Narratives Over Numbers

When I'm not sure what I want to write about, I start reading blogs until I come across something that interests me or strikes me. Today the blog that did that to me was Chris Dixon's. A few weeks ago he wrote a post about sizing markets with narratives, not numbers.

I love that advice and want to reinforce it. I see pitches every day, sometimes several in a day. And I can tell you that a picture/vision will light up my imagination in a way that numbers never will.

Chris says:

Some popular current narratives include: people are spending more and more time online and somehow brand advertisers will find a way to effectively influence them; social link sharing is becoming an increasingly significant source of website traffic and somehow will be monetized; mobile devices are becoming powerful enough to replace laptops for most tasks and will unleash a flood of new applications and business models.

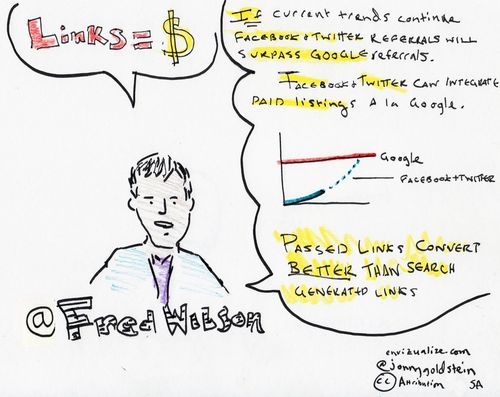

Let's take that social link sharing "narrative." Last year at this time, Jeff Pulver asked me to talk to the 140 conference. I wanted to explain to everyone why I thought Twitter was going to unleash a potent new economic model on the web. I could have gone and found some analyst's projections and thrown some big numbers on the screen.

Instead I talked about search versus social. Here is Jonny Goldstein's sketch of my talk (link to a video of it):

I love that sketch Jonny did. I wonder if you could turn his sketches into a textbook.

Anyway, by comparing social to search, I created a narrative that suggested something very big. Paid search is a $30bn market and is still growing. I didn't even have to show any numbers to make that point.

Another reason narratives are better than numbers is that it is easy to challenge numbers. You'll get "Where did you get those numbers?" or "They didn't do that math right." A narrative is just a story and you are the storyteller. It's harder to poke holes in a story, particularly if it is told well.

So I would encourage all entrepreneurs and everyone who is selling something to someone to focus on narratives over numbers, particularly when you are in the initial meeting. If the person you are pitching bites, there will be an opportunity to go over the numbers later. But you have to get yourself that opportunity and story telling is the best way to get there.

Comments (Archived):

You sound like a mathematician who skips lines in his theorem and confounds people with the end result. He is right, but how the hell did he get there?(First time mine is the first comment at an AVC post)

I wonder though if there is a distinction between telling the growth story of a start-up using narrative vs. data, and telling the story of an entire market/segment in the same way. In the case of the former, narrative makes sense because there really isn’t much company-specific data to use, and the data often used to depict its market opportunity is so staggeringly enormous by comparison that the reference is pretty much meaningless anyway. But when dealing with whole market segments and trends, or companies that are already established and contain good quantitative information, I wonder if narrative has its limits there.

Sigh…I wish MBA classes taught us narrative over numbers. If anything, we are taught numbers over narrative when pitching because numbers are considered ‘hard’ data. I do think narratives are more interesting, and when forecasting growth, I haven’t figured out why going any further than 2-3 years is necessary. I think that forecasting past 2 years is more along the lines of hogwash and pulling numbers out of thin air, especially when it comes to new media/technologies because the space changes and advances so quickly.

Hmmm, I suspect it is not “narrative over numbers” or even “narrative or numbers” — I think the right answer might be “narrative with numbers”. No one dimensional approach is ever right.When things are difficult to model is when the assumptions are the most important when the work is the most informing. You don’t ahve to champion a single solution but you can embrace a family of curves.

Here’s my take. When done correctly, they must iterate. A hypothesis narrative suggests what you should model, what paths to test out. And some of it works, some doesn’t. So you refine (totally re-write?) the hypothesis/narrative. And you refine the numbers further. And it goes around and around again until you land on a cohesive whole. A story you can tell with words and numbers, interchangeably.I am biased toward starting the whole thing with a narrative, though. Not the numbers. Some of you may disagree with me. I feel if you must start with a visceral conviction around who that customer is, what they’re doing and why they’re doing it. Creating narratives cold from a set of numbers always strikes me as disassociated from reality.Then again, I guess that’s what banking research people do all the time….

Yes, I agree completely. The iterative approach is exactly how I see things developing. The first negotiation is always with oneself. And it is the story which swirls around in your head.I like the image of working the narrative/numbers and then the opposite element until the puzzle is solved. Narrative — numbers — narrative — numbers.It is the basis of calculus — the rabbit jumps halfway to the lettuce each time and eventually, if the rabbit knows calculus, he leans over that last iterative slice and gets a mouthful of lettuce.

In fact I think that forecasting for new businesses is almost impossible even for the first year, so more than that is usually pure wishful thinking. However, there’s a value in forecasting. When you sit and crunch the numbers you learn a lot. You may not get them right, but you have to do them. Working with scenarios y studying the different outcomes is something everyone involved in a business should do.

Usually the audience already has preconceived notions on the market size (in most cases they would think it is smaller than what you think it is). When you start to show your numbers, you are fighting this preconceived notion that the audience already has.By telling a great narrative you reset the mindset of the audience to come up with a new set of preconcieved notions of the market size. At the very least you will have erased the preconcieved notions for long enough that they will look at your numbers fairly. In the best case scenario, if you have done a good job with the narrative, the audience will sell themselves on the size of the market and you just help them get there.

Love that way of looking at it — addresses the Why and the trending. Not just the market size right now….which will be gone by the time the business captures a piece of said market.

I have been building and leading sales organizations for a long time and amongst the most basic advice I give new and experienced sales people is that sales is simply story telling with a call to action. If in doubt then go back to basics and just tell the most visually graphic (lots of vivid description) you can to help the person stay focused and use their imagination. Good advice Fred!

sales is so key to all aspects of business. so much to learn from selling.

Amen. The best part of my work at Netvibes was sales.One of my mentors wrote a fantastic blog post about how selling is about listening and asking questions. Don’t list all the features your product has, ask what they want. When they say “Does your product do X?” don’t say “Of course”, say “Yes, but what is it you want X for?”It’s simple, even a cliché, but so powerful in my (limited) experience and so often overlooked.

Brilliantly subtle. You made him engage and you positioned yourself as the expert.

Interesting. P-E, you worked for Netvibes?

Yes, I did a summer internship there in biz dev. Why?I have an NDA, I’m not sure how much I can share. ;)PEG

Absolutely.So many cod/pseudo intellectuals in our (and other) industry choose to overlook this fundamental truth. It’s a cliche, but so true: People Buy From People.

Great storytelling allows the listener to make the narrative his/her own. This is why it is so important for selling. If you tell me a great story, I will be able to easily repeat it, to my colleagues, my boss, my team, whoever I have to bring on board.A great story also stirs the imagination, so that the listener fills in the blanks, enlarges the story, and adds additional detail to support the basic premise. In other words the listener becomes the teller of the story himself almost as if he originated it. Now it begins to spread. Did I tell you the one about (fill in the blank)?This is something we easily forget as we often come to believe that the numbers are what are important and don’t see that it is the narrative that imprints the numbers into our imagination. Both need each other to be really persuasive.

“if you tell me a great story, i will be able to repeat it”so true chris

Nobody has ever said: “Man did I see a great graph last week.”The numbers have to be “woven” into the story in such a manner that their thread is part of the story.

JLM, “woven” and “thread” are exactly the right words.

Excellent comment Chris. I’ve put too much emphasis on the tech and what I think, and not enough on the framework and retelling strength of my pitch.

I like this approach for situation you described. The challenge of using narratives on the Internet is the “opposite of everything” phenomenon. There’s always (underlined) someone out there that can put out a cogent, smart, PHD-level narrative that’s almost the opposite or the flip-side of anything. When that happens, it just becomes an arms race using numbers to determine which narrative is more correct; which leads to context bending, statistics warping, celebrity quoting and other devices to back up your narrative.

If your goal is to convince people of a point of view, this is good strategy.If your goal is to understand what’s actually going on, it’s a horrible strategy. You’ll be so busy making up good stories instead of doing deep analysis that you’ll miss what’s important.

i’m not sure that is true. working on the 140 conference talk gave me great insights that we’ve been leveraging in our work

A better way of phrasing my comment is to say that telling good stories and doing good analysis are to some extent independent of one another. I’ve heard tonnes of great, memorable narrative-driven talks that were utterly wrong. And some of the driest most boring talks were among the deepest and most prescient.The right combination is obviously deep analysis, presented with a terrific narrative. This is obvious, but rare, perhaps because it’s such hard work to do both.

What you have described is Michael Nielsen’s unique style of processing information. What might have been dry to some was in your wheelhouse as to your ability to receive and learn from. It’s all about preferred learning style. Not that everything has to come in that package but you have to be open minded enough to continue processing the information when you recognize it is not your preferred learning style.

I don’t disagree that preferred lining styles are important, but I’m talking about something quite different. I’m pointing out that some people tell great stories, but are utterly wrong about reality. It’s worth avoiding such people’s talks, and it’s certainly worth avoiding becoming such a person.

Agreed. Hmmm, Bernie Madoff?Told and lived an otherwise attractive but huge lie.

I think it’s a matter of balance. Obviously storytelling can’t replace research and facts. You need to take a deep hard look at the data but you also need to “connect the dots,” i.e. build a narrative that explains the various data points you get.Figuring out what the next trends online (or on any market) isn’t science, it always involves a gut call. You have to know the facts cold but ultimately it’s not what clinches the decision. I think it’s best to recognize that.

The story telling has to include the research and facts. They have to be woven into the story.

Great post. I agree, as usual.I like that you make the point that 1) this isn’t limited to pitching to VCs but to sell anything and 2) it’s important for the “first meeting” — I don’t want people to get the impression that you don’t need any numbers at all. Unless your investor is already convinced of the narrative you’re pitching, you’re going to have to show him numbers, and facts, to validate the narrative. “Total addressable market” sizing is always a bit hazardous, but you need to show some hard evidence that points in the direction you’re talking about. The narrative grabs the interest, but you need (some) data to back it up, in an intelligent way.

I have been a numbers guy all my life and nothing lies like numbers. The invention of PC’s and electronic spreadsheets raised the ability to obfuscate and overwhelm with numbers to unprecedented heights. This skill set quickly moved from financial modeling to financial reporting such and from there to financial products. It should have been a red flag to everyone when no one could understand the story of how the Enron business model made money. Ditto when Wall St. was making billions on bad mortgages. The old saw is that Numbers Don’t Lie. HOWEVER, if the story makes no sense you can be VERY CONFIDENT that the numbers lie.

“i’ve been a numbers guy all my life and nothing lies like numbers”great line robert!

As a numbers guy myself, I think the big advantage of being able to model a financial investment is the ability to develop alternative scenarios.”Please let me introduce my friend — Rosie Scenario!”Alternate scenarios are the sensitivity testing that provides the real time answer to — what if?Embracing a single model as the likely outcome often leads to trouble while having alternative scenarios can easily lead to that “aha” moment when you know which curve you are truly on.

Could not agree more. I have extensive consulting experience in Scenario based strategic planning. What I have seen too many times however, is large detailed financial models used to create a highly “plausible” scenario that makes the venture in question look wonderful. Any one providing a financial projection should be asked to provide credible stress tests. Investors should require robust financials not just credible ones.

I always force my financial people to document all of the assumptions at the top of the spreadsheet and then arbitrarily change them in real time to see where the sensitivities are and how the outcomes differ.

This is something that gradients capture between state transformations. You can see the spikes jump out with small deltas. But higher dimensional surfaces are tricky to plot.

Pro tip, hammering home the futility of a single model. In tracking problems the multiple model algorithm allows quality estimates and transitions by mixing covariances between varied assumptions. I think about this technique when reading topical opinions. A diverse range of assumptions and models yields different trends, but which is closest to the truth?

When the deal works within the entire width and breadth of the chalkstripe, then you are likely going to make a buckWhich one is right? The one that gets the pay window to crack open, in my book.

As Robert knows (disclosure: we’ve worked together) — I’m a narrative person, the one they stick in the front to tell the story.There is no amount of lipstick we can put on the pig if the numbers suck. At least, not if you want to look your audience in the eye.If the narrator has any semblance of intellectual ethics, s/he will have a hard time delivering the story with compelling energy.But if s/he believes the narrative to their core, you’ll hardly be able to keep them from jumping up and down in excitement over it.

In the turnaround business, the numbers sucking is an attractive bit of info. The entire business is about reversing the trend.Conviction is everything. Everything. Give me a person who has conviction and a fair plan over somebody who has a great plan and is light on conviction.As Stonewall Jackson said: “You may be whatever you resolve to be.”

yes — if the numbers suck but they don’t have to, that is an opportunity!

I always like to ask sponsors of decisions, deals, plans — would you put YOUR money into this deal?The answer is not as important as the SPEED with which they answer. If they break eye contact, look down and to the left, hem and haw — well then you have your answer.I make everybody in the company who is involved with a new venture or deal or who has conducted the due diligence to “endorse” the deal in writing before I make the final decision. I make them own their opinion. We use a “Decision Memorandum” which we then use to inform the Board. It is a good discipline.I recently had a guy say — “I’d put my kids’ trust fund money into this deal.” We made a 100% unleveraged ROI year 1.

A great litmus test. And I like the pressure-test of the commitment with the signing.My former boss asked me last week for me to send him two prospectuses when it’s ready. He wants to recommend it to his dad. I can’t tell you what a confidence builder that was.A great relief, too — since I used a slice of my kids’ college savings to seed this biz.

Facebook and Twitter referrals will not surpass Google referrals (organic and paid) – in this case you need to do the numbers for reals.

i can point you to any number of websites where they already do

My bet is that this will be highly category specific. Sites like this, TPM, huffpo and other media sites are most likely to cross the chasm on this. Transactional sites (e.g. banks) and reference sites (e.g. Wikipedia) less likely.

I love this interchange because it totally illustrates the issue.Susan writes that twitter referrals will not likely pass google referrals. Strictly speaking a suspect Susan is right. Google does something like 3 billion searches a day, the vast majority of which result in traffic driven somewhere. There are what 100 million tweets a day? Some percentage of those tweets include links.Fred reframes the argument using a narrative that points to specific websites. This is important because to the owner of a specific web site, traffic to their specific site is all that matters.One is an intellectual response, one is an emotional response. You need to connect on both levels to be successful.

word

So true Fred.Numbers are the proof points to the story over time.

storytelling is one of the most subtle forms of bypassing the critical faculty and inducing hypnosis.stories capture the imagination and disarm the conscious mind allowing the words to go directly to the subconscious which does not possess a critical faculty.Once thoughts, ideas, images are in the subconscious……a lot of the “sales” work has already been doneMartin Luther King said “I have a dream”, NOT “I have a plan”

Fabulous comment.I like to study people who are wildly successful, particulary ones I do not have a natural attraction to, to see if I can glean from whence their success has come.My favorite fact about MLK was that he had a PHD from Boston University. He was quite the intellectual, a powerful leader and a great speaker.King had a dream and a plan to make that dream come true. He had studied all the philosophers and became energized when he studied Ghandi’s philosophy of civil disobedience.A dream with a plan is pretty damn powerful. It changed our country forever.

What underscores the truth of both of your comments, and this post, is that MLK had a dream and a plan. He spoke about the dream, and executed the plan.Something for me to keep in mind.

1. The book Made to Stick is a great read for anyone about getting your ideas to stick. That goes for entrepreneurship/pitching/selling. Narratives work.2. Meanwhile, over at Bijan’s blog, he’s defending freemium business models and says “I believe this with all of my heart.”Apparently VC’s aren’t all cold hard numbers after all. 😉

the good ones aren’t

Agreed.

Unfortunately, a lot depends on the listener.I totally agree a good story (which creates a mental picture) is worth a 1,000 words.But most of the MBA types I’ve pitched are still in the dark ages and want to see a BGC matrix or other such bollocks more appropriate to launching a new brand of shampoo.

that’s sadly true of too many entrepreneur’s experiences

The BGC matrix is a cover your a$$ technique. If things go wrong with the deal, it allows one to blame the tool. “Well, we did our due diligence.” It’s more difficult to tell a boss “Well, they had the right story. Not sure what happened.”

All too true, David.

Start with a story. It’s a far more compelling means of persuasion than facts and figures. Tell a compelling story and people will always give you more time to make your case with numbers.

Fred, let me predict a narrative for you. Sooner than later, someone (likely Robert Scoble) will use @hashpool’s system for an interview on twitter. It will catch on. Journalism will feel another minor disruption. See http://j.mp/cgu9VY

i’d love to see it

I tried it out briefly but didn’t hit the aha! moment.By the way dig the wordpress template? for the landing page, I had a version of that for victusmedia 1.0

Fred – we added ‘Narrative’ to our product explanation a month ago and have seen a noticeable increase in sign-ups http://www.decisionsforhero…

What makes this most interesting is that often a technical founder is either a) so deep in the weeds or b) too analytics/numbers/data driven to properly step back and tell the *real* story to an outside observer.That’s why the pitch process of raising money can be so valuable – like your experience creating the talk for the 140 conference – telling the story over and over (and refining, understanding, and even modifying the story) can be extremely valuable for a founder. And like others have pointed out, there is a natural extension to sales.Developing the ability to effectively tell “the story” can be an important skill for the founder/CEO across a bunch of functional areas.

Remember that in raising $$$, you don’t have to have a very good batting average. Success is still OK at 2/100.There is nothing that sharpens your pitch like practice. Ask every audience member after they break your heart — what can I do to improve my pitch?

Every professional musician and actor I know rehearses before they perform, including generally once on-site. Every athlete practices on-site before the game, to get to know the venue.And yet so many aspiring (and experienced) entrepreneurs do not practice their pitch; and almost never do a run-through on-site.Last fall I was helping a (seasoned) entrepreneur with a pitch that was new to him, and was going to be given to a group of 10 or so angels. The conf room was available 3 hours ahead of time. I suggested — why don’t we do a dry run, to work out the kinks? He looked at me like I have seven noses…..e.g. ‘that crazy chick’….Wouldn’t you know — it was a stinkbomb presentation. Diarrhea of the mouth, painful to watch. And it was totally avoidable.Why do we think we can pull off what seasoned performers cannot?

Because nobody pays admission to hear us and the audience never applauds, we just think they do?What a brilliantly pointed and powerful comment. At the end of the day, we are all just performers playing out bit parts in life hopefully absent the hubris that just a bit of success imparts. Oh, you, Prom Queens and basketball team captains!I really do think that the learning style of the audience, the custom tailored complementary style of the presentation, the length of the presentation and the manner of the “ask” are all critical elements of any successful pitch.There is no downside. We can only get better w/ practice.

Well, it also bears mentioning that if someone comes off as too slick, that’s also a red flag.You need to have grokked your script to such a degree that you can dial up and dial down pieces in response to who you’re speaking with.I must say, all in all, I much prefer one-on-one conversations to a room where you’re broadcasting.

You hit the nail on the head. It is a conversation, not a lecture. Even when the room is full, it is still a conversation.

Thanks JLM for the reminder. I was impressed reading about Pandora’s 347 pitches for their second round. I’m batting 0/7 and reworking the tools more to give me greater understanding and confidence than to impress the subject of the pitch.Chris made a great point in today’s comments:”A great story also stirs the imagination, so that the listener fills in the blanks, enlarges the story, and adds additional detail to support the basic premise. In other words the listener becomes the teller of the story himself almost as if he originated it. Now it begins to spread. Did I tell you the one about (fill in the blank)?”I believe one of my mistakes is trying to fill in every what if, with definitive what will be. I should craft the pitch to be more succinct and to allow embellishment by those who pass it on. Of course due to miscommunication, and personal creativity, I’ll be starting a voyage to discover new routes to India before I get funded… 😀

Have you ever read Barbara Minto?

Nopemy backlog of incredible books has grown too large 🙁

Here’s one slide we’ve been using in Cloudomatic presentations (investor pitches or just normal event talks) to tell help tell the narrative of where the market is going: http://imgur.com/XyHoC

There is no question that most everything in life is about a story which the audience hopefully embraces and makes their own. You don’t just have to have a story, you have to be a story teller. A damn good story teller. This is an art form that anybody can learn.You have to be patient but leaning forward. You have to let the story tell itself and to champion the story as being right.But the issue oft times is more importantly — how does your audience “process information” or what is their learning style. This has huge implications as to when the light goes on in their heads and they become just believers or TRUE BELIEVERS.People learn and process information orally, verbally and visually. That is why Power Point became such a powerful tool — not the be all and end all — but a powerful tool nonetheless. It combines those three processes and thereby allows the audience to opt in to its learning style rather than your story telling style.Look to the Myers-Briggs type indicator as an indication of how you and your audience most comfortably process information. Understand there are people who do not even begin to process the info until they sleep on it.I once raised a boatload of $$$ for a deal from a guy — Hvd MBA, Law, 6’4″, big jock — who looked and acted like a hugely decisive deal guy. It had dawned on me he was an intravert (as used in the MBTI context). I pitched him the deal in the afternoon, had a nice dinner never discussing the deal and came back the next morning and answered his questions. He could only process the info by sleeping on it. Made the deal.

i process a lot of stuff by sleeping on itthat’s why i write best first thing in the morningi agree that it is critical to know your audiencei used to post my personality profile this blog for that reasonmaybe i should go back to doing thathere is my personality profilehttp://www.personaldna.com/…<http: http://www.personaldna.com=“” report.php?k=”wyiEjwwMJLStHhW-OK-DACCD-5478″>

Fred, please lie down on the couch. LOLEverything in your personality DNA is exactly what I would have expected having met you once in person for an hour, knowing your familial background and reading your writings.We all change over the course of our lives and how we look at things at 25 is different than at 50. At 50, we peer down into the abyss and begin to wonder. Oh, yes, 50 will bring out the craziness. Feed it, don’t fight it.We also struggle with becoming not the person we are but the person we want to be.Your seemingly low score on “empathy” is an interesting score. Well, Fred, to be perfectly frank, Fred does not think he has an empathetic bone in his body.You are apparently natively not a particularly empathetic person but clearly your writings indicate you want to be perceived as such a person and I would opine your writings and actions indicate that you are empathetic though you apparently are not naturally so. Good for you. You are wrestling your own demons to the ground.You are becoming the person you want to be and natural tendencies be damned. That is growth.OK, you can get up now! Sorry, I could not resist.

you and my friend jerry colonna say the same thing about my lack of empathyhe likes to put me on the couch too

The fact that you know who you are on that score defeats any negative implications — well almost all negative implications — that that tendency might have for your life.The application of that Kentucky windage to your life, empowers you to become more effective and makes you a dangerous person as you can, in fact, operate opposite to type. And that is the most fun in life.To be able to operate opposite our “type” is what makes us complete as people.Your charitable activities lay the lie to your natural instincts and I would bet therefore more gratifying personally to you as in your quietest moments you take great pleasure from them and in defeating what you may perceive otherwise about yourself.But then you already knew that didn’t you?

I’ve only been reading the world according to Fred for a little over a year, but I don’t need to look at a personality profile to get his message. Those classification structures are like kids drawing hyper surfaces with crayons. I suspect advances in neuroscience to finally reveal the limitations of social psychology.

At the end of the day, isn’t everything just about context? The more we know about a subject or person, the richer the context.

I do agree, but conditioned on the fact that when fusing data we recognize the quality of each source. I’ve merged some weighted measures before and when you mix poor signal data in, it can actually reduce the quality of one’s estimate. In this case the quality of Fred’s blog is much stronger signal than a behavioral test.I completed a behavior test a year or so back when working with a business coach and while I agreed with the categorization it was too vague for my liking. When people really start to believe the categorizations they paint themselves into a corner. Is Fred a weak empath? Relative to who?

Perhaps you are delving a bit deeper than the subject matter suggests. I was commenting only upon a personality DNA overview provided by Fred. Whether Fred “believes” it or not is solely Fred’s business. But Fred created the results.The tool is only as good as the craftsman wielding it allows it to be.I would always encourage folks to consider carefully those things about themselves with which they do NOT agree. We all have blind spots and sometimes the data is there but we refuse to believe it.I am a huge fan of self learning exercises of any kind. You have to consider them all with a healthy dose of intellectual skepticism but also as a “fire starter” something that gets you thinking.I regularly conduct a “trust building” exercise amongst my direct reports and never fail to learn something about myself and others. The exercise is very, very simple — blind cataloging of strengths and weakness.I cannot say that I have ever headed off a mutiny, but I have learned some interesting things about how they perceive our relationship. Better yet, if I change something then they own the change and are highly likely to buy into the results.

I did delve too deep. Had too much time to overthink it over while sitting outside of Michelle’s bridal shower waiting for the party to finish up. I’ve learned enough to stay clear of rooms full of 30 women 😀

Wow, 30 women thinking about anything related to marriage is far beyond critical mass. Be careful, friend.

All of these characteristics are within the context of all others. No one can be 100% in all things.Someone who is 100% on the empathy scale probably makes a great nurse, Kindergarten teacher, or Mother Teresa. But not a great VC.And someone who is on the low side of empathy is not necessarily a torturer of small animals.In this job, you probably need just enough empathy to (1) be effective at meeting new people, (2) see market opportunities in a visceral way and not just a numbers way, and (3) be cognizant of the downstream effects of our actions so people want to work with us again.As we age, we experience seeing people very different from ourselves accomplish amazing things by leveraging talents which we don’t have. We gain appreciation. And we learn how to fortify and shore up our weaker areas.And unexpected life experiences create pools of empathy in us we never knew we were capable of.I’m not really concerned at all by Fred’s empathy score.

Brilliant.I also think as we age, we discover we have a whole lot more talents than we ever thought we had. We become more confident in our ability to deal w/ failure and thus the barriers to entry come down.

Totally.And hey — let’s not forget, Fred’s REALLY old. So he’s had time to learn a LOT.;-)

As a guy who can actually manipulate a slide rule, I will have to take that under advisement.Once upon a time, my college age daughter used to invite people over to have them see me operate a slide rule.The greatest pleasure in my life is recognizing what I do not know and the realization that I can learn it.

I recently framed into a shadow box the drafting kit my father used for many years for his mechanical designs.It is a profoundly beautiful set of tools.They were extensions of his hands and his great mind.Which perhaps sounds quaint. But does make me wonder. In the future — what will we frame to celebrate visions created? I think most of us are tossing (recycling) our laptops every few years. That tactile connection is going away.

We all need talismans. Things which are connected to our souls and which peer deeply into our hearts and which remind us of who we were and who we are still and to whom we are connected in life.My family has a superstition of each child being given a Silver Dollar of the year 100 years before they were born. It is thought to bring luck and protection. Mine has worked pretty damn well thus far.My father gave me a K-bar which he carried on 6 June 1944 and he used to shave with during WWII and the Korean War. I carried it through my service and it served me well. Once I got caught under a chute in the water and slashed my way free before I drowned. If I had not been carrying that knife, I am probably not typing this comment.I have a collection of Mont Blanc and Pelikan pens I used to sign the biggest deals I ever made. I think they are a bit pretentious today.These little trophies are important to our lives and should be celebrated.

whoai told you i read every comment 🙂

Zing!

I am an instinctive decision maker who forces myself to reflect upon and re-process my initial instincts by sleeping on it.The big question really is — are you “processing” the info or are you allowing the information to “age”?Are you thinking about the info or are you becoming comfortable with its implications?Neither approach is better or worse, they are just a bit different.”I could never imagine myself doing…””Hmmm, I guess I could do that…”

So true. Those creating these narratives are later written about by those putting the numbers. Narrative-people are trail blazing and forging new ground, which then becomes markets that analysts put numbers on. Entrepreneurs are in the trenches and are seeing what others aren’t. They are seeing the billions if not millions in these new markets.Like Columbus and the New World, Queen Isabella did not ask Columbus: “Can you show me your spreadsheet with the ROI calculated and show me the value of finding a New World”.

Point well made; however in the pursuit of historical accuracy, Columbus in fact did have a business purpose for his enterprise — to shorten the overland travel route in the spice trade.Chris cut himself a pretty good deal, if memory serves me right — he got to be declared “Admiral of the Oceans”, governor of all lands he found (which was the real payoff as he had the right to levy taxes), 10% of the action on the gross and 1/8th of any subsequent commercial enterprises spun off. He was operating with OPM all the while.Remember Columbus had tried to finance his deal initially with Italian business interests and then the Portugese crown and finally the Spanish Queen.He got turned down by all of them until the Spanish Queen’s religious mentor told her he liked the deal.He discovered the entire Caribbean including Cuba, Puerto Rico, Haiti, etc. He always believed that he was on the eastern edge of India thus naming the natives “indios”. Go figure!He ultimately made 4 or 5 voyages and brought back to Spain — gold, slaves and syphilis. Well, 2 out of 3 is OK? Well, I guess only the gold was really appreciated.

Nonetheless, a good model for entrepreneurs.

I agree completely, if not more.I think of people like him as “visionary” in their ability to literally see over the horizon. If they can condense their vision into a story and ultimately an executable plan, then anything is possible. Anything.The challenge with many people is that when they close their eyes, they see nothing. Not everybody has the ability to envision things.Now the other problem is that sometimes what looks like a vision is really a mirage and can be deadly in the process.

Too true- great comments on this.It’s always the narrative that gets people to sink into a pitch and understand it. I’ve worked with a few talented sales executives who were terrible at the math, but they were brilliant with narratives. They closed the lion’s share of business.If you can tell a story based on mutually shared assumptions, then play with those assumptions, you can get people on board with an idea.

“they closed the lion’s share of the business”yup, that’s my experience as well

Wish I knew who to credit for a line that has always stuck in my mind:”He/she who tells the best story and draws the best picture, gets the order.”

telling and drawing are very relatedgreat line Rex

This is why drawing and sketchbooks have always been so fundamental to the practice of art. I miss drawing nudes- looking at humans and all their nuances, and you can truly see through how the lines fit together the story of that person. it is the most beautiful thing in the world, and your goal is to see the order of that story to make sense of the picture.I truly miss nude drawings.

there’s a great poker analogy in this post.poker is largely a numbers game. at each point in the hand you need to be able to calculate the number of possible combinations of hands your opponent has and the odds. the problem is that you cant do any of this without a story. you need to listen to the story the villain is telling with his/her betting patterns and size. once you understand the story, you can decide if it makes sense to hear more.

poker is a great way to learn business

i have mixed feelings about that.the problem is that poker theory generally revolves around the concept ofreciprocity. in the long run, a player will see every hand in everyposition. therefore, you can only earn a profit when you make a decision ina specific position that differs from the one your opponent made. clearly,thats not the case in business. imagine if there was no proprietary dealflow and every vc got to see the same deal at the same time. it wouldfundamentally change the way you had to make decisions.

Well played!

Take home: stories and narratives tap emotions. Emotions are a more powerful influence than numbers and logic.

Though I can appreciate its beauty and the power of its seduction, mathematics to me has always been an abstraction, or as Nassim Nicholas Taleb would say (though I am not sure that he would agree with me), “a reduction of true complexity”. The value of mathematics is clear to me in, for example, leveraged buyouts, where you are calculating interest coverage, etc., but less so when making seed and early-stage investments. That’s where those who possess a facility with ideas have a true advantage.

Would you then say by extension that numbers/projections are not required, are of equal importance to the narrative, or are one part of the narrative?In my opinion, numbers are just one part of the larger narrative which would be incomplete without the numbers, and similarly, the numbers alone cannot tell the entire narrative without referencing trends, user behaviors, evolving technology, etc.

i think numbers are important at some pointbut we would make an investment without numbers but never without anarrative

I’ve got a play by play narrative almost 400 posts long. Each one capturing what and where I see society and Tech moving. It’s good pitch practice, especially narrowing down each post to essentials, and a compelling story.If football coaches opened their playbooks and posted them on a blog they’d get pulverized. Would be founders do the same and they find cofounders, partners, funders and early team members that buy in to a consistent although shifting vision.

You don’t touch on it in this post Fred, but I remember a post you did back in January about your areas of interest for VC investments: http://www.avc.com/a_vc/201…This struck me as a narrative approach to investing – identifying key themes/trends to be on the watch for and then finding startups that are a part of them. I had a chance to read the new Michael Lewis book a few weeks ago and he mentions that one of the investors in the book would always asked analysts to pitch him a story rather than data points off of a model. It seems like the right approach because you don’t end up shackling yourself to a financial model whose projections could be wrong.Like you said, once you look at the story and it makes sense, you can start delving deeper into the numbers. Its probably much less common in VC investing, but with traditional equity investing I’ll often come across investment pitches that are totally model driven and completely devoid of common sense.

Once I know that a market is “freaking huge and growing” that is all I need from numbers. (Although I admit to having wasted too much time in the past putting together a bunch of market data stats to keep an investor happy knowing that those stats were not really that useful to the business and knowing that the investor knew that as well!). The only number I need is “is my value at least 2x” the incumbent – twice cheap or twice as revenue-generating or twice as fast or twice as pick-your-metric. To get traction for something really new I have found one needs that level of arbitrage.

This could have easily been an MBA Monday post.Story-telling is a skill that every aspiring entrepreneur, salesman, bartender, janitor, manager, and parent NEEDS to succeed. Don’t tell me that Babe Ruth hit the ball 443 feet to left-center…..tell me how he called the shot, and how the crowd felt about it.

story-telling is also useful for finding a girlfriend

Indeed. Landed me a great wife, a couple good girlfriends and a few bad mistakes.It’s ALL sales at the end of the day, isn’t it? 🙂

Does it help in keeping a girlfriend?I’m not so sure…:-)

Similarly, story-telling helps with the pitch, but you have to follow up with numbers. Can you imagine having milestones and measuring progress with just a narrative?

Nope — you are absolutely correct. If you haven’t worked it through at the micro, you cannot own it forcefully at the macro level.And every single time you uncover a detail which refutes your hypothesis, you must test it.it is either an outlier, or something you need to bake into your model….or something that undermines the whole thing. You need to know which.You may only need to know it for the Q&A, or perhaps not at all — but knowing you turned every stone is a great confidence builder.

Let’s see now, I guess that would depend upon whether you also have a wife, si, El Tigre?

I have a husband. And my observation on that one is that if you have to explain yourself out of things, it’s already too late, and you’re probably already on the road to Splitsville.That goes for either of us.Best way to get out of the doghouse is to stay out to begin with!

Girlfriends are like the ultimate SaaS model: you don’t perform, you get canceled really fast.No platform lock-in or maintenance contracts, like wives… 😉

When I was dating my (now) husband for what at that time I felt was too long…(I was, after all, going to be turning 30 soon), I told him — I am not a car that is rent with an option to buy.It worked!SaaS — that is hysterical. Love it.Now, I am a deeply entrenched green screen legacy system.

That’s how my marriage is too and it’s the best way for a marriage to be. 🙂

What is the numbers alternative there?

So true, Andy.

People need a reference point to compare things to. “Gross margins 35.8% versus 39.6%”, “10,000 songs in your pocket”, “bigger than paid search”. Sometimes you need a number, sometimes a narrative will do.The difficult bit is finding the right reference point for your story.Many markets that Gartner and IDC are covering are $1bn+ by 2014. The problem: these numbers do not speak to anyone. Wrong reference point.

Chris Dixon On Twitter: Not Impressive http://goo.gl/fb/Bx435

don’t judge someone by one blog posthe’s a terrific entrepreneur and investor

That is the f-i-r-s-t thing I said in my blog post, that he is a great entrepreneur and investor. I hope my blog post adds to the discussion and I hope it does not come across as any kind of name calling.

We need to talk some resonance sense into this guy. I think there is some fancy phonetic word for what you just did there…

And what would that be? Educate me.

Can’t agree more. I started to draw a lot of things recently and discovered it’s a excellent tool to memorize and share points of viewWant to see another story ? Chirp – Twitter announcing their focus: Infrastructure, friction-less, relevance, revenueshttp://www.inno-swiss.com/p…

Fred — regarding your Passed Links talk. I’d be really interested in data that estimates a premium in click-through rate of passed links versus paid search.Do you have, or could you direct me toward, any data around that? Even a ballpark.It’s an important assumption in what I’m working on.

i got that from some proprietary data from a couple of our portfoliocompaniesi am sorry but i can’t share it

NP. thought I’d check.I profoundly believe if your trusted peeps tell you something it’s way more influential.so curious to learn, though experience, what that premium is.guess i’ll have to see it in play for myself!

This is also probably why the best investors are usually thesis-driven in their bets too. Warren Buffett is a good example, him and Charlie Munger have an eye for the right intangibles in great businesses and the leadership behind those businesses: http://bit.ly/bdze1o.It's always hard to quantify the intangibles today, and very few people pick up on them, but the numbers always follow the intangibles in the long-run – in markets, in companies, and also in people too, I think. This is probably why Buffett often makes analogies between love/marriage and investing.

It’s all about the story. Everyone likes a good story. Telling a good story is the best way to sell, and running a startup is selling, selling, selling — whether to prospects, existing customer, potential investors, or employees.

I’m so glad of two things:One that I am literate. Literate also means cultrally literate, that I am able to understand and tell stories.Two: That I took a class where someone gave me the book Flatland (http://www.geom.uiuc.edu/~b… . Not only is it a witty parody, it points out how numbers and stories truly fit together in one large whole. It asks questions about the ideas of dimensions and perspectives through story, and only through story do you really understand and ask all sorts of complex questions about geometry in general.A Good story will do that to you- so will good quality numbers. Flatland is among the best- and I think that should be the goal of any story/number operation- a sign of very high literacy.

You know the axiom that I may not be right, but I am definitely not confused. It’s an elemental condition that’s at work when you are driven by a clear, coherent narrative.

I’ve gotten a lot of utility out of his concept:You want to be approximately right, and not precisely wrong.I think the narrative can get you to “approximately right”, while the numbers try to safeguard against “precisely wrong”.

Good stuff. That’s one way of looking at the concept of thresholding.

Um, this is more fun and effective but I have run across no VC who would not, in the end, say, “yah pretty pictures and nice story but show me the numbers.”

i guess you haven’t pitched me yet 🙂

That almost sounds like an invitation :-)But I gauge VCs based on where they place Neutral Milk Hotel in the music canon. Well?

number 160 on my listhttp://www.last.fm/user/fre…<http: http://www.last.fm=“” user=”” fredwilson=”” charts?rangetype=”overall&subtype=artists”>

won’t try to debate the stones … but at least the smiths is on there 😉

I spent the last three years working with an unbelievable group of salesmen and marketers. The most valuable piece of advice I got during that time was from one of the best we had. He told me that every powerpoint slide should send a single message, and that if he couldn’t give that message in a single sentence, the slide was too complicated.For a while that made me angry, because I could conjure up some really fancy numbers. However, as I gained more experience, I began to understand just how critical narrative force and clarity are in any communication.Great post Fred.

Interesting concept.A good story is absolutely harder to counter than specious numbers…

I have never worked in a sales position, but I agree with the notion that sales teaches about business and human behavior. However, a good story and even good numbers can only ever take a business so far – at the end of the day, you still have to have something that cannot be duplicated, whether that is through product differentiation, human capital, infrastructure, or market & organizational strategy. I think companies, both large and small, sometimes use their narrative and sales pitch to create cover for not having this figured out. I guess some people might argue that, at least in the world of ventures, this is both a positive and a necessity. It seems to have worked for Twitter, but does it work in general? I’m not sure – it’s definitely an art.

review software companies bazaarvoice vs. powerreviews is a perfect example of this. they both offer review software for ecommerce companies, and bazaarvoice pulls in anywhere from 2k-a few hundred thousand per month, while powerreviews has mostly given the software away for free. the winner by far is bazaarvoice who has 800+ clients and the majority of the top retailers and probably 40x the revenue of powerreviews.

Interesting – I’m not familiar with these two companies, but they seem to have the same platform partners. However, while these two companies seem to be largely undifferentiated in terms of their product, each has a different market strategy. However, it would be tough to say, without more insight into their product suite or business model that powerreviews is covering – for not having figured this out yet or for not having built a sufficiently competitive product – with a narrative and sales pitch of free and/or freemium. It could very well be that because they are largely undifferentiated, powerreviews is taking an approach which they believe is better in the long-run. Who knows, as eCommerce continues to grow, there may be more money in having a larger installed base that can feed you more data than you would make by selling the software-services. I think that narrative & sales pitch makes for a much more risky bet, but the free or freemium model gives them a certain amount of optionality that a more traditional service/subscription model cannot. The assumption here, of course, is that they are more capital efficient and can sustain themselves long-enough until either they convert customers to paying ones, monetize access to their platform data stream (alla Twitter), and/or collapse their less capital efficient competition (or at least erode the margins until they can no longer compete using the traditional business model). It seems to me that some of this conversation goes back to the difference between west coast and east coast VC. West Coast being the get big quick and figure the monetization out later model versus East Coast focus on getting to cash-flow positive as quickly as possible.

Figures can’t lie, but liars can figure.

That is the advantage of having a sales guy on the team. The good ones are GREAT story tellers. They live by the narrative.

Joan Magretta wrote an HBR article about business models several years ago, that I find helpful. She talks about the ‘story” and the numbers; and how you have to have both. But she leads with the story.A great story compels the listener to self-generate the numbers. I just saw a pitch for a software that reduces energy costs. As I heard it, I found myself estimating the market size, about 20X the size the founders saw. That’s a lot better than the opposite happening (where the founder provides numbers 20x the size the investor estimates it will be).

don draper

The example that hit home for me was in John Brockman’s 2007 Edge annual question:Alun Armstrong’s: “4.5 x 10ˆ20. That is the current world annual energy use, measured in joules. 3,000,000 x 10ˆ20 joules. That is the amount of clean, green energy that pours down on the Earth totally free of charge every year. The Sun is providing 7,000 times as much energy as we are using.”Or Oliver Morton’s:”The simple facts of the matter are that the sun provides more energy to the earth in an hour than humanity makes use of in a year.”Which statement makes you more excited about the potential for solar energy?Chip and Dan Heath explain why we remember stories in their book “Made To Stick” (http://amzn.to/amap7J) – one of the best books I’ve read on why some ideas resonate while most are instantly forgotten.