Fearful Friday: When Will This Bull Market End?

We are going to do a variation on Fun Friday today. We are going to discuss the near future of the public stock markets, particularly the NASDAQ, where so many of the tech stocks trade.

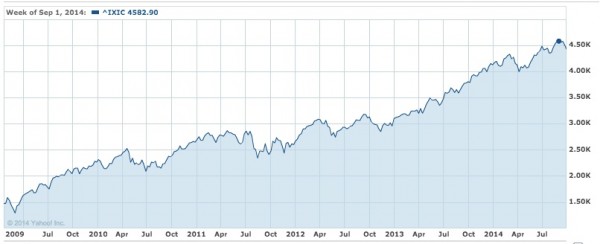

Here’s a chart of the NASDAQ over the past six years.

What you see is a big run upwards since the last downturn (and the election of Obama). He’s been great for the stock markets. If you had bought the NASDAQ on his inauguration on Jan 20th, 2009, you’d have tripled your money in six years. A 3x in 6 years is a 20% compound annual return. Whatever you might think of the President, he surely has been great for wall street.

But I am not really interested in the rear view mirror. What I am curious about is when this bull market will end.

I’ve posited on this blog that rising interest rates will eventually suck the wind out of our sails and bring stocks and valuations back to earth. But we could get a break before that happens. Ebola could start spreading in the US, ISIS could take all of Iraq and Syria, Putin could take the Ukraine and then start thinking about the Baltics. Or something else could happen.

We could do this via the comments section, and I am sure we will discuss this there, but I’ve created a poll so that we can easily see where the sentiment of the AVC readership is on this issue. So please vote away and add any color you’d like in the comments.

Comments (Archived):

I don’t think these geopolitical events would negatively affect the Nasdaq for the long term. Maybe they’ll bring a hicup, but not a halt. I think the technology segment is just getting going.What might be fearful is if something happens to the Chinese economy. In my opinion, that might affect the Nasdaq more severely.

markets are greed and fear. the market price is a function of those two feelings. when fear rises over greed, the markets go down. fear can come from anywhere.i’ve been afraid for much of this bull run. the last time i was really bullish was 2007 and 2008 when everyone was losing their shit.

Agreed, psychology is a big factor.

You probably meant “shirt”, but in this context “shit” works too 😉

You’re a contrarian… I bet you’re almost always “too early”.That’s why you’re a great VC and probably would be an awful public market investor— liquidity is your enemy.Ya I’m also kind of talking to myself.

Didn’t Buffet say something to the effect of: there is no such thing as a bad investment – only bad prices

“There are no small parts, only small actors”- Constantin Stanislavski

Hey William,Here is one of the best blogs on china by Michael Pettis, a Beijing based economist. He only publishes probably 2-3 articles / posts a month, but bar none the best consistent economic analysis of China.http://blog.mpettis.com/201…(haven’t read this latest article of his yet).Short run answer is next decade you should expect 3-5% GDP growth (wouldn’t we kill for that here in US? lol). He has published numerous treatsies and arguments why that is most likely case

Wow. Amazing analysis. I devoured that article. Thanks for sharing it. This point makes you think:”Put differently, the world economy is necessarily volatile, and to the extent that the US tries to limit destabilizing volatility, it can only do so by finding a way to absorb that volatility itself. The most obvious way the US absorbs external volatility is by absorbing trade and capital flow distortions, and the associated cost is likely to be higher to the extent that other countries try to game the system to generate more growth at home.”

If China only has 3-5% GDP, there will be consistent uprisings and instability. They need a lot higher GDP than that.

Depends. ISIS is a bitch. Those guys are crazy. Is the break up of the EU a geopolitical event or financial one? Look at EU bank balance sheets. Lots of non-performing junk assets on them.

ISIS is a puzzle that will need to be solved soon. But you know, the biggest global fears may not be financial related- it could be coming from some virus outbreak that spreads, food related stuff, weather related, earthquake (God forbid), etc. We must look for those as well.

The other side of that equation, however, is that the more trouble the rest of the world is in, the more flight of capital we see come to U.S. markets.For example, foreign money has and is piling into real estate in the U.S. and accepting incredibly low returns and frustrating many in the market because it’s hard to make money. The foreign investors just seem to want to park their money here as a safe haven and accept a low return because it’s better than leaving it overseas.So, the more turmoil we see is undoubtedly scary for many reasons, but it also may send more capital to the U.S. markets and keep asset prices high

Fred, I personally think the stock market is quite over-heated. I didn’t vote on the six month poll because there is no way to know. Best stock market quote was from Benjamen Graham (warren buffet’s mentor) – In the short run the markets are a voting machine and in the long run they are a weighing machine. Point being I am actually more confident saying the market will be BELOW where it currently trades 5 years (potentially 10 years) from now, but that could happen in 3 months or could take up to 24 months to correct in my opinion.Lastly, I wanted to challenge / propose an alternative theory on interest rates. The ten year treasury is around 250 basis points (2.5%). Again, I would be surprised if any time in the next 5 years it goes above 300 basis points, and in fact its more likely that it goes below 200 basis points.Japan (the only other major OECD economy in the last 30 years to be where Europe is now and the US is sort of headed), has head sub 200 basis points on 10 year for at least 20 years or so I believe. Also, most of Europe is sub 200 basis points. There is VERY little risk of interest rates rising… more likely case is cuts as a result of debt write off (world has about 40% of GDP too much debt… you could argue more … so about $30 TRILLION needs to be written down over the next decade). Now, we know how hard it is for politicians to let ANYTHING painful happen, let alone $30 trillion in write-offs. The likely result will be “write-offs” through surpressed interest rates for probably at least a decade.. maybe 2. This is what Japan has done since late 1980’s… and also reason they are at 240% debt to GDP (just on GOVT. debt.. before private sector!)Apologize for the long comment… but kind of an area of expertise and I wanted to share some thoughts and get some reactions

apologize????this is the definition of a great comment and we need more of these.thanks for stopping by and sharing your views

Hey thanks Fred. Been lurking on your blog for a while. You and Mark Suster are in my opinion the elite class in the venture blog space (your life goal right? 🙂 ). So really appreciate the comment and will definitely speak up a little more going forward.

I see your point and know lots of people that have lost a lot of money rolling interest rate puts. There is a great book, “The Rotten Heart of Europe” and if we see a break because of pure finance, I think it starts there. The EU is a political organization that cannot really control it’s countries.

Maybe. That is one thing that Pettis talks about (definitely check his blog out). SO I may butcher it.. but her is why I don’t know that is true. (this is my summary of pettis and my own thoughts.. I may be wrong). Most of the reason for china’s insane growth last 15 years has been infrastructure. Like literally 50-55% of GDP (even japan in its glory days of the 70’s and such was never above low 40%’s I think). Point being, this suppressed the wages of the chineese households. So, IF, and this is the key, the Chinese leadership rebalances you could see 3-5% GDP growth, along with 7-10% personal income growth… and lets be real.. people don’t riot over GDP. 🙂 But they will over income

Matt – great stuff today. 2 questions:1) Deflation – which is where we seem to be headed – in the rest of the world affects China how?2) One PoV is that geo-political issues are decoupled from financials at the moment, as we go through a unique period in history where major economic units integrate (1950’s Europe & USA was another). How does that affect things? What happens when that is complete (me thinks bad things)? Isn’t that why Putin is pushing so hard for Russian interests (b/c he knows he can do so without retaliation right now)?Oops, more than 2.

Thanks first of all1) I think deflation / very low inflation hurts china in the standpoint that it makes less purchasing power for the goods they assemble and export. Their goal is to move “up the value chain”… to actually start producing the computers / physical IP (not just assembling).. to be a player in pharmaceuticals etc. However, I am skeptical because all the businesses I know / briefly interacted with (mainly fortune 500) don’t trust putting real intellectual assets in China because they simply steal everything. Overall, I think China is in trouble UNLESS they can adjust and deal with the crony state businesses. I remain skeptical.2) Not exactly sure I follow the question, but maybe this is on lpoint.. Biggest geopolitical issues are middle east based in my opinion, and I personally think that 20 years from now middle east will be a much more free / open place (all relative here)… and that actually bodes well for stability in the long-term.. obviously short-run issues. In regards to Russia I guess its mainly an issue of Putin trying to grasp / retain power and influence over Europe I think… but he messed up because he proved that he can never be trusted.. and Europe (especially merkel and Germany now knows). Big play here is if this leads to LNG plants from US to ship nat gas to Europe. I think this is officialy and unofficially in the works

Also worth noting that Japan’s Nikkei 225 is still well off its ~1990 peak.

This is a cultural problem more than anything. The children of the “other” great generation (japans industrial pioneers post WWII) seem to have the motivation of a bear in hibernation.

Japan in many ways (e.g., unemployment rate, life expectancy, infrastructure) is doing better than we are. Stock market returns don’t tell the whole story there. Or here, for that matter, where, despite the current bull market, the middle class is poorer than it was in 1989: http://wapo.st/1pGn4xf

This is definitely an equity bubble.

Ok, you asked for a reaction.You say that the stock market is “overheated” and that prices will be “lower in 5 years than they are today”. Yet, you give “NO’ support for your prophecy. The only clue is your low interest rate forecast (which would, keeping all other things constant, drive asset prices higher not lower).If you believe in innovation, and believe that innovation correlates to improvements in productivity, lower energy prices, and lower labor demand, it sure is hard to be a “bad news bear’ going forward.The impact of the technological revolution in the E of PE have just begun.

Ok, well two main reasons I think that the market will decline:1) Valuation: Based on the CAPE Shiller PE (basically a ten year P/E ratio) we are currently at raound 27x (with average being 14-21), and only other time higher since 1970 was in 1999-2000. So, to get to normal that would be 25-50% decline. Obviously not decisive but one major reason2). Corporate profits as % of GDP: Currently 11%. Historical range is 4%-7%. Again a case where 30%-60% declines COULD be in the works. your point on interest rates is huge. SInce there really is no good alternative in bonds… that may be the one factor that makes the decline take longer to happen or perhaps not happen. I think the two valuation and profits metrics support my 5 year assertion on total market valuation

Relying in the Shiller Trailing PE ratio is like calling balls and strikes from the bleachers. Follow Schiller and you would have missed the Entire 2008-2014 Run.As for Corporate Profits – Only a bad news bear can argue that the market is overvalued because companies are making too much money in the new global economy.Technology drives profits and so do 1 billion or so new global consumers (just ask APPLE or GOOGLE).

On shiller metric there is some validity.. but again.. every bubble goes past fair valuation. That would be akin to saying that shillers housing ratings wouldn’t have been useful in 2006. Hosuing was overvalued from 2002- 2007 .. so that does not really say much. Again, that is why I say it would take 3-5 years before I would be certain for a material decline.And on the profits front, the basic tenants of capitalism is that it tries to compete profits away. Sure, with all the corruption and lobbying power of the wealthy companies you could I guess argue they will have profit margins TWICE historical norm.. but actually technology and free information should make profit margins LOWER.. since competition and new businesses should be easier… again.. that is where political corruption leads to inequality.. but myself and my company will do a good job (small or lareg) at competing it away 🙂

The myth is that technology through capitalism drives down margins. But the facts get in the way of that myth. Technology seeds margins and monopolies. The S&P 500 could conceivably end up being made of companies having the Margins of Apple and or Google.

Not sure I agree with you, we are at a watershed moment where the Power Law nature of the networked economy is starting to kick in, this means it will be really hard for “competition” to drive profit margins lower until the incumbent continues to drive innovation and value. Refer to Peter Thiel’s Zero to One book, we are not talking about those monopolists who got to seek rent because they were wrestled their way to monopoly power, we are talking about those companies that are building such a great product that their customers vote with their feet and with network effects they will take majority of the market. Think Google, they are a monopoly in Search, think Apple, they are a monopoly in High End Mobile devices. Amazon and Alibaba more or less will take a monopoly on online sales. Therefore when we move into the world of Extremistan of Power Law, Averages don’t work they are not descriptive statistic of anything. Averages don’t matter, because it would be like averaging the wealth of Bill Gates and everyone else.

you nailed it

companies are “making too much money” because they aren’t investing in growth. They have cut capex and fired people and are dividending the money out or buying back shares. Anyone who thinks that these kinds of profit margins are sustainable “because technology!” is deluded.

It is difficult to generalize here, the question to be asked are 1. does more Capex bring more innovation? or 2. Does having more people bring more innovation and a definitive future? I agree that if companies keep hoarding cash their balance sheets would crumble on their own weight. It is encouraging to see the number of startups communities cropping up all over the place that means that a small group of people are willing to take the plunge to see if they can solve a hard problem not specifically in Silicon Valley or New York.

If you want more rationales for the bearish view, from a super-smart investor, see John Hussman’s market commentary (Hussman is a mutual fund manager with a PhD from Stanford). Actually, you can see any of John Hussman’s weekly market commentaries for the last several years.And that’s precisely the problem with market predictions: even the smartest investors aren’t very good at them. With that in mind, I came up with a tool last year designed to enable investors to get decent returns in good markets while crash-proofing their portfolios in the event of a bad market (more on that tool here: https://portfolioarmor.com/… ).Now I’m in the process of backtesting it to see how well this tool and the hedged portfolios it generates would have done over every time period from the beginning of 2003 to early this year.

.I agree more with you than you do with yourself. Great stuff. Well played.JLM.

As long as interests rate are this high, why would the run end?

Did you mean low? Just curious… they are pretty low structurally. If not.. why do you say they are high?

Great comment. Here is the only question? Your underlying assumption is that governments can control interest rates. If that is true you are right that if that is the case there is “VERY” little risk of interest rates rising.However, what happens if a government like the U.S. cannot keep interest rates low. Yes they can buy their own bonds to suppress the rates. But what happens if somebody like China dumps bonds at very low prices (means rate is high) and people lose confidence and start dumping.This is what always happens at a crisis: a fundamental value gets overturned. Housing prices will never drop, etc, etc.

Sure it does assume that. But I think ample evidence that the US can. Our current debt to GDP around 100% (80% or so publicly held.. which is still a misnomer I think due to fed’s balance sheet which could swap mortgages for treasuries as needed). Bigger point is Japan is around 240%, and they have had the lowest interest rates for the last 15 years.Fed can monetize with few consequences… not sure I think that is good policy.. but as long as you issue your own bonds in your own currency and you are good.And lastly, the US is still by FAR the best major economic unit out there (Germany has some brief case.. but they are very small compared to us). Europe overall is way worse structurally.. and Japan is in decline. We are the healthy horse in the glue factory :)A little bit of a rambling response.. but I hope it sort of addressed why I think they can control interest rates for forseeable future (10+ years)

You know what they say assume stands for makes an: “makes an” ass “of” u & me.I agree in general but it is those black swan events that cause massive dislocations. I agree with your assessment and unfortunately think there is additional downside risk due to these type of events.

why stop at 6000 when the powers that be could decide to invade Venezuela and push the mark to +7000.the foreign policy technocrats need more headroom.

In 6 months from 4500 to 7000? That’s not headroom. That’s stratosphereroom.

US foreign policy technocrats have ambition unbound, and a lust for controlling ever more of the world’s essential natural resources (think russia). pyramid economics.

Our world is a lot more antifragile. This means we can handle uncertainties & shocks better. I like what my friend Nassim Taleb recently said: “Rather than naively fooling yourself into thinking that you can predict, you should focus on building systems that can handle unpredictability.” “You might be able to predict the weather tomorrow, but you cannot predict the outcome of stock markets, wars, diplomatic negotiations, or things like that. So based on that, you have to completely change your approach. Rather than naively fooling yourself into thinking that you can predict, you should focus on building systems that can handle unpredictability. By not accepting unpredictability, you are doing something wrong.”Fascinating read of a recent interview here:theglobalobservatory.org/in…

and for startups, that means getting profitable or close enough to profitable that you can cut a bit and sustain yourselffragile is out of control burn ratesanti-fragile is profits

100%. I loved what Danielle Morrill recently said, that it’s important for startups to “flirt with profitability”, i.e. to show that you can be profitable if you wanted, while you are still funding your growth (if you’re at that stage).If you look at the great large companies we admire, -Nike, Microsoft, Google, etc., they all became great by being regularly profitable. Even Amazon keeps flirting with profitability, because they can.

Horses for courses.Some ideas need to have capital sunk into them.Finance people typically know the price of everything and the value of nothing. They also specialize in herd dynamics.Know your deal and what it takes is a truism. Everything else is hot air.

“Finance people typically know the price of everything and the value of nothing.” That’s a quote quote. True.

spot on. dependency is fragile, sustainability is anti-fragile.Creating long-term dependency is one of the worst sins.

interestingly enough, co-dependency is the highest form of anti-fragility.Much less fragile than independence.

I have always agreed with this, in almost all cases you should somehow be able to see your self to close to breakeven with the cash you have raised.Where I disagree when you say Obama has been great for the stock market. I am not saying that to rip on Obama. I am saying that he has no control unless he is purposely doing things to make it go up.That is the biggest problem I see. If our government (both sides) somehow think they can take credit or blame for things they should not control. You get some huge out of whack behavior.That behavior in the long run is a huge waste of resources. There should be a concentration of executing what they can control for instance sensible regulation on things like the stock market and anti-trust laws, but they should try not to goose the stock market.You just see this on a smaller scale with start-ups. You can do absolutely everything you can to execute and increase adoption. But you do not control the market. The burns you see are no different than the government trying to throw money at a problem to get the result they want. You throw tons of money at a market and think you move it but all you really do is get marginal adoption that will go away really quickly when you stop throwing marketing stimulus at it. Now the pendulum usually swings past the normal into the negative and you now have the whipsaw because it is worse than it would have been and you are saddled with the debt/capital structure of a much larger market along with the cost structure to boot. So now you get hit with the double whammy.

Amen. Think big…but build for durability.

“Rather than naively fooling yourself into thinking that you can predict, you should focus on building systems that can handle unpredictability.”Is this another way of advising for more risk aversion?

I think in Taleb-speak, he prefers risk resiliency, i.e. built into the system. You cannot avoid risks, but you can be better prepared for it.

Hi William. You an not predict stock prices, but you can be pretty sure blue chips that pay dividends will continue to pay each quarter and increase dividends each year.The dividends (payments for your stake in the business) are the system that can handle the unpredictability you mention.An idea is to make your big money with your startup/ business, then turn it into stable, growing cash flows.

Jim – I like the idea of horizons of reliability.No Wall Street PubCo stock picker had gone longer than (I think) 13 years of beating the market. And, amazingly, when they miss, they give so much off their upside back that you end up behind a Vanguard spider.So, how certain is the first question?How far out is the certainty a certainty is the second?

Hi JamesI don’t think you need to beat the market at all times to do very well. And “losing” less when the market is down sure is nice.If you have a stream of dividend payments coming in from great companies- you are not trading, so a downturn doesn’t effect your payments since you are not selling and prices return and increase later.Thanks

Right, but I just listened to this guy – https://www.linkedin.com/pu… – tell a room full of people a lot older than me (late 40’s) that ‘the 6% return they are looking for’ is being rigged out of the system.Its more like 2-3 and after inflation its more like 0.And, the bond market is more fragile than ever.So, you are right about the dividends. But, what is the horizon of certainty?I reference my wife’a career too much, but the oil business likely still has 30-50 year horizon. Ot maybe it does not?Who knows these days…..

But the US system is more fragile than ever.Its unbalanced.The management of the system is small and insular (certain schools, certain income brackets).The system no longer functions, at least in DC.The only saving grace for the US economy – becoming energy independent by fracking shale gas and processing crude from AB & Venezuela) – is a political third rail.#concernedCanuck

The article that was shared here was a great read on the US economy subject: http://blog.mpettis.com/201…

I’m not sure how you come to that interpretation of the article or the book. I have not read but here is a NYTimes quote: “In Mr. Taleb’s view, “We have been fragilizing the economy, our health, political life, education, almost everything” by “suppressing randomness and volatility,” much the way that “systematically preventing forest fires from taking place ‘to be safe’ makes the big one much worse.” In fact, he says, top-down efforts to eliminate volatility (whether in the form of “neurotically overprotective parents” or the former Fed chairman Alan Greenspan’s trying to smooth out economic fluctuations by injecting cheap money into the system) end up making things more fragile, not less.”In the article: “Second, systems that are highly concentrated or centralized cannot handle unpredictability. Generally, you want the army to be centralized, but nothing else”The amount of centralization that has gone on in the government and the banks is huge.As is pointed out here due to zero interest rates there is also huge leverage in the system.This is no different than what happened in the housing market. If you have participants that can pull down huge amounts of money when the are right and not lose any of it when they are wrong. When things are going well they attribute things going right as their knowledge. When things go wrong, there are huge explosions. Taleb says that you can not predict many things.I would agree with that except I would say the most dangerous person is one that does not know what they do not know. So I think people think they can predict when they cannot.I cannot predict. But I can observe. And what I observe is not different than many other times except since interest rates are so low, you have people chasing any return and people that can borrow having huge leverage to make a return. Both of those are not anti-fragile. Anti-fragile is when bond rates are high enough they compete for capital right now just not the case.

I should have specified “tech/startup world”, not meant world/countries in general. You’re right, Taleb thinks too much centralization in government affairs creates single points of failures, and that’s not resiliency.

The unpredictability arises from people’s perceptions because that’s what adds color and context to our behavioral actions.The problem for global society is that there was no system to precisely and coherently measure our perceptions. The only tool we’ve had are the pseudo-science survey tools in psychology and EQ tests which were designed to fit with Probability — rather than to be independently robust and usable as a tool invention.The whole school of predictability arose as a combination of C16th Descartian logic, the follow-on C17th invention of Probability (which measured the behavior of dice, cards and counts) and then the Industrial Revolution where the ideas of “man as machine” and the subdivision of labor were designed to improve efficiencies.Probability provides what can be considered to be the control constraints; limits and bounds between which we round pegs can be “shoe-horned” into boxes, homogenized and “predicted” on the convenient scale of 5-stars (0=0%, 1=25%, 2 =50%, 4=75% and 5=100%).Except that Taleb, Kahneman and others make valuable points: There’s more to us than this version of probabilistic predictability. We’re naturally chaotic and complex whilst Probability is a control tool designed to measure the logic of 6-sided dice. The last time I checked, humans aren’t shaped like dice and whilst we have consciousness, feelings, language, culture, morals, values, beliefs and so on which all affect our decisions to invest/not invest, dice don’t.The question then becomes, “What tool can more accurately measure our chaos and complexity?”The answer has its roots in the insights of, arguably, the world’s greatest genius: Leonardo Da Vinci, who was around before Descartes, Pascal and any number of Scientific Management theories that put us into probabilistic logic boxes.Da Vinci wrote, “All our knowledge has its origins in our perceptions.”Now, some of us would interpret that to mean he was talking about the technicalities of optical perspective (the straight lines, angles, curves, depths we see) and pattern recognition. For example, we see the graph provided by @fredwilson:disqus and the trend looks to be an upward 25% increase because of the angle between the line and the horizontal axis — this is without us doing in-depth calculations. It’s a form of Kahneman’s heuristics.However, there is something much much deeper in Da Vinci’s insight and the clue is in the ‘Vitruvian Man’. This has been one of my favorite pieces of art since early childhood along with the works of Picasso, Severini and Monet.What the ‘Vitruvian Man’ shows is that we humans can certainly fit inside the box (of logic and probability) and it captures the static homogeneity of us. However, we can also fit into the sphere which is where the dynamic complexity of us is and is in continuous flux.So…if Probability is the tool to measure us in the box…….What’s the tool to measure us beyond the box? How would it complement the Probability box?The great thing about Da Vinci’s picture is that, if you’re an art+science nerd (I am), you can easily connect it with Schrodinger’s super-position theory of the dead/alive cat. The Vitruvian Man is simultaneously in-the-box/beyond-the-box, static/active, probabilistic/perceptual.The square and the sphere are not mutually exclusive states and planes. Instead, they complement and co-exist to form a coherency.So…that means Probability and Perceptions are complements that create a more coherent picture. Yin (female, language and intuition) and Yang (male, logic and actions).Solve this and the systems for our future will be able to detect the white swans of Probability and the black swans of Perception to enable levels of Perspicacity we didn’t have previously.That still leaves the availability of market uncertainty and arbitrage, by the way.It simply increases our coherency rather than pulling the levers of control and then having nothing to really detect our human complexity which goes beyond the Probability box.Ah and it will get us on a path to solving some of the paradoxes for Quantum Theory as it applies to our stardust of conscious and sub-conscious matter as well as pathing a way forward for the intelligence of the machines.A Brave New World for human understanding, economics, QT and AI…All available when we can stand on the shoulder of giants like Da Vinci and Schrodinger and comprehend the ways forward they were trying to show us.

I kept nodding. Kahneman & Taleb are a great pair of thinkers. There is a video of a discussion they had last year.

Bull never ends when you can create your own wealth.

#truth

That’s a brilliant quote Andy.

Not everyone can do that or think that way.

not with that attitude they can’t

But maybe they should act and expend effort as if they could?

first create value for others.

that’s how 99% of wealth is created. Of course it starts there. No one sits down and says “OK… how do I make something that no one will want to use”

Well you know nobody wakes up in the morning and says “I want a root canal today” or “I want to get a fiber probe shoved up my ass”. Point being there is money to be made in things that aren’t things that people want (in addition to the Apple mantra of giving people things they didn’t think they needed). Get the point you are making of course. Maybe a better quip would be to make something that solves some problem, provides some value or gives someone something they didn’t think they needed. Part of marketing. No question you like your drink for more than the taste it’s something that is going on in your mind that is not in my mind.

i’m reassured.

Bull never ends when you can create your own wealth.Unfortunately it’s not that simple.If the stock market isn’t doing well it ends up effecting most things possibly with the exception of alcohol, drugs, cigarettes or other “necessities”.Take Arnold’s lulitonix. If the market tanks and I mean tanks (I don’t mean drops 5%) very possible that if a percentage (re-read “percentage”) of the customer base feels uncertain that they will decide to not purchase the product and result in a change the economics of the operation. So all the sudden the brand new truck used for delivering the product (I don’t know this I’m just making a point) sits unused some of the time and the new warehouse space is a bit empty. Same bookeeper same overhead though but less business. Possibly enough to cause Arnold to buy less wine. Or not invest in some shrink wrap machine. And so on. Or the local supply store that is doing well when the market is high (because people feel “rich” on paper) doesn’t have a steady stream of contractors coming in to purchase products to build new kitchens and bathrooms. And so on. Don’t underestimate psychology in purchasing even if it effects “the other guy”.I can tell you for sure that when people feel “rich” they spend like drunken sailors. Not all of them but enough to move the needle. And it doesn’t even depend on “whether they have the money” it’s a state of mind.That said the stock market is not investing it’s gambling. And it’s certanly not a way to earn a living for most people.

Makes for a nice headline, but a lot of people can’t–plain and simple. They lack the means (financial, intellectual, emotional, etc.) to rise above.I’m no “bleeding heart liberal” (I thought I was, then I moved to Seattle), but an awful lot of people are suffering today and class disparity sadly is only accelerating.

redacted due to stupidity.

OK then don’t

The bull market never ends for great people.

Wtf when did I say anything about entrepreneurship?!!The guy that fixed my car created a lot of wealth this week!The only one assuming “create wealth” = “entrepreneurship” is you.

I type corrected. An AVC first I believe.

So did the guy that detailed a car for me, driving to me with all his supplies. He was a cousin of a friend. He had past issues with drugs and did time…but he saw opportunity and seized it. Met him because he volunteered to help at a car wash fundraiser. That was a smart investment and networking opportunity.

That “Bull” can only go so far on his island of exceptionalism before the global economic foundations of cyclical production/consumption stasis, now in collapse, bring him down too. Though commendable it really only amounts to a temporary short term isolationist reprieve for the too clever by half crowd.All the money printing and other inflationary tactics now in play to relentlessly confiscate all vestigial middle class wealth, in order to backfill the interests of the alpha Bull’s financial mismanagement, only serves to accelerates the collapse of our most fundamental/pivotal economic requirement.That being the maintenance/improvement of “effective demand” through the construction of new network-adaptive market feedback mechanisms targeting the pivotal importance of distributively sustainable “effective demand”.Given the accelerating pace of automation and the amplified interdependencies of a network-based economy, reworking market mechanisms around solving the pivotal issue of sustainable “effective demand” seems like a no brainer?I know their are a lot of folks here that are far smarter and much more educated than myself but it sure feels like the whole discussion is trapped in a echo chamber vortex of myopic 19th century economic framing assumptions?The concentration of WEALTH/power/education/control is not so much immoral as it is mathematically unsustainable especially now under the accelerated social/economic interdependency stressors inherent in a network driven reality.Seems like time for some seriously network-based economics/social reframing ?PSThe looming cost of an Ebola pandemic is just one of many hidden costs associated with the economic karma of poorly distributed WEALTH/power/education/control as in poorly distributed/maintained “effective demand”. When we get to focused on justifying winners and losers we all become loser at the end of the day.

Looks like “gridlock” hasn’t been too bad for the market either 🙂

and obamacare too

I believe the “cost” side of that law has been postponed until after the elections.

yeah, but the information is in the market

I agree somewhat… O-care is definitely not a stock market killer (boon for insurance companies to have mandated customers lol) and probably not an economy killer. Liberty we can debate later :)But the info is NOT in the market right now. There are exemptions and delays that are not predictable. “Not going to enforce that” that aren’t predictable. There’s still a lot of cake left to be baked there, IMO.

so maybe that is what will break the market 🙂

FED 100x more powerful than any inept law(makers).

Didn’t my trading account feel that pain in 2009? Yes it did.

and obamacare tooYeah but that’s a bit like saying “see I eat like a pig and smoke and I haven’t had a heart attack!”.There are other things that are keeping the “patient” alive. That’s one of the reason’s why I hate when people trot out all sorts of figures to back up some trend when as if a single point of data can explain everything while it really can’t. Things are much more complicated.

But without it even better.

History disagrees: http://blog.landonswan.com/…

Wait for the market to fall and then load up on indexes then. 🙂

I’ve considered the same thing however I’m not a fan of attempting to time the market. By investing money now you get the ride of the market up plus dividends

That was actually tongue in cheek. I’d agree with you – I’m a big fan of committing to a certain frequency (e.g. twice a year) and then dollar cost averaging…

I voted for the 5000 mark based on the tremendous opportunity for consumers and business to reduce costs and improve their lives with new products that could start to enter the market. Drones – Variety of uses for consumers and businesses to provide a better delivery or photographic moment. Self Driving Cars – While not fully adopted by 2015, strides are being made for a safer automated car. Hybrid Vehicles – These make another quantum leap thus allowing consumer to reduce their operating costs not to mention the environmental savings. Businesses – More adoption of cloud computing and ability to increase their speed to deploy applications with improved processes and automated self-service portals. (buh bye centralized IT control) Security products – Consumers are increasingly concerned for identity, credit card theft and will invest in products that can eliminate that risk. Perhaps Bitcoin (trying to help Fred) can add value in this space? Each of the areas listed above requires a purchase by a consumer or business thus contributing to an increase in the market. (I know brace for impact.)JJD – Half full

Our growing energy sector and independence along with a return of some manufacturing will continue to move this market higher.There is always a ton of money in the market that has no real conviction or idea why it’s there and that cash can spook very easily. But along this incredible run there has been buying when that cash gets nervous.Some of my positions now are getting long in the tooth and it gets tempting to sell but I don’t think we’re there yet.On the macro side, I believe we are in the very early stages of a major economic move to the upside here in the US and this will drive markets (and wages) long after the Fed is done.

Banks, as they exist today, must die.And I say that with some amount of sadness, as I spent an early part of my career growing up, getting schooled and trained by some really great people. In a very different culture than today’s culture.(For one thing, riskier stuff was happening in private firms, with partners’ capital on the table. And when someone took a fall for something really lousy, partners let them be led off the floor in handcuffs.)I look forward to seeing what can be done with blockchain. Uber for financial markets?

Playing with your own cash changes things a lot. The old partnerships would have laughed at a synthetic CDO

Yup. Did you hear last week’s episode of This American Life? It was tremendous.http://www.thisamericanlife…

Thanks

on my to do list

Michael Lewis’ new book…“If it wasn’t complicated, it wouldn’t be allowed to happen,” he went on. “The complexity disguises what is happening. If it’s so complicated you can’t understand it, then you can’t question it.”http://dealbook.nytimes.com…

Ah, thank you. LE (I think?) pointed me to this yesterday:http://www.bloombergview.co…

Yes, that’s the article I read that initially turned me on to Lewis’ latest thinking and book. Sounds spot on.

I am a total Lewis fangirl.

or know what;s happening. Leverage is more dangerous than complexity. You can withstand a stupid move but not if you multiply by 40 or 100x

No argument there. However, I think the quote relates to regulators just not knowing what’s going on…so it continues to go on!

But the attempt by the CFTC to past Regs on Derivatives was pounded out of existence by Rubin, Summers and Greenspan

Yeah, who needs regulations when there are free market forces at play….doh!

I talked about this the other day when I explained that you can win simply by the shock and awe of overwhelming the other lazy side with to much information so they don’t even try to defeat you or think about how they can. There is a reason that fine print is so small. And line lengths are so long. It’s hard to read. You lose your place. I’ve even suggested this to customers by the way. (Eye has a hard time following a long line where it doesn’t wrap to a line below..)The fact is while it might be complicated since it’s not the low hanging fruit of understanding lazy people don’t take the time to understand it and stop it. Whose fault is that? The people that take the time to game the system or the people who whine and don’t want to fight back? I mean we expect more out of sports teams we don’t accept that they say “the other side practiced longer and harder and that’s why we lost”.I don’t get why people don’t understand that in business people will exploit every angle they can for an opportunity or advantage as long as it’s legal.

“Complex”? Check with J. Simons, M. Avellaneda, or E. Çinlar, but isn’t it just S. Kakutani’s 1940’s observation, given in more detail in M. Blumenthal and R. Getoor, Markov Processes and Potential Theory or J. Doob, Classical Potential Theory and Its Probabilistic Counterpart, of the Brownian motion solution of the Dirichlet problem in potential theory? This is now old stuff.

Jim,Update on Disqus: On my desktop computer, Disqus continues to have serious problems. Firefox won’t show the comments at all. IE gets into an infinite loop, pegs CPU busy at 100?, grows the virtual memory paging file to infinity, and too soon gets too slow to use, e.g., even to type into a multi-line text box. Chrome works but sends the virtual memory paging file to infinity.Since on simple Web pages I get no such problems on simple Web pages, a suspicion has to be a massive memory leak in some client side Disqus JavaScript.

There was some other investor that had a great quote about this. I believe it was about the Conrad Black scandal. His basic point was that if he could not understand your financials without you explaining them, then they must be “engineered”Of course Buffet said this about CDO’s

Aint going to change. Banks will get bigger. Dodd-Frank ensures they will. Killed all their competition. Until Bitcoin….

.Community banking is long since dead. Now banks are run by the examiners. That cat will never sit on another stove again.JLM.

I am very optimistic. As more of the global population becomes connected to the Internet this will provide startups (and business in general) with an ever increasing customer base.

YES

I think markets are expensive relative to economic growth prospects as many are alluding here. But, as we all know the pendulum does swing from one extreme to another. While this time is no different, there are always some elements that vary and drive the behavior. Robert Shiller who called the last two big bubbles has been on this again and has a new theory for the present conditions.Here is what Shiller said on CNBC “You might think the stock market should go down when people are anxious. But people are anxious now because of the international situation…and they’re anxious now because inequality is getting worse. People are worried about being replaced by a computer. All these things are on people’s mind and it creates kind of a desire to save more…and they bid up the prices of everything.”I expect a lot of discussion on this theory with some agreeing and others disputing the argument. It will be interesting to see the trends in savings rate and investment participation from general public. It is possible that most of the savings of average household are getting cycled through retirement plans and not necessarily through active investments. If Fed is forced to keep interest rates low for extended period given all the macro issues Fred highlighted in this blog, the markets can remain high for some time to come.

Schiller has predicted 10 of the last two downturns.

To his credit, he only tries to identify the bubbles evolving not necessarily the timing nor downturns. In my opinion, he is probably one of the most down to earth economists out there and he is mostly not sure of things.

i voted 4500. there’s a form of cycle analysis which calls for a major turning point in about Q3 2016 — i would expect the market to top there. i don’t expect a huge decline but rather a flattening in real terms (i.e. relative to purchasing power). still expecting an exodus from the dollar/bond market to be bullish for stocks.obama may be “great for stocks” but that is only because he supports monetary policy that has effectively transferred wealth from non-financial asset holders to the banking and financial class, resulting in higher stocks at the expense of higher costs of living. basically, just like every other president since at least reagan and on. so much for change!

Great point. Fred’s initial point that Obama has been good for stocks had me thinking that increasingly loose monetary policies may have helped public markets more than Obama’s policy initiatives.

The market doesn’t like or dislike Obama. It likes free money.

I think looking at stock charts now is a pretty sore way to judge markets. There are far too many artificial manipulators like low interest rates to accurately make a guess on why the market is still going to continue to go up.But in this flood of artificial motivators, deserving stocks are going up sky high very fast. And that is a problem for late comers like me. I belive any time some of these artificial manipulators could be turned off and the stocks will come falling down almost immediately. I cannot predict when that will happen with the same surety as I predicted tesla and Netflix and Amazon, and maybe Google proper valuations.In the end though, the market is recovering TOO quickly. And the rest of the market indicators are not catching up as fast. That is a problem because it gives people the wrong impression of what is working and what is not. It also doesn’t allow people to fully benefit from a slowdown.This recession could have been a beautiful timeout but with double stimulus package of monster size all flooding at the same time, it didn’t allow anyone to think back what went wrong.In geotechnical engineering, we call this a splurge effect where load designed to compact soil ends up destabilizing it because it is too much. And then you need piles instead. That could be the case at this point. Where the piles are the artifical manipulators.

Markets break from the places you least expect them to break. When you look back at the break and analyze why it did what it did, it’s usually a pretty simple reason like the nose on your face-but no one could see it. I felt that the last break in 2008 was like that. Few really saw it. I was short commodities-but only because of supply/demand issues not because of any insight into real estate. When the market blew, everything broke.If I look at big breaks in the past, (1987, 2000, 2008), to make money all you had to be was short almost anything. It wasn’t just stocks that broke, it was all asset classes. In 2008, they got destroyed.This bull market trades unlike any bull market I have ever seen. There is not one trader I know that feels this is normal-which is very unsettling to me. The core reason is the Fed is on 0% interest rates. If the Republicans win the Senate, look for the Fed to move. Things have gotten way over politicized in Washington, and I see no reason for it to change now.Jason Calcanis tweeted the other day that he invested $250k in a startup and felt no fear.I just invested $250k in a startup & forgot that that’s a big deal for founders. I’ve completely lost my fear of failure & love to gamble.— jason (@Jason) October 2, 2014Let’s assume that Jason is like Fred and other VC/Angel investors and are always early. The moment fear goes out the window is the moment when you should have a lot of fear. I think when you see the very wealthy get all in on stocks and you start hearing about it at every single cocktail party you go to is the time to sell. We aren’t there yet.

If he’s lost his fear he needs to change professions

Amen.

There is so much capital being forced into private early stage ventures (due to all other classes being rigged to low returns) that he is merely telling you that he know that venture has more outs than ever before.#stupidmoney

That”s part of it”

I would like to upvote this a 1000 times.Chief Market Strategist @ Russel investments says this bull has had no pullbacks. In 5 years, until this month, not even a streak of 3 down days.People running the system forcing people to take risk. Artificial. Never good.

On your but no one could see it. well, there wasRichard KovacevichChair, Wells Fargo (2001-09)and a long interview of him by Frontline still athttp://www.pbs.org/wgbh/pag…with Exactly. And we would just go around the room. And when they came to me, I would say: “This is toxic waste. We’re building a bubble. We’re not going to like the outcome. I’m very concerned.” And some other people would either say nothing or they might say: “We don’t see that concern. These things are performing fine. And we think option ARMs [adjustable rate mortgages] and negative amortization ARMs and low-doc and no-doc mortgages are OK.” and much more, e.g., some remarks to the bank’s shareholders.It’s clear enough from Kovacevich that, for people paying close attention or on the inside, the bubble was easy to see. Moreover, the bubble was deliberate, that is, was liberal politics.

The ones that saw it were statistical outliers. Ironically, early on with the bull market in 2009-10, the bulls were a minority. The ones that saw it and monetized it (the break) were even fewer.

.A stunt is not a stunt if you can actually do it. Like jumping out of an airplane.I was clueless the first time. The second time I was fearful because I knew something now.The 92nd time I was fatalistic but I was not afraid. I knew the extent of the possible bad outcomes and I had a quick reserve chute trigger hand. [Never deployed a reserve ever but I was always just a second away.]JLM.

you probably wouldn’t call a skydive a “gamble” though. Yes, it is an environment that is foreign to most, though no more (and statistically considerably less) dangerous than getting behind the wheel of a car. I wouldn’t ride passenger side with someone who maintained such a cavalier attitude towards driving as Calcanis expressed!

What about the Fed and debt?? There is most likely going to be a tightening in 2015, maybe sooner, who knows. When that happens expect the obvious pull back. But after a few rough patches in the markets, maybe 10% decline, I think we go higher in 2015-2016 for two reasons.3 things from Ray Dalio that can guide us, productivity growth, short-term debt cycle and the long-term debt cycle. Productivity growth drives long term growth, and doesn’t stray too far from the 2% trend line. Credit drives short term growth, because it increases people’s purchasing power, and drives transactions in the market, which increases seller’s incomes, which allows them to purchase more. This cycle goes on and on until people can no longer service their debts. At which time we enter a deleveraging.Side note, it is also very important to watch that your nominal rates don’t get above your growth rates, but we don’t have to worry about that for a couple of years, I don’t think. So, what controls credit? Central banks do. Thus, tightening and easing become extremely important. And, we’re back to the Fed guessing game of when they are going to start tightening. You can never guess exactly when, but it will happen at some point, and when it does expect a pull back.But here’s the thing I’ve been thinking about. It seems to me that there is all this money floating around the world, and tons of people trying to figure out where to put it, and few have a good answer. So, what are your options? Most emerging markets have not produced the returns that the risk warrants. Europe is still a mess, and maybe if Draghi starting “printing some money” he’ll pull them out of it, but that will take years. Wouldn’t touch Russia with a ten-foot pole. Abenomics is not really working in Japan. Investing in India is difficult to say the least. You could go to Africa, but it will be a decade or more before you see any returns, if at all, although I think Africa will be very important in the future. And there are signs that China is slowing. IMHO, I think the world is going to send their money to the US. Property values in major cities are going to go even higher as a store of cash. And so will the stock markets. But expect a little pull back when Yellen ends the buy back.

The only thing I’m sure of is stock prices / the nasdaq will do something other than what I think they will do.Asset prices have benefited greatly from the low interest rates as companies can borrow cheaply, but more importantly people have no where else to put their money as they are punished for saving.Got a WSJ notification this morning that 248k jobs added in September and “unemployment” now below 5.9%. Let’s see what the Fed does with raising rates as it’s long been speculated they would raise when “unemployment” falls below 6%. I doubt rates will raise anytime soon because the “unemployment” rate is really just a headline at this point – the real metrics to follow are the labor participation rate and wage growth. Labor participation is incredibly low with a lot of people still on the sidelines or working less than they would like. Wage growth completely flat.Interest rates likely won’t go up until those metrics are moving in an upward direction.You don’t necessarily need to worry about asset prices falling as interest rates rise, though. That is because if interest rates are rising it, *hopefully & should*, mean that more people are working and earning more and contributing to the economy as a whole and prices will stay elevated because that is a fundamental reason for asset price growth – not an engineered reason.Predicting this stuff is a lot like a golf swing – so many moving, mechanical parts and you can focus all you want on one piece of it but then you realize you’ve totally missed something else that is now screwing you up…

.America needs to create that many jobs just to absorb kids getting out of high school and college and veterans being discharged. Those are not heroic figures. They are anemic.We are, at best, treading water in the deep end of the ocean.Take Texas out of the numbers and the US is a banana republic with a shortage of bananas.Remove the collective Oil Patch and we are living under a bridge.JLM.

I’m sorry Fred, if you can find ONE single thing Obama did to help the market or the economy, then we can associate his name with this graph. For a mirror image, take a look a the Labor Participation Rate (the number of people actually working). It has been on a steady decline since the day he took office.http://data.bls.gov/timeser…Do we want a market that goes up when average folks are not working? That seems to me like “the rich getting richer” – something the President would hate. Once the Fed stops the QE, the market will tank. It happened in Japan and will happen here.

.The Labor Force Participation Rate is the blood test which shows the economy is still sick, very very very very sick.We have 94MM Americans who are out of the game — an all time high.We have an anemic LFPR which is as low as 1978 and someone with a brain thinks there is a recovery at work here?The economy is doing just fine except for the growing dependency class, the deadly LFPR, the continued erosion of middle class incomes and the $3-4K additional family cost for health insurance plus a $5K deductible.The insurance companies, who have been able to churn all their low paying policies, are doing well. And, after all, isn’t that what we really care about?Well played, David. Well played indeed.JLM.

i agree that this economy is a “rich get richer” one.if you go back and read my post, you will see that I did not assert he has been great for “the economy”. what i said was, “He’s been great for the stock markets… Whatever you might think of the President, he surely has been great for wall street.”that said, i think he made a bunch of calls early in his Presidency in terms of bailing out the auto industry, providing stimulus to the economy, and generally having a positive optimistic outlook that things would get better. he did not panic.and the jobs data we got yesterday was pretty persuasive that the labor markets are finally starting to open up

Whether the market is overheated or not seems to be a question of value. How can you value something when the unit of measure has increased by 2 or 3 or 4 fold in 6 years? It is hard enough if not impossible to predict the price of something based on the fact that your trying to figure out the sum of 6 billion people’s decisions. When the unit of measure is then distorted like it has never been distorted before it really becomes impossible.Will banks start to lend more to pick up the slack left from the fed’s QE program? Will the fed begin the ramp up QE ? Will they continue to use financial repression?I think the macro political issues you mention and Obama are far less important to where the market will be than what the federal reserve and too-big-to fail banks decide to do. Since they are a reactive body there is no telling what they will do. The fed is only constrained by drastic price increases in necessities which has been subdued by the huge productivity gains that resulted from more freedom world wide and huge gains in communication from the internet.With that said US true money supply has been seeing smaller year over year gains. This deceleration of money supply growth has preceded the housing bust, the tech bust and the 2008 crash. It is possible the banks will pick up the slack and begin to grow the money supply through increased lending but their financial situation is already precarious. The federal reserve reacting to the lower unemployment rates, frothy market will continue to reduce the amount of easing up until the point there is a sustained down turn. It would seem that that downturn will happen in the s and p 500/nasdaq considering that is where the bulk of the money has flowed. This will cause a liquidation event but at what price will the liquidation occur? There is no telling could be at today’s price or could be at year 2000 price or it could be 2 to 3 times higher price.

Historically, the stock market has performed well during the initial periods of rising rates as rates tend to go up on the back of growth and economic strength- bot good for stocks.

These polls are fascinating in that we can compare them to historical results and see the cognitive bias apparent in even intelligent people’s estimates.Here’s a graph comparing the poll results with results estimated using the Nasdaq’s historical 6-month returns for the past 20 years.A few things stand out:• The audience has a bias for movement, when in fact the most probable outcome is no change.• The audience is on par too bullish (by about 8% of the distribution)• The audience substantially underestimates tail risk to the downside, but mostly by underestimating the magnitude (not direction) of the move.Note: this includes the tech bubble, so these results will have some real kurtosis to them.

These polls are fascinating in that we can compare them to historical results and see the cognitive bias apparent in even intelligent people’s estimates.Here’s a graph comparing the poll results with results estimated using the Nasdaq’s historical 6-month returns for the past 20 years. Here’s a link in case Disqus’ images don’t take http://cl.ly/image/2Y0x3e1E….A few things stand out:• The audience has a bias for movement, when in fact the most probable outcome is no change.• The audience is on par too bullish (by about 8% of the distribution)• The audience substantially underestimates tail risk to the downside, but mostly by underestimating the magnitude (not direction) of the move.Note: this includes the tech bubble, so these results will have some decent kurtosis to them.

I voted 3500 based (totally impulsively) on thishttp://gbr.pepperdine.edu/2…The good news is, I’m always wrong.

“Just because it is inevitable, doesn’t mean it is imminent.” -can’t remember who told me that recently but great quote!

No Idea when – but I actually think we’re very far away.Two things – the job market is still very strange – long term unemployment still has not dissipated, and labor rules still are weak – so the Fed still feels a need to cover until those jobs actually come into being to stabilize the rest of the economy. Temp gigs, while creating full employment, don’t actually do much, and Yellen knows it.If Ebola hits seriously in the US (or Entovirus starts heavily infecting adults) we’re also going to see mass labor distortions. Or another seriously bad winter.And war tends to stimulate the economy.We’re in for a wild ride…

When will this bull market end? I give it a year!

Depending on your time frame…bull markets never end… #lindzanity

Add a coordinated attack on financial services data to the list of triggers — http://dealbook.nytimes.com… A day when nothing works, nothing is connected, no transactions can occur, accounts are randomized or zero’d out.

I think we’ll see a massive market crash within the next 6 months simply because bubbles always burst sooner or later – and equities are definitely over-valued in the short term. Also all the algo-trading and leveraged ETFs amplify market moves in high volatility scenarios, so a 50% market crash isn’t unrealistic these days. But this would present a great buying opportunity as always: since we’re off the gold standard the government has just one solution to all problems – print more money. Inflation and unemployment figures are bullshit, things are much worse than the government would like us to believe. If they would be honest about the real inflation rate, the voters will quickly realise that the printing press is expanding the gap between rich and poor at unsustainable rates. However, the lies and statistics are what keeps the government in power, and they will continue to spend with one hand, and print with the other, because that is all one can do when stuck in a debt spiral, and as long as people are fooling themselves into thinking that inflation is low and their wages aren’t really going down (BS, just compare wages to housing costs!) then we’ll be fine. Until the next revolution.

You’re Elong Musk?

The time to do that was in early 09 but both the Big Banks and economy were too far gone to do that. But ab host of guy could have and should have gone to the can.

Why is the Obama administration market-friendly for Wall Street? Because of low interest rates?Banks are constantly being prosecuted by this administration and have paid hundreds of billions of dollars in fines. It’s probably more of a news story these days to wake up and read the paper and NOT see anything about a bank paying a settlement fine.I’m not arguing that they didn’t deserve to pay, but I don’t know if this administration is friendly to the Wall Street banks.

.Obama’s “plan” on everything is to do NOTHING.On Wall Street, cleverness always fills the void. He is not “market-friendly”, he is MIA.After all the pissing and moaning not a single prosecution on WS about derivatives? Really?What President fails to receive the PDB 60% of the time? A guy who is not in the game.JLM.

It’s the yeast I can do for my pal the baker. Tickled it got a rise out of you.

But also huge fines

The root of all of this is really lawyers. Government essentially is outgunned by the legal muscle that a corporation can wield for things of this complexity (as opposed to an oil spill which also is helped by being clearly visible by nightly news report cameras).

Obama wants a middle class like I want a hole in my head. There is NOTHING more savory to the statist than a large and growing dependent class.

opportunity everywhere. literally. I’ve got no time for people that don’t seek to take advantage of it, and happy to help anyone that does. I’m not alone in that sentiment.

agree. Fed must be strictly limited in scope. Otherwise you get….well…this.

I didn’t say anything about being an entrepreneur.

.In a small and abstract way, everyone is an entrepreneur or perhaps everyone starts out as an entrepreneur and then life beats it out of them.JLM.

Jim, I am laughing out loud.

http://instantrimshot.com/

Change the word Obama in your comment to “Big Government” and it holds. There are politicians on both sides of the aisle that love big government.

You already have at least 5 holes in your head…we all do.Nose what I’m sayin?

agree completely.

Doctors aren’t entrepreneurs?

What’s with the “oops”? So maybe you jumped to a conclusion based on pappy’s point but the truth is, like the Ted Knight character said in “Caddy Shack” – “The world needs ditchdiggers too”.https://www.youtube.com/wat…I’m glad most people don’t spot opportunity to me that’s a good thing not a bad thing.

Glad that I amuse you.

Agreed. Fines are just sales commissions paid to the government.

Apple thinks they are expendable.

No they aren’t. I mean you can stretch anything if you want but even doctors in small offices with their own practice by my definition of “entrepreneur” I wouldn’t call them “entrepreneur”.I mean a doctor who tells jokes everyday is not a comedian, right?

An apple a day keeps the doctor away? Yes, that’s how it goes, so they say.But not: An iPhone a day keeps the doctor away.

I know that. You trust politicians more than I do.I don’t agree with your version of limited liberty.

Point taken, but the fines are not insignificant. If anything, they send major mixed signals…System has many flaws but no system this large & complex is without flaws.

.I could not agree with you more — it would be illegal.JLM.

Hahaha. Nice site. Very useful.

One of the reasons health care costs are so high is that physicians are often paid as if they’re entrepreneurs, even though, to the extent that ~50% of their money comes from government, they’re effectively quasi-public employees.I’m not in favor of nationalized health care, given the horror stories I’ve read about Britain’s NHS, but the shamelessness of docs like this Harrison Mu character exemplify the problem of the current system of paying them: http://ri.search.yahoo.com/…

Not only that you don’t want them to be either. They are best when they are single function machines that concentrate on their craft to the exclusion of pretty much anything but medicine.

Dr Oz? Dr Atkins? Dr Seuss? Dr Doolittle?

a doctor that puts up capital, owns and operates a business, competes with other businesses, and is responsible for the success or failure of said business is an entrepreneur. Would be interested in your unusual definition of entrepreneur that excludes doctors.

You forgot “bad for some people”. It hurt me financially.

Hurt my business here in SF, CA as our insurance costs went up almost 90% with worse plan. Not only that, but many of our employees Doctors won’t accept these new Obamacare approved plans. Booooo!

I don’t know but if your version of political discussions involves bourbon I’m down for that anytime bud

Your sense of humor amuses me. You, I take seriously.

Salt of the earth and all of that.

When digging ditches, no fun competing against a backhoe or some of the other relevant machines!Now if can grow the job to some case of ‘civil engineering’ used, say, to cut a six lane, divided highway through some hills and valleys, figuring out how to move the dirt and rocks cut from the hills to fill the valleys, maybe have something!

Harold Ramis was a genius.

Hot streak.I am not sure we hold similar political views, but government is, at its heart, a system and the players in the system must be held accountable for breaking the rules.The DotCom and Housing bubbles were, at their core, absolute fraud schemes. 100’s of Wall Street types knowingly sold people investments that were not as advertised.They should all be on trial and many of them should end up housed next to Bernie Madoff, based on their activities b/t 1996 & 2009.The last several Presidents have been ‘very Goldman Sachs friendly’ – just look at the overlap b/t DC & GS.A cabal of privileged insiders who are above the rules is, I assume, a harbinger of doom.

.The Treasury (or Goldman DC as I like to call it) is NOT going to prosecute anyone on Wall Street because it’s run by WS guys on loan.JLM.

Too far gone like too big to fail.Please – where do high level bureaucrabs go to get the payday?

I love the way Oz was corrupted by fame.

HFS: 10/10(not to up you but could be cologne for porn characters called “Shlong Musk”)

3 to 4 great comments in a row.

Maybe some parts are more antifragile than others. Most risks are silent…until they become obvious.

Timing

.There is a difference between “banking” and Wall Street. The banks sometimes are following the advice of the smart guys on Wall Street and sometimes they are not.Sometimes the banks — Wells Fargo as an example — are investment bankers themselves and use their balance sheets to underpin their commitments and to push product out the door. WFB has an incredible IB and distribution mechanism with an enormous balance sheet.JLM.

.It is not just the organized varsity level defense put on by corporations, it is also the Four Corners — they wait out the administration and the DOJ and the AG.Then, they decide to open their own lobbying operations (Microsoft) in DC and lobby the Congress, WH and DOJ. They get to the problem before they can be indicted.JLM.

there isn’t anything explicitly wrong with derivatives. doing crazy things with them is a different story.

.Calling bullshit on you, CC.The guy lives above the store, has a cook and a home gym. If gravity is working, he can find his way to his office where are assembled the most knowledgeable intel and domestic policy guys in his cabinet all waiting to inform him on yesterday, today and tom’w.And, for what reason does he fail to avail himself of this most detailed and classified briefing in all of Christendom?Cause he has an early tee time?OK. I could actually give him that one. Of course, he could get the PDB that afternoon after he clears the 18th green, no?SIXTY percent of the freakin’ time? And, he never misses a workout?The guy is lazy. He’s dialing it in. He is not doing his job. he’s just not very good and it shows. The results speak for themselves.Last week I listened again to his first Middle East speech in Egypt wherein he suggested all would be well with the muslim world because he was cool, had a muslim name, had grown up in a muslim country and he was cool (repeat).That muslim stuff and the Middle East has really worked out well, no?You really need to get over the Brushcrutch. It’s getting pretty damn shopworn here going on 7 years later.JLM.

.Real estate derivatives chopped low quality mortgages into thirds — tranches.Top third was “AA” rated.Second tranche was at par credit.Third tranche was lower than wall crap on the ocean.Then some idiots insured them all.The insurance was leveraged to falsely increase the perceived quality of the securities. The insurance was NEVER good.When the mortgages failed and it was necessary to foreclose nobody — NOBODY — involved knew how to collect the collateral and nobody could find where each piece of a single mortgage had come to rest.So, yes, Virginia, some derivatives were flawed from the very beginning. Even Greenspan said as much.If you can’t collect the collateral upon failure, you don’t have a SECURITY. Derivatives are supposed to be securities.JLM.

evidence for this claim, or is this an opinion? Are doctors working for a large health care company better than small private practices?

You are trying to fit an analog subject to a digital “is or isn’t” definition. You can stretch anything if you want. You can call “me” an “athlete” because I run every day. You can of course call a doctor an entrepreneur because he shares some of the same qualities as a guy who opens a restaurant or opens a plant to make sewer pipe. But according to my defintion (and I’ve been around entrepreneurs for a long long long time and graduated from Wharton (in the entrepreneurial program itm) that’s not the way I see it.

A statement that starts with “they are best” is not the same as saying “it’s well know that”. So it’s my opinion and it’s based on the fact that as a generality I tend to like people that focus on a narrow area of expertise “master of one”.As such if I had to choose a doctor that was both a cardiologist and a neurologist vs. just either profession, all else equal, I’d take the guy who is expert and concentrates in one area unless the other area is so related as to provide a benefit or be synergistic.Likewise my feeling is that the best doctors are not the ones who are focused on opening up many offices and making big dollars. Except if having many offices doesn’t impact the practice of medicine and allows them to see more patients and thus be a better “expert”.

there’s probably an important difference here between a specialist such as the examples you mention and a GP or a surgeon that focuses on plastic surgery or sports related surgery.