Flip

Last year our niece decided to move about half way through her lease and ended up having to Airbnb her apartment for six months until she got out of her lease.

This summer our daughter is at graduate school upstate and rented her apartment to her friend for the summer.

One of our analysts decided to move to Brooklyn and had to figure out what to do with her apartment in Manhattan.

This is how millennials live. They go from apartment to apartment, roommate to roommate, city to city, job to job.

But this is not how apartments are rented. The apartments are leased for one year, two years, three years, with upfront security deposits, brokers fees, and a bunch of other costs that make the “fluid” approach to living difficult.

Enter Flip.

Flip is “the easiest way to sublet or get out of your lease and it is 100% free to list”

So if you or someone you know is looking to move and wants help with a sublet or needs to get out of a lease, Flip is the place to go.

The Gotham Gal has been an investor in Flip since the very beginning. I have been watching the company grow and build out this market opportunity with interest.

Earlier this year, she introduced the Flip founders to my partner Andy and the result is that USV is now also an investor in Flip.

Andy explained why USV is so interested in Flip on the USV blog a couple of days ago.

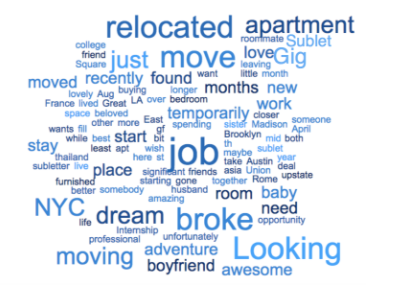

It’s a great post and you should go read it, but my favorite part of the post is this word cloud, taken from Flip’s listings, that explains why people use Flip:

Finally, Flip is looking to hire some engineers. They have built everything with just four people. That’s bootstrapping. I love it. They plan to double the team to eight people with this new investment. So if you want to work with great people, building technology that helps people with important changes in their life, Flip would be the place to do both of those things.

Comments (Archived):

i hope it’s not a flop.tents?

Don’t be flippant.

flipping landlords

https://www.youtube.com/wat…

I am clearly not a millennial, yet very much the target market for this on both sides, having 2 NYC apartments (sell side), and dragging my family around Europe, where we live indefinitely and enjoy some country- and apartment-hopping (buy side). We have loved staying in Berlin, Malta, winters in Mexico, now working on basing ourselves in Paris, and I have new work which is Tel Aviv-based which might move us there for a time period I’d need to keep flexible.And so, platforms like flip are very helpful to the “Digital Nomad” stack listed on USV’s themes page– I’m not sure if you and Andy nec would assign it that label, but I think it goes there.A big question I’ve had about flip for a while is that, for example, in NYC, most rental leases have a big bolded “no subletting without permission!” clause, and that permission can prove very hard to get in practice. So, is the strategy “don’t ask, don’t tell”, hoping that it gets enough critical mass that it’s eventually widely demanded, but also attention-grabbing so widely fought too. Certainly reminiscent of Uber and Airbnb in both directions.

Flip works with landlords and have been doing that since day one. The landlords want help with this issue as well.And yes, this is very “nomad stack”

A lease as a token (LAAT) model could work to create a more liquid demand side market.Edit (1 pm GMT);financed landlords need time (revenue) lease certainty. post financed (they own the property outright, although it may be collateral on another financed property) landlords might be the token target market.

… then you ICO, and it’s coin flipping.

heads the landlord wins, tails the tenant loses.Edit (1:15 pm GMT);historically property rights trump (ha) human rights, but perhaps tokenisation could help to balance this uneven equation.

You sound like a classic Flip user, Ken! It’s true that not everyone who lives this way is a millennial (I’ll probably always need to use Flip!). To answer your second question, our platform is designed to make it simple to get landlord approval. We handle the legal docs and qualification of prospective subtenants. Fun fact though: in New York and Illinois if it says that in your lease agreement then the term in null and void. The state law gives tenants rights to sublet that supersede the contract law.

True but in many states (including CA), the original tenant is still liable for the rent and damages to the unit.

.I am not aware of any legal reason why that would not be the case. A subtenant takes on all the duties of the tenant while the tenant is not released from any of the duties.There is a privity issue which is cleared up by further documentation including a guaranty.JLMwww.themusingsofthebigredca…

How do you know everything? It is really quite stunning.

.I am older than dirt and I make a lot of shit up.JLMwww.themusingsofthebigredca…

.What you are talking about is the State Property Code which provides that a landlord cannot “unreasonably withhold” permission to sublet.Pragmatically, that means nothing.A landlord could, in good faith, object on the basis of the credit, criminal background check, social profile, remaining term of the lease.A landlord can also charge a “reasonable fee” for his administrative costs.A landlord can take an inordinate period of time to approve a sublease transaction.In the end, it is all about the security deposit and the last month’s rent if paid at time of lease execution.JLMwww.themusingsofthebigredca…

It’s about more.Many building for example don’t allow airbnb tenants.It is about the dynamics of the building more than paying the rent.This more complex than simply the laws on the books.

.AirBnb is “short term rentals” which is a different legal residency than a residential lease. It is more akin to hotel regulation.If I were a building owner (apartments) or a home owners group (condos or coops), I would oppose AirBnB as short term rentals are not the same folks as long term residents particularly in a condo v an apartment.JLMwww.themusingsofthebigredca…

I think there are cases where the building owner actually walks a line between not wanting airbnb and wanting airbnb as long as it doesn’t disrupt the other tenants. The reason is simple. If your tenant can make extra money subletting and if it doesn’t bother other tenants (big ‘if’ but let’s go with it) then they can get more money from you on renewal or original lease.I own a few small commercial properties for example and in one case I have these therapists all sharing a suite for their practice. In most cases for the rent I charge and with the revenue that they earn they have a hard time paying the rent. One poor divorced lady pays the late fee every month even though she’s 15 days late consistently. Her mother also rents another suite and she is the guarantor. She tells me ‘if she gets to 30 days let me know’. But I’d rather not because the late fee is much better than getting the rent on time 10 or 15 days earlier. . Also the mother wants to teach her a lesson as well I’ve figured out ‘tough love’. Anyway with her and the other sub tenants I say the same thing ‘go ahead and sublet it’. Anything they can do to keep paying their rent is fine with me. At the point they find someone to rent that is serious and long term I will probably take a cut of that extra rent. Not spelled out in the lease will just do it on the fly when it happens (and I told them that when renting so…)In other cases I’ve gotten tenants to resign leases, physicians that only practice 1 or 2 days a week, by telling them I will help them find someone to rent the other days. Anything to keep them in and paying the rent I will do. Of course this is different than residential (we have a commercial complex with separate entrances).That said you are 100% right. Transients (in residential) totally are objectionable generally and I would never live in a building or buy in one that allowed that (other than as an investment). Some buildings (as you know) also keep the percentage of investor owned units down because it messes up the ability to get a mortgage (from what I am told at least).

Yes that is generally correct. That is why we put so much emphasis on qualifying our users using the same standards as the most stringent landlords.

that is more than just fun, if fact.I wonder if municipalities in turn can have laws that supercede those of the state?I would highly expect that San Francisco, if not all of California, does uphold the landlord’s end on this, my prediction based on personal experience as a former tenant.In any case, still great business potential if you have some precedents done and need to do some heavy lifting for compliance yourself (very much Uber’s and ABB’s story).

Everybody is doing more in less time, so it seems the breakdown of the lease is inevitable – but if services like this become mainstream will the market react by selling micro-leases or taking profits of the change process or otherwise encouraging the changes themselves (e.g. “soft” leases)?

Yes, it’s already common practice in LA

.A hotel is a furnished apartment with a nightly lease.There are weekly and monthly rental hotels.JLMwww.themusingsofthebigredca…

Since I got out of my parents’ home to study abroad in 2009, I’ve moved 8 times. It’s been roughly one time per year and I can relate very well with the problem they’re trying to solve here.I believe the housing market has a lot of potential that’s still untapped. Not just in short term rentals (like Airbnb or Uniplaces) or even solving the problems of medium term rentals like Flip. But also on long term renting. If there’s a upper class product for every single market in the world, I guess we still have to find one that can be the long-term Airbnb.A product that would solve all your legal problems, communication with the landlord, and process rent payment. Can’t someone solve this quickly for rich guys first and after the concept is proven, make it mainstream?

This is flipping great, wishing I had come across this since I moved twice in the last 10 months…

while i am not the customer, rental and lease is a bitch at the low and high end and great to see this disrupted as much as it can.it is worth noting that in three startups i’ve worked with they are all using weworks and paying what I consider high rents cause they do not have a sign a lease.there are analogs here.gonna look at this company as curious how they are getting this done. its a bear to break up the market and good on them.

This is part of the Airbnb market as well from my experience.

It is. That’s both an opportunity and a threat for Flip. Both my niece and my daughter used Airbnb to deal with their “fluidity” issues. This generation is very reliant on Airbnb but it is also true that the Airbnb solution is problematic in a number of ways and so that is Flip’s opportunity

I believe sublets are 20-25% of AirBnB’s business (not confirmed). Seems the risk is that AirBnB could fairly easily bolt this on to their existing massive, massive host/landlord user base. They have said multiple times they are investing in longer term rentals later this year. My question to Flip is what’s the moat? What can airbnb not launch late and replicate?

There’s nothing preventing AirBnB from simply entering the space and taking over. There’s really only so much you can do with a peer to peer marketplace, and the moment Flip or any startup in the space starts getting landlords to buy in en masse it becomes very attractive for AirBnB to simply jump in and offer a similar service. I’m definitely interested in seeing what Flip is able to do, as we were also very interested in creating a p2p marketplace prior to pivoting to become a more traditional listing portal, but at this point I’m quite skeptical. It seems like their best bet is to drum up enough interest/traffic to get AirBnB’s attention and hope that they’re acquired. That’s likely going to be an uphill challenge as it looks like their site’s been losing steam in recent months.

What listing portal are you working on?

Leasehop

I have come across leasehop before. Not sure if you’re a founder, but would love to get a founder interview up on Geek Estate if interested.

And to further add to my original post, if landlords do buy into Flip’s model it’s not farfetched to expect more traditional aggregators like Zillow, Streeteasy, etc to move into the space. They’d probably have a competitive advantage over airbnb as there are likely more people searching sites like zillow over airbnb for longer term rentals. Furthermore, the zillow model is cheaper for outgoing tenants/landlords. Flip functions as a type of brokerage replacement and charges relatively high fees compared to what it would cost to post an ad on streeteasy.

Arnold, have you seen Primalbase?

not as yet but will look at it.

There are many competitors in this space, hard to one dominating the market

.As a guy who owned tens of thousands of apartments, there are a couple of very subtle issues at stake here.When a landlord approves a sublease, a journeyman-like lease ensures that any difference between the underlying rent and the sublease rent is the landlord’s.When a landlord approves a sublease, a landlord has to underwrite the credit, behavior (criminal background check), and social habits of the subtenant. Most apartments are non-smoking.The landlord and the subtenant do not have a direct legal relationship (privity of contract issue) and it is important that the legal arrangement acknowledge or fix this. This is often done by a guaranty executed by the subtenant.The landlord will never release the original tenant from his legal obligations under the lease.A smart landlord will attempt to enter into a new, longer lease with the subtenant which has the benefit of the landlord not having to incur a “make ready” cost or a leasing commission to flip the apartment upon lease termination. This could be a big inducement to a landlord.A landlord would be within his rights to ask for a sublease administrative fee for his time and effort. Not unusual at all.Landlords hate to allow subrentals when there is a very short term left on the lease. My policy was to not approve such arrangements if less than half of the lease term remained, but I always approved allowing a tenant to break a lease because the rental market was so strong. Usually, the tenant would pay half a month’s rent to break the lease.Landlords are not offended by this when done up front and directly.For the underlying tenant, a sublease is a no win-lose situation. No benefit other than getting out of the lease which would otherwise cost him the security deposit and the last month’s rent.Typically a tenant pays the security deposit, first month’s rent, last month’s rent in a stable market. In a weak market, the landlord may waive the security deposit and the last month’s rent.From a landlord’s perspective, this is a pain in the ass and in a good market — rising rents — getting back a unit with an older rent rate is a good thing.JLMwww.themusingsofthebigredca…

All the legal mud wrestling of most old fields of business are MUCH worse than for my Internet software startup! In fact, AFAIK, my startup has no significant legal mud wrestling at all!!!!!(1) Think of a Web site. (2) Work out any secret sauce. (3) Design and write the code. (4) Get the code running on a suitable, first Web server. (5) Get some ads from some ad networks. (6) Do a few routine things, e.g., LLC, tax ID, trademark, static IP address and registered domain name, certificate authority, business bank account, etc. (7) Go live, get publicity, get ad revenue, make money.Hire people? Nope: Sole, solo founder, janitor, security guard, lead software developer, server farm system administrator, …, CEO.Real estate, restaurants, selling bottles of pickles, etc. — the legal and regulatory stuff sounds just horrendous.

.There is a licensing issue which permeates these kinds of deals which is often overlooked. If an entity is dealing with leases, it has to be appropriately licensed both as a broker (the firm) and as a leasing agent (the individual who could be a broker or a salesperson).This is state law and there is no reciprocity amongst states.A NY licensed broker can conduct real estate in Texas, but only in cooperation with a Texas licensed broker.A firm has to have a broker’s license in every state upon which to hang the licenses of its practitioners. Every person dealing with negotiating a lease has to be at least a salesman in the applicable state and be working under a broker who is working under a licensed firm.There was a Colorado company which was doing exactly this in Texas with excess high tech space. They overlooked the licensing requirements and got their heads handed to them.If a broker in the state in question reports the firm to the state licensing agency and to the real estate commission/association (industry group which is many times the disciplinary board for brokers), there will be Hell to pay.I have never seen one of these deals which is correctly licensed.Air BnB is going to get nailed on this before too long. Their argument is always that the actual transaction is being undertaken by the owner. Owners do not require brokerage licenses to transact real estate business when they own the property in question.The issue is real and dicey and the brokerage community is going to go ape shit (technical real estate term) if somebody from out of state is eating out of their chili bowl.JLMwww.themusingsofthebigredca…

Flip looks like they allow anyone to market the property and collect a bounty upon the successful lease of a property. To my knowledge, this would require that the person collecting the success-based fee be a licensed real estate salesperson. Do you know how they are getting around this requirement? This is what has hampered real estate affiliate marketing in the past.

.I have no knowledge about how Flip is doing anything other than the public info.To be very accurate a licensed “salesperson” has to be operating under the sponsorship of a licensed broker.A firm which conducts brokerage operations also has to be licensed.A licensed firm employs brokers (including the firm’s sponsoring broker) to employ salespersons.JLMwww.themusingsofthebigredca…

AirBnB and Uber — both of them have looked to me like a long walk on a short pier, that is, they are about to fall into a pit full of angry lawyers.I’m surprised at how long it’s been taking to shut down AirBnB and Uber, but I have to suspect that both of them are spending lots of money on lawyers, lobbying, etc.Maybe neither of those two will encounter a single legal action that will shut them down fully quickly, but I can’t believe that either of them has a real future.

HA. Read my blog today. I could have used Flip! Instead I had serendipity http://pointsandfigures.com…

Why not an assignment vs. a sublease, which would relinquish all prime tenant liability and pass it on to the new tenant? With proper vetting, credit approval, etc., this is a potential win for the landlord (revenue continuity) and the prime tenant (no ongoing liability).That said, many apts in NYC are rent stabilized w/ a host of restrictions on subletting. As a former NYC landlord of rent stabilized apts., for starters I would never consent without being able to pass along a vacancy allowance to the new tenant, an amount that is set annually by a governing board and generally is 18-20% higher than the previous tenant’s rent. There is an economic disincentive for me to do a traditional sublease. Also, the notion of a landlord having to chase down a prime tenant, who may have moved out of state, if the subtenant defaults is def another disincentive. There are just too many moving parts. Co-ops of course are even more restrictive, Condos less so.Flip def fills a market need, but the laws and restrictions around subletting are often quite murky and can be fraught w/ peril for all parties (the landlord, the subtenant and the prime tenant, who retains liability and likely is a complete stranger to the subtenant.)

We see that as an opportunity as well. It’s too hard for your average renter to stay compliant but we can help them to do so. In the coming months we will be building out a knowledgebase that will cover all of these topics.

.An assignment of a lease is typical in commercial real estate transactions. The classic case is when Company A acquires Company B which has a lease. Company B assigns the lease to the acquiring entity, Company A.The landlord has to consent to the assignment.In most instances, the landlord does not release Company B from its obligations.The “assignment” notion is not contained in the Property Code of most states. I don’t know of any which discuss assignment while many discuss subletting.JLMwww.themusingsofthebigredca…

From NYS Tenants’ Rights Guide:Assign A Lease:”To assign means that the tenant is transferring the entire interest in the apartment lease to someone else and permanently vacating the premises. The right to assign the lease is much more restricted than the right to sublet. A sublet or assignment which does not comply with the law may be grounds for eviction.A tenant may not assign the lease without the landlord’s written consent.”https://ag.ny.gov/sites/def…

.Doesn’t that provision apply to rent stabilized apartments wherein a gov’t entity has control of who can rent a unit and under what circumstances?Rent stabilization is not common in the US.What you quoted from is a Renter’s Guide which harkens back to the actual Property Code. In its entirety its says:”To assign means that the tenant is transferring the entire interest in theapartment lease to someone else and permanently vacating the premises.The right to assign the lease is much more restricted than the rightto sublet. A sublet or assignment which does not comply with the lawmay be grounds for eviction.A tenant may not assign the lease without the landlord’s written consent.The landlord may withhold consent without cause. If the landlordreasonably refuses consent, the tenant cannot assign and is not entitledto be released from the Lease. If the landlord unreasonably refuses consent,the tenant is entitled to be released from the lease within 30 days11from the date the request was given to the landlord (Real Property Law§ 226-b(1)).”When a rent is “stabilized” there is no upside for a landlord to move tenants in or out as it is “stabilized.”JLMwww.themusingsofthebigredca…

Not entirely true, JLM. The amount of annual rent increases in stabilized apts is detemined by a rent guidelines board, who also sets the amount landlords can charge on vacancy leases, which historically has been between 18-20%, vs. the typical 1-3% on renewals. If you own a rent stabilized apt., whose rent is often below fair market value, there most def is an incentive to “churn” the unit to take advantage of the higher vacancy allowance.There’s nothing worse than spending a day in NYC Housing Court (especially when not your f/t gig). It’s a cesspool! Very, very pro-tenant to an unhealthy extreme, imo. I was always flexible when a tenant was in arrears, but getting rid of a genuine deadbeat tenant is a nightmare.

I know literally nothing about this other than what I have read. But I do know of at least one person that rents a rent stabilized apartment from another person who is the actual rent stabilized renter. (Got that?) And guess what. The person that I know rents it out! That’s right. There are multiple people making profit off this one rent stabilized unit. I am sure this is not entirely uncommon either for some reason. Was presented to me as if it’s something that is done frequently.If widespread this is such a mess. But it makes total sense that government would not be able to offer either incentives for someone to snitch on the party doing this or offer the right penalties or procedures to insure that it doesn’t happen. For example if any of these people get caught what is the ‘stick’ or penalty? And even if a penalty does anyone actually get hit or is it like a government ‘anti spam’ charade?And don’t get me started on ‘the poor door’.

I benefited (as a tenant) and was a victim (as a landlord) of NYC’s Byzantine rent stabilization laws. The apt that I rented (long time renter) was in a bldg consisting of half condo and half rent stabilized units. Because of an approved conversion plan, when rent stabilized apts in my bldg become vacant the landlord (or sponsor) can sell the unit at fair market value. With this plan, rent stabilization laws no longer apply upon vacancy, but the plan does entitle tenants to stay as long as they like (non-evict). The rent on my 1B apt in a white glove bldg, in a prime location was only $1K/mth because I had been a resident for a long time and rent stabilization laws precluded large annual increases in rent. (Fair market rent was between $3K-$3.5K/month for my unit, while a renovated, destabilized unit sells for $1M.) So the landlord wanted me, and anyone like me, out and they were willing to write checks. I knew I was moving to Seattle so I was in play. I got my next door neighbor to deal too so they could combine two 1B apts into one 3B/3B apt. The buyout started at $100K each and I just laughed. I put together a couple of P&L’s to demonstrate my knowledge of the market and potential value of a combined apt sale post-renovation. Suffice it to say, the final number to us was way, way over the initial bid. I didn’t even own the place. The combined renovated apts (top notch reno, btw) just went to contract at $2.4M. NY RE is simply crazy.

Well that is great for you. But you have to admit there is something wrong with a situation and system that allows that to happen. To the detriment of people who can’t afford housing it most certainly drives up the cost of apartments because it makes less affordable housing cost prohibitive.Let me further explain. I take no issue that in negotiation someone being asked to move deserves to be compensated. And to me it doesn’t matter that you were going to move anyway. But honestly the fact that (I assume) you were earning a good living and paying $1000 per month rent and locked in (what I get for this view at the jersey shore for a place that I own a small studio $1050/month) [1] is unfortunate for others. (Not that I would do differently but just putting on another hat here..)The question is why is someone in your position (and again I would do the same I want to make that clear) able to make that kind of money in the first place?By comparison my Mom sold a place a few years ago in Sunny Isles Beach that Dezer wanted to develop. He had to buy out the entire motel esq property. My dad bought the place in the 70’s for maybe $30k. Finally sold out a few years ago for $450k. They are tearing it down and building this:http://rbacmiami.com/render…They got the entire building to sell out (a percentage needs to agree). The project by another developer was almost done in 2008 prior to the crash and then shelved.One last thing. There was no shortage of housing in that area either and no people that needed the housing.[1] https://uploads.disquscdn.c…

Rent stabilization laws help create affordable housing, and that’s a good thing, though the laws need to insure landlords can also still make a reasonable return on their investments. That’s where there’s a disconnect. Often increases in annual operating expenses exceed the amount of rent increases allowed by the rent guidelines board. This isn’t public housing, yet the city is in a position to determine the ROI on a private investment.My situation w/ the buyout was very, very unusual. The stars were aligned. I got lucky. There is an income cap on rent stabilized apts. If your income exceeds the cap, then you can lose your stabilized lease. I did exceed the income cap w/ my rental, though my landlord never solicited me for income info., and that burden lied w/ him not me.

.I defer to your actual experience and wisdom. Well played.JLMwww.themusingsofthebigredca…

“rented her apartment to her friend for the summer”Yup, that happens all the time. That’s certainly one of the use cases we see for horizonapp.co — places to stay/live (sublets) within existing trusted communities. I’ve spoken to Susannah, and am a big fan of their model.

What about leases that don’t permit sub-letting?E.g., the property owner might want to know who the heck is occupying their property.

Extended, derivative idea: (1) Property owners want to know who the heck is occupying their property. (2) And the customers want to be able to move quickly from place to place. So, don’t have just a listing service like Flip (that has to encounter leases that do not permit sub-leasing).So, Idea 1: Have a REIT or some such that owns rental properties in lots of places and encourages their customers to move among the properties they own. Okay, that takes a lot of capital. So:Idea 2: Have the property owners form a consortium or exchange where they accept sub-leases from each other’s customers. So, no big Capex and minimal Opex. So, if your daughter has a lease in Manhattan and wants to move to Upstate, then she just moves to a property owned by someone in the same consortium as that of the owner in Manhattan.

#2 — So Flip within existing trust networks/groups/communities?

So, right, that’s the guess at an idea. Maybe on a good day that and a dime would half cover a 10 cent cup of coffee.Better yet: Get a real job, get a spouse with a real job, save money, buy a house, be a strong limb on the tree, and f’get about this foot loose stuff.

> They have built everything with just four people. That’s bootstrapping. I love it.Gee, Fred, you love bootstrapping. So do I! They have built everything with four people? Okay. But, then, why hire more? Four should be enough.Heck, I’ve built all my software, ready to go live, with one person! So, if I can get rid of the rest of the external interruptions, I’ll go live. The software is fine, runs just as I envisioned it; the interruptions are a total pain.These days, one person can do a lot with software. Uh, in a sense, the main cost is not the opex of writing the code but just the capex, that is, getting the background info on the tools to be used. Why? Because there are so many good (software) tools; they are so darned powerful; can do so much just wrapping some software mortar around the tool bricks, but the crucial documentation for the tools is usually poor.So, the main cost is just getting a good first, even just test case, use of the relevant tools. Then using the tools again for the real work can go really fast.E.g., SQL Server: Right, once get through the horribly badly written documentation for security, authentication, users, logins, connection strings, routine system management, installation, connection pools, etc., SQL server is darned powerful and fairly easy to use; can do a lot with just a few queries. Also, to help, for the interface to SQL Server, have Microsoft’s Active Data Objects (ADO.NET). And with BizSpark, can’t beat the price!E.g., Microsoft’s Internet Information Server (IIS) and means of writing Web pages Active Server Pages (ASP.NET), form another layer of syntax and semantics on top of just HTML, but okay — after paw through maybe 1000 Web pages of documentation and begin to see the sense of how it works — that sense exists and is fairly simple.My basic documentation on the tools I’m using grew to something over 5000 Web pages before the rate of collecting more pages slowed down. That was a LOT of capex.And IIS has some super nice features for both development and production; these are not easy to discover. The development stuff is super nice — an HTTP GET request comes to the local host IP address for a Web page; IIS gets the request and, if necessary, compiles the code for the page (starts a thread on the compiled and running code otherwise), and, if there are compiler errors, puts up, via the Web browser that gave the request, as a Web page, a really nice description of the errors including compiler output. So, don’t need to use an interactive development environment, and I haven’t, and just a text editor is enough to type into (I use KEdit). Works great.Net, once get to where can use all the basic software tools, the work itself for the actual business can go surprisingly fast.No doubt the four engineers in Flip are good with the tools now. So, they should be more than ready for a lot more quite productive software development quite quickly. Besides, they all know each other and have worked together successfully. Even if they have specialized, say, front end, back end, SQL, core algorithms, etc. they can continue to do so.Remember likely the most important single remark in all of software engineering “Adding people to a late software project makes it later.” Right, Frederick P. Brooks, The Mythical Man-Month with a cover image of a big dinosaur getting stuck in the La Brea tar pits! Why? Adding people requires recruiting, teaching them the work so far, and, then, continually, more channels of communications. Spend more time in meetings.I’d predict that the effort to add four people and get them productive on the team will be for months one heck of a setback for the directly productive work.There are some more places can save: One of the best is the old rule, the KISS principle — Keep it simple, stupid.E.g., in my case, I want my Web pages simple, dirt simple. Is it possible to be successful with simple Web pages? Sure: Proof: Look at the main page at Google — just one single line text box, a few links, a few simple images, and that’s ALL folks! So, my Web pages are all dirt simple. Really, as far as I can tell, all of Google’s Web page are also quite simple.Twitter?: Once I got to your site, soon I get a big image overlay I have no easy way to delete. No, I very much do not want to add my full name, blood type, pet’s name, mother’s maiden name, street address, e-mail address, phone number, favorite hobbies, age, income, place of birth, colleges attended, etc. Sorry ’bout that. So, I have to close the page and connect again. Bummer. Advice: Make the overlay much smaller or just get rid of it.Disqus: I keep my mouse cursor on the Disqus Web page so that the page stays at the top of the Z-order, gets the focus, and my mouse scroll wheel will work. So, sometimes the cursor goes over a user name, and then, BOOM, BANG, much of the screen fills with a bio of the user. Bummer. I do NOT want that.Those are some cases where an overactive development shop without enough important work to do adds on stuff to make the screen jump around, etc. and piss me off. Better: Don’t do that stuff.Next my pages are also simple in that I have no pop-ups, overlays, pull-downs, roll-overs, etc. And I make minimal use of JavaScript — so far I have yet to write a single line of JavaScript, and my Web pages look and work just fine even if the user’s Web browser has JavaScript turned off. Microsoft’s ASP.NET writes a few lines of JavaScript for me, I guess to help implement some of the finer points of ASP.NET, maybe logical page locations or some such. It’s just a few lines. And I make nearly no use of CSS — mostly it’s not worth the bother since the search function in my text editor easily enough gets me to the places where CSS might help me make one change in several places — it can be easier just to use keywords in comments than the CSS tags or whatever they are called. And I make no use of cookies, and users don’t log in or have user IDs or passwords. Did mention KISS?Then there’s the problem of Web session state, fast, scalable, reliable, etc.: Sure, might have used Redis. Gee, in less time than just to understand Redis, I wrote my own, all of a routine use of TCP/IP sockets, object instance de/serialize, and two instances of a standard .NET collection class. Works great. I tried what Microsoft had; it didn’t work very well, and I spent much more time just trying to understand what they had than it took just to write my own.Again, once know how to use some tools, just writing what you need using those tools can easily be faster and better than just trying to understand some new tool. It’s the same for cooking hot dogs: It’s faster just to boil them in a pot or fry them in a pan than even to unpack, plug in, and figure out some specialized hot dog cooker.Gee, now the Flip team will have to do well in care and feeding of a BoD. Good luck, guys!

Do you ever wonder what all these tools that make everything so easy is going to do to young people?Their ability to judge risk and negotiate?Their ability to assess people, statements, sources or data quality?Just a random hot summer day thought.

Very dependent on local regulation