How To Be In Business Forever: Week Two

First we'll take care of some logistics and then we'll get to the post of the week in my Skillshare Class on sustainability in business.

Office hours will take place at 6pm eastern today. The link to the hangout is here. I don't like the way office hours worked last week and so I am changing them up. I will start by asking people to post questions in this discussions section. Then I will review a few business model canvas projects live for everyone to see. Then I'll finish up the 30 minute session by answering as many questions as possible while time lasts.

There are roughly 80 business model canvas projects posted so far. You can see them here. Since I will only be able to review a few of them today in office hours, it would be great for anyone who is taking this class to stop by and pick a few to give comments on.

If you are looking for a web-based tool to build and share your business model canvas, this thread mentions several of them.

OK. Now that we are done with the logistics, I will move on to my second post in this series.

—————————————————————————————

Last week we talked about long term thinking vs short term thinking. But sometimes, no matter how long term you are thinking, things happen that you didn't plan for and they can impact your business. Actually, this always happens. And that is when you need to adapt.

You will not stay in business forever if you don't adapt to changing market conditions. This doesn't mean adopting the "business model of the hour" model and this doesn't mean pivoting either. What I am talking about is the once every few years "oh shit moment" when you realize that the path you are on isn't going to work in a year or two and that you need to make some changes.

This is a frustrating realization. I have a good friend who has been running a business for more than a decade. He told me a few weeks ago that he thinks the market he has been operating in is changing and it is starting to impact his business. And just when he had everything firing on all cylinders.

That's how it is in business. Just as you are taking the victory lap for the kickass execution you and the team have delivered, the track takes a tilt and things start getting harder. Businesses don't operate in a vacuum. They operate in a dynamic ever changing market that is going to make things difficult for you, especially if you want to be in business forever.

I think some examples will help. The one that comes to mind front and center is Microsoft. By the middle of the 1990s, Microsoft had it all. They had a dominant share in desktop operating systems and a dominant share in desktop apps. They were literally printing money. Then the commerical internet happened. Netscape showed up. And Microsoft's market changed, forever.

Microsoft did adapt. They built Internet Explorer in reaction to Netscape and then used their desktop dominance to push it into the market, hurting Netscape so badly that it had to sell to AOL. That got Microsoft into trouble with the Justice Department and they were investigated as a result.

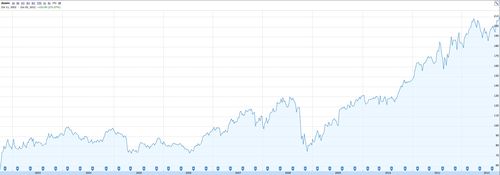

But what Microsoft didn't see in 1995 was Google because it didn't exist. And they didn't see the emergence of cloud based productivity apps because they didn't exist. In hindsight, it is pretty easy to see how fundamentally transformed Microsoft's business has been by the Internet and it is also pretty easy to see that they have not been able to adapt sufficiently to maintain any semblance of the dominance they had in the mid 90s. This stock chart tells you everything you need to know about what the Internet did to Microsoft. They may be surviving but they are certainly not thriving.

Another great example is RIM. I don't even need to tell this story. Everyone knows that the dismissive tone and stance that RIM's management took toward the iPhone and what it represented was essentially the death knell of a great company. I suspect they wish their stock chart looked like Microsoft's.

But let's look at a more positive example. As Ron Ashkenas points out in this HBR article, IBM saw that the hardware market was changing and their competitive position in it was changing with it. They sold their PC hardware business in 2005 to Lenovo and doubled down on consulting and related services. Their stock chart tells the rest of this story.

Adapting doesn't always mean exiting a business that you decide has issues. You can also retool, reshape, and refocus the business. A company that I've worked with for more than a decade saw the industry it services go through some painful transitions in the 2008/2009 downturn. They built an entirely new line of products that service the growth part of the industry while working to maintain the older products through an orderly and gradual decline. It's been a difficult transition because it has meant that the company's top line hasn't grown during this transition. But the company is still in business and the new products are growing quite nicely.

Every situation is different and I don't have some "silver bullet" to help you all think about how to figure out when to adapt and when to stay the course. But I do have some observations. The comfort of a strong balance sheet (and a nice looking stock chart) is often your enemy not your friend in these situations. The most agressive CEOs I've seen in these situations are often the ones with less than a year of cash in the bank and survival instinct in full on mode.

Another observation is that getting your organization to adapt is harder than you might think. Organizations have inertia. The bigger they are the more inertia they have. If you think you need to adapt your business quickly, you will need to figure who is in the boat with you and who is not and make the changes you need, particularly on your senior team, to align the team with mission and get going.

Finally, you cannot be in adaptation mode all the time. If you map out long living successful businesses, you will see they go through periods of great stability followed by periods of great change and then move back into stability mode. You have to know when to get into which mode and you need to see each one through to its logical conclusion.

Given how hard all of this is, you might wonder if you really want to stay in business forever. The answer may be no. But even if it is no, you had better plan for and act like you do. Because I am certain that if you don't, you won't.

Comments (Archived):

“Business, more than any other occupation, is a continual dealing with the future; it is a continual calculation, an instinctive exercise in foresight.” ~ Henry R. Luce.“Prediction is very difficult, especially if it’s about the future.” ~ Nils Bohr.

Great quotes Carl

Thanks, Fred – serendipitous timing – they are in my blog post, today…http://carl-rahn-griffith.t…

The future, make it happen or let it happen.

Knowing who’s in the boat with you is not easy.Your old winning team maybe your new losing team.People get set in their ways and it usually takes a few good shots to the head before they realize that something is wrong and maybe not even then.Maybe teams, companies have a life span and that’s it.As an aside I’m very bullish on MSFT these days. They are grossly undervalued.

They have the products to win but maybe not the brand. This post is illuminating http://www.feld.com/wp/arch…

That effect goes both ways. Some people love a struggle. Put them on a winning team and they look for things to break.

It’s so amazing what sparks someone to shin.

Jesus, that sounds familiar, lol. Never ceases to amaze me how many bloody sociopaths are out there in business.They’re amongst us.Sounds like a job for MIB 😉

I’m looking forward to the 26th of October, Windows Phone release day.

Definitely. I haven’t been in one their stores but will take a look soon.

Great Article! I have experienced this with my own businesses, and find it difficult to understand why several fund investor teams seem to miss this completely!

for avid readers, see more in the books Good to Great and/or Built to Last

Great suggestions Reece

thnx @fredwilson:disqus@carl_rahn:disqus Good to Great is solid. talks about companies that make a change and sustain the improvement. lots of pithy takeaways per Collins’ usual style

Built to Last is very good. Not read the other one – now on my list; am off to the library later today – good timing, ta! 🙂

Change is the most constant thing:“It is not the strongest of the species that survives, nor the mostintelligent, but the one most responsive to change.”Charles Darwin

That’s why Darwin is one of my favorites

Ditto. That’s why I’m always dipping into my wife’s books – her teaching ethology and all thing related is very useful to me, and relevant to all facets of life and business.

Evolution will show you all the answers. The better you understand it the better you can predict where everything is heading.In fact all answers already exist, it’s finding the questions that many of us strive to do.

That’s why I build a system to teach the Tree of Life.Navigation of that should be as important as grammar in schools.

Ooo. Is online?

Not yet. We are busy refining before app begins build in a week. Lining up top institutional partners to have some logo bling in the app store. Will be for iPad.There are many products too which will be licensed. They work with digital system.

Cool. Anywhere I can follow / add email to to get updates?

Yes, connect to me on engagio.

@mattamayers Panterosa is referring to using the Send Internal Message on Engagio and you can reach her that way 🙂

Thanks, William, for the clarification. I sort assume most people know about that feature.

It has been available for about a month but I only blogged about it yesterday.

congrats: tell us when the launch happens!

Sure thing!

I found it a beautiful system to study many dynamics.

Yes. Wondering with the comment above on revisionist history if you read Wonderful Life by Steven Jay Gould.

Yup…back to the animal instincts that Fred referred to last week. It’s a jungle out there, literrally. Only few startups will be assured longevity.

Nice connection. Also reminds me of #metainstability

reminds me of #myinstability 🙂

I think too often we confuse survival with success too.

Which is so confusing!!! You made it….but why??

There is a never a silver bullet- ever. That’s why you need an AK-47 full of bronze bullets.

Indeed

I love everything about this; you couldn’t have picked a more resilient rifle.

Aye, lol. There’s plenty of silver-tongued bullshit out there, though…

If bullets were made only of gold fewer people would get shot.My aimless and irrelevant thought for today.

If politicians had to do a tour of duty very few bullets would ever be shot.

Right on, Brother Carl.

i was really excited for this class, as the “be in business forever” bent felt fresh compared to the quick-win mentality that i currently feel is omnipresent.but maybe its just me, but it’s not living up to the fred standard.the first post amounted to “think long term.” the second one says “adapt.” it might just be me, but these don’t feel not-so-fresh — everyone says these things, and they’re pretty much common knowledge. moreover, they feel a bit obtuse when something more pointed and specific would be more inspiring… or at least more unique and ownable to the fred brand.my favorite fred / avc content:- the behind-the-curtain ways of calculating “startup math,” like the employee equity formula, etc. these lessons fill a gap in startup education because everyone else is usually so vague when it comes to how to calculate stuff, which is a skill people need to acquire.- the nerdy research reports, like last week’s USV education report, or posts you’ve done highlighting the research of professional academics. i find the “fred brand” to be more academic in its approach to thinking about the web, which i like, and when you get knee-deep into research it gives a perspective that is unique and can’t be found on the other blogs.- the anti-establishment posts, like “defense of free”, etc. the startup community has (what i think is) an unhealthy habit of looking for the quick win instead of doing what’s right… and then talk themselves out of things like free, choosing short term gains over longevity. spelling out why this is bad is both educational and good for the community.i *think* this class was supposed to be in the vein of that least bullet point. but as i read today’s post about adapting, which everyone knows they need to do, and the common knowledge examples of Microsoft and RIM used to illustrate it, i’m hoping the rest of this class will incorporate some of the classic, ownable, differentiated fred material that i love… and i think others do, too.

in defense of last week’s post, and in an effort to clarify what i’m looking for, the most powerful thing for me last week was the notion that ROI isn’t the way to calculate success. that was unique… and i would have preferred a whole post on why, and alternative methods of calculating long term success.

You may be unique, Brandon. A lot of early start-ups companies I talk to don’t seem to realize you can indeed run a business for a long time and that can be a good thing, too. We over-glorify quick wins and fast growth in the tech community.

hm… thanks for the perspective.

I think you are right, Elia. I am definitely not an expert on running a business. However, I’ve seen a lot of businesses up close — and the ones I don’t see up close, I have a certain type of outsider’s vision that lets me see more than meets the eye. It is surprising how much seems as though it should be so obvious but isn’t.I know it is easier to see things than to do something about it — so hats off to those who are out there in the fight!!! But awareness is a good starting point — and check-in point — and it seems that this course will lead to awareness that we didn’t have before, for some of us.

I accept the criticism but I’m not sure I can fix the problem you’ve articulated. Nobody bats 1000.

as elia pointed out, maybe its just me. i’m also jetlagged and cranky. :o)trying to be helpful nonetheless…

it is helpful. i have not felt totally at ease with this class for a number of reasons.

It’s The Holy Grail stuff, Fred.Quite a challenge!

I think the class is going quite well, mostly because of the opportunity we get to ask you questions and possibly get direct feedback on our businesses. It’s also extremely informative to hear you weigh in others’ businesses and to read their business models.I would bet money that most of us who are participating would take the class no matter what you titled it. So, you know, you’re kinda like the Feynman of start-ups at this point ;-)I did struggle to see where the long-term decisions were coming into play while filling out my canvas. So maybe there’s some enlightenment to be had here – that there *are* decisions I’m making now that affect my start-up’s long-term prospects that I’m not recognizing.In some ways, a lean canvas might be in conflict with thinking about the long-term, since lean is about thinking about what’s working right now?But if I was only allowed to convey one thing, it would be, “don’t sweat it.” We are all enjoying the hell out of the class and are really grateful you’ve chosen to use your time to do it.

I sweat everything unfortunately

I still don’t think Microsoft or RIMM are good examples of long lasting companies. IBM maybe.

Adaptability and properly sensing competitive threats is key, and many startups will get killed because they missed this.Are they examples from the startup world that you can think of? I think they would be closer to home for many of us.Second point, also a threat for startups is when they settle into their “metrics comfort zone”, and start to rely on them solely, and forget about their gut feels to innovate or wrongly assess the competitive threats that arise.Evolution is never a straight line. There are breaks on the upside and on the downside. Be the one that makes the break, not the one that the break is imposed on.

SWOT analysis is always – still – a good one to revisit, regularly. But, nowadays it should also somehow incorporate the Zeitgeist. That’s what seems to make/break many startups – and legacy companies – more and more, of late.And it’s a damn hard one to pin-down!

Good old SWOT. I had forgotten about that. We used to start with it regularly. I just noticed the Canvas is missing SWOT. Thanks

I’m not a fan of SWOT, or at least not a fan of SWOT-done-badly. It tends towards “our weaknesses are our strengths, our opportunities are our threats”

Hmm….I’ve never seen it interpreted that way. It’s a serious exercise. Same as the canvas. The benefits are two-fold: a) the thought process it forces you to have, b) the resulting actions that ensue.

Ditto.

Hmm….I’ve never seen it interpreted that way. It’s a serious exercise. Same as the canvas. The benefits are two-fold: a) the thought process it forces you to have, b) the resulting actions that ensue.

I’ve seen some – well, too many – very lightweight crap ones – maybe you have only seen those, lol ;-)I have done many very thorough ones – very illuminating exercises, when done right – and if acted upon.

SWOTs performed by third parties (even if those third parties are paid) are much more effective in eliminating post-analysis fallacies that very often occur (e.g. That’s not ‘really’ a weakness because…)

just humble suggestion to rename the course: “How to stay in business forever (without lobbying and regulations)”

🙂

“Given how hard all of this is, you might wonder if you really want to stay in business forever. The answer may be no”.This, the Microsoft example, and me recently upgrading space (all Landlords setup each of their buildings as separate entities) made me think maybe the answer is no. Maybe if you have a great cash cow its good to milk it and then use that cash to start other completely separate companies. The double tax on dividends makes this tough, but the upside is you really can have creative destruction.

“Maybe if you have a great cash cow its good to milk it and then use that cash to start other completely separate companies.”In an ideal world you would be able to use the cash cow and effortlessly expand into other areas. But I think that attention and time wise it’s probably very difficult to do this in practice without absolutely rigid discipline. Thinking of all the time and attention something new takes, it’s hard to keep your hand in several pots. Of course it can be done but like climbing mount everest or running a marathon it’s certainty not low hanging fruit.

My take on this is that Sustainability is mostly a function of the firm’s innovation IQ. What most firms fail to appreciate is when it comes to innovation, 95% of the firm does what brad feld coined grin fucking. Most employees grin and nod when it comes to innovation. This is because it takes an exceptional mix of talent, including technology, business acumen, and creativity. Moreover, this mix must be swirl 24 hrs a day. Collectively, this a a rare combination of skills, knowledge and desire. (I worked as an engineer amoungst the best and brightest in the aerospace industry and even there is was very rare but made up for with huge R&D budgets and oligopoly power). When you have this capability in house, sustainability, either through internal innovation or as in ibm’s case, m&A of data analytic companies, is like picking low hanging fruit. P.S. Long posts via a cell phone are not fun.

“Finally, you cannot be in adaptation mode all the time.”It took me a fairly long-time to snap out of this the first time. It’s the creative side of me that likes and sees things evolving – and my mind doesn’t stop until it’s found and understands the extremities. What the phrase above really highlights is that it’s creative vs. execution, and so it’s really keeping in mind that staying competitive, scoping out the world around you, etc. is all apart of execution.

And there are times when the company is in such a strategic box that there may well be no possible successful outcome. The ideology of rugged individualism whereby if enough effort is made a good outcome is assured does not change the sad reality that companies, like species, do not have a right to exist.

(Sorry for the long comment but it’s on topic.) I’ve run my software company I started in college for 16 years. It hasn’t been on purpose. It just so happens that I have a vision that has yet to be satisfied and I keep trying to achieve that vision.The last few years have been brutal as the market (mobile computing) completely collapsed then re-birthed from the ashes. Our successes were built on partnerships and in the re-birth, first those relationships became harder because control of the industry moved to carriers and then the software side was completely (I don’t have the right word) gutted by Apple. It’s not possible to sell software the way we used to and at the sustainable prices we used to.I’ve spent the past few years trying everything with the old products to make them sustainable again, everything from different business models to different partnership strategies to different product mixes. All we wanted to do was give us a baseline so we could focus on new ideas to achieve that vision. We have never been able to do that. But we have a unique new perspective and pursuing it fully. I said to myself that if this crashes and burns I’d rather do it making the transition then trying to revive the old, although the gravity of the old product is very strong and powerful.Two lessons as we attempt this that Fred doesn’t mention here but are critical. 1) We may not be able to take the old customers with us. This is very hard because these customers LOVE our products, literally carried decade-old PalmPilots to use it. They are a huge pull. But the market has changed and the old product doesn’t work anymore from a revenue/business model perspective. Old customers are a glorious and horrible trap. Learning from them without giving in to their wishes of a better old product is extremely hard.2) The worst part of making the transition is the psychology. It is hard to explain. It is part grieving process as we deal with old successes dying. It is part fear as we have no idea what we are getting ourselves into. It is part sadness as we said goodbye to 90% of the team that got us success in the first place (from 13 to 2). It is part bull-headed-ness, obstinance and wanting to spit in the face of everyone who wrote us off. But most of all it is excitement for what the future holds about doing something different that might finally achieve the vision we set out all those years ago and have yet to achieve.At this stage of the game, the lows are really low and the highs are really high, and the true believers are few and far between.

Great comment. Success (on any level) is often *way* more crippling than failure on moving forward.

Great additions. Thanks for taking the time to make them

You are welcome.

Thanks, Elia. Excellent comment.

From what you wrote it seems that you have a product that still throws off cash and opportunity, even if dying. Wondering if I understand your correctly if you could spinoff the operation of that to someone else so that you could concentrate on the next thing? (Or am I confused about what is going on here?)

Thanks, LE. You aren’t wrong. There is opportunity with the old stuff but I keep getting stuffed by Apple’s App Store shifts and can’t maintain reasonable sales to pay anyone. (And we are probably in the top 10% revenue generators in the iOS App Store.) Frustrating to say the least.

It was interesting watching the initial burst of excitement then rapid decay to apathy that surrounded the announcement of PalmOS application support in WebOS. Nobody could really come up with a must have app from that catalog to make it a killer feature on a new Palm device. The Apple economy has followed the same kind of trajectory that the Palm economy did, but on a bigger scale and a possibly longer timeline so far.I had a chance to play with a Google Nexus S over the weekend, it clearly resembles a late 2000’s Palm device in size and feel, while so many other devices are getting larger.

iOS sucked all the air out of the room. webOS had no ability to breath. Plus, Palm f***ed its entire developer community multiple times, acted egotistical when launching webOS, and pretty much shot themselves in the foot. Too bad, too, as I really liked webOS in general.

I have a feeling the best parts of WebOS and B2G will come together for HTML5 on the homescreen goodness. Gecko has really shaped up as a ARM web runtime, it was very slow in the CE days.One of those things I want to see is a Node.js based app development framework, with more of a GL powered scene graph than an HTML layout engine, inverting the browser paradigm and nativising the widget concept. At some point the publishing time for iOS and Android apps will become a significant obstacle for companies chasing the next big thing and a streaming delivery platform will win out. Firefox OS is just beautiful, and, like WebOS, it can easily be skinned by someone with HTML/CSS knowledge to be practically anything you want. You can download a new face every day as an installable XPI, a far cry from ‘rooting’ Android or ‘jailbreaking’ iOS.Facebook’s app on Android is a massive disappointment, the time it takes to launch a toast notification is making it far more likely I’ll switch to something a bit more productive. The attention economy is a killer. Sometimes people forget the role Netscape played in making server push, first with RDF, then simplified with RSS (not by Netscape of course). Microsoft and their partner at the time, PointCast also had a competing platform with CDF.I missed the hangout, and the class today unfortunately, but I should admit that I’ve never managed to reach *any* Google+ hangout. The platform is so far as frustrating as many of the 1996-era websites.Oh, and speaking of an earlier era, cloud-productivity was already being developed with products like Desktop.com with it’s ingenious use of IFRAMEs for building a browser or shell environment, complete with pre-AJAX interactivity. It’s just that the browser had to become a platform and not an Applet host for the dream to be realised.

How are you dealing with the psychology of all of this?

Been very hard, ShanaC. Thanks for asking. There’s a horribly long story in all this, including almost breaking out (had product/market fit before being killed by a partner decision) and revolutionizing an area I care about deeply (6-12 math education). Feeling like I am just about always running out of money even though I have deals for 9 months, which keeps making me feel like I need to do a little more with the old products even though those revenues keep getting worse, doesn’t help. Worried about feeding my family even though I know I’d have another job before my feet hit the ground. A constant struggle between my head, heart, better angels and personal demons.I’m trying to stay focused on the new stuff, which I’m really excited about and believe I can find others to be excited, too. (Every conversation about it at least raises interest. And my story sucks right now!) I keep looking at my two kids (6 and 4) and my wife every day to remind myself what’s really important.You’re in my head now. It’s pretty ugly in there. 🙂

But I must say that your awareness of what’s in your head is pretty remarkable and impressive. I am really struck by this comment and appreciate @ShanaC:disqus for asking the question. This is about as real as it gets. Thanks. Really.

Thank you for saying so. I try to be self-aware.

@eliafreedman:disqus In the words of Teddy Roosevelt: “Far better is it to dare mighty things, to win glorious triumphs, even though checkered by failure…than to rank with those poor spirits who neither enjoy nor suffer much, because they live in a gray twilight that knows not victory nor defeat.”

Great quote. I bet it’s a lot easier in retrospect, though. 🙂

.Inside the head of a warrior. Keep the faith. You can and will do it.See you on the high ground. <<< What Infantry Lts used to say to each other before crossing the LD (line of departure) and to go take some heads.See you on the high ground..

Thanks, JLM. The faith is there. See you on the high ground, too.

Hey, I am like that at times too. Actually, it is good to know I am not alone, and that dealing with this sort of stress is normal

I cannot tell you how much I appreciate this comment and the insights you’ve offered from your experience. Especially the honesty.What you share about not taking customers (hard-earned customers, i.e., gold) with you is powerful. There is agony in that and it goes against all instincts in business doesn’t it?The part about psychology too. We don’t hear as much about that side of it, but I have experienced and observed the detrimental effects of ignoring this, the blind spots it leads to.It sounds like what you are describing is a lot like pruning. It hurts like hell to cut off what you’ve worked so hard to produce but that’s the only way to keep the thing alive and at its most productive long-term. Oh yeah, that’s the point, isn’t it?

Thanks, Donna. I don’t know if pruning is the right analogy. It feels more like grafting plants together to create a new one.

Ah…

.Well played and well done!.

Fred, One business element that has to adapt/stay flexible is leadership in the face of crisis. You should mention this at some point for those who don’t read AVC. The man behind a great example of leadership just passed, and is profiled here: http://www.bloomberg.com/ne…

I’ve rarely signed on to a startup or started my own thing without the intention of building something to last.Shit happens and while some of these companies are around and independent or even functioning within another, i’m batting poorly on the built to last.But I”m batting pretty well on the build value and create wealth and give raw individuals a chance to become rock stars perspective though.We start with the intent of value forever even if the situation is opportunistic. It’s the very rare occurrence where it turns out as such. I think there a value in the outcome even if it is shorter term.

“give raw individuals a chance to become rock stars perspective”It doesn’t surprise me that you do this and the other things you mentioned, Arnold.In @gothamgal:disqus ‘s post today, I was impressed with how a company did this very thing with a person who eventually became an entrepreneur and is featured in GG’s post. I reflected that I think companies would build such better teams if they got better in hiring the right people and not necessarily just hiring the right person for a particular job. I’ve seen companies miss out on so much potential by not being more “investment oriented” in their thinking when it comes to hiring. I understand the needs created by limited funds and pressing demands, especially for a startup, but still it is a pity to see such lost long-term opportunity.

I didn’t read GG’s post. Been time crunched big time.I understand your point of view of hiring talent not hiring matchable capabilities.But there is conceptual smarts and real time needs.Companies need things…mobile. Market development. Whatever. The best is when talent can do that and a whole lot more.Business is a game of course. But market and cash needs are the rules that dictate how it is played.

Yes, I get that.I hope being time-crunched is a good thing in this instance. Crazy here too.

;)I’m spread thin but everything is moving along well on the consulting and on the personal projects.Focus has never been an issue for me. Deep focus across multiple projects and a hands on level is a human challenge!

“The one that comes to mind front and center is Microsoft. By the middle of the 1990s, Microsoft had it all.'””They may be surviving but they are certainly not thriving.””I’m no fan of Msft and I can fully understand wanting to use them as an example of what they should have and could have done.But the truth is that cash machine that was at the top of the world in 1995, isn’t doingall that bad now either, close to 18 years later. 18 years.$250 billion market cap23% profit margin$73 billion in revenue$22 billion in profit$62 billion in cashThis is no Kodak by any stretch. That is probably the gold standard for this argument.

They get a bad rap for past sins but they have made major positive moves in the last few years.Maybe a new face.It’s very hard to change sentiment.

“Everyone knows that the dismissive tone and stance that RIM’s management took toward the iPhone and what it represented was essentially the death knell of a great company.”I think this is the classic case of “some company got a chance to buy Xerox and passed on it, boy what a mistake they made (back in the 50’s or 60’s)”.Not a double blind study. You don’t have any data on the 50 or 5000 other things they evaluated that they could have poured money into that haven’t taken over the world. Just like when HP passed on Wozniak’s work. How many other engineers had products that turned into nothing that HP passed on? [1]http://www.foundersatwork.c…VC firms regularly pass on opportunities (airbnb?) that turn out big. And in that case the risk is much much much less (downside is the investment and opportunity cost, it’s not going to sink the VC firm) than what a company that has had to retool for a perceived threat would have to invest. That said of course RIM did fup here. And maybe this was a particular case where the writing on the wall was so obvious. Or perhaps the iphone was so good there is no way to defend. I’m just pointing out that it’s really hard to look at these things as they are happening in real time and make the correct decision. It all reads real well in business magazine articles after the fact of course.By the way IBM in 1981 with the pc legitimized the pc market by their release of the IBM pc. And they paved the way for clones who were able to undercut IBM because they didn’t have the same attention to quality in product and service. And IBM has been criticized for allowing Msft to license the OS that they had sold to IBM. But like the “happy face” button [2] who knows what would have happened to the growth of the PC business or direction w/o the “mistake” by the IBM execs?[1] (Or as my father used to say “he only tells you about stocks that he buys that he makes money on, not the losers”)[2] Growing up my parents knew the people who popularized the happy button. It was a huge hit. I remember my mom saying “imagine if they had trademarked that”. She was wrong. Truth is even if they had been able to trademark it without a zilliion people knocking off the idea it wouldn’t have grown as large as it did.

I see you doing with your “Office Hours” in a microcosmic way what you are advising companies to do. Adapt. Adjust.Unfortunately office hours conflicts with 6th grade flag football today — in just a few minutes actually. I’m glad the video will be available later.This jumped out at me:”If you think you need to adapt your business quickly, you will need to figure who is in the boat with you and who is not and make the changes you need, particularly on your senior team, to align the team with mission and get going.”Wouldn’t this always be the case, whether or not the business needs to adapt quickly? Seems like having a team aligned with the mission and in the boat would, in itself, be a huge aspect of sustainability.

I must have missed the time when Microsoft was literally printing money. No wonder they had so much cash! 😉

I’ve heard pattern recognition touted as the key skill to seeing what is going on in a business, or market, or person. Can you elaborate on the patterns, besides graphs, which you might have seen enough to have pet names for?

Trend lines

There is a reason only 1 company on the original Dow 30 is still there – GE. Change is hard. + something like 68% of the Fortune 500 from 1965 are completely gone. Including the WalMart of the day – A&P Grocery. Clayton Christiensen has the best explaination, but bad management is mostly to blame.

Wow

Someone I really respect (you will see why if you keep reading!) said this to me, in the very, very late 1990’s:’We really only need pure marketing guys for 6 weeks out of every 7 or 10 year business cycle. The rest of the time, sales can do the tactical marketing.The trick is this: no one other that the pure marketing person knows what events will truly change our market, what to think about / how to think during the 6 weeks after those events and, obviously, to come up with what the right answers are, based on those changes.And, of course, it will take 4 to 5 years for the rest of us to figure out that we missed those events, did not do any long term thinking during those key 6 weeks and are now doomed.”Smart guy – we worked in major accounts for HP and – IMO – his spider sense was telling him that the world was changing under his feet (but maybe not in Palo Alto….).

Hey FredI posted an suggestion at the course page.As everybody else, i would like your feedback on my canvas but there’s 100 of them so it will be impossible for you to pick every single one.But some feedback will be really useful. We could try to assign at least one canvas to each one in the course for feedback so everyone can have an “outside overview” of the work. I already comment on some but will pick another one that has no comments.Could you endorse the suggestion at skillshare?

That’s a great critique Charlie. I guess I am participating in revisionist history

I had an interview with them in Paris at about that time – suffice to say it didn’t come off (I am the nearly man, defined), very (very!) odd set-up, but what the hell, something there worked, clearly. I was also trying to get a partner to do a deal with them in the UK – they declined, said it would never catch on, lol…

Both, actually, lol – Paris for Netscape but about that time was also flown to Redmond for a couple of days/interviews. Very odd experience! 😉