Last year our niece decided to move about half way through her lease and ended up having to Airbnb her apartment for six months until she got out of her lease.

This summer our daughter is at graduate school upstate and rented her apartment to her friend for the summer.

One of our analysts decided to move to Brooklyn and had to figure out what to do with her apartment in Manhattan.

This is how millennials live. They go from apartment to apartment, roommate to roommate, city to city, job to job.

But this is not how apartments are rented. The apartments are leased for one year, two years, three years, with upfront security deposits, brokers fees, and a bunch of other costs that make the “fluid” approach to living difficult.

Enter Flip.

Flip is “the easiest way to sublet or get out of your lease and it is 100% free to list”

So if you or someone you know is looking to move and wants help with a sublet or needs to get out of a lease, Flip is the place to go.

The Gotham Gal has been an investor in Flip since the very beginning. I have been watching the company grow and build out this market opportunity with interest.

Earlier this year, she introduced the Flip founders to my partner Andy and the result is that USV is now also an investor in Flip.

Andy explained why USV is so interested in Flip on the USV blog a couple of days ago.

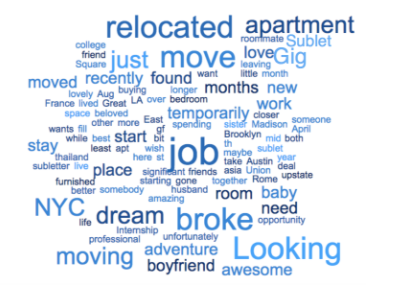

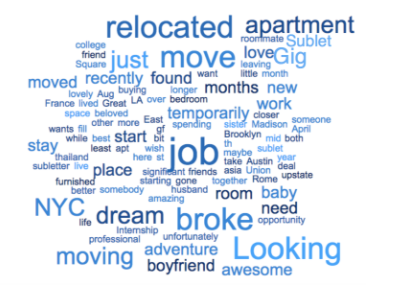

It’s a great post and you should go read it, but my favorite part of the post is this word cloud, taken from Flip’s listings, that explains why people use Flip:

Finally, Flip is looking to hire some engineers. They have built everything with just four people. That’s bootstrapping. I love it. They plan to double the team to eight people with this new investment. So if you want to work with great people, building technology that helps people with important changes in their life, Flip would be the place to do both of those things.