Fun Friday: Best Performing Public Market Investment In 2017

I am curious what the best performing public market asset (stock, bond, REIT, etc) will be in 2017.

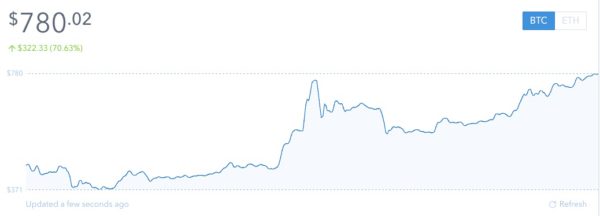

Here’s my nominee – Bitcoin, up 71% this year to date:

Please leave your nominee in the comments.

Comments (Archived):

2016 a huge winner was CLF which went from $1.20 to over $10/share.2017 big winners list is for clients only ;)https://uploads.disquscdn.c…

Do you know why?

Because short term demand was greater than supply… :)In the long term, there is 100% correlation with how great a company is and how it performs. In the short term, too many artificial things can drive demand or limit supply.But what do I know – I moved to 80% cash early this year….

1. Crackdown on illegal importation of steel, which is what they sell 2. Increased demand for steel (people are building stuff)3. The Donald

Interesting. By my calculations up 55% since Nov. 8th, up 18% since the yearly high, but down 92% from the all time high in 2008.

The background cognitive load of owning bitcoin is hard to appreciate.At what price would we be happy to fully divest? I don’t think there is one.Whatever highs it hits it could always feasibly continue to go much higher. Impossible to model or predict.I prefer it higher than lower obviously, but save substantial new information coming to light, by which time it will be too late, price highs amount to background noise. Albeit tantalising.

I treat Bitcoin like art. Never sell

Art is an asset class although it does not lend itself to ‘valuation models’ like equities do.Not clear how bitcoin is classified as an “asset”.

Art, wine and bitcoin are classified as alternative assets.

I understand the idea of alternative asset classes.See Fred’s commentary here – “… treating Bitcoin like a currency is the most helpful approach”.https://avc.com/2014/08/bit…A medium of exchange/transactions is less an asset class and more a tradeable commodity (~ $5 trillion of FX trading happens every day).I was referring to Fred’s language in today’s post to an “asset” that yields “investment” performance.

Sure, I hear you.Fred also says above that he treats Bitcoin like art rather than as a currency.That means its functional utility is not the same as its investment purpose and profile for him.

Its not about Fred’s personal view of his holding as art, but his blog post above about Bitcoin as an asset.

I have a small cellar, but wine is the one asset class where I want to die broke.

I’ll steal that quote in the future! Thanks 😉

Fred is going to be the Warren Buffett of Bitcoin.

Or the Jacob Westerson

I am guessing his exposure isn’t great enough to be Nelson Bunker Hunt with Silver.https://en.wikipedia.org/wi…

Def not cornering the market

Pretty useless as a currency if you never use it.

Bitcoin is whatever you want it to be.

That may be a strength or weakness. If something is what ever you want it to be – then people will have a problem understanding what ‘it’ is.

And your reason for holding bitcoin (not as a medium of transaction but as an investment) is where all the noise is coming from. By the way, it’s my reason for holding as well.Curious if anyone has attempted to model what “equilibrium” looks like on the “medium of transaction” path.At some point bitcoin progresses to a place where it takes x% share of the global currency marketplace. When that happens, and given an assumption that BTC supply is fixed per Satoshi’s original plan, what is the unit price per BTC?For the group… Has anyone tried to do that estimation?

Think of Bitcoin’s price in terms of the purchasing power it affords you, rather than the number of US Dollars you can exchange it for.The urge to sell Bitcoin when the price is high is, fundamentally, driven by a desire to increase one’s purchasing power in US Dollars (or whatever currency you exchange it for).But as the price and acceptance of Bitcoin increases, so does its purchasing power. And that increase in purchasing power eliminates the need to exchange it for another currency. Instead, you directly spend your Bitcoin on the goods and service you’d previously have used US Dollar for.

You end up with a pretty cluttered house.Got that problem.

I always wonder about people who have collections of anything they have amassed over the years in their basements. Seems odd that something so important to you would be so able to go up in smoke in an instant, even when insured.

Good question.I have come to the conclusion that I want very few much treasured possessions. I have been weeding out more and more stuff and find it liberating.

Artwork value is typically insurable but I am wondering how a policy would be structured that might cover the loss of bitcoin (not the drop in value in the market but by theft or fraud even though drop seems like a widely more likely risk).http://www.artbusiness.com/…I had looked into some cyber insurance policies. They weren’t cheap and they had tons of exclusions and nooks and crannies. It seemed to be a waste to purchase the policy as a result and it made a typical insurance contract look simple to interpret by comparison.

If you never sell then it’s not an investment – it’s a collection

Not that there’s anything wrong with being a collector. And some people’s collections (art, cars, baseball cards) turn into investment assets when they get inherited by children who have no qualms about selling for the right price.

Imagine if within a year of Bitcoin starting you began a sophisticated mining operation with 1000s of square feet of servers. That’d be nice. Like owning Shakespeare’s paper and quill before he started writing. So much magic to be built, so much money to be made

nice turnaround: Sprint from $3.69 to $8.45 (+129%)

Wow. Good for them

QCOM, Qualcomm. Around 35%YDT

I feel that 71% could be the “every year” performance of bitcoin. But because bitcoin has no brand manager, no one actually conducting research on it and listening to the consumers, it is being branded by default as a tax evading, proxy currency. I personally love my bitcoin and the future I hope it delivers to us in terms of ease of transactions, 100% perfectly balanced and transparent ledgers, and cross border sales as easy as apple pay. Why is no one promoting the brand? Is it because it is open sourced? Linux and Ubuntu don’t have this problem. Thanks AVC!

NVDIA (NVDA) is +199.48% to YTD. VR and self-driving cars provide opportunities for NVIDIA.

NVIDIA will likely have a great 2017 too — given the need for AI chips, generally. https://uploads.disquscdn.c…

Made me a mint in 2016. But you think it has more upside then FEYE in 2017? Given all the hacking (fear trade)

I think Elon announced he was designing and making his own – if that makes sense

It will be some unknown new cryptocurrency that has yet to be floated. 2017 is the year of the ICO hype and when things will crash after an incredible run of irrational exhuberance. Bitcoin is safer than most other crypto assets. $1,500 is my target for end of 2017. But ETH will also appreciate and reach $30 (about $3B in market cap).

went to ycharts.com, and just put on a screener. https://ycharts.com/screene… The ones that had the most eye popping returns were all penny stocks. Most in the mining industry.

Santa honey… one little thing I need…https://www.youtube.com/wat…

Santa cutie, there’s one thing I really do need, the deed/To a platinum mine!

Eartha Kitt !!! I saw her live during the late 80’s. Singing Where is my Man….Wow.

He’s asking for next year ladies and gentleman. It’s a game!

exactly. i had a typo in my post that made this confusing.

FNMA. Housing is still the main engine of the Economy and there is no yet valid alternatives to Fannie Mae. Likewise for 2017.

Bitcoin. How about – Best performing financial asset of ALL TIME. +23,485% in the last 5 years..

war bonds

Lockheed Martin.

Cats out of the bag on NVDA, but my picks for ’17:-Chipotle (value, countercultural)-Fireeye (Russian spooks everyone)-Activision (nerds taking over )-Palantir IPO (the home run swing)

Oops, CMG being counterccyclical, that is!

VIXIt’s not really a class, though I guess you could probably consider “volatility indicators” a class.

#humblebrag

Francis Underwood–I mean Mike Pence–futures. He’s got that glint in his eye. With a sly smile he whispers to his wife Karen every night, “iceberg straight ahead.”

If electric cars continue to do well, watch the sleeping giants, the Semiconductors, continue their comeback.

Litecoin-backed ETF

Hi Fred,here’s my prediction for 2017:1. Short TSLA on Jan 1st, 2017, 10x leverage. I bet some imaginary $100,000.Let’s see how I do on Dec 31st, 2017.Happy to get your bet and whoever does worst pays a dinner to the other. Deal? 🙂

This is a fun conversation @fredwilson:disqus. I set up a fake $1m portfolio with 10 securities (long or short) and am playing this fantasy portfolio against friends for 12 months. See http://tinyurl.com/1mstockgame for that. The fun part is I went short on $AMD and $NVDA, which proved to be a disaster. But I shared on Medium how to set a game like this up. Would be interesting to see how easily one could do a fantasy competition of this type.https://medium.com/@louisgr…My #1 pick for the current game? $SRPT. But in 2017, it’ll probably be some biotech firm I’m not watching.

If it counts as a public market investment, ETH.

CONTRIBUTORS:Aptose Biosciences (APTO)Aurinia Pharmaceuticals (AUPH)ParkerVision (PRKR)Calling it before the equity increases iswhere respect is established. Anyone can Google winners of other firms picks.There are hundreds of equities that if this is your working space wouldn’t impact your core investments to cite a couple.The posers are laughable with the reasons they can’t cite picks.Return end of 2017 and review these picks.

Square (SQ) – could have a strong year given growing market penetration among small businesses and the a the growing adoption of mobile payments among the current society. With economic activity picking up, small businesses could see increased economic activity, which will directly benefit SQ. Fin Tech players could be poised to have a strong year as bulge bracket banks continue to see disruption with in their field. I wouldn’t be surprised if a large brokerage house or bank takes out one of the smaller automated investing firms or a robo-advising firm (Wealthfront/Acorn)… That might lead to a domino effect of other banks scrambling to get exposure to this tech focused approach to investing.Cyber security had a tough 2016. The increase internet rhetoric around hacking could be a catalyst for companies like FEYE and PANW to have a strong 2017. In this slower growing economy, companies that can grow their revenues more than 25% YoY will continue to trade at a premium. One or two publicized internet attacks can shift the focus back to cyber security.Full Discloser: I have a position in SQ and FEYE.

Lot’s of winners this year because of Feb sell off and Trump rally. Even stalwart US Steel (X) achieved a 5 bagger. Predicting winners has a 50-50 probability. The ones who end up right happened to end up right. That being said, conversations like these can open new ideas for people. (Check out Chicago’s TastyTrade.com for a more strategic approach to financial management and let probabilities work for you.)

The next market disruption can be in the FinTech Industry!! So I will pick LendingClub(LC).