The Berkshire Hathaway 2008 Annual Letter

I took some time on Sunday afternoon to read Warren Buffett's annual letter. I don't make it an annual practice to read the Berkshire Hathaway letter as many do (nor have I ever been to the shareholder's meeting which Buffett calls "Woodstock for Capitalists"). But given that 2008 was a year unlike any that I have ever witnessed, it seemed like the thing to do on a cold and snowy afternoon.

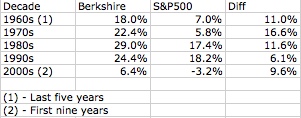

Buffett and his partner Charlie Munger are the most successful stock market investors of the 20th century and they have consistently outperformed the public markets as shown by this table of annualized returns that I put together with data from the first page of Berkshire's annual report (I love that Buffett starts with the numbers):

It is very interesting to me that the past five decades have seen the S&P significantly outperform the long term average for equities of around 7% per annum. Even with the miserable performance of the public markets this decade, we'd have to be flat for another decade at least for the markets to average 7% per annum from 1965 on.

But Buffett and Munger's performance is something else entirely. While it is correlated to the market for sure, it has been so consistently superior for so long that it is clear that they are doing something right (and better).

So with that in mind, here's my take aways from reading Warren's letter.

1) The economy – It's really bad. Warren says the "freefall in business activity" is "accelerating at a pace that I have never witnessed before."

2) TARP and related efforts to stablize the financial system – The Fed "stepped in to avoid a financial chain reaction of unpredictable magnitude. In my opinion, the Fed was right to do so." But it will "bring on unwelcome aftereffects." One likely consequence is "an onslaught of inflation." And "major industries have become dependent on Federal assistance, and they will be followed by cities and states bearing mind-boggling requests. Weaning these entities from the public teat will be a political challenge. They won't leave willingly." That last line is classic and true and Obama's greatest challenge.

3) Berkshire's two most important businesses are insurance and utilities, sectors that "produce earnings that are not correlated to those of the general economy."

4) Buffet and Munger are value investors and contrarians. Warren says "When investing, pessimism is your friend, euphoria the enemy" and "Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down" and "Beware the investment activity that produces applause; the great moves are usually greeted by yawns." Words to live by.

5) Housing – Berkshire has exposure to the mortgage and housing market by virtue of its ownership of Clayton Homes, the largest company in the prefab home market. Buffett says "Enjoyment and utility should be the primary motives for [home] purchase, not profit or refi possibilities. And the home purchased ought to fit the income of the purchaser." And "an honest to God down payment of at least 10% [I think 20%] and monthly payments that can be comfortably handled by the borrowers income. That income should be carefully verified."

6) History as a predictor of the future – "If merely looking up past financial data would tell you what the future holds, the Forbes 400 would consist of librarians."

7) Quants – "Beware of geeks bearing formulas."

8) Lean and mean organizations – "BHAC: Who, you may wonder, runs this operation? While I help set policy, all the heavy lifting is done by Ajit and his crew. Sure they were already generating $24 billion of float along with hundreds of millions of operating profit annually. But how busy can that keep a 31-person group? Charlie and I decided it was high time for them to start doing a full day's work." Wow. I'm stunned. And now I have something other than Craigslist to use as an example of a lean and mean profit generating machine.

9) Bubbles and Panics – "The investment world has gone from underpricing risk to overpricing it." And "When the financial history of this decade is written, it will surely speak of the Internet bubble of the late 1990s and the housing bubble of the early 2000s. But the US Treasury bond bubble of late 2008 may be regarded as almost as extraordinary."

10) Derivatives – "Derivatives are dangerous" and "When Berkshire purchashed General Re in 1998, we knew we could not get our minds around the book of 23,218 derivative contracts, made with 884 counterparties. So we decided to close up shop. Though we were under no pressure and we operating in benign markets as we exited, it took us five years and more than $400 million in losses to largely complete the task. Upon leaving, our feelings about the business mirrored a line in a country song: "I liked you better before I got to know you so well."

11) Risk and Responsibility – "It is my belief that the CEO of any large financial organization must be the Chief Risk Officer as well. If we lose money on our derivatives, it will be my fault."

I'll stop there because I really like lists with eleven entries. It's a quirk of my personality. All you have to do is read Warren's letter (or even my cliff notes version) to understand why he's the best investor of the past century. Common sense married with a native understanding of markets and value is what produces the returns at the top of this post. Everyone who invests and manages money for a living can take a lot away from Berkshire Hathaway and Warren and his partner Charlie.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=950ef638-9fde-4a09-82fd-c1999a769f9f)

Comments (Archived):

Does Buffett have someone that looks up the folksy sayings for him (“I liked you better before I got to know you so well.”), or does he really know all of these sayings? I’m very curious. I’m from the midwest, so I like them a lot.Anyway, my thought was that Buffett has been hammered by the financial blogosphere in the past few days. I had a brief comment on my site about how America needs Buffett to live up to the myth at this point. Post is here: http://realpropertyalpha.co…

No, those sayings are all from Buffett. He truly is that witty.

Thanks for posting your thoughts on this, great as you put it “cliff notes version”.

Great synopsis, thanks. Buffett’s amazingly reasoned in his approach. We all have to own the Chief Risk Officer comment going forward.Along those lines, 60 Minutes had a great segment on the Madoff Scandal tonight (It’s Available Online: The Man Who Figured Out Madoff’s Scheme: http://bit.ly/12Qsu4). Paints a fully formed picture of the absence of Chief Risk Officers across the entire scam food chain (from the perpetrators to the victims).Note aside: I’m with Reeder, Buffett must have a team working in a cave somewhere coming up with Buffett-isms. 🙂

Just the facts.S&P 500 performance since 1965Unadjusted for inflation5.38% without dividend reinvestment8.72% with dividend reinvestmentAdjusted for inflation.9% without dividend reinvestment4.1% with dividend reinvestment———————————————-S&P 500 since March 1957 (More or less, the beginning of the S&P 500)Unadjusted for inflation5.91% without dividend reinvestment9.3% with dividend reinvestmentAdjusted for inflation1.85% without dividend reinvestment5.11% with dividend reinvestment—————————————————-Market Return since 1923 (S&P 90 linked to S&P 500)Unadjusted for inflation5.47% without dividend reinvestment9.82% with dividend reinvestmentAdjusted for inflation2.41% without dividend reinvestment6.64% with dividend reinvestment—————————————————-United States “Market” Return since 1871Unadjusted for inflation3.89% without dividend reinvestment8.68% with dividend reinvestmentAdjusted for inflation1.79% without dividend reinvestment6.48% with dividend reinvestmentThe numbers speak for themselves. On using data from 1871, Charlie Munger once remarked: “When you go back that long ago, you’ve got a different bunch of companies. You’ve got a bunch of railroads. It’s a different world. I think it’s like extrapolating human development by looking at the evolution of life from the worm on up. There wasn’t enough common stock investment for the ordinary person in 1880 to put in your eye.”Over the next 10 years, the S&P 500 will likely outperform your VC portfolio. (At least you’ll have fun.)

thanks for that. i was simply using the data on from the Berkshire report.the S&P has never outperformed my venture portfolio over any significant period of time and i don’t think it ever will.because we are investing “from nothing to something” and it is hard for a market of established companies to beat that.

(The data is from Yale University’s Robert Shiller.)

I like number 3 – does he follow that strategy in the boom times too?

I assume soHe’s been increasing his exposure to those sectors for a while now

You don’t seem to have understood the figures Buffet quotes, summarized in your table, which compare his book values per share over time with the S&P 500’s share price changes including reinvested dividends. Berkshire Hathaway’s actual share price hasn’t done nearly as well as the book value numbers he focuses on in his letters. Most of his impressive-seeming ‘outperformance’ since the early 1980’s melts away if you plug in the ‘apples to apples’ numbers for BRKA.

Its interesting that price/book has moved so much over the years. What do you ascribe that to?

It’s surprising. Buffett and Munger’s advancing age, to some degree. The really peculiar thing is that, given how scathing Buffett has been over the years about e.g. other managements’ stock option accounting, along with everything else we think we know about the guy, you would think his book value numbers would be viewed as robustly and distinctively conservative. Yet Berkshire Hathaway’s price to book value has now fallen all the way down to 1.0 (the S&P 500 is I believe around 1.7). No premium at all, for such a widely admired figure, is decidedly odd.

It makes me want to buy the stock. Would you?

Yes. The free cash of an insurance operation which is not poisoned by derivatives has got to be a grand thing. Also, he internally keeps enough cash to solve any and all problems. Cash is going to be the critical commodity hereafter. No great revelation there.You gotta like his lines of business though I think that Net Jets will suck air forever. Though an argument can be made that corp America is going to get rid of its stuff and rent it. I see a lot more commercial flying in store for the big dogs.I see the real downside risk being his mortality. He is John Wayne of the investment world and John Wayne never really had a replacement.

That was my own conclusion. Since October I have been buying stocks I want to own for the next 3-4 years and matching them against a somewhat larger short ETF position, and there is certainly a case for adding this one now. The one point I’m not comfortable with is that he said he had to sell stocks to make his recent preferred investments. I had thought his cash hoard was way bigger than he needed to do the deals I’m aware of, so I’m concerned that there is a liquidity drain somewhere in the business that I’m not seeing.

That could well be. But he’s got great cash flow in his operating businesses so he maybe sells to buy in order to maintain his cash balancesI really like the way he went into excruciating detail on his derivative contractsI just don’t see this guy hiding anything

One of the reasons he likes the insurance business is the ability to invest the reserves. This “float” is enormous given the magnitude of required reserves. They gotta hold it somehow.

He talks a lot about that. He says they have a negative cost of capital. Most people would be a lot more agressive with a negative cost of capital. He and charlie have not been very reckless but they’ve benefitted from it enormously anyway

Funny thing about being “aggressive” with low cost money — for the first time in a long. long time I am completely consumed with the investment equivalent of ennui, torpor, languor and melancholy.I was visiting w/ my banks today (they tell me that I am their favorite boy just now cause I don’t owe them enough and I have never screwed them yet — one young guy w/ a bit of mousse told me I was their “most attractive and ideal target client” — I told him, we’ll have none of that young man, I am happily married, thank you very much) and they all are most cooperative and falsely cheerful and we were laughing at the low, low cost of capital at P – 1% — but I cannot think of a single good thing to do with itWho in their right mind would lend money to someone at P – 1% today? It’s too damn cheap. Frankly it feels obscene.I have not one good idea (well, other than my day job) because things just keep sliding further down. I think I need a month in Mexico at the beach to further my liberal arts education. My wife keeps telling me we need a personal stimulus plan — her best idea is Steamboat Springs — nice opening bid and I am addicted to spring skiing.While I am a contrarian and I dearly love Mexico and there are some unbelievable bargains out there, I fear that the whole world has stopped spending money. Myself included. I have started looking at the wine prices at dinner. I don’t need to but I somehow feel compelled to.I wonder what will happen to Mexican resort real estate? I would love to own a sprawling Cuban beach house.

The book value issue is like the old LTV conglomerate issue — on the way up the conglomerate gets credit for its cleverness, at maturity it peaks and in decline it is a huge disadvantage as the parts are worth more than the whole.If you think about it BH is an old fashioned conglomerate with a bit less business glue among the constituent parts. The glue is the investment philosophy.

Any apology for how Berkshire-owned Moody’s keeps screwing up? (Enron, Fannie Mae…)

Just a brief mention and no apology

I’m also a fan of Buffett for quite some time. Thanks for the recap. One quote sticks to mind as a good opportunity for discussion.”Sure they were already generating $24 billion of float along with hundreds of millions of operating profit annually. But how busy can that keep a 31-person group?”I’m also a big fan of lean-and-mean: I’ve never been part of anything but small startups. However, given the only way out of this economic mess is full employment, how do we balance “lean-and-mean” with “providing-ample-opportunity”.Obviously computer-based automation continues to create efficiencies that remove large swaths of manual tasks that used to support employment. Clearly we don’t want to subsidize inefficient systems by keeping manual tasks around just for the sake of employment.But this – to me is a core problem – we can’t get out of this until we can find this balance.

I think we are seeing an explosion of self employment, freelancing, and DIYI don’t know if it can make up the loss of all those jobs, but its a trend for sure

i don’t see it fred. you have massive collapse of industrial era industries meeting a golden age of tech innovation ‘driving efficiencies’ ‘lower costs’ – its a perfect storm of sorts. I have not found any big thinker writing about this.

i agree that it requires a bit of optimism, perhaps to a delusional extent, to see how this scenario can end well when a lot of the tech stuff is about not hiring many people and enjoying 80% profit margins. with that said i do believe there is a golden age of sorts coming, so perhaps i am by my own standards a delusional optimist. :)the argument goes something like this:1. the current crisis not just an economic one; it is a political one.2. if we can accept that the crisis is beyond just the stock market being down and unemployment up, we can see how this may lead to the collapse of governments, war, riots, rebellions, revolutions, and that type of stuff. (to clarify i do not advocate violence, generally the only thing i advocate is hanging out at the beach. i am just saying what a lot of historians expect). we are already seeing this in iceland and greece, and of course war is an everyday occurrence, just ask folks in the middle east.3. out in conspiracy world, virtually all conspiracists agree that all this stuff is being done by design to create a “new world order” which will be a one world government with a one world monetary system and eventually a one world currency (it is unclear whether we are going to jump straight to a one world currency or a regional currency or exactly how this monetary crisis is going to play out. but serious conspiracists are in agreement that greater centralization of the global economy is an objective, and that a centrally planned global economy is a major goal).4. personally, i dont think the elite are going to get their new world order. in many ways this is nothing new, there is always some fool trying to take over the world (roman empire, hitler, etc). it always ends the same way, the empire devalues the currency as a way of robbing the people and trying to finance its empire. eventually people wake up after they get robbed and the empire collapses. society is left in ruins, but is free to rebuild itself. rest assured, we are on the same path here. history does indeed repeat, doubly so when no one is paying attention.so what happens when the new world order fails?1. i think people grossly underestimate how much of a hindrance govt is. we have as much innovation as we do in spite of the immense amount of taxes and regulation we experience. once we are freed from the parasite that we call govt, there will be tons of new industries, innovation and progress will be MUCH easier (and hence a speedy recovery is conceivable) as we will be able to have stable capitalism, something most of us haven’t experienced. while stupid people taking loans they cant afford is a part of the issue, govt is the primary cause of this mess.2. related to this is the amount of suppressed information. all sorts of alternative medicines, energies, technologies are already developed. aside from cancer and HIV, the biggest joke in the world has to be energy scarcity. free energy is real but suppressed. when these technologies are unleashed it could create a golden era with tons of new industries and an even lower cost of living. not to mention cheaper bandwidth!!!! hooray!!!!3. people will have to open their minds and learn new skills. that is one of the biggest obstacles given that most people who stumble upon this comment are too closed minded to even read the whole thing (granted i am getting kinda long winded here but it’s important! 🙂 )alternatively, the openly stated agenda of the elite working to create their new world order is to establish a one world government and then introduce a eugenics/human population program to reduce the world population by 80% – 95%. china is the model here, note it is both a centrally planned economy (which we in the US now are as well) with population control. the whole “green movement” is largely about creating the illusion of environmental scarcity, which will be the pretext by which they sell population control. so much of this stuff is admitted, they literally write books about it and brag about it. it is kinda ridiculous.i sort of wrote about the collapse and renaissance at the link below, though i was focusing more on the collapse as this was a couple years ago. i also toss in spirtual stuff because most conspiracists agree there is something “out of this world” that is involved in what is going on (fundamentalist christians will say the elite are channelling the devil….i think they are a bit mistaken but either way they have been right on so much for the past 10 years so i take their viewpoints seriously)http://www.kidmercuryblog.c…anyway this stuff will sound ridiculous if you have not heard it before but like i said the conspiracists have seen this whole thing coming. and it is from this viewpoint how i can see a golden age could emerge.of course it will take the facts, i.e. the Truth…the truth will set you free, as conspiracists are fond of saying.

I certainly struggle to see a way out of this other than lower incomes, more stay at home parents, lower costs, and different lifestyles

We also need more support for freelancers. Not so much as a “safety net”, but rather an acknowledgement that the workforce is going to be more engaged on a “per-project” basis rather than a long-term commitment. What “recognition” means concretely, I’m not sure yet.But for sure, I don’t see this acknowledgement in the current tax structure.What needs to happen is the recognition that: freelance = small business/startup (of sorts)One thing that stands in my mind is when I was living in Germany in the late ’90’s, the belief that “Freiberuflich” (free-lance) was really just assumed to mean “unemployed” or “underemployed”. A pejoritive connotation in any case. US isn’t so bad, but there’s still a somewhat negative assocatiation with that word.On a related note:Yes, there is a major correction of lifestyle expectations that will occur over the next 5 years. In particular, I wonder how this will play out in terms of public vs. private school. As we’ve discussed I’ve – admittedly ambivalently – enrolled by 6 y.o. into Private school. Otherwise, we’re “lifestyle poor”, but we’ve put a value premium on education. (I loved the NYTimes article this past weekend, in the Styles section [ick] nevertheless).This could be a good opportunity to re-align the values that people believe that private schools confer into a lower-cost option. I know you are very interested in this opportunity segement, so I think we are both eagerly watching this space.

I fear that the political objectives have begun to overwhelm the triage of the economy.I do not see any way you can stabilize the economy, rebuild the banking system, rehab significant industries, redistribute wealth, increase taxes on the most productive segment of the economy, increase taxes on capital and enact huge new programs which must be funded by tax dollars.Please note I am not suggesting any intellectual opposition to any particular social program — I just don’t think you can do it all at the same time. There is no incrementalism when almost every development or building program is based upon a step by step iterative process which makes the next move based upon the success of the prior move.Ready, aim, fire is a sequence which cannot be reordered with a successful outcome. Even if you control the US Congress.

While I like to think, I’ve been thinking this for awhile, there was a NYTime article recently to the contrary:http://www.nytimes.com/2009…It’s actually all very tricky, if you think about it. While freelance or project-based engagements are common place for technologists and developers, I really don’t think most americans are ready for the plunge.

Check out Jeremy Rifkin’s “The End of Work”–2003 Edition. He’s been writing about these issues since the early ’90s.

I have been thinking about this growth in self employment, freelancers and contractors, wondering what services they need to help them and how you can deliver them cheaply – legal, insurance, etc. Is there a social media aspect to either the delivery of the service itself or customer acquisition?

I think marketplaces for people like this are interestingEtsy is an example of that

Does Etsy have stats yet about how many users can support themselves selling their wares on Etsy?

They don’t know what each seller’s cost of living is so no they don’tI figure its 10pcnt and may get to 20pcnt somedayAnother significant group supplements their income or their partner’s income by selling on etsy

We need companies to get back to proper human capital management. Great managers generate great future managers who whether the company grows or shrinks spread out to generate value either in new business or at established. Normally there is always more things to be done than people to go around, automation is a great way to free up people for higher value tasks.In my opinion the way out of this mess is getting back not spending more than you earn. Sure it will hurt as the demand curve shifts down, but once we start growing again based on investment not borrowing it’ll be more sound.

Interesting question, in that it’s relevance is manifest only in the last few months. I remember back in the day, say, up to mid-2008, the biggest worry was demographics. Pretty much all of the developed world has a population bulge heading into retirement (including China, due to its one-child policy)… After this economic malaise is over, we’ll find out that efficiency and productivity is our friend as a diminishing working-age cohort will have to service a large retiree base.The biggest problem is: what do these people pay with? They have been absolutely creamed by all of this and by the people who manage their money… When the smoke clears there will be winners and losers and the biggest losers will be the 55+ who have seen their IRAs and 401(k) evaporate with no time left on the clock to make it up… This is a huge issue.

Two of the best investing books I’ve ever read are based on the wisdom of Charlie Munger; they should be required reading for any investor: http://bit.ly/rAMTjAndreessen had an interesting Munger post a bit back but never finished it off: http://bit.ly/sMCMO

I have read Munger’s book which at times reads a bit stilted but it is GREAT stuff. I used a bit of its philosophy to design an incentive management program and it worked like a charm. Great stuff.

Amen. He focuses very heavily on psychology, but he lacks the clear crisp writing that Buffett has been gifted with. If you’re looking for tips on how to design a human “system” or product that has a high likelihood of capitalizing on (or some would say manipulating) factors intrinsic to human nature, look no further.

My favourite quote from the report “In God we trust, everyone else pays cash”

bit.ly obfuscates what’s behind the URL (in this case, a PDF), and dilutes the PageRank of what’s behind whatever you’re linking to… in a non-space-constrained format like a blog entry, why use it?Just curious. I half expected a PDF anyway, but it would have been nice to know where/what I’m clicking to before I click it.

lol, yeah i know the feeling the “oh schnap i didnt know it was a pdf” is always a traumatizing experience

I got the report via bit.ly and that’s the only url I have for it

Way to go, contrarians!

Interesting – the visibility he provides into not just his books, but his thinking is so transparent. As an investor, you can see exactly what he is doing. He admits mistakes.I recently read Stephen Covey’s “Speed of Trust” (http://bit.ly/JDRDz). In it, he talks about how trust is the cornerstone of any relationship, success, etc. Those that inspire trust, inspire success. Those that shirk it may find short-term cash, but not long-term value.I attended transparencycamp.org this weekend in DC. It was an unconference about how to leverage data and open technologies to improve the transparency of government.It would be interesting to try and measure how much the transparency provided and trust fostered drives Berkshire Hathaway’s performance…

In his letter, Buffett admits to making a very big mistake with his purchase of Conoco last year. that was impressive.

“But the US Treasury bond bubble of late 2008 may be regarded as almost as extraordinary.”yup. inflation is the story, long gold/short 20+ year treasuries is shaping up to be the trade of the year.buffet is still a punk ass chump though. for anyone looking to hate on buffet, here is some ammo: http://www.lewrockwell.com/…

ashamed of myself for not mentioning this earlierhttp://www.google.com/searc…

“This One Goes To Eleven!”

This is the telling part re: Derivatives “it took us five years and more than $400 million in losses to largely complete the task”. My take: Multiply that amount X100 to extrapolate what’s needed for the banks to clean-up their mess. Five years is probably realistic too.

Perhaps the most interesting and disturbing thing about derivatives (CDOs in particular) is that nobody ever modeled “walking the cat backwards” in the event of a huge default. They collateralized something in which it was almost impossible to actually collect on the collateral.

His current letter is a good read and only 23 pages long. An easy read. It is the front section of the Annual Report. You gotta love his honesty in admitting his failures. I admire that very much.It is interesting to read his letters through the years. They are all available on line. I love their consistency and I respect the elegant simplicity of his approach. “Doesn’t understand tech” — so no tech investments but he is a great friend of Bill Gates (not to imply that MS is a big tech play).He understand cheeseburgers — so he buys Dairy Queen. Is anything more basic than a cheeseburger?An interesting point of reference is that lots of folks think he is quite a bit weird in his personal relationships and life. Not to be a hater but an interesting frame of reference nonetheless. I guess weird, like beauty, is in the eye of the beholder.

It’s a bit weird for him to be planning (I read somewhere) to not leave his children a single dime. Not saying it’s crazy or sick, but a bit weird, yes.

“It is very interesting to me that the past five decades have seen the S&P significantly outperform the long term average for equities of around 7% per annum. Even with the miserable performance of the public markets this decade, we’d have to be flat for another decade at least for the markets to average 7% per annum from 1965 on.”This is, to me, the most poignant insight of your post. If you believe that long term (and i mean really long term) results tend toward a norm, we’re in for a long slog. Sure there will be individual success stories in the next decade, but the market as a whole will be stuck for some time once it finds a bottom.We’re facing an unleveraged (or drastically less leveraged) future which means that all of our recent data and predictions on earnings and spending need to be thrown out the window until some new trends can be established. That’s going to take a while.

Thanks LarryBut the comment left by “The Facts” in this thread suggests that I might be reading the facts incorrectly

I guess it depends on which facts you choose to endorse, and to some extent, the year you pick as your baseline. The market is at roughly 0% growth for the last decade, but if you start counting from 1990, we’re up 140%.I’m not disputing “The Facts,” I think those numbers still suggest that we’re very likely in for an even longer period of negative/no/slow growth when measuring the broad market. I don’t see how you can look at those numbers and extrapolate that we’re in for higher than average growth for the next 10 years.Beyond that, much of the accelerated growth in the past 10-20 years has been fueled by leverage. That leverage isn’t going to be there for the next 10-20 years, at least not at the levels it has been.

I had a nice conversation with Mo Koyfman on this very subject on his blog here: http://bit.ly/k0iLOI'll sum up and extend my position. I have prayed at the alter of Buffett/Munger, but my issue is how badly they got things wrong in 2008. Since October, Berkshire has halved from its high and been about as correlated to the current crisis as everyone else if not worse. I’m sorry, but all of the WB’s wisdom you listed didn’t save him and serves as misdirection from the near term truth regarding Berkshire’s performance. He and Charlie got it wrong, and his classic “margin of safety” approach for downside protection wasn’t nearly as pronounced as John Paulson with regards to credit crisis, David Einhorn on the investment banking collapse, and Jim Simmons on how quantitative strategies can capitalize on making dispassionate decisions based upon facts both instantaneous and long term. All three of these guys have been on the record for a long time now regarding what’s wrong with the economy, but unlike WB, they had the conviction to capitalize on it.We must be vigilant when separating luck from skill. Neither saved Berkshire value over the past 4 months. When “The Oracle” starts trading like ORCL, you need to take pause.(and yes, it does make me feel queasy saying these things as I’m a huge Buffett fan, but so be it)

Damn good and fair point!So, if the Oracle of Omaha has a winning strategy and philosophy, why didn’t he produce the results?Having failed to produce the results, is his strategy and philosophy really a winner?

I’d rather hear Buffett talk about his mistakes than rehash stuff that he’s said before (his letters are brilliant – I have them all on my machine right now). However, I like to see transparency in both people’s successes and failures so I can make my own determination of what is skill and what is luck.

How much of this is the stock price versus the book value? It seems that much of the decline in stock price is a collapse in price/book, not book, which was only down 9.6pcnt in 2008

There are a lot of reasons for the run-up prior to the Oct high and the decline post (panic rotation, etc.) – but I won’t speculate. In my original comment, I wasn’t speaking about 2008 performance entirely, but his performance from Oct 2008 until today in terms of market correlation. As much as spoon-fed wisdom and common sense makes us connect with Buffett – and it is brilliant and authentic marketing/branding – it’s tough to keep propping up a self-affirmed Luddite in the face of everything that is going on in the world. The complexities are deep and wide. He’s not going to solve today’s problems with pencil, paper and a calculator (the guy doesn’t own a computer, let alone know anything about the type of investments USV engages in). I’m not being dismissive or disrespectful. My point is, given there are Buffett 2.0 types out there, we should be identifying and listening to them.

TrueBut I think his knowledge of the insurance business is up there with the best and he owns a lot of thatAnd his decision to invest heavily in energy utilities also seems smartI don’t know much about either business so I may be buying the brand as you suggest

The scary part (and I’m admittedly too lazy/busy to go look it up right now), is if you consider how much dry powder Berkshire is sitting on (my guess is ~$40B+ ex the $5B $GS Q408 investment), I’d have to imagine the losses on their book today are *much* heavier than the 50% drop I spoke about (assuming they didn’t lose anything on their cash & cash equivalents). Again, I’d have to dig in the numbers and, well, as a perma-snark web dork, I can’t be bothered. 😉

Why wouldn’t they be reflecting those losses in their book value?

OK, so I did look up a couple things after all (I guess I’m not THAT lazy). Let’s look at one of Buffett’s great recent energy investments. From here (http://bit.ly/L0Mbm), a $2B investment in debt from Dallas energy firm, TXU.In summary, he bought the 10.25%’s at 95, they now trade at 45. He bought the 10.5%s at 93 and they trade at 36.5. He’s lost a little over a $1B in a year.Like I said, the truth is out there: http://bit.ly/jk83RIn The Oracle’s own words: “During 2008 I did some dumb things in investments.”I respect that.

Energy utilities were always a hot sector, even in times of crisis.

Book value is a funny thing — it is an accounting determinable number. The real question is what is the enterprise worth? Or maybe not? Does what the stock market valuation really mean anything? If you can take a company private, it sure does.I have no opposition to looking at book value as one of a number of different useful values to assess “true” value but it is not trump as this game is played.When the GAAP accounting standards were changed to provide for the annual assessment of the “impairment of goodwill” and the requirement to determine “segments” of like type business in which to aggregate goodwill for the sole reason of assesing impairment rather than the annual “amortization of goodwill”, then book value became a bit more suspect.Take a look at a good GAAP manual and see how different the segmentation process and impairment is from the amortization requirement. It is quite subject to arbitrary decisionmaking but it is also compulsory.The impairment rules provide a real dilemma — mandatory write down of goodwill in bad times but you cannot increase goodwill in good times. Therefore all book value becomes a bit suspect. Over a period of time, book value has to become a huge bargain price — and maybe that is WB’s point.I guess I come to the conclusion that measures of accounting value, real enterprise value and the price of a share of stock are very different measures of value. Still the only one that can be turned into cash w/ your broker is the quoted share price.

Good point on intangiblesBut the book value of the union square ventures portfolios are what my partners and I think they are worth at that point in time.We put a lot of thought into it and we’ll stand by those numbersWhen an investor in our fund needs to sell (none yet), they may not get that priceBut it’s what I think is the fair price for the assets we own

I was musing about the concept of “book value” as used by WB in discussing BH. A GAAP defined term.The challenge w/ book value is that there are two warehouses each filled up w/ inventory but one has a sales staff and a book of business and a list of customers. The other one does not. They both likely have the identical GAAP book value (Acquisition Cost – Hard Assets = Goodwill).One has a going concern or enterprise value which is based upon its ability to generate cash flow and therefore under the goodwill impairment rules is not required to recognize any impairment of its goodwill while the other one may be required to impair a significant amount of its goodwill.A year later when the second warehouse full of inventory has the same sales staff and book of business and list of customers, it has already impaired its goodwill but it cannot now write its goodwill UP under GAAP. No argument w/ the accounting principle involved here.They both now likely have the exact same cash flow based enterprise or going concern value but decidedly different book values.This will become very interesting because surely the recent economy is going to require a bit of goodwill impairment for just about everybody.The example is, of course, a gross oversimplification.

Fred,What struck me is that one glaring item has never been mentioned except once, and that was by a treasury Rep before congress, the fact that our non banking part of the financial economy has changed drastically over the past 40 years to become 1/2 half o f hat financial market which was 20 trillion(US) before the fall crisis.With that growth came a lowering of checks and balances such as corpate governance through mutual funds and etc voting blocks and etc.The danger certainly is in over reacting to fix such problems and thus not balancing corrections against market dynamics.Have you seen signs from any direct and indirect Obama advisors, WB is an indirect advisor) that they are facing up to these issues?it seems we have two groups of issues both short-term, righting the market, and long term fixing the 10 trillion non banking system

Aw come on, you have to explain what the deal with 11 is.

Always wanting to do more than I really can

This amp goes to 11.

What struck me was that 7 out of 15 stock positions are under water. If you exclude the long-termholdings (amex,coke,wapo,wellsfargo), it appears that most recently opened positionsare under water. Its too early to tell but its likely that Mr. Buffet didnt follow the margin-of-safety mantra that heso dearly loves

Its also true that the market is down roughly 50pcnt in the past year. Most portfolios will ve under water on recent investmentsAnd its also true that BH makes a lot of money on its operating companies so the investment protfolio is only part of the story

FYI there’s a pretty good book that categories the annual letters into one not-that-long book.”The Essays of Warren Buffett”https://www.amazon.com/dp/0…

thanks

Warren Buffett holding company, from $12 a share in 1967 to $70,900 in 2002. The company beat the S&P 500’s performance by about 13.02% on average annually! only last year is not good. Buy a dollar value stock for 50 cents. http://www.Trade4Rich.com

Warren is god.

Warren is god.