Changing Public Perception

Nuclear power (both fission and fusion) has the potential to provide much of the energy the world needs without the damaging effects of carbon emissions which are warming our planet.

And yet nuclear power is politically unpopular in many parts of the world and that has led to a massive underinvestment in nuclear power over the last fifty years. It will take a much different attitude about nuclear power among the public before nuclear power can remerge as a major source of energy for the world.

That is but one example of very promising technologies that suffer from negative public opinion.

Web3, which will usher in a different way of engaging with web services also suffers from a negative public perception. And yet a web3 that allows users to control their data with web services that will need our permission to use it offers a radically better model for the web as we know it.

Vaccines, which are one of the most important public health innovations of the last hundred years also suffer from negative public perception. Way too many people don’t trust vaccines and don’t avail themselves of them.

So what can those of us in the business of creating and bringing these important technologies to market do to reverse these negative opinions?

I believe that getting these technologies into market and showing people their benefits is the very best thing we can do.

For nuclear, that means smaller, safer, and more “personal” nuclear power. There are pacemakers that have nuclear batteries in them. Why not put way more nuclear powered devices into our lives and show that the benefits massively outweigh the risks?

For web3, that means shipping applications that mainstream users will use and see the benefits of controlling and provisioning their data. I think gaming and social applications are likely to be the first mainstream web3 applications because not everyone is a trader or investor. Mainstream means our parents and our children.

For vaccines, it means better and more effective vaccines. It means easier delivery (like nasal sprays). And it means less side effects. It’s hard to be enthusiastic about a wellness benefit that makes you feel like shit for a day or two.

All of these industries have large public policy organizations and spend lots of money on changing public perception. I’m absolutely in favor of that.

But there is nothing better than putting amazing technology in the hands of ordinary people and changing their lives for the better. That moves public perception more powerfully than anything else.

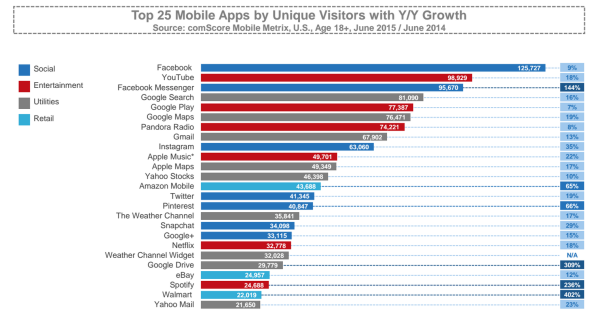

Here’s a shot of the app store a couple days after the kids got new phones for Christmas.

Here’s a shot of the app store a couple days after the kids got new phones for Christmas.