Easy Come, Easy Go

I saw a friend last night who has been trading fiat currencies for thirty years. He looked at the Bitcoin chart and said “I would be worried about Bitcoin if I were you.”

He knows that we own a fair bit of Bitcoin (and Ethereum).

My take on the selloff that continues in the leading cryptocurrencies is “easy come, easy go.”

Anything that goes up 38x in six months can easily go down by just as much.

I am not saying that ETH is going back to $10 or that BTC is going back to $1000. That of course could happen. I am just not predicting it.

It has been too easy to make money in crypto this year. It has been too easy to raise money in token offerings this year.

Tapping people who have made 50x their money on ETH to invest in your whitepaper is a great way to raise money until those people start to lose money on their ETH and fear starts overtaking greed as the dominant emotion in crypto land.

But crypto has not been an easy business to be in over the last eight years. It has just been an easy business to be in over the last seven months.

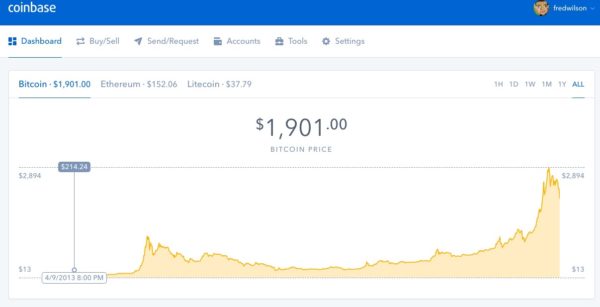

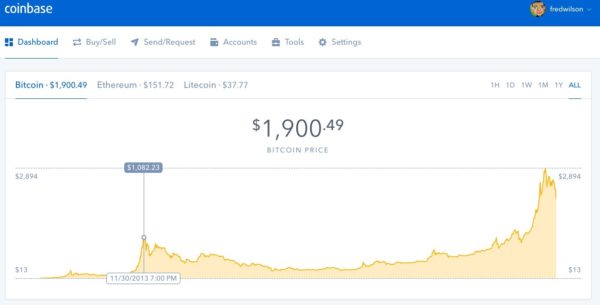

I remember the two bubbles we experienced in BTC back in 2013:

In April 2013, BTC peaked at just over $200 and then quickly retreated back to below $100.

In November 2013, BTC traded briefly above $1000 and then faded, and did not see that level again until January of this year.

I remember back in the late 90s, a reporter asked my partner at the time Jerry Colonna what he looked for in entrepreneurs.

Jerry said “I want to back people who are doing a startup because of the mission rather than the money, because someday the market will crash and the money will be gone and I want to be with an entrepreneur who will still be around then.”

Bubbles always attract people who are chasing the easy money. And those people come and go.

But crypto is about a lot more than making money.

And the people who are into crypto because of the mission, a global decentralized platform for innovation, are going to be around after this bubble bursts, and the next one bursts, and the next one bursts. They have been around since before the April 2013 bubble and the November 2013 bubble, building this important technology. And so have I and I’m not going anywhere either.

Comments (Archived):

In it for the long haul is the best strategy for anything in life. I appreciate this post.

Ironically it might be your fiat currency friend who has more to worry about, since crypto trading volume will increasingly take away from fiat trading volume

Or make everything bigger

word. – is a tad disheartening though that mercenaries do a hit and run, profit wildly, pollute the pool and scarper – leaving the missionaries with busted portfolios and a whole lot of mess to tidy up.

the missionary position can be uncomfortable

It is more than a tad disheartening,maybe that is British understatement :-)It pisses me the hell off. I have been doing this since 1992 starting five companies.It is more than pissing in the well it’s shitting in the communal well.Everybody that truly has a love and passion gets screwed. Customers having been burnt by the mercenaries are totally gun shy, investors who got bit dry up investment, employees that didn’t know better get burnt to a crisp.

My new found daily meditation practice has taught me to view things with a certain detachment.Else I’d be fucking furious!

Exactly. Reality always strikes back.Reality distorsion is typically short-lived.

The reality distortion field created by Steve Jobs lives on in Apple products https://uploads.disquscdn.c…and yet … https://uploads.disquscdn.c…

Funny

“Exactly. Reality always strikes back.”Correct me if my english isnt good enough to understand. But You means that price was too high, just high expectation, and now reality has brought it back down?

In part, that’s the outcome. But my comment wasn’t about the prices only. It was also about what led us to where we are today, namely some recklessness in ICO practices.

Yes ICOville was insane, EOS was tip of the iceberg. Caught me off-guard… I will wait next bull wave whenever it comes, this tech is not going away. :)Regarding price if you dont mind me asking, in the sell-off blog, you commented you thought was retracement ( which I thought too , 50% crypto “normal” retracement)… How do you see it now?Thanks!

Phew! Glad I read your post about cost averaging

There’s a late afternoon summer thunderstorm and there’s Sandy. One can alter the landscape forever and send a lot of investors to the sidelines for a long time afterwards.

I wonder, does anyone here have any stats as to the part of trading volume attributed to internal trading (exchange within cryptocurrencies) VS external (exchange between crypto and fiat)?

There is no buble. There is good business and nas business. There is ICOs with a solid team, solid business market and going after a large enough market where blockchain can have an impact at a reasonable valuation for whatever methodology you like. And there is those without it. Additionally, there is new possibilities/utilities for digital currencies as a whole that could also sustain and drive appreciation of bitcoin further.

“Don’t buy bitcoin, it will crash” – https://www.youtube.com/wat…

ha! https://medium.com/@mcasey0…

Or. Buy it when everyone wants to sell it

Fred, it’s interesting to see how this panned out. I try to remind those who were asking me whether to get in at the BTC/ETH peaks of $3000/$400 – of those two corrections. 50% corrections are normal in trading, especially when the bubble pops. There are extreme cases of 90% corrections like in the Baltic Dry Index in 2008. The recovery from those lows is slow… and if you look at the cryptos, you’ll see such long winded periods of flatness before it starts to pop again.I’m glad to see this boom bust cycle as its part of the free markets. There’s so much more information now than there was in those years when the crashes took place. That’s good, because the information sharing helps reduces the asymmetry.The ICOs were definitely the most interesting to watch, rather than the protocols/coins themselves. I’m with @wmoug:disqus on this regarding the over-fundraising and a day of reckoning will come to these startups. However, what’s not said is how VCs have also gone through this cycle by over funding companies, merely because of the marketing prowess or brand names attached and the closed network. Case in point with Medium – $130+ million in funding, 5 years go by and what we have is… as one person put it – a glorified typewriter!ICOs to me are the disruptive force, yes it will evolve. And yes some may be big failures as time passes on. But we need that.I got in late to the Blockchain & Crypto game, in July 2016 – that’s because I was having trouble withdrawing money from my PayPal account to a bank account – the problem persists.Which is why when I see fintech companies, I’m so excited. While many say its bubble, we haven’t really seen a bubble yet because the “Rest of World” hasn’t participated in this boom. When that happens, yes… I’ll be more cautious.A truly disruptive technology has to be international, global in scope – not just limited to a few developed countries. Staying tuned.

Yup. I keep saying: Speed kills. Rushing a revolution will sure make it stall. Crashing a party will spoil the good times others were quietly having.The dot com bust happened because zealous people wanted things to happen right away, not over a few years out. So they took things to the moon, and the moon doesn’t like it if you get too close to it. It sends you back to earth.But sometimes, there is no choice. You need to touch the fire before realizing it can burn you.

I remember that conversation. I also remember the entrepreneur who’d presented a business plan that provoked the feeling. When I asked him why he was doing the business he said, “Everyone I went to business school is getting rich ‘on the internet’ and it’s my turn.”Now that I’m a little wiser, I’d say the same filter should be applied to investors. I know that an investor’s job is to take a dollar and turn it into two (or more) but if that’s ALL motivates them, then they will turn tail and run at the first down turn.Part of your point here is that there is something much important going on in crypto. Where it will end up is still a guess…but the inquiry into this is very important.And with regard to ROI on investing here…what if things hadn’t spiked as they had…what if a dollar investor in some form “merely” returned, I don’t know, only 40% over, say, five years.I remember the days when that would have been considered a home run. I’d encourage you to continue to talk about this:”But crypto is about a lot more than making money.And the people who are into crypto because of the mission, a global decentralized platform for innovation, “

Yup. As I said in my opening remarks at the Token Summit, it’s about the business models, not the price of tokens:https://twitter.com/token_s…

But but I want to buy a Porsche. : )

the use cases can’t take hold because the traders are speculating.

Why are the use cases being held down by the traders?

You are spot on about investors.Let me first say look we (entrepreneurs) don’t always have a choice which a ton of times is not mentioned, so you do what you do, and I don’t fault anybody for that.But you can instantly tell if an investor cares about the business or just about money.The test: Do they dig into your product or service? If they say yeah, yeah, I know the technology works let me see the deck and more importantly the spreadsheet, then when times get tough you are in for a world of hurt, because they haven’t bought into the product or service but just the numbers.

Ok sure. But the other side of it is someone who is so into it they give a little to much weight to what you are doing because they personally have a good feeling for the business or it has secondary meaning for them. I have thought about this with relation to Fred’s investments in music related businesses. The impossible (and it’s always impossible) suddenly seems more possible because of a positive bias.So the emotional attachment can sometimes be crippling. Doesn’t allow you to make rational decisions.That said a rising tide and profit floats everything. There are many things that I have no excitement about but would certainly get excited about if they ended up being profitable.For example I would say I would never find it interesting to invest in Funeral Homes. But if I found a way to make money off of that I can tell you that it would get interesting and important very quickly.

How well did you know how your printing presses worked?

A great deal. Let’s put it this way. When I started I bought for roughly $2000 a small duplicator similar to the one in the video below. It was old and broken down and I probably over-payed for it. I got someone to help me haul it from the used equipment dealer down to my place in a truck that I rented. I then found a man who worked at the Philadelphia Inquirer at nights to show me how to use it. He spent maybe an hour let’s say then said “I have to get to work we are installing a big newspaper press tonight” (size of city block). And he left. This is a machine that people take a long time to learn. People go to school to learn printing or they have someone in their family they learn from. Or they apprentice. Not me. Zip. I had to learn to use it after that one brief instruction period and actually produce jobs (that I had) that someone would pay for. Painful. The video doesn’t show all parts to the machine but each of those (like with computer programming) needs to be right or the job won’t come out and you won’t get paid. Tremendous amount of pressure no other instructions or certainly youtube videos. I could explain to you what each part does.Do I like machinery and equipment? Sure I do. And I liked it even more after I was able to make money with it. I remember sitting there and paper coming out and it was like a slot machine to me. I remember the pleasure of cleaning the machine (very ritualistic) after a job well done. And have to mention the agony of defeat. Lot’s of spoilage, scumming, jams and so on because I was not ‘classically’ trained. After a bit I hired someone obviously. But the fact that I had a basic understanding of what was going on was obviously tremendously helpful. And I bought better equipment new equipment when I could afford to. Also put AC in the pressroom (because humidity is important in printing). The people that worked for me always liked that I hung around and asked them questions. (You already know this concept). Wasn’t bs I did want to know and I still ask today with workman doing jobs.Bough a photo typesetter (Itek) and the guy who sold it was also a service man and spent a few hours explaining it to me. (Steve Blanken great guy). He left and I had to produce with it. To draw a box? No mouse, you program coordinates. No hard drive, floppys. Each font was iirc hundreds of dollars. Stuff I did was good enough that people paid for it.Later repeated the same thing with big ($100k) Xerox machines for volume duplicating. By then I had people working for me obviously but still understood everything. Cases where a machine was broken that someone worked on everyday and they were stumped. I would go down and take a look and say ‘here is what you need to do’.I did the same with computers. Bought a multi user Unix system (1985) it just came with manuals. Set it up (no help) and learned to program it and wrote job estimating and management programs that were still in use 5 years after I sold the company. (I am not a programmer and not particularly good but good enough to get the job done). That knowledge is what allowed me to do what I am doing now actually.Did I enjoy it? Yes. But the downside was because I could and because I could do so many things I got dragged into fixing problems that others would have not spent time on.https://www.youtube.com/wat…So for sure I buy into the ‘what you love’ angle as beneficial (noting the drawbacks). And part of how I make money today is doing something that I love that I started to do for free.

Exactly my point. You could have said, yeah, yeah it just works, let me hire the greasy pressman to work it. I only care about the numbers.

Interesting about the printer/duplicator/typsetting stuff. Was your getting into Unix connected in some way with getting into typsetting etc? Asking because Unix started off being used for word processing and typesetting work at Bell Labs – that was the reason why the Unix inventors got funding – by saying they would create an OS and apps for the Bell labs paperwork to be done on, including the patent department, etc., IIR(ead)C.

Was your getting into Unix connected in some way with getting into typsetting etc?Nope not at all.But the Unix system actually was an AT&T 3b2/400 which I hooked something like 14 Wyse terminals up to. AT&T made computers at the time. Was pretty expensive. I’ve put the price here before something like $4000 for just the 70mb drive (or maybe it was $4000 for the 2 megs of memory..) You could run a whole business on that because there were no graphics.Came with a dozen or more professionally bound manuals. At the time I had no clue about any of this. See photos…. https://uploads.disquscdn.c… https://uploads.disquscdn.c…

Cool.>AT&T 3b2/400Not sure. but an early edition of the K&R book (1st photo above is of that book, I guess) may have mentioned that AT&T machine (or an Interdata m/c), maybe while talking about the systems that C and/or Unix had by then been ported to.Also, I remember reading heavy/big Unix manuals like that back in the day. That and on-the-job learning was the main way I learned Unix. Experimented a lot, used a lot of Unix commands, wrote a lot of C programs and shell scripts, etc. Good fun and learning, and has stood me in good stead throughout my career.

When I asked him why he was doing the business he said, “Everyone I went to business school is getting rich ‘on the internet’ and it’s my turn.”I don’t see that statement the same way as I think you do. After all you are talking about someone who went to business school. And perhaps even someone who went to a very good business school. Possibly a top ranked one. People go to business school because they are interested in business and business is certainly about making money. [1] And many people who go to business school do it so they can make money and enjoy a nice lifestyle. Just like many people become actors and recording artists so they can become famous (not everyone is Laura Nyro).Additionally the person who said that was young. So you have to cut them slack for what might appear to be ‘the wrong answer’ at least in your mind. Or maybe the way you were investing. Or how you viewed the world. Being smart enough to give the right answer doesn’t always make you better (at a mission) but it does show you put the effort in to understand who you are selling to (so you get points for that).And this isn’t someone who went to Dental or Medical school and made the same statement ‘My friends became rich as Doctors and now it’s my turn’. That’s different. But even that doesn’t make them bad doctors. Some of the best doctors were attracted by the ability to make money. That is definitely one of the reasons our medical care is as good as it is (and as expensive unfortunately). That said myself I go for the academics at medical schools.Also it’s never ‘all’ that motivates someone. It’s like having a beautiful wife (or a hunk of a husband). It’s something that attracts people but it’s certainly not the only thing. But making money is important. No shame in that.[1] It’s part of what makes business fun. Just like winning a game is what makes sports fun. And gambling on sports is what makes it fun for some people the chance to make money.

Still do not understand what this means as a mission – “a global decentralized platform for innovation” – when applied to cryptocurrencies.

Perhaps listen to this podcast by Blockstream CEO Dr. Adam Back:http://www.bitcoin.kn/2015/…

https://promarket.org/expec…

So when the dust settles exactly how much did the ICOs raise? How much is available to build a business/network? Let’s say it falls to $50 in the next couple of days. Then what?This is a good read on distributed systems: http://on.ft.com/2usb0Nx“At the end of the day, there are only two groups of people prepared to go to costly lengths to decentralise a service which is already available (in what is often a much higher quality form) in a centralised or conventional hierarchal state. One group is criminals and fraudsters. The other is ideologues and cultists. The first sees the additional cost/effort as worthwhile due to the un-censorable utility of these systems. The second consumes it simply as a luxury or cultured good.”

Are the values of the cryptocurrencies issued in these ICOs necessarily pegged to ETH or BTC? Could you denominate one of them in fiat? I suppose that would make it iliquid for a while, until it gained sufficient economic weight as to develop a trading market in it, but the same is true of shares in any startup.

Most ICOs require you to purchase with either BitCoin or Ether. Actually, I suspect a lot of the current price down turn is tightly related to this fact.Company X does an ICO which gets them ‘millions’ in value, but it’s all in ether. So they immediately start selling a lot of the ether for USD, and even though they are driving the price down, they are still “up” as a whole (so what if they raised “10 million USD value of Ether at time of ICO, but only actually got 7 or 8 million USD out of it; they gave up no equity and *prob.* haven’t even built a product yet).

Yes, that’s my understanding, at least until the coins become tradable in of themselves.So, for example, had you bought BTC or ETH earlier this month just in time-of your investment in the ICO of Tezos, which I believe is not yet tradeable/redeemable, you’d be down 10-20% or so since effectively it (Tezos) is still pegged to whatever underlying crypto (BTC or ETH) you used to buy Tezos with and the underlying price you paid in fiat currently for that crypto (BTC or ETH) .Falicon’s point below is important too –> the companies doing the ICOs need fiat currency with which to pay vendors, employees, etc. So when they raise money in an ICO via BTC or ETH they will likely, unless they are already well capitalized in fiat currency, need to sell the BTC/ETH to pay their bills and employees. That could be a current driver to downward pressure on BTC/ETH prices.

It depends – some peg to fiat (USD), some peg to other cryptos (BTC/ETH). I wrote about this experience. The ICO was pegged to USD i.e. 1 WTT was 1USD. However, I invested using ETH – shortly after, ETH started to soar. So basically invested 50% more in USD terms (if I used USD instead of ETH, I would be sitting on 50% more USD) Here’s the post – http://jpmartin.com/ico-tok…

Thanks @jpmartin:disqus @brooklynrob:disqus @falicon:disqus. I meant “denominated in” rather than “pegged to” but I think you guys figured it out (though it seems that WTT really is pegged? So basically they are putting out there exactly what Rob is say: “Pay us in ETH/BTC if you want, but we are thinking about this as USD b/c that’s what we pay our bills in”). Interesting to see that the same forces that are pushing the crypto-reserves (ETH/BTC) prices up are then the ones pulling them down: People rush into cryptocurrencies to jump on the ICO bandwagons, but supply is constrained b/c no one wants to sell – they are waiting for the ICOs as well. After the ICOs happen, all the crypto-reserve currencies acquired by the newbies in transactions that drove the prices up 38x or whatever the number was, now sits in the hands of the new coin issuers. The coin issuers take their new crypto-reserves and go sell it for whatever fiat currency they use to pay their bills (H/T Rob). Unless there is a steady flow of new ICOs and therefore proportionate new interest in buying crypto-reserves, their prices crash. I’m not sure there’s a model for this in fiat currency. It’s as if there was a small country with strange currency controls, such that a) to invest in local IPOs you have to convert your int’l reserve currency (let’s just call it GLD) into the local currency (let’s call it LCL), b) vendor and bill payments are made on the black market in GLD, so the local companies that raise in LCL have to convert it back to GLD in a short period of time; and c) the volume of trading b/w GLD and LCL as a result of these IPOs is a significant fraction of the total volume of currency exchange b/w GLD and LCL, b/c our “small country” doesn’t actually make anything worth conducting foreign trade in.In most cases where I invest in a startup, even if that startup denominates its shares in a foreign currency – e.g. I’m in the US using USD and they are in the UK using GBP – I buy the foreign currency when it is time to invest, and then I don’t really care what happens to it so long as the startup pays its bills in that currency.* My investments won’t cause market fluctuations on either side of the pond, and neither will they if they decide to convert it all back to USD for some strange reason.* when the investment is not denominated in the same currency as the startup’s bills, you do end up with the same problem. I remember Israeli startups having problems with this at one point when the shekel was strengthening against the dollar. Suddenly the amounts of money they had raised, which were in USD and being kept in USD-denominated accounts, didn’t pay as many engineers’ salaries. But the net change was nowhere near this kind of craziness.

The big bear will come roaring back.

I understand that Union Square Ventures has the majority of its holdings in companies such as twitter, etsy and snapchat and their stock hasn’t been doing so well…however, I think investing in ethereum at this stage might be risky. It’s initial surge was due to JPMorgan, Microsoft + financial institutions banding together to build an alternative competitor to bitcoin and creating an artificial demand, but this surge is unsustainable.Just my humble opinion, but as we enter the 4th industrial revolution, moving away from social media companies and cryptocurrencies towards energy companies that rely on hydrogen fuel cells and biotech companies that utilise photobiomodulation might be more worthwhile for long term gain.

Fred holds twitter but I believe USV cashed out when they went public. Both Fred and USV hold ETSY stock. USV was not an investor in Snap.

Missed opportunity to close the article out… “And so have I and i’m not going anywhere ETHER

I’m still long on crypto, specifically Ethereum (but also a little on BitCoin) because *real* companies are finally being built on it.I suspect the prices are going to spike and drop a lot over the next year or two as people attempt the ‘quick cash out’ or flip…but there is *real* work going on too, and so that is why I’m not currently worried about my (tiny) amount of cash in (that is now currently ‘worth’ less than I put in).

Wait until you get paid in crypto and that happens.That’s putting my crypto where my mouth is — although I may ask for my next payment in USD. 😉

More than any other investment I’ve seen, these blockchain based fully distributed systems with no governance are just plain casinos. There’s no actual value to back them like a commodity or a company. Its just money sloshing around from one fund to another. You really don’t want to own these things if USV/Microsoft/MS or what ever other “big” investor decides to slosh to another shiny rock.

Path of least resistance is BitCoin $1000 and ETH to $10.Some high frequency trading firms are taking advantage of emotions of novice investors where there is no govt regulations and whipsawing both ends(long & short) and making a killing. June and July has been easy money for these high frequency trading firms.

no mention of SegWit in your analysis. why? it is driving the ‘panic’ of the uninformed investor.

People forget there is usually only one Exit door. Seen it many times. picture yourself in a room with 10000 people in it all trying to get out the same 36″ door.”Strong hands” might buy it. Or hold it. But you better figure out your max pain because it’s going there

.Damn good point.JLMwww.themusingsofthebigredca…

.Discussing cryptocurrency and investments in the same story feels like going to the dentist voluntarily for a root canal.You know it will sort itself out in the long run, but the instant that drill starts turning, there is going to be a lot of pain and you, as the patient, are going to be paying for it.There is nothing wrong with calling bitcoin, et al, a speculation. Speculations are not mortal sins though they are absolutely not an investment thesis.What is real is the underlying blockchain. It is still casting about for its killer app, but it is a real thing.Bitcoin is like fingerpainting — it isn’t an advanced investment art form. It is a speculation. Not meaning to hurt your feelings or suggest your baby isn’t a beauty, but it is just a speculation.If tokens are the new VC art form, then we need to anticipate a similar failure rate. Right now, nobody wants to believe there will be failures and they have to be priced into the value, just like a VC can tell an LP — “Seventy-five percent of our investments with your money turned to shit, but the other twenty-five percent are a bit of all right.”The problem always is the same — The VC didn’t know which deals were the winners when he invested the OPM.It is delusional to suggest that “this thing is different” or “this time it’s different.” That’s immature and feckless reasoning.There may be a big winner, but there are going to be a lot of flop sweat losers before this bubble bursts.JLMwww.themusingsofthebigredca…

What is real is the underlying blockchain. It is still casting about for its killer app, but it is a real thing.A killer app is nice but maybe nicer for a consumer level product rather than a business product or category.WSJ Print (which I read) has a healthy mention of the blockchain. Here are some articles:https://www.wsj.com/search/…One in Particular “Daimler Uses Blockchain to Issue Bonds”https://blogs.wsj.com/cfo/2…The bitcoin speculation and price swings are both good and bad. Bad for the obvious reasons but good because it brings attention to the sector and makes it interesting. It’s what I have called ‘dead bodies on ebay’. [1] The bad actors or negative events are great publicity for something that nobody knows about as long as nobody is killed and Ralph Nader doesn’t write a book about it.[1] Facebook has that with Facebook live. You know a story that says ‘someone live streamed a killing on Facebook today’ is good for Facebook live. I don’t use it but I took a look to find out what it was after hearing that. I am sure many others did as well.

@JLM:disqus speculators are an essential part to the markets. If you didn’t have traders, your investments would be illiquid, there would be massive bid ask prices. And you could lose money the moment you bought a share.I was lucky enough to see first hand the dot.com boom/bust (I had joined Merrill Lynch in 1999 for my first job). And I agree with a friends quote about all this blockchain and crypto…”Blockchain no doubt is the future, it’s like we are in 1996 and we hear this thing called internet.”From the Dot.com bubble burst, people were right “this time/thing is different” but not in the way they expected. From the rubble, some amazing companies came out. From the exit of those companies, founders were able to start new ones with the capital they cashed out on.Oh and for VC – no matter what they ‘tell’ the LP – they write “your investment could be subject to 100% loss of capital” in the fine print. AND, they charge 2% on OPM having the privilege of not really having a clue which investments will become winners. How is that different from an ICO? At least we’re not being charged a fee to be an investor.

.No foul if speculators are “part” of the market. Something to watch when they are the entire market, no?It’s too early to compare the results of ICOs and VC. Nobody has a handle on ICOs. Too new.JLMwww.themusingsofthebigredca…

I agree its too early to compare results. But we won’t have to wait 5-7 years to hear about it.

Agree with everything you say. But my (perfect) 2 year old daughter objects to your finger painting simile.

FRED:We acknowledge you have a vast grasp on business and life experiences. Can the AVC community be blessed with more of this type of insight on what you and circle think of emerging market trends before they explode and become untouchable. This post was well presented. Before posting within our circle of trust we all enjoyed the post. It only affirmed if we can’t review the fundamentals we can’t participate and be Deadpool.Again thanks for the stimulating post.

Yawn. Prices go up, prices go down in a speculative marketplace. News at 11.

A good thing to invest in a falling crypto market is that you will own the market at some point of time. That should propel to take decisions and drive business models created by bitcoin, ethereum, etc.

The most telling fact is that the price bitcoin is about $ 2,000 and the price ounce gold $ 1222. Digital win Analogic today.

.Agreeing more with you than you do with yourself, I want to sound another more obvious concern — raw competence in the face of easy money.When it became easy to raise money for real estate LPs — pre-1986 — guys got in that business to stand under the waterfall of money.Same thing happened with drilling partnerships in their day.Then it came time to convert that ocean of money into something real and people found out that building high rises or drilling were difficult businesses. The failures were ones of insufficient competence.Money being raised on the back of tokens, et al, assumes that the money raisers know what they are doing with the underlying business. They may not.In addition, it is difficult to understand how VC faux money doesn’t have the same success rate as VC real money.VCs are pretty damn good at what they do by trial and error, if nothing else. The people raising this token trashbag money are unproven money raisers, money managers, and company builders.No, this thing ultimately devolves to the same success rate — lower probably — as VC.Your note of Theranos — faux tech by a blonde in a black turtleneck with a great, clueless board — is a perfect example of wanting to believe, or wanting to be fooled. It was a head fake.JLMwww.themusingsofthebigredca…

You mean criminals use tech? Shocking. Or that criminals use various forms of currency, like USD and Euros? Shocking, again.Hot takes on the board today. Genius.Everybody repeat after me: Criminals will use BitCoin. (Like they use everything else. Now get over it.)But it’s not 99% like Pablo here thinks. Actually the reverse.

JLM for the long-winded confirmation bias. I love this blog.

“VCs are pretty damn good at what they do by trial and error, if nothing else.”Probably so. VC = Mutual Fund Managers vs. Retail Investors. Of course the exchange houses have their limited KYC like the crypto exchanges today. So what’s the difference? As per the SPIVA reports – MFs deliver pretty bad returns. So how good would retail investors be? Probably better without the 2% management fee. It’ll be interesting to see an ETF appear which invests in all the Cryptos or even fintech companies.

.The SEC has turned down at least two BTC related ETFs.JLMwww.themusingsofthebigredca…

yeah, i remember the first time – I was watching it closely. Cryptos took off shortly after that (never expected that). I guess people don’t respect the SEC that much after Bernie Madoff.

.Madoff was almost a decade ago, so probably not in play, but it is truly incredible to learn how many times he was looked at by the US SEC and nothing happened.JLMwww.themusingsofthebigredca…