Hashpower Podcasts

I sent these three Hashpower podcasts to a friend who was trying to make sense of the whole crypto thing and she found them valuable.

So I am sharing all of them with you today:

I sent these three Hashpower podcasts to a friend who was trying to make sense of the whole crypto thing and she found them valuable.

So I am sharing all of them with you today:

Whether you have a e-commerce business, a SAAS business, a media business, a marketplace business, or some other business model, you are going to start thinking about customer acquisition at some point.

And there are a lot of options out there for acquiring customers; direct sales, indirect sales, channel, search engine marketing, social media, email, display, etc, etc.

But the best option, if you can pull it off, is to own an organic customer acquisition channel that is large and that sustains itself.

At USV, we have investments in a bunch of companies that have very large organic and sustainable top of the funnel customer flows. Many of these companies use a number of customer acquisition techniques, but they start with the organic channel and optimize it with their product development efforts.

Here are a few examples:

Codecademy – Codecademy offers a number of subscription learning services to people who want to learn to code. But because it has been offering free curriculum for learning to code for six years now, it was the first organic result I got this morning when I typed “learn to code” into Google:

Quizlet – Quizlet offers over 200mm study sets on the web and mobile to people who want to study and master something. No matter what you want to learn, you can find a study set on Quizlet to learn it. Quizlet is the “Wikipedia of studying” and because these study sets are free on the web and mobile, they have a huge organic flow of new users every month. Quizlet offers two subscription offerings to students and one to teachers and this organic flow is the primary customer acquisition channel for these offerings.

SoundCloud – SoundCloud is the first place most musicians go to post their music on the Internet. There are upwards of 200mm tracks on SoundCloud, the vast majority of which are free for anyone to listen to. This content is a huge attraction for listeners on web and mobile. SoundCloud has three subscription offerings, two for listeners and one for creators. The organic channel is the primary acquisition mechanism for these subscription offerings.

Kickstarter – When a project creator launches a Kickstarter project, they share it with as many people as they can through email, social, blogging, etc. This brings millions of backers to Kickstarter every month. Most of those backers arrive to consider backing a specific project and move on. But enough of them stick around to see what else is going on that Kickstarter has been able to build a large and sustainable business without any need for paid marketing channels.

Etsy – Etsy is now a public company and is no longer a USV portfolio company but I am the Chairman and remain actively involved with Etsy. Etsy is similar to Kickstarter in that sellers who have shops on Etsy are actively promoting their shops through various channels. Most of the buyers who arrive on Etsy that way purchase from the seller who brought them but some stay and shop from other sellers too. Etsy explained in it’s IPO filing that the vast majority of it’s traffic was organic. That is slowly changing but in Etsy’s early years, all of the traffic was organic.

I could keep going but I think you get the point. One of the things I look for in an investment is a free and sustainable flow of customers. This big top of the funnel may not be the only way a management team will choose to build their business but it makes a great foundation to build on and the LTV/CAC is infinite.

I saw this video a drone enthusiast made on AirCraft and thought I’d share it with all of you this week:

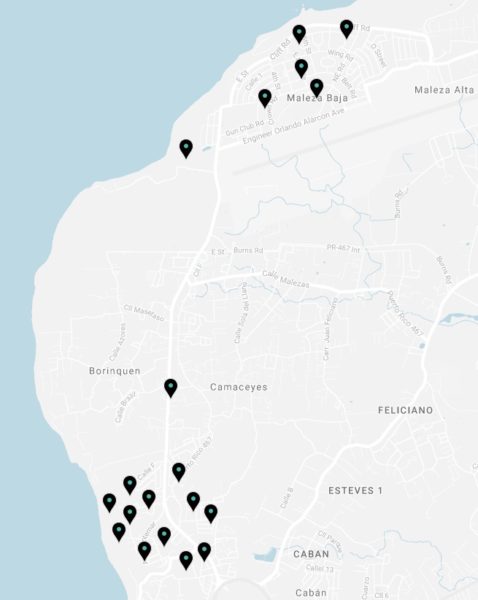

Our portfolio company goTenna sent a bunch of their mesh networking devices to Puerto Rico in the wake of Hurricane Maria and a number of mesh networks lit up on the island.

This is what the goTenna network map looks like on the west side of the island now:

So they kicked off this crowdfunding campaign to purchase another 300 devices to get more mesh connectivity on the island.

I backed the project yesterday and it would be great if the AVC community could close this out with more donations today. The total raise is $15k.

If you want to learn more about goTenna, this Techcrunch story is a good place to start.

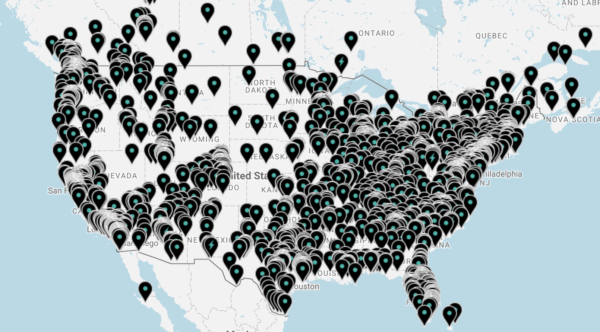

In a few short months the goTenna mesh device has built this network around the US:

I’ve been a fan of the idea of people-powered mesh networking for a long time. It is great to see it happening.

Yesterday, our portfolio company Kickstarter announced that they had relaunched Drip, a subscription platform they acquired almost two years ago.

Perry Chen, Kickstarter’s founder and Chairman, wrote this blog post explaining what they are trying to do with Drip.

I would like to highlight a few quotes from that post:

Kickstarter is for projects, Drip is for people. – Kickstarter and Drip are different. Kickstarter is about funding a project. Drip is about supporting a person.

In recent years, we’ve seen the growing validation of subscriptions for serial online content creators — podcasters, YouTubers, bloggers — using tools like Flattr, Patreon, and Steady. It’s been great to see organizations build tools like these — the world is far from having too many tools for creators. But there remain large groups of artists and creators who don’t see subscriptions as fitting their creative practices. Our goal with the new Drip is to change that. – Drip is about expanding the market for subscription patronage beyond serial online content.

creators will be able to export their data and content, and we’ll even help creators securely transfer subscription and payments information to other subscription platforms. We believe creator independence means not being locked into a platform by design. – Subscriptions are different than campaigns, they are for the long run. Being able to leave one platform and join another is critical.

Every Drip begins with a founding membership period to help creators build momentum. The founding membership period is a way for creators to entice their fans, friends, and new audiences to jump in and build up their base of support. (This is not all-or-nothing like Kickstarter, but it does build on our experience that a strong call to action is essential.) – Kickstarter knows that having a call to action is key to generating early support for a project. Until now, that notion has not existed in the subscription market.

We also designed Drip to be both separate from but complementary to Kickstarter. One way we’ve done that is that existing Kickstarter users can use their stored account and payment details to easily support creators on Drip. Kickstarter and Drip are different services but they share user accounts and payment credentials. If you are logged into Kickstarter, you are logged into Drip.

We will operate Drip with the mission and values codified in Kickstarter’s Public Benefit Corporation charter, which mandate our commitment to helping people bring their creative projects to life, not putting profit first, and maintaining higher standards for our practices. We think these commitments are more important now than ever. – Kickstarter is a different kind of company, a Public Benefit Corporation. Their products and business practices reflect these values.

I backed about ten drips yesterday. It is about the simplest thing to do on the Internet if you already have a Kickstarter account.

If you are interested in doing the same, you can find some great Drips here.

I just saw this on my twitter:

The @NVCA has been working hard to make sure #innovation & #entrepreneurship are drivers of US growth!#TaxReform pic.twitter.com/q1Ez7EfbC7

— Phil Sanderson (@SanFranciscoVC) November 15, 2017

This means that the Senate has now made the tax reform bill a win for those who work in startups instead of a loss.

I’m thrilled and I want to thank all of you who called your elected officials and those in the Senate Finance Committee who clearly understand the importance of equity compensation to the startup model.

My partner Rebecca posted this to her Twitter yesterday:

Excited to band together with a group of women that I’ve learned so much from to help women starting the next generation of breakout businesses. Female founders we’re so ready for you! Apply here: https://t.co/hQkMiylfDf https://t.co/u2zkL8qDoz

— Rebecca Kaden (@rebeccak46) November 13, 2017

FemaleFounder.org is a group of women VC investors who are doing regular “office hours” to advise and mentor female founders.

As they say “A community of women helping women”

I know most of the women who are doing this and they are all great people, investors, and advisors.

If you are a woman getting started on your startup journey, check out FemaleFounder.org.

It’s a great initiative.

The current draft of the Senate Tax Reform Bill would tax stock options and RSUs upon vesting.

Currently, stock options are taxed upon exercise and RSUs are taxed upon release of the underlying shares.

This is a HUGE deal to everyone who works in companies that partially compensate their employees with these two equity instruments.

What this would mean is every month, when your equity compensation vests a little bit, you will owe taxes on it even though you can’t do anything with that equity compensation.

You can’t spend it, you can’t save it, you can’t invest it. Because you don’t have it yet.

Taxing equity compensation upon vesting makes no sense.

I have seen many employees leave companies and not exercise their vested stock options. It happens all of the time.

That should be a clear enough example to the lawmakers that vesting should not be a taxable event.

But, sadly, I don’t think this is really about what makes sense. It is about politics.

The US Senate, particularly the Republican leadership, needs to hear from you, the employees who will feel the pain of this change, that it is wrong.

Otherwise, I think this provision could become law.

And that would be the end of equity compensation in startups as we know it.

If this provision becomes law, startup and growth tech companies will not be able to offer equity compensation to their employees. We will see equity compensation replaced with cash compensation and the ability to share in the wealth creation at your employer will be taken away. This has profound implications for those who work in tech companies and equally profound implications for the competitiveness of the US tech sector.

So, what can we do about this?

First, we have to move fast. The tax reform bill is moving quickly with a goal of getting it done before year end.

This particular provision, which was in the House bill and was taken out last week, will be considered by the Senate as soon as TODAY.

So, please reach out to your Senators and let them know that they “must remove Section III(H)(1) from the Senate Tax Cuts And Jobs Act”.

The best way to do that is to call their office and speak to the staffer who handles tax reform for them.

Here’s a short explanation of how to do that.

Please do it today. This is really very important to everyone who works in tech.

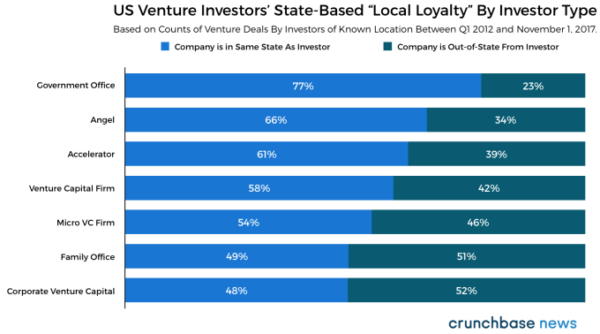

Here are some “truisms” about startup investors and location that I’ve experienced and passed on over the years:

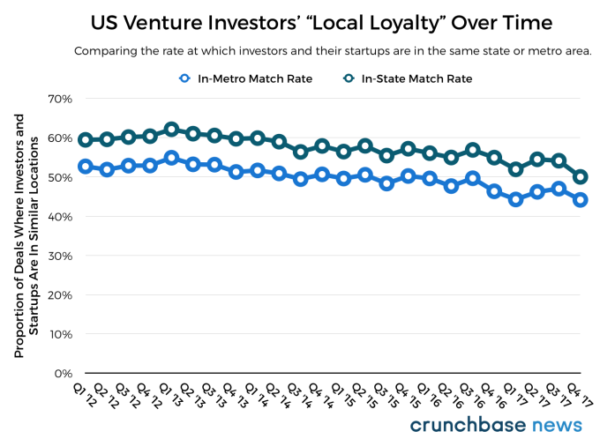

Last week Techcrunch published some numbers on the issue of location and startup investing using Crunchbase data on 36,700 startup investment rounds they have tracked from Q1 2012 through October 2017.

So let’s see what the numbers say about these truisms.

Startup Investors Prefer To Invest Locally

This is true, over half of all investors in startups are in the same state. But it appears that the location preference is declining over time, maybe brought on by the significant improvements in videoconferencing and other communications technologies.

The Younger The Startup, The More There Is A Location Preference

This is true. 66% of angel investments come from in state investors whereas only 58% of VC investments come from in state investors.

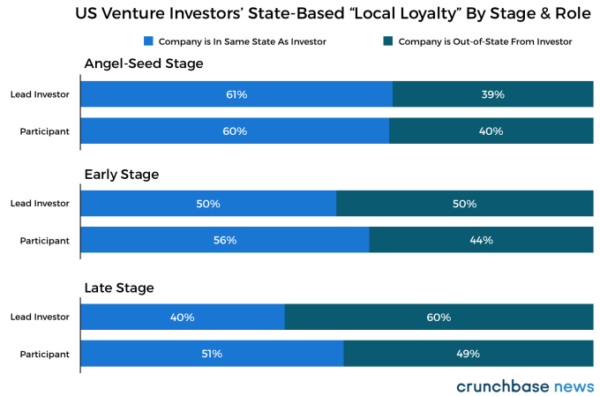

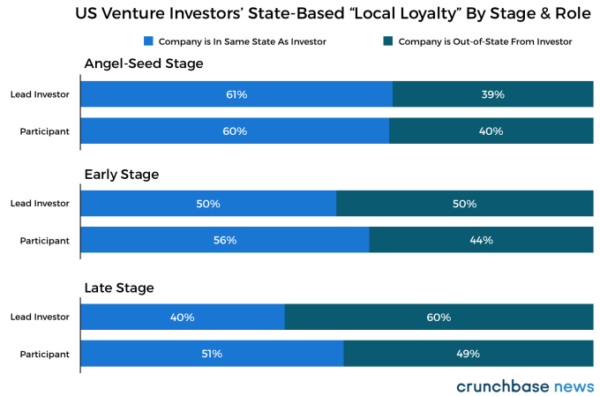

Lead Investors Tend To Have A Stronger Location Preference Than Passive Investors

This does not appear to be true.

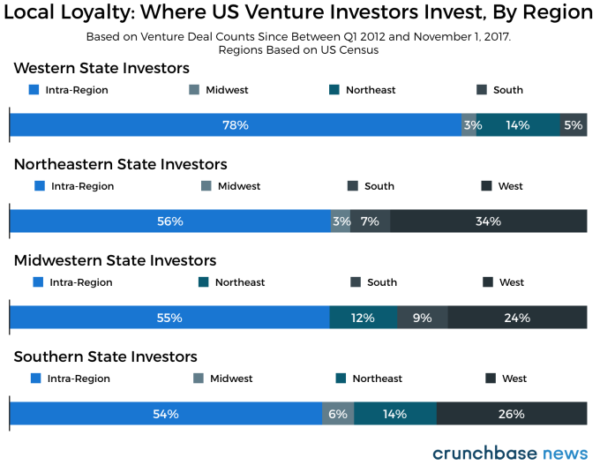

Location Preference Is More Pronounced In Vibrant Startup Markets

This is very true.

The Location Preference Fades As Companies Mature

This is very true.

At USV, about 25% of our investment activity is in NYC, 50% is rest of US, and 25% is outside of US. We are not completely location agnostic as we don’t invest very far away (South Asia, Asia, Middle East, Africa, etc) and we likely over-index on NYC vs the rest of the VC industry.

But the truth about being a startup investor, unless you are located in the bay area, is you have to go where the best opportunities are. That is particularly true if you are a thesis driven investor, as we are at USV.

So as much as I’d like to walk to my board meetings, that just isn’t reality. That said, I plan to walk to a board meeting on Tuesday.

Our portfolio company Nurx provides prescriptions via an app on your mobile phone.

The initial offerings are birth control and HIV prevention medications, but they will add other prescriptions in the future.

This news report talks about their launch in Texas this summer which was extremely successful.