Video Of The Week: Fred Ehrsam's Bitcoin Presentation

Someone posted this video in the comments a week or two ago. I watched it and liked it a lot. Fred Ehrsam, the co-founder of our portfolio company Coinbase, does a good job explaining what Bitcoin is and why it is important in ten minutes, no small feat.

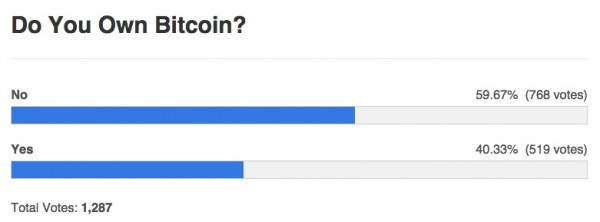

In other Bitcoin news, the results of the AVC poll on Bitcoin ownership are in. 40% of AVC readers own Bitcoin, 60% do not.

I purposely did not tweet out this pool as I only wanted regular readers of AVC to participate. I think if I had tweeted out a link with the headline “Do You Own Bitcoin?”, that would have skewed the results as Bitcoin fans would have poured in to vote.

Comments (Archived):

…custodial sentence for serial offending.is all your bitcoin buying through coinbase?

Bitcoin is a global transaction network is a better definition than the over-narrow one of digital currency.

i see it as a global *trust* network, answering the problem that people don’t trust each other and need reassurance, which this technology has the potential to provide.

Trust has subjective connotations — what makes us trust Goldman Sachs more than Citigroup or Bank of America and do any of the major financial institutions command the same trust post-crisis?Meanwhile, transaction has objective associations. The system *does something for us involving an exchange of value* and it does this on a trans (global) basis.In this case, the trust has to be inherently factored in in the form of:(1.) Technical performance.(2.) Counterparty risk guarantees.(3.) Transparency => Open source.The financial institutions built up the trust over centuries with face-to-face bank tellers and physical pieces of paper.In this digital era, our frameworks of trust are different (e.g., AirBnB model where people let other people into their homes based on one or two reviews) and the time span to establish trust is shorter.

peer to peer trust. institutional trust is an oxymoron in my view of institutions. i don;t think we have a difference of opinion, or perhaps we do. i wait to be corrected.

Branding and communicating anything finance-related that aims for retail market rather than institutional is difficult. With Bitcoin the base of it is its function as a global transaction network layer. The trust element is like a wrapper over or the earth wire within that network.The transaction and trust are intertwined, in other words.

Possible Freudian slip, “bitcoin will grow drastically over the next ten years”.At best he should have used “dramatically” .

yes, extrapolating the trajectory of the line on the graph points to dramatic future growth, and yet i see in my mind an image from CERN of particles colliding, with lines curving off in many directions as the bitcoin ‘identities’ (see above) separate and either achieve mass or not.

Sure Bitcoin/Blockchain form “a global *trust* network”.But their pivotal attribute is their endemic “trust mediation mechanics”.The question is whether those computational mechanics will prove to be bullet proof at a truly ubiquitous global scale.It seems to me that we are still a long way from actually tasting that pudding ?

I totally agree.

My Strategic Investments portfolio at UBS included all the major transaction platforms for the banking sector on the institutional and retail side, so as Fred Ehrsam talked through the legacy structures of counterparties, compliance, settlements, ledgers etc (all implicit markers for trust) it was easy to follow.I’m also one of the few people who drafted a blueprint of all the Electronic Exchange Networks in the sector and how the transactions and settlements flow. Plus my colleague that I shared an office with was one of the architects of the LSE’s Turquoise platform. He’s now its CEO.So I understand Bitcoin as a global transaction network proposition better than as a mere currency.Following the global financial crisis, I did wonder why most of the conversations and policies were around band aid fixes when the opportunity is to apply technology to innovate new systems and instruments.I see Bitcoin as part of that more than the card-reader mobile payment plays.

Actually, Bitcoin has 8 identities (according to me):1) Digital crypto-currency2) Peer to Peer network3) Distributed accounting ledger4) Open source software5) Software development platform6) Computing infrastructure7) Transaction platform8) Financial services marketplacehttp://startupmanagement.or…

Some of these are characteristics, not identities per se, right? IOW, few of them could act as a definition of Bitcoin on their own.

Hmmm….Each one is a separate function. And they work well together.

Yes

As is easy to see with some simple Google searches and as Disqus may already know well, as of a few days ago suddenly Disqus quit working with a significant fraction of instances of the Firefox Web browser. E.g., here at AVC, Firefox 27.0.1, with minimal or no extensions or plug-ins, refuses to show the comments.

Thanks. I forwarded to our Product Support team a few days ago.They couldn’t reproduce any loading issues in Firefox 27. But they’ve made a note of this and will keep an eye out for similar reports.

Those are all valid because, depending on the user, Bitcoin does have different identities. For example, to traders who don’t code and mine it, it is just a digital crypto-currency. To people who are buying digital goods it is a financial services marketplace.In a way it’s like defining what a car is:(1.) Mode of road transport.(2.) Engineering of moving metal parts.(3.) Fuel converter into energy and momentum.(4.) Not a horse or an elephant.(5.) Social status communicator.:*).

exactly.

What’s the difference between open soft software and a sw development platform?

open software — the source code is available to the public. So the basic bitcoin functionality of the block chain, etc., is open software.sw development platform — software to exploit when writing more software; the platform is supposed to be more than just some triviality and, instead, have some significant functionality and likely generality and also make relatively easy and well documented how to write the software for the exploitation of the platform. So, if write software that really is mostly just another way to make use of the open bitcoin software, and, maybe, also make use of PayPal or, maybe, connect with a Swiss bank, then maybe that bitcoin software can be regarded as a platform.

Thanks!

Thanks and of course you are correct.But to the software community at least in my experience that distinction is taken for granted and breaking it in two arbitrary.It’s been 10 years since I ran an open source community but when I was in charge of trixbox.org from the beginng growing it to fairly massive community, that distinction was simply not there.

40% is not a bad ratio compared to the fact that only 2.5 Million people own Bitcoin overall.But even 2.5 Million is not a big number, and we need to see that number jump faster. The growth in adoption is no where near what it can be. Maybe we need to reach at least 10 Million to start to see Bitcoin make a dent in the universe.

Where did you get the 2.5 million figure ? It seems unclear how many people actually own bitcoin but the common numbers being thrown around these days is 6-9 million

It’s a consensus number from here: https://bitscan.com/bitnews…

https://twitter.com/chrisam…

Western Union…oops.

This is a great intro video, thanks for sharing. Between yesterday and the day before I queued up 3 videos about Bitcoin that were mentioned in the comments. Great content crowd sourcing!

Do you have an Android or iPhone? I have an Android App for you that lets you watch videos that you queue up anywhere there’s a TV.

Android. What’s the app?

It’s an “App-in-progress”. You’ll need a Chromecast & a Pocket account to save the videos first. https://play.google.com/sto…And after that, you can try this one to discover/play Internet videos on your TV:https://play.google.com/sto…

Thanks

I love the Chromecast! It’s so useful when the API for it is open for all developers.

Great. Do try those 2 Apps I mentioned, and let me know what you think.

I think both of those apps are pretty nifty, but I’m not sure about the PocketTV one. I haven’t really found a real advantage to just adding YouTube videos to “Watch Later”, and then playing the entire playlist on my Chromecast or PS3.I might be blind and might have overlooked a cool feature. Do you care to explain more?

OK. I use the pocketTV because I constantly queue up videos to watch later, prob 2-3 per day on average. These Apps will evolve as they are beta-ish.

I took the kids to see Guardians of the Galaxy last night and in a few scenes they talk about “transferring units” – their currency transactions. Made me think of Bitcoin.

Nice shiny shirt. Did he get it at a late 70’s vintage shop? (in some throwback thursday photos, I am sure I have a few of those) I think the block chain could become the new supply chain network.

Yeah. I liked his shirt too

he have his dancing shoes on?

On Coinbase website are open positions with problems they’d like help with solving. Here’s how I’d answer those problems.(1.) Product DesignerQ: What’s the first thing you would redesign at Coinbase?A: The pricing chart (see attached example).(2.) Software EngineerQ: What’s the first thing you would build at Coinbase?A: Contextual pricing chart as extensible AJAX slide, pooling in events and news items that affect the Bitcoin price. Then JQuery annotation pods that let users have conversations around price movements. This data behind Hived then being cross-compared with Twitter streams on Bitcoin using SparkQL to pipe in the Twitter and apply predictive analytics on the price and market sentiments.(3.) Business `DevelopmentQ: Who’s the first merchant you would onboard to Coinbase and how would you do it?A: Square because they’re the 13th largest merchant group in the US and Square is making itself Bitcoin-enabled:* https://blog.squareup.com/t…How? Show Jack Dorsey how Paypal is strategizing to use Bitcoin partnerships to collect data on consumer behavior (but not via Paypal wallet) so if Square means to be a better data play, Coinbase may be an interesting option.As it is, I’m passionate about building a network play of my own. A system to measure and share the perceptions that affect consumption and why we say, do and buy what we do.Bitcoin doesn’t have the same implications for Human and Machine Intelligence. Plus my system is what I really want to see and implement in the world.

It would be useful to know the distribution of the amounts of bitcoin held by the 40% as well as the yearly bitcoin spend.

Bitcoin as a federated value operator and missing layer of the Internet (the author uses “link” but I believe layer is more appropriate):* http://techcrunch.com/2014/…

He’s definitely mastered the art of “thought condensing” — it’s all there, in a neatly packaged, well-rehearsed, 10 minute allocution. I’m making a point of learning from it.

If anyone can talk in detail about the Shopify integration, please do.Shopify if you have built on it is the opposite in concept from everything I understand about Bitcoin. It’s locked down, completely inflexible, awful app ecosystem. It’s like waterwings for a business and really difficult to grow with although great to start with.Curious if they are simply a Barney partner or I”m missing something.

change yo shirt boi

It is a good and clear presentation. But I do not think that the potential of decimating financial transaction cost is what the audience needs to be convinced of: it is 1) is it really secure, and 2) when will Bitcoin be a stable currency.The latter not necessarily against the dollar, but for people who transfer partly to a Bitcoin economy (for example a web freelancer receiving bitcoin and use it to pay for things in bitcoin, they should in theory not care about USD/bitcoin value swings)

Bitcoin is the second coming. LOL Perhaps crypto-currencies broadly will be.

That was a waste of time.