MBA Mondays: Cap Tables

Cap Tables (short for capitalization tables) are spreadsheets that show how much everyone owns of the company. You can get a stockholder ledger from your lawyer that will list all the stockholders and show how many shares or options they have, but I don’t consider that a cap table.

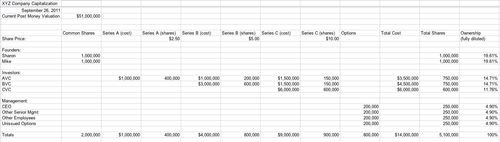

For the past 25 years, I’ve used a simple form, mostly given to me by the partners I worked for when I first entered the venture capital business in the mid-80s, but with a few modifications by me over the years. It looks like this (click on the image to enlarge):

Last night I put together a public read-only google spreadsheet that shows you a basic cap table in the format I like to use. You can check it out here.

The basic outlines of this cap table are:

1) it shows all the major stockholders of the company listed down the left side. it also shows the major option holders and buckets of option holders

2) it shows all of the classes of stock and how much was paid for them across the top of the columns

3) for each investor, you show how much of each class was bought and how many shares of that class they own as a result

4) you total up the cost and shares and then calculate ownerships on a fully-diluted basis (which means you include the options, whether issued or non-issued or vested or non-vested).

I like this presentation for its simplicity and because it shows the progression of financing activity. It also has the benefit of showing how much each investor has put in on a cost basis, which many cap tables leave out.

If you want to make a cap table for your company, feel free to replicate this format. If you have angel investors, put them in the angel section. I would include the largest ones and bucket all the rest into “other angels.”

If you’ve got any questions about this cap table, or cap tables in general, feel free to ask them in the comments. I will answer them (maybe not until late today or tomorrow -I’ve got a crazy day today). And I bet the community will answer them too (probably well before me).

Comments (Archived):

Thanks for sharing this Fred. Perfect timing for us!

I’m a frequent reader of your blog, especially of the MBA Monday posts I really enjoy.Could you explain me why the total shares for the CEO (or other management) is 250,000 while the options are 200,000 ?Thanks,Aaron

you found a bugi originally had 200k for each bucket of options and then i changed it to 250k but changed the wrong column.thanks for finding the bug!i fixed it

Hi, I was just curious what are the common day-to-day uses of the cap table (aside from seeing the ownership of the company)? In other words, what decisions (either from the company’s or investors’ point of view) involve consulting the cap table? What are the pitfalls of having a poorly constructed cap table? Thanks so much. Tom

they are usually pulled out when you are thinking about raising more money. you can model out the impact of a new round on everyone

Thanks!

Thanks.Nothing to comment except when I need this info, this is perfect.Good luck on the keynote this AM.

Thanks for sharing this layout – it is very clear. Do you make any adjustments to the table to indicate liquidation preference of the various investors?

We often create second tab called liquidation waterfall and model that out. Maybe that’s my followup post for next week

Great – look forward to it!

yes, that would be a good follow-up.

Thanks Fred, looking forward to it!

Resources of this kind along with advice byhttp://www.bothsidesoftheta… (Mark Suster)and metrics by http://www.forentrepreneurs… (David Skok)and many others make an entrepreneurs life easierSee http://en.wikipedia.org/wik… for a thank you !She described these guys better than I ever could

That’s quite a compliment

I used this as a eulogy for my father (though at the time I believed it was a Ralph Waldo Emerson piece). He was an early VC & set up Innotech – financed by David Sainsbury in the UK with some guys out out the National Enterprise Board.He convinced me that backing small enterprises was the biggest contribution a well connected “do-er” could make to many problems of society. It is still clear to me that there are massive holes in the investment “opportunity landscape” that need plugging – Eg European <$250k Switzerland in my case where VC and public backers still expect 40 page business plans for a SaaS startup.I know you guys aren’t in this market – So – I am merely giving my $0.02 feedback, but I think it is a shame that your skills cannot be applied here. Though still looking for funding myself I am now starting mentoring ( Prague next month), because I too have learned enough to want to help.Sorry for long post – but it’s important to me – and I guess to you:)Thanks again

Thanks for explaining that. Its an even bigger compliment than I realized

Hey Fred, would you split up founders equity into different buckets if they’ve agreed to have their equity vest over 3/4 years?

No. This table is silent on vesting. It shows fully diluted numbers

Nice. Interesting and helpful. Is it typical that cost/share double with each round of financing?

Nothing is typical in startups but doubling the share price each round is a good goal

Generally not a commenter on Monday’s but what the heck.One column I like to also see in the simple cap table is the total % of a given round that a given investor holds.Particularly once you get out past the seed series stuff and start to get into protective provisions – it helps to understand who has what ownership % in a series I find.

We make it a point, almost a deal breaker, to never ever have class votes. I hate them so much

Agreed. They can be a cancer.

I think I know what you are talking about, but have never heard the term class vote.Can you expand briefly?

Each class of shares has different rights or protective provisions. Drag-along and Anti-dillution would be two common ones.So if the class decided to exercise or waive a right, theoretically it could come to a vote of just that class.I can tell you from the entrepreneurs perspective watching people discuss/argue about their rights which you don’t have is beyond upsetting.

Thanks Phil. That falls into the general take I had formed. Class warfare between investors!

Each class votes on the big issues separately. It gives each class a block. Big problem

Thx Fred – most of what I believe re:investors can be baked down to ‘maximize alignment of interests.’ It seems to be valid as a test for almost any financing related issue that is in the blogosphere.

Yes, my lawyer discouraged them too.

Not even for protective provisions (antidilution, seniority)? These don’t mean a lot if junior preferred can waive them.

Perfect, as usual.I would add the option exercise cost (# of options X strike price) to total cost in order to square total cost w fully diluted ownership. Otherwise the total cost at full dilution is understated by this amount.

True

1) Fred, this is great, thanks so much.2) I kind of wanted to see if I had a nickname under your nomenclature…

Very helpful, thank you for posting this. Really enjoying following your posts!

Quick question: In your investments is there a current equity percentage that you target or request in each round of capital?

We have no rules and no lines in the sand on ownership.

Why did comments close for the moneyball post?Hope your preso is going well!

Who typically sees this info? Is it restricted to shareholders?

Yes

Thanks for sharing. We bought the Venture Hacks spreadsheet, which is great, but this is actually easier and I love that it’s in Google Docs already.

How do you account for convertible debt in this model?

Long lurker, first comment. (unbelievably informative blog by the way!)I can’t seem to get my hands on a cap table that has a convertible debt seed round.When it converts, my understanding is that it dillutes the founder’s stock (keeping the VC’s stake at the targeted %), but it would be really helpful to see a cap table that incorporates a note seeing that it’s so common place.Any suggestions? Many thanks!

I believe the more typical scenario with convertible debt is that it converts to preferred stock at a discount to the price paid by the new money.Looking at a note we once issued… it basically says “the Principal Amount plus accrued and unpaid interest shall be converted into shares of such equity securities at a conversion price equal to eighty percent (80%) of the per share price paid by the investors in such Qualified Financing” (that is, the Series A).Rather than “keeping the VC’s stake at the targeted %”, I would expect the note to convert when the VCs first invest in a priced round. I would also expect the VCs to factor that in when considering the investment, and to be wary if the discount were too large.

Fred, my partner and I are setting up a startup in East Africa in mobile payments. We registered our company with 10,000 shares initially, but each of us only took 2550 shares on registration. Will we be able to sell the rest of the initial shares at a higher valuation? Or was this a huge boneheaded move?

Probably dumb questions but I will ask anyway:1) Is the current valuation always filled based on last round of funding ? Isn’t it reflecting old values, which are not relevant for eg., when I go for next round of funding?2) Is it a norm that all the ownerships are diluted? Won’t there be people with fixed ownership percentage?

Can anyone please answer? @fredwilson:disqus ? others?

Hi Lucky:1) What do you mean by “based on” the last round? It is certainly a data point, but your valuation will change as your business does, whether or not you raise additional funds. You will likely have independent valuations performed – often in conjunction with granting stock options – in order to determine a fair market value that keeps the IRS happy.2) yes, dilution is the norm. Also, it’s probably important to mention that just because there is a valuation doesn’t necessarily mean there is liquidity ( you can’t always cash out ).

Thanks a lot .. That clears my doubts 🙂

Thanks Fred, this was a great post. Looking forward to the followup post on the “liquidation waterfall”.

Question about post-money valuation total: if total money raised is $14M in exchange for a 40% equity stake (add up the AVC, BVC and CVC totals) isn’t the total valuation much lower than $51M?

No, because all rounds re-price to the latest round. Series A & B bought in at $2.50 and $5.00 respectively. But since Series C bought in at $10, the previous series appreciate to the new price. That’s the reward side of risk/reward!

After the series C round the next step would be IPO right? Then if the startup did decide to file for an IPO what determines the amount of shares offered to the secondary market?

Typically, yes, but you can have Series D, E, F, etc. if need be. Not ideal.

Do you keep a bucket of stock (say 10%) if you know you are going to compensate your future management team with equity or do you just dilute down when the time comes?

Hello, I wanted to explore if we can syndicate MBA Mondays content on soon to be rolled out B-School.comPlease connect on mail or revert here.

Thanks for posting this, Fred — it happened to be useful just today.To date, I have been using this spreadsheet: http://www.angelblog.net/Sh…from http://www.angelblog.net/Sh…which is also helpful. To those that may use it, it has some issues with the way it rounds #’s

I would like the ability to mark things as spam. Please tell the Disqus Devqelopers

If you click on the flag (which appears as you move your cursor near the like button) I believe this alerts the @disqus:disqus team. I’ve already flagged it but you are welcome to do the same.

It might be that I need to enable it

@fredwilson:disqus / @disqus:disqus – can you confirm what exactly flagging does? There’s been an increasing amount of spam on here recently, and I sometimes flag it, then feel guilty about overloading your inbox even more (the popup says that the flagged comment is sent to the blog’s moderator)