The Kickstarter 2017 Public Benefit Statement

Our portfolio company Kickstarter is a Public Benefit Corporation.

One of the requirements of a Public Benefit Corporation is that they publish an annual benefit statement outlining how they are doing living up to their PBC charter.

This is Kickstarter’s PBC Charter.

And this is their 2017 Public Benefit Statement, which was published yesterday.

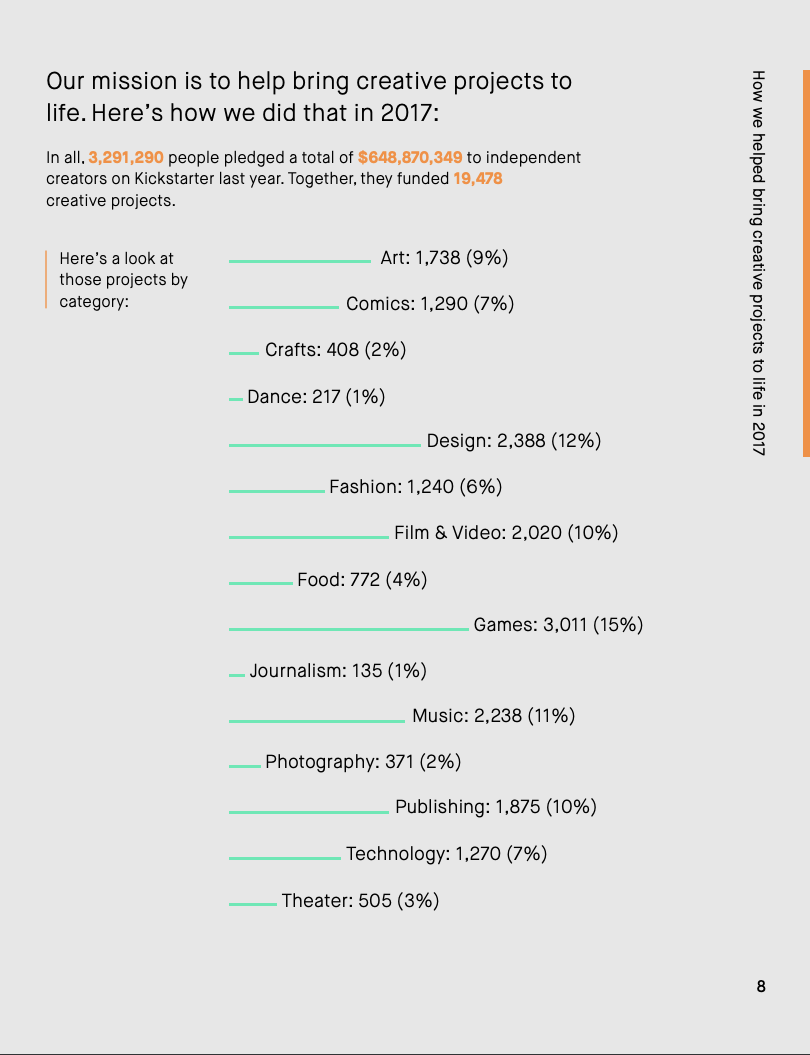

Here is a page from the 2017 statement, which shows how much funding they provided to creative projects across the categories they support.

That is a lot of economic activity, almost 20,000 creative projects were brought to life by Kickstarter PBC and its creator and backer communities.

Innovation takes many forms. Innovation in governance and business model is particularly important right now. And Kickstarter PBC is exploring a new way of running a for profit business and showing the way for others who might want to do the same.

Comments (Archived):

Big thumbs up!This is all goodness.

I saw it yesterday in my notifications. It’s an eye-opener as to how a PBC is run when profits aren’t maximized at the expense of mission and values.Curious what are other prominent examples of PBC’s?

https://en.wikipedia.org/wi…Patagonia is one. Wear your values.Ecosia is another. Plant a tree.

thanks!

has any PBC ever filed for an IPO?

Patagonia has always been an interesting company.

Yvon Chouinard is a rare breed.

Indeed and basically invented, and for a bit owned, urban wear outdoor gear back when.

I will dig up pictures of me climbing and kayaking with him. He was not about urban outdoor wear. Urbans found him, not other way around.

To me doesn’t matter. He took the market.Though has lost it to a massive amount of smaller brands.Whether that matters–who knows–but I know it’s been 5 years plus since I shopped there and lived down the street from his soho store for a decade.

Sad part is that he did not lose it to smaller brands. North Face totally sold out to Vanity Fair.

to the consumer this is of no consequence.

it is to this consumer. it may not be to NYC’s consumers, but NYC isn’t all consuming. NYC and Patagonia are antithetical.Yvon never sold out. Perhaps Kickstarter will learn from his example.If Fred’s looking for a different kind of legacy then perhaps he should consider writing off this investment to protect Kickstarter from malign forces that would certainly subvert the long term sustainability of the company’s vision. Holding his shares in a trust in perpetuity would be a benevolent decision.

It does to this consumer as well. In the 1970’s and 80’s North Face meant the best gear you could buy. I climbed the Jungfrau, Monk, Finsteraarhorn, Oberaahorn, Taninsptiz, McKinley, and countless others with their gear. It was quality made in the U.S. Now that they sold out to VF their cheap crap made in China only has the logo.

an interesting contrast is GoFundMe, in which 1/3 of the campaigns are for medical/healthcare (~$1.5 B per year). why is it that kickstarter does not allow for healthcare campaigns? also, is it possible for a B corp to IPO?

This is terrific. I’ve read the founders intend to keep Kickstarter PBC private, without a sale or IPO. Would love to hear more about how this has worked for USV and your LPs? Many founders are concerned about forced exits to provide liquidity to their investors, yet (from the outside at least) it seems you at USV have been great at supporting the founders here. Would love to hear more about that.

we don’t know, but we will find out at some point

Wow, those top line numbers are really something.I’ve backed 24 projects so far on Kickstarter, and only one didn’t fund. Not bad! I really really love that it’s a PBC. I’m looking forward to their relaunch of Drip — I’m backing 46 Patreon creators right now. As I add to that it’ll be great to have it go through a PBC.

Kickstarter follows the macro global trend of adults acting like children.

Because creativity is childish…? Because children aren’t cynical yet? I honestly don’t know what this means.

I’m not convinced that this era where giving trumps savings and where currency is detached from work is going to end well

What I found interesting among other things from the report:The median salary of employees on our executive team in 2017 was 1.86x the median salary of non-executive employees. Our CEO’s salary in 2017 was 3.04x the median salary of all non-CEO, non-founder employees in 2017.But in particular also this with regards to equity:Median compensation of executive employees, including both salary and equity, was 2.06x the median compensation of non-executive employeesWhat can you do with that equity if they are not going to IPO.Also this:D. Kickstarter will not use loopholes or other esoteric but legal tax management strategies to reduce its tax burden.This sounds somewhat like ‘we know it when we see it’. After all it’s either legal and acceptable by IRS standards or it’s not. If it’s legal it’s legal.Esoteric? Here is the definition of that:intended for or likely to be understood by only a small number of people with a specialized knowledge or interestWhat’s negative (implied) about ‘esoteric’?

>> What can you do with that equity if they are not going to IPO.https://equityzen.com/ or https://equidateinc.com/ , etc.A marketplace built on top of an opaque “mark to model” valuation model. Nothing to worry about here 😉

I know but if there is no end game what is the end game? You just sell the equity to someone who wants to own for purposes other than making money? Or if they pay a dividend which wouldn’t seem likely.I just be missing something here other than ‘wants to own for reasons others than in the end making money’.This is also taking into account the idea that even though they have said they will not IPO that could change at any time in the future just like their legal status could change. Also I don’t know the current ownership % but wonder if it would be possible to buy enough ownership to change the way the company operates.These are just questions I am asking I don’t know enough of the ins and outs other than to ask the questions because I am curious.

+1 on the curiosity. Not sure if the end game is clear…

Virtue signalling – its part of the market position to be goody two shoes.

@fredwilson are you able to share, or do you have, the percent of funded projects in those categories that delivered their promised products?