Splitting Ownership and Display/Consumption

I wrote about NFTs last week and said this in that post:

But when a party emerges online that anyone is invited to attend and the 500 person group picks up a punk with a party hat and they all change their social network avatar to this, well that got my attention.

https://avc.com/2021/08/the-opening/

Fractional/collective ownership is something we have been interested in at USV for a while. It fits well with our thesis about expanding access. We have an investment in Otis that is providing fractional ownership for collectibles and NFTs.

But there is an important difference between fractional/collective ownership of physical and digital goods.

When you purchase a share of a 1985 Air Jordan collection, as I did, you can’t showcase it in your home or office. It is shared ownership with many others. So it goes to a gallery or somewhere it can be shown publicly. That’s fine but somehow less satisfying than having it in your home or office for everyone who comes to visit you to see.

Contrast that to what happened with the punk. Everyone who bought it put it on their Twitter avatar. They collectively displayed it on their own digital property.

That is because of an important point my partner Albert made in this post a few months ago.

The underlying misconception here is to think that in the digital world copies are indistinguishable from originals. In a trivial sense this is true. Let’s say you copy a digital artwork, you will now have exactly the same bit sequence as the original. But in a much more profound sense it is not.

https://continuations.com/post/645017712412786688/a-word-on-nfts

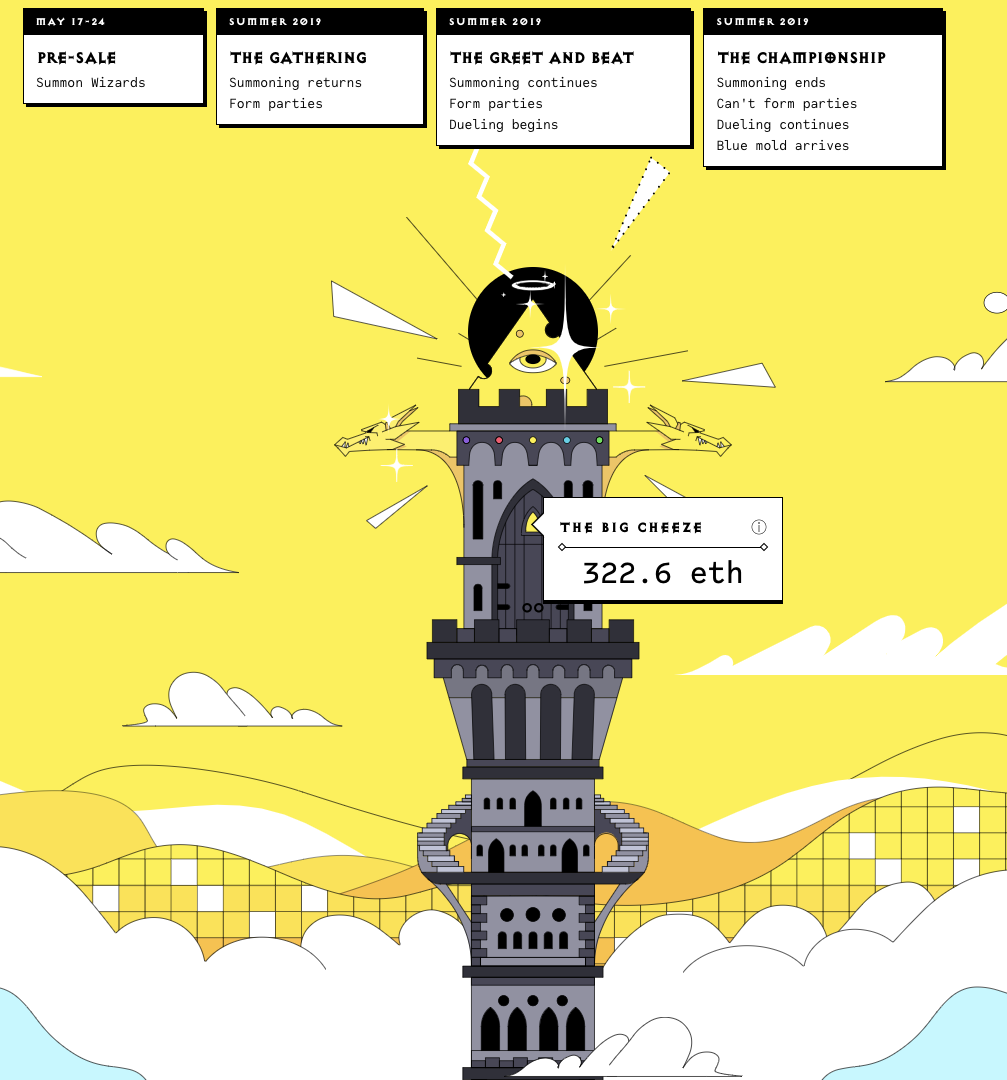

What NFTs do for digital art (images/Punks, videos/Top Shots, music, animations, etc, etc) is they separate the concept of ownership and the display and consumption of them. The ownership is on a public secure ledger. The display and consumption of them is out in the open for everyone to see and hear and more.

That’s not something that is easy to wrap your head around but it is profound.