Back in the early days of the ATM machine, you could only transact on ATMs operated by your bank. If you were a Chase customer, you needed to find a Chase ATM to take cash out. That, of course, was a pain and the banks recognized it and formed roaming networks. The one I recall best was NYCE, which was formed by NatWest, Chase, Manny Hanny, Chemical, Barclays, Marine Midland, and Bank Of New York.

The same thing has happened with mobile wifi networks. If you are a T-Mobile Hotspot customer, you can often roam on a Boingo network or some other mobile wifi network.

Roaming is a great solution to the problem when multiple businesses offer a proprietary commodity service. The customer is forced to choose one provider but in effect the service is identical from vendor to vendor.

And that is the case in subscription music services. I have used Mog (now owned by Beats which is rebranding it as Daisy), Rhapsody, Spotify, and Rdio. They all offer essentially the same libraries. The listening experience is almost identical. They differentiate with slighly different user experiences. Some are more social. Some are faster. Some offer better curation. But in my opinion they are all proprietary commodity services and a roaming service that would allow a subscriber to Rdio to log into Spotify would be a good thing for a lot of reasons.

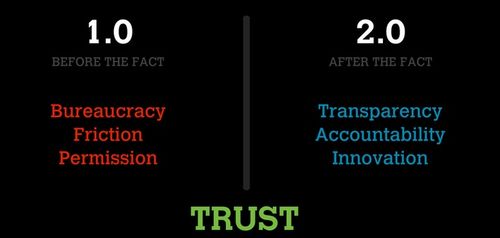

And the music industry really ought to want to see this happen because they are coming to realize that subscription music services can bring in significant revenues. This is an important future business model for them. But they should not make the mistake they made in the mp3 market where they essentially gave one company, Apple, the dominant position in the market. If the music industry came together, like the banks came together to create ATM roaming networks, to create a subscription music roaming network, they would create a dynamic where no one subscription music service could create the kind of network effects that would allow them to become the dominant subscription music service. And that is very much in the music industry's interest.

It is also in the consumer's interest. Just yesterday my friend Kirk found some new music because he follows me on Rdio. But I can't do the same thing with my friends who are on Spotify. Because all of these services are silos, by definition of their paid business model. If a roaming network existed, there would be more social music discovery, listening, and, I believe, uptake of the paid subscription model by consumers.

Of course, a roaming network could be started by an entrepreneur who thought this was a decent business to be in. It does not require a music industry consortium to come together to create this. But regardless of how it happens, I think it should happen. And I hope it does.