What Did And Did Not Happen In 2016

As has become my practice, I will end the year (today) looking back and start the year (tomorrow) looking forward.

As a starting point for looking back on 2016, we can start with my What Is Going To Happen In 2016 post from Jan 1st 2016.

- I thought AR/VR and wearables would disappoint in 2016. They did. As my friend Sunil points out, the biggest thing in AR/VR in 2016 was Pokemon Go:

Easy to build content (apps) on a cheap widespread hardware platform (smartphones) beat out sophisticated and high resolution content on purpose built expensive hardware (content on VR headsets). We re-learned an old lesson: PC v. mainframe and Mac; Internet v. ISO; VHS v. Betamax; and Android v. iPhone.

And Fitbit proved that the main thing people want to do with a computer on their wrist is help them stay fit. And yet Fitbit ended the year with its stock near its all time low. Pebble sold itself in a distressed transaction to Fitbit. And Apple’s Watch has not gone mainstream two versions into its roadmap.

- I thought one of the big four (Apple, Google, Facebook, Amazon) would falter in 2016. All produced positive stock performance in 2016. None appear to have faltered in a huge way in 2016. But Apple certainly seems wobbly. They can’t make laptops that anyone wants to use anymore. It’s no longer a certainty that everyone is going to get a new iPhone when the new one ships. The iPad is a declining product. The watch is a mainstream flop. And Microsoft is making better computers than Apple (and maybe operating systems too) these days. You can’t make that kind of critique of Google, Amazon, or Facebook, who all had great years in my book.

- I predicted the FAA regulations would be a boon to the commercial drone industry. They have been.

- I predicted publishing inside of Facebook was going to go badly for some high profile publishers in 2016. That does not appear to have been the case. But the ugly downside of Facebook as a publishing platform revealed itself in the form of a fake news crisis that may (or may not) have impacted the Presidential election.

- Instead of spinning out HBO into a direct Netflix competitor, Time Warner sold itself to AT&T. This allows AT&T to join Comcast and Verizon in the “carriers becoming content companies” club. It seems that the executives who run these large carriers believe it is better to use their massive profits in the carrier business to move up the stack into content instead of continuing to invest in their communications infrastructure. It makes me want to invest in communications infrastructure honestly.

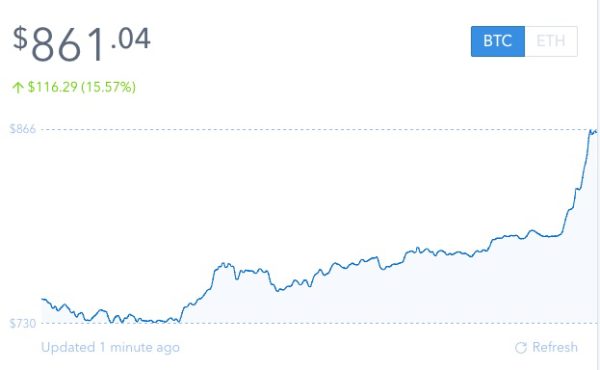

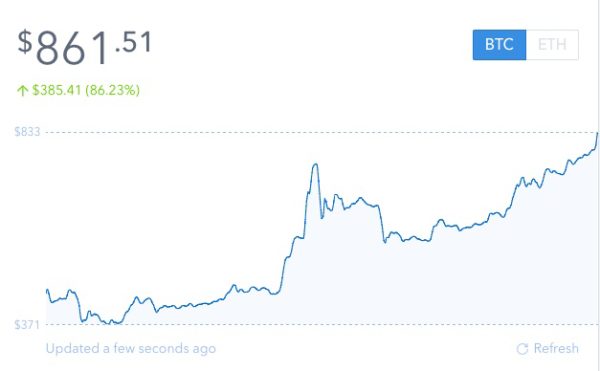

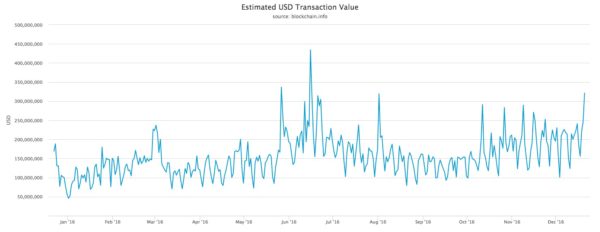

- Bitcoin found no killer app in 2016, but did find itself the darling of the trader/speculator crowd, ending the year on a killer run and almost breaking the $1000 USD/BTC level. Maybe Bitcoin’s killer app is its value and/or store of value. That would make it the digital equivalent of gold and the likely reserve currency of the digital asset space. And I think that is what has happened with Bitcoin. And there is nothing wrong with that.

- Slack had a good year in 2016, solidifying its position as the leading communications tool for enterprises (other than email of course). It did have some growing pains as there was a fair bit of executive turmoil. But I think Slack is here to stay and I think they can withstand the growing competition coming from Microsoft’s Teams product and others.

- I was right that Donald Trump would get the Republican nomination and that the tech sector (with the exception of Peter Thiel and a few other liked minded people) would line up against him. It did not matter. He won the Presidency without the support of the tech sector, but by using its tools (Twitter and Facebook primarily) brilliantly.

- I predicted “markdown mania” would hit the tech sector hard and employees would start getting cold feet on startups as they saw the value of their options going down. None of this really happened in a big way in 2016. There was some of that and employees are certainly more attuned to how they can get hurt in a down round or recap, but the tech sector has also used a lot of techniques, including repricing options, reloading option plans, and moving to RSUs, to mitigate this. The truth is that startups, venture capital, and tech growth companies had a pretty good year in 2016 all things considered.

So that’s the rundown on my 2016 predictions. I would give myself about a 50% hit rate. Which is not great but not horrible and about the same as I did last year.

Some other things that happened in 2016 that are important and worth talking about are:

- The era of cyberwars are upon us. Maybe we have been fighting them silently for years. But we are not fighting them silently any more. We are fighting them out in the open. I suspect there is a lot that the public still doesn’t know about what is actually going on in this area. We know what Russia has done in the Presidential election and since then. But what has the US been doing to Russia? I would assume the same and maybe more. If your enemy has the keys to your castle, you had better have the keys to their castle. And as good as the Russians are at hacking into systems, the US has some great hackers too. I am very sure about that. And so do the Chinese, the Israelis, the Indians, the British, the Germans, the French, the Japanese, etc, etc. This feels a bit like the Nuclear era redux. Mutually assured destruction is a deterrent as long as both sides have the same tools.

- The tech sector is no longer the belle of the ball. It has, on one hand become extremely powerful with monopolies, duopolies, or nearly so in search, social media, ecommerce, online advertising, and mobile operating systems. And it has, on the other hand, proven that it is susceptible to the very kinds of bad behavior that every other large industry is capable of. And we now have an incoming President who doesn’t share the love of the tech sector that our outgoing President showed. It brings to mind that scene in 48 Hours where Eddie Murphy throws the shot glass through the mirror and explains to the rednecks that there is a new sheriff in town. But this time, the tech sector are the rednecks.

- Google and Facebook now control ~75% of the online advertising market and almost all of its growth in 2016:

updated duopoly #s. new IAB data came out yesterday. easy to run vs earnings for goog and fb, it’s evident everyone else is zero sum game. pic.twitter.com/wolgdpfcxp

— Jason Kint (@jason_kint) December 30, 2016

- Artificial Intelligence has inserted itself into our every day lives. Whether its a home speaker system that we can talk to, or a social network that already knows what we are about to go out and purchase, or a car that can park itself and change lanes on the highway automatically, we are seeing AI take over tasks that we used to have to do ourselves. We are in the age of AI. It is not something that is coming. It is here. It may have arrived in 2014, or 2015, but if you ask me, I would put 2016 as the year it had its debut in mainstream life. It is exciting and it is scary. It begs all sorts of questions about where we are all going in the next thirty to fifty years. If you are in your twenties, AI will define your lifetime.

So that’s my rundown on 2016. I wish everyone a happy and healthy new year and we will talk about the future, not the past, tomorrow.

If you are in need of a New Year’s Resolution, I suggest moving to super secure passwords and some sort of tool to manage them for you, using two factor authentication whenever and wherever possible, encrypt as much of your online activities as you reasonably can, and not saying or doing anything online that you would not do in public, because that is where you are doing it.

Happy New Year!