Twitter Moments

Twitter has quietly built their news product. It is called Moments.

The sports page this morning:

If you haven’t tried Moments in a while, you should. It is really good.

Twitter has quietly built their news product. It is called Moments.

The sports page this morning:

If you haven’t tried Moments in a while, you should. It is really good.

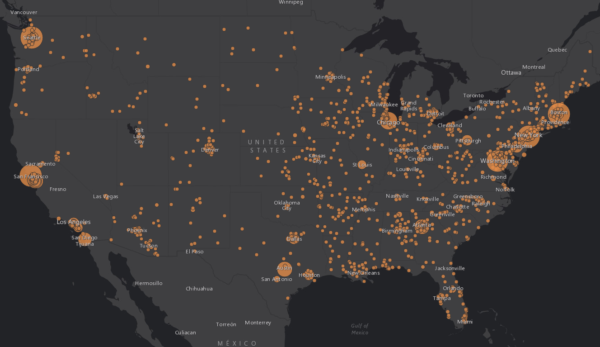

I came across this blog post, based on a study by the software industry trade group, The App Association, which includes this map of where the software jobs are in the US:

Essentially every big city in the US has a lot of software jobs. If you want to be a software engineer in Atlanta, there is work for you there. If you want to be a software engineer in Chicago, there is work for you there.

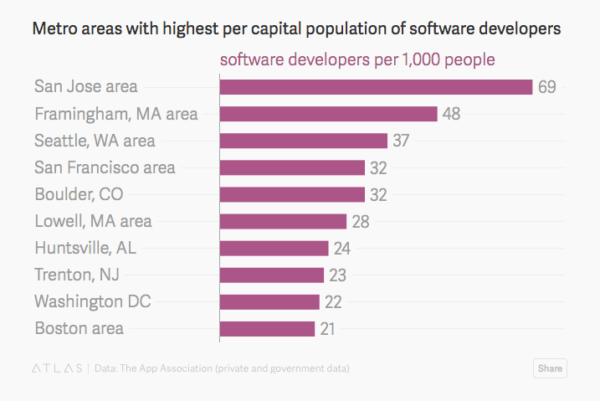

The highest per capita density of software jobs are, of course, in the Bay Area and Boston.

So if you want the highest density of software jobs, go to the Bay Area or Boston.

But if you want to live and work somewhere else and find a good and well paying software engineering job, you can find that in most of the big cities in the US.

And, I would suspect the same is true all around the world.

That’s a good thing.

I saw this tweet yesterday:

“Great Board Directors behave like shock absorbers, not amplifiers”

wisdom from @roelofbotha

— Tom Hulme (@thulme) August 4, 2016

It really resonates with me.

Companies go through lots of “shocks” over the years. I have seen Boards react in different ways. Sometimes they freak out and make things worse. Other times they are the calming force and voice of reason.

It is that latter behavior that the Company needs in that moment. Everyone is already freaking out. Amplifying that, as Roelof calls it, is not in the least bit helpful. Their is plenty of time for post-mortem analysis and learning from the situation. That can wait.

Companies need support and help during times of crises. Boards are uniquely positioned to provide that. The ones who can actually do that are incredibly helpful.

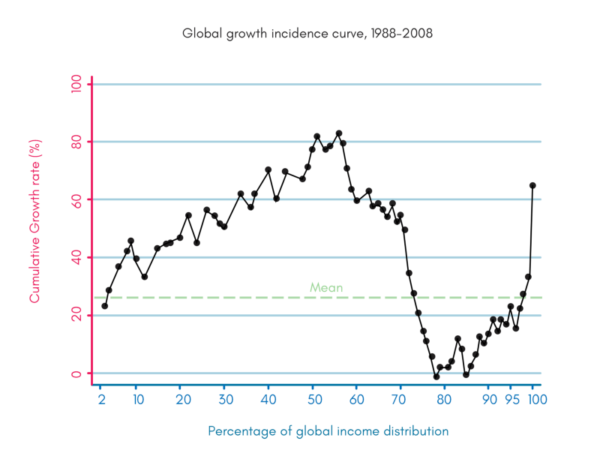

I came across this chart today. Maybe all of you have seen it, but I hadn’t.

It is called “the elephant chart” because the shape of the chart looks like an elephant.

It was created by Christoph Lakner and Bruno Milanovic for their book, Global Inequality: A New Approach for the Age of Globalization.

It charts the change in income by the absolute value of income on a global basis. So we see how someone in Africa living on a dollar a day compares to someone living in the developed world at $100 a day.

Bruno Milanovic discusses this chart in this blog post. It is short and well worth reading for some context.

For me, the story this chart tells is the movement of low cost labor from the developed world to the developing world over the past 25 years. This movement has allowed the “global middle class” to raise their incomes 60-80% while the middle class in the developed world has been stalled out.

But globalization doesn’t stop, nor does automation. And what one would expect over the next 25 years is the global “middle class” will similarly stall out and we will see increases at the far left (the 0-30% range).

The small group of people that are immune to this trend are those that make their money on capital, not labor. They are on the far right of this chart and they have done very well over the last 25 years and, if this story continues to play out as it has, should continue to do so.

There’s a question of whether this is a good thing or a bad thing. The least developed parts of the world are developing rapidly. And very few people are experiencing absolute declines in income.

But whether or not this is a good thing at the global level, this redistribution of income growth creates political issues locally and we are certainly seeing them play out this year. And I would expect these issues will become more pronounced in the coming years.

Yancey Strickler, CEO and co-founder of Kickstarter, gave a keynote at Tech Open Air in Berlin last month.

He talked about some issues facing entrepreneurship and society today. It is an important talk.

At USV, we have tried many different videoconferencing services over the years.

I use Google Hangouts for my personal videoconferences.

But as a firm, we are currently using Zoom.

And we have a number of Beam devices to allow people to “beam into” meetings.

Many of the portfolio companies I work with are using Bluejeans.

So I am curious to find out what all of you use in your businesses (not personal like Facetime).

I sent this out last night. In case you missed it, I thought I’d share it with all of you this morning.

A book that has really stayed with me since I read it is The Prize, the story of the attempt to reform the Newark public school system.

And there is a particular scene in that book that really sums it up for me.

The author is at an anti-charter school protest and meets a woman who had spent that morning trying to get her son into a new charter school that had opened in Newark. The author asks the woman how it is possible that on the same day she would spend the morning trying to get her son into a charter school and the afternoon at an anti-charter protest.

The woman explains that most of her family are employed in good paying union jobs in the district schools and that the growth of charters is a threat to those jobs.

As I read that story I was struck by how rational the woman was acting. She was helping to preserve a system that provided an economic foundation for her family and at the same time opting her son out of it.

In some ways that story is a microcosm of what is happening in the economy right now. Many people in the US (and around the world) are employed by (and trapped in) a system that no longer works very well. And although they realize the system is broken, they fight to support it because it underpins their economic security.

My partner Albert argues for a universal basic income to replace the old and broken system so we as a society can free ourselves from outdated approaches that don’t work anymore and move to adopt new and better systems.

I think it is worth a shot to be honest.

I saw Joe Fernandez‘ tweet a few days ago and thought “he is making an important point.”

too many young entrepreneurs talk about vc’s like they’re heroes and their blog posts are scripture

— Joe Fernandez (@JoeFernandez) August 19, 2016

VCs are not heroes. We are just one part of the startup ecosystem. We provide the capital allocation function and are rewarded when we do it well and eventually go out of business when we don’t do it well. I know. I’ve gone out of business for not doing it well.

If there are heroes in the startup ecosystem, they are the entrepreneurs who take the biggest risks and create the products, services, and companies that we increasingly rely on as tech seeps into everything.

VCs do have a courtside seat to the startup world by virtue of meeting and getting pitched by hundreds of founding teams a year and sitting in board meetings for many of these groundbreaking tech companies. We get to see things that most people don’t see and the result of that is that we often have insights that come from this unique view we are given of the startup sector.

Another thing that is important to know about VCs is that we operate in a highly competitive sector where usually only one or two VC firms are allowed to make a hotly contested investment. So in order to succeed, VCs need to market ourselves to entrepreneurs. There are many ways to do that and the best way is to back the most successful companies and be known for doing that. There is a reason that Mike Moritz and John Doerr were invited to lead Google’s initial VC round. By the time that happened, they had established themselves as the top VCs in the bay area and their firms, Sequoia and Kleiner Perkins, had established themselves as the top firms in the bay area.

Another way that VCs market ourselves to entrepreneurs is via social media. And blogging is one of the main forms of social media that VCs can use to do this. And, given that VCs have this unique position to gather insights from the startup sector, we can share these insights that we gain from our daily work with the world, and in particular entrepreneurs. If anyone has played this blogging game well enough to get into the top tier, it is me. I know of what I speak.

So how should entrepreneurs use this knowledge that is being imparted by VCs on a regular basis? Well first and foremost, you should see it as content marketing. That is what it is. That doesn’t mean it isn’t useful or insightful. It may well be. But you should understand the business model supporting all of this free content. It is being generated to get you to come visit that VC and offer them to participate in your Seed or Series A round. That blog post that Joe claimed is not scripture in his tweet is actually an advertisement. Kind of the opposite of scripture, right?

But you should also know that there is data behind that blog post, gained from hundreds (or thousands) of pitches and dozens (or hundreds) of board meetings. If VCs are good at anything, we are good at pattern recognition and inferring what these patterns are leading to. And so these blog posts that are not scripture, and are in fact advertising, can also contain information and sometimes even wisdom. So they should not be ignored either.

What I recommend to entrepreneurs is to listen carefully but not act too quickly. Get multiple points of view on important issues and decisions. And then carefully consider what to do with all of that information, filter it with your values, your vision, and your gut instinct. That’s what we do in our business and that is what entrepreneurs should do in their businesses.

If you are at a board meeting and a VC says “you should do less email marketing and more content marketing”, would you go see your VP Marketing after the meeting and tell them to cut email and double down on content? I sure hope not. I hope you would treat that VC comment as a single data point, to be heard, but most likely not acted on unless you get a lot of similar feedback.

VCs are mostly not idiots and can be quite helpful. But we are not gods and our word is not scripture. If you treat us like that, you are making a huge mistake. And I appreciate Joe making that point last week and am happy to amplify it with this post.

The New York Times has a piece today about how bay area tech companies are giving the Phoenix Arizona economy a boost.

I think this is a trend we are just seeing the start of.

A big theme of board meetings I’ve been in over the past year is the crazy high cost of talent in the big tech centers (SF, NYC, LA, Boston, Seattle) and the need to grow headcount in lower cost locations.

This could mean outside of the US in places like Eastern Europe, Asia, India, but for the most part the discussions I have been in have centered on cities in the US where there is a good well educated work force, an increasing number of technically skilled workers, and a much lower cost of living. That could be Phoenix, or it could be Indianapolis, Pittsburgh, Atlanta, and a host of other really good places to live in the US.

Just like we are seeing tech seep into the strategic plans of big Fortune 1000 companies, we are seeing tech seep into the economic development plans of cities around the US (and around the world). Tech is where the growth opportunities are right now.

A good example of how this works is Google’s decision to build a big office in NYC in the early part of the last decade and build (and buy) engineering teams in that office. Google is now a major employer in NYC and the massive organization they have built has now spilled over into the broader tech sector in NYC. My partner Albert calls Google’s NYC office “the gift that Google gave NYC.”

We will see that story play out across many cities in the US (and outside of the US) in the next five to ten years. It is simply too expensive for most companies to house all of their employees in the bay area or NYC. And so they will stop doing that and go elsewhere for talent. That’s a very healthy and positive dynamic for everyone, including the big tech centers that are increasingly getting too expensive to live in for many tech employees.