Resilience

One of the things about Bitcoin that I’ve always been amazed by is its resilience. It goes up, it gets knocked down, but it hangs in there, and then it goes up again.

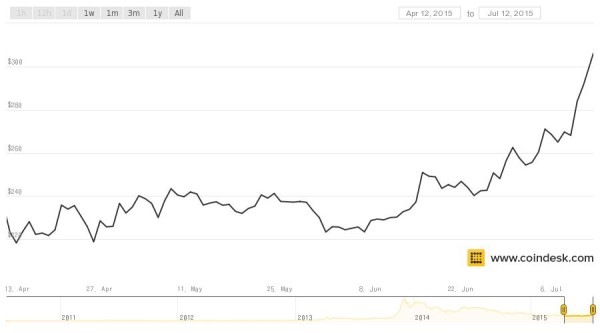

It’s happening again now.

It is unclear what is driving this recent move, maybe its Greece, maybe its China, maybe its something else.

But every time this happens, I gain a bit more confidence that Bitcoin is around for the long haul.

Comments (Archived):

That graph in the footer is volume, yes? And it looks relatively low as compared to 2014…not that I’m disputing your point. Just saying more volume please, would be nice.

No, the footer chart is price over a multi-year time scale.

Ah, thanks for that.

It will be around likely, but used more as a currency or a quasi “digital precious metal” like gold, silver etc? I am firmly in the second camp (figured I would reiterate this for about the 10th time on the subject). Its a super small asset class (under $6 billion right now), so super easily to respond to the whims of a few anxious investors.

Has to be Greece. In China you are jailed/executed for selling stock.For the “common good”, of course– so who are we to question! All hail the collective!

The devil is in the nervous-system/networking details that embody the collective !Not all collective are born equal.America is a collective 🙂

The death of Bitcoin has been greatly exaggerated….about 20 times already.Aside from market psychology, geopolitics and speculators, the “technical” side of Bitcoin’s strength is showing strength across the board. https://blockchain.info/charts has all the charts you need to look at. Some of the ones to watch are:1) Number of Transactions per Day 2) Daily Bitcoin fees3) Local Bitcoin volume

Great links / charts William. I think we differ on how valuable bitcoin will be, but it was striking to me how LOW the transaction fees (want to make sure my math isn’t off by an order of magnitude). Miner fees have averaged 20-40 bitcoin a day? So Around $5k to $10k a day? Which at one point strikes me as very little underlying economic / profit, but in the same breath this supports 200k transaction so like 5 cents a transaction, so perhaps this fits with bitcoin supporters like yours thesis how efficient it is?

Hey Matt, miners who find a block (which occurs on average every ~10 mins) are also rewarded with 25 BTC. Transaction fees are currently subsidized by increased bitcoin supply, however the rate of inflation will also decrease over time. Hypothetically, we would expect miners fees on individual transactions to rise in order to price-in the decreasing rate of bitcoin supply inflation.

Interesting. thanks for the explanation. what is the time frame before most bitcoin are “mined or exist”.. unsure of the right term. But its somewhere near 21 million correct? Do you know how many exist now and how long until they will all be in existence?

Some people see the ~5 cents per transaction as a weakness. Others see it as a strength. It’s only a part of the equation.

By far most compelling. The currency aspect is actually holding it back

Agree. But it’s a difficult mistress to send away. Next to sex of course money is probably the nations next pastime. Network plumbing and financial back office stuff simply is not going to grab any large press mention or attention. [1]Let’s talk about Pizza for a second. If you can get people to buy into the fact that it’s part of a nutritional meal instead of simply “junk food” then that’s a way to sell more pizza. Most likely one reason they offer it in schools now (but not the only reason).Walk into a bar one night (leave the wife at home) and see how far you get talking with the women about “bitcoin” vs “distributed dns”.[1] Imagine if it was called “bitchain” at the outset or “blockchain”. How far do you think that would go?

well, you can’t easily remove the money aspect of bitcoin outside of other aspects. it’s all part of the same (complicated) thing. if we project into the future, bitcoin is just an alternative currency,- but one that isn’t run by a sovereign government.

Buy some or an ETF and stick it in the back of your desk for 5 years or so. Robert Greifeld, CEO of NASDAQ, speaking after the NTSE halt this week was very positive about their Bitcoin testing to date and felt it was going to be a big asset for them. We shall see

From what I can find Robert Greifeld is talking abou the blockchain and not bitcoin. So I don’t think it’s accurate to say that he is “very positive about their bitcoin testing” but rather you mean to say “their blockchain testing”. There is a difference, right?http://www.ft.com/cms/s/0/8…http://www.ibtimes.co.uk/na…http://www.programmableweb….Note that the headline of the 2nd story link is actually wrong.

They’re testing on the ‘bitcoin blockchain’, so no there is no difference.

Nope. Statement implies they are testing bitcoin not the technology that it runs on or is associated with in some way.https://blockchain.info/wal…http://bitcoin.stackexchang…

bitcoin is intimately associated with the ‘blockchain’, you cannot have one without the other.http://www.technologyreview…

Water flows through pipes. You can’t have one without the other.Testing the pipes or distribution system [1] that water flows through for some other liquid is not the same as testing water.[1] Similar concept in trucking where one commodity is used outbound in a tanker truck and another (after the tanker is washed) is carried on the return trip.

You absolutely can have a blockchain without bitcoin.

As I understood, they were testing on the bitcoin blockchain using colored coins. There must be a cryptocoin to pay miners to secure the blockchain anyways, and bitcoin’s blockchain is by far the most secure, currently backed by ~350 Petahashes/second. It would be in their best interest to use the bitcoin blockchain.

This is what I was basing my use of Bitcoin on.http://coincenter.org/2015/…But I also use it meaning both

Thanks for the link.What is interesting about that (and it dovetails with what the bitcoin proponents are saying in the replies to my comments) is that by stating it that way (excellent PR for bitcoin) it’s overall great for bitcoin because it creates the appearance of using bitcoin more than just as a payment method. So to me that is more marketing than it is reality. Others apparently differ with me on this point which is fine.Anyway the particular statement that supports what you are saying is:So, to be abundantly and perhaps pedantically clear, Nasdaq’s platform will trade shares by trading bitcoins. This is not blockchain-technology standing alone, this is Bitcoin being used by Wall Street. It is technically impossible to use Bitcoin’s blockchain without holding and transacting in bitcoins. In this case, Nasdaq is using Bitcoin’s blockchain, so they are using Bitcoin, not just “the technology behind Bitcoin.”

This link dovetails with the idea that people think of bitcoin as an alternate payment method which is the basis for the point that I am making:http://www.technologyreview…(Note it’s from MIT Technology review btw).

NASDAQ is focusing exclusively on the Bitcoin Block Chain. It is the largest and most secured Worldwide Ledger system in existence today. Those who think they can just reproduce it and not find themselves at a drastic deficit security-wise will likely scrap their private projects and coopt the Worldwide Ledger.

Maybe Greece…Maybe BNP Paribas writing that the technology underpinning bitcoin has the potential to make existing companies “redundant”:* http://uk.businessinsider.c…Like Blockchain, a bit indifferent about currency movements.

Really good point. On the adoption cycle the key is what happens during the “trough of disillusionment”We’ve seen the hype, but has you point out it looks like a slope of enlightenment.https://en.wikipedia.org/wi…

I don’t think that the data is mature enough at this point to come to that conclusion. From what I can pull off of coindesk bitcoin has gone from $225 on June 1st to $311 today a little over 1 month later. One month increase like that doesn’t seem to me to be a slope of enlightenment type increase.Noting that from the same chart bitcoin hit above $979 in Nov. of 2013. It is not uncommon for speculators (in anything) to take a look at a past price and try to time and guess when things are heading back up. The previous high price provides an anchor point whereby the speculator knows that a price “could go that high because it has” and evaluates the potential of it heading in that direction. This is based on my observation and experience in things not related to bitcoin and not some textbook or article that I read btw….

I’m not going to disagree but look at the chart in my wiki……close……

All (practically) academic bullshit to me (if I may say so) and self serving to the private company that came up with it (Gartner). And as you know I went to a good school as you did where “those who can’t, teach”. (Not an absolute statement of course..)Now that is not to say that they didn’t develop it based on actual data which they managed to fit the model which they have described. Or that examples don’t exist that confirm what Gartner is talking about.But you are an engineer (or were trained as one at Penn) so you know this isn’t exactly rigorous in any way and doesn’t even come close to science (note that I said only “come close”) and furthermore it’s something that is applied after the fact to a technology that fits the model.Many technologies no doubt would fit at any point on that scale that never go anywhere at all (flying cars, or car boat combos as one example). Remember the Wankel engine?Not only that but noting that time is not even defined on that scale so it’s fairly easy to massage any event to make it look like it follows the model. [1]As you can tell I have general disdain for things like this. I note pronouncement like this from Gartner:http://www.gartner.com/news…”Gartner Says Major Organizations Will Need to Grow Capacity and Performance Management Skills That Are the Foundation of Web-Scale IT”And I note that there has never been a single study that correlates what Gartner (or anyone else says) over time to what actually ends up being true.Gartner got cloud computing right:http://www.gartner.com/news…[1] A version in a way of what fortune tellers do the way I see it.

First I will agree that Garter et al are the biggest bunch of shysters ever.I have paid them so much money in my life and it just sucks. The only thing I will say is I didn’t pay Forrester and that was a huge mistake. Costed me a ton of money. People that believe them are so stupid I almost don’t want them as customers except that a customer is never wrong unless they are not a customer.But sometimes a blind squirrel finds a nut and in this case have described something I have seen over and over. I can remember networking, wifi, internet, a ton of stuff.All of your examples had a ton of hype and never came back.

There is this saying in business such that “the easiest person to fool is a salesman”. Meaning salesman fall for the same shit that they use on their prospects. (Can’t find any link to that oddly enough but I have definitely heard this many times pre-internet and have seen it to be often true).And what I have also found is that (and this is strictly my anecdote) people trained in hard sciences (like medicine, engineering and so on) are more likely to put greater weight than they should on things that are not hard science that they don’t understand or is not their realm. In other words they assume things are rigorously vetted or controlled or regulated just because that is the world that they currently live in and have the most experience with. And that people are honorable (reason for all this internet openness which never anticipated that someone would spam being the perfect example). Which doesn’t make sense at least on one level.The world that I was raised in and came that I came from could be described as “everyone trying to get one over the other guy”. Hence that is the way I am “trained” and the way that I see the world. The way my dad survived the camps most likely. Every man for himself when it comes down to food and survival.Funny thing in a recent condo board meeting happened. The guy who runs the management company says at the meeting that with respect to a large office building that they managed and also owned which lost a large tenant “we gave that back to the bank” in response to my question “how is XYZ building doing?”The other board members are all doctors with one exception (college associate professor or something like that). And they all sat there with a mix of both confusion and “oh that’s nice” and also with a look that said they didn’t understand what he meant. At all. Nothing to see here, move along.So I simply said “he means he defaulted on the loan”. And he kept repeating “we gave it back to the bank”. It was pretty funny. As if nothing bad had happened. Board members finally got the point of course.

Anti-fragility for sure! Have my doubts we’ll ever see another technology that has so many use cases.

Please, let’s not fall into the old paradigm of referring to the market “it” as an animate object.Sorry but I still remember, during my first highschool internship on wall st, asking traders why they do this.

Over the past year and a half, speculators have made a killing by shorting bitcoin, then placing massive btc sell orders (which may or may not be backed by actual bitcoin) into markets such as Bitfinex. For some reason, there seemed a renewable supply of short-term optimists who were always long bitcoin on margin at these exchanges. By placing a large enough sell order, the longs’ btc holdings were instantly liquidated to meet margin calls, thus providing more fuel for the speculator to continue this strategy. Some people call this rinse-and-repeat fleecing “Buterin’s Waterfall” as an allusion to a complicated conspiracy theory, which you can look up elsewhere if you desire.My hypothesis is that the opportunity to fleece short-term bitcoin optimists has dried up, and the big $ speculators have flipped strategy to squeezing the leveraged btc short sellers. Either that, or there are some new entrants into the market with large $ war chests allocated to manipulating bitcoin.Perhaps related to recent manipulating in the past week in litecoin, namecoin, and a couple other assets, which have moved dramatically.In sum, I don’t think the geopolitical news has anything to do with recent price movements. Almost entirely driven by speculation, combined with increasing ease of finding easy, legal conduits for deeper pocketed speculators to move $ into bitcoin.

There has been a noted uptick in the interest of the blockchain (not the currency) within the information security and privacy field. The general sense is that the technology can also be harnessed by the “good guys” to add value to the security ecosystem.https://privacyassociation….

The underlying security is proportional to the network hashrate which in turn is incentivized by the value of the underlying token. The Bitcoin blockchain is the most secure because bitcoins are the most valuable digital currency. You can’t separate the tokens from the tech. The tokens are the tech.

Huh? Are you saying the price correlates with the level of security? Totally lost me on that one.

Yes. More miners/hashing power is attracted into the field as the exchange rate of the bitcoins increases in order to capture the excess profits. This increase in hashing power is what secures the network and clears transactions.

A question for all of you.What’s most important: the value of bitcoin, or the adoption of the block chain? And how do we compare these two appropriately?

I think it depends on how you see the bet. If you see it as underwriting the market for how people exchange value and not just just as a form of currency, then adoption matters & things like the announcement in Chicago are a sign of traction ( http://tullman.blogspot.com… ). Will this be immensely financially valuable? Yes, but that return is still a ways off, and as a founder or investor you need tolerance for some failure in the meantime. Not a bet everyone wants to or should make.I’m no bitcoin expert so I’ll leave it to others to debate it’s success or failure as a currency specifically, but IMHO we’ll know it has real legs when the growth starts combining consistent, crisis resistant growth with spikes (see attached. when you drop timescale far enough out, most hockey stick growth looks more like the 1st, especially true in fin / biotech where compliance and industry standards catch up in the lull / plateau).

Both have a cause and effect relationship. The adoption of the blockchain increases the value of bitcoin and vice versa. Moreover, do not get distracted by “Bitcoin 2.0” or other “blockchain without bitcoin” projects. These are vaporware. Focus on Bitcoin’s blockchain, where true value resides.

“The adoption of the blockchain increases the value of bitcoin…”I don’t understand this. Without the blockchain there is no bitcoin and if there were other major applications I am unclear how that would increase the value of bitcoin.

Without Bitcoin there is no incentive to maintain and secure the Blockchain. Major applications using the Bitcoin blockchain would necessarily use satoshis as base units and therefore create demand for bitcoins

The blockchain.You can’t.

can’t have one without the other. The blockchain only works because of the incentive of mining bitcoins. And bitcoin doesn’t work unless logged on a blockchain. Bitcoin and THE blockchain. There’s a zillion other alternate cryptocurrencies and they all are worthless, Bitcoin has already achieved the necessary momentum and network effect. “Blockchain Technology” is just the media hyped term the Bitcoin community has luckily (or someone with deep pockets has paid for) gotten for the media to talk positively about Bitcoin.

.Greece is 45th largest economy in the world (can you name the 44 who are bigger?) with a GDP of $238 Billion.After five years of GDP contraction and one year of bogus expansion, it is contracting again. The gov’t spends something like 49% of GDP and takes in about 44% of GDP — it is on a continuous road to ruin. Has been for a long time.There are 11MM Greeks.The Greek economy was destroyed by the Germans in WWII and now the Germans are being asked to save it. Fair?What nobody focuses on about Greece is that the Greeks control 15% of all the commercial shipping on the planet. Funny number and subject to a lot of interpretation but — wow — that’s a lot of shipping.Point being — Greece is not really a big economic driver of anything other than some awkwardness for Germany and the EU.I did, once upon a time, almost set off an international incident by putting Russian dressing on a Greek salad. I was young, Stupid. Insensitive.Total bitcoin from a standing start in Jan 2009 is about 14.4 Billion. Check me on that, please.Point being that Greece isn’t a pimple on the world’s ass and bitcoin is still a very modest undertaking.This is still a very embryonic “thing” still desperately looking for a killer use case. The fact that it fluctuates in value — whether recent or from its all time high — is more of a “tulip” phenomenon than anything else.When, if, the killer use case comes along, then it will be important. Until then, not so much.JLMwww.themusingsofthebigredca…

There are 11MM Greeks.And some, I assume, are good people…

.I will defer to The Donald on that one. Haha.But, yes, one can assume that most of them are good people.JLMwww.themusingsofthebigredca…

“Atticus, he was real nice.””Most people are, Scout, when you finally see them.” – Harper Lee.

They may be good people – but they seem to be clueless. Seeing the young masses rally in the street to reject a deal is a scary sight that is already being duplicated here in the US. These youngsters that grew up on that massive socialist buffet have no idea about debt. It is just a number created by evil capitalists who want to control them.

Debt is a risk.

.Sure, they’re clueless. Almost everyone that age is. Part of growing up.If they were clued in perhaps they would still be rioting because they would realize their leaders had saddled them — their generation — with massive debts that they will be required to repay.BTW, the US debt per capita is $58,604 while Greece’s is $38,444.Take a look at this to see comparative debt amounts.http://www.bloomberg.com/vi…The riots will begin shortly.JLMwww.themusingsofthebigredca…

You hit on the point – the youngsters need to be educated on who the real villains are. In the US they are taught to hate big business – not big government.And the riots are already happening. Remember Scott Walker? That was essentially a mini-Greece. But none of the dire predictions came true. He saved the budget AND all of the jobs.

.Indeed.Based on actual experience, Walker might make a damn good President. He belled several sacred cows in the process.JLMwww.themusingsofthebigredca…

is more of a “tulip” phenomenon than anything else.Having just experienced a mania with the Chinese who went through a 3 or 4 month “tulip phase” buying something that I know a great deal about, I have actually lived through and rode the wave of a tulip mania. I had one younger tulip buyer make 40% of the purchases (god it was almost pathetic how he got sucked in thinking prices would go up forever) but even the older more experienced tulip buyers still got sucked in. Just not as much.This actually really really happened I am not making this up. Big dollar amounts also.

There is a wide chasm between the value of bitcoin and the bitcoin economy. Focusing on the BC/$ exchange rate seems a like a distraction.

“What will happen to the Stock Market ?””It Will Fluctuate” – J.P. Morgan, early 20th century.Currency trading is a $4 Trillion a Day market. $4 Trillion a Day.Edit: $5 Trillion a day.

Since you opened the Greek can of worms, I agree with Nassim Taleb’s recent musing that the case of Greece is one of a marriage gone wrong. Greece has more in common with the Eastern Mediterranean than it does with Europe. Their European marriage will end in divorce, and both parties will be happier.And if you want to help the Greek economy, buy their products- olive oil, fish, cheese, whatever…

.Greece is a petri dish of the most liberal policies taken to their own natural end. It is the end game of running out of other people’s money.I like to look at Greek expenditures and revenue as a percentage of GDP as a way to reflect upon what happens when governments collect and spend in proportions that are out of balance.GDP is all there is. This graph shows what happened to Greece — growing until 2009 and contracting thereafter while increasing spending. It is lemonade stand economics that a Shih Tzu can understand.http://www.tradingeconomics…If you take in 44% of GDP — a huge number — and spend 49% of GDP (another huge number) and accumulate a debt far in excess of GDP — you are, in the words of a Shih Tzu, fucked.The US is not immune to this calculation even though we have a 17.4 Trillion dollar GDP. Our debt is getting ready to choke us.I will have a Greek salad tonight, perhaps, with French dressing.JLMwww.themusingsofthebigredca…

I wished there was a place where world politicians get to learn economics, business and math. And have them realize that running a country is about business more than it is about politics.

I’m wary of utopian fantasy, but I’ve wondered for a long time if it was possible for a country to exist that was run more like a business. Trying to think of examples but so far no luck..

It wouldn’t be utopian. It would by dystopian.

Singapore is pretty close to that. And maybe Switzerland to some degree.

.Texas!On Earth as it is in Texas where the legislature meets every two years, the funds available to be allocated are certified before the Lege comes to town, the budget must be balanced and there is even a substantial Rainy Day Fund.It is a very businesslike process and there is still no personal income tax.Run like a bidness, y’all, pretty damn close.JLMwww.themusingsofthebigredca…

how about singapore

Can’t agree with you there in two regards:1) business is indeed important, but ‘running a business’ is not the best analogy for running a country. In fact it is a dangerous one. The model of the household or the firm is imperfect when applied to a national economy. It is doubtless for this reason that in economics they are treated separately. Microeconomics and economics of the firm is NOT = macroeconomics. (this model of economy as household is intuitively appealing and a blessing for those with no formal training in economics. It may explain why it is that those with no economics background whatsoever speak with such confidence about macroeconomic policy.)2) running a country is more about politics than anything else. The state is the means by which differences between any social groups in society are resolved. By no means all such differences are economic.:)

What I said was to be taken with a grain of salt, because there are some really badly run countries by incompetent politicians and strung by bad systems. True, there are socio- factors at play that enter the decision-making.

I don’t think that would help. Politicians are engaged in politics not governance. The voters determine whether to elect their leaders based on pandering or good governance. We have met the enemy and he is us.

True, but they can influence what gets done, stalled or accelerated.

True, I shouldn’t comment when in a cynical mood; it happens so often though when I speak of politics. We should get in the habit of rewarding courage. In this day and age, simply conceding something to the other side of the aisle is courageous. Speaking the truth is also courageous: that fixing things might cause some hardship. Whether Greek politicians suffer a lack of courage or their electorate suffers self-centered short sightedness they’ve ended up where you might expect, with bigger problems to solve.

Greece has finally revealed a major fissure between northern and southern Europe which has been showing stress fractures for years. The ultimate cause is cultural: the more north you go the greater the sense of community.One of the principal upshots of this is in politics: the more north you go, the more likely people will vote for the good of the community; the more south, the more they will vote for the good of themselves.And one of the principal upshots of this is that in Europe the quality of politicians deteriorates proportionally to the latitude. In other words, southern Europe is a hotbed for fly-by-night populism. They tell the people what they want to hear, knowing full well that what they propose is either damaging, or impracticable, or both.For over 15 years Greece has been taking other people’s money and promising reforms. The money kept coming, but the reforms never did.All that’s happening now is a bunch of tired creditors finally saying enough is enough.

North vs. South is symbolized by butter vs. olive oil.At the end of the day, it’s about governing well, being less corrupt, being efficient, and accountable.

David – I have no idea if you are from Europe, I am, but I just don’t recognize this characterization at all. There are most definitely important cultural differences between north and south but I don’t feel you have captured that reality.

If you accept corruption as a reasonable proxy for lack of civic-mindedness, you’ll see that this chart makes my case.

“I will have a Greek salad tonight…”.Those go best with a nice beer bread made from a stout.

and pay in Bitcoin! so the receivers don’t get their money held by the bankers in euros.

Isn’t bit coin’s killer use case “Ubiquitous Usage” as a value exchange ?This translates into a classic “chicken or egg” problem.Bit-coin cannot deliver its potential of massively-distributive inertia-based stability until it reaches “Ubiquitous Usage” and it cannot reach “Ubiquitous Usage” before it can first deliver up that same massively-distributive inertia-based stability.At some point it may reach a critical tipping point along its “chicken or egg” evolutionary trajectory required to jumpstarts its organic potential for massively-distributive inertia-based stability.Its pivotal/killer use case under “Ubiquitous Usage” then becomes the replacement of “the US dollar” or “gold” or any other commodity as the underpinnings of a global currency with a global bitcoin currency backed/underpinned by the sum total of global GDP under distributive exchange.Ok . . . Ok – maybe I’m just exercising my right to dream onHope springs eternal 🙂

.I have no dog in this fight one way or the other. As a general proposition, I am a natural skeptic but bitcoin is not singled out for special treatment.But the volume of words you have used seems to indict the notion that there is any use, let along a killer app.JLMwww.themusingsofthebigredca…

In short bitcoin could replace gold as a universal currency underpinning.I think that counts as a killer use case !

.That may or may not count as a potential use case. It is the present that concerns me.Bitcoin will likely cure the common cold at some future date, no?JLMwww.themusingsofthebigredca…

No. A cure for the common cold has a specific set of criteria that bitcoin almost universally does not meet.A superior money however, has a specific set of criteria that bitcoin not only meets, but utterly dominates far, far, FAR beyond that of any other thing of value on this planet.

.May I quote you on that?I only hope I live that long.JLMwww.themusingsofthebigredca…

Putting a halt to the endless history of currency manipulation while providing a universally frictionless global exchange mechanism, all underlined by the sum total of tangible global GDP, seems like a major use case to me.This is a solution arriving just in time to meet a critical/evolutionary economic imperative that will naturally be resisted by all the incumbent monetary/banking forces.But like everything else “dynamically intelligent currency” is just part of the larger trent towards automated intelligently-adaptive everything. It is the universally meme/spirit of our time and it is advancing on internet time.High speed network-effect interdependencies now mandate that we implement an organically clever yin-yang style integration of the public/private, individual/collective, interests.I’m old too and I not that comfortable with “rushing in like fools” into this new automated intelligently adaptive everything mania but for better or worse resistance seem futile 🙂

.I may have a scheduling conflict — when exactly will the future be arriving? I want to put it on my calendar.JLMwww.themusingsofthebigredca…

That’s a pretty big ‘could’ when its utility value is far from clear (as is its liquidity).

True but !The search for something tangible to underpin the vale of currency that can not be manipulated has been an ongoing problem for centuries and now we have a mechanism that can in a very practical/enforceable way underpin a global currency with total of all Global GDP value exchange.That seen like a true “Strange Attractor” !

I obviously concur that the search for something tangible, to underpin the value of currency that cannot be manipulated, is ongoing. I do not concur that it is Bitcoin – it isn’t tangible to enough people hence why the market for it isn’t as big as its enthusiasts have hoped for.Stability appears to be returning but liquidity isn’t. Maybe it will, maybe it won’t but either way it will be one of a plethora of new digital currencies that store value and double up as a means of payment that networks use to exchange value.But what Bitcoin ‘produces’ in the ‘work’ that it does, is only marginally better than money itself. Bitcoin is mined into existence whilst money is lent into existence.What we need for true liquidity and true stability and true democracy is a currency that is earned into existence by the people, for the people and with the people. For doing good.

once it’s stable and it can scale, an out of the box basic capability is providing basic personal banking, without any fees for minimum balances, fixed low fees for transfers of any amount (cents or millions, so hello micropayments and good buy wire transfers, huge killer apps right there, and already being used by several smart people if you sit down to look at the blockchain in real time, the future is here, just not evenly distributed they say…), and anybody in the world can take your money if they can install a Bitcoin wallet in their phone.That’s a shitload of people out of work right there, and that’s just the 5 minutes of explaining the basic Bitcoin features.

I don’t think that the situation is as “chicken and egg” as you describe. Bitcoin can find any number of real use cases without ubiquitous adoption. Any international money transfer, including remittances, evading Greek capital controls, etc can use bitcoin.

“I did, once upon a time, almost set off an international incident by putting Russian dressing on a Greek salad. I was young, Stupid. Insensitive.”.I’m not allowed to hang out here. But I just had to laugh about that. Good one!

This assumes that Satoshi’s intended use isn’t the Killer use case.Bitcoin was specifically designed to separate our money from the state. Argentina is starting to show signs that it is working… If Greece stays in this shape for long, they might show us too.

.Yes, where Argentina and Greece lead, the world will boldly follow.Wait, did I really just say that?JLMwww.themusingsofthebigredca…

The killer app? A global currency that appreciates in value once the mining chills out. I hope were still here in 5 years to hear what you have to say 🙂

i coming from a shipping family. greek God father and all! They do control large parts of the shipping market (as defined by ship ownership – not trade).But none – i mean none – in any way contributes to the greek GDP as my father explained to me last night that there were a couple of deals done with the military Junta in the 1970s that provider for complete tax immunity in perpetuity to all shipping companies and their related entities in return for something like $500M.The asset base of the greek shipping market now sits in bermuda, madeira, london and other locales….free and clear of its country or any obligation to it…..Although there were grumbles in london last week amongst the greek shipping community thanks to our good chancellors announcement…..but i digress.

.Yes, I knew all of that. It is the business talent that fascinates me.”Calling all Greeks. Come save your country.”JLMwww.themusingsofthebigredca…

I was just reading this last night. It says Greece’s Bitcoin use has gone up 500% in the last 4 weeks. http://fortune.com/2015/07/…

Sorry, Fred, from all I can see, so far BitCoin and the blockchain, in colloquial but common and fairly significant terms, don’t measure up, or cut the mustard, have significant traction, and aren’t ready for prime time.More significantly, so far there is no significantly important real world problem for which BitCoin/blockchain are promising as powerful, valuable, defensible solutions.So far, are BitCoin/blockchain good as toys, curiosities, topics for newsies to write about to try to get eyeballs, don’t yet have a solid proof of being too weak forever, etc., sure.I’m sensitive to such considerations: Anyone trying to apply a background in advanced technical material and related original research is commonly dismissed, at least early on, as having only a solution looking for a problem.I sacrificed a lot to get a really good academic background; while I have a lot of curiosity, e.g., about, say, natural philosophy, e.g., mathematical physics, overwhelmingly my interest was to be useful in practice, to make money, the green kind, to be a good provider in a good family. Being irrelevant in the practical world was to me despicable; I deeply resented such accusations of irrelevance.So, in graduate school and later I commonly pleaded that academic seminars had lots of professors and graduate students with solutions looking for problems but far too few, usually no, people from the practical world with problems looking for solutions. I suggested that the two sides in effect meet in the middle; the academic world would get some good applications and additional research directions, and the practical world would get some good solutions and more practical problems; both sides could do better financially.Yes, for more detail, we can say a little about both sides, (A) Research and (B) Practice:(A) Research.Broadly in total for civilization the most valuable research has been fundamental research. Leading examples include (i) Newton’s work on calculus, his second law of motion, and his law of gravity plus his work on optics (bright guy), (ii) Maxwell’s work on electricity and magnetism, (iii) chemistry and the main contributors there, (iv) Einstein and both special and general relativity, (v) Schroedinger and quantum mechanics, (vi) Pasteur and the microbe theory of disease, (vii) biochemistry, (viii) cell biology, (ix) Watson, Crick, and Franklin and DNA.Math? (i) Calculus, (ii) ordinary differential equations (e.g., deterministic optimal control theory), (iii) stochastic optimal control (Kalman filtering, Bellman recurrence), (iv) partial differential equations (of mathematical physics for heat, fluid flow, mathematical finance, etc.), (v) numerical integration (e.g., for satellite orbit determination, space flight trajectories, solutions of partial differential equations), (vi) abstract algebra (e.g., group representations for molecular spectroscopy, algebraic coding theory), (vii) linear algebra and numerical linear algebra, (viii) differential geometry (general relativity, solid mechanics), (ix) probability theory, (x) mathematical and applied statistics, (xi) Fourier theory (the fast Fourier transform and digital signal processing), (xii) optimization (linear, non-linear, integer, network linear), and much more.But there have also been oceans of powerful, valuable applied research, e.g., (i) Bessemer and iron, (ii) steel, (iii) Watt and steam engines, (iv) electronic vacuum tubes, (v) telegraph, radio, and TV, (vi) internal combustion engines with, e.g., the Carnot cycle, (vii) turbine engines, (viii) the transistor, (ix) photostatic imaging and copying, (x) microelectronics and computing, (xi) plastics, and much more.(B) Practice.(i) Central. In some parts of practice, pure/applied research is central to the work. Examples include the latest microprocessor manufacturing techniques, say, now, to 7 nm, proprietary pharmaceuticals, specialty materials, genetic engineering (e.g., for crops), and much more.(ii) Not Central. In some parts of practice, pure/applied research is important but not central to the work. E.g., manufacturing cars, farm machinery, textiles, concrete, etc.(iii) Not Relevant. A guess is that somewhere there are parts of practice where pure/applied research is not relevant, but I’m having a difficult time finding any. At least in the industrialized world, a business will have a tough time going as long as 10 years without significant impact from pure/applied research.Usually when some research impacts practice, the activity in practice sees a good and fairly immediate reason. Otherwise practice is reticent, reluctant, gun shy, etc. to pursue research.E.g., suppose some area of practice, say, business, is willing to consider parts of pure/applied research. Okay, in quite broad terms, a business has some work to do, has some freedom in just how to get that work done, and is eager to get the work done for least cost.So, an approach is to find how to exploit the freedom to get the work done at least cost, maximum profit, or nearly so. A surprisingly large fraction of the Nobel prizes in economics have been based on this broad idea, at least from Kantorovich (how to ship from factories to warehouses at least total cost) to Nash, Solow, Arrow, etc.Broadly the field is called optimization, and there have been successes in airline crew scheduling and much more.Academic fields of applied math and engineering have done good, relevant applied research in optimization for decades. Still, businesses are reluctant to pursue projects in optimization.J. Simons at Renaissance Technologies built statistical models of financial data, used them for automatic trading, and built a significant fortune:https://www.youtube.com/wat…He makes clear in this video clip that he doesn’t want to trade based on some guy rushing in claiming from gut feel or some such something like “Google is a great opportunity just now”. Yet, there’s a lot of evidence that the rest of the Wall Street community would much rather go on gut feel or whatever than carefully constructed and tested statistical models.Business apply optimization? Statistics? Mostly, nope.Result: Even with solid and powerful foundation research and focused proposals, business is very reluctant to pursue applications of pure/applied research. For such a proposal to be accepted, need luck, hype, and/or a very well supported, quite specific project proposal with quite reliable milestones and high return on investment (ROI).In practice, research that does not meet these criteria are contemptuously rejected as “solutions looking for problems”.So, where does this leave the field of BitCoin/blockchain?Is that field really good pure research, say, comparable with Newton’s second law, calculus, or Fourier theory? Nope.Are there now some quite specific, pressing real problems that a project in that field can solve, with reliable milestones and high return on investment? Nope.Net, from what we know now, I see no real hope for BitCoin/blockchain.Or, I’ve invested a lot of my time, money, and energy in pure/applied research with the goal of making powerful, valuable applications, and my current project is an application of some original research, but I’m not willing to make such investments in BitCoin/blockchain. That subject looks like a fairly routine application of encryption and distributed computing and not very impressive pure/applied research still looking for how it can be a powerful, valuable solution for an important real problem; with this situation, history tells me just to f’get about BitCoin/blockchain.Sorry ’bout that. Many are culled; few are frozen.To try to be more clear, it is clear enough from history that new ideas, new techniques, new research results can remain of somewhat significant interest in practical fields for a while, sometimes years. But with only rare exceptions, for the interest to remain solid and the work to have significant effect, business has to see significant dollar signs at least on the top line.It’s super tough for business to make novel applications. IMHO, the main reason is that business is still organized much like it was 100 years ago where the supervisor was supposed to know all that was needed for his work and the subordinates were just to add routine labor to the knowledge and work of the supervisor. So, a supervisor doesn’t want anything new.In a traditional business organization, about the only person who can sponsor something very new is the CEO, and even there a CEO can easily get resistance from the BoD.So, the main way new work is brought into practice is by organizations lead by people who specialize in the new work.E.g., for someone with some research that stands to be powerful and valuable in practice, to get that work used in practice, that person really must just start their own business that sells that work to others.Net, crossing the chasm from research to practice is challenging even if the research is new, defensible, powerful, and valuable. So, since optimization and statistics have so much difficulty, there’s not much hope for BitCoin/blockchain.For my startup, to help cross this chasm, there are some special circumstances: The capex to start is meager; as soon as there is any usage at all, the opex stands to be less than 10% of revenues; my original research is crucial secret sauce, but no one needs to understand this but me; the users never need consider that there might be some research behind what they are seeing. That is a quite a list of special circumstances to let some research get into practice; most research will not have such good circumstances and, as a result of the lack of such circumstances and more, will likely struggle or fail in business; I have to conclude in particular that BitCoin/blockchain will fail.

….+1 for including Rosalind Franklin. She is often forgotten when you typically hear “Watson and Crick”…

Franklin was ripped off — stolenfrom — by her lab director, Watson,Crick, and the Nobel committee.

‘would much rather go on gut feel or whatever’.Logic is the thing to use for decision making in the business world. But, keep in mind, emotion is the thing that makes life worth living. Maybe people on Wall Street want to enjoy their day at work so they don’t use logic..Anyway… I have to go before Fred see’s me here.

Back in the day, one could have said the same about Research in Motion (Blackberry) stock.

Behind closed doors, whales, banks, financial institutions are positioning themselves. Industry changing announcements coming in the next 6-12 weeks.

in this case, it’s speculation on greece. but, yes, it is resilient and the blockchain will certainly be around for the long haul.

Let’s call it the LaMotta effect.

Fred speak a great deal about the blockchain and it’s potential uses as do others. I consider use of the term “bitcoin” to be a payment method in lieu of cash, wire transfers, checks, ach and so on. I consider the blockchain to be the plumbing and/or method that helps carry that particular usage out.If someone wants to use the blockchain for some other purpose, and that usage involves “paying bitcoin in order to make and update” to me that isn’t “using bitcoin” it’s “paying to use the blockchain for some other purpose”.

Well said, but…I don’t think we should rule out next generation blockchains. There are real technological limitations to blockchain 1.0 which was, in fairness, a proof of concept rather than a mature design that embodied a good deal of experience wrt how the blockchain would operate at scale. I do recognize that the introduction of any such 2.0 blockchain no matter how technologically superior will indeed be a challenge.

Bitcoin and Bitcoin Blockchain are inextricably linked. This was the point I was making a couple of months back as well…see attached comment. Doesn’t negate the point of other Blockchains (and applications).https://disqus.com/home/dis…As a simplification, think of it as 3 things:1. Bitcoin2. Bitcoin Blockchain3. Other Blockchains with significant impact.The Nasdaq references seem to be about Bitcoin Blockchain.Thanks.

There is a third leg in the bitcoin and blockchain synergy: micropayment channels.

Amen.