The Cost Of Loyalty

In the local transportation market, we now have lots of options in addition to mass transit. Here in NYC, we have taxis, Lyft, and Uber. In SF and LA, we have taxis, Sidecar (our portfolio company), Lyft, and Uber. Around the country and world, there are various options including our portfolio company Hailo.

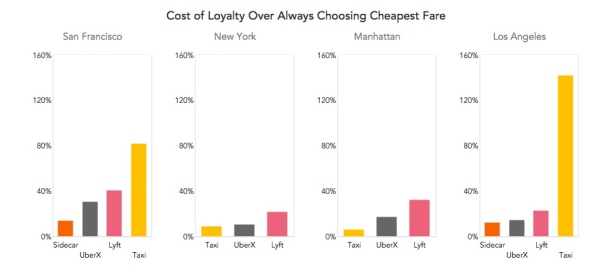

I’ve always wished there was an aggregation app that pulled all the prices and availability in real-time across all the available services and got you the best fare at the time. Or allowed you to make the choice between price and ETA (the way sidecar’s app does). It turns out there is a lot of price variability in the market and there is not one choice you can make all the time that will work out well for you. Being loyal to one app costs you.

Then this morning, a blog post popped up in my inbox courtesy of my friend Boris. In this post, they calculated the “cost of loyalty” to one just one app.

I mostly use taxis in manhattan when Citibike and subway won’t do and that’s because they are the cheapest and most available option. Uber and Lyft are for times you can’t get a cab and you’ll pay through the nose when you take that option as they are almost always surging at those times.

Another interesting thing about these charts is how taxis are the most expensive service to be loyal to in SF and LA. That is crazy. They are going to go out of business in those markets with that pricing.

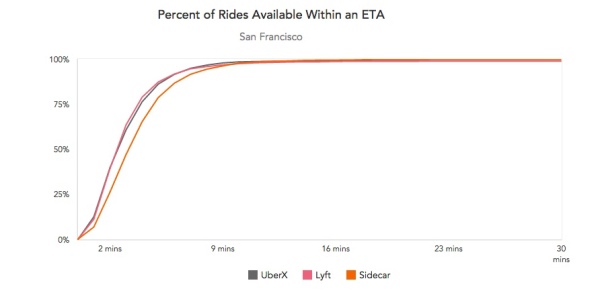

But mostly I am proud that our portfolio company Sidecar is the least costly service to be loyal to. That is because they don’t use surge pricing and instead allow drivers adjust pricing in their marketplace model as they desire. Sidecar is committed to using a true marketplace and things like shared rides to deliver the lowest cost rides in the market. It is also true that Sidecar ETAs are a bit longer as this chart of SF shows:

Going back to the opening thought, which is that someone should build an aggregation app on top of all of these services so we can replace the app on our home screen that we are most loyal to with an app that works across all services. The authors of this blog post did just that and you can use What’s The Fare to tell you who has the best price in the market. It looks like right now its just a web/mobile web app and all it does it give you the fares. If they or someone else went further, made it into a mobile app, and used the services APIs to actually book rides (if the APIs were available to do that), then we’d really have something.

That’s the way this market should work long term. I hope we can get there soon. Google Maps and Apple Maps are the ideal interfaces to make it happen. Let’s go!

Comments (Archived):

Will have to try that. Also downloaded RideScout. Daughter switched to Sidecar. Like you I use public transport or my feet

Software is eating transportation. So, that’s becoming like booking a travel ticket.Can Whatsthefare.com become a Kayak or is it a utility flavor of the day? Will Uber, Lyft, Sidecar give them a % for referring users?

I think it is fairer to say that logistics is the where winning meets the public.Creating the best at the best price is really really hard.I hate getting caught using Uber during surge pricing time and getting screwed. I do it but I’m always angry about it.

I wonder if you could buy “fare futures” to protect yourself against surges. That wouldn’t surprise me if Uber came up with that. E.g. buy 10 fares at current market price + a small premium, but that will guarantee you a lower fare than surge pricing.I just did that with our propane supplier and fixed my costs for the winter, so I’m guaranteed to not be affected if world events or weather related supply shortages affect the price of propane. Last year the price of propane surged 40% in the winter.

So who pays the driver then? Surges are a supply side guarantor.Uber is a marketing win. Uber is a verb honestly but as a service for all its efficiency, I like it no more than I like Facebook.But I use both.

Well, Uber would pay the driver and eat the difference, which they are making-up via arbitrage / yield based modelling because you would be spending most of your pre-paid tokens on regular fares anyways, and there could be a time-limit when you have to spend them.There is financial modelling going on for sure.

I’ll take a bet that this is not going to happen.This is NY and in my small slice of the world from my most well off friends to the local shop owner, public trans and walking is what people do.Uber is an option. Who needs a token for something you infrequently use?

I was just speculating. Surge pricing made Uber unpopular somehow. Allowing customers to pre-pay for fixed rates wouldn’t be a bad idea, if they did it.But being Uber, it wouldn’t surprise me either if they started manufacturing snow and blowing it on the streets in order to justify surge pricing 🙂

Sounds like a top down marketing fix to me.Any solution that starts with a spreadsheet and not the consumer to me is simply exercise, not strategy.And I’ll take my exercise in the gym–actually right now so have a great Sunday my friend 😉

Accounting for the futures would be interesting. They’d have huge accounts receivables. Would almost be impossible to correctly match a down in receivables to revenue to apply to expenses. Also, it opens up a whole new revenue stream-gift cards. a person could give another person a ten ride gift card.

It’s interesting–as many of William’s ideas invariably are–but a huge undertaking that I wonder gets anywhere near the top list of things to do to move the needle.And in this case, i have no idea what their top tier challenges are.For family members, staff, you simply give them a credit card and put Uber on the phone for emergency or special usage. I do this in both cases today.Gifting is always a an interesting idea. Often never the right solution for sharpening the growth curve.

You mean paying developers a commission to use the API? like Ordr.in does?

Like Kayak. If you go to Uber after checking whatsthefare, Uber kicks them back a small % or fixed referral fee. I think it’s different than Ordr.in because there are only a few suppliers (like airlines), whereas Ordr.in caters to thousands of suppliers.

Got it. I think Ordr.in get a commission from it’s suppliers and then shares a small % of that with apps that use its API.

Why would Uber pay a commission if their price is best, or they believe their value is better? User will pick best value. Aggregator not much of a service without Uber.

Well, it depends on how the competitive ground plays out. Airlines do it because it’s a fragmented market. If Uber’s market share ends-up like Google’s search market share, then for sure they won’t need any referrals. I was just asking the question.

Understood. If all the car services appear to be commodities, then the aggregator getting paid model works better.

That’s the problem you end up with paying for recommendations. If Uber corners the market, similar services are more likely to pay me for recommending them, and Uber likely will not. I might be inclined to leave Uber out of my results, making my product inferior.Then again, if I do include Uber and they consistently show as a more expensive option, that might drive a little competition. Did all these travel booking services drive competition in those markets?

It’s a tricky problem to solve. And let’s not leave out the very important fact that the aggregator needs scale themselves before any provider would consider paying or even cooperating.

I used the same logic 15 years ago to argue that Google would not dominate search because aggregators had emerged that displayed the top results from all the leading search engines. Why, I asked, would you use a single search engine when an aggregator would give more complete results?As we know, it didn’t play out like that. I’m wondering why this time it would be different?

Uber definitely has the allure of a Google. They might become immune to these aggregators if they end-up owning 75% of the market. [yup, I remember these now defunct search aggregators…. that was when you could see some minor differences in search results]

Let me Dogpile that for you.

I misread that as dongle – thought it was a callback to Friday’s post.

Eyes up here and not on my dongle.

nice try, but there’s no way I’m upvoting that

Upvote yours!

I don’t usually upvote my own comments, but if you insist.

Let me http://en.wikipedia.org/wik… that for you.

🙂

Great question !!!!!!!!My take is that Google used their lead to amass a huge amount of data that made their engine way better than the others and that data network effect was impossible to surmount. To compete with Google you have to do something they don’t (like save search data!)I don’t see the data network effect in this ride sharing market. I do see marketplace liquidity network effects which Uber is pressing very hard on right now in order to push everyone else out before some aggregation model emerges which makes their liquidity advantages moot

In other words, a land grab. Which is ok, as long as they play fair

While of course I agree, I can look at when I had market share in companies and leveraging that to whatever point I could get away with was exactly my job description.

And you’d be 100% right Arnold. Instead of “fair” I should have said “legal”. I don’t know if the allegations are true and, even if they were, whether they could be construed as anti-competitive.What the BBC article demonstrates, if nothing else, is what’s at stake in a market with such huge global potential.

Yup–the stakes are huge.And the power of these brands once they take hold is somewhat unstoppable.The more these platforms tie back into real world logistic, like crowdsourced drivers, even the battleground now for just-in-time urban delivery services, the more the idea of what is ‘legal’ from a monopoly of supply perspective gets grayer and more interesting.

how would an “aggregation model emerges which makes their liquidity advantages moot”? the aggregator’s value increases only if there is huge fragmentation in choices. The marketplace inefficiencies are being dealt with by the players (Uber, Sidecar, etc.), not by the aggregators.The aggregators would play a comparison or referral role primarily in this case, like Kayak does. And then it becomes a brand play. Who will know about an aggregator when all we know about now is Uber, Sidecar, Lyft, Hailo, etc. Kayak or Orbitz are useful because there are dozens of airline and route choices for any given flight.

Not sure if it’s solely an issue of supply availability though. Take a look at the daily deal space. Groupon has managed to dominate the space despite thousands of other daily deal sites and aggregators.I think they have managed to do that due to 1) extremely high brand loyalty that consumers were willing to pay the higher “loyalty cost” and 2) they dominated the industry so quickly that most consumers only have heard of Groupon and maybe one other site.Wondering what your thoughts are on that?

I don’t have the data on this segment specifically, but it does look like somewhere between a near monopoly (Google) and 5-6 players splitting the pie with a dominant one.

Prediction: Given user repeatability, look for Uber, Lyft, Sidecar to introduce subscription/membership pricing (like a costco membership) to secure loyalty, revenues, and profits. Or perhaps mileage benefits like the airlines. I’m surprised they haven’t yet! I know a lot of people who would love to be an “Uber member”

There is already a sidecar commute that just came out.

Not quite subscription…but looks like the Sidecar Commute test is a toe dip in that direction: http://techcrunch.com/2014/….Re: network effects, I think Uber missed an opportunity early on to build in user interdependencies so that their customers would be less willing to try other services. Or maybe they tried, e.g. ride sharing, and they just weren’t strong enough. I do think there may still be opportunities to do that on the supply side, though — i.e. driver-to-driver features and benefits that make them less interested in driving for a rival service.

For Google the product is the data. For any ride company the product is the ride. That is a huge difference. You have to control the product. I am with kid in that I like Amazon (not their stock price, but the company) because their product is getting stuff. It is also why for stock prices I like UPS and FedEx, and think the USPS shows why government run organizations just suck.

Google’s search efforts are still essentially just keyword/phrase search with results sorted by gross popularity measures, e.g., page rank, and date. For that approach to search, they have done a terrific job and are tough to beat. But Bing, and supposedly another effort in China, have done much the same and are also good. Trying to beat Google at what they are doing is not an attractive business opportunity.Google’s approach to search and their execution are just terrific for a major fraction of search. When have keyword/phrases that accurately characterize what want, Google is usually just terrific, a nice step forward for the Internet, computing, and civilization. It’s terrific stuff; no joke.But, asking users for those keywords/phrases is, for a lot of the content on the Internet, searches people want to do, and results they want to find, a lot, really too much. So, there’s more to do in search.For wisdom of the masses voting, Top 40 lists, Yahoo’s hierarchical Directory, the interest graph, the social graph, cluster analysis, natural language processing, image processing, speech recognition, natural language understanding, semantic analysis, intuitive heuristics, …, and the rest that’s been considered, I don’t think so!

Bing does well. DuckDuck has potential. Alibaba is gonna run them all over. GOOG has neutered it’s algos. eradicated SEO in process – which was an actual, analytical practice. But then again full disclosure – I feel GOOG is the plague, for reasons and data I have gathered over these past 15 years in search. But – relatively-speaking, yes, they hit it out of the park. first.

Meta search emerged at a time when each individual search engine was incapable of crawling all the content available on the web. As a result, each search engine basically had its own unique index. Combining the content from each engine into a single index and then reranking those results meant that meta search engines often created a more comprehensive experience than any one search engine could offer on its own. That advantage pretty much disappeared once search engines (and Google, in particular) got better at crawling the web. The differentiation was no longer in the size of a search engine’s index, but it’s ability to rank those results in the most relevant way.

Thanks. What you’re basically saying is that if any one service gets good enough, the benefits of aggregation diminish. Correct?

That’s how it played out in search. Aggregation only emerged because having more pages indexed than a competitor did often created a more relevant experience. But once Google and Yahoo were able to compete in that area, meta search became less attractive. It no longer had an advantage in size of index and was also significantly worse from speed and UI perspectives.

You seem to know what you’re talking about. Where do you see similar dynamics in the taxi business? For example, what’s analogous to index size? Driver inventory, perhaps? What are other factors that would diminish the benefits of aggregation? UX perhaps?

such a great crisp and concise explanation. thanks peter!

One thing the brain does not do particularly well is complex algorithms of optimization. It seems to prefer clustering type algorithms.A center fielder will optimize his route to the ball as well any algorithm, but the same center fielder will spend precious time trying to find the cheapest gallon of milk and then stop for a $5 cup of coffe on the way home and put the charge on his credit card and pay 23% interest.Uber was smart (built its brand in the limo space) and lucky (built it brand in the limo space) in that its offering falls into the cluster where brand trumps price.

This kind of stuff always reminds me of an excellent book I read a while back ( and one I think someone else mentioned in the comments here recently ) – The Paradox of Choice. An abundance of options can be more of a curse than a blessing. Terri is shocked every time I change the car radio when Zeppelin is on – but I gotta find out what’s on every other station, don’t I?On the other hand, services like What’s The Fare could be a solution to that problem in this space. Technology leads to more choices which leads to more mental overhead which leads to aggregation services, theoretically to reduce that overhead.Until, of course, a similar service is launched … then we need another app to help us decide which of those is better.

Car radio? Why use that when there are so many streaming services like, Rdio, Spotify, Pandora, Rhapsody, …doh, I just made your point.

Don’t even get me started. It seems as soon as I’m happy with my music streaming choices, or where I get my news, or my phone’s home screen, Fred posts something that triggers my obsessive side. Please make it stop!btw, I have 9 music apps on my phoneand 4 launchers – down from the six I had when I decided I needed to factory reset my phone and stop installing so much junk 🙂

I didn’t think there were 9 music apps worth considering… or should I say worth the screen estate.

lol…I still just use iTunes & the main Music app. So I’m essentially at zero music apps..

That works

Shuddle. It’s “Uber for kids”. Drivers have childcare experience and appropriate insurance. Saw this news yesterday and thought it was a great idea. Adding a unique component to the model, like childcare specialists, makes them less vulnerable to competitors out there now. And not commoditized through aggregators (just yet…until/unless someone copies them).

Clever

I think Shuddle was founded by one of the Sidecar founders. Likely on USV radar.

Sadly no

Jim, I saw this a few days ago as well: http://recode.net/2014/10/2…Sidecar co-founder, Nick Allen, is credited in that post.

That’s where I saw it. Thanks for the link.

Is there one for Dogs too? It’s currently fragmented with local suppliers. Might be a good startup…or an extension of DogVacay or Rover.

Good idea. Definitely not barking up the wrong tree.

I think I have seen 3 similar start-ups in the past couple of months – getting competitive very quickly.

3 Ubers for Kids? Or 3 Ubers for (_______)?

3 is ok, as one could emerge as a leader and we’d have two contenders, then one of them will buy the others or merge. I would be more worried about crowding if there were 7-8 such companies that got properly funded, no?

I ask Uber drivers. Literally 30% of business shuttling kids. Ask any. It started when I had a driver in Boston pick me up in the morning and say he was super busy. I said lots of guys like me going to the airport. Nope. Kids.I have asked every single Uber driver. Same ratio. LA, Boston, MN, etc, etc.

Interesting. This may have been the trend that the sidecar founder observed and led to him starting Shuddle.

Where I live Uber doesn’t work. I have to arrange a car service when I take a long trip. However, I love to observe and ask questions.I went to Boston and my very, very close friend who lives in Lewis Wharf had sold his car.Hmmmm, that means Uber is not just about replacing cabs and black cars, its about replacing cars. My friend and I had that discussion. When I had to call a cab no way, but push a button, get an Uber, not pay parking (either coming or going), insurance, maintenance, car? No brainer.When I asked the driver about why he was so busy, and he explained parents text him he drives and is the closest and picks up the fare…..hmmmmmBut the issue is who is providing the value and can he switch????Just like Groupon acquiring is one thing…..exacting a tax is another.

what’s the maximum number of passengers any of these options can carry on a single journey?

Right now two but that’s just a software limitation at the moment so they can nail the shared rides experience before adding additional riders

i’d like to see the communal multi stop app.

interesting idea. how do you see something like that working?

We had that when I was a kid. We called the driver Mom and the service was called carpooling.

in Europe ride sharing is very popular, especially in Germany.a taxi service using this approach would need to crank up its real time execution considerably. It could start with scheduled daily shared rides, and then progress to more dynamic demand. all the bits and pieces are in place to do it. maps, location, gps, notifications, et.c.the economics of it are obvious.

so three is a crowd. a surprising limitation.

RideScout tried to do this but could not get Uber and Lyft to publish rates next to Taxis, Bus , train and bike options.

Because that’s the big threat to their defensibility

Aggregator commoditizes players. Players should not want to be commoditized because it vaporizes their USP (unique selling proposition).

I push back on “aggregator commoditizes players”. It depends. Aggregators need to have a lot of value beyond the aggregation itself. Aggregators can scoop inventory and make the delivery of services/products more efficient and accessible (e.g. Amazon or Uber), but aggregating the aggregator is very tough.Then, what’s not visible is always the switching costs, and what’s really happening inside these marketplaces. Just because something makes sense in theory doesn’t mean it will be successful in practice.

There’s a difference between marketplaces and aggregators.The aggregation of car services based solely on ETA and price strips out any real or perceived uniqueness that any of the car services might have. That’s commoditization to me.Not the same with marketplaces or etailers like AMZN which convey full descriptions and unique attributes of every product listed.

“but aggregating the aggregator is very tough.” Not always true.. it depends on how well/badly the aggregator is serving its customer base. Indeed did a fantastic job aggregating jobs from careerbuilder, monster, dice.com, etcUber, Lyft, sidecar are all young, hungry, competing fiercely and trying to do their best to win customers. You are most likely true in this context.

I’m a bit late to the party… Having just started using Uber in Minneapolis. I was just saying to friends last night that it has changed our relationship with my city. We head downtown more frequently, and feel safe having our daughter use it to shuttle from her dorm… We will start experimenting with other services, but are loyal users so far.

Not that it isn’t already, but an aggregator will more strongly commoditize the industry and with wide adoption will create downward price pressure that can only benefit consumers (not companies). Like many, my biggest beef w/ ride sharing services is w/ surge pricing and was surprised to see in the What’s The Fare analysis a significant diff when competing companies are in surge mode and the disparity in their rate multipliers. I think if ride share companies were more interested in lifetime value of a customer vs. shorterm or immediate payout they’d model their biz quite differently (and with loyalty more in mind).

aggregator gets players a wider net to cast. consumers are given comparative data – it’s not all about price, over time. in an aggregate environment RT, the providers are pushed to optimize. that is good for everyone.

An aggregator may provide consumers w/ more comparative data, but price is unquestionably, and will continue to be in the current paradigm, the primary driver on purchase decision.If I’m Uber I’d introduce a premium subscription service to complement it’s core base biz. For an annual fee of $75 or $100, a subscriber gets a 10% discount on all car service. This add-on creates brand loyalty and creates a disincentive for using alternate ride share services. To create add’l value Uber can layer in affiliate deals w/ hotels, rest chains and other travel related services. This premium service caters to high frequency (not casual) users. Easy to model.

you’d have to gather data post-app-launch to back that statement up; I don’t make assumptions about “paradigms”. not everyone goes dirt-cheap. other factors merit value upticks. 10% is peanuts. “loyalty” is earned not by price alone; there’s driver relations, car cleanliness/style, route precision/area knowledge/nav; reliability/timeliness. Cheap is not equivalent to Best. do you loyally drink Natty Light because it’s cheaper than Sam Adams?

Beer, automotive, soft drinks, apparel, are all image driven categories. Brand choice in those categories is as much a reflection of the individual, as it is the attributes/benefits of the product itself. Car sharing services deliver functional utility: I want to go from point A to point B. There’s nothing aspirational about it…it’s a utility! Yes, the consumer’s hierarchy of importance on product attributes may include cleanliness, ETA, driver courtesy, etc., but I assure you, like with most commodity based businesses, a vast majority will rank price as the senior criterion; which is why I think Uber should explore a sub model specifically for heavy users w/ member benefits (e.g. frequency discounts) driving loyalty and incremental value.Easy concept to test market (sub fee relative to frequency of use relative to % discount and incremental benefits).

We will be experimenting with a similar model at Convoyer (same day delivery for SMB here in Dallas) We charge $99 a month subscription to the SMB and $8.99 per delivery to the customer.

Car2Go just launched yesterday in Brooklyn (they are in many other cities too). In places outside of Manhattan (where traffic / parking / driving is too much of a hassle), they could be a really great option. I used it 5 times yesterday – took me half the time it would in a subway. At 38 cents a minute, it’s a great alternative to owning a car, which is the ultimate goal of many of the taxi / car services / ubers.

Searching by price for (non airline) transportation seems like a solution looking for a problem. Seems to me that a large number of Uber users, based in part on their use patterns, are price ineleastic (at least within a fare range).

I wonder if Uber and the the others look at these costs of loyalty and tailor their incentives for signup relative to their competitiveness in the market. If not, they should….or the other method, SWAG, also works.

Cool. My wife and her staff in NYC has to take car services home after working late nights. She constantly gets asked to save money on this. This will work and also provide proof of money she is saving.

the interesting thing is that fare is usually not the only consideration. sometimes not even the first for some people.for me, if surge is in effect, i’ll look to another app before confirming a ride — but the app i open first depends on mood. i heard ryan hoover of product hunt say the same thing recently, and many people use this criteria (perhaps subconsciously) to open up their app of preference.after that wait time and past experiences come into effect, but the price difference (at least between lyft and uber) have become immaterial.low prices are table stakes. the winner(s) in this space offer something different.

There seems to be a lot of development risk here. An app built on 4 apis. If any one of them pulls a Twitter or FB and cuts off the API spigot you’re done. Also I know nothing about the average customer demo but is price the primary choice point for these users? And I think there’s a larger question. Apple has the majority of the most valuable customers. Like Apple, has Uber achieved snob appeal? Has Uber built a brand where it’s consumers are more willing pay to say their taking an Uber car over Lyft or Sidecar? Have they captured mindshare in a valuable demo? If so, how would that affect the value of the app?

so you don’t cut that deal with that risk. do the biz dev deals to aggregate the providers for the app, cut rev shares to app relative to bookings net revenue through app (& whatever other KPIs matter to those providers) – free app, no ads, wide distribution.

bingo bingo

While I love the theoretical discussions about the aggregation model on this thread, they mainly ignore the primary point – a large number of consumers (myself included) would use the product. It is a pain to open several apps and price compare. Looking forward to using the whatsthefare app once they get it built.

Funny. was thinking of that idea too. problem is that in order to do that you need access to direct routing /pricing APIs of each service (which not only does not exist yet but not even sure will exist) but also build an equivalent of waze ETA to get accurate data. complex. but indeed very useful.

While the demand side is definitely important in terms of giving users one app, I would say even more important is the supply side. That’s the side that really needs one app so that the drivers can choose at any time to pick someone up from any of the services. Going even further, adding other on-demand services that they can partake in, like Shyp, and the app would basically tell them what thing to go do that will make them the most money in the least amount of time based on where they are and what time of day it is.The fragmentation on the supply side is more important than the demand side. The issue is that I doubt the individual platforms would ever allow one app to build significant supply side reach, because at that point they risk having that one app then go build a demand side and screw them all. But it seems some kind of smart assistant for the supply side is inevitable.

cross app cross functionality, same driver. opportunity cost of doing one task vs another. that’s interesting.

excellent point!

tthe intermediary services that exist today won’t allow that – for what would stop that service from replacing lyft and uber eventually?

I made this point later on, sorry for not seeing this. A practical challenge is that without <whole route=””> data it’s hard to optimize as a supplier.

When you’re happy with the service of a company, you become loyal to its brand — and the cost of possibly having bad service isn’t worth the occasional monetary value you’ll maybe save if you were to use a multi-brand aggregator (I’m thinking like a human, not a VC reading a graph).For a non-car example, this is why Amazon has not, and never will, kill the rest of e-commerce; people are loyal to brands for all sorts of emotional reasons, usually a combination of them, and price when measured alone is generally a very weak indicator of loyalty. People go to Amazon and Walmart not *only* because they are cheap, but also because they “have everything” or fast shipping or good return policies, etc. It’s the whole package. But when it comes to ride sharing, what can an aggregator do beyond offer a marginally better price? I can’t think of much, other than uncertainty of experience, therefore I don’t think the market will really respond too wildly to such an app if it were to even exist.

Take away amazon prime and Amazon.com becomes a commodity. Amazon has the money and the talent to open lots of doors in its quest for luck.

Agreed. People forget the power of the brand sometimes. Trust & quality of service are part of the loyalty equation, not just price.

And switching costs! Insurance companies and banks print money based on the frictions of switching.

Yes.

I wish they hadn’t used the word loyalty in their analysis when really they’re highlighting the relative cost of hypothetical usage of almost interchangeable services. That’s interesting in itself, especially in terms of the vulnerability of taxi service in SF and LA that Fred highlights.But the use of the term loyalty implies that taxi users might behave like this and serves to strengthen the assumption that loyalty exists in most markets – an assumption that is rarely backed up by data.

I like Citymapper more than Google Maps, from experience. No ads, beter discrete routing/tracking, and aaves previous starts and destinations. Also saves offline. Free.

If Sidecar doesn’t have surge pricing, why should I ever use it? Forcing me to wait around for long times during peak usage times or special events isn’t a product “feature” I would be touting if I were you, Fred.

it has a different version of it. as i said in my post. they let the drivers set whatever price they want. so prices do surge in their marketplace approach, but not universally. and you can pick driver by price and eta.you should give it a try if you live in Chicago, SF, LA, San Diego, Seattle, Boston, or Washington DC

Corral was an app that aggregated ridesharing by connecting the APIs. I believe Uber shut it down / disconnected, as it wanted to own the customer.

Alas, no more sidecar in NYC.(The subway is still the cheapest)How should you check which is going to be the cheapest when you need a taxi-like service?

.The entire notion of loyalty in business is grossly misunderstood. The measure of loyalty is fairly specific:1. A loyal customer will use your service or product exclusive of all others.2. A loyal customer will be wiling to pay a small premium to use your product or service thinking that small increment is returned in the value proposition.3. A loyal customer will vigorously recommend — a brand evangelist or zealot — your product or service to others.4. A loyal customer will invest energy in the relationship and will absorb the same reflected energy from the brand.5. A loyal customer will provide honest feedback when you fail to meet expectations and will not simply abandon you.6. A loyal customer will forgive you when you fail to meet expectations and having provided honest feedback will allow you to make it up to them without holding a long term grudge. In many instances, the handling of a complaint may be the well spring of the initial loyalty.7. A loyal customer will grow with you as the product or service broadens and expands. They will be amenable to packaging other products and services as the opportunity presents itself.I belabor this because much of what is discussed is not “loyalty” and may just be the “shiny penny novelty”.The most important consideration is this — less than twenty percent of your customers will ever be LOYAL customers. The objective of converting average customers to loyal customers is the most important work of the existing customer base. Very few companies see or act on this.As an example, I like Uber but can never be a loyal customer because I find them — rightly or wrongly — to be price gougers. I therefore consider them a utility. Perhaps a “favorite” utility at times but not a business to which I will pledge loyalty.On the other hand, I adore Amazon because of their administrative efficiency (yes, I know others may not have had the same experience), their shipping, the warranty, their unconditional guaranty, their product breadth and depth, and their return policies. I am a loyal Amazon Prime customer and consider all the digital media to be just a cherry on top.The second one begins to talk about “aggregation” and price shopping, the notion of loyalty becomes suspect. These are competing sentiments. I can be both a loyal customer of some products and services — as an example, AVC.com — while being a competitive bidder of other commoditized products and services.JLM.

Exactly right. I call it the 20-80 rule. Yup not the 80-20.You have to work on keeping the top 20 and moving the bottom 80 up.

Your analysis is spot on and backed up by the data, but I’d argue that the key task is to keep acquiring new customers and that should even take priority over making existing customers loyal exactlybecause you’re unlikely to break through that 20-25% ceiling.

I agree more with you than you do with yourself.Well played.JLM.

I’m imagine that’s what a therapist would say.

.And how does that make you feel?JLM.

Disloyal.

The “aggregation app” is applicable on both sides- this would be an obvious add on to an intelligent car which is used by a casual uber/lyft/sidecar driver (or an autonomous vehicle)- though the key data (destination) is required do do proper optimization.

It would be tough to get the data, but I’d love to know the cost of loyalty on the labor side.

All of this points to the increasing commodification of the rideshare business, which will diminish profit margins and favour the eventual emergence of a cooperative, non-profit driver-lead booking system which has no house-take and leaves no room for intermediaries to make any money at all.

This market ‘feels’ like it could arc similarly to the airfare/hotel sites market (if all these taxi alternatives survive).

Fred, have you seen OMG Transit? Aggregates all manner of public transport and rideshare on a map. Might want to take a peek: https://omgtransit.com/

Same problem exists in the accommodations world with the likes of Airbnb and Housetrip and Homeaway and Expedia and Booking. That’s why we created http://AllTheRooms.com, and it’s working well. Aggregation is definitely still useful.

I’m one of the authors of the cost of loyalty blog post that was cited here. Thanks for sharing this and starting the discussion Fred. Unfortunately, we don’t believe that the ride-sharing companies will allow a third-party to disintermediate the ride-booking process. Uber has already expressed disapproval of merely showing fare estimates next to those of competitors and has cut off our access to realtime Surge data as of a few days ago. Making an app for price comparisons is difficult, even without the ability to book rides. We still feel that transparency and easy access to real-time fares is important for the consumer and vital to the health of the ride-sharing market. It just means that anyone working on this opportunity will have to find alternative ways to get the data.

well that is very telling and explains where Uber is threatened

Uber, Lyft, Sidecar are more like Expedia, Travelocity, Ctrip (for China) than Google. So an aggregator would be more like Sidestep (now Kayak). More importantly, just as Expedia doesn’t own the planes/cars/hotels, Uber doesn’t own the taxis. And just as travelers (and airlines, car rental companies, hotels) aren’t loyal to one travel booking service, I find it hard to imagine riders or drivers staying loyal to one taxi hailing service – a competing service is just one tap away…

But – is that cost of “loyalty” enough to matter even over a lot of usage and long term? Just not having to mess around, even with reading a one page listing would divert my attention from more important things and what’s that time worth to me?

Hey… was just thinking about SideCar or other competitor to Uber’s growing network density and effects.. In order to break them, give the driver’s an equity-like stake in SideCar.In other words, make it a much greater incentive for the drivers to use/choose SideCar and away from Uber where Travis has gone on the record that “Uber will be cheaper once we get rid of the drivers” and now they are trying the old capital/labor fight..Usurp that model and put the labor on the side of capital at least to gain traction

hmmhow would you give them an equity like stake?

Variety of potential ways to go for it1. Earned credit based on rides, revenue, hours, (probably some fairly straightforward legal structure that passes muster along one of those lines)a. Optionsb. Restricted stockc. Phantom stock (see Reddit)2. Increases in credits or shares/shorter vest/acceleration based on exclusivity/plurality to SideCar3. Simpler administration could be done with revenue/ride thresholds to immediately earn shares/units each monthLots of other possibilities if finance team gets creative

there are regulatory issues with issuances of equity so many of these would be challenging

You’re almost certainly right that there would be some regulatory issues for most of those suggestions, but I’m confident that some creative financial structures could at least yield the 2 components that the drivers (SMBs) desire1. Some modest level of economic materiality2. Feeling that they work at least somewhat for themselves (building equity combined with present autonomy) and moving away from what they fear being, namely a disposable and hired resource

really like the loyalty cost approach…see a lot of value in taxi aggregator kinda service in our country (India) ..with competition heating up with multi players like uber ,olacabs (softbank invested $210mn last week) , merucabs, taxiforsure etc..when we go out we open up 3-4 apps to check ETA and the cost..and the structure is getting complicated day by day..also by the fact that surge pricing is just starting..the question is…is this going to be a winner takes all market? and if it does then whats the future of a service like this? if it doesn’t then i am assuming the taxi guys will shell out a % as affiliate marketing cost…how do u push these guys to open up their apis?

Sorry for my tardy reply, but wouldn’t a price aggregator app just drive a race to the bottom? Once customers are making decisions based on accessibility and price relative to the company’s competition, that’s what companies will devote their resources to. Being as cheap and available as possible, at the expense of everything else (driver wages, cleanliness of car used, background checks on driver, customer service, etc).Think about students in school. If a kid is being graded based on how many definitions they can spit back at the professor rather than understanding how those terms relate to each other, then that student is going to spend his study time memorizing terms that can easily be looked up, instead of understanding what is being taught, the outcome is that he leaves the class learning nothing.If companies are being “graded” by their customers based on how accessible they are and how cheap they are, then the company will devote significantly more resources to getting a better grade in those areas, inciting a mcdonalds-type of structure in transportation (quick, cheap, accessible, but unhealthy and often unsanitary locations).I wonder if customers collectively would prefer cheaper prices (in general) to having more spending money.That way, maybe more than the top 1% can enjoy nice things too.