A Chart To Ponder

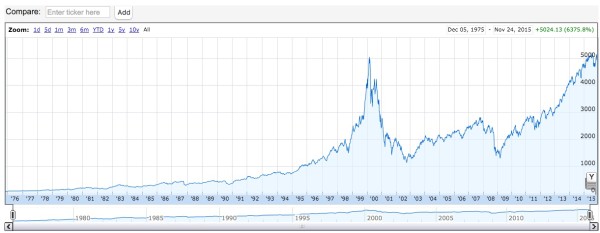

I was looking at some charts this morning. This one of the NASDAQ got my attention.

You can see the wind we’ve had at our back since the financial crisis of 2008/2009. Seven years of good financial markets.

My career as a fund manager started in 1996. We had five years of good times followed by three years of bust. Then we had five years of good times followed by two tough ones. Now we’ve had seven years of good times.

I will leave it at that. Sorry to be a bummer this morning.

Comments (Archived):

It’s great to be investing after your predicted crash period in early stage companies because the valuations will be more reasonable.Bad times for some are good times for others. It depends if you look at it from a selling or buying perspective.

Buy investment property as a NASDAQ hedge. uncertainty -> instability -> less demand for owning a house -> increased demand for rental units + low interest rates = solid stable income with big upside potential to flip when stock market stabilizes.

William Mougayar:have you had the opportunity to read Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money by Nathaniel Popper?

No but I am familiar with that story.

Only a pause in a great run. Record corporate profits and balance sheets that are the best in decades. The consumer out there spending earlier in the year on big home projects and John Stumpf says that their balances are also the best in decades. 40 buck oil and insane presidential candidates, hey it’s America. I’m still long and I’m usually early too

I wonder how that balances out if you deduct the debt, etc.

Where’s Hamilton when need him, on Broadway

.Less than 10% of the folks reading your comment even know who Johnny Boy Stump is.Happy Thanksgiving.JLM http://www.themusingsofthebigredca...

And a great Thanksgiving to you Jeff and yourfamily

I suspect that that has mostly to do with lack of PR outreach and a conscious choice on his behalf. Most people have heard of LLoyd and Jamie for example so I don’t think that is any boating accident (Jaws reference).Also it’s a West Coast company and being located in or closer to the media capital of the world will get you more press than when you are on the West Coast, the exception being startups of course.Unless you are particularly colorful (like Warren Buffet) or a villain (like the Koch’s).My theory anyway….

well done

By the way, your initials sold at auction a few weeks ago (to the Chinese) for $44,317 USD. See attached….

hey it’s AmericaMellencamp:There’s a black man with a black catLiving in a black neighborhoodHe’s got an interstate running’ through his front yardYou know, he thinks, he’s got it so good(@falicon:disqus primed my brain in this case..)

“Capitalism is above the law, it don’t count, less it’s sells, if it costs to much to make here, make it somewhere else”Dylan

Market crash is essentially (a lot of) money transfer from many to few. This happens all the time, in one way or another.

What will be the trigger or tipping point for this correction, in your opinion?I’m seeing a lot of greedy investment bankers pushing hard on (very) late stage valuation rounds, and that’s where lots of hair cuts will happen…which will trickle down gradually.

Market Theory would have it that a correction is equally likely up or down.I was wondering which you would view as a correction 🙂

war.

If the trigger looks anything like the previous one, over inflated valuations of… wait for it.. college degrees

Private late stage rounds won’t move the needle by much.. The trigger will be more macro, I think.

But one or 2 disasters might trigger something.

Monday’s child is fair of face,Tuesday’s child is full of grace,Wednesday’s child is full of woe,Thursday’s child has far to go,Friday’s child is loving and giving,Saturday’s child works hard for a living,But the child who is born on the Sabbath dayIs fair and wise and good in every way.it must be Wednesday. go and have your breakfast groul.

http://youtu.be/0L_6PGTDUQM

I only watched part of this so far (had it taped from the first showing) but it was pretty good. I grew up watching this and obviously never knew what happened behind the scenes.I see that it is on Nov 26 at 2pm again:http://www.smithsonianchann…

I’ve watched that as well (and used to love the reruns after school in the 80s)…contrived and all, I *still* like the music and the show 😉

Yeah it for sure passes the “grey whistle test”. I always liked it as well.When they got the first pressing of a record they would play it to people they called the old greys – doormen in grey suits. Any song they could remember and whistle, having heard it just once or twice, had passed the old grey whistle test. I wonder what the Internet equivalent of the GWT is.[1] https://en.wikipedia.org/wi…

Hah, same here although it’s been a while since I’ve watched.

Sounds like you think the Turkey is stuffed.

that’s Russian thinking.

so it’s all about to go pop again?how might this influence bitcoin i wonder.

Statistically we’re due for a down turn. However, the levels of financial engineering that have taken place since 2008 to stave off the crisis may not be done yet.

“Due” for a downturn is nonsense. Yes there is a business cycle, but the stock market doesn’t have to go down as part of it because it should be rationally priced in (that doesn’t mean I don’t think stocks could be too expensive, they could be). But often business cycle timing arguments are based on a sample size of about 6. Resist the human tendency to find pattern in everything. Was the crash in ’08/’09 rational? There was a huge recession, but it seems like the market is much higher now so maybe the fed acted too slowly and instead we could have had a bull market from 2002 to today. Yes, it’s good to clear out the cruft, but some of that might have fallen out anyways.

“it should be rationally priced in” is a big assumption, and probably the cause of every bubble and subsequent pop. People aren’t rational, they are emotional. Why do you think Silicon Valley values uber so high? It’s because they use and love uber rides. The rest is creative justification. “Momentum investing” is Yiddish for emotional investing. It’s all emotional, just don’t get caught without your pants when the tide falls.

People are both rational and emotional to varying degrees; the fact that emotion is so prevalent is in part a side effect of people diversifying beyond their ability to thoroughly understand their investments (due to lack of time, inclination, or both).Also in part due to varying risk appetites, and in part due to press releases not having ansible-level speed, but the time commitment is worth more attention than it’s had.

I agree mostly (n=6 +-) but will note that self fulfilling prophecies also drive behavior.

Going by average cycle time, perhaps. It does “feel like” we’re building toward another systemic re-pricing, but how and when I have no clue. I hear anecdotes from people involved in securitization and structured finance generally, that business is BOOMING. Unscientific measurements like weekends and holidays at the office all point toward insane profits being made. But I have no idea how or where, and I couldn’t say that any particular asset is mispriced in any systemic way. It’s all kind of scary, b/c it seems like maybe we “should be” due for a correction, but it’s hard to say what needs to be corrected. It’s possible we’ll keep building until the paper value of wealth out there is tremendously higher than ever before, at least in nominal terms. So any correction will be a big surprise to everyone (other than doomsday preppers, who like a broken watch, are eventually right).

How much is this driven by interest rates and employment because then all the charts in the world are going to look odd

Driven by interest rates. To many dollars chasing to few investment opportunities. Just like housing prices were driven to bust by cheap mortgages to people who didn’t qualify for them. And NY high end real estate is driven (apparently) by foreign investors and instability.

Well with negative rates, maybe this is normal

Everything seems so calm and steady up until about 1996….now what happened around then….some sort of interruption to the system which caused a huge unravelling 😉

I suspect the internet had something to do with it.

Regarding his comment, I suspect sarcasm had something to do with it.

Ah, your right, regarding my previous comment, I suspect the lack of coffee had something to do with it.

And Al Gore thought it was the Telecom Act of 1996.

Either that or it was Fred becoming a fund manager 🙂

Not a bummer, just something interesting to ponder moving toward weekend.

Meanwhile, the economic gap is widening and fewer are sharing the wind. I’m hopeful whatever the next cycle entails, it’ll be more leveling of the economic playing field. I’d love for technology to play a big role in that, but the economic gap is being mirrored fairly closely by a digital divide that a few programs by big tech cos. can’t fix alone.

Yes, if the US government prints a trillion dollars a year and collapses returns in the debt markets, the equity markets balloon. Looks like a pretty solid example of Austrian Economics at work.

If a rising tide raises all boatsAn ebbing tide leaves idiots strandedSo throwing out the garbage occasionally is good for the rest of usIf VC were the Olympics – it would be the Marathon runners and the multi-discipline winners we would admire the most. Many of the rest could take a long jump and we really wouldn’t care !

True Entrepreneurs: Shipping code, fielding customer issues, making payroll–evangelizing.LPs: in background and on the sidelines counting money.VCs: In the limelight, trading in and out, watching markets.

On that cheery note from Fred…Happy Thanksgiving everyone!

If you believe that’s true, should buy security stocks and bitcoins. Market tanks->trickles down->people get poor->people get desperate -> people commit financial crimes and go to war -> black market increases -> bitcoins increase and need for security increases.

better off selling puts. 70% better odds over simply buying the underlying.

that’s a good “call”.

If software is eating the world, this is no time to leave the table.If earning are leading the world, however, look out below

Each one of these peaks and troughs need to be understood (normalized) with respect to monetary/interest rate policy and trade policy. And both of those look negative now. (EV/OCF is a better ratio which normalizes financial/balance sheet engineering.)There’s also a fundamental technology disruption associated with each peak as investors speculated too soon about future promise:1929 = radio (distribution of content)1967 = transistors (processing of content: computers)2000 = internet (spontaneous generativity and repurposing of content: networks)2015 = mobile (real-time, 7×24, 2-way knowledge generation)Unbeknownst to many who talk about Perez’ cycles on this thread is that we’ve been in a modern digital information revolution since the 1840s (yes, the telegraph was “digital”). The cycle was extremely generative until 1913 where we took a step sideways and then 1934 when we took a step back with respect to policy and competition.Things got a whole lot better in 1984 and then got ahead of themselves by 2000. We’re at a an inflection point now with respect to policy and sustainable business models as I said above in another comment. If we get it right I am very bullish (in part because we are still playing catch up and in part because the technology opportunities continue to race ahead of the institutional realities), but if we get it wrong, then we might look like the late 1960s with respect to multiples and valuations.

@samedaydr:disqus is correct in looking at a P/E chart on a normal scale. An E/V chart is a better one. But whenever looking at absolute stock prices, need to use log scale. Agree, though, in general with your time frames and believe also that there are fundamental flaws in today’s mobile app model much like there were in the internet model in the late 1990s as relates to underlying network access (and lack of settlements north-south and east-west).1999 = slow, dial-up, mostly 1-way narrowband2015 = disconnected app model (everything’s a silo)

Follow the share buy-backs.

Agreed. I pointed to debt/equity (im)balances and financial restructuring/manipulation below.

Oh, my. Can’t wait to see Fred’s post tomorrow. If there isn’t one, the world will surely have ended. 😉

Just cycles, no biggy. Only hurts if -> you liquidate investments and miss the return (stocks, etc)-> you’re trying to raise capital on a down cycle and valuation is highIf we could predict the down trend based on X months/years of general growth, it wouldn’t be a real market.Looking at the growth another way, long term. Any dip we have now will look like the dip in ’87 in 30 years.

Follow upMy initial reaction to this post was ride out any downturn and keep buying cheap. After a little research I think I can do better.I did some reading over a few techniques to hedge my “virtual earnings” over the past few years and cash looks like the best choice. Inverse etfs and puts are a little too heavy/hands on for the type of investing I do.Right now I have about 5% cash (the rest is split between 2 stocks and the s&p 500 index), and may increase that position to 20% which will eat into growth over the next year, but give me some great investment opportunities if there is a downturn.For example, Bershire Hathaway is building a nice pile of cash. It seems like a reasonable hedge or later buying strategy as long as an oportunity to invest occurs.

Someone else sees this!I made a meme from this a couple months back…http://i.imgur.com/lQt3Ylr.jpg

that’s great

Oil market did the same thing for the last 15 years…and then whoa.

I will leave it at that. Sorry to be a bummer this morning.Happy Turkey Day!

The market has an impact on everyone no question about that but this is less of a bummer to those of us that have no money in the market and are waiting for a nice drop as a buying opportunity.

I’ve been waiting for a good sale myself.

The market has simply recouped what it had lost from the previous peak. Significant new highs will be made in the next 3-5 years to come.

Sold Both hands Palms facing out Thats what i would have been screaming in the pit Instead i am selling calls I do have friends that are bullish They say you dont sell new highs you buy them

When someone mentions the problems of anything, people, government, Block Chains,or systems we reflect on how to solve the problem.The original computer could barely fit in a room and if someone was contend with thatconcept or design the current computers couldn’t fit in a briefcase or many say yourhand (phones).http://www.sunnyvale.it/img…The simple people talk about peopleThe average people talk about eventsThe great people talk about ideas.We are honored to share space with some amazing people. The one’s who are great and not the ones who think they are great. If you have to thing about it one second you are not great. One’s deedsdetermine their greatness.Fred when the economy was actually doing bad could we expect comments from contributors to your blog blaming one individual? When the economy is doing well all the other reasons appear to be highlighted. And yes we realize no individual can takeclaim of how well or bad this US economy performs. The US is a consumption basedeconomy which actually leads the world in 69% consumption as a percentage of GDP.Just fell of high horse back down to reality.

I have never been more optimistic about the future of America than I am today.

So, that’s the rearview mirror, what do you expect the next couple of years to look like? Or better yet, how are you planning…

I am bearish. Been bearish. If I were in the pit, I’d have both palms facing out and yelling Sold! Think it is overdone, but I also think that money is cheap. Risk/reward ratios are messed up. I don’t see a “crash”. I could see a correction, and a sideways market.Great companies are often started in economic downturns. I am looking forward to that because there are a lot of me too companies out there. Happy Thanksgiving everyone.

I did not see the equity markets doing this well for so long, but as they say don’t fight the fed, I have thought for a while eventually the Fed will not be able to control interest rates but I have been wrong.In the startup world I have been through two major cycles and this is the third. Each one has gotten bigger actually due to the impact of the technology:Late 1980s PC: Everybody can have a computer on their desk.Late 1990s Internet: Everybody can connect with everybody and all informationLate 2000s: Everybody has a networked supercomputer in their pocketHuge potential and benefits during each, but as we all know you have the innovators, imitators, and idiots. We are in that last stage.The valuations combined with how much money people are willing to have companies lose has me shaking my head. Early stage ideas going for $10mm+ pre and late deals willing to lose $100mm+ a year, I sound like an old man but both of these are ridiculous.For $2mm I can build my own company why would I want a 20% share in yours?Losing $10mm a month? That is tourniquet time. One that should be on your neck.This Thanksgiving I look at my wife’s 96 year old Grandmother and think what she has seen since 1919, but the last 30 years have been just as impressive as her first.

I agree with a lot of your thoughts. Sometimes it’s easier just to say “Get off my lawn” : ) Happy Thanksgiving to your Grandma (and your family). My grandparents lived until they were 98. Holidays were always awesome with them, and get more special the older they become.

You too. I have a 30lb Free Range Turkey in the oven.

OMG. Huge oven. (Prime rib for us, my sister is allergic to turkey)

Mine is the big one standing near the post on the right:

*Formerly* free range, to be exact 🙂

I am absolutely ignorant about the complex aspects of economic theory but I like to think that I am good at visualising patterns, so I often try to look for patterns in things, specially flows, instead of focusing on static data. I have read LE writing about this before.So as Fred points out and if the crises have a frequency, linear or not, a new crisis may be lurking ahead. But what I want to focus on is that, just looking at the graph (Nasdaq index / t), the recovery speed or climb after each crisis seems to be faster/stronger than the previous period. And that’s a good thing.Just pondering, cheers.

Which means only a year of bust? That is great news for all investors in the public markets because the pain will be shorter than usual!

If you think the NASDAQ bull market is getting long in the tooth, you might consider hedging.$QQQ @fredwilson’s long view. https://t.co/MySiyXVBRx Maybe worth considering some downside protection. pic.twitter.com/uWdCKTzIFs— Portfolio Armor (@PortfolioArmor) November 26, 2015