usv.com/timeline

We quietly rolled something out on usv.com a few weeks ago and Brian (who led the effort to build it) announced it on usv.com yesterday.

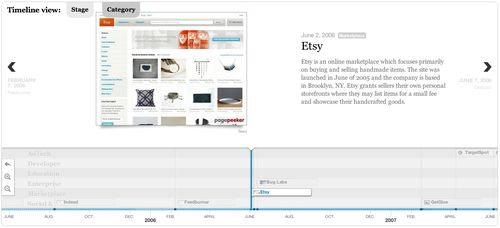

It is a timeline view of all the initial investments we have made at USV since we started investing in the fall of 2004. It looks like this:

I would encourage you to click on this link and check it out because it is a highly interactive experience.

We built this because entrepreneurs really want to know things like "does USV do seed investments?" or "does USV still do ad:tech?". The answers to those questions are yes and no and you can see that live on usv.com/timeline. You can also see what seed investments we have made and what ad:tech investment we have made. And much more.

I would also encourage you to read Brian's post where he explains how he and his colleagues built this:

Zach, our hacker-in-residence and I developed the timeline using an open-source project, TimelineJS. The theme view arranges our portfolio into six investment areas:Advertising technology, Developer tools, Education, Enterprise, Marketplaces, andSocial & Search. The stage view organizes our investments by the stage (Seed, Series A, Series B, or later) of our initial investment. We will continue to improve and update the timeline as we invest in more companies.

I am pleased that we have the talent inside of USV that can take open source projects, hack them a bit, and put up valuable tools on our website that make USV easier to understand. We are going to do more of this.

Comments (Archived):

First to comment!Off topic as usual!I am not a developer so this looks cool to me.https://www.touchdevelop.comMacro App assemblers for the rest of us?Knew it was just a matter of time.Surprised it is from MicroSoft.Necessity is the mother of invention I guess?Is it at the threshold of useful ? ? ? ? ? ?Hope so !

mayor of the thread

hardlybut still an unexpected tasty worm for a little west coast birdie

The early bird gets the worm….but the 2nd mouse gets the cheese.

lol

Not so easy…they have to say something related to the post, not just “first comment”, or “I’m here but haven’t had time to think about it” 🙂

Good point

I didn’t have time to fabricate a connection like:I wonder if something like this could be replicated using https://www.touchdevelop.com to make it more accessible to frontline business and political operative types. . . . or I might not have made it in the door first!Still no excuses – your right it was a little cheesy !but then again my standards are low as I am an interloper here.

Cool. Imagine if government/corporates did this…

Transparency for the win, Carl!

Yes ! Yes! a library full of useable public and corporate visualizations!Interactive online campaign ads making the case for 2016 !

Yes!

On the government side, that is why we need to accelerate the release of government data sets.Open data sets do two things. One, they lend themselves to the creation of apps or other visualizations to manipulate and present the data, which in themselves can be very valuable, like what USV did.Two, they help both entrepreneurs and investors find potential market opportunities and/or test hypotheses.

There’s always two reasons for everything. The one that sounds good and the real one. I imagine you’d get a bunch of “sounds good” stuff instead of “real stuff”.

It’s a great chart and represents excellent transparency. And I’ve said before that each VC firm should do something like that to facilitate a better understanding about them by outsiders.But it’s really a look into the rear view mirror. I’m not sure that past is prologue in this case, because the chart doesn’t reveal the nuancing changes in the minds of the USV partners that will determine how it evolves.How much are we to form an opinion about future investments based on the past ones? (To some extent I’m sure, but the devil is in the details of the moving target)

Great point, William. +1

Excellent point William but honestly, time lines by definition always stop at yesterday! That’s their nature.If someone want’s to know what USV is thinking and what the market may be moving towards, they join this conversation.

wordddddddddd

Excato mundo. The chart is a snapshot. If you want to follow the moving target, come here everyday.

And here:http://continuations.com/I've become a regular at Albert’s blog. A daily dose of original thinking from a different point of view.

Yes. That’s why we need USV.com to show an aggregate view

I’d like that.There are very few communities that juice my day forward daily. Your’s and Albert’s do that.

Albert’s posts are terrific. You can see the PhD training come through in his blogs!!

Ditto! It’s interesting to see how once in a while the blogs come together in weird ways. I wish Albert would post more often though!

Albert is quality.

Couldn’t agree more.With Fred’s blog I rarely read where I don’t comment cause I follow what is of interest and have strong opinions.With Albert, often I’m building background through knowledge and a different point of view. When it surfaces to touch the market I engage.

“join the conversation” nice!!

if you could draw trends lines around this data that would project where we are going

As Arnold said, the conversation here and on the other partners’ blogs complete it.

This a beautiful timeline and site. In stark contrast to Benchmark, another amazing firm with a somewhat similar but broader thesis of investing in large communities of engaged users, USV is trending toward more transparency. Benchmark replaced its site with a page showing contact info.

i didn’t understand that move at all. transparency is at the heart of being entrepreneur friendly.

I have the feeling that a lot of people didn’t understand the move… I didn’t.

Long answer.The model you are using (openness) works for you because you are all in and have some twists on it that make it work. It’s possible that Benchmark and others aren’t willing to make that full commitment and they decided that they might as well do nothing rather then operate in a semi transparent state with possible drawbacks.History wise, in business and especially from what I have seen with investing (hedge funds as one example) people tend to hold things secret and not be open. Over time that has proven to have it’s benefits more than it’s detriments especially with established firms. Apple is certainly one example. I’m sure the wholesalers on the lower east side are not sharing deals they are working on and their ideas with their competitors. In fact, I’m certain they’re not. Walt Disney assembled all the parcels for Walt Disney world in Orlando by shell companies. As the story is told they all flew from different airports so as not to drive up the price of the land. Back in the day one of the important things to manage was salesman who visited your company. Because they were the most likely to move information back to your competitors. Likewise proper management of those salespeople was key to finding out what the competition was doing. Supermarkets can find out how much business a competitor is doing simply by getting the info from the milk delivery driver (since milk is fairly stable proxy for total sales. Source: my cousin who operated supermarkets and did this. I can share this because he no longer is in that business.) I could go on and on if anyone needs more examples. This “openness” thing is something that has come about in the recent history of business. You find out about business not only by reading but by speaking with other business people.There is a case where releasing information to your competitors can have a benefit if it is well placed and “misinformation” that they buy into. This is all strategy and has to be well thought out. People also confuse info that is public and could be found by any means with info that you have to work to get or is handed to you. There is a difference.

i think that is yesteday’s model. i don’t think it has any advantages and i think it is bad.

Are you referring to VC firms or to business in general when you say “i don’t think it has any advantages and i think it is bad.”?

business in general

In any case openness is a matter of degree, certainly not black and white, and where one draws the line is really what people differ on.You can be open and share things with your wife but that doesn’t mean that you will tell her that you saw some other women on the street and found her beautiful and maybe even chatted a bit. (Some men might because their line might be different of course.)In any business a new approach can yield benefits for either an incumbent or an upstart if it breaks some rule and gets people’s attention. Or has some other purpose that fits in a particular situation.The most important thing is to remain flexible and not get married to any one concept. Stating “it doesn’t have any advantages” is not being flexible and recognizing that there are, in many cases, advantages and that it depends on the particular circumstances.I had a customer (right after college) who was studying to be a priest. He told me he did counseling as part of training and relayed a story about a man who went out to drink every night at the bar. I stated very emphatically “well obviously he is wrong – that is wrong!” or something similar. He immediately came back with “well we look at why he is doing that, maybe his wife has certain behaviors that she needs to work on that make him want to leave every night.”.People (and companies) have varying reasons for not wanting to be open. (And you acknowledged this in a post at one point about people’s choice of their handles as well). In fact, one of the top and well respected commenters on this blog JLM chooses not to make his true identity and company name easily available.

True

why?

Such a puzzling move. Their explanation for it on quora (quoted in this Fortune piece) was even more puzzling:http://finance.fortune.cnn….

The timeline is truly awesome. I loved clicking on the different companies. It is nice way to view the progression of the web technologies over the past several years!! Perhaps in the future you can add a link to the original blog post you or USV wrote about each one!

So cool. Overlay a rap genius type annotation tool so your community can add comments, market events, thoughts on the gestalt at specific times, links to USV blog posts, and generally add meaning and it will be even cooler!

feature request shared with the team. thanks!

I like the suggestion about linking to blog posts

#upvoted. i love the idea of crowdsourcing annotations, although it seems like the technical logistics there will be significant given the diversity of external services being incorporated.

That would be very cool. Also, the annotations could be useful as explaining how funding works for similar companies (do search companies get more at series b or c? compared to what?)

it does look like a musical score sheet. perhaps a piano melody playing as it scrolls across, set to an appropriate song. what could that song be?

One other aspect, Fred, that I think would be interesting would be to see the timeline by location in the world. I’ve talked with a few who think USV is NYC only.

great idea.

done! (it’s not live on the usv.com version, but here’s something) http://bit.ly/USVtimeline-l…

+100 for responsiveness and +1000 for hacking speed. Very well played.

yeah. we should hire him!

Letting him go to one of your portfolio companies would be a better move… 🙂

that may happen. it did with charlie and eric

this rocks!!!!!let’s add this to usv.com asapone nit. the map has usv in the wrong place

After Sandy, everything is in the wrong place…perhaps the map has the GEO-location correct and it’s the city itself that is in the wrong place!? 😉

ha!

Or maybe he used Apple Maps 🙂

Nice! 😉

love that idea!

I believe we discussed in another avc post how a timeline would give a good feel as to how USV’s investment thesis has evolved over time. Mission accomplished!

thanks to our youngsters!

“thanks to our youngsters!”Sounds like something that someone who is ready for grandchildren would say.

brian and zander are about the same age as my daughter jessica

Uh oh… Child labor… lol

Looking good. Too bad the screenshots aren’t always up to snuff.

they are dynamic in most cases unless the website doesn’t exist anymore

Love the timeline.The Wesabe screenshot just looks like the pagepeeker element doesn’t recognize wesabe’s css. Maybe due to their security cert.

Is this the golden age of design in startups? Transparency is king

This is not just a history of USV investments, it’s like a mini-history of the social web.

I’m seeing a trend among the top VC firms in the US. Each has their unique andoriginal stamp of extra contribution. This is great.USV – Extrovert blogging partners and hacking technology into VC insights.A16Z – Hands-on team that helps in talent, marketing, research, sales,research.First Round Capital – Technology Platform as a formal support/collaborativenetwork for entrepreneurs.Foundry – Pumping books that help entrepreneurs & startup communities.

these are all new firms that were started in the last 10 yearsthe top tier may include these firms, but don’t forget about Sequoia, Benchmark, Greylock, KP, Accel, etc, etc, etc

OK. But these are the “start-ups” of the VC world. They couldn’t win or differentiate on # of partners or size of funds, so the solution was: INNOVATE! Just like start-ups do.

Khosla is doing a great job of being open too.The site is filled with white papers and in particular the videos from his Summit every year are valuable.My favorite part in preparing something for them was finding on their website a guide to the types of no-frills presentations he likes: he put a copy of the original Sun Microsystems Business Plan, which is quite humble and humbling to see!

yeah but knocking off/cloning a startup he couldn’t invest in is really really bad form

didn’t know this.- but just did a searchlearnstreet/codeacademy – I guess.

correct. really bad form. we would never in a million years even think about doing that. it’s nuts. its about the most entrepreneur unfriendly thing a VC could ever do

Good company to be associated w/.

I would also include Spark ( It seems like both USV & Spark co- invest in deals)

What’s their unique original schtick?

Great observations, William. VC is a service business and needs diffrentiation. Capital has become a commodity. The industry is also evolving: VC’s –> Accelerators (YC etc)–> Platforms (Angellist, Trusted Insight etc)

I have a major complaint about this chart.The music soundtrack overlay is missing. Imagine a 20 sec sound clip when you click on each company:Feedburner – Burning down the houseReturn Path – Return to senderFoursquare – Street legalKickstarter – Kick it up a notchDisqus – Talk talkEtc. I’m sure a co-operation of Kirk Love & Fred would help to produce it.

Ha! Love it. USV, the musical. Now appearing on Broadway (and 21st).

We need it. If I still had my 2 turntables and mixer I would put that together in a couple of hours. Is there a digital equivalent to a music mixer, like an App or something like that? @kirklove @fredwilson:disqus

I would think there would be but I’d rather handle audio stuff on a computer, you know? I heard that there is a good audio mixer for Linux 🙂

brian knows more about music that i do. he could and would do that. but it might be a lot of R&B and Hip Hop.

Great. Trick is to find the 10-20 sec of lyrics that are relevant, & to pick pop songs that everybody can relate to. I did that a couple of times at HP meetings & put people in stitches.Here’s a couple I remember (music please):What’s the competition saying about us? Lies Lies LiesWhat did customer X tell sales person Y after that big order? I pledge my love to you You can imagine the rest

That would be cool. A great suggestion from William

no. just no

Agree that this chart is great. One nice potential enhancement would be to add a consistent “Status:” or “Outcome:” line directly under the company name, so that people could clearly and immediately see what has happened to each portfolio company. You do have the dates and some of them point out acquisitions in the text description – e.g. “Delicious (Acquired by Yahoo!)” but it is not as consistent and accessible a it could be. Nice work!

” One nice potential enhancement would be to add a consistent “Status:” or “Outcome:” line directly under the company name”Agree. Use of colors would also be helpful in conveying this info.

Fred, what is USVs mobile user percentage? Can’t really make out the timeline on the iPhone? We blogged about mobile and mobile first. Did this come up in USV edit.

it looks great on my android in chrome

damn looks like android first

That’s an incredible run!!Would you overlay the fund(s) return during this time frame?

no. because the fund’s returns include unrealized gains/markups that are required by FASB but aren’t and maybe won’t be realized. i don’t like to count my chickens until they hatch.

Can you provide some hatchling numbers?

hatchling?

You said you don’t like to count your chickens before they hatch. After they hatch they are hatchlings. So, can you provide some numbers on the hatchlings?.Sometimes Disquss has a typing delay and some words don’t make it into the post.

Not really visible on my iPhone, but surely will check it out on my laptop later

Lol. That’s pushing it. You want the native app too & a windows 8 version?

Just curious to see it, and since I read today’s blog post on the go… 😛

Ha, we’re going to fix that soon. The switching between views messes up the mobile experience, and we just wanted to put this out there

Cool!

was pulling your leg 🙂

Cool! I really like it.I would be curious to know your exit status too, but you might not want to share. Which of these companies had an exit, and of which kind (IPO vs acquisition)? Which went under? Which fire sale?

we do that on usv.com/investments

Thx

Nice. Still be cool to see it on the timeline.Nothing like an outsider from AVC community volunteering more work for Zach. 🙂

Excellent request.

Nice.I’d also like to see the USV anti-portfolio timeline. Take inspiration from Bessemer;http://www.bvp.com/portfoli…The Google entry is hilariously honest.

I like that list from Bessemer. Well, we know AirBnB’s story & USV.

no, we don’t. do tell.

Short of it. They passed & have a box of cereals from them to prove it.

it’s here:http://www.avc.com/a_vc/201…

That is a great find.In addition to the Obama-Os story that William refers to, I have always enjoyed the story of Larry Cheng’s missed investment in Facebook.http://larrycheng.com/2009/…Of course, post-Social Network, everyone knows Eduardo Saverin now!

good suggestion. do we include the ones we wanted to invest in but lost out competitively?

Sure and for those ones you could show a video of someone throwing a pie in your face. You’d only have to record that once though. I bet you were beginning to sweat on that one.

like this?https://www.youtube.com/wat…

No, we’d want to see you covered in pie, a real one. You could put the pie brand at the bottom of the video. You could sell ad time to the pie companies.

one for the shaving mirror.I don’t normally shave on the weekends, but yes, including the ones you lost out on would be good. there’s the USV thesis, but there’s also the USV discipline. LPs will like that message.

yes. Also, I think defining the anti-portfolio might better explain the direction you are heading in. I’m still curious as to why there are less adtech companies as opposed to marketplaces – I think an antiportfolio might explain that

it would be nice to have a vague idea of how long USV spent looking at each investment before doing the deal.

Even more *interesting* would be to get raw numbers on traction at the time USV started to consider or made the deal…

So an analysis of the investment selection from the mind of Fred the Gadgeteer.

we don’t track that unfortunately.

My guess is it ranges from 1 day to 5 years.

I really enjoyed the timeline as well and it def. changed my perception of USV and seed deals especially.It was also fun to dig into the source code a bit and track down the Google Doc you guys are using to power the timeline views. 🙂

is that google doc public? it is read only?

yes and yes…but it’s also *mostly* hidden (you’ve got to get through a copule layers of javascript and iframes to discover the real URL)…so I think you are all good (I would have emailed you guys about it if not).

That hack sounds familiar :)(inside joke for Fred)

Fred, what did you do to find out what people come to USV for? In other words how do you know what to offer on the new site to be sure it fills visitor needs?

well we’ve heard the questions i mentioned in the post time and time again. so that’s why we did this.

Maybe you could go full-blown nutzo, Fred. Well, I’m not talking like riding your bike in your pajamas or nothing.You could do a fully online live VC funding process site. So, people would start the process for funding and we could all see how things go live. We’d see the application, the requests for more data, the review thoughts and process, then the acceptence or refusal.Hey, then you could put the loser in a dome to fight for their lives. Oh wait.. no.. that’s the Hunger Games.

Now, that’s what I call transperancy.

we can only do what we can do without revealing anything confidential about the entrepreneurs we engage with

I understand that. You should still consider it. It’s easy to leave out information with a lable “Privacy Required” or something. You’d know better than myself. But, I think it really fits your open and honest style.

or do what 60 minutes does and “fuzz out” the person they are talking to

Cool, then when they get killed in the dome you could unfuzz them. Oh wait… that’s the Hunger Games again. lol

You could let visitors comment and get realtime readings on market interest before investing.

like an online version of shark tank/dragons den. i’m totally a believer in that, amazed it hasn’t already happened. i think the incubators/accelerators will embrace that first; their stakes are a lot lower.

“…the incubators/accelerators…”.Those need to be closed down. They don’t do what is needed to build businesses. They are a great place for entrepreneurs to gather but that’s better down as social gatherings. They give a bad impression that its easy and cheap it is to build a business. If people are going *help* entrepreneurs then they should be paid consultants and there should be *results* required of their services..Those are another example of going fashionable and not taking care of the foundations of business. Making it cheap to hack all day and say you own a business really distracts from how hard and costly it is to build a *real* business that is sustainable.

Its hard to argue with YC’s success

Looks great at Venrock we have a physical version in our offices

nitpic – spell error in brads quote on USV in 140 chars or less….

Thanks!!!!!

Just found out about USV’s YouNow investment. Brilliant.

That came out of our failed Oddcast investment so we had an inside track

ok – thats an amazing run…As a company, we use – indeed (found our CTO) / twitter (obviously) / disqus / Flurry (in the next month or so) / meetup / twilio (my favorite) / stack exchange and workmarket.individually, you can add etsy, tumblr, kickstarter and zemanta.this has to be one of, if not the best 6 year run for any VC anywhere.

It has been a good run. But we have to keep running.

looks great. this might catapult USV to the top of the charts for best VC web site. i used to give that award to first round capital, although i’m not a huge fan of their redesign. that might just be me though. their web site is very fancy now and i don’t like fancy things. if it’s ultra cheap and barely good enough, i like it.

@falicon:disqus Are you involved with this? If not this sounds like another good project to hack on 🙂

I’m not involved…just a fan….if I only had a dollar (or the time) for every good project worthy of hacking on! 😉

Perhaps the success of Gawk.it could make your wishes come true. Is there any updates to the business side of gawk.it yet?

On the business side, we are only about a mil. short of making our first million…so we are on our way! ;-)Seriously though – right now the focus is product/market fit (ie. traction and getting installed on as many blogs as possible), team, and product (in that order actually).On the business side, I put out the sponsored results program so that if someone wants they can spend some money with us (and so I could make it clear to all parties what our initial revenue model intent was), but it’s not really our focus at all right now. So I’m not actively pursing or pushing any sales (yet).

Love the timeline! Just curious. Looks like 6 investments and 2 exits on ad:tech. Using the theme of “What has changed” – why no more investments in ad:tech?

I believe the label AdTech is short for Advertising Technology – not ad:tech the tradeshow…

they are not large networks of engaged users

Hard to believe this firm has been in existence less than a decade. That’s a pretty packed timeline.

thats really cool.Being able to re-use open source (and understand the particular license of a piece of open source code) is a required skill for devs these days.

Yep, I’ve been a software engineer for about 15 years. You can also have systems that let people extend and customize them without needing to mess with the original source code. This is much better because a person can update the original souce code in the future providing new features and they won’t break the extensions added by the cutomizer..A much better approach to system development.

totally agree – systems designed for plugins are great. Amazing to see how many really successful open source projects do this.

This timeline page is very very well done. It looks like it includes failures too.I really like the way you did this.