The Early Stage Slump

I tweeted out this article from Techcrunch in the middle of last week:

“we believe 2012-16 was a bubble in early-stage funding” https://t.co/VZlKOCDg5P

— Fred Wilson (@fredwilson) December 1, 2017

And the response from the Twittersphere was a desire to hear my views on it.

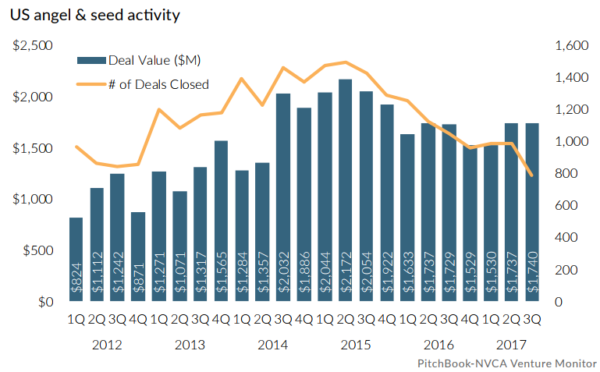

The data is pretty clear. The seed and early stage investing market has cooled substantially in the past few years.

On a dollar basis, the cooling off has been mild.

On a deals basis, the cooling off has been dramatic and looks to be getting worse.

So what is going on?

When I talk to my friends who do a lot of angel investing, I hear that they are being more selective, licking some wounds, and waiting for liquidity on their better investments.

When I talk to my friends who started seed funds in the past decade, I hear them thinking about moving up market into larger funds and Series A rounds.

You can see that in the data. Less deals and bigger deals.

Here is the thing. Seed is really hard. You lose way more than you win. You wait the longest for liquidity. You lose influence as larger investors come into the cap table and start throwing their weight around.

It is where most people start out. Making angel investments, raising small seed funds. They learn the business and many see better economics higher up in the food chain and head there as soon as they can.

If you hit one or two right, you can make a fortune in seed. But those bets take a long time to get liquid. And if you don’t hit one or two right, you end up with a mediocre portfolio.

The Facebook IPO in May 2012 was a real boon to the angel and seed markets. A lot of instant millionaires re-invested their gains back into startups (just as BTC and ETH instant millionaires are re-investing their gains into ICOs right now). Many startup people reinvented themselves as angel investors, AngelListers, seed VCs, and early stage VCs. As I quoted Techcrunch in my tweet “2012-2016 was a bubble in early-stage funding.” I think the bubble actually started letting out air in mid 2015.

You could see all of this in the pricing of seed rounds. For most of my career, seed rounds were sub $1mm and they bought 15-25% of the company ($4-6mm post money). At the peak of the seed bubble, uncapped notes of $3-5mm were the norm for seed rounds. That wasn’t going to work. It was unsustainable.

So where does that leave us now?

For entrepreneurs just starting out, it will be tougher to raise your first rounds. That is how it always has been so it is a return to normal. It is not great news, but it is the reality. If you price your seed round appropriately and have a good team and plan, you can raise money. But it will be harder.

For investors, it means seed rounds are going to be the place to be. When others leave the market, it is time to get in. The uncapped note will turn into a priced $1mm round at $4mm pre/$5mm post. This is as it should be. The risks of seed investing are so significant that the valuations need to be reasonable. When you lose on 60-80% of your investments, you really need the ability to make 10-20x on your winners. And getting the entry pricing right is part of how that happens.

You can tell where there is too much money and too little money by looking at valuations. When valuations are extended, that means there is too much money. That was seed in 2014, growth in 2015/2016, and ICOs in 2017. The trick is to get into these sectors before the money shows up and get out when it does. And then get back in after it leaves. And not get burned along the way.

Comments (Archived):

How could any seed (pre anything ) “business” possibly be worth anything more than the capital raised? It seems absurd, and the probability tree and success rates appear to make that more accurate than false. Crazy. Lotto tickets would have a better IRR

I get asked frequently what things are worth. Something is worth what someone (arms length, no pressure yada yada) is willing to pay. [1] And don’t get me started on appraisals. [2][1] If you are the guy at the auction who wins by that theory though you overpaid because the guy who came in 2nd defined the value. So in that case I would say it’s worth the 2nd value. I am sure others will disagree. I just lost out on a piece of real estate by a small amount. In one way I am glad because it was proof that the market said the property was worth what I was offering. But worth is also defined by a point in time. And in the case of (as only one example) real estate you have already lost money since (at a point in time) most likely you’d have to pay realtor commission to even sell for what you paid or even to the number 2 buyer. So is it worth what you paid? Depends on what you mean by ‘worth’. And there is one more very important principle. It doesn’t matter if you overpay if in the end you have a win and prices go up. Rising tide and all of that. So the stupid guy could come out ahead in that case.[2] I once helped a divorced woman with getting one over on husband in her divorce settlement. I told her to get at least two re appraisals and simply use the higher one. The difference was roughly 10%. The judge took her husbands appraisal and her appraisal (the higher one) and split the different. So it was (simple math) 5% more for the cost of a real estate appraisal. I would have gone for more appraisals than two knowing that I had little to loose in doing so. Her husband who didn’t have access to the house couldn’t do that. Neither the husband or their lawyer even anticipated this happening. (A case where experience pays off).

Sure, get all the offers on the table at the same time and pick the best. For the math, the best is better than the average and usually much better if have a lot of relatively independent offers on the table at once. So, don’t take and consider the offers one at a time if can avoid it.If have to make the decisions one at a time sequentially, then there is some cute math: Look at the first half of the cases and notice the best. Then in the second half of the cases, pull the trigger on the first case better than the best case in the first half. Under mild assumptions, the rule maximizes the probability of picking the best.

Yup, supply-demand. We do seed investing in our fund. We also are investing in a spot where not a lot of people invest. We decided not to do the $100k per deal approach and instead make fewer bets but write larger checks. Statistical analysis shows this is the correct path. It’s a lot harder for sure. Lots.

“When valuations are extended, that means there is too much money.”- This is so true for token offerings in crypto markets today. Most ICOs are getting over-funded. And their success rate might end up being lower than traditional startups.

$3.6B+ for ICOs only this year. I suppose very soon investors need to ask for MVP and some market traction

Demand it

Success rate MIGHT BE lower?Unlike the web, tons of people CANNOT find a use case for crypto that makes sense to them. Success rate is going to DEFINITELY be lower.However, Albert is likely right – if there is one that wins is likely worth trillions.Really impressed by your ability to be in the eye of the storm but keep your balance, relatively.

Trillions ? The top “three” companies of over the last “three” decades have a combined market cap of 2 T.

CNBC has turned into a joke of a business channel. https://uploads.disquscdn.c…

Hey–I was asked to evaluate a rollout plan within developer and market from an ICO that closed recently.The amount in legal fees shocked me. Is there a metric US and Non US investor that provides some % of raise or flat for this?

Misc fees can range from 4-15%, there is no standard.

Quite a range.In the half dozen rollout plans I’ve reviewed all have been on the high side of that number.Curious if you have rules of thumb for ongoing hold backs for legal.This is useful info that should be made public as a lot of ancillary services from legal, to advisory, to marketing are all piling on the Pre ICO budget and the premium for the risk of failure of the raise are really considerate.Thanks!

Hallelujah. Discipline returned to seed stage valuations will help entrepreneurs too.

It could also be that there just aren’t any good startups to invest in.

And that the investors perhaps are suffering from ‘experience is a drawback’ syndrome. That’s where you are less likely to make bets when you have more knowledge and can therefore spot potential problems in advance. [1][1] I discovered this by how I felt with in second business vs. my first. In the first business I had little to no fear because I hadn’t been burnt since I was just starting out. I remember my Dad saying to me “‘oh in business school they will tell you to ‘hire someone good’ but you will see how hard that actually is”. And sure enough when you start the 2nd business you think ‘wow it’s hard to hire good people not looking forward to that part’. [2] And it impacts what you do and how you do it. This is why young people often have an advantage over older people. They don’t even know what they don’t know and do all sorts of things that an older person wouldn’t touch. So in certain things more experience (when involved in win big betting such as startup investing) could be a drawback even if in other ways it’s a benefit. [3][2] In these examples my money on the line and zero room for error.[3] Remembering Fred’s example the other day of what he said when Albert proposed DuckDuckGo ‘you want to compete with google?’.

See Charlie Munger’s speech on The psychology of human misjudgment

There is a story about Stanley Druckenmiller. Around 1978, he was promoted early in his career ahead of several, more experienced people. He asked his boss for the reason. His boss said (paraphrasing here, don’t have exact words) – “For the same reason that generals send 20-year olds to war. You are too dumb and inexperienced to not know to charge ahead. All of us here have been around in a bear market since 1970. A bull market is coming. But we have all got scars from the last several years and won’t be able to act decisively. So I need somebody inexperienced like you…”.The bear market actually ended in 1982.Life is quite often about functioning with opposing ideas that are both true (F. Scott Fitzgerald said this more elegantly).Experience is invaluable. Except that experience can hurt you.The trick is knowing which is true when.

So how did Stanley end up doing? :)Okay, I checked.https://en.wikipedia.org/wi…Not too bad (financially), I guess.

From that Wikipedia article:”Duquesne Capital Management posts an average annual return of 30 percent without any money-losing year.”This reminded me of The Book of Five Rings (Go Rin no Sho) by Miyamoto Musashi.[ According to the book, “Musashi, as he was often simply known, became renowned through stories of his excellent and unique double-bladed swordsmanship and undefeated record in his 60 duels”. ]I liked the style of writing in the book.Excerpt of first two paragraphs of the Wikipedia article about the book:[ The Book of Five Rings (五輪書 Go Rin no Sho) is a text on kenjutsu and the martial arts in general, written by the swordsman Miyamoto Musashi circa 1645. There have been various translations made over the years, and it enjoys an audience considerably broader than only that of martial artists: for instance, some business leaders find its discussion of conflict and taking the advantage to be relevant to their work. The modern-day Hyōhō Niten Ichi-ryū employs it as a manual of technique and philosophy.Musashi establishes a “no-nonsense” theme throughout the text. For instance, he repeatedly remarks that technical flourishes are excessive, and contrasts worrying about such things with the principle that all technique is simply a method of cutting down one’s opponent. He also continually makes the point that the understandings expressed in the book are important for combat on any scale, whether a one-on-one duel or a massive battle. Descriptions of principles are often followed by admonitions to “investigate this thoroughly” through practice rather than trying to learn them by merely reading. ]

.Haha, the beginning of wisdom is the ability to recognize that, at times, two opposing thoughts can be correct at the same time.What is important is which one you feed and which one is more powerfully led.JLMwww.themusingsofthebigredca…

I heard the story as he trained his wife ( no market knowledge) to react to system signals for trading. He always was second guessing the signal and wanted someone to just react.

> but you will see how hard that actually isMore generally, in the last few days I reviewed people and families I’ve known since childhood. I see a huge fraction of train wrecked people, lives, marriages, families, and work groups. The reality is usually thickly covered over, but it’s still plain enough to see if just look.A lot of the people I’ve seen up close did well or covered over the problems well. Still, if look carefully, the number of walking wounded, by analogy, missing at least one leg, but really between the ears instead of below the neck, is shockingly high.I concluded in particular that some good news about the US Congress is that the several hundred people there mean that there will be a lot of total wack-o stuff but there are so many different ways to be wack-o that the wack-os don’t get a majority and the majority is usually surprisingly better than the average wack-o level.So, from 50,000 feet, apparently part of the job of a CEO is getting all the independent, flawed, ducks walking in line effectively individually and as a team.So, right, finding a good employee might be tough. Then given 20 employees, keeping down internal fights, hanky-panky, gossip, sabotage, jealousy, lies, various forms of theft, partitioning into cliques fighting wars, goal subordination, etc. might be tough.Apparently, net, have to accept that nearly everyone there has some serious problems so that can’t be surprised that there’s some total BS stuff going on.Then don’t just wonder with incredulity why such nonsense could happen and, instead, accept the average sick-o situation and take action, including firing people, as needed.I mean, why can’t people just concentrate on doing the work, cooperating, and then going home happy for a good Sunday afternoon family BBQ? Nope — instead too many people want to extract miserable defeat from the jaws of magnificent victory. My guess is that the most common cause, and maybe 50% of all the causes, is just some form of anxiety based on a lot of ignorance.I recall an old, blunt, crude, brutal management lesson: When have a team that is not performing well, for whatever reason, find the worst performer, in whatever sense, and fire them. “Works every time.”. Maybe I’ll have to do that.Maybe another lesson is to have some high standards about some things that appear directly to be nearly irrelevant, e.g., in K-12, perfect school uniforms. So, enforce discipline on that surface stuff and, then, hope that the discipline also works on the less obvious stuff.I’ve seen situations that look like the famous Norman Rockwell painting of Thanksgiving but where in reality the woman carrying the roasted turkey would like to have rat poison in the turkey and kill one or more people at the table.It took me a while to figure out how commonly bad people, lives, marriages, etc. really are.

There is also less competition, so early investors can sit on their hands longer.

.”When the dentists get in, GET OUT;When the institutions get out, GET IN.”This has been the rule forever.JLM http://www.themusingsofthebigredca...

I think there might be a point on the curve where the dentists getting in still presents an opportunity.I have been thinking about this with regards to Fred and William’s enthusiasm for crypto. They have access to the ‘feel of the trading floor’ (what pointsandfigures has described?) that we don’t. We are just observers on the outside trying to be rational and use the limited info that we have. But they feel, the pulse of opportunity, because they are immersed in it. And they can sense the increase such that they could see where it’s going that we could not. (I could also argue that they are blinded to actual reality but that is not the point I want to make in this comment).I have told the story before of my Dad buying a property from me and making a killing to teach me a lesson. He had that feel for the area that I didn’t (Old City Philly). He was there many days and I was not. He saw what was happening and had that ‘feel of the trading floor’ and I did not. He bought the property and ended up selling it several years later for something like 4x what he paid me. Then that guy sold it for 2 or 3x what he paid my Dad.

One good reason to read AVC is having access to their feelings on the feeling on the trading floor. Plenty of soft data here. They have good placed sensors.But there is also gut feeling, I think everyone has that. To ‘do what you have to do’. Having the courage to do it and take the risks is another thing.On 2010 I got some money selling family property. I recall that I considered then going full Apple as a believer and a fan. I had the gut feeling but didn’t take the risk. Not sure today if I lost 4x, because later I ended up financing a personal project, but have to admit that I haven’t seen many Xs yet. 🙂

.I have watched and invested in the commercial real estate markets for 40 years (CBD office buildings, suburban office buildings, tech office, apartments, warehouses, retail, storage, some mixed-use land) and there has been an immutable correlation between amateurs entering into commercial and the end of the upward cycle followed by a downward trend, the rediscovery of value, and a wholesale changing of the guard.I have bought hundreds of millions of dollars of commercial real estate from institutions who were headed out of the market. At today’s prices, it would be well into the billions.It is apochryphal.Very rarely is there sufficient growth for both the amateurs and the pros to both be happy, though the boundary is not hard. Both can be right for some period of time in a growing market.It is true that opposing truths can be both wrong and right at the same time, but over the long run the laws of business gravity reassert themselves.One of the reasons it is so powerful in real estate is because it is an operating business. I used to purchase run down apartment complexes (250 units or more, never little ones) across from somewhere an apartment company (usually a REIT) was breaking ground. I would renovate them, put in a new clubhouse and pool, reprice them, and re-staff them.I used to think my special sauce was fencing the property, ultra lush landscaping, and a clubhouse/pool which was spectacular. In the end, this is actually a very small element of the physical plant, but it is seen and touched by everyone.The guy across the street was in for $85K a unit (early 1990s time frame) and I was in for $22K/unit.I used to let them run all kinds of marketing and have a single sign on our property. It used to say something obnoxious like, “Check our prices before making a decision.”Worked like a champ. We would charge 85% of what the new apartments would demand. People were quite cost conscious. Our returns were, pure math, through the roof and we never spent a penny on marketing.Now, I think we ran our complexes better than our competition. I hired only women who were divorced with a child and a college degree. The entire division was run by a hard, tough woman who was the best people manager I ever met. We hired maintenance men who were certified. I paid them all well with an incentive comp plan which paid them for financial performance.A 1% change in occupancy is a huge financial implication.The oil business has been similar. People forget that in the last 20 years, oil has been $20/bbl. All kinds of individually owned, producing wells were for sale on the timeless formula of “Getting your bait back in 24-28 months.”You have to have real balls to buy in those times. It is still true today. We are at a comparatively low oil price.I think this differs as it relates to cryptocurrency as it is a new undertaking. There is no long, gray haired view. It is a trade not an investment.I think it has been a very good trade and I admit to dipping my beak. I am still completely unconvinced as to its long term “currency” implications. Not opposed, just unconvinced, but I think it is a trade.JLMwww.themusingsofthebigredca…

Crypto? I have not dipped my beak for the following reasons. I am sure their are more so this is just off the top.a) I am typically only interested in things that are repeatable. So I don’t want to spend time on something which I feel I won’t be able to repeat the angle but most importantly I am depending on things beyond my control mostly ie ‘his daughter thinks she is a genius’.- You may win once or twice at the casino but over time the house has the edge most of the time. Anyone who wins will probably try over and they may loose that house money in the process and more.b) I don’t do investing off the bat that common sense says is not smart and doesn’t make sense unless there is a reason. A reason might be a conversation with someone that others are not having let’s say or something that I know that others don’t or where I could add value.c) I don’t gamble large amounts. And if you are not gambling large amounts (and I don’t know what you mean by ‘dip my beak’) you are not going to win big. So it’s entertainment then.d) If yes if I don’t win big then it’s just entertainment. And I have enough things to entertain myself with and to do.e) I don’t have any advantage over the other guy. In fact I am at a disadvantage.f) I have made serious money from crypto but not buying any coins or ico’s. That is by exploiting things I know that others don’t that I can make money from. So I ‘stick to the knitting’ (hey till the bitter end!)g) It’s hard when you are not stupid to think like stupid people who gamble and have no clue – (Jamie’s daughter). And no they are not just ‘doing their research’. They just (majority) don’t have a clue. The genius in Fred and William is that they are involved enough ‘feel of the street’ to identify this. To my point, I am not.I like making money the way you did in the example you describe above. By being clever and perhaps devious. I wonder how many people reading your comment can appreciate the beauty of what you were able to do and how you in theory were creating something that you could repeat again and a barrier to others doing the same (because they don’t know what you know). It’s a work of art to me when people in business do that type of thing. So that is what I find fun and what I do or try to do. Simply betting in buying crypto is just not my thing. Not deriding others doing it to be clear. They have made money. I am making money off of them in a pick axe way if I can.

The best lesson I’ve learned from the folks at AVC is to stick to my circle of competence and outsource or stay out of what I don’t know.

Will point out though that you are still young enough to develop new areas of expertise. What I would suggest (and what has worked for me) is to put a percentage of your time (arbitrarily 10 to 20%) into learning and doing that has no immediate benefit. But may payout over time. Not sure this is the best example but the Unix and playing with computers that I did in the 80’s as well as hobbies prior to that (one example photography) have all paid off later. Most importantly they were fun to do. Which is an important part of the strategy. And no, the idea isn’t to do gut things either. One of the ways I make money now is offering a service in the last 10 years that I started to do at no charge originally just because it was fun for me and I got positive feedback.

.The only reasons I would trade Bitcoin is because of the zealotry of guys like Wm M, et al. They are smart guys.I was impressed that BC took a dip and came back. That is the mark of a trade.I predicted on my blog that BC would end up much higher in 2017. I came to this conclusion by studying where the trades were coming from and concluding it was a proxy for flight capital (meaning China).The trade is just a trade. It is like feeling a crosswind in the seat of your pants when landing an airplane even when the approach controller hasn’t mentioned it to you.I intend not to be the last guy off the merryground when the music stops.JLMwww.themusingsofthebigredca…

.One last thing — we are an all time high in disregarding what the “smart” guys or money think. The election proved that and continues to prove it.I don’t think there is much “feel of the street” in BC as it is way too early. It is all just gut. Not even informed gut.JLMwww.themusingsofthebigredca…

The thing to remember is that bitcoin is doing what even Fred or William would not ever predict might happen (price wise). You now also have blowhards like McAffee that are further fanning the flames and remember the ‘grandma’ picture I posted the other day:https://www.cryptocoinsnews…So this is entirely unnatural. And both of us know that while bitcoin has increased in value for the right reasons (those are things that Fred and William might say; from now on we will shorten that to “Frewilliam” ) it has gone up the way it has in the last few months primarily because of grandma (and now you) jumping in trying to ride a wave. Isn’t that what happened with the housing bubble? I mean for sure the difference is I think most investors gamblers aren’t on the hook and probably don’t stand to lose anything like the shirt of the housing crisis. I will agree with that. So yes if they are all only putting in a small amount they are less likely to pull that small amount out. Like a tax on every single citizen.One other thing. With this amount of interest it is more likely that the feds will decide to put an end to the party in one way or another. So while nice growth and increase in price is good at a certain point the government will begin to regulate it or try to stop it.

.The IRS took one of the big uncertainties out of the equation when they decided to tax it as property (securities).I’ve been in for a lot longer than you think — a trade, nothing more. A bublicious trade.JLMwww.themusingsofthebigredca…

I am thoroughly enjoying this whole thread.BTW, my son just popped into my office and said, “Oh, hey, is that the Big Red Car guy? I love reading his blog.” He and I have had many dinnertime conversations about what we’ve both read here on AVC and Big Red Car (and other places online too). We don’t always agree but we appreciate the reasoned viewpoint.

While my apartment unit is not in the best cosmetic condition (and could really use a rehab) I am terrified of leaving because my property management company is so damn good and responsive and I have heard horror stories. It makes a huge difference knowing that when stuff breaks or is there is a problem the management company will fix it within 24 hours, and the maintence people are all friendly and respectful. It really does make a difference as a tenant.

.When a landlord loses a tenant, he usually paints, shampoos the carpets, fixes all the appliances (if more than 4-5 years old, he probably replaces the carpet, 5-7 years for appliances). This is a standard procedure.I would usually spend $2-400 to “make ready” an apartment, but remember I had 18K apartments and make ready crews.Next time you come up for a renewal, ask for a free make ready. I would do it for any tenant if they asked. Even mid-term if they would extend their lease.When a tenant would renew a 12 month lease, I would often do a make ready and give him a month of rent free because I would do the make ready when he was in the unit.I bet you can get them to do that.JLMwww.themusingsofthebigredca…

Now that is valuable wisdom. I will make sure to remember that next year. This is a large(ish) property management company with units across Cambridge. I imagine they have more than a few FTEs that spend their time handling that when its the season.

.Don’t wait. Strike now. The future belongs to the bold.JLMwww.themusingsofthebigredca…

Dad could have done that. He was terrific at all the trades and plenty smart and well educated otherwise. Mom was terrific with people, including the high end country club elites.When my wife and I were in grad school, we lived in an apartment collection something like that — a good maintenance guy and a smart woman running the place.

LE:When respected VC’s are courted and presented opportunities early it always looks brilliant. Crypto-currency needed Fred, William and anyone on Wallstreet with any credibility more than the former needed it.Nathaniel PopperDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyThere are no fundamentals just speculation so your view of they knew anything but what it could be with their support.

In Europe there has not been an implosion of seed & angel rounds, as the following chart shows: https://app.dealroom.co/fun… (note: 2017 will still increase because many seed rounds are only announced 18-24 months later – at series-A… or exit)https://uploads.disquscdn.c…

Notable exception is the UK, where seed rounds have not grown since 2014 https://app.dealroom.co/fun…

it could be that europe did not see that rush of money that the valley saw in 2012/2013 and thus did not get too far ahead itself

Either that or Europe is just behind the curve

It’s not fun striking out 8 out of t0 times in seeds. Especially, after some initial success. Many people believe that their 2nd time out will also be successful and almost a given.

A good way to ensure failure ? Personalize your previous success.

I like that.

Fred, I already Tweeted this at you but thought it was worth adding to the comments here. I looked at this in April, and seems that — when looking at 1st fundings as a share of all fundings — we’re back to normal. So, I agree with you here http://www.ianhathaway.org/… https://uploads.disquscdn.c…

yupi saw your tweet. you were ahead of the curve here

I enjoyed your post; great explanations and context.

Sorry, sore point with me from doing graphs in freshman physics; I can’t make any sense at all out of your graph:(1) What are the units on the vertical axis? There should be some indication of time, e.g., quarters, right? In the freshman physics class I went to, leave off clear axis labels and get a big, back X on the graph from a big Magic Marker and a grade of flat F.(2) What the heck are the little dots. Apparently there are many more than just one per quarter.(3) What is the “trend”? A guess is that you used some least squares spline fitting, and if so that’s not nearly the usual meaning of trend.(4) What the heck is the meaning of “alternative”? You totally lost me.

Thanks for touching on this subject. I’m told seed funds are for building a product, yet the advice I have been given was to wait until my product dominates the local community I am building for. Maybe someone here can weigh in, I’m curious what checkmarks I should reach to prove a business to a seed/angel investor.I lack some experience here since I just graduated college but I have launched a MVP & gained traction.

Depends on the fund and the risk appetite of the fund managers. I’d be very direct with them and ask exactly what sort of “traction” they want since that term is vague. If they don’t tell you they are just kicking tires and it is best to move on. For our fund, we need some customers with some revenue (20k-30k a month is nice). We only invest in B2B Fin Tech and are very strict about what that looks like-and we have a pretty good idea of what it’s going to take to be successful and survive to the next round.Another thing to find out from fund managers is their metrics around investing. Does the check they write have to pay for their entire fund on an exit? If they have a $50M fund, you can figure out how big a check they need to write based on a range of exits and a couple of other variables to see if you should keep talking to them.Fund raising is really hard and it’s important not to waste your time. You might not like what you hear from the funds, but if they are honest and direct they are doing you a favor

> 20k-30kSo, how many information technology startup companies have such traction but refuse equity funding?To me, it would be weird if a startup with such traction would consider taking an equity check.

Depends,but my advice is to never do business with a VC if you can bootstrap.

Thanks for this insight. I imagine metrics must be against something less tangible than revenue for seed fundraising though.

You are right, it’s not just revenue. For us, we like to see a little revenue given what we are doing. Venture Deals is a great book and series that I would read before I fundraised.

This is good – too many me too companies diluting talent. Too much noise in the ecosystem.

This feels a bit overgeneralized and slightly out of touch. Overlooks “pre-seed” which is definitely on the rise as an asset class. Doesn’t mention the much higher bar for Series A leaving founders no choice but to seek much larger seed rounds. And completey misses the phenom of founders retroactively re-naming their first seed as “pre-seed”, only to raise a bigger “formal seed” so that they have the metrics for the “big A” that every company in NY/SF needs to hire the talent for explosive growth. This is incomplete.

From an entrepreneur perspective here: of course the big VCs Do It Better. I have spent some time building a product on my own dime. As an outsider developer it makes NO SENSE to take money from “angels”. The only thing that matters is succeeding long-term and that works only once you start BUILDING THE BUSINESS. In other words, series A and after. If you are building anything of value, you are going to have competition chasing you and that is why experienced VCs matter.They have experience dealing with shifting markets, bubbles and crashes, competition and can see the “bigger picture” in ways that we entrepreneurs can’t. If you think building early product is the issue you have failed by your own admission. This is the test the true entrepreneurs are meant to pass BEFORE THEY RAISE OUTSIDE MONEY!!!! HELLO!!! Anyone giving up 20+% of their company before product to someone who has no stake in the actual long-term strategy of the company is making a big mistake.

> If you are building anything of value, you are going to have competition chasing you and that is why experienced VCs matter.That’s stuff, just stuff, shoveled out partly to denigrate entrepreneurs maybe as an initial negotiating strategy.Besides, the claim is just ignorant since business has lots of strong counterexamples, e.g., the first, good Xerox photocopying machine, lots of products with strong patent protection, lots of products with unique, powerful, valuable, Buffett-moat, trade secret protected, secret sauce intellectual property. Uh, there are some big reasons for the patent laws and associated legal protections.

| And not get burned along the way.That’s the most understated ending ever.

No special comment, it all makes sense… Maybe seed funding will never return in fiat currencies though.

CONTRIBUTORS:”The trick is to get into these sectors before the money shows up and get out when it does. And then get back in after it leaves. And not get burned along the way.” -Fred”In any investment sector when there is a lack of creditable and sound fundamentals investors with a solid plan will walk. When smart money uses the term derivatives to attract and serve Institutional investors duck.

Yes, I happened to see (amazing thing the Internet) the TC article. IIRC it appeared that the article was saying that the 2015 or so bubble was from the fad of social, mobile, local sharing apps or some such.Fred’s remarks are interesting on the odds, distributions, and expectations.But there is a huge problem with Fred’s approach. Really, for getting something of value for the real issue, Fred’s analysis doesn’t make much sense, really, just strains over gnats and forgets elephants.Or, to try to be more clear, it’s been clear in US information technology (IT) venture investing at AVC and more generally for a long time that the averages and distributions are (1) awful and (2) nearly irrelevant.”Awful”? Okay, two of the old pieces of evidence were a Kauffman PDF long athttp://www.kauffman.org/new…and from AVChttp://www.avc.com/a_vc/201…For “irrelevant,” or, by rough analogy, Fred’s analysis describes haystacks when all that matters are the needles.How much hay there is in the haystack and the nature of that hay just do not matter. All that matters are the needles. In particular, investing in even relatively good haystacks is still silly; nearly no haystack is good for investing for long; again, all that matters are the needles, good, solid, shiny, sharp needles and to heck with the hay.Or, by rough analogy, Fred’s analysis describes the oceans or maybe most of the life in the oceans when all that matters are the tuna.More directly a key point for IT VC investing is that (so far, but below see how we can change this sad game) it’s all about the exceptional, the one in 10, 100, 1000, 10,000 or so.So, in simple, fundamental, blunt terms, IT VC investing is about a case of filtering, separating the rare and exceptionally good from the rest.In the haystack analogy, the goal is to separate the needles from the hay.In atomic power, the goal is to separate uranium 235 from uranium 238.In California and Alaska gold rush gold mining, the goal was to separate the flakes of gold from the mud and gravel in beds of streams washing down from the mountains.So, in each case, there have been improvements in separation techniques and results.Then, sure, seed/early stage IT VC investing needs (1) more input (call it deal flow) and, then, especially (2) better separation.I will interject, as an entrepreneur, depending on just (1) and (2) looks tough, and, instead, I get an advantage; I get to depend on something mostly VCs can’t; I get to depend on (3) — cooking up new, better projects. That is, I’m not limited by what is in some deal flow (1). I have some really good reasons to believe, bluntly, that I can beat everything that gets funded on Sand Hill Road, Bezos included, — solid reasons and no joke. The same, that they could beat anything on Sand Hill Road, is true for a significantly large collection of people, none of whom ever communicated with Sand Hill Road.In a gold mining analogy, while the CA VCs are struggling at Sutter’s Mill, I get to go to some mountains in, say, South America. I.e., I get to create projects that are not in the current deal flow at all. Again, so can some other people, but, again, mostly they never heard of Sand Hill Road and would get a big upchuck if they visited there.Sure, instead of just filtering, looking for the 1 in 1 million that is not even in the deal flow, it would be better for VCs to be effective at stimulating better projects. Sure, bluntly, from 50,000 feet up, IT VC investing, all of investing, all of US business, all of business in the world, all of civilization are all very short on good projects. More, really good projects are needed.But, short of stimulating lots of new and much better projects, the IT VCs should be able to do much better with much better filtering techniques.E.g., given that IT projects are in part about technology, what IT VC does with the technology is shocking, shockingly dismissive, oblivious, ignorant, incompetent, and hopelessly blind.Technology? Albert, for something really simple and elementary, who on Sand Hill Road knows how to prove Jensen’s inequality? Who on Sand Hill Road is qualified for a slot as CTO, a tenure track slot in a STEM field at a good research university, or a problem sponsor slot at NSF?There are other major parts of our civilization that are quite good at filtering in the STEM fields. The projects they choose to back and fund have much higher batting averages than anything in IT VC investing. By analogy, IT VC investing is having trouble finding a horse able to plow the north 40 while the rest of the STEM fields find Mach 5 easy and are on a low risk path to Mach 10.So, what does success in IT have to do with success in IT entrepreneurship and VC? Well, it can be, and should be arranged to be, crucial: By analogy, what does success with high bypass turbofan engines have to do with putting the Atlantic passenger steamships out of business? Uh, with just turbojet engines, before high bypass turbofans or turbofans at all, the Boeing 707 quickly put the Atlantic steamships out of business.Broadly, the jet engines were an overwhelming advantage and blew away everything else in style, luxury, fashion, art, fancy French food, romance of the seas, dinner at the captain’s table of the steamship lines.So, a lesson would be, get some overwhelmingly powerful technology from the STEM fields. Then evaluate that technology with the quite highly reliable means long available in the STEM fields.Uh, incongruous juxtaposition: (1) We just go ahead and take for granted that it is routine and low risk to launch small spacecraft that some years later send back fantastic, high resolution images of Pluto, fly between the rings of Saturn, touch down on an asteroid and do some mining, wander around on Mars for years, sending back fantastic data, detect X-rays from black holes and gamma rays from the formation of neutron stars, and, without leaving earth, detect gravitational waves, direction, magnitude, and other details, from the merger of black holes a billion or so light years away and where we learn the sizes of the two black holes and that the final, third, one is missing one solar mass converted to gravitational waves. (2) Our best IT VC project filtering picks 80% losers and has low ROI otherwise. Amazing.In short, it’s not about the averages or even the distributions but, first cut, the quality of the filtering of existing projects and, then, getting better projects to filter.Cunard Lines, let me introduce you to some guys we know, Boeing, McDonald and Douglas, GE, and Pratt and Whitney.Yup, the IT VC situation is sick-o.But the flip side is terrific for me! I have a really good project and zip, zilch, and solidly zero competition! Anyone with my project could walk down Sand Hill Road and they and I would all receive just the same reaction — at best just laughter.Nice movie The Big Short: it has some really good scenes of some people with some solid knowledge and some other people, over confident but ignorant, laughing. Good scenes! Early on the movie gave a simple answer: The people that knew found out because, and may I have the envelope, please [drum roll], “They looked.”. In that case, what was seen was trivially easy to see, really childishly obvious, and much more, better, and more powerful is also possible!

Thanks for posting. It’s a different story in Latin America, albeit from a very low base. The number of seed deals stayed flat in Latin America from 2016 to 2017, but dollars doubled in 2017.http://www.nathanlustig.com…https://uploads.disquscdn.c…

As an entrepreneur running a seed stage startup, who rose VC through the whole cycle of 2009-2015, I can literally hear the differences in my conversations with other entrepreneurs and VCs.There are plenty of good startups, but there are also – as you’ve noted Fred – a large number of ex-operators now doing the check-writing, and they’re writing different investment contracts with new terms, in new configurations. Newer VCs are bringing their experiences and biases to the table and that has made Seed the new Series A (product-market fit stage), and Series A the growth round that Series B used to be. Every investor is doing diligence and de-risking like the next stage from what they are (Seed due dili ~ Series A).And as long as VCs and Angels are looking for measurable and meaningful ‘traction’ in Seed stage startups, you will see fewer deals. And some sectors like Adtech and Mobile are seeing no deals, so where do successful operators from those sectors go next when starting a company?There’s still investment to be found by early startups, but how many Early stage funds are going to be started when you can invest in Crypto, have easy liquidity and a higher win ratio? I think crypto investing is the silent killer here and it won’t retrace back to 2015 anytime soon…unless we add token sales into the charts.

so the slump you describe and the rise of the ICO in 2017 (crowd funding phenomenon) are causal?

Ouch. We are living this right now. We have an experienced team, defensible IP, and a selling product in a hot market – and yet not getting traction from Angel investors. The conversations sound almost exactly like the conversation with the VC money. They want 50x growth or are looking for dude’s (now girls) in hoodies writing the next FB. So I ask myself, where did the seed money go?I sensed this was happening, but now you confirmed it with data (and a great historical explanation of how the ecosystem evolved.) So what does a company do? We just keep plugging and making money. Timing is everything sometimes.

” If you price your seed round appropriately and have a good team and plan, you can raise money. But it will be harder.” – As one of the few black founders today who is running a startup that has raised a few million dollars, this particular line scares me. It leads me to believe that this seed crunch is going to be especially challenging for black and brown founders whom investors may not have familiarity with and deem “a good team”. A lot of us minority founders know we have not secured the type of pre-launch, pre-PMF valuations of our white and Asian male peers, so my guess is this valuation sensitivity will impact certain minority founders even more. I hope the growing number of minority-focused investors and VC investors helps, but I see a lot of them moving further up the funnel too (at least the VCs), so we’ll see. We can’t count on NBA players to do all our deals.

For what its worth, as a white-middle aged founder, I see a different bias. A desire for more women and black CEO’s in their portfolio. And a definite bias toward young founders. Seems like most big VC firms are especially concerned with “diversity” and what that implies to them. Like you said there is a “growing number of minority-focused investors”. There is not one single groups saying “we need more middle-aged white guys in our portfolio”. So I see your race as an advantage in the funding game. I think the moral of the story is that we all face biases – we are just tuned into the ones we see and feel.I can see it now: Transgender Founders Fund , anyone?

Agree 100 % to bubble prices. The same outside of US. In Berlin I have seen seed rounds with 20M pre valuation expectations last year. Most of them didn’t raise and ended up 60 % lower.Especially for pre-seed rounds, too many buddy-deals destroy the prices. 10 friends chip in 50k each and do not negotiate valuations. Sets the bar higher for seed/Series-A and a lot of cap table cleaning has to be done.