How To Write A Misleading Headline

I know I don't have to explain this to anyone because it's done all the time, and I've done it plenty myself. But this headline from Claire Cain Miller's post on the NY Times blog yesterday is a good example of accentuating the negative in the headline:

Here's the facts from a VentureBeat story on the same data:

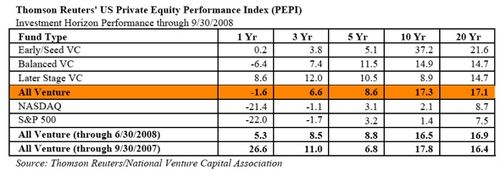

So let's look at this data. Venture returns across all funds and stages are 6.6% for a three year period, 8.6% for a 5 yr period, 17.3% for a 10 yr period, and 17.1% for a 20 yr period. Venture as an asset class has outperformed the public markets by 7.7% over a three yr period, 5.5% over a 5 yr period, 15.2% over a 10 yr period, and 8.4% over a 20 yr period.

And the headline that comes out of that data is that "venture capital returns dip below zero"?

The thing that really bugs me is if not for FAS157, which I posted about a few weeks back, we wouldn't even see negative returns for VC in the past year. FAS157 is an accounting ruling which requires venture capital firms to mark their investments up in good markets and mark their investments down in bad markets. I am not sure if this was an intended consequence or not, but FAS157 is going to make venture returns more highly correlated with public market returns than they have been in the past.

I'm quite sure that the -1.6% one year return for the venture asset class is driven by the roughly -33% drop in the NASDAQ from september 2007 to september 2008. Many venture firms, including ours, use NASDAQ traded companies as the comps in our FAS157 valuations.

But talking about one year venture returns is like talking about the score in one inning of a baseball game. Venture capital is a long term asset class. I recieved a distribution last week from a fund that I helped raise in 1994, fifteen years ago. Returns develop over a long time horizon in venture capital and focusing on what happened in the past year is not useful.

I'll end this rant/post by saying that the venture business does have issues. It has not produced the kinds of returns this decade that it is known for and is expected to produce. Generating a 8.6% return over the past five years is nothing to brag about. But venture has outperformed the public markets over any time frame you want to talk about and I think it will continue to do so. And the venture business is going through its own restructuring, forced by dwindling returns and financial stress in the limited partner base. There will be fewer firms, less capital, and less competition and overfunding in the next ten years than there was in the past twenty years. So I think its a very good time to be investing in venture capital right now if you can put money with a good manager. But that doesn't make a good headline, particularly in these times.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=74cc5060-65d1-4228-817b-a1f9a3d13a11)

Comments (Archived):

I saw some equally misleading headlines about the economy recently: “Economy comes to a halt”, etc. If we have zero percent growth, it doesn’t mean the economy comes to halt. It just means we’re running just as hard a last quarter/year/… So if last year was great, this year will be equally great.Of cource, the zero percent number doesn’t really reflect what’s going on.

Totally. The media should be careful what they wish for

I was under the impression that the venture class benefits from ‘survivor bias’ more than most public classes.In other words, if a fund is wound-down (for whatever reason) then it is simply removed from the data sample. The same applies to public classes, but occurs less frequently.I wish I could remember where I read this – but I can’t.

Its possibleAll data is wrong

You might be thinking of this paper by John Cochrane at U Chicagohttp://faculty.chicagobooth…He calculated returns from actual exits, not estimatesIt’s hard to summarize such a complicated topic but my take is:*Commonly reported returns to the venture class are way too high due to survivor bias*Still, the actual returns are significantly higher than market indexes*But they are correlated to market indexes so you don’t get diversification*Once you subtract the fees, you might be looking at lower returns than a market indexHe doesn’t really address the fact that returns are skewed — a few firms make a lot of money, and most don’t. So it’s a different game if you’re in on the best funds (hello, Fred!). With most funds, you’re probably better off investing in a market index

That’s excellent feedback, thanks.I seem to recall now that my info came from a HBS paper, but I could well be wrong.

Check out andrew’s comment below. Much better reply than mine!

The data from Cambridge Associates is not affected by survivorship bias, many of the bottom quartile funds are busted funds. I’m not familiar enough with data from other sources to know if others are affected or not.There is survivorship bias in quartile rankings for sure. Many of the top quartile funds can claim they are in the top quartile simply because they still exist. If you compared only active VC funds, many “top quartile” funds would drop in the rankings.

damn boss the ‘sphere is continuing to drop buckets of hate-or-ade on you and your peeps. those youngsters need to check yesterday’s post on empathy!i dont think the fact that accounting rules peg you to public markets is a good thing; new standards are needed. problem is no one wants to challenge the system because of the system’s seemingly all-powerful nature and because of the political risks involved in doing so. i think new monetary, accounting, and valuation standards need to be created, and like technical standards are, need to be crowdsourced, or stem from the grassroots. otherwise i think there is the risk of being pulled by the public markets, which i think are not really value creation markets at this time, guided more so by the whims of speculators who have too much paper money to gamble with thanks to inflationary monetary policy.

Dam straight!

If you don’t mind a tangent:This is a severe flaw with analog, large-scale journalism which is carrying over into digital media.The NYT covers the story as generalists whose expertise is in getting news onto newsprint. That’s their self-professed product: *All* the news that’s fit *to print*.On the other hand, VentureBeat is a team of venture specialists. It could be fairly tagged as “All the *tech* news that’s fit to *publish*”. If they could profitably put their content (or similar content) into print, they would. But in no case would one expect to see a story on VentureBeat profiling a cornerback for the Arizona Cardinals or an op-ed involving an economic analysis of using US versus foreign steel in the Golden Gate Bridge. (The Times had both in the last two weeks.)Everyone falls prey to the occasional misleading headline. But it shouldn’t surprise you to see the specialists such as VB have it happen less often. They have the knowledge to report fairly and accurately that the generalists lack. And more newspapers are going to die until the newspapers themselves realize this problem.

Public markets, by and large, have been driven over the past 10 years by faulty, and some might way, fraudulent gains, so your comparison is actually much more favorable than some might think.

Definitely a flawed headline……but I wonder sometimes about the “fewer firms, less capital and less competition” point in your last paragraph. Having been in and around the tech industry after Bubble 1.0, I heard a lot of the same predictions about the coming shakeout in the VC asset class. I’m not sure it ever happened on the scale most were predicting, and I question whether it’s coming this time around.That said, I think a lot of firms were propped up by the glut of liquidity among LPs (primarily due to cheap credit) after the first bubble, so perhaps the situation will be different this go-round. In any case, thanks for the post.

How does real estate sit as a comaprison in investments over the long term?

Andy Rappaport (August Capital) has been saying for over a year that VC returns in his area (electronics) went negative well before the crash. He claims to be accounting for the time lag and other factors. (He has similarly adjusted numbers for VC as a whole.)There’s a link to a talk that he recently gave using pre-crash numbers at http://www.stanford.edu/cla… . (Post crash is even worse and he explains why he didn’t update.) It also has some very interesting discussion about the option economics and equity economics as it applies to VC. (That discussion is related to one of Wilson’s posts about fund size and what it takes to get reasonable return.)Of course, hardware isn’t all of VC. And, he does have a point of view. (He thinks that hardware is getting about 5x as much VC money as it “should”. One could argue that that is self-serving since he’s pretty sure that he won’t have any problems raising money for his funds.) And, the upper quartile is making money.Nevertheless, it does show that this story is not a just bad press.

One sector doesn’t make a marketHardware is a tough place to make money because its largely been commoditized and there aren’t many places left to innovate. The innovation is rapidly moving to software, and even beyond devices into the cloud.But when talking about VC, you have to look at the entire asset class.What have the returns been in life sciences? Web services? Materials sciences? Clean tech?Her post was about the VC sector as a whole and I think her headline got it wrong

> Hardware is a tough place to make money because its largely been commoditized and there aren’t many places left to innovate.While Rappaport somewhat agrees with “tough” (at least as far as VCs are concerned), he seems to disagrees on the rest. Then again, the deals that he sees are different from what most folks see.> What have the returns been in life sciences? Web services? Materials sciences? Clean tech?Are any clean tech funds old enough to make that call?Rappaport says that he backed out the time issues so his numbers are not influenced by fund-stage problems. (He even pointed out how some of the numbers for past years would be affected by things that have happened in the last year.) I haven’t checked, so I don’t know that he didn’t screw up data collection, manipulation, basic arithmetic, or something else. However, the fact that he’s done the work gives him a leg up on someone who points out how different errors could have affected the numbers.

I’m curious. Does it make any sense to even measure 1 or 3 year returns of VC funds? Investors put their money in venture class with the full knowledge that it takes 3-5 years to deploy and another 3-5 years to harvest. By publishing these 1 and 3 year interim return numbers, would it get in VCs’ heads and make them lose focus on the long term? Do those numbers really mean anything?Also, if 10-year early-stage return is at whooping 37.2% (congrats, Fred!), almost twice average, why do a lot of funds kept saying they’re moving toward later-stage? Or is that a result of less competition in early-stage deals?

One year returns mean almost nothing. That’s my point.I believe the reason managers move to later stage is they can deploy more capital in those dealsAnd the compensation structure 2/20 is driven off of capital under managementSome say only the fees are, but here’s the issue on the carry:If we invest $5mm in TACODA and take out $50mm, we’ve made 10x, $45mm gain, $9mm of carry for five years of workIf big fund invests $25mm in some late stage deal and takes out $100mm, they make 4x, $75mm gain, $15mm of carry for probably a lot less work (maybe no board seat minor involvement), and probably a three year holdEarly stage is harder work that pays less

Makes sense but with all those funds moving later-stage, I guess it wouldn’t be too long before supply-and-demand balances itself.But early stage is also more fun! When you get to expansion stage, innovation is more marginal and operational.

Worth pointing out that your headline is itself misleading. I clicked on it expecting it to be misleading, but since it was actually an accurate headline for this article, my expectation was not met. Therefore, I was misled by your deceptively accurate headline.

Clicking on links is always a risk

All in all, I think the use of the word “dip” (as in temporary) made this headline acceptable, despite its idiotic focus on one year in an absolute-return business.Here are some alternatives that might have generated a little more buzz….venture capital returns begin negative trendventure capital recession beginsventure capital bubble begins to burstred ink the new norm in venture capitalventure capital not immune to writedown-itisventure capital is fuckedis venture capital the next ponzi?RIP venture capitalventure capitalist private jets rise as returns fallVCs slammed by negative-return environmentWhen will Obama take on “BIG VC”?”Windfall profit tax” on VCs shelved as returns go negative

Andy – you never fail to either crack me up or annoy me with your well articulated conservative views. This is great stuff!

This is just the pat on the back I needed to rededicate myself to my lucrative “annoying yet amusing and articulate” blog-commenting career.

Fred, VC has obviously been a superior asset class over the past 20 years but what would you advise for someone new entering the VC realm in this current paradigm?

fred your point is well taken — so-called one year return is an absurd measure for VCbut the real issue is, there is no good data to use to even think about such thingssurvivor bias is an issuebut also using VC funds own internal reporting of valuations is a waste of timethe only measure that matters is cash on cash. how miuch cash did an investor invest and when, and how much cash did an investor get out and when?i have never seen reliable, broad, specific data on cash on cash returns, other than for the funds I invest in — and even then its rare (I have to figure oit out for myself) as many funds send “capital account” statements that at best use FAS157, and at worst use “last round” valuations, which especially in times like the present are almost entirely bogusas best as i can gather, if cash on cash is the measure, VC as an overall asset class has been a relatively poor performer for about a decade now. yes some funds are all stars, but that’s a very tiny group — top decile, not top quatrile — and the rest are money losers, with high high fees demolishing mediocre returns

Realtor 6% = $ management 2/20%Gotta die sometime, but later than you think.

Hi Andy. sorry I don¹t understand

Fred,I was really disappointed to read your post – it was far from the thoughtfulness/push for truth that I typically see on this blog.To define excellence in this case, I would have expected you to explain the reasons behind WHY the VC industry outperforms the S&P500/NASDAQ/other benchmark. I can speculate that is because of some combination of the significantly reduced liquidity, some hidden leverage (portfolio company debt, VC financing, etc.), overweighing of specific alpha generators (the wizards at USV/other funds) due to survivorship bias and/or high barriers to employment in the industry, the beta differential between VC heavy industries and the general benchmark, and the inefficiencies of investing in a VC fund (i.e. you need to either know a guy who knows a guy or you need to be an institutional).Of course, as a (much) more informed party, I would expect a more nuanced view from you to describe the profile of venture capital as an asset class and what that means from the investor perspectives, and finally WHY the 1 year view is meaningless. I realize you don’t owe anything to us as readers in the form of detailed and nuanced answers but you open up the potential for appearances that you aren’t a balanced and reflective investor. Having the open and frank discussion of VC as an asset class (and USV as an alpha spread over that) would spur far higher quality discussion on your blog – and I suspect that is your ultimate goal.

Its a blog post not a phd thesis.That kind of discussion should happen in the comments, related blog posts that derive from this one, or in the halls or by the water coolerThis is conversational media not an academic exercise

Fred,You’re right it’s a ridiculous headline. But I think you severely understate the problems of the current VC industry. There is $25B raised and deployed every year. Assume that VCs own 2/3 of companies after multiple rounds of financing. For the VC industry to do 2x (not great long term returns), there would need to be $75B of exits annually. Even in the “good” markets of 2004-2007, we were no where near those numbers. The industry as a whole is way over-funded. Even the LPs will tell you there are only 5-10 firms worth investing in out of hundreds.

That’s some very enlightening math RobHard to argue with itBut even in an overfunded industry, there are places to make money

Hey fred,I did not really get the data. What does mean 17,3 % Performance over 10 years. Is this the IRR Rate of return per year or what you actually get out as a lp after management fees after you have invested for 10 years?

I believe these are returns net to the investor

Couldn’t agree more, Fred. I actually have this chart taped to my office door. As is so often the case, reporters – living in a deadline-driven world – often have neither the time nor the inclination to delve deeper into their topics than the obvious negative headline. Sure, ther are many flaws and biases in all reporting systems, but the trend themselves tend to reflect reality to a greater extent than they distort it. FAS157, Survivor Bias, etc., all accentuate both the ups and the downs, but the relative performance remains.

In response to Andrejk – I agree – there has been a lot of misguided information about the economy. Business owners should do as much as they can to lower costs and save. At our firm, we recently cut our travel expenses. I hear that other companies are doing the same thing. Some are even conducting meetings from one office through video conferencing from http://www.24conference.com. Other than that, I give this post two thumbs up!

Are those VC returns BEFORE the GP’s 2%/yr fees and 20% carry takes 25% to 30% out of the 5-year ROI? If so, this is a thoroughly misleading comparison to the public equity markets!I’d like to know.

Yes, these are net to the LPs, after fees and carry

The data from Cambridge Associates is not affected by survivorship bias, many of the bottom quartile funds are busted funds. I’m not familiar enough with data from other sources to know if others are affected or not

The 33% drop in the Nasdaq is part of the calculation – you moron! You have to take the good and the bad when doing ROI calculations. You probably have spent a lot of time counting eyeballs. ROI analysis requires counting dollars.Venture capital has been crap ever since the market recognized that high tech companies do not deserve premium valuations. It is a mature industry. Selling hype is soooooo done.

Your opinion is welcome here but your attitude is notPlease don’t call anyone morons when leaving commentsAnd of course I know that the 33% drop in the nasdaq is part of thecalculationThat’s why I mentioned it

http://pedatacenter.com/ped…Cool analytic tool that tracks the valuation of a vc funded company along the performance of pe/vc funded companies listed on the Nasdaq.

Great discussion. I believe there is an even bigger problem in the VC return numbers than survivor bias. It is that under performing funds tend not to report. That reinforces jrh and Steven Kane’s comments about the published numbers being way too optimistic. This is my post on the bias http://www.angelblog.net/VC…

BasilI just left a comment on your postThis is a great discussion

Fred – I agree. Thanks for getting it started and thanks for the post to my blog.

Seth’s Blog has a post about “highlights” that I think ties in really well to the idea of misleading headlines. We’ve become highlight/headline driven consumers of information. We scan through 150+ blog titles, plow through search results, tweet, post, and stream our lives through phones and cameras. There is so much low level information noise in our lives today that we are in a constant state of distraction. Therefore the headline, highlight, and 5 tips to success (not even 10 anymore!). So where is the substance in new “me”dia? Here and then in Friendfeed, retweeted, and blogged about again. I think we will have more substance than ever before and will use headlines and highlights as starting points for great conversations and learning and connecting with one another.