How To Think About Selloffs

The crypto markets had a good day yesterday but have been down a lot since peaking in early January. Bitcoin peaked at almost $20,000USD in mid December and has gone down by roughly 60% since then. Ethereum peaked at almost $1400 in mid January and has gone down by roughly 40% since then.

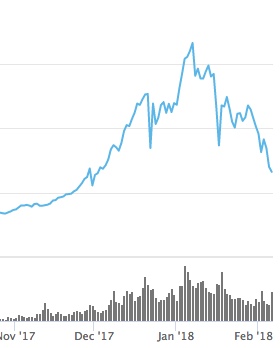

A chart that I like to look at, the total market cap of all crypto tokens, has made a classic head and shoulders pattern and is now retracing on the downside:

The total market cap of all crypto tokens peaked at roughly $825bn and is down roughly 50% since then.

But most of you know all of this.

The more interesting question is what, if anything, to do about it.

In times like this, I like to turn to the fundamentals to figure out where things stand and how I should behave.

So how do we do a fundamental analysis of crypto prices. Is $8000 high or low for BTC? Is $800 high or low for ETH? I see people opining on these things all of the time based on historical prices and that is not a proper way to value an asset. You need to have some fundamental theory of value and then apply it rigorously.

There are plenty of people doing that kind of work in crypto-economic circles and I saw two blog posts in the last week that I thought were quite good.

Here is a post explaining the NVT ratio (network value to transaction ratio).

And here is a post critiquing the monetary velocity approach (MV=PQ) and proposing an alternative.

What you can see from these two posts is that not everyone in crypto land is speculating without thinking. There is some serious economic thinking going on and it is going to be super important in the coming years.

However, the bigger problem in crypto land is that none of the public blockchains have really shown they can scale to the volumes of transactions that would be required for blockchain technology to go mainstream. I have likened this situation to dialup modems in the 90s eventually giving way to broadband internet (and mobile broadband internet) in the 2000s. I am confident that trust-less consensus-based systems will be able to scale to the volumes we need to go mainstream but we are not there yet. The transaction ratios and monetary volumes that drive value in the economic models I linked to above just aren’t there yet to support the almost trillion dollars of value that crypto tokens reached in early January.

But there are some very promising signs out there.

We have the Lightning Network getting implemented in the real world. Lightning is Bitcoin’s great hope for scaling transaction volumes.

We have Truebit going live on an Ethereum testnet this week:

Massive milestone today — Truebit Lite is live on Rinkeby running verification for the DOGE-ETH bridge — Check out the demo! @sinahab @mattgcondon @hdswick @ethchris @robbiebent1 @mrsmkl https://t.co/e26S0imBFO …

— Truebit (@Truebitprotocol) February 5, 2018

Truebit is off-chain computation for Ethereum.

Neither I nor USV has an economic interest in either Lightning or Truebit. I mention them because they are two of the more interesting efforts out there to scale these big public blockchains. There are many more of them.

The truth is that if you look behind the scenes, you will find quite a number of strong technical teams that are working on scalability and some of the other fundamental challenges of public blockchains. The crypto sector is full of get rich quick schemes and janky token offerings, but it is also full of brilliant computer scientists and strong engineering teams working on solving these challenges. And I am quite confident that they will solve them. When and how is harder to predict.

So given all of that, how does one do a fundamental analysis of crytpo tokens and the crypto sector?

Here is a three step process that I recommend:

- Get the Cryptoassets book and read it. The authors do a great job of outlining how one can and should do a fundamental analysis on crypto tokens.

- Follow the crypto-economists who are writing regularly about this stuff and read what they have to say. I linked to two of them above in this post.

- Understand the technical challenges and follow the progress being made in solving them. As more progress is made, that should be reflected in the prices of the top public blockchains. If it is not, that would be a buying opportunity.

I don’t believe that the recent selloff is a massive buying opportunity, but I also don’t think that anything has really changed in the fundamental analysis of the sector in the past month. I remain long term bullish and short term cautious.

Comments (Archived):

Thanks for sharing those links, I got through the first one and will read the second later. Eye roll for your use of technical trading jargon. Ratio analysis fails when it is hard to identify comparables and there is no historical basis. A different analysis I read is you can determine fundamental value by using the actual cost to process a transaction (e.g. cost of computing resources). I shared a few that I liked at the bottom.Re-highlighting the top highlight of the first article you shared, “There is, however, another more fundamental weakness of NVT. It only takes into account total value of on-chain transactions, but it doesn’t factor in the number of transactions or the number of addresses (wallets) participating in these transactions. Let’s call this metric Daily Active Addresses (DAA).”Summary of the uncertainty by U Chicago. http://review.chicagobooth….Research paper discussing the fundamental value of BTC: https://www.researchgate.ne…Adam Hayes Cost of Production: http://www.economicpolicyre…

I think of technical analysis as a nice compliment to fundamental analysis. Without fundamental analysis, you are lost. But if you know where you are given your fundamental analysis, technical analysis can help you be a bit smarter about how to proceed

Technical analysis is the bastard child of analysis. It’s an unexplained phenomenon where some of it works consistently.

technical analysis, depending on which subdivision of the field one ascribes to, can have numerous explanations:1. supply/demand TA is generally explained by strong hands accumulating or selling, and those patterns appearing in price and volume data2. cycle-based TA is about cycles/patterns in the universe (this is a somewhat mystical discipline and presupposes an underlying belief in an orderly, cyclical universe unfolding through a space-time continuum)3. momentum/trend-based TA is based on herd psychologybut in the age of big data the distinction between fundamental and technical analysis is blurring quickly. new school is to gather data, train a model, and predict. a fundamental component here is in understnading which factors to include/exclude in a model. and i think this approach will be useful in valuing crypto stuff as well.

Sports nerds are learning this lesson – the advanced stats should support what your eye and knowledge are telling you.Not the other way around.

Thanks.If the community wants to add to the list of crypto economists and podcasts to follow please do.I’ve read and follow those mentioned and am a big fan of them.There is a ton of noise and self serving noise out there as expected. Helping the great stuff find wider audiences is a good thing.

This medium post is great and you can skip to #9 Navigating the Blockchain Community for a list of who to follow and listen to. https://medium.freecodecamp… Laura Shin’s Unchained podcast is great as is anything on crypto from a16z usually with Chris Dixon.

thanks.

We are a long ways from definitive assertions on quantifying the intrinsic value behind these new models, despite some of the attempts you mentioned. That said, what we can do a bit better today, is to value the various cryptocurrencies on a relative basis to one another.About a year ago, I wrote this, and still stand by it:In traditional venture investing, we are used to relatively well defined stages: angel, seed, Series A, B, C, D, E, F, then IPO. Each one of these phases has generally accepted stage characteristics pertaining to product evolution (alpha, beta, launch), product-to-market fit, and continued user growth, and resulting market acceptance and share.In public companies, analysts and investors use metrics such as revenues, net income, EBITDA (earnings before interest, taxes, depreciation and amortization), EPS (earnings per share), P/E ratio (price to earnings ratio), and sales growth in order to correlate market capitalization justifications.For ICOs and token-based projects, what are the equivalent performance metrics?

What’s the ICO or token-based project equivalent of free cash flow from [core] operations?

Some have revenues.Most protocols don’t.

It should be MV=PQ. The P and Q are very real in this equation and PQ is the GDP of the economy represented by the token. Notwithstanding the great posts Fred linked to, I am still struggling to understand the V on the left side of the equation.

This level of economics will keep Normals away.Trustless is a great word, in that it projects the lack of trust needed to transact.And, @fred@fredwilson:disqus has consistently said that the biggest job of any startup is to change behaviours. So, whenever a troll shows up to accuse him of shilling the BlockChain, they have no support.But, Whoa Nellie! We are talking about an insanely entrenched behaviour model. When is the last time you did a deal with someone and put no thought to whether they were trustworthy?The only time this happens – and it happens billions of times a day – is when there is a trusted third party intermediary providing the value of a trusted transaction.Hello, my name is VISA.Hello, my name is NYSE.Its a great VC style bet, but only because the upfront, professional investment risk is dwarfed by the potential return of being in early on the new platform for all financial transactions.(If you are 25 and have every penny you own in this bet, you have skewed the professional risk immensely, as an aside).But, instead of this professional VC value bet:- providing established value faster and cheaper- or providing a value proposition that is indiscernible from Magic and something that people LOVE once they realize that they can actually perform that Magic at a reasonable cost so that the Magic creates new, non zero sum value…….> i.e., ‘Holy Cow, its 1991 and I am driving in my car in Calgary talking to a guy who is cdriving in his car in Manchester England and its not costing $100 / min. What?!?! I am telling everyone I know about cell phones.’…….Willie, Fred and the crew are betting that people don’t really value that intermediary they have been paying lo’ these last 3 millennia. And, once they feel the fever of the Blockchain, they will wake up to being screwed and its Stampede time.Don’t see it, as I have made clear.Mainly, because people are happy to pay a middleman to be on the hook. Its a great deal, when you measure it against the time and energy required to chase down a deal that does go sideways or to worry about deals going sideways or wallets being breached, etc.Its kind of like saying that people would prefer to self insure, if they knew they would never have an accident. It might be true, but what Normal is buying that story?

Yeah, You make great points. But…I do think there are three broad opportunities that are very real and can be addressed by decentralization:a) Democratize rewards based on contributions: We live in a world where most of the large tech companies (GOOG, FB) are profiting from the contributions of user generated content without giving anything back. Things like Steemit and DTube need to be welcomed, irrespective of how early it is and how great the odds may be of upstaging the incumbents.b) Automate contract execution where there are multiple parties, disparate sources of data, and no transparent view of data. From crop insurance in South Asia to non-profit funding based on impact to micro-credit and micro-insurance, there are genuine opportunities to make change and deliver better outcomes to the stakeholders. Some of these problems simply cannot be solved as well with centralized services.c) Tokenize physical assets to make them liquid and tradable. This can be a big deal and there is no way to do this easily with current systems.I think it is good for the skeptics among us to allow for doubt, just as the fanboys need to take criticism seriously. After all, it is the craziest of ideas that often result in dramatic progress.

Food for thought.First reactions:- social media is ad based, so…..- something there, but not a new paradigm…..- REALLLY interesting, if there is demand (not my spot – sounds real estate-y @JLM:disqus perhaps?

-Social media need not be ad based. That is the point. Check out steemit, dtube, and busy.org.

Why is crypto required for either?I don’t get Busy.org

the people who contribute (write or upload videos) get paid in crypto. it is an open source community that runs by itself with multiple types of participants.

But that is a choice, right?Or are all the accounts anonymous for some reason?

yes, everything is a choice including anonymity. I know people who are making non-trivial amount of money writing on Steemit.

This is more at the heart of things.

None for the companies.How is Gold valued? Best analogy for the currencies?I can’t see how valuations can be done – maybe use the SV Angel approach and just buy winners and not worry about price?I really like Fred’s word ‘ trustless ‘ . It seems other words are required to get the idea into Normals frameworks and then we will find out if real adoption will occur.Mind you, those words will just hasten the demise……..some times the head and shoulders move also goes hands and arms too!Nothing kills a bad offering like good marketing.

It depends if we are talking about protocols, apps, currencies, platform, etc.Not all tokens are born equal.

This sell off has to be putting a strain on the ICO market, correct?I can buy twice as many tokens with my ETH than I could last week.

I love this line of thinking William.As the crypto market took a bit of dive over the last couple of days I asked myself the same question that Fred poses in this post. How can we measure value? Interestingly my mind drifted to what is the DCF equivalent? But! the input assumptions for venture invests are extremely speculative so I like your more qualitative approach of Product Market Fit, etc…The question I have for you is this: What stage equivalent are we in? and what heuristics should we use from what cohort of people? (I would imagine it is largely developer enthusiasm as opposed to consumer)

It depends if we are trying to value multi purpose beasts like Bitcoin or Ethereum, platform specific ones like EOS or NEO, protocols like Filecoin or 0x, single purpose currencies or emerging Apps like Status.Anecdotal signals are more useful, like EthDenver (next week, I’m speaking, judging, mentoring) had 500 wait listed developers. That’s real traction and a clear market signal for demand.

Yes, that is true although from my reading it seems that a lot of these protocols will have to work together, and in some sense are dependent on the success of one another. Although, it seems projects like Blockstack are less dependent on the success of others with the virtual chain. (I am not a developer so apologies if the terminology is off)And Yes! community and the hive is truly a great signal, it is even mentioned in crypto assets as a market signal.

I think it’s safe to say that it’s currently a much more subjective interpretation than a science based on the things that are perceived as important and valuable to each tribe. Of course there’s the speculative layer but underneath lies “THE MISSION” that essentially some would be willing to HODL for, even if that means going to 0. That in itself may be priceless.

The venture capital models are based on the company generating revenues and profitability in a traditional sense. But behind the dashboard of financial metrics, there always is some type of user value that is a) tangible and b) worthy enough for the user to offer time, data, or money as exchange.Irrespective of whether an app is decentralized or centralized, and how it is monetized, user value is still at the very core of measuring performance. There are some simple questions that can be asked of blockchain projects:1. JOB TO BE DONE: What is the core “job to be done” for the user? What are the metrics for the user job to be done? Why does this project do it better than centralized alternatives? What does the before and after look like?2. USERS: What is the size of the network? (# of users on-boarded and by type)? How is it growing over time and is there a user acquisition cost? How often do they use the network and how is this measured?3. TRANSACTIONS: What are the types of transactions (and volume) passing through the network? What is the value of the network and how is it best measured? How fast is it growing and why? (Transaction is a proxy for any request on the network that results in a value exchange: i.e. tokens changing hands)The valuation of the blockchain project should be a function of size of network, the value it delivers to users relative to status quo alternatives, and its growth, Anything else (coins in circulation, supply schedule, demand for the coin, etc.) is really not relevant in judging intrinsic value.Answers to these questions for most projects today is “It is too early to say”.While there are multiple dependencies on infrastructure, scaling etc., and both investors and founders need to be patient, there is also the truth and reality of the marketplace. If someone does not see real value in using something, the shit eventually hits the fan, irrespective of how well it is capitalized…

Beautiful…JTBD thinking applied to Crypto is brilliant. The key question here could be What is the push/pull of the underlying tech and how does the token incentivize the vision of the future for the user in x domain? eg. filecoin incentivizing IPFS for the job of file storage everywhere, all the time.

I think the bigger question is what JTBD need Crypto overhead when HTTP protocols can be programmed to do the same ‘ smart contract ‘ work?

It might work just as well, but the smart contract is not open source, its workings not transparent, and one party controls the data that flows into it,Why is this even important?At its core, the decentralized movement is about human nature and protecting against its dark sides. Specifically, a) concentration of power, and b) Unfairness and Inequality.When individuals have agency and control, and when there is transparency of contributions, both ills are better addressed. At least, that is the hope. And it is hard to argue these are not worthy and noble pursuits.https://twitter.com/cavepai…

You are upending the social order here.This is a new epoch in history, basically.Not saying, just saying……

How do you account for marginal differences in these distributed models? Pareto and standard (normal) distributions are to be found everywhere in nature. Nature is nothing but a series of networks never completely in balance, but always trying to get there. Socio-political and economic institutions created by humans should be no different, yet they are. We both see that as a problem, but answer my question (about clearing marginal supply and demand) if you will. I doubt you can.

So let us take something like file coin – decentralized storage – as an example. It is essentially an alternative way to store your docs; parameters for the user to consider include price/ GB, ease and speed of access, backup, security, etc.Unlike a Dropbox or Drive, in a decentralized ecosystem, supply and demand are fragmented entities (users) who are bound together only by the specific token – in this case file coin. Supply is not a centralized data center built out through capex.Initially, there is little supply (users offering storage) or demand (users willing to store their files). But the network offers incentives (through tokens raised from a capital raise) to bootstrap both demand and supply. Until such time, there is liquidity (as in there is enough supply for demand to get value, and enough demand for supply to make money), the token economy is propped up through incentives.Once there is liquidity and at which time, if user economics is substantially better than alternatives, there is potential for both supply and demand to be elastic to each other. i.e. users and capacity ramp up and down depending on the money there is to be made; and demand flows or recedes based on effective $/GB and user value.Marginal demand and supply will be cleared, not dissimilar to what occurs with Uber surge pricing.Of course, there are many factors that influence this, including product-market fit, competition, and user acquisition cost.Bottom-line: A blockchain startup is not dissimilar to a traditional marketplace like Uber or Airbnb. The same laws of gravity apply irrespective of how you raise money and the virtual currency being used.Hope this helps. Don’t know if I understood you correctly.

Yes you did. But I think you need to flesh out your answers more in depth.First, “But the network offers incentives (through tokens raised from a capital raise) to bootstrap both demand and supply.” How long does that last. Have you read how hard it is for platforms to avoid churn? What if the value goes down and users flee to a more secure platform (or model).So where are the incentives to drive cost of supply down (at the margin)? Who’s bearing the risk of that? And won’t they want a disproportionate share of the value derived for taking that risk?If large volume users want better pricing will they get it? How will that be advantageous or disadvantageous to low volume users.Lastly, has anyone given any thought as to how to achieve universal service; not that it has ever been achieved efficiently but at least before the internet (IP stack) there was a semblance of and attempt at that (aka TA-1934; and failure of TA96 not addressing it in a multi-modal digital age). I don’t see ANY notion of universal service or “internetworked” settlement systems ANYWHERE in the crypto discussion. Not sure if any if this latter point makes sense to you as it is anathema to most who grew up under the “settlement free” internet influence.You see, the internet is a place where risk is entirely one sided. But a DLT approach doesn’t solve that. Just as with IPv6 being incapable of reaching 40% penetration after 20 years, how do DLTs provide incentives for protocol stacks to eat their own?

Valid points and great questions. The crypto blockchain ecosystem is very early… but almost all companies will run into one or more of these issues.First, if the network does not reach liquidity and the incentives are no longer available to drive adoption, it is no different than a company running out of cash. If users transition to a competing protocol (or even a copy of the same one with better utility), then the protocol faces a crisis and may not recover if they are unable to offer better value to users. Only the protocols that have developed a strong network and have high utility/work value will survive. Shorthand: Expect most tokens to crash to zero at some point.Two, at least in my mind, post product market fit, and pre-liquidity, the incentives to drive cost of supply down is really with the major token holders. especially, the developers who built the protocol, understand the problem domain, and who are on-boarding the early suppliers. If the domain does not naturally lend itself to decentralized problem solving at lower cost, this is much harder to make happen. Suppliers are individual modules who fit into the whole so they are competing to get the customer’s business and will be priced out if they are too expensive. At least, that is the theory of the case.Three, If large volume users want better pricing, they surely can get it, because the negotiation is peer-to-peer between suppliers and customers; the competing interests of suppliers (within and across decentralized and centralized options) should resolve the price. Transactions can be anonymous (in terms of identity) and also be masked depending on the protocol.Fourth, At the moment at least, there is little collaboration across blockchains. There are few common standards imposed by ERC20, but I am not sure there is any inter-operability designed into these protocols at a very deep level. But there are some projects like Sovrin (for identity) that are trying to design horizontal layers that can cut across multiple projects.Most crypto protocols are not at the TCP/IP or networking level. They are at a higher level of the stack. IPv6 update has been slow because network operators, enterprise operators, publishers, app developers, etc. all have to make changes and the incentives were not always clear.Crypto protocol updates are very messy today needing hard forks. I am not technical enough to understand if/how these can be upgraded like the way cloud systems are managed (with minimal impact to users and automatic migration of underlying data).

still early to see the full picture on many of them, indeed.

For early stage token-based projects people try to use things like social influence, number of GitHub commits (https://cryptomiso.com/), or whether they hit their milestones on time. For me, I think this is the wrong approach. Social influence can be faked, GitHub commits does not equal quality, and projects could hit milestones without anyone caring.What I think is better is to treat these projects like seed stage investments and over time, add to your position if they’re making significant progress. The equivalent performance metrics will be a little more obvious over time. I personally like the Blockchain activity matrix, because it shows what people are actually using in the real world – https://www.blocktivity.info/.

I like those 2 sites you linked to. They do offer some interesting indicators, but not all conclusive. Prices are driven by macro sentiments mostly, so far. They all move up and down together, generally. This means there is no real discrimination about micro specifics.

‘activity’ – can that be unbundled? What are different types of activity (behaviour, motivation,… et.c.)?

have you scheduled your next Token Summit event?

Yes, http://www.tokensummit.com . May 16-17. It has been scheduled for a few months 🙂

Thanks William. Still no love for Old Europe? Paris in the spring, where could be more appealing?

For assets with no intrinsic value (Bitcoin), its the price at which vanishing supply = vanishing demand. In thinly traded markets, plot the daily volatility / 1/squareroot of volume to see how the liquidity curves can quickly move. Second, cognitive biases played a huge role in moving the bitcoin price and transferring wealth. Do an econometric analysis of media mentions / billionaire. The brilliance of the bitcoin (notice how no one talk about the valuing the blockchain) was how well this was executed.

>> We are a long ways from definitive assertions on quantifying the intrinsic value behind these new modelsNo we are not.Crypto is like pet rocks- a fad which has caused people to believe stuff that is essentially worthless is valuable.“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”― Benjamin Graham (Warren Buffet’s mentor)

Will there be a next wave of projects where funding is not through the ICO model? I can imagine the self funded stage coming next, with airdrop distribution of tokens, and measurable organic growth based on tangible user behaviour, behaviour which can be observed and analysed.

Yes, that’s very true and possible, indeed.

and i think ‘airdrop’ will be replaced by a targeted distribution of tokens. imagine a decentralised Twitter project. The founders may seek to infiltrate the Twitter network and target a particular user profile. What would Twitter do? go defensive, start banning, and slowly get chirped away at?

I don’t believe that the recent selloff is a massive buying opportunityFrom ‘Confusion of Confusions’ [1]:The first rule in speculation is: Never advise anyone to buy or sell shares. Where guessing correctly is a form of witchcraft, counsel cannot be put on airs.Comment: In particular because it involves both buying and selling and knowing just one bit of info (in particular ‘buy’) is not enough. Imagine being the person who counseled ‘don’t sell at $20k’ or ‘buy at $20k’ and so on.The rest:- Accept both your profits and regrets. It is best to seize what comes to hand when it comes, and not expect that your good fortune and the favorable circumstances will last.Comment: In particular only tell people your wins and hide your losses.- Profit in the share market is goblin treasure: at one moment, it is carbuncles, the next it is coal; one moment diamonds, and the next pebbles. Sometimes, they are the tears that Aurora leaves on the sweet morning’s grass, at other times, they are just tears.Comment: This dovetails with JLM’s view of bitcoin vs. his trading of bitcoin ie ‘it’s just a trade’ (from a comment he made at some point). Ditto for Jamie Dimon- He who wishes to become rich from this game must have both money and patience.Comment: You have to have money to make money. And yes it’s a game with many factors that you can’t control.[1] https://en.wikipedia.org/wi…

Like most people, I don’t have the time or experience to follow this analysis. That’s why I need a crypto-mutual fund.The selloff is just as mysterious as the rise. To me it seemed to best correlate with the realization that none of these public currencies will be able to support real-world apps. (Scale-ability issues you mentioned.)Of course the most likely reason for the massive decline is that I put some more money in at the frothy levels. I can crash any stock or currency.

I’d love to see it in a mutual fund too.

I couldn’t think of a bigger way to sucker retail investors than to create a crypto-mutual fund. Maybe a Title III equity raise that you could access through etrade.

Absolutely.

They are coming. I think that is what most people want actually

Agree. The scene is way too complicated and changing too quickly, especially the tax treatment.I have actually ran into some youngsters in Houston that are buying and trading baskets of crypto (including alt tokens) for other people. I seriously doubt if they are licensed.

Were they wearing Resistols and Wheeler boots, with that squinty eye frontier look to them?;-)Not licensed ……

Yes, i think so!

+1B.

“The recent formation of numerous investment trusts in this country and the pouring of several billions of dollars into them are bound to play an important part in American industry and finance in the future. This is the opinion of Arthur Reynolds, chairman of the Continental Illinois Bank and Trust company, but it also is his belief that the chief function of these great accumulations of capital has been misunderstood.” Chicago Daily Tribune, 1929.

🙂

“I don’t have the time or experience to follow this analysis”Why would this mean you need a mutual fund? Shouldn’t it mean you won’t invest in what you cannot understand?

I have already told William twice that if he had a vehicle that was broker friendly, he would have a chunk of change from me.Trading this puppy is a goldmine, for a pro.

Which is to say you understand it, no? As a trader, I don’t get why a basket would be better, longer term I do.

No, I would give him some $ to trade.

I think all the major houses are looking at this. If they got regulatory clarity it would be game-on.Right now Coinbase is it. I’m logging into the first version of Bear Sterns.com with a 1400 baud modem and trying to slay the dragon.

Bear Sterns? (Too big to fail?)

Seems like just yesterday, huh? (And yes I worked at Enron – so I have seen it all. ;>)

And I invested in Knight back in the day 😉

“Bud, sometimes a man looks out into the abyss, and all he sees staring back is the abyss. That’s when he finds his true character.”

It’s more nuanced. I really don’t understand the stock market either. But I can buy “peace of mind” that some super-intelligent fund manager is watching things for me. Same with crypto – if I give some guy or gal 1% and they do it for me, I hope they are paying better attention, In the end I can blame them instead of myself!Probably better will be some ETF that tracks each major crypto-currency, like I can do with gold or pork bellies. (Depending on which type of “coin”)

there’s no mystery. it’s snakes and ladders, and that’s how the crypto investing establishment (based in low or zero tax territories) makes its money. pump and dump, better understood as hope and fear, is the strategy for their profits. They own the editorial policy of crypto publications, and their ‘journalists’ are willing puppets.

Interesting links about valuation!I have also written about it focusing on the value drivers and relating monetary velocity approach and transactions ratio.https://medium.com/insights…A coin with high velocity has more transactions but it does not mean greater value. One question remains: how to better esimate velocity?

.What logic did people use in buying crypto currency originally? Was there any real info or analysis available? Was it an investment or a trade?If not, why would there be any now?The coins and blockchain and the underlying apps being built are wildly different things – a currency, a process, a business (?).The valuations being tracked are solely the auction value of the currency which is a commodity. The commodity does not even have an industrial use like silver or copper. It is not tangible.This bed was made without analysis and it will not be explained by analysis now. The analysis being applied is not typically used in FOREX. Total mismatch.It takes more faith in the unknown to try to explain than it takes to embrace the Holy Trinity. Perhaps, it is a religion.It was and continues to be a trade in the face of a limited number of buyers. Sometimes the Bigger Fool Theory taps out the supply of fools.The killer app?It’s a trade.JLMwww.themusingsofthebigredca…

What you say is very true for currencies, not decentralized apps. Things like Steemit are more real with actual users and significant usage. But for every Steemit, there are 100 tokens representing apps that have no usage, are outright scams, or ideas that are way ahead of their time. But that is the nature of creative destruction, I guess? There is a lot of froth before things settle down.But, yes, human nature, fear, and greed is the better explanation for market movements.

.100:1 is a pretty strong margin.JLMwww.themusingsofthebigredca…

i was literally making that up, but may not be that far off from the truth.

https://www.youtube.com/wat…Lifechain.

Good post. Worth waiting for.

I agree, and has prompted some comments that I am reading carefully.But what do you mean by “waiting”?

LA(te) is too far west for GMT natives. What was my early lunch is now my evening meal.

CONTRIBUTORS:https://youtu.be/MEaJYeRpl1gCaptain Obvious!#UnequivocallyUnapologeticallyIndeIndepent

CONTRIBUTORS:Deju Vuhttps://youtu.be/-1BfwRi0pzYCAPTAIN OBVIOUS!#UNEQUIVOCALLYUNAPOLOGETICALLYINDEINDEPENT

It is super important to note that the DOGE-ETH bridge is a joint effort between Oscar Guindzberg, Truebit, and CoinFabrik as you can see in the DogeRelay and Scrypt Interactive repositories. We are trying to solve this bounty.

I laugh at people who say there is “technical support” in the crypto market. The market isn’t big enough or liquid enough to have “technical support”. Trading off charts will cost you big money in the long run.That being said, crypto solves some very interesting problems. If you buy crypto as a speculative bet-treat it as a speculative bet. When you are up dough, take it. If you buy crypto because the company is using blockchain to solve a problem core to its business, you can ignore the price and hold.The danger is buying as a speculative bet and then finding confirmation bias reasons to hold it fooling yourself that you bought it for an economic reason and not just to make a buck,

Hey Fred. With your permission I’m going to share some information here. There are only 150 projects worth considering in the crypto space right now. It’s not a random number, I’ve been through each and every one of them and have given them a score based on Management, Moat, Meaning, Margin, Crypto Reliance and Product quality. I’ve been working on this for a while now because I wanted to make better investment decisions.After this hard work, I can tell you there’s some really, really great projects out there. I know you’re invested in at least one of them, that in my view didn’t pass the Crypto Reliance test.Anyway, here’s the list for anyone who’s interested to see it: bit.ly/CryptoProjects.

I thought it said, “How to Think About Selfies,” and I’m disappointed, frankly.

It will be really interesting to see how this influences the field of macroeconomics over time, if at all. (I’m betting that it will.)

I thought the selloffs were related to Bond, James Bond… and hypersensibility.Fake 2017!Live long and prosper 2018.

“You need to have some fundamental theory of value…”Without wishing to be unduly pedantic this is wrong isn’t it?Modern economics, unlike classical economics, has no such intrinsic theories of value.Perhaps it would be more accurate to say “You need to have some credible theory of valuation…”These two are importantly different.