Stash Your Cash

My partner Rebecca announced our most recent investment yesterday in a company called Stash.

Stash is a simple mobile app that you connect to your bank account and each week (or month) you stash some of your cash away (ie save) and the app invests it for you in a portfolio of funds that it puts together for you based on your investing interests.

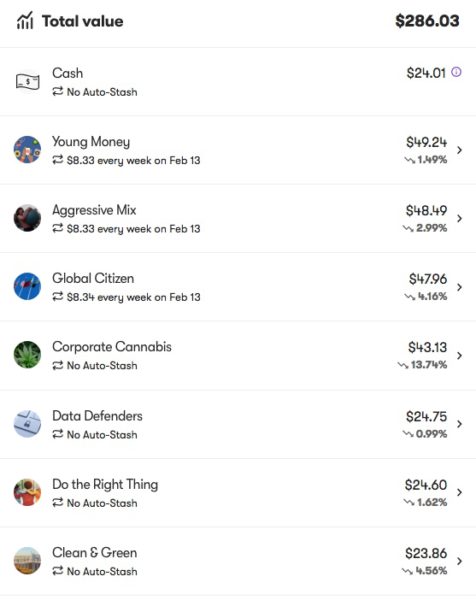

Here is my current Stash portfolio:

As you can see, I “auto stash” $25/week and it gets invested in the first three funds.

I have also directly bought four additional funds. I get mobile notifications on my phone when new funds are offered (like “corporate cannabis”, that was an instant buy).

I can move around where I want my weekly auto-stash funds to get invested. I think I might do that today and direct more funds toward some of these other funds that I quite like.

If you want to get Stash on your phone and start saving and investing, you can do that here: iOS Android

Clearly Stash is not aimed at people like me. We have traditional brokerage accounts and portfolios that we manage there.

Stash is aimed at young adults and people who are having difficulty saving for their future (home, college, retirement, etc).

As Rebecca wrote in her post:

85% of users on Stash come in as either beginners or without any investing experience and now can open their investment account with as little as $5.

That is a great stat. Stash is helping to build a new generation and a new cohort of savers and investors. With the decline of pension plans and other “safety nets”, it is more important than ever that everyone learn to save and invest. And the only way to do it is one day, week, month at at time and using the power of compounding earnings to your advantage.

When we looked closely at our USV portfolio recently, we realized that most of our best investments are all about expanding access to knowledge, capital, and wellbeing. Stash fits directly in that theme by making saving and investing easy and affordable for everyone (in the US for now).

Comments (Archived):

Simple (https://www.simple.com/) has also been doing this well for a while, although without the investment piece and it’s a full-fledged bank account. Would be great to see more apps like this not only helping people save and invest, but also do so to take advantage of tax benefits, i.e. 529s, 401k/IRAs, etc… even modern companies still have old-school ways of addressing those needs for their employees. Thanks for bringing attention to this space.

Acorn is another. We’ve been using that for a few years. It’s cool to just forget about it and then see that you have thousands built up at the end of the year.

Accorn concept is a little different and even simpler as they round up your purchases and invest it for you in stocks and bonds. You don’t even need to choose where you want to invest which is what is intimidating for some people. Now lets see their results:)

The limited choice of investment products and set & forget are the magic.

Been using Acorns since it launched. I love it.

Sent to a teenage family member who is babysitting, teaching karate, dog walking so she can do a save-the-reef project in Central America.So cool as something like this can connect to an individuals dreams.Like this one.

Does anyone know if stash is available in Canada?

i don’t believe so

Nah ! Tried it.

Congratulations to Rebecca.Is Stash available outside the US?

not yet

Just looking in SA – is this affiliated through Liberty? https://www.stash.co.za/

I love STASH! I’ve been playing with it for about a month now since you mentioned it in a comment thread. I sent it to my son who is 21 and some of his friends. I find it’s a fun way to pay attention to the stock market. I also like the Feature called “Who Owns It” where you can see what percent of people in the STASH space are invested in the same funds.Here are some screenshots from my account. https://uploads.disquscdn.c… https://uploads.disquscdn.c… https://uploads.disquscdn.c…

oooh. i need to add “roll with Buffett” to my fund mix

do you think ‘buffeting’ (the centralising control of capital) is good for the many? it’s good for him, but what about the many that Rebecca speaks of in her statistics? Don’t you see a casual relationship between the conditions of the mega rich and the conditions of the destitute masses.? I do.I think people like Buffet suffer from behavioural psychological problems. It’s a compulsion that’s been allowed to get way out of hand. Too many people ‘buy’ the propaganda that the ‘no limits’ of capitalism is a good thing.It’s a OCD thing getting out of scale.

Immediately when you said this:(like “corporate cannabis”, that was an instant buy)….in particular you said the ‘instant buy’ and I immediately realized that was a secret sauce. It’s almost like clickbait or linkbait but for investing. [1] So the more they know about the ‘investor’ the better they can target things that result in what you said ‘instant buy’.[1] Compared to how most ETF’s investments are sold.

I read Rebecca’s post this morning (my morning), and some of the statistics she quotes are quite shocking. Centralisation is both a powerful and a neglectful force. Do we want to live in a society/ world where most people have next to nothing and a few people have far more than they know what to do with? It’s a fucking criminal enterprise. That’s what modern capitalism has become, a self reinforcing network effect for morally bankrupt monied elites around the world.If you want to stash it first you have to have it. Universal basic income would work well with this micro model of saving and investing. Could spread like a RASH.- ‘Internet We’ (not ‘Net Neutrality’).

The saddest thing I’ve read this morning:With the decline of pension plans and other “safety nets”…The other thing that the next generation gets to do is decide whether this is the way they want things to go.

While footing the bills their parents racked up?

.Gov’t funded defined benefit plans — old plans — are less than 50% funded. There will be gross and ugly failures.Defined contribution plans are where the action is.JLMwww.themusingsofthebigredca…

See Illinois (read wirepoints.com)

Great idea and super cool BUT if you REALLY want to help people save, focus on the underlying fees. The underlying ETF/fund fees and expense ratios are not listed on the website (!) (I called the company, they said only on the app). Plus, Stash needs to at least offer, if not promote, low expense ratio options (e.g., ultra-low fee S&P500 index funds are available at 30-40 bps expense ratio). These 2 things are easy to fix, and if you don’t do them, it’s just not right.

Stash’s fees are listed on the Apps’ page in Google Play or Apple’s Store. Per Stash, $1 / mo up to $5,000 invested and $2 / mo for retirement accounts. After $5,000 in assets, it’s 0.25% per year. These fees would be on top of whatever ETF or fund expenses come with investments you’d make. Those fees are consistent with other spare-change type investment products.

.The first investment I ever made was in a Merrill Lynch Sharebuilder account in the 1960s.I was cutting grass, diving for pearls, a relief lifeguard on the weekends, and working in construction (digging ditches, installing sidewalks, finishing concrete) in high school. I made as much money over the summer as a full grown man made working construction for a year ($4-5,000 per year.)Minimum wage was $1.40/hour headed to $1.60/hour. I was making $2.50/hour at least.The innovation was that you could invest in dollars and not round lots.I eventually bought my wife’s engagement ring with the money in that account.I used to buy ATT stock and utilities and re-invest the dividends.We got a call one evening and my mother said, incredulously, “Jeffrey, it’s your Merrill Lynch stockbroker.” Haha.JLMwww.themusingsofthebigredca…

Diving for pearls… — is there something you haven’t done JLM ? 🙂

.Haha, “diving for pearls” means washing dishes in a restaurant.However, I did dive for real pearls on Cheju Do in Korea in the 1970s. In those days, they had no roads, lots of rice, and the best pheasant hunting in the world.Now, Cheju Do has a huge casino and a lot of Japanese gamblers.I was there on R & R and went pearl diving with the ladies. I was stationed up on the DMZ with the 2nd Cbt Engineers of the 2nd Inf Div.It took all my stamina to get to the requisite depth. I had to follow an anchor line because I could not swim like those ladies.I traded a case of C rations for a handful of pearls and had them made into rings and earrings when I got home. My wife, to whom I was not married then, still has some.Dishwasher = pearl diverJLMwww.themusingsofthebigredca…

I didn’t know about the second meaning — well played.Is there one for stacking shelves? Because the younger me had a lot of experience in that particular field..

.Inventory Superman?JLMwww.themusingsofthebigredca…

Spatial merchandise supervisor?

.Spatial Merchandise Engineer — cause engineers have to actually do stuffJLMwww.themusingsofthebigredca…

Yes, better.

Just brilliant. Had auto-pay into a CDN 401(k) at my first ever job.If you don’t see it you can’t spend it.

.Pay yourself first.JLMwww.themusingsofthebigredca…

Needs a connection to Coinbase so they can buy ETH

Glad your firm has invested in Stash, Fred. I’ve used the app for six months as a way to show my two kids (10 and 12) about investing. They help make decisions about where to invest our weekly auto deposit. They like looking at the ETF’s go up and down. Stash’s UI is insanely easy and, though I don’t follow it initimately, the Stach Facebook community is very active. Good luck with the investment. We’re big fans.

FRED:We viewed that investment by USV and wondered when you were going to post. Well here it is.Captain Obvious!#UnequivocallyUnapologeticallyIndeIndepent

Awesome app. Sent this to my three kids (18, 14, 13). Thanks for sharing.

Just started work at a new job with a steady check and saving was top of mind. Set up my 401K deduction this AM. I think I will use this to save additional money for a rainy day

Very difficult space. Lots of failure. Let’s hope they make it. Saving is a good thing. My friend Rendel Solomon is teaching kids about investing in the stock market by having them buy one share of stock.

Living in Canada feels like having a Mac in early 2000’s. All the cool apps – you can’t have!

This is one of my favorite USV investments. A great concept and much needed tool!Sharing with all of my kids.

The product looks cool. I will check it out. I use Acorns but don’t like that I can’t own my Acorns account jointly with my spouse. Joint tenancy is an important feature to have and I hope these products offer it in the future.

It seems like the biggest difference between Stash and its competitors is the higher amount of choices one has. Doesn’t that create friction for a first time investors or those who may feel trepidation (i.e. the paradox of choice)?

Am I missing something or is the “investor” blind to the overall performance of those employing their money? Input would be appreciated as my queries to the support team seemed to confirm this. Thanks