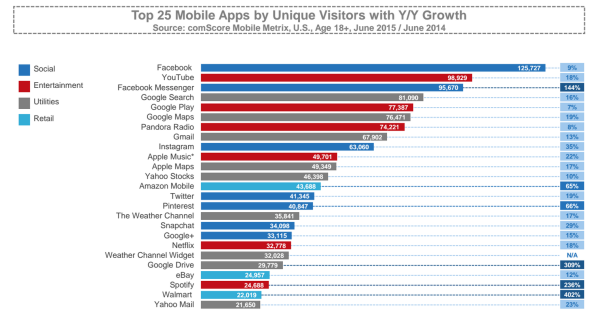

Look at the top 25 apps in the US:

The top 6 mobile apps and 8 of the top 9 are owned by Facebook and Google. 10 of the top 12 mobile apps are owned by Apple, Facebook, and Google.

There isn’t a single “startup” on that list and the youngest company on that list is Snapchat which is now over four years old.

We are now well into a consolidation phase where the strong are getting stronger and it is harder than ever to build a large consumer user base. It is reminiscent of the late 80s/early 90s after Windows emerged as the dominant desktop environment and Microsoft started to use that dominant market position to move up the stack and take share in all of the important application categories. Apple and Google are doing that now in mobile, along with Facebook which figured out how to be as critical on your phone as your operating system.

I am certain that something will come along, like the Internet did in the mid 90s, to bust up this oligopoly (which is way better than a monopoly). But it is not yet clear what that thing is.

2015 saw some of the candidates for the next big thing underwhelm. VR is having a hard time getting out of the gates. Wearables and IoT have yet to go mainstream. Bitcoin and the Blockchain have yet to give us a killer app. AI/machine learning has great potential but also gives incumbents with large data sets (Facebook and Google) scale advantages over newcomers.

The most exciting things that have happened in tech in 2015 are happening in verticals like transportation, hospitality, education, healthcare, and maybe more than anything else, finance, where the lessons and playbooks of the consumer gold rush are being used with great effectiveness to disrupt incumbents and shake up industries.

The same is true of the enterprise which also had a great year in 2015. Slack, and Dropbox before it, shows how powerful a consumerish approach to the enterprise can be. But there aren’t many broad horizontal plays in the enterprise and verticals seems to be where most of the action was in 2015.

I’m hopeful that 2015 will also go down as the year we buried the Unicorn. The whole notion that getting a billion dollar price tag on your company was something necessary to matter, to be able to recruit, to be able to get press, etc, etc, is worshiping a false god. And we all know what happens to those who do that.

As I look back over 2014 and 2015, I feel like these two years were an inflection point, where the underlying fundamentals of opportunity in tech slowed down but the capital rushing to get invested in tech did not. That resulted in the Unicorn phase, which if it indeed is over, will be followed by an unwinding phase where the capital flows will need to line up more tightly to the opportunity curve.

I’m now moving into “What Will Happen” which is for tomorrow, so I will end this post now by saying goodbye to 2015 and hopefully to much of the nonsense that came with it.

I did not touch on the many important things that happened outside of tech in 2015, like the rise of terrorism in the western world, and the reaction of the body politic to it, particularly here in the US with the 2016 Presidential campaign getting into full swing. That certainly touches the world of tech and will touch it even more in the future. Again, something to talk about tomorrow.

I wish everyone a happy and healthy new year and we will talk about the future, not the past, tomorrow.

Here’s a shot of the app store a couple days after the kids got new phones for Christmas.

Here’s a shot of the app store a couple days after the kids got new phones for Christmas.