Funding Friday: Saving Brinton

I backed this project today to bring a film about saving some of the earliest movies made to the big screen.

I backed this project today to bring a film about saving some of the earliest movies made to the big screen.

I wrote those words to a friend of mine yesterday. We are working on a project together.

He wrote me an email listing a whole bunch of investments to be made and where we are on them.

I read it and understood it, but it didn’t really register with me.

So we are going to make a spreadsheet with a few columns, total some stuff up, and look at it together.

The Gotham Gal calls that a “fredsheet” because I do better with numbers in a spreadsheet.

This is an example of presenting information in context.

I feel that how information is presented is often more powerful than the underlying data.

And when you want someone to understand what you are saying, it is best to put that information in the format that person is most comfortable in.

For me, that is often a sheet.

The news broke earlier this week that our portfolio company Coinbase has acquired Earn.com.

A lot of the press attention was centered around the fact that Earn’s CEO Balaji Srinivasan is becoming Coinbase’s CTO and the backstory about how Earn came out of a pivot from a failed Bitcoin mining company called 21.

But an overlooked aspect of this transaction is that Coinbase has acquired a business that is the crypto version of Mechanical Turk or, perhaps, Task Rabbit.

Earn.com allows a user to create a profile and earn Bitcoin by doing tasks. The tasks right now are centered around the crypto sector (analyze a white paper, accept an incoming email from a recruiter, etc). But if you squint, you can imagine how this mechanic could be extended to all sorts of other tasks.

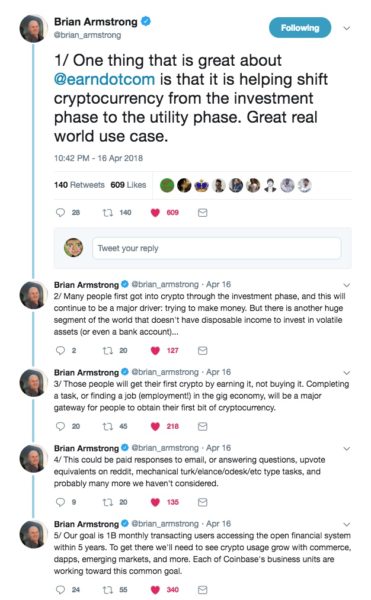

Brian Armstrong, Coinbase’s founder and CEO, tweeted about this yesterday:

It is not enough for all of us to be buying, selling, and holding crypto assets. Earning them is a very important function in the development of an ecosystem. So I am excited to see Coinbase supporting and investing in a business where users can earn crypto assets and my hope is that this becomes something as meaningful as what Amazon has done with Mechanical Turk over the years.

In the fall of 2010, I wrote a series of nine blog posts about Employee Equity as part of MBA Mondays.

You can read all of them at the links below:

Most of what is in those posts remains valid today.

But the final post, How Much, is very much out of date as the talent market has moved in favor of employees a lot in the past eight years.

That has been particularly true of the top executives and some key talent categories.

Most of the movement has been on the equity side of the comp package.

The How Much post is one of the top posts on AVC.

Though I wrote it 7 1/2 years ago, it was the seventh most popular post on AVC (sixth if you don’t count the home page) in the last year with almost 10k page views.

So I have been concerned that this blog (aka me) is spewing out of date information to a lot of people every day.

And so we are on a mission to fix that.

I have enlisted my colleagues Bethany and Zach on this project and this is what we in the process of doing:

We have collected data on employee equity grants from USV portfolio companies. Many of our portfolio companies use a reporting tool called Advanced HR and through it, we have been able to access anonymized data on every grant that these participating companies have made. Since these are our portfolio companies, we know what their equity is valued at and what it has been valued at over the years. We also understand the context behind many of the outlier grants.

So we have been normalizing the data and bucketing it and looking at distribution curves and understanding it.

We are mostly through all of this work and it is my hope we can publish the data before the middle of May.

As part of that, I will rewrite the How Much post and I will go back and edit the original post with an update section at the end clarifying that the data has changed (a lot).

We also plan to publish a calculator that will help a founder/CEO/HR team understand how to use the numbers we are going to publish.

So stay tuned for this update. It has been a fair bit of work to do this update right and we are excited to get the data out there so all of you can use it.

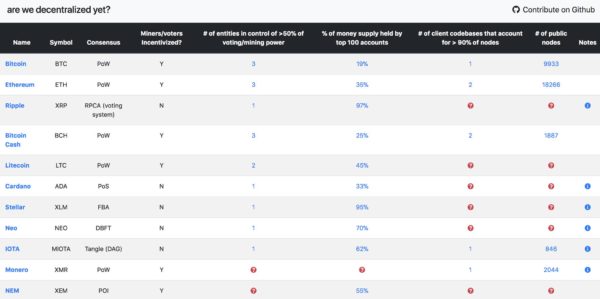

My friend Chris Burniske told me about this site last week and then tweeted about it last night:

So the answer to the question posed by the name of the website is “not really.”

But that doesn’t mean we won’t be someday.

This chart also shows the issues with highly valued chains like Ripple, Stellar, and NEO.

These chains offer some things, but certainly not decentralized consensus.

It is still very early days in the development of decentralized consensus systems and there is a lot more work to do.

One of the least discussed aspects of investing in startups is the value of the time commitment one makes to a company they invest in.

The money part is pretty simple; you invest capital into a business and get an equity participation in the upside. Both sides of that deal can analyze that transaction and understand it fairly well. Of course neither side knows what the ultimate payoff will be, but one can handicap it.

The time piece of the transaction is way more complicated.

Consider:

1/ The founder doesn’t know if they will actually get the investor to deliver on the promises made to add value and spend a lot of time on the investment. A founder can reference an investor and get a better sense of this but there is nothing written into an investment agreement that binds either party to make a specific time commitment to an investment.

2/ An investor doesn’t know for how long they may need to contribute to an investment. Will it be three years, five years or fifteen years?

3/ A founder doesn’t know how much of their time they will have to spend managing their investor group. Will the group be invasive and annoying or will it be value adding and helpful, or both?

4/ An investor doesn’t know if they will have to shore up a weak team with a ton of day to day support or if the team will be largely self sufficient and only need occasional advice and counsel.

I could continue with these examples but I think you get the idea.

Time is a valuable resource for all parties and it should be a factor that both sides include in the deal making analysis. But it often is not.

A good example of where it is explicitly considered is a late stage financing where a company specifically seeks out “passive capital.” In that scenario, both sides are choosing to largely remove the time equation from the investment analysis and simply treat the deal as an exchange of capital for equity. That is clean and simple and well understood.

Contrast that with a hotly contested seed transaction where a founder has demand for 5x what they want to raise. Every investor is promising to add value to get into the deal. The founder has to assign some value to the time each investor will contribute along with capital but has very little information to do so. The truth about these situations is a few seed investors will massively over deliver and the rest will massively dissapoint.

As an early stage VC who typically invests at the seed and Series A stage, I feel that the time piece of the equation in our deal making is the hardest part to get right. We should price our time into the investment math. We should pay a premium valuation for an investment that will require less time from us. And we should get a discount for an investment that will require a lot of our time.

We do consciously think about this in our deal making but we don’t have a crystal ball and we get this part wrong a lot. I have spent huge investments of time on situations that have not moved the needle for us and likely won’t. And I have been involved in companies that have delivered fantastic returns to us and our partners with very little effort on our part.

If one has time to evaluate the time commitment issue as part of an investment process, it becomes a bit easier for both sides to get this right. A rushed financing makes it harder and can lead to miscalculations on both sides.

Like everything in business (and life), you learn about this by getting it wrong. Founders and investors with a lot of experience understand the importance of this and factor time heavily into their investment decision making. And that leads to a healthier dynamic for everyone.

One of the crypto projects I am most excited about is Filecoin, which comes from USV portfolio company Protocol Labs, which also produced the popular hypermedia protocol IPFS.

In this talk, from the Blockstack Berlin conference last month, Protocol Labs founder/CEO Juan Benet talks about Filecoin, why they are building it, and how it will work.

Jacqueline got me about five seconds into the video with this line “a lifestyle brand for nerds that is dipped in super girly magical girl aesthetics.”

Anything that breaks down the societal norms that girls can’t be nerds is right in my wheelhouse and I backed this project with excitement.

For much of yesterday if you came to AVC, you were greeted with this message:

Long time AVC readers have seen this before and it is a sign that something is awry on the shared server that I run WordPress on at Bluehost.

A number of regular readers reached out offering to help me move to a static platform and I will likely take them up on that.

Until then I can only apologize for the availability issues yesterday.

A friend asked me at breakfast this week “what gets you excited in crypto these days?”

I answered “Dapps.”

If the second half of 2016 and all of 2017 was about raising capital to fund development efforts (and speculating on all of that), then it sure feels like 2018 is the year we start getting decentralized applications (Dapps) we can use.

Our portfolio company Blockstack offers a decentralized platform that developers can build Dapps on.

I have Blockstack’s web client running in Safari on my home desktop and here is a screenshot of some of the Dapps I can run in that environment:

A cool thing about Blockstack is that identity is built into the platform so I am already a user and have a profile in every one of these Dapps because I have a Blockstack identity/profile.

Another ecosystem that is really taking off right now are Ethereum based Dapps.

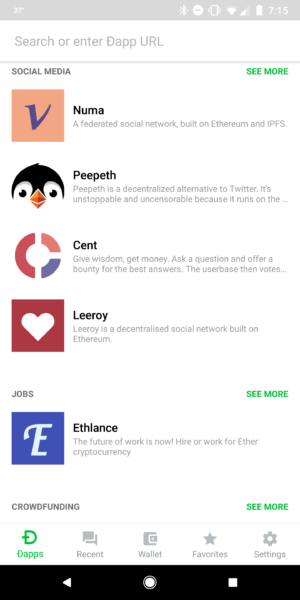

I use our portfolio company Coinbase‘s Toshi Dapp Browser to access them. Toshi is available on both iOS and Android.

When you launch Toshi, you can put some ETH into it. Toshi has a user-controlled ETH wallet inside of the browser.

When I open the Toshi browser on my phone, I see a bunch of Dapps I can use:

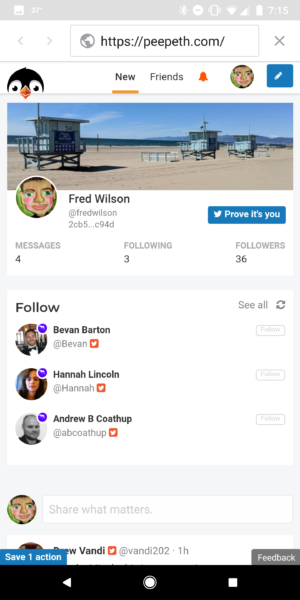

I like the Twitter-like app called Peepeth, which looks like this inside of Toshi:

But there are hundreds of Ethereum Dapps you can discover and use inside of Toshi.

You do need some ETH to power these apps so if you want to play around with Ethereum Dapps, load up your Dapp browser with ETH before you go.

The bottom line for me is that we are finally seeing some useful decentralized applications being built for consumers on these blockchains.

Right as the market for capital raising and speculating on crypto cools off.

As it always is.