The Power Of Diversification

I have written about this topic before but it's important and I want to say it again.

Investing in startups is risky. If you make just one investment, you are likely going to lose everything. If you make two, you are still likely to lose money. If you make five, you might get all your money back across all five investments. If you make ten, you might start making money on the aggregate set of investments.

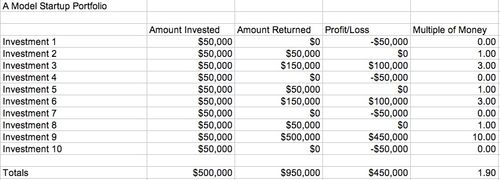

The math behind this is pretty simple. If you assume that the average startup has a 33% chance of making money for the investors, a 33% chance of returning capital, and a 33% chance of losing everything and that only 10% will make a big return (>10x), then you can model this out.

All the profit in that ten investment portfolio comes from the big winner. If you don't make that investment, you would have made nine investments for a total of $450,000 and you would have gotten back $450,000. You would have been better keeping the money in the bank.

So you need to make enough investments to be confident that you will get at least one big winner. And so that means making enough bets.

There's another important aspect of this. You should invest roughly the same amount in every investment. Don't try to pick the winners at the time of investment by putting more in the ones that are "sure things" and less in the ones you are less sure about. The only sure thing about startup investing is that there are no "sure things."

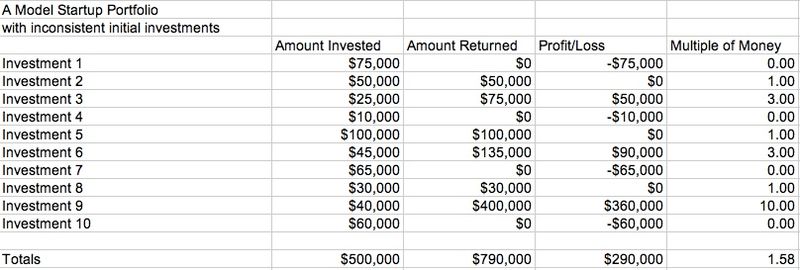

Let's look at the same portfolio with a set of random initial investment amounts.

You can see that even with the same set of outcomes for each investment, the amount invested in each one has a big impact on the total return of the portfolio. It really all comes down to how much you have invested in your big winner. And since I do not believe you can predict which one will be your big winner, my view is you want to be as consistent as possible with your investment amounts.

When you are an investor, there are days when some of your investments are doing great and some are doing badly. If you are broadly diversified, those days are easier to take. If you are all in on one investment, then those days are brutal. Entrepreneurs go all in and are rewarded accordingly when they hit it. Investors should not go all in. They should be diversified.

Comments (Archived):

Big respect for the pragmatism and transparency.

“When you are an investor, there are days when some of your investments are doing great and some are doing badly.” That applies to startups as well pertaining to ups and downs along the way.Is what you described more applicable for early/seed investing (up to A) because later stages of investment have been already de-risked somewhat?

Interesting, William. Also, the nature of our industry and its ‘products’ strikes me increasingly as being more akin to the music/entertainment industry – eg, lots of investment in developing and nurturing a band as the ‘next big thing’ with zero guarantees – just a mix of zeitgeist and hunch from the backers, based on a group of people with a talent. The rest is down to the market.Similarly with films, I’d surmise. Lots of development and ‘product’ being created, daily/globally, with very few hitting it big – most just treading water, as it were.If we drew more parallels to those industries we may better understand ourselves and our ventures/RoI, rather than when we look at ‘conventional’ industries and their business models…

True in many aspects.Greatest truth is that the market is always the great unknown and ultimate equalizer of all dreams and aspirations.

Beautifully expressed, Arnold.

Yes. Late stage investing has a different set of outcome probabilities. You still want to be diversified though

Speaking of which, @fredwilson:disqus I know the basic premise still holds no matter what (3rd losers, 3rd break-even, 3rd make some money and 10% crush it), but if you were running a much smaller fund and your successful investments ultimately did a series B, C, etc., would the dilution screw your returns if you couldn’t participate in follow on rounds?In your opinion is it still worth getting into the game if you can’t continue to put chips in later on?

Great stuff, one minor edit in the last paragraph “if you are all in one one investment,” => “if you are all in one investment,”

Thanks!

If you turn this post upside down from the entrepreneurs perspective, the odds of success are really daunting.VCs invest their dollars. Entrepreneurs invest their lives.Goes to what is often said here. You really need to love your dream, embrace the process and see it as a win, regardless of the outcome.

Fascinating to reverse the perspective. As you say, daunting – $s vs Lives.

We all see the world through our own lens.As a career long operations executive, I see the world through the view of the operator. That’s alway’s my bias.That’s why I like advising as I’m not a pundit at heart but a collaborator by nature and can’t help but internalize the challenges at hand.

Collaboration is still massively untapped, I truly believe. Hugely overlooked but my resources (in all respects) don’t enable me to have another stab at addressing this, currently. Was the original intent of my idea/startup, egoboss that became ensembli – but, as they say, that’s another story… 😉

I agree. Once companies start working together – collaborating – then people will be able to start collaborating more efficiently, effectively – and so it will happen more.

If your startup was a plate of bacon and eggs, VCs would be chickens and Entrepreneurs would be pigs; while the chicken does contribute, the pig is truly committed.’ | Trevor Loy

Lol, excellent. Not heard that before. Maybe we should go for the vegetarian option 😉

I think the pig remains the same :-).

Not heard that version. Is it like ‘The Song Remains The Same” …? 😉

SOMEONE READING BOOKS ON AGILE DEVELOPMENT.

That was a good FG bate 🙂

Bait (correction)

HURR HURR.

They are pretty daunting. I see people around me doing tech startups. Only a very few will last longterm unless they find dumb money to fund them, and then perhaps if luck hits them. I try to offer constructive criticism where I can, though with my holistic understanding from being passionate / studying the internet and technology for so long – I know they don’t have the same perspective on ecosystems and functionality online as I do.I would say there’s an optimistic approach to it though. I should start saying this more to people: Only do it if you find a way to enjoy the process and to healthily manage and recover from the stresses — have backup plans in place, safety nets in place – even if that’s a friend you know you can crash on their floor for awhile if worse comes to worse.I did yoga teacher training last summer, teaching yoga being something I’d enjoy doing for the rest of my life, in case my projects for whatever reason stopped moving forward; I don’t currently see that being an issue now, though I still would like to teach on a regular basis to connect with people.An old highschool friend has been crashing at my place for two months now. He’s been working / has a job now and can afford rent – though I’m trying to help foster his creative side, he’s musically one of the most brilliant people I know. He doesn’t have the basic tools / equipment at the moment to write music efficiently, and he needs the efficiency because he can crank out his creative work. He’s passionate, but depressed while he can’t create.I feel you can draw similarities to the above story of the musician without instruments, to that of an entrepreneur without the resources needed to move forward – and create.And what positive aspect everyone should take from trying anything, is that it is experience, it is learning, it is improving yourself, your knowledge. The struggle creates character of a certain nature, and I find that those people are usually the most passionate about what they do.

As Dylan said:’There’s no success like failure and failure is no success at all.’

I must be too fixed in my own thinking right now as I can’t understand that.. I’ll have to revisit the quote. 🙂

POINT OF STARTUP IS STARTUP. CHANCE OF GET RICH JUST NICE SIDE EFFECT.

Though you have to show how this is possible, which is good because you’ll be bringing people’s livelihoods into the mix.

IF NEED TO HAVE LIVELIHOOD, STARTUP MAYBE NOT GOOD CHOICE.

Useful insight. Are investments made on outliers? We read a lot about the founder/product/market fit a lot, do you think some investments are made to diversify on industry risk too?

Interesting to note that Gladwell’s new book concerns the Underdog and success. He’s pretty much got all bases covered. Diversification, Mr Gladwell? 😉

The choice of word was complete chance, I’d not seen “Outliers: The Story of Success” before. 🙂

Ah ha. We have reached a Tipping Point, then 😉

.Haha, I get it. I like Gladwell’s stuff. I am re-reading Outliers and going on a MG readathon. Very interesting stuff..

If he did a book specifically on diversification then that would be a book I would read. Would love to see what insights he’d conclude.

MORE LIKE “KNOW WHAT PEOPLE WISH WAS TRUE, GIVE IT TO THEM”.

That’s for sure! 😉

Does someone seem or feel like an outlier if you jive with them, and understand their vision though?

Good question – is the vertical they’re in matter more than that understanding? I know investors wouldn’t put money into a totally unknown industry, but (diligence being done) might they into a less familiar one to diversify the portfolio if the team really impressed?

Well this is why USV’s investment thesis is fairly broadly yet well defined. Networks of engaged users. They’ve determined engaged users are good to have, for one reason or another – and included that as their leading metric for investment.If you perhaps made your investment thesis ‘mobile applications’ – then well, that’s pretty broad – and pretty scary right? But maybe you really believe in mobile applications because you understand them.Apple believed in mobile applications, and built an ecosystem to support them – and take a pretty hefty cut from revenues generated. That was a very smart investment in the ecosystem by Apple that had many trickle and amplifier effects that benefitted them.You’re correct in realizing the diligence being done is probably the most important thing a VC firm does, who have a broad scope / thesis investment. They can let go of any worry from unknown risks (mind you first passing a filter if they like the founder / team), and then make sure there’s a big enough market in the area. There are benefits to going after the bigger markets too – less people will attempt to get into them because you really have to understand ecosystems really well in order to navigate, and every detail really has to be fine-tuned and nuances learned and applied along the way.There are various investment models that you can see around, YC, 500 Startups, USV. Being careful with money and investing in relatively few carefully – and then loading them with money in follow-up rounds, vs. large fund, invest in a bunch of small motivated teams and hope they create a package good enough for follow-up investment by other firms.I would love to start a fund of some sort myself, though I’d have to find investors in my own projects first that are supportive enough to allow that to happen simultaneously; I imagine people might think it’s not possible or a good idea (taking on too much, etc – as I regularly hear from people who don’t know my full plan, or don’t fully understand it), though I’ve put a lot of thought into it and it can be mutually beneficial to the company I am creating – so would be win-win-win.

There is only one free lunch in Investing that is Diversification

Fred, are you aware of any effort to make sure educate the general public in advance of the JOBS act? My fear: it’s not going to be pretty to watch people learn the difficulty of picking the next Facebook.(I’d love to see you online, Khan Academy style.)(Understanding compound interest would be good for the general public, too. Head slap.)

i am not aware of any education efforts. i like your idea of a kahn academy style investing academy

Well, I guess there is a limit to that strategy in that it leads to a performance equal to the market performance…

You can only profit ‘greatly’ by being just ahead of the curve. The curve will always catch up to you; I suppose patents and the like slow that down, hopefully those will be gone in the future though.

The Power of Diversification for entrepreneurs is ….Fail fast and start the next one. Take the same 3/10 approach you won’t be loved by investors initially though… hah… that is until you hit your home run. Then the ball game will turn similar to the ‘late stage investment for investors’.Look this as a 10-opportunities from a single investor available than looking at it in upside-down approach.I donno whether any of the successful serial entrepreneur in this tribe can support my stupid statement.

Not at all stupid – makes sense. Trouble is, as discussed elsewhere, so many startups are an intense passion and the founders strive for success at all expense – personal, financial, career, emotional – all too often. Is so very hard to walk away and ‘fail fast’ when so deeply involved.Somewhat more cynical (not meant in a pejorative way) startups have a much better chance of taking this approach. To be kind we could call it an iterative model. Whether they would succeed more, I don’t know…

This philosophy struck me when i met with couple of youngsters in one of the meetings… am sure (wish) i will see them hit home run soon …. they don’t care about making mistakes and they don’t attach much emotional or career to it … they have the entire time and everything to throw away. They don’t have financial requirements … just a sleeping bag and couple of friends who can take similar risks.May be i and them are wrong.It struck me when they said ….”what uncle? we will give it a shot for 1-2 years and jump to the next idea”.

That’s cool. As long as there is some learning transferred from each cycle – and some humility doesn’t go amiss (difficult when young, I know, lol – the folly of youth and all that – good for them!). Many a great band has evolved from earlier incarnations that didn’t quite hit the sweet spot, for whatever reasons. Try, try, try again.Somehow, apropos…”Why do you keep banging your head against that brick wall?””Because it’s nice when I stop.”

that brick one is funny …i will use it somewhere.

Entrepreneurs don’t diversity, they focus.It’s the opposite way to approach business life in my perspective.Sure, you need to know when to move along but inspired people aren’t usually wired that way. They live in a world of ‘no’ every day and turn them into ‘yes’ and move forward,I would never invest in or work for or advise a company that was just throwing stuff at the wall to see what stuck.As an investor, sure diversity. As an building of market value, this is not the other side of the coin.

Well said.

Agree.

and humble

And therein lies the dichotomy…

Sure is not the other side of The coin … but sounds to me like a side of A coin.young guys are talking like … fail fast is like fast dating.I am also not sure whether what i am thinking about this ‘fail fast’ is right/wrong/good/bad … that is why I have asked for some serial successful (I am serial … but not successful … may be I am not successful because this is in the back of my mind somewhere hidden) entrepreneur to support/reject that statement.

STACK FAIL UNTIL TALL ENOUGH TO SUCCEED.THAT KEY TO FAIL FAST.IT ONLY WORK IF DIRECTION FAIL IS UP.

I agree they focus – I would add though, in a case like mine, that focus doesn’t necessarily keep them from a broad plan or view of things; You do have to prioritize properly and do things when they most make sense in achieving the success you’re aiming for.

Fred do you know of any VC firm or other entity that has tried to make a value-prop out of giving diversification to its portfolio company shareholders?Example pitch from VC: If AVC invests in your portfolio company, instead of putting all $1m into your company, your will get $900k into your company + your current shareholders will get a $100k limited partnership stake in our fund.Consistent high-returning VCs could in theory attract not just more LP capital, but perhaps better entrepreneurs/valuations as well.All just top of head food for thought nonsense…I’m sure there’s a lot I’m missing.

Is that something called “you want to have the pie and eat it too?” 🙂

I believe first round capital has a program where founders can contribute a portion of their stock to a pool to benefit from the collective portfolio gains.

I actually had a VC offer me a deal like that once. It didn’t end up working out, but it was an interesting proposition.

Interesting. I wouldn’t do it because I’m just arrogant enough see it as a negative expected-value trade.

Indeed. And that’s why I’d turn it down if it was offered to me today. I intend to ride $RSK to the moon.

I think the loss of influence/control over that $100k/10% is the detractor. But diversification and investment are different animals than founding.

If I wanted to diversify, I’d have become a fund manager. 😉

I think you have to ask yourself if this is better for the VC or better for the entrepreneur. If it’s better for the VC (meaning any VC) then it’s a great idea. If it’s only good for the entrepreneur then what will happen is if it works and if you are able to attract better entrepreneurs you would over time loose that advantage to other VC’s who adopted the same practice. Then it would deteriorate into a (hate this expression “race to the bottom”) with people now giving more percentage points thereby putting you at a disadvantage unless you did the same. And it’s not like cell phone minutes where the market of quality entrepreneurs will increase with more favorable terms.I would argue that this strategy has a chance with a new entrant into the market trying to gain an edge who doesn’t have anything to loose by other adopting the same strategy though.

yup. first round capital has done this. i don’t like it. imagine if i had asked jack dorsey to trade his stock for a basket of USV portfolio stocks.

A very common problem with angel investors. Angel investors often invest in a few companies after they have been pitched by family, friends, ex-coworkers etc; they are not in the space actively and invest only when the opportunity comes to them, often leaving them with 2-3 investments – not enough to provide diversity.

I have seen a very detailed study showing you have no chance of making money as an angel unless you have at least 10 investments

I would just add that diversification by itself is not enough.Ten strike outs are just as bad as one.It’s really important to be selective, especially at the seed stage when it’s not too clear what the traction curve will look like.

True.If taken too literally such an approach could – in the extreme – be seen as being akin to “Throw enough sh-t at a wall and some is bound to stick.” 😉

#truth

Right on.

@fredwilson:disqus would you say then that funds such as David McClure 500Startups are on the right track for their investment thesis.

How does a fund like the new NEA one for $2,6B change the marketplace? Are they doing size for diversification or larger deals?But doesn’t this kind of money put them out of the start up world.

Clearly Zynga is still a winner, saw a lot of tweets yesterday afternoon.

Hmmm, interesting one, they be (looking for a @rrohan189:disqus style of expression, there)… 😉

Hmm…Sure…but it’s going to be a long steep climb. I don’t feel compelled to buy at $3.

If you are passionate about social gaming and believe in its future, now is the time to buy $ZNGA.I’m long term bullish on the sector but I can barely bring myself to try out social games much less consistently play them. So it’s not a compelling buy for me either.

Mark’ll figure it out.

this post reminds me of the story of richard dennis, arguably the most successful commodity trader ever — he turned $400 into over $200 million over a course of 12 years. for part of that stretch he relied on a method that had a 95% loss rate. the losses were kept so small and the winners were so enormous that it worked. consistency and discipline were what dennis regarded as the true keys to his success; even though his strategies involved exceedingly high loss rates, he had to be sure to try each one of those times because you don’t know at the outset which one is going to be the lottery ticket. if you’ve done your homework and understand your edge and the trend you are riding, you can be reasonably sure one of them is going to be the lottery ticket.

Dennis also traded in a far different time. He is still trading. He mostly traded currencies and bonds. Today’s markets don’t offer the same types of advantages. Dennis could get out, and limit his loss even with a big position. Today you cannot possibly do that with the algo’s etc.

i think it is certainly much tougher today, but dennis’ basic principles of pyramiding into positions and riding trends is still valid today, in my opinion. i also think one can use algorithms to one’s own advantage; in fact dennis himself morphed into an algo trader in the mid 90s.dennis did get a bit lucky in the 70s due to the enormous moves that were going on in some of the commodity markets. i think the times are in now are a bit similar, in that we are in a new era of volatility which will provide trained speculators with some enormous opportunities.

Markets don’t trend anymore like they used to. It was possible in the old days to use things like market profile and think about things in terms of variance, std distributions, etc. Today however, because of electronic trading markets don’t trade through a range of prices. They get lumpy. When you are right, it’s great. When you are wrong, it’s a roach motel and the algo’s simply push it even more against you (front running etc).Commodity markets have never been more volatile, or less trendy within ranges. They used to go up, and stay up. Now they resemble the old manipulated pork belly trade.Dennis was/is a great trader and I haven’t seen him in awhile but I think he might agree.

That’s an amazing story. Now I want to read more about Richard. http://en.wikipedia.org/wik…

my favorite part is how even after making hundreds of millions he still lived a remarkably plain life. rented an apartment, drove a used car. now he trades to raise money for political causes.

“my favorite part”I don’t know why people think that is so great. It’s like only being able to need 5 hours of sleep, early to rise, minimalism, being humble, and jacuzzis and hot tubs.Spending the money, even on luxury goods or things I would never buy personally (like watches) puts people to work. I will assume the money he made isn’t sitting under a mattress but he is doing something with it investing it. I won’t even get into what I think about the way he made his money.

he donates most of his money to political causes, he’s a staunch libertarian.i like the simplicity of it, as well as the philosophy/spirituality of non-materialism and self-denial. i hope to live somewhat like that, although it’s easier if you’re entirely single and plan to stay that way (as dennis is). it’s not really about being cheap and miserly. cheap and miserly people rarely have the psychological requirements needed to do the style of trading dennis does because they cannot handle small losses which is absolutely required to find the big winners and optimally time them.

I have an uncle who has a fair bit of money (by middle class standards). He is about 89 now. He never spent any money on anything he still lives in the same twin house in a not great part of town. Maybe within the last 10 years he bought a lexus. He never developed any hobbies or did anything that typically people who work hard and earn money do. By the time he was older, because he never developed an interest in anything, he had nothing to do but still go to work every day and do the same thing he had done for the last 50 years or so. He didn’t buy a shore house so he couldn’t even trade up to a nicer shore house (with the excitement of that) when he had more money. He didn’t know about boating so he couldn’t buy a bigger boat and skiing so he couldn’t get into the excitement of planning nicer vacations (another relative who is older continued to ski into his 80’s). By the time he got to the age where money really didn’t matter he was to old to even begin to do things with the money that might have brought him enjoyment had he only experienced those things when younger.Having money allows you to have experiences and some of those experiences are pretty good. I was perfectly happy just going out in a power boat (and owned one for many years) but then I tried sailing once when I couldn’t find a power boat to rent on a vacation (I do the sailing in a hobie cat and took to it immediately). So I found something that I really like and enjoy that I look forward to whenever I get a chance to go away. Same with skiing (which I actually haven’t done in many years unfortunately).I don’t follow sports at all because it wasn’t something my father was into when I was growing up. I am perfectly happy and don’t plan to start now. But I do recognize (especially from reading this blog as well as popular culture) that following sports gives people a great sense of enjoyment that I don’t have. (On the upside I do other things that I enjoy with that time so that’s a plus I guess). In retrospect given the overwhelming evidence I’d say it would have been nice to have an early appreciation of sports.”philosophy/spirituality of non-materialism and self-denial”Look people can make themselves happy any way they want it’s a personal choice.

yes that is true people can do what they like to be happy, i don’t disagree with that and if folks want to buy nice things as a way of enjoying life i agree that is their right, assuming government lets them.i don’t mind spending on education — like travelling abroad, which i think is a great use of money even though it’s a bit expensive thanks largely to government fees. what i hope to avoid is spending money on luxuries and on status symbols. many people attach their self-esteem to their wealth, even in very subtle ways they may not notice. society as a whole tends to value rich people so it is an easy trap to fall into. as tyler durden said, the things you own, end up owning you.

things can own you. I hate things, used to love them. I still have a couple. I have a 1962 Rolex that I didn’t pay that much for that’s cool to me, but pretty pedestrian to everyone else. Beauty is in the eye of the beholder.Dennis is libertarian, or liberal depending on your views. He is gay-lives up in Lakeview. (I don’t care about that, if someone described me they’d say I was married and lived in the Gold Coast). For a person of his stature, he always stayed behind the scenes. Never was active politically in exchanges. The hard thing is when your entire access to income has dried up. That’s what we are seeing with a lot of people today. Dennis may have “algo” traded in the 90’s, but it wasn’t the environment we are seeing today. He is just a good trader period. I know a few of them.Our market structure is broken, and codified in really bad regulation. On the SEC side, it’s deliberately tiered. The internet has blown apart traditional distribution systems but the SEC allows it to persist-so does the FCC in media! Catching a theme.

Diversification is more of an internal rule needed, in case you’re bad at selecting what might be good (prediction based on theory), and forcing you to not be too narrow in thinking and therefore selection.Success of a company seems more to me to be dependant on the strength and depth of vision, the founder(s), the team or the ability of the founder to build team — target market size plays a role in there too, of course. With the internet, that can be a big market.But what do I know, I’m only just starting to look for angel/seed in a serious way now..

Good points. This is why I am promoting investments in digital arabia space. The market conditions there are terrific (albeit still risky) for those looking to do startups and the ecosystem is improving. Here are two sites that shows some of these market metrics http://www.ddarabia.com/ & http://www.insightsmena.com…

What type of investments do you see being successful there?

I think investments in startups developing digital arabic content whether it is to deal with e-health, e-education, entertainment, gaming, etc.. will have a chance to succeed. Some of these will be copy-cats of their western parts but others will have to develop unique service and business model to fit the region. The other big area is e-commerce and payment gateways which are becoming very competitive. There is a gap between the number of Arab-speaking online users and the Arab content on the web which I believe will be developed. Obviously the challenges in the Arab world are the inherent political risk factors but I am bullish on the future of the Digital Arabia architecture. We can chat more about this when you are in Toronto!!

I’m with you about this – the political clime in arabic speaking states is changing, in part to the internet. But there isn’t much out there in native arabic…

Very interesting.Just for shits and giggles, I ran the second spreadsheet n=15 times with random investments uniformly distributed between $10k and $100k (no other changes), I get a mean multiple of 1.88, stdev 0.419 which is not significantly different from 1.9 [p=0.854].Obviously this is a tiny sample and an unrealistic simulation (the range of multiples was 1.475 – 2.728 ; not a single portfolio had a negative return!), but it’s a somewhat interesting demonstration that for the same set of outcomes the expected multiple for random investments is approximately the same as the guaranteed multiple for consistent investments.The real meat in this sandwich is in the distribution of outcomes. Using the model you’ve used in the spreadsheet, I calculate the expected value of the return on your $50k investment to be 0.33*-50000+0.33*50000+0.33*(0.90*3*50000+0.10*10*50000) = $61050 …Where do I sign? ;)It would be very, very interesting to model a fund and run some simulations, although I’m sure someone (many people?) has done it and is hoarding their results.

My friend Kevin has done some more complex modeling of early stage venture funding. http://possibleinsight.com/

Excellent stuff.

Hah, you’ve shown VCs and Random allocs are similar for this tiny (optimistic sheet)One of my earliest comments on @fredwilson’s blog was about the outcome of investments looking more like chaos theory on a trial by trial basis.Gawk.it to the rescue! Thanks again @falicon/@KevinMarshallhttp://www.avc.com/a_vc/200…Also bookmarked this article based on your quick look. http://digitalknowledge.bab…

Thanks for that paper… and to think I thought my Friday afternoon was open!Did you ever build the model?

Me, nah, not drawn to financial modeling. There are plenty out there though if you poke around.

Niether. I find the typical assumption of an efficient or complete market tiring.

It’s a ‘very rarely’ type of thing…but I do really enjoy doing a search on some people’s names and sorting by oldest comment…fun to see what got them started/active/involved in the community (especially around here)…and fun to see how they have evolved over time…

Oh. You Stalker. 🙂

Even though I’m a techie at heart…I really like getting to know people and trying to understand them…so yes the secret is out, I am a bit of an online stalker 🙂

Now I’m curious of Daniel Ha’s first comments. not sure what blogs though (not time atm).

can I see your model?

I killed the window straight after I did it. It was simply Fred’s deterministic outcomes model with randomly allocated investments (spreadsheet 2), only repeated 15 times.It was done in response to another comment, not to counter Fred’s argument (which is a good thing, because it doesn’t 🙂 )

no, but i like the way you think and work

The obvious conclusion here is the need to have the right to continue to invest in deals pro-rata. I believe @gothamgal has said she would not do a deal without said rights and I am right there with her. Hard to get as an angel, and a lot of folks talk about how you shouldn’t need them. Then of course their are the situations where you actually have them and the founder and VC takes them away. In any case, without them, I don’t see how you build a successful portfolio.

there are only three things you need in a VC deal, prorata rights, a liquidation preference, and board seat/information rights

Your math and assumptions are generous and is vulnerable to the narrative fallacy. A random grouping with assigned outcomes can be made to look however you want. Your assumed average value proposition per investment is positive, therefore, you make money.

Gene Fama was right. Efficient Market Hypothesis works.

Meh. The market isn’t efficient when he invested in – these are such illiquid types of investments it is hard to tell if it was the market or something else

It was efficient in 1962, and it’s more efficient now. Look at Facebook ($FB) movement yesterday post earnings, and watch it today. Efficient.

Although, market structure is far from perfect, and that is a different topic.

for venture investing?

no, the SEC has some really bad regs that allow a tiered distribution system, dark pools, etc. On the CFTC side, co-location and front running are a huge issue.

Fred, did you catch Sean Parker’s comments in the NY Times a couple of days about how he felt about his own move from being an entrepreneur to investing and back to being an entrepreneur. Posting because related to your post. This is what he said:”How can you as an entrepreneur that’s had success, has a reputation, ever build the courage to go and do something again? Most entrepreneurs don’t remain entrepreneurs. It’s just too psychologically draining to have to constantly start over.[As a VC,] [y]ou have a whole portfolio, you only focus on your successes, you ignore your failures and you get to continue looking like a player, but you’re ultimately not in control of anything.Everything is probabilistic, nothing is deterministic, so you never have that satisfaction of knowing that you’re in control of an outcome. So you spend all of your time managing your reputation, managing your relationships and you spend almost no time thinking creatively or doing the things that an entrepreneur is good at doing.”

“It’s just too psychologically draining to have to constantly start over.”The advantage of starting over is you have a reputation and can draw on better resources. People will take Sean Parkers phone call and he will be able to hire a better quality person and attract money much easier than Joe Blow will be able to.The disadvantage though is obvious. If you believe that luck played a part in the success of the person (if enough smart people try enough things something will work) then you have to believe that second time around (excluding the above mentioned advantages) it’s going to be much much much harder to have your venture work (even with the added knowledge).Being an entrepreneur is great. But so is staying out while you’re ahead. That’s why so many entrepreneurs that were so visible want to be angels, mentors and VC’s. Why risk the cow?

LUCK ALWAYS PLAY A PART.USUALLY 10X AS MUCH AS EVERYONE ASSUME.

Jonah Peretti from Buzzfeed wrote on a recent Chris Dixon blog site “A big part of our recent success has also been luck. People don’t like to admit it but skill is 63% luck” 🙂 http://cdixon.org/2012/07/2…

I am obviously taking that number as a joke!!

RANDOM HAPPEN ALL THE TIME.LUCK IS DO SOMETHING WITH IT.

It is important to know when you got some luck. It is not always obvious to some people

IT HARD TO KNOW WHAT AN OPPORTUNITY. THAT WHY ASSUME EVERYTHING IS.

he is right for the most part. i fight that every day.

Timely that this post was written on the same day that https://thefundersclub.com/ launched, which allows accredited investors to better diversify their early stage portfolios by making smaller investments. Of all the crowd funding businesses I’ve seen that plan to capitalize on the JOBS Act, this one looks the most promising. USV must be talking to these guys.

This post reminded of a quote in the book black swan regarding VCs. Turns out it was a top answer on quora http://b.qr.ae/P2XNKM

Your model shows that the “big winner” returned 10x your investment. I’m curious: are you using 10x because it’s a round number or is that what a VC would consider a typical return for a big winner? I’m curious what a VC considers a big win. Thanks.

General rule of thumb…Angel = 10XVC = 3X or more

Hmmm…if 3x is considered a “big winner” and you only get about 1 big winner for every 10 investments, how do you make money?

I’m talking minimum returns on entrepreneur has to be shooting for. That’s a different side of the lens.

10x is how i think about big wins. although i’d rather have 100x 🙂

This is such a great discussion because diversification is used in so many ways, most of them wrong. I dont believe in diversification so much unless its in my core strategy. I love angel investing so that is where I diversify so I dont blow up within the strategy that I want to make my living.Also – I like to use the recent them of Social media investing as an example. The FLY writes this great post about how Social Media investing has imploded…YES – if you chose the four horseman and symbol of social media http://ibankcoin.com/flyblo…But Ivan and I created a Social media index that was diversified across industries and companies that are exploding because they are using the social web. The index includes $ZNGA but is up 7 percent in the last year.http://swebindex.com/I hope this example helps.

I really should start using stocktwits again. I joined two years ago but have not been active at all!! This social media index stuff is really interesting

So you are saying to diversify narrowly within your strategy sphere. Is that like hedging? I think the Social Web has more lasting power than social media. That’s because the end game for social media is to be integrated into other things.

In general, diversification protects against idiosyncratic risk — the risk of something bad happening to a particular company — but doesn’t protect against industry or market risk (when nearly all companies get hammered at the same time). Hedging can ameliorate market risk in a way diversification alone can’t.

How do you hedge market risk?

One way is to buy put options on exchange traded funds (ETFs) that track market indexes. Put options (or, “puts”) are contracts that give you the right to sell an underlying security (such as a market index-tracking ETF) at a pre-determined price; as such, puts will tend to move inversely with those market indexes, and in a nonlinear way: when the market drops significantly, the put options can rise in value by a much larger percentage. You can see a few specific examples of that in this post of mine, “Here comes another lesson”.

Thanks!

Angel investing is a far out thing I’d love to do when I afford the losses. Even if I broke even I’d love it. You’re playing a critical role at the inception of new businesses.

“Even if I broke even I’d love it.”At that point it becomes entertainment and perhaps education.But you also have to look at the opportunity cost of spending your time that way unless you are willing to give up other time that is not well spent in exchange. You have the exact same time each week as Richard Branson does.Back in the day, before law school was expensive and law jobs were available , the saying was “a law degree is always a good thing to have”. Not true. It takes over three years. And it changes your thinking you end up having a law perspective on all things (what’s that expression about a hammer?)I agree it sounds like fun and I’m sure it’s something that many of us have considered. But it’s important to separate something you enjoy from something you do to achieve a goal. Ultimately you should try to spend your time on something that does the latter.

Earlier this year, I noted that high optimal hedging costs could be a red flag for stocks such as Zynga (“High Optimal Hedging Costs Offer Another Warning”). It might be interesting to sort your social web index by optimal hedging costs and see if there’s a similar correlation with returns going forward (e.g., will the half with the lower optimal hedging costs outperform the half with the higher optimal hedging costs over the next 6 months or year).

A) That index is amazing. Though I question why Citrix is in it. Or oracle.b) at what point can you no longer hedge/diversify? At what point is the system too interconnected? (I keep thinking about LIbor and the fact that food prices will spike next year – how will it affect the stocks in your index)

As true as this is for startups, it’s equally true for investing in anything.On Monday, when the market plunged, if you had been all-in with US equities, your portfolio would have been down -2.9% at the low. If you had been all-in with emerging markets, you would have been down -7.5% at the low. That’s big money when you’re talking about your entire nest egg.Instead, the portfolio I’d built on Riskalyze.com with just a little bit of diversification was down -0.6% for the day. https://riskalyze.com/#p/65…Diversification works.Right now, Riskalyze is totally focused on helping people figure out how to map their money to publicly traded stocks, ETFs or mutual funds.But we might have to think about building a synthetic $STARTUPS symbol to help people answer the question: do I have the risk tolerance to invest any part of my portfolio in startups, and if so, how much?

I read over the suggestions from Riskalyze, but ended up picking only a handful of funds and etfs (and Apple stock because of my own psychological macubation streak)

That makes a lot of sense. I too prefer to keep my IRA investments simple and just have it in a handful of funds with some basic diversification.If you wanted more of an allocation in $AAPL than Riskalyze gave you, there are two ways to do that. Just click on the symbol, and you can set a minimum allocation, or you can set a higher price target based on your belief about Apple’s future value.Either way, that higher allocation in something like Apple will force adjustments to the rest of the portfolio to drive up your diversification and keep you in the “risk/reward” window you’re comfortable with.Thanks for giving it a try!

awesome, i’ll have to update my riskalyze portfolio asap.

I’d like to fork a bit with an idea for any of the following @wmoug:disqus @disqus @falicon @gawkit @engagio (btw @disqus handles aren’t being pulled up correctly – only a few choices and not proper ones are coming up [1]).IdeaMany people on AVC recommend products and or services or plug companies (either their own @aaronklein:disqus or others). I think this is fine.Unfortunately if you don’t take action right away the company or service recommended is long forgotten if and when you need that information.There should be a feature, or a site, where you can get all the info that was plugged by community members so you can go back and find it when you need it. So off the top I thought of engagio, disqus or gawk.it being able to pull this off. With a link from AVC.com to the info.To prevent spam a website or product wouldn’t get listed or mentioned unless it came from a community member with some standing (you can figure out how to define that) or was somehow the topic of activity. This has nothing to do with whether products are in comments, only whether they make it to the official list.I like the fact that people give their personal experience with things they use or know about on AVC and the discussions around that. But there is no way to find that info if it is ever needed in the future.[1] Attached as far as disqus not bring up handles

Error on the attachment. Here it is. And the error as well.

Love the idea. I hope my comment was less a “pitch” and more of adding value to the post. But the AVC community is amazing: both generous and demanding. I love their feedback on the product.

they are being pulled up correctly – as annoying as it is, the person has to be in the conversation already. I’m not sure if that fact is a feature or a bug….

@ShanaC:disqus that is definitely a bug and it makes no sense as a feature.If anything by enabling the mention of someone not in the conversation they get an email (if enabled) that says they were mentioned which would draw them into the conversation and result in more activity.

No, I agree in general, but I think in this case it was a design choice.

I have been annoyed by this ‘feature’ a handful of times as well…also note that because I wasn’t already in the convo, disqus did not alert me to having been mentioned…I had to manually come to the comments (luckily I do that all the time anyway)…and then read through them all (again do it all the time anyway) before I would notice I was being mentioned…That’s me having to find the conversation…and that’s a BIG problem with today’s web…

Love it…this is a big driver in the entire gawk.it idea (finding conversations realm)…in fact right now, if you use the search bar on this blog for any conversation bit you sort of remember having (or any product/idea you think someone in the community might have mentioned), you *should* get some quality hits (just click over to the ‘conversations’ tab in the results)…I will def. be making this MUCH better over time though…finding the conversation around products and services is a key to gawk.it eventually making money (at least in my current thinking/plans)…so it has to be improved a TON in my mind (though honestly it should be ‘OK’ in the current gawk.it service).BTW – thanks for the mention and idea (away on vacation with the family this week so just catching up on most conversations a few minutes each night)…wish I was here for this one throughout the day…great stuff from everyone!

good self plug :p (no really, it is!)

Thanks. It’s annoying to me to read comments that don’t add value to a discussion, so you wouldn’t see me comment about Riskalyze on a post about New York tech, for example. But when it adds value…this is an awesome community with which to share things you’re working on.

Agreed. Two additional points:1) if you can do so without hurting the overall quality of your investments it is also worthwhile to diversify across things like when company was started (“vintage”), and sector (b2c, b2b etc).2) According to CAPM, diversification is the closest thing you get in finance to a free lunch: done right, it can lower variance without lowering returns.

+1Giving investors a simple way to find the elusive portfolio that lowers variance without lowering returns has been the major driver of our growth at Riskalyze.com.

Chris, as an investor wouldn’t the skills needed to invest in b2b, b2c be different enough for you to be successful in picking winners in both? I am just curious if this is the case or whether picking the right company with right team involves the same basics no matter what

Yeah, some investors like to stick to a sector or theme. Investing outside of your area of expertise could hurt your returns. Personally I’m interested in b2c & b2b so try to do both.

@cdixon:disqus, what are some of the not-so-obvious benefits of investing in a vintage company as opposed to a fresh company?

“vintage” in VC-speak just means the year the company was started. When you look at historical VC returns this is a key driver of returns. E.g. 1999 was a good vintage but 2001 wasn’t.

I had no idea. Thanks.

so startups are like wine

i prefer JLMs jockeys, horses and courses analogy to wine.

thanks for explaining these terms – I had not idea either. It is a fresher way to refer to 2001 as a bad vintage year rather than dot.com bust terminology 🙂

Or vintage funds ( when a fund was raised)

But you need a bigger pile of money (or people) to diversify with later rounds – vintage.Sectors too, bio costs are historically higher than software for early rounds.

I’d argue a person probably shouldn’t be angel investing unless they have enough money to properly diversify.Biotech/healthcare is different enough from IT that few people invest in both. B2b & b2c IT are much more similar.Agree that investing in highly capital intensive businesses like bio can be especially risky for individual investors.

“I’d argue a person probably shouldn’t be angel investing unless they have enough money to properly diversify.”I realize that this comment is written from the point of view as an investor looking for an ROI, but this leads me to a question (and hope this isn’t too much of a thread derail):As someone interested in tech VC in the future, one way I was told to build some credibility/track record is to begin making angel investments. Given that In my case it’d be probably micro-angel (not the size of an angel investment but above an amount you’d typically put into a crowdfunded project), do you think the goal would be here to diversify still, or given limited funds would a selective view be more relevant/beneficial to the goal of building a VC track record?

I guess if the money you invest is in your “job training” bucket your goal should be to pick good companies over diversification. But a few caveats: 1) a lot of startups don’t like to take investments under, say, $10k because of the administrative hassle, 2) if you aren’t “accedited”, you can’t make these investments in the US (until/if the JOBS act goes into effect), 3) there are lots of other ways to impress VCs. E.g. why not blog about the company’s you like and why?

very fair points. #1/#2 are what i’ve been struggling with.re: #3, blogging is tough when you have restrictions based on your day job ;/

@chris – doesn’t this mean technically that if investors get together into a fund, and diversify their investments together into startups, then they minimize the risk for everyone in the fund? Classic collectivization.It kinds of makes me think that if every worker invested their wages — to hedge against inflation — into some funds tracking a public stock market index, we’d have the answer to the problems socialism was seeking to solve, without all the politics.PS: In socialism, workers basically only had the option to collectively “own” the factory they worked for. But it would probably be better if they had individual choice to reinvest into other companies or mutual funds and diversify their investments. I am not an expert on economics or anything but this seems like a better alternative to socialism.

isn’t that the understanding of founder’s collective to begin with – angel investors in an angel fund together?

Yes, it is. By diversifying you get less risk and also less reward. By pooling your money you are able to diversify better — hire fund managers, etc.But also … taken to its extreme it would solve the problems that Marx outlined (crises of productivity) and socialism tries to solve through collective ownership.SMALL ECONOMICS RANT————————————My friends on facebook have just pulled me into a bunch of macroeconomics discussions over the last year and I learned a lot. So one of the things that I realized (partially from reading stuff by Stiglitz, et al) is that this current recession is a result of falling demand for local labor.Before the great depression, the US had a big “primary sector” economy (agriculture, raw materials etc.) and there was a crisis of productivity. Afterwards everything got restructured as the out-of-work people moved to cities, worked in factories and manufacturing. Now, thanks to improvements in technology, supply chains and communication in the last 30 years, we have outsourced / automated a lot of our “secondary sector” (manufacturing etc.) So now we are feeling the effect of that, and the only thing that’s left is the “tertiary sector” (services, research, online content etc.) Our exports now include lots of IP, etc. I think that’s a big reason why the copyright / patent lobby is so strong in the USA.Anyway … the main problem is that local businesses lose their comparative advantage to globalization (local stores will soon lose to Amazon for example). And they lay off their workers, while the big companies (e.g. Amazon) compete in the global market and have pressures to keep prices low. So they can’t pay workers as much. So the average laid off worker and his family have less and their buying power goes down, and eventually demand goes down, etc.Usually what happens is some of the people break out of their local area, go somewhere else (e.g. silicon valley) and start some profitable business. The others however are stuck.My question is, if everyone diversified their holdings wouldn’t that practically prevent these things from happening?

I think I’ve just been doing entirely too much debating on facebook. Gotta get back to releasing our product 🙂

Nice economics rant. I think it would help, but individuals can only diversity what they have.

Mark: That’s true. And Pete: I don’t have all the answers.I still think at the end of the day, as globalization and automation increase, there will be a growing disparity between people’s incomes, and we as a society will have to increase social safety nets.I do think I know where innovation will take place in the next 3-4 years that will help our economy: http://magarshak.com/blog/?…But in the long run, I simply have no answer other than paying people for not working. Similar to a negative tax that Milton Friedman proposed, or some other safety nets. Give them money they can’t gamble away, but can only use on food / housing etc. So they can afford to take microeconomic risks like staying at home and writing a book. JK Rowling is a poster child for this … stayed at home on welfare but eventually helped create a billion dollar industry around Harry Potter. Will “investing in the poor” always pay off? I have no idea. But it seems humans reducing their danger and increasing their creature comforts just for being human is what civilization has always been about.

I understand the analysis but not the question. Why do you think such diversification would help forestall structural changes?

yes, pretty similar.

.Jockeys, horses, courses.In small businesses, you are betting on the jockey — management.On the horse — business model.Course — economic environment.Make a matrix of the combinations — “good jockey” & “good horse” & “mediocre course” — and look at the combinations.The key ingredient is the entrepreneurial jockey. The driver. The Steve Jobs, etc..

for 2) why?

I think it would take a few blogs posts to go through the whole CAPM argument http://en.wikipedia.org/wik…

I would read them.

This reminds me of something relatively basic from my math phd days …The AVERAGE of the sum of random variables is the same as the sum of the averages,But the VARIANCE of the sum of random variables gets smaller and smaller than the sum of the variances, the more random variables you have, because the swings cancel each other out. This is especially true the less correlated the random variables are.So as long as your investment strategy in startups gives you a positive expected value, repeating it across more startups will guarantee you greater returns with lower risk.The question is how to pick such an investment strategy in the real world 😉

I keep thinking about this strategy in the real world. Maybe I should just buy indexes of everything

Well I think you can keep it simple…http://jlcollinsnh.wordpres…This is a good blog to complement diversification, but it’s mostly for living your life:http://www.mrmoneymustache….http://www.mrmoneymustache….

yeah, this is why CAPM recommends buying uncorrelated assets.

What’s great is that I’d say only recently for b2b you’re getting both sides of the puzzle solved. While for a bit of time now the barriers to making b2b software have been reduced (for same reasons as b2c), we’re finally seeing SMBs and Enterprises need to evaluate innovative new solutions to reduce their legacy, clunky software because the TCO is too high, they have new technical requirements which aren’t met by what they have installed, and subscription pricing often better suits their needs vs large upfront purchases.So given that there is a need for new products, it’ll be exciting to see b2b companies (and their inherent business models from the get-go, as opposed to many of their “grow and we’ll see” brothers in the b2c space) get their time to shine.

Chris, the problem with following CAPM is that if you believe it is true, then just buy the market portfolio and diversify it with some bonds. According to CAPM, markets are efficient, so nobody has any special skills in picking investments, so why is Fred collecting 2 and 20 then ? having said that, I am not belittling diversification, just pointing out that in reality if you can’t pick good angel investments, then don’t make them at all, unless you’re in it for the love of the game, and instead just invest in an index fund

I’d push back on that. Fred or any VC’s ability has nothing to do with efficient markets. Investors are paying Fred for his ability to analyze and source deals, and make investments for them. It’s in Fred’s interest to invest in a balanced portfolio to decrease the beta risk off all his investments. His investors do better if he diversifies. CAPM has nothing to do with it-however, it is similar to Eugene Fama’s theory of efficient markets-similar only.Fama merely proves that all known information is included in the stock price. That means the average investor cannot beat the market-which includes 100% of investment advisors.CAPM to me is a great theory, but a flawed model in practice. Even Eugene Fama has developed better models, like the three factor beta model.VCs invest in start ups which are different animals. I speak from experience, as a commodity trader and angel investor looking to raise a fund.

Agreed. CAPM is a nice approximation but private markets are very far from efficient.

I think they are more efficient than you give them credit for. Depends on information. The more information, the better the market.

more specifically: the startup market tends to be very inefficient PRIOR to product/market fit (or “TRACTION”), and very efficient AFTER. this might indicate most of the gains in such a market are to be made by early investors prior to some notable point of traction, which then serves to disseminate information much more quickly than before to investors in that market.

@cdixon:disqus Not only is this diversification as you mentioned – but it’s also a form of “tail”-investing (basically relying on tail events – such as a massive exit – to generate most of your profits while diversification shields you against a huge range of directional movements).I come at it from the point of view of a quant – so the obvious analogy for me, rather than diversification via CAPM, is actually investing in cheap deep out of the money options (via seed/Series A funding in multiple companies – you lose only your upfront amount if the company goes bust while retaining upside – and on, top of that, the upfront is not really upfront – funding is always done in tranches) and hoping at least one of them comes in-the-money .So, here although Fred has portrayed this as diversification, it’s only half the story.A VC can enhance returns by doing the following in conjunction with each other:(a) by making a huge number of investments (buying deep out of the money options) – statistically, some of them will pay off even if you made some dumb decisions, and(b) by increasing the probability of those options (investments) coming into money (Edit: thus, reducing the “huge” number in (a) to a more manageable size).See, a VC’s business is an insider’s business. They can actually – via relationships, board control, investments and advice – _alter_ the return on their investments. They work to make their “assets” work. That can reduce variance on the investments while still allowing for massive returns on the odd exit. It’s the blood and sweat on the VC side that causes the market to price risk for a VC differently than that for the S&P500.This also explains why CAPM doesn’t quite work here. CAPM comes from the principle of no-arbitrage which states that there is a single market price of risk for all assets. So the higher the risk (or variance) of your asset/portfolio/derivative, the higher the payout expected of it. But this relies on a market where information is freely available to everyone and intrinsic asset returns are independent of the actions of market participants (clearly not the case here).

Great points.The challenge is your points a) and b) are in tension. It is very hard to make a lot of investments and still be helpful (and maintain a reputation for being helpful). I agree that early stage private markets are not at all “perfect markets” so CAPM is an approximation (although still pretty useful).Not sure about your point about tranches. Most angels invest once and maybe (but only sometimes) do pro-rata in following rounds. Literal tranching used to happen but is very rare now. VC’s usually do pro-rata and sometimes “double down” so in that sense there is something like tranching.

Sorry for the confusion – by “tranching” I meant cashflow tranching in lieu of receiving a net stake – not milestone-based financing per se. Pro-rata would then indeed look like multiple cashflows acting as a combined premium payment for an option on a single entity.

some might say it *is* possible to a) make a lot of investments, and b) still be helpful… ;). however, the trick is not to try and scale b) thru your individual time / boardseats, and rather develop scalable resources and peer networks that actually *increase* in value as the size of the network grows (& in fact, the pace of value can even accelerate as the network grows). this is a bit contrarian and non-obvious at first, but the fundamental assumption is that the size and value of the network can actually improve the ability of any individual node to perform better at scale, rather than decrease it.

Yes, you are trying something new and interesting. I guess I should have said it is hard to scale lots of investments with the “traditional” VC/angel model.

I like that way of thinking and that’s what we are doing with the USV Network. Its working pretty well. We pair that with the unscalable old school VC model. It doesn’t help us do more investments but it does help our portfolio companies a lot.

Have you looked at some of Erik Falkenstein’s posts on CAPM (e.g., this one)? Falkenstein’s a proponent of diversification and passive investing as well, but he says there’s no evidence for any positive correlation between higher beta and higher returns. So he advocates low beta investing.

But we are comparing the stock market to start ups. It’s not a fair comparison. Start ups have a very high beta.

Startups have high risk (defined as the chance their investors will loose money). Beta is a measure of volatility relative to an index. As such, I’m not sure it’s a useful term in the contextof startups. It’s true though that Falkenstein applies his approach to publicly traded securities. But CAPM is usually used in the context of publicly traded securities as well.

I would agree, it’s an apples and oranges comparison.

Great points and explanation here, Fred. One question that I’d love to get the community’s take on, given some recent discussions I’ve had:Why do many VCs insist that they “have to own a certain %” of a company when they make an investment?

greed

Things might have changed in the last few years, but when I was doing research on this while working with an angel group, I found that ~10% of all startups that raise capital break even or better for their investors, and of those, approximately half return a 3+ multiple. The likeliest return time was 3-5 years, but after 5, the chance of return diminished significantly, and after 10, there was just about zero chance of any return.

Diversification is obviously important for investors – but dangerous for entrepreneurs. Entrepreneurs who try to do too many things at once do none of them well. It’s in the entrepreneur’s interest to concentrate all of their eggs in one basket (provided, of course, they’ve identified the right basket).

The thing I find interesting and correct is that the 10Xer means everything. I once ran some numbers a long time back after driving up the NJT thinking that I could have a different type of fund: one where entrepreneurs weren’t forced to swing for the fences.I put the numbers in the spreadsheet and if you don’t have a single investment that essentially returns your fund you might as well put your money in the bank.

depressing

Not depressing. Read Chris Dixon’s blog totally fine.

In poker when discussing ROI and avoiding risk of ruin some suggest 50-100 buy-ins should be the minimum amount someone has before entering a tournament. Do you feel that investing in start-ups could/should be approached in the same way in terms of managing each investment as a % of bank roll?Specifically if an investor has $1M in cash to invest in start-ups should the investor be making $10K bets to be diversified enough to make a 100 bets and when enough cash has been returned to make $20K bets the investor can move up in investment size?

The revelation behind the data is that some investors will look much better than they actually are (picking 3 winners out of 10) while other, equally good investors will look completely incompetent (picking 0 winners out of 30.)This is a concept that any serious poker player understands very. Two players can both make the correct decision based on all the information available at the time, but variance still has a large hand on the outcome.

.This comment is not right on point because it does not really apply to the VC world but I do want to make this observation.In keeping with the 10K Rule, I believe there are investment opportunities in which the purity of the focus is the assurance of success both from a performance and a financial perspective.A company or individual who has complete mastery of a business — having logged the 10K requisite hours to be able to make that statement — and whose focus is on growing a multi-unit, multi-state operating business has a bit of geographical diversification — acknowledge not the kind of financial diversification we are talking in this blog post — and a sense of the common demand for that good or service.An example is fast food or other restaurants whose basic product is attractive across a broad cross section of folks and whose challenge is to get as many units as possible.As overhead as a % of gross revenue declines, the enterprise becomes progressively more profitable at the margin.If one looked at McDonald’s over the course of 1970s forward, it is difficult to see too many lean years and you were rewarded handsomely for having made the bet.Just a random thought..

If diversification is so important, how come we haven’t seen big funds that have multiple industry focus? I compare this to large hedge funds that have multiple strategies and focus.

Ha! So, correct me if I’m wrong, but startup investment is kind of like the old joke about the recording industry: “How do you find a hit record?” “Take 10 records, throw them against the wall, and then see which one sticks.”

@chrisdixon love your points on diversification but think you probably like the CAPM a lot less than it may seem. Here is why: diversifying across vintages is a key driver of absolute returns largely because you pick up discount rate variation (or change in the risk premium) which actually does not play too well within the CAPM framework.I actually think you articulated risk-factor asset allocation which is much more in vogue now than the CAPM especially after the financial crisis.This primer may be interesting for some so thought I would include the link: http://faculty.chicagobooth…

At some point:diversification = diworseificationAnd in some cases you get just that – an index fund – at which point, you are playing solely for the hell of being in the game.I love the idea of having cash or income producing investment enough to cover your life and then put the rest in risk assets – i.e. start-ups and work like hell for them – so that you can influence the outcomesthat’s the real key, minimize losses in that spreadsheet above and you have a double instead of being up 58%. That 58% if realized over 7 years is not much of an IRR. Doubel in 7 yers and you have a 10% IRR and you get to play the game again.

The same strategy holds true for a single company’s product diversification.

I don’t believe anyone really understands ‘diversification’ – especially within an individual asset class.Guys like David Swensen have shown that investing across asset classes can be very lucrative and help mitigate risk because of their lack of correlation. But how do you really know whether you’re ‘diversified’ and to what degree within an individual asset class? To me it seems like a lot of hand waiving.For example. In equities, what most people would suggest is that if you can’t pick specific stocks, you should be invested in an index to be diversified. But most indices are cap weighted and systematically bias me towards large companies. I’ll end up owning hundreds of times more of Apple and Exxon than I might of a smaller company at the bottom of the index. While this might be a better proxy for the impact these companies have on the broader economy, is this really diversification?Guys like Markowitz would suggest that at above a certain number of investments, you’re moving towards an asymptote and that an additional investment won’t have a real impact on my diversification. But how does that reconcile systemic risk — when the vast majority of these stocks become correlated (see 2008)?Is the goal then to just find a bunch of themes / sectors / or types of companies that sound very different and allocate capital across these? How do you know how efficient you’re being with your diversification strategy? Or what impact they’ll have on your fund performance.Mind you, all of the examples listed above describe public markets investing (while not perfectly efficient) are certainly more so than private market investing. Is there really a way to get true ‘diversification’ in startup investing? And what does that even mean?If the VC market were so efficient, the top decile of funds wouldn’t generate the majority of returns. While I agree that taking more swings at the plate can improve your chances of hitting a homerun, the VC business seems to be mostly about access and relationships, and those aren’t easily modeled in a spreadsheet…

I wouldn’t focus too much on perfect diversification. I just want to be diversified enough that a few mistakes don’t kill me.

That’s a cool post Fred. You sure did leave out a bunch, but I liked the post anyway.

I try to keep things simple

Diversification if you are to stand on a cliff do you put one leg out both or none,seems you’ve. already taken the choice to stand tall stay away from the edge and build a platform. in seperate stages each reaching a seperate entrance so that although you have to make each entrance. once you are there each is a surity ,if one is found needing to increase one can always add to a specific platform or maybe more though remember a foundation should be based on a solid research into the platforms history this is a nessersary to be able to predict its performance so to versify. is to cut your risk of loss through loss due to lack of investing in the early stages relying purly. on its own success , to fully understand one can’t leave an investment to perform one has to include marketing awareness giving each product or service a solid foundation

That is one of the beautys. of Facebook it is a foundation of social interaction there for there will only be an increase in its user numbers this means even when it slows it increases this means a steady growth rate that will never dissolve away? so with this afermed. we have a growth rate of sales rates of any communication product sold by any company that’s capable of using Facebook! quiet simply Facebook is a company that is equal to Alexander bel’s phone invention only more sophisticated

Love this post! It conciliates Venture Capital as a way to invest in selected companies with the rules of diversification! Awesome. Indeed, I believe a good VC is not able to pick the one likely homerun in his 10 portfolio startups, but it would be 1 out of 100 (sort of speak), before the filter of investment selection. This means that, although the VC cannot pick winners, it can filter some startups to create a pool of companies that are a little more likely to succeed. Now which of the ones will indeed succeed is impossible to predict. Diversification obviously matters here! Additionally, the VC also adds value after the VC investment, by helping the management, and thus creating a bit of an arbitrage opportunity for a “double-down strategy” in a later round. This should push VC returns up.

Don’t see why you are advocating the size of each investment has to be the same. Logically, you chose NOT to invest in a lot of other companies, so you are trying to predict the winners to a certain extent . . . you declined investing at all in companies (or invested a zero dollar amount) in companies you calculated had a very low chance of success, why is investing 10k versus 100k any different to you?

Its discipline that insures you have as much in the winner as the losers

Interesting article – though I’d like to see what amount of capital you keep in cash (for follow-up investments, add-ons, etc). From a portfolio management stance, I think VC is very challenging. I also came across this [http://larspsyll.wordpress….] post today. Given that you only have a few investments, the strategy may not apply – but if you have enough investments with similar risk profiles, the Kelly Criterion can help an individual or a corporation figure out how much they should invest in risk assets.