My friend Steve Kane suggested I take a longer view in my pair of year end posts this year:

And so I will.

Here are the big things that happened in tech, startups, business, and more in the decade that is ending today, in no particular order of importance.

1/ The emergence of the big four web/mobile monopolies; Apple, Google, Amazon, and Facebook. A decade ago, Google dominated search, Apple had a mega hit on their hand with the iPhone, Amazon was way ahead of everyone in e-commerce, and Facebook was emerging as the dominant social media platform. Today, these four companies own monopolies or duopolies in their core markets and are using the power of those market positions to extend their reach into tangential markets and beyond. Google continues to own a monopoly position in search in many parts of the world, has a duopoly position in mobile operating systems, and controls a number of other market leading assets (email, video, etc). Apple owns the other duopoly position in mobile operating systems. Amazon has amassed a dominant position in e-commerce in many parts of the world and has used that position to extend its reach into private label products, logistics, and cloud infrastructure. Facebook built and acquired its way into owning four of the most strategic social media properties in the world; Facebook, Instagram, Messenger, and WhatsApp. Most importantly, outside of China, these four companies own more data about what we do online and also control many of the important channels to reach us in the digital world. What society does about this situation stands as the most important issue in tech at the start of the 2020s.

2/ The massive experiment in using capital as a moat to build startups into sustainable businesses has now played out and we can call it a failure for the most part. Uber popularized this strategy and got very far with it, but sitting here at the end of the 2010s, Uber has not yet proven that it can build a profitable business, is struggling as a public company, and will need something more than capital to sustain its business. WeWork was a fast follower with this strategy and failed to get to the public markets and is undergoing a massive restructuring that will determine the fate of that business. Many other experiments with this model have failed or are failing right now. When I look back at the 2010s, I see a decade during which massive capital flowed into startups and much of it was wasted chasing the “capital as a moat” model.

3/ Machine learning finally came of age in the 2010s and is now table stakes for every tech company, large and small. Accumulating a data asset around your product and service and using sophisticated machine learning models to personalize and improve your product is not a nice to have. It is a must have. This ultimately benefits the three large cloud providers (Amazon, Google, Microsoft) who are providing much of the infrastructure to the tech industry to do this work at scale, which is how you must do it if you want to be competitive.

4/ Subscriptions became the second scaled business model for web and mobile businesses, following advertising which emerged at scale in the previous decade. Startups that developed the skills to execute a subscription business model with positive unit economics delivered fantastic returns to investors and capital flowed into this sector as a result. This was a very positive development as subscriptions better align the interests of the users and the developers of mobile and web applications and avoid many of the negative aspects of the free/ad supported business model. However, as we end the decade, a subscription overload backlash is emerging as many consumers have signed up for more subscriptions than they need and in some cases can afford.

5/ Silicon Valley’s position as mecca for tech and startups started to show signs of weakening in the 2010s, largely because of its massive successes this decade. It is incredibly expensive to live and work in the bay area and the quality of life/cost of life equation is not moving in the right direction. The physical infrastructure (transit, housing, etc) has not kept up with the needs of the region and there is no sign that it will change any time soon. This does not mean “Silicon Valley is over” but it does mean that other tech sectors will find an easier time recruiting talent to their regions and away from Silicon Valley. And talent is really the only thing that matters these days.

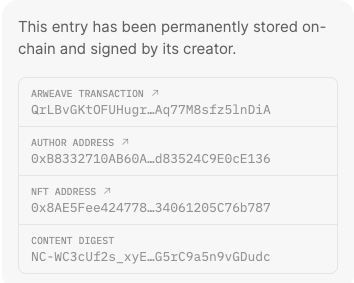

6/ Cryptography emerged in the 2010s as a powerful technology that can solve some of the web and mobile’s most vexing issues. Cryptography and encryption have been around for a very long time, well before the computer. Modern computer cryptography came of age in the 1970s. But the emergence of the internet, web, and mobile computing largely did not integrate many of the central ideas of cryptography natively into the protocols that these platforms were built on. The emergence of Bitcoin and decentralized money this decade has shown the way and set the stage for cryptography to be built natively into web and mobile applications and deliver control back to users. Credit to Muneeb Ali for framing this issue for me in a way that makes a lot of sense.

7/ Technology inserted itself right in the middle of society this decade. Our President wakes up and fires off dozens of tweets, possibly while still in bed. We are all hostage to our phones and the services that we rely on. Our elections are conducted using machine learning technology to segment and micro-target important voting groups. And bad actors can and do use the same technologies to interfere in our elections and our public discourse. There is no putting the genie back in the bottle in this regard, but the fact that the tech sector has such a powerful role means that it will be highly regulated by society. And there is no putting the genie back in the bottle in that regard either.

8/ The rich got richer this decade. Axios wrote in a recent email that:

“The rich in already rich countries plus an increasing number of superrich in the developing world … captured an astounding 27% of global growth.”

But the very poor also had a great decade as Axios also reported:

The rate of extreme poverty around the world was cut in half over the past decade (15.7% in 2010 to 7.7% now), and all but eradicated in China.

The losers in the 2010s were lower middle class and middle class people in the developed world whose incomes stagnated or fell.

Technology played a role in all of this. Many of the superrich obtained their wealth through technology business interests. Some of the eradication of extreme poverty is the result of technology as well. And the stagnation of earning power in the lower and middle class is absolutely the result of technology automation, a trend that will only accelerate in coming years.

9/ This a post publish addition. A huge miss in my original post is the emergence of China as a tech superpower and a global superpower. There are many areas (digital money for example) where China is light years ahead of the western world in technology and that will likely accelerate in the coming years. Being a tech superpower is a necessary condition to being a global superpower and China is already that and getting more powerful by the day.

I will end there. These are the big mega-trends I think about when I think about the 2010s. There is no doubt that I left out many important ones. You can and will add them in the comments (wordpress for now), emails to me, and on Twitter and beyond. And that is what I hope you will do.