An Earth Day Message To The New York State Legislature

It is Earth Day, a day to celebrate our planet and rededicate ourselves to saving it. I plan to walk and ride my bike, avoid cars, and enjoy being out and about in NYC today.

But I’d also like to talk about something that is bothering me.

The New York State Assembly and Senate are working to pass a bill that would put a two-year moratorium on “proof of work” cryptocurrency mining. Here is the most important part of the bill:

1. For the period commencing on the effective date of this section and

25 ending two years after such date, the department, after consultation

26 with the department of public service, shall not approve a new applica-

27 tion for or issue a new permit pursuant to this article, or article

28 seventy of this chapter, for an electric generating facility that

29 utilizes a carbon-based fuel and that provides, in whole or in part,

30 behind-the-meter electric energy consumed or utilized by cryptocurrency

31 mining operations that use proof-of-work authentication methods to vali-

32 date blockchain transactions.

33 2. For the period commencing on the effective date of this section

34 and ending two years after such date, the department shall not approve

35 an application to renew an existing permit or issue a renewal permit

36 pursuant to this article for an electric generating facility that

37 utilizes a carbon-based fuel and that provides, in whole or in part,

38 behind-the-meter electric energy consumed or utilized by a cryptocurren-

39 cy mining operation that uses proof-of-work authentication methods to

40 validate blockchain transactions if the renewal application seeks to

41 increase or will allow or result in an increase in the amount of elec-

42 tric energy consumed or utilized by a cryptocurrency mining operation

43 that uses proof-of-work authentication methods to validate blockchain

44 transactions.

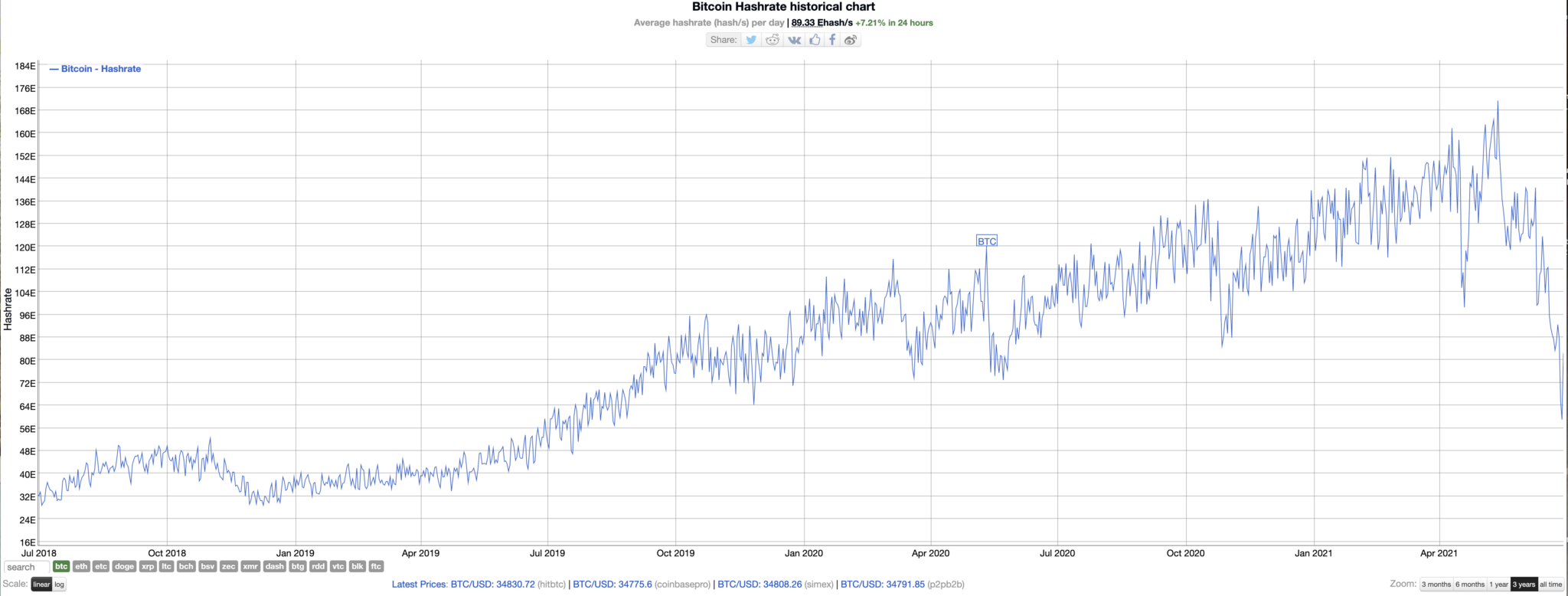

I believe this bill resulted from an application to fire up an old coal-powered electric plan to power a Bitcoin mining facility and I will be the first to admit that is a horrible idea. We should not be firing up old fossil fuel plants for any sort of economic activity. It is time to retire fossil fuel-powered plants and replace them with nuclear, hydro, wind, solar, and other clean energy sources.

But the idea of targeting a specific industry for this moratorium and leaving all other economic activity in NYS free to use fossil fuel is just absurd. Is it OK to use fossil fuels to power bowling alleys, movie theaters, car washes, sports stadiums, data centers, banks, homes, cars, etc, etc? Is it just not OK to use fossil fuel to power a network that secures our next-generation technology stack?

And at the same time New York State is doing this, the State of California is preparing an Executive Order that will be extremely friendly to the emerging crypto/web3 industry. New York State is already fighting an uphill battle with the crypto/web3 industry with its god awful BitLicense law and now they want to do this.

New York State should just put signs up on the Holland Tunnel, the Lincoln Tunnel, the George Washington Bridge, the Peace Bridge, and everywhere else people arrive in New York State that says “Web3 Is Not Welcome Here.” And save themselves the time and energy of doing nonsense like this.

We get the message loud and clear.