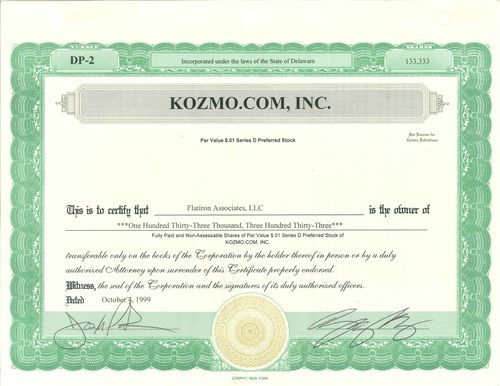

Worthless Stock Certificates

Longtime readers know that I'm a bit obsessed with worthless stock certificates. I like to keep them around and displayed so that I see them on a regular basis. They are a reminder that we make mistakes in the venture business. I think it's a good idea to remind yourself on a regular basis (particularly when markets are like they are now), that everything you touch doesn't turn to gold.

We are moving our offices upstairs to a new office and we've spent a fair bit of time this week cleaning out old files. I came across a big stack of worthless stock certificates from the Flatiron Partners portfolio and thought I'd share one of them with all of you.

Kozmo was a decent idea that actually worked in NYC. But in the mania that existed in 1999, the company raised hundreds of millions and went on a spree opening up something like 18-20 cities. That expansion was largely unsuccessful and the result was that the company went under. We lost our entire investment as did all the other investors.

On a week when we are celebrating lots of good news in the Internet world, I think its useful to also remember what didn't work and why so we don't repeat those mistakes.

Comments (Archived):

Isn’t the job of venture investor to deliver outsized returns? And if so, that can only be done by attempting new and untested ideas and models (and investments). While there is no excuse for sloppy work and execution, this industry is also driven by the mistakes.

absolutely. the initial investment in Kozmo wasn’t a mistake. the concept actually worked and was profitable in NYC. the mistake was raising hundreds of millions of dollars and going on a massive expansion without proving the model in a second and third city more carefully. we got caught up in the mania and we messed up.

I actually remember reading about Kozmo for school. A lot of the discussions we had were around the fact that many of these companies had no clear way to make money. It is super interesting to mention that kozmo did make money initially. What do you think, knowing what you know now, caused the bust?

overexpansion

think the issue of growth is a difficult one once bigger money comes into play. i’m talking to a very interesting well funded start-up here in Toronto that has a pretty interesting idea, already has some great partnerships etc. However, the current user experience is…well….think 80%+ bounce rate for the home page. Telling the CEO to fix the experience in the next 2 months vs.driving traffic and focusing on acquisition is a hard sell. He’s thinking sell expand sell and that sometimes is the big issue with the big money. You start focusing on your investors and stop focusing in on your users.

Funny, I actually applied for a job there in the later stage but they went dark (and then under).I was bummed because I really liked the service, I was a fan.Ironically by staying where I was I wound up working on some really interesting — totally new at the time — multi-local stuff. Designed alternative service delivery models for a few different types/sizes/concentrations of geography. That was 2002. We were among the first to do this. Had to establish different service levels cost base connected to a geo’s profitability.It was complicated but solvable. But it required patience. There wasn’t a whole lot of patience back them.

A really good reminder on how hard it is to build a large, sustainable business and that “going to 0” is something that could actually happen.

well you saw it first hand Bethand not just this onein that pile of flatiron certs i have a few for Obsidiana.com!!!

I can definitely say I did not expect to think about Obsidiana (or some of the others) today!

A good reminder at the right time. You probably have to reiterate this over time. LinkedIn might be off to great start but others – investors, entrepreneur, public should not get carried away.Stay Foolish. Stay Hungry.

There are a lot of things from the late 1990s that we need to avoid this time around. Always good to have fresh reminders. 🙂

History is littered with periods of time from which later societies can learn … the late 1990s being just one period. 🙂

I admit I agree with your underlying theme. Introspection, self-awareness, and contemplative thinking about ‘perspective’ seems to work as well for business pursuits and activities as it does for personal & spiritual development and growth.

For the super lazy: http://en.wikipedia.org/wik…

If any friends get arrogant, you should send them a brief note about how their behavior mirrors that of a key person in one of these companies, and write it on the back of one of those certificates. 😉

I’ve got a stock certificate from the International Mercantile Marine Co. hanging in my hallway for the same reason. They owned the Titanic.

that’s cool. where did you get it?

Fortunately, I am not the original owner.I bought it in 1997, around when the movie came out. I saw an ad for it and bought this plus a bond from a train company, Chicago and Alton, that was robbed by Billy the Kid. I have the receipt and info in the back. They did a very nice providing me with info and papers along with the certificate and then I got it framed.I am looking at the package they sent along with it. The name on the envelope appears to be “Antique Stocks & Bonds” in Williamsburg, Va. but they do not have a website under that name.

The Titanic was a mixture of terrible luck and bad execution.But I suppose that’s the point…

That’s cool. How much did you pay for that?

I’ve also been fascinated recently with the failure of tribe.net.It seemed like a really good idea and it was pretty much first to market, yet it failed to gain traction.http://en.wikipedia.org/wik…

i was an investor in tribe personally (as an angel)i’ve been an investor in every one of mark’s startupsi think i have my tribe certificate somewhere

I’d love to see someone do a postmortem on tribe. I know they’re not technically “dead’, the site is still running, but I think it would be very valuable to learn what went wrong.

yeah it’s a bubble, linkedin is a bubble, youngsters are ignoring it because they lack the maturity to face the facts and to learn from history, and of course if you are a shareholder profiting from the ponzi scheme it is far more pleasing psychologically to tell yourself some fairytale about efficient markets or something like that. of course the cause is inappropriate monetary policy and the solution is moentary policy reform. ignoring this only ensure the mistkaes will be repeated. remember when you are paying $4+ for gas in the USA that dollar devaluation and stock market bubbles share much of the same root cause. the real solution is monetary policy reform.

How do you feel about Zaarly? Attacks some similar use cases, but with a peer-to-peer twist.

i’ll check it out and let you know

similar to us – except we do not insert a middleman. No idea why they would do that. we launch June 1st in boston – go see how it works. http://www.getabl.com/home/… interested to get any feedback.

Mark – the company name is a non-starter. Pick a combo of words that can be repeated to someone easily.

aghhh – naming….its not easy believe me. thanks for thefeedback

Hmmm… is something along the line of ‘getabid’ taken? You can play with syllables. ‘getabar- ‘ somehow doing the trick with the last syllable would take some thought.Or….use a different angle than get.Good luck in Boston… you do have the right idea and I will be sending to you what I’ve promised William.

Zaarly is a neat concept whose team is pivoting more than a Knicks power-Forward, no surprise. A risk they have is providing many things to many people– it’s a classic startup dilemma: you want to maximize your market but might not get there without focus on a niche or 2 to start. Hopefully for them, many people will try it and a couple killer uses will emerge that they didn’t even think of (was true of early craigslist).In a related realm, another company by whom I’m super impressed is Red Beacon. They have a top team and great technology. And they’ve taken the disciplined approach of focusing on 1 particular specialty, at least to start.

How have they pivoted? The idea was pitched in February and just launched 2 days ago in NYC with the same idea I remember reading about initially.Your point on being many things to many people is valid. TaskRabbit handles some of the same ideas, but is in a more succinct niche. Not sure how Zaarly will handle it, but so far some great experiences are being had : https://twitter.com/#!/ajv/…

that sounds right Frank. task rabbit is cranking btw.

aha, re TaskRabbit– that’s what I mean by what I would have expected. I wonder what that niche is, (and more importantly how they found it)? It’s not particularly clear to me by the website.

no pivot there – i know this company pretty well. where did you get that from?

I was exaggerating with my reference to Fred’s Knicks fandom, and meant ‘pivot’ in a very positive way– I had heard that the original concept was “get me a beer” (personal services), and that the use might be turning more towards selling goods, but I could have been misinformed and the current website indeed is consistent with the original “gopher” concept.My prediction remains that they’ll encounter some very interesting use cases they didn’t predict, which will make them pivot in a good way.But I don’t actually know them– would love to hear more about your POV, since you do. Great concept, and some cool early traction already.

there problem might be fighting the FAD EFFECT.what brings people back?we connect you direct with merchants – and they bid for you – no middle man. Its real-time reverse auction micro market – all pull based – so you initiate a gesture of interest to an audience of merchants – and then the fun begins.we look at it like this. Everything in life is negotiable. Everything. we create the bartering mechanism.the gopher thing…..could well work i dont know.

I think its the mobile aspect that will help it!

Totally agree. It adds the realtime dimension neccesary to make this work at scale. I see that they added “Verified” Zaarlys today, so you have another layer of authentication/trust in completing transactions. This is the kind of startup than can create efficiencies in communities (why buy another power tool when you can borrow it from a neighbor?) and create new economies (think eBay).

your on to something frank!we are going after the realtime ebay bartering thing – but we are going straight at merchants – no middle men.

I think I’m onto something too 😉

“I think its useful to also remember what didn’t work and why so we don’t repeat those mistakes.”Incredibly true words. I would like to add, however, that nothing is ever the same, what failed years ago may succeed going forward. All in how you handle the context.

yup, and as i said, Kozmo did work. we just financed it inappropriately andexpanded it inappropriately

Personally I think that’s the biggest lesson for people to take from the dot com crash…it wasn’t that the ideas were all that bad (I think most of them still could have been solid businesses)…it was that you can’t just spend money for the sake of spending money…and just trying to grow really big is not a ‘strategy’ or a route to profits…I think there has to be a focused reason, with measurable results, behind the money you take and the money you use.

yes, exactly

@kidmercury Do you leave the same comment on every post?Meant to reply to kidmercury’s comment, but it didn’t work, auto-linking with @ doesn’t work either for some reason…

David, I think this post was misplaced and ended up in the main feed rather than as a ‘reply’ to someone. At least it is showing up in the main comments thread for me. FYI is all.

Yes. I was trying to reply to @kidmercury:disqus Not sure what happened. Updated comment.

yes, i more or less leave the same comment on every post, tailoring it just a bit so that it is relevant to the discussion at hand. i’ve been doing this for several years now and plan to continue until the monetary policy issue is made a priority.

Do you think Zaarly will be able to complete with the help from Mobile now in the picture?

Momento Mori

carpe diem, quam minimum credula postero

An educated man!Nos moritamus te salutemus!Sic Semper tyrranusThus ends my book of latin quotations – unless you would have me start reciting the Aeneid.

Son, if you really want something in this life, you have to work for it. Now quiet! They’re about to announce the lottery numbers.- Homer

Kozmo was great. I’m skeptical that they would work outside of NYC (actually Manhattan). I’m not sure they needed VC funding.

http://ryder-ripps.com/STOCK/

that is a cool art project. thanks for sharing

Dude, not a day goes by that I don’t think, “Gee, I sure wish Kozmo were still around.” I don’t have any stock certs, but I do have a bunch of dot-com schwag including old copies of Silicon Alley Reporter and my vintage SonicNet mouse pad!

i also have some of that schwag

A Web 1.0 Yard Sale to raise money for charity…? Just a thought.

I have some ‘vintage’ dotcom 1.0 tee’s that I still wear occasionally!The thing about schwag is it is usually good quality. The marketing departments just can’t themselves ;)Unfortunately history seems to be repeating itself again on the schwag front.

thats absolutely brilliant Fred – i remember that company well. i was lucky enough in the first bubble to be too young to have a stake – but it sure was an education. something tells me you’ll fare alot better this time around!

i sure hope soi’m not sure i could take another collapse

“worked in NYC”Emphasis noted. I keep thinking of Kosmo lately when I see all these cab/car finding services. In both cases, there is such a clear value prop in Manhattan, London, and a few other urban moneyed places but much tougher to imagine significant scale elsewhere.

I think about that a lot when it comes to location services. I think you really need to think about location dynamics more closely. This is despite thinking we are entering an era of increased urbanization

I am waiting for someone to start offering t shirts with web 1.0 company logos

Ebay used to have an awesome “Dotcom-iana” category, but I think it’s gone now. Like everyone who used it, I loved Kozmo.

I did too. We used it a lot in NYC.Another one I loved from back then — Vindigo. On my Palm.

vindigo was another flatiron portfolio companythat one was better managed and was sold and we made a good return on it

I fucking LOVED Vindigo.Was weird bc then Blackberry flooded in but they were steps ahead with email but a century behind on delivering delight around places to go.

aww man, Vindigo… that was good stuff for about a year or two. Didn’t @dens:twitter work there for awhile?

he didjupiter toohe’s got great NYC internet pedigree

Vindigo was my second job out of school and the startup that got me on the “build things that make cities easier to use” kick. David & Jason (Vindigo co-founders) were both huge inspirations to me… two guys that quit their day jobs to start a company that build things they wanted to use.

high paying day jobs at a hedge fund if i remember correctlyso much goodness to that story

Oh lets pour one out for Kozmo; I loved loved loved that company! I used them all the time, first in Seattle and then in NYC. I really wish they could have stuck around in NYC. I’d like to think they could make a go of it; but then again, you have stories like this: http://www.metafilter.com/6…

I recently found a kozmo.com tshirt in a far recess of the closet — I was a customer, and it appeared in my mailbox one day, sent via U.S. mail. (I usually ordered DVDs, if I remember correctly, and probably didn’t hit the $15 average all the time.)

I simply kept the handouts

Fred, I think in the future there’s a market for worthless stock certificates

i’ve got a whole stack of ’em

thinking I’ll go over and get worthlessstockcertificates.com 🙂

a group tumblog?

I wonder if this can be extended to other worthless things…. hmm….

Fun idea….

You can have some of my old pitch decks if you like

I would make a wall of “lessons learned” with all of them 😉

I remember Kozmo, they delivered a Nintendo Game Boy Color to me in Boston. Great idea for the right localities. Bad idea to expand too quickly. But I can see the “suppose someone else gets in to some of these markets first” urgency. And there may have been some “we can get VC, so we should spend in on expanding” thinking.

my roomate in college would get cigarettes and rubbers. there was a competing service but its name escapes me.

Urbanfetch.com

I started my career in private wealth and we had many clients who had once been – on paper – multi-millionaires or even billionaires…but failed to diversify and lost the vast majority of their former wealth.Looking at this & other worthless stock certs, how do you feel about the recent trend of founders taking cash of the table sooner?

i am a fan of it for that reason and othersbut it should be in moderationmy mother is a big fan of moderation and i have learned to appreciate thatwisdom

makes sense — though moderation is easier in theory than in practice, especially when things get frothy.

The coolest bike messengers carry Kozmo messenger bags. They’re practically the Seal of Approval for “Old School.”

Regarding Kozmo, I remember reading this quote by its CEO in Vanity Fair in January, 2000, about how there was no downside for him in starting the company:Last September, in the big, raw, empty space near Wall Street where Kozmo.com’s new offices were about to be built, Park, a graduate of N.Y.U. who is 28 but looks more like 14, explained how he’d weighed the pros and the cons of entrepreneurship: “I said, The pros are: I’m going to start my own company, which is incredibly exciting. I’m going to get into the Internet, which is probably the most fascinating thing that has ever happened to people in history, a revolution in its making. And third, the upside reward is just unfathomable, it’s just incredible, financially.”And the cons? Park leaned forward, ignoring the incessant beeping of his Sprint PCS: “Listen,” he began, “the bottom line for me—worst-case scenario—is I fail, like, let’s say, six months after I launch the company I just absolutely fail. So what’s going to happen? I’m going to apply to business school and have an incredible application.… The downside is very limited. The status thing—I mean, I don’t do things, personally, for status—but I really felt that, hey, listen, if I care about status, then by failing I could probably have an easier time getting into the top business schools anyway, whether Stanford or Harvard, and then I’m back with the same people I left.”I wonder how your LPs felt when they read that (assuming they read it).

Funny. But, I don’t think him being right (or honest about it) is necessarily a bad thing. Based on his wikipedia blurb, it seems he went on to success: http://en.wikipedia.org/wik…

When other people’s money gets invested by folks who have lots of upside but no downside, I think that’s a bad thing (for the teachers, firemen, or whoever’s pension money it is, ultimately, down the line).

I think that’s often the case, but not always. Some people are just driven to succeed, and the risks to them don’t factor in very much.When you are talking about groups of people, i think it’s a different equation.

so true Dave and there is a bit of a disconnect at the moment with what’s happening in the tech world and the average joe’s world

I love Kozmo.com references. I was working at Boston.com back then and we had a woman who would order a pint of ben and jerry’s ice cream every day from Kozmo. I never understood why she didn’t just bring it in herself since she ordered it EVERY day. If only they had stuck with a few successful cities, maybe they would still be around. Instead they just come up as a joke from time to time.

I can’t wait until one of our companies has a certificate like this…even if it’s never worth anything, at least it will have existed! 🙂

Attaboy.

I enjoyed watching the documentary about Kozmo.com called E-Dreams (http://en.wikipedia.org/wik…. It’s worthy of 94 minutes of ones time. This stock certificate is a cool relic.

I liked it too. I’d also recommend Startup.com (which, incidentally, also featured an entrepreneur who was a Goldman alumnus).

I’m a fan of StartUp.com too … first watched it in an Intro to Entrepreneurship class in college. It sure does a good job giving an overview of the roller coaster of emotions you can expect to experience in a startup. I looked through all the Netflix Instant documentaries a few months ago and couldn’t find any other startup documentaries .. any recommendations appreciated.

I recommend Dot.Con. interesting overarching narrative

Agreed. Love the scene of Joe Park on the piano chanting “IPO, IPO”. Classic. A real world equivalent of the “Greed… is good” line.

I haven’t saved the certificates but I have more than my share of life lessons that I’ve learned from the experiences.

Fred – I have to admit that I was one of the people that helped drive Kozmo out. I used to order, for delivery, a single candy bar or soda at a time for my girlfriend (at the time).I found it quite entertaining to tell you the truth 😉

that’s life. they made that possible

I’m sure it’s reaching *way* back into your memory banks but would you be able to let us know approximately what the average order size was @ Kozmo?

no ideasmaller than was optimalbut large enough that we made money in NYC

If I can recall the average order size was around $15. I was a production artist at kozmo.com. When it came time for my raise I was offered 20,000 shares of stock. Needless to say I never did collect and ended up going down with the ship.Good Times!

So a client had to order at least $15 worth of goods? Did the company take a percentage from the $15? How did they make their money? I know the company is closed but just wondering since I read that the deliveries were free.

I really wasn’t involved with the business side but I just remember most orders were a can of coke and twizzlers.

There was no minimum order and shipping was free. Hard to believe it went bankrupt!

I have one from last year that says I own 3% of a company for “advising.” The thing is history, but I keep the certificate for the art work on it. I remember Kozmo vividly. A high school friend of mine from Kathmandu was a top finance dude on the team. Nuru Lama. Personally knows Edmund Hillary, one of the first two to climb Everest. Wait, is Hillary still alive?

Sir Ed died in January 2008: http://en.wikipedia.org/wik…

Oh, okay. I thought he died. Thanks for the precise info.

PayCheckr: Not Dead Yet http://goo.gl/fb/hDmPk

Always good to have reminders: I’ve got a toy Globix London taxi sitting here on my desk; part of the $700 million investors lost. And above my desk are beautiful Chinese bond certificates, issued the month before the collapse of the Qing Dynasty in 1911. Still have the defaulted coupons attached.

sweet

Oh, and for the record, I came onto the scene at Globix late in the game and was involved in getting things cleaned up. A true bubble story. And I had nothing to do with the collapse of the Qing Dynasty

I don’t know about that. I just Googled the Qing Dynasty and they mentioned a “J McCarthy” who drove them into the ditch.Hmmm?

I can explain that, but it might take a while. It all started with a bet I made with Puyi over a long lunch in Shanghai. Can’t go into the details, but let’s just say it had long term implications.

I don’t have stock certs — wish I did — but do have photos from my grandfather’s produce wholesaling biz…before the Communists seized it. He’d bootstrapped it and built it into something substantial. And then the other grandfather’s hospital too. Both thriving and then gonzo, overnight.Sometimes it’s the company’s fault. Other times totally exogenous. History happens. Have a bunch of old birth certs though….although now it seems they were faked. You do what you have to to survive.

My entire office at home is filled with turn of the century failed Chinese, Russian, Rumanian and American bonds with coupons intact from the day before they defaulted.I used to buy them every time I went to Paris as they were in the basements of Parisian investment banks.At one time I had hundreds and used to give them out as Christmas presents.I love them for the beautiful engravings and artwork.I will take a picture of them tonight and send it along.

Not a literal stock certificate per se but still pretty worthless.

i beat you all – i have my CMGi employee handbook – anyone beat that!

@jerrycolonna probably has his CMGI handbook

A friend of my wife has an Enron employee handbook, including the section on ethics. 😉

My friend had one….until she threw it out when they fired her for being pregnant. :-)There was lots of bad behavior going down in various dimensions.And another very close friend made partner at Arthur Andersen weeks before it shut down. That case really bummed me out (even as a competitor, and we benefited significantly from their demise). What an overcorrection. Great firm.

I had a Disney employee directory from 1996. In 2007, a neighbor moved in next door to my house who by this point was the president of Disney Publishing (he has a fancy house, I am the trailer trash). I was like — HEY — I was there too! Whipped out my directory and we played the name game for about an hour. Immediate friends. Awesome neighbor, and now he’s a mentor. So next thing I did was throw the thing out. I figured, who knows why I kept it that long, but it’s done its work.

I took my personal and financial pounding during this time but there was something extraordinary about that first explosion of energy and anything can be done feeling. I miss that part of it.

I think the company might have lasted longer if they charged the clients a small fee to deliver the items and if they were not delivered without an hour, they would have waived the fee. Then they would have some money…no?

I keep my certificate in iChat on the wall just as a reminder of the old days also. The only thing of value out of it was the domain name (ichat.com) which was sold at a really low price to Apple.

The problem is we don’t know which ones are gonna be mistakes. But I’m with you on having too much money is almost certainly bad for startups.

Love the old certs. – I’ve seen collections with phenomenal art work dating back to the 20s. Happy to digitize them for anyone interested in sharing online/preserving.

I have to say the post title is off. It’s anything but worthless, as you establish in the first paragraph and the last. For much those same reasons, I keep my option agreements from previous employers who went under, and I think I have learned a great deal being in those companies.

great point tom. in fact dennis crowley told me last night that he thinks some of these certs would fetch a decent amount on ebay

I’ve got a mini-Rubik’s cube memento that came with the stock cert from UrbanFetch, the Kozmo wannabe. Most expensive toy in my child’s closet.

I remember using their service in NY, it worked great. I just couldn’t figure out how they could afford to messenger bubblegums for $2. Biggest lesson I learned those years, the hard way, was to execute for the best but budget for the worst.These days, I am mostly concerned with sentiment of exuberance. The companies are real, the upside is tangible. But companies and investors alike are behaving as if money will always be readily available, and spend like it. And inflationary bubbles can also form by over spending.Personally, I feel it in my bones. I hope I’m wrong.

Wow, the memories. I’ll trade you some of my Urbanfetch stock for your Kozmo stock.I know this is part selective memory, but I partially believe the Kozmo S1 filing was the breaking point for the bubble bursting in 2000. I believe the S1 filing was in late-March 2000, and said something to the effect of Kozmo lost $27 million on just $3.5 million in revenues in 2009, but wanted to raise another $150M in its IPO at some multi-billion dollar valuation. The press coverage that filed was understandingly dubious. And, according to Google Finance, the Nasdaq closed at 4,963 on 3/24/00 and 3 weeks later it was at 3,321. Just saying.To your point about the model working in NYC, CNet had an article with an update on the success of Max Delivery recently:http://news.cnet.com/8301-3… Lastly, here’s a funny story I don’t think I’ve shared yet…For Valentine’s Day 2000, Urbanfetch had lined up some deals with local florists to deliver flowers across the city (in under an hour, of course). It turns out the demand overwhelmed us, so much so, that internally it became dubbed “The Valentine’s Day Massacre.” That’s not the funny part, though. Because we were having so many issues handling the order volume, we were monitoring the queue pretty closely. And, somehow, I came across an order that said something to the effect of, “Tina, don’t tell anyone where you got these flowers from. Happy Valentine’s Day. Love, Seth”. Obviously, since Seth was the EIR at Flatiron, we all got a big kick out of this. So much so, that I think Ross, the UF CEO, even added a personal handwritten note to the delivery. Though, because of our delivery issues that day, don’t know if Tina ever did get those flowers. If not, sorry about that, Seth. 🙂

That’s funny. I will make sure Seth sees this

I loved Kozmo.com and I think that in Feb 2001 I didn’t leave my NYC apartment even once because of them. Well that and the 9ft of snow outside. I still have one of their CD openers in my desk drawer. I was sad to see the implode like that.

I sent a sock puppet to the Lehman broker spinning me shares.

The news this week has been good for the founders and early investors in LinkedIn; whether valuations of 30x are good for the industry, or wider world, remains to be seen. I think there will be few more worthless certificates yet.

Still have some Engage stock certificates, I should frame them too, that’s a good idea!

A fantastic idea. I’ve seen many examples of companies hanging up their very early Apple investment docs, in some ways a reminder of unfailing brilliance (or for some, dumb luck). We do need reminders of our mistakes, otherwise we end up thinking we’ve made no mistakes (as Trump believes).

could never figure out how a pint of ben n jerrys and a wilco cd could show up at your door w/no deliver fee. we were living the hi-life

What did Kozmo do?

I was at another Flatiron portfolio company and if I remember correctly, didn’t Lee Majors become Kozmo’s pitchman? Clearly I’m getting old b/c I can’t remember for sure but I remember wishing Flatiron would have some type of portfolio get together so I’d get to hang out with Steve Austin (my childhood crush 🙂

yes! We then scrapped that ad for others that were done (I think) by Chiat Day. My favorite you see a delivery guy sitting on a couch with a woman, who is clearly nervous. Finally she looks at a pregnancy test, squeals in excitment and hugs the Kozmonaut. Who then puts on his hat, congratulates her and walks out. So funny. There were about 4-5 others.

yes, that is right

Kozmo ? As in Kozmo Kramer on Seinfeld ? Yeah, that was sure to be interesting stock!

I was one of the first hires in Kozmo’s San Diego spoke. It was the first true venture backed startup experience I had, and after busting our asses, and leaving right before it imploded to go to a startup in the bay area, I never looked back. Been in the “startup life” ever since.The stock might be worthless, but the experience was gold.

Just pulled out my certificates from Adero, a dotcom CDN Akamai competitor. We were 1 month from filing our S1 and couldn’t get the thing out the door. Then instead of IPO, we went on a Series D hunt and then a pennies on the dollar sale. I learned more from that “failed” experience than the “successful” IPOs & acquisitions I’ve had: 1) how quickly a market can tank (and ‘$15/share going on $50/share’ can turn into nothing for common in the bat of an eye), 2) focus on fundamentals & 3) see #2

Just for the kick, can you share pics of something that was a huge hit?

you have to turn in your stock certs on your winners when you sell themthus, the only stock certs i can keep forever are the worthless ones

I actually collect real stocks (hopefully they won’t become worthless!) and have been getting one each year for a different company – I find it fascinating to have a REAL share of Microsoft… I have three of them now and continue to think this is a cool thing to collect.I love that you have this share and its a great reminder of the past. Anytime you want to offload extra shares – know that I will frame it and put it up!

PayCheckr: Not Dead Yet http://goo.gl/fb/hDmPk

so why didn’t kozmo pull back to just NYC?

they had enorrmous liabilities associated with the expansion that they couldnot shed