The Coinbase Tax Center

Our portfolio company Coinbase launched some much needed tax tools this week.

I used them today to calculate our gains in 2017 and send the reports to our accountants.

The Coinbase tax center is here.

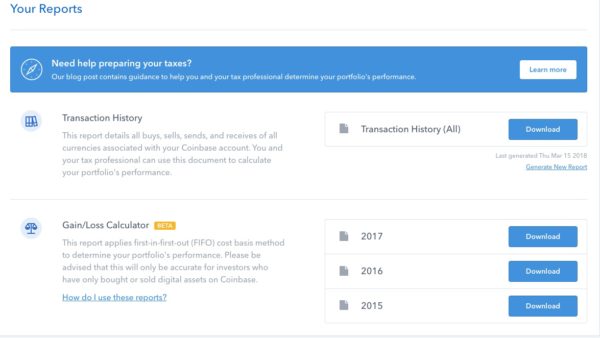

The tools look like this:

I generated all of those reports just now and sent them to my accountant so we can report the 2017 gains on our returns.

Sadly in 2015 and 2016, we had no gains. Some small losses which might offset a few of the 2017 gains, but not much.

2017, on the other hand, was a material year for us. The BCH fork generated real value and we sold some of that. We will be paying taxes on that shortly.

I tell you all of this because gains and losses on crypto trading is taxable income and you should declare it and pay the taxes.

That’s the law and it is important to comply.

Comments (Archived):

unfortunately native only to coinbase. an open tax reporting system would be a lot more useful like liberta

For those who missed it, the House financial subcommittee had a hearing on crypto yesterday. A video of it can be found on C-SPAN.

CONTRIBUTORS:Coinbase & taxes in same sentence.Cough cough.If you have any funds with Coinbase you need to file on time. Your information already was forwarded to the IRS when it was requested.Captain Obvious!#UnequivocallyUnapologeticallyIndependent

Wrong!!!!!! Only 13,000 of their 25mm accounts were shared .A huge win for Coinbase and it’s customers won at great expense to Coinbase. Pls refrain from spewing bullshit and false information here

fredwilson:we have no need to spew any false information. Factual reports on the amount of customers provided to the IRS is in the public domain. We never cited numbers.In our view based upon the initial Coinbase model one customer info provided is one too many.You provided the misinformation of 13,000 which it was actually 14,355 but what is a 1,355 more. Is it your intention to flame us and frame us as adversarial? Not getting it.Since our first post we have never intentionally provided misinformation. We embrace and take pride in facts. No need to characterize our intent nefariously when you have an active base of Right leaning posters for that .An apology from you will not be forthcoming and would never expect it. It would require a valuable character trait.We are truly independent and not swayed by your financial status or perceived adulation by many contributors . We are free market supporters and not envious of your success or influence with people waiting for you to tell them what they don’t realize they need. We proudly collectively think for ourselves.Your response to jason wright was more in line with civility but choose a disrespectful slant when responding to the identical view.We are not even disappointed you incorrectly attempted to flame and put shade our way. That would be like us being shocked you are defending any of your financial positions.https://youtu.be/nM_A4SkusroCaptain Obvious!#UnequivocallyUnapologeticallyIndependent

Great to see these tools coming from Coinbase and more compliance in crypto in general.How are you tracking your assets outside of Coinbase and calculating your taxes on those transactions? Have you tried any tools like http://www.cointracker.io (full disclosure: I work on this project)?

We used to pay blended tax on a mark to market basis even for unrealized gains in commodities. People can whine about high taxes or level of taxation- but never complain about paying a tax on a gain since you have a gain. Loss carry forwards are more painful

Coinbase, neo branch of government inc.

That’s kind of harsh. They fought the IRS for over a year to protect their users (all 25mm of them) from a broad over reach from the IRS and at great cost to them got a settlement that reduced the request to something like 13,000 accounts

harsh, but i think not unfair when we look at it from high altitude.Google and Facebook have become monstrously oversized nodes on the TCP/IP protocol. Coinbase is in danger of becoming a similar problem child in the blockchain space. The IRS issue kind of confirms this. The concentration of all that customer data gave the IRS a target to go after. If there’s no concentration then there’s no target. In my view Coinbase created the conditions that brought about the issue that you say it so valiantly sought to defend its customers from. Coinbase is the issue. Its form contradicts the core principle of decentralisation. Coinbase is not native to decentralisation. It’s in danger of becoming an oversized node much like Google and Facebook. I’m not criticising their hard work and efforts, or your involvement, but there’s a fundamental flaw at the heart of what Coinbase is as a design that just repeats the same problems we’ve seen before in digital networks.I can see that there was the opportunity to create a Coinbase. It was almost inevitable that a Coinbase would come to be. I sense though that it is on a branch of the evolutionary tree that will eventually wither.’Internet We’.

Eventually crypto leads to soverign states, whether that is through floating cities, Puerto Rico, billionaire islands, etc. Deferance to the nation state system is not sustainable over the long run, and so alternative solutions are needed and a fertile entrpreneurial opportunity.

“Eventually crypto leads to soverign states” Yeah, um, well, I mean I guess, I kind of, sort of, um… No. Nope. Not even close! Utter nonesense. Crypto is like baseball cards. It’s a fad. In the 1920’s crew (rowing) was very popular in the USA. Today the most popular professional sports are the NFL, NBA, and MLB (football, basketball, and baseball). 50 years ago the NBA wasn’t very popular at all. Then came Magic, Bird, and of course Jordan.See. Well. Here’s a little secret I am going to let you in on. Ok? Military victories lead to soverign states. But hey, why let a little things like historical facts get in the way of your fabulous theories? The internet is full of folks with absurd theories. Stop trying to peddle your foolish fantasies. I suggest you change your monikor from “kidmercury” to “kiddingyourself.” Sheesh. At some point Fred needs to curate comments otherwise this blog will continue to go down the drain.

lol i had to upvote your comment for the good chuckle it gave me this morning. thank you! :)the roman empire fell due to a monetary crisis, and created a void for rule by barbarians (effectively non-state entities). history will rhyme accordingly…..

I first opened a coinbase account when they offered $10 for students with a .edu account. http://avc.com/2014/05/free…I figure students who opened those accounts have a nice little nest egg….

It seems like the IRS should treat Coinbase accounts like brokerage account.The paltry number of returns that include gains on crypto speaks for itself w/r/t not paying taxes. @fredwilson:disqus I disagree that the IRS overreached on this. In addition to collecting taxes its owed, there is an equally important factor of accessing KYC for purposes of preventing money laundering and embezzlement – important factors in detecting funds that may be going to terrorists/terrorist organizations.Below is a links to updated court case about USA v Coinbase https://www.scribd.com/docu…