Reblog: How To Calculate A Return On Investment

It turns out this is one of my most viewed posts of all time. I guess that’s a good thing. So I’m reblogging it today.

————————-

The Gotham Gal and I make a fair number of non-tech angel investments. Things like media, food products, restaurants, music, local real estate, local businesses. In these investments we are usually backing an entrepreneur we’ve gotten to know who delivers products to the market that we use and love. The Gotham Gal runs this part of our investment portfolio with some involvement by me.

As I look over the business plans and projections that these entrepreneurs share with us, one thing I constantly see is a lack of sophistication in calculating the investor’s return.

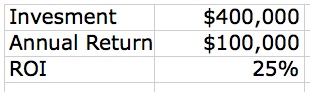

Here’s the typical presentation I see:

The entrepreneur needs $400k to start the business, believes he/she can return to the investors $100k per year, and therefore will generate a 25% return on investment. That is correct if the business lasts forever and produces $100k for the investors year after year after year.

But many businesses, probably most businesses, have a finite life. A restaurant may have a few good years but then lose its clientele and go out of business. A media product might do well for a decade but then lose its way and fold.

And most businesses are unlikely to produce exactly $100k every year to the investors. Some businesses will grow the profits year after year. Others might see the profits decline as the business matures and heads out of business.

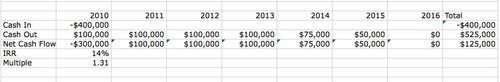

So the proper way to calculate a return is using the “cash flow method”. Here’s how you do it.

1) Get a spreadsheet, excel will do, although increasingly I recommend google docs spreadsheet because it’s simpler to share with others.

2) Lay out along a single row a number of years. I would suggest ten years to start.

3) In the first year show the total investment required as a negative number (because the investors are sending their money to you).

4) In the first through tenth years, show the returns to the investors (after your share). This should be a positive number.

5) Then add those two rows together to get a “net cash flow” number.

6) Sum up the totals of all ten years to get total money in, total money back, and net profit.

7) Then calculate two numbers. The “multiple” is the total money back divided by the total money in. And then using the “IRR” function, calculate an annual return number.

Here’s what it should look like:

Here’s a link to google docs where I’ve posted this example. It is public so everyone can play around with it and see how the formulas work.

It’s worth looking for a minute at the theoretical example. The investors put in $400k, get $100k back for four years in a row (which gets them their money back), but then the business declines and eventually goes out of business in its seventh year. The annual rate of return on the $400k turns out to be 14% and the total multiple is 1.3x.

That’s not a bad outcome for a personal investment in a local business you want to support. It sure beats the returns you’ll get on a money market fund. But it is not a 25% return and should not be marketed as such.

I hope this helps. You don’t need to get a finance MBA to be able to do this kind of thing. It’s actually not that hard once you do it a few times.

Comments (Archived):

Fred–I love the simplicity of this logic here and have shared this post a number of times.In non tech businesses especially, where growth invariably drives additional capitalization to deliver on success, initial investments when successful often drive follow ons. And at least in my experience, the discount on the next round is why some investors are interested even more than the early ROI.

Yes, I have had a lot of bean counters lay out this concept and it ends up like spaghetti.Fred was wise to skip the explanation of IRR!

I agree with you.That is not though what I see from the certified investor side of mid sized seed rounds though.

I had a typo that needed to be cleaned up -iPhone!Can you explain this a bit/I totally agree w funding the first round is about being first in line when it is apparent that Leaning In is required.

This is not so helpful because most tech ventures do not produce cash flow, especially if they are growing quickly. People often forget that a profitable business usually consumes cash as it grows in order to fund working capital and expansion. The “simple” example completely avoids the issue because the business is presumed to end before the 10th year. However in practice, nearly all of the value to a startup – if there is to be any – comes at the exit and nearly all startups funded by VC will seek to have an exit within 10 years. A typical way to handle this would be to add an eleventh column, titled “Terminal Value” and to fill in an amount of lump sum cash equal to what the investor will receive when the business is sold. The sale price of the business is estimated from the financials, for example, 2X the revenue of the company in the 10th year. (The actual sales multiple varies from 2X widely particularly by industry, growth rate, and profitability.)

Fred contextualizes his description of his cash flow model right at the top: “(we) make a fair number of non-tech angel investments. Things like media, food products, restaurants, music, local real estate, local businesses.”My favorite book on this topic is “Valuation: Measuring and Managing the Value of Companies” from McKinsey. But that’s a whole lot of complexity for what is fundamentally a pretty simply concept as Fred lays out elegantly (…and I’m guessing Fred and USV have some complex models they use in their investment portfolios).I’m also not sure the assumption is that the business ends after 10 years, so much as the investment, or at least the investment time horizon being evaluated. And since human lives are finite, having a finite time horizon is important. Perhaps more importantly, these simply models are helpful in evaluating different investment choices. As you point out, this doesn’t account for an exit, but the fundamental cash flow analysis is the essential beginning to making apples to apples comparisons of investment opportunities (a topic the McKinsey book explores in depth). A next step, which I’m sure is probably included n USV’s internal models, would be to add the dimension of risk.

Everything in early stage food or storefront business is all risk. You can quantify it but its really just a swag.More true in centers like NYC where space lease terms are a huge tail of financial responsibility that is unavoidable.

But all businesses carry inherent risks associated to the specific industry and jurisdiction where they operate. In corporate finance you normalize this by identifying the appropriate discount rate / required rate of return for the type of investment. If the IRR is greater than the discount rate, then it’s a good investment. All of this is obviously very theoretical. In reality it’s both art and science.Anyone know what the typical discount rate for a NY restaurant is BTW?

Really well stated.

In corporate finance you normalize this by identifying the appropriate discount rate / required rate of return for the type of investment.Start a business from scratch and hire people to see how much risk there is that in no way shape or form can be quantified in any formula.

Yes – that’s what I was getting at … Fred’s model shows how to create a cash flow model … the next step would be to discount it based on the risk profile on the returns as compared to a “standard” baseline investment — in the theory/academic model this baseline is usually US treasuries. The discount factor – which as your correctly point out can be as much art as it is science – is what makes an approximate apple to apple comparison at least possible conceptually.

It’s not worth the effort.Delta of success too high.

I don’t know, but you cannot invest VC style w an IRR mentality. You can raise that way, …….

Everything in early stage food or storefront business is all risk.Small business (storefront or otherwise) can be summarized by a comment my Dad made prior to my Bar Mitzvah. He said “the cook has a fight with his wife and you have a bad affair”. (Forget that this is a food example btw.).Business (on a small scale) survive or fail based on key people. In a restaurant obviously it’s the chef. In a printing company it’s the pressman. Most businesses have some equivalent person or people. Or several of them. Like the driver not showing up to make deliveries or the truck breaking down. Or a few salespeople with key accounts. Lose them (could be they are poached could be they get sick could be a family member gets sick) (or have those things happen) and you are toast. You don’t have excess money to throw at the problem either. You aren’t Burger King or even the Union Square Hospitality Group. Or perhaps (like my father) you get a large part of your business from key trade shows. Fail to get the show setup or get sick that week and you’ve lost a large portion of your seasonal business. There is a crap-load of moving parts in any business but in what you would call an early stage business any of those moving parts failing can sink that business.My guess is that most investors who have never run any business themselves have no idea at all at how many near death experiences a typical business has day to day or they would be scared shitless of what they are investing in.

Early stage startups are truly insane as you say.And quite wonderful.

The best is yet to come! Wait until you have to deal with collection issues from customers who continue to give you business. Then one day the musical chairs ends and you are left holding a worthless bag.

An endemic problem with all small businesses.Already there.And economy where most everyone up and down the chain is balancing (or not) the books. Fun stuff.

Think of extending credit as a cam eccentric, one of my favorite (and earliest) mechanical devices mastered in business. Needs to be “just right” for pressure and transfer of ink. (The other was the stepper motor, loved the sound of that stepper and solonoids). [1]Anyway, my point:Do a poor job “extend credit where you shouldn’t” and you lose money (on bad debt).But also do a poor job “don’t extend credit where you should” and you lose business.The proper balance is really difficult. Plus early on you are more likely to gain accounts that are poor payers (in theory) since good accounts (who pay well) are kept happy by their current vendors. So you can get the riff raff and you take your chances in many cases. At scale this doesn’t matter as much as long as you don’t have a large % of your sales in any particular basket. The aggravation and anxiety factor is huge. I had some city accounts that paid 120 days but it didn’t bother me since I knew we would be getting the money and didn’t have cash flow issues at all. So no problem waiting.Back in the day (early mid 80’s) when calls came in I would dial up to Dun & Brandstreet by modem to pull a credit report while the customer was still on the phone with a CSR. That way we could see how much to suck up to them if it wasn’t apparent from just knowing the name.[1] Some web presses utilize variations on this basic theme, such as a cam or eccentric roller controlled by a lever that controls the amount of ink transferred to the fountain roller (Cam eccentric in another context for reference to anyone interested).http://www.technologystuden…

Honestly its all over the place at wholesaling to retail.From Whole Foods on one end (really great vendor to work with if you have a brand to bring to their shelves) to people who just use a cc, to people who just pay everything every two weeks to people who do nothing and one a month, you fax a statement and send a courier to pick up the check.Each can be worth depending on circumstances.

For the education of others (I assume you are familiar with this) there is factoring. While it doesn’t take into account bad debts (only advances a portion of the money owed you are still on the hook) it can come in handy for certain businesses for cash flow purposes:http://www.rtsfinancial.com…http://www.newcenturyfinanc…I’m not familiar with any company that takes over either just the non bad debt collection process (making the calls and, um, doing the “pickup”) while still maintaining the delicate client relationship. But it seems that it would be a business opportunity for someone (even if they didn’t take on the risk of bad debt, just to shield you from the day to day collection process).My ex wife (as another example) had to collect advertising costs from her customers (all retail and restaurants) that she sold ads to (her business). She would get a call to pick up a check, show up, and the owner wouldn’t be there or the check wouldn’t be there. And all types “jerk you around”. People with money, people without money, people you trust, people you know, even relatives.By the way another thing to watch out for (land of a thousand stories here for those who like my stories) is the good paying account who you trust that pays well with no issues so you continue to increase credit until one day they stop paying. All a ruse, start small, build trust, then dump.

And of course, when you are bootstrapping, or extending cash, or cutting expenses to address margins which is many businesses, when you have a down month, you are part of the problem when you stretch payments as well.Circle of life.

Numbers mean nothing; assumptions they are based on mean everything.

Fred,Thanks for the reblog…..I am a financial guy and sometimes struggle to explain these concepts to CEOs.I remember one of the MBA Monday’s posts – where there was a discussion ( I think it was in the comments).I think there was a simple metric of $ 10K/head/month.You talked about various / typical rounds w/ Dollars raised, % given up…and it got translated into heads and months post round.Would love to have that re-postedor as Charlie says – Shop talk!

I find it hard to believe you factor something like this in more than the other soft people factors which I would guess make up 90% of your thinking.So the proper way to calculate a return is using the “cash flow method”. Here’s how you do it.Other than the fact that you obviously do this and have done this (and we can assume you make money from this) I don’t know how any formula or spreadsheet can be used when it is totally based on fictional business plan numbers. Garbage in garbage out. In the end either the idea works and money is made (and the investor gets a part of that) or the business struggles along and does essentially nothing. Like if you have two investments to make and you line them up “ok let’s do this one it will return 20% because the other will only return 15%” I say this doesn’t happen ever.I bought some real estate cheap in 2010 and was making close to (NICE)% return. The market changed for the type of property I have (in this particular case) and I will be happy to get a tenant and get a (NICE/3)% return. Same property in a different area and I’d probably be doing better. My dad bought property back in the 70’s and his returns obviously reflect that. All the calculations were really simple and weren’t made if something passed a certain “return” threshold since there were other things that mattered more (where you thought the neighborhood would go and what the downside was).Moreover:The entrepreneur needs $400k to start the business, believes he/she can return to the investors $100k per yearBelieves? What is the “he/she” even based on? Are the people being invested in doing something that they have done before so they can come close to accurately predicting that they can return anything, let alone 25% or 18% or whatever?

The last two restaurants I worked at took an approach with their investors that is perhaps unique, or maybe common. I don’t have enough experience to know (the other spots I’ve worked at were either self-funded or a managing partner/investment partner model).The money more or less worked as a short-term small business loan. The restaurants paid back all of the money with a nice% return on top in three months. These investors (a VC firm among them oddly) made a quick return, but have a tiny stake in the current cash flow. Granted, the restauranteurs had a track record in the business making this structure appealing. While a track record might not translate to hard numbers it would be easy for a serial restauranteur to peg numbers to previous performance/similar markets, not unlike how models are constructed for tech companies prior to real data. One thing is certain, if you can make a night-scene pop in NY its big $$ fast.I believe they would have retained a higher percentage of cash flow had money not been returned quite as swiftly.

Option thinking.They trust the entrepreneur, feel like they are 100% getting the capital back & everything else is gravy.Seems really smart.

‘I survived Genoa’ever onward!

I for one think that IRR is a dangerous number for the uninformed. The IRR on a project is the single “discount rate” that equates today’s investment with tomorrow’s free cash flows. One of the shortcoming of the number is that it fails to take into account that cash flows (particularly for a startup) are not independent (or IID) year to year. Moreover, IRR really was not designed to serve as an ultimate criterion for making investment decisions. So while IRR measures return on an investment, it does not take into account time value of money, inflation and riskiness of cash flows. User beware.

Always like Net Present Value myself – in a nutshell the value now of making the current decision correctly ( as opposed to alternatives) taking all knowns and estimates into accounthttp://en.wikipedia.org/wik…

Yes, the easy response would be to criticize this model for its shortcomings, but for people unfamiliar with finance this type of thing is very very useful. This goes beyond the investment that one might make in a non-tech investments such as a restaurant.The fact is I used this type of model (far more complex) on every venture deal with which I was associated… Assuming I got to the point where I really wanted to know if the financials worked.Yes IRR has its shortcomings, but the fact of the matter is it provides additional information with which to make the right decision.I will give an example of this. I used a slightly more complex model than this to assist my wife when she made the decision on which teaching job she would take. The jobs started at different pay rates, had different expected increases each year, and the change in rate per year was not necessarily consistent. But obviously, one does not make a decision related to employment on numbers alone. This just gave her a little better understanding from a financial perspective that it might be better to take the job that actually started at a lower pay rate. She then took that information and combined it with all the nonmonetary factors and made her decision. The IRR and the NPV were just part of it. In that sense it had everything in common with every deal I ever did. I didn’t just take the deals that said they would provide the highest IRR. The return was never taken in a vacuum, but just part of the investment decision process.

Hi Fred, you mention the second example “is not a 25% return & should not be marketed as such”.Aren’t all future returns projections? As such aren’t they always guesses? Marketing about future returns may always be subject to interpretation.

Great! thanks for sharing.

The 25% in this example has its own definition in the industry, it’s known as the Current Return, or the “cash on cash” return during a single year of a multi-year investment period.The Current Return can be a useful metric to take a look at, but Fred’s right, it’s a totally different concept than ROI, which is the total return over the life of the investment, including the acquisition cost, all recurring annual cash flows, plus the exit value.For typical VC investments, the exit value represents the bulk of the ROI and may bear little or no relationship to the Current Return of any given year, which may be zero (or less than zero) for many perfectly healthy technology companies during R&D or initial growth phases.

My fiend just asked me “How does Twitter make money?” and I realized I really do’t know. I told him Fred should know – so here it is – has this been discussed online?

Advertising

I am surprised this is one of your “most viewed posts of all time.”