When Markets Overcorrect

When capital markets change direction, to the upside or to the downside, they often go too far before finding the right balance. When they overshoot to the downside, you can find some real values.

Back in the financial crisis of 2008, I was blogging about that as it related to the big tech stocks (Apple, Amazon, Google). The market hated everything and you could buy the big three tech franchises at crazy low prices as it related to their fundamentals (revenues, profits, cash flow, etc). And so I did and a lot of other people did too. And when the market came back in 2009 and beyond, those who bought at those bargain prices were rewarded.

So, it may be time to start thinking this way in crypto land. The reason I say “may” instead of “is” has to do with the fact that really bad bear markets take a while to find their footing and start moving up again. I worry that it will take crypto a while before it can make a move upward again. I wrote about that in this post a few weeks ago.

But nevertheless, I think it is time to at least start looking for fundamental value in crypto land. Ethereum is trading below $10bn. There are some traditional businesses in the crypto sector that are valued at almost that level. And if you believe in the fat protocols thesis, as I do, that gets my attention.

But there are more rigorous ways to think about fundamental value in crypto and one of the best known fundamental value thinkers in crypto is Chris Burniske, a partner in Placeholder, a crypto venture firm that USV is an investor in and I am an investor in too.

Chris posted a bunch of charts and analysis yesterday comparing Bitcoin and Ethereum to a bunch of measures of the fundamental value of their networks.

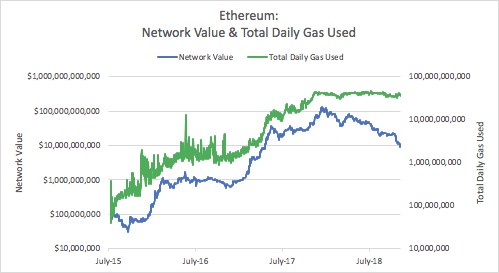

This chart from that post is the most telling in my view:

The green line is the use of gas to pay for smart contract execution on the Ethereum network. The blue line is the market cap of Ethereum. The growing gap between the green and blue lines represents, to me, the sign of market overshooting itself.

There remain some important fundamental questions about Ethereum so it is not like Apple, Google, and Amazon back in 2008. There is still existential risk in Ethereum. It could fail as a protocol and go to zero. So there are many reasons not to go all in on Ethereum right now.

But if you view Ethereum as a call option on the possibility that it will retain its role as the leading decentralized smart contract execution platform, then I think it is starting to look pretty compelling. And analysis like the work that Chris is doing is really helpful in determining things like that.

Comments (Archived):

For Ethereum, the increasing gas volumes are a true reflection of the thousands of developers already on that platform, and that is a healthy reality check on the adoption scale. No other blockchain comes even close from that point of view.What followed irrational exuberance is now nonsensical apathy. However, I think we will need to see more market failures at the project levels before we are out of the doldrums, because there are lots of overlapping technologies being built, and many of them will be thrown away. How many protocols do we need for a given function? Eventually the winner(s) will distance themselves and others will dwindle away, just as we had a good dozen search engines vying for that space in 1999-2000, and each one wanted us to believe it was better than the other.

This is the most interesting thing I read yesterday. https://www.delphidigital.i…

went through it this morning. super detailed analysis. but conclusion is we still don’t have a clue how this plays out.

You can’t compare cryptocurrency to fiat/gold for the sole purpose of proving whether it can potentially replacing them. Cryptocurrency will excel in the online world and in the blockchain world, but it is full of friction during the cross overs, and certainly in the physical world. Its efficiency transfer attributes are its ace card.

The doubtershttps://uploads.disquscdn.c…

William, do we know what % of cumulative gas volume is spent on executing standard ETH transfers vs. ICO smart contracts vs. platform smart contracts involving actual usage of an application? Increasing gas volumes could just be a function of more speculative buying and selling of ether vs. more usage of smart contracts.DAUs of Ethereum dApps are pretty low. Is there a different proxy for usage that reflects adoption better?

Not sure, but check these 2 sites for data:https://amberdata.io and https://bloxy.info/

Thanks, William. Will check them out.

I still find it hard to get over the velocity problem which utility tokens will suffer them. Tokens will be seen as working capital. Stockpiling them unnecessary and pointless. I’ve yet to find a real riposte to John Pfeffer’s paper on the subject from last year, and I’ve asked a lot of people.Fat Protocol thesis seems to have more detractors now than proponents. And it seems to have morphed somewhat too. As in fat protocol theory isn’t necessarily talking about the absolute base protocol. So Ethereum could be the smart contract protocol winner but NOT accrue as much value as middleware layers built on top of it. Makes the game much harder.I can see the value in tokens from a short/medium-term speculative play. But at long-term equilibrium. Am still super uncertain.Moreover everything is predicated on multiple mass use-cases and thus far they all seem to be AWOL.https://uploads.disquscdn.c…

The thing is there are few examples to prove that theory (or any theory for that matter). When you can see it, then you can believe it. Take 0x as a good example of a middle layer protocol that has spun several end-user apps around it and is flourishing as a protocol in of itself. What I don’t fully agree with the fat protocol thesis is that App Tokens will also have a significant role earlier than they think, and can become giants themselves given a lot of usage. Take Kin/Kik for example which is beginning to show their usage traction based on real transactions on its blockchain (now 5th largest according to Blocktivity).

The best example of a working security token that gives you access to a marketplace and private blockchain is the B Share at the CME. Here is pricing: https://www.cmegroup.com/co… If I own a B share, I also own one share of CME stock. So, it’s a security token. If I own a B share, I get a huge break on trading fees. So, the math is pretty simple. If I trade XXX contracts per day, the break is XXX, the cost of the B share is XXX, so I might be money ahead owning. In 1992 I think I saved 500K in trading fees by owning. The shares go up and down with supply and demand. You can also lease them out. There is a smaller fee break if you lease.The problem with Kin/Kik is there really isn’t a lot of demand yet. But, it’s super early. Twenty years from now we will look back and in hindsight it will be easy to see which crypto’s were worth buying and which weren’t.By the way, if CME was ahead of the curve, they’d replace their B share structure with a true cryptocurrency and redo their fee structure based on the elasticity of demand per contract rather than product group.

Is the CME example real in operation or hypothetical?Kin has real transactions already and millions of active users.But comparing security to utility tokens is like apples and oranges.

In operation since 1898. In one contract, the Eurodollars, they do more in notional volume in one day than the NASDAQ+NYSE do in a year.

ah of course. i was thinking on the blockchain. thanks.

.”Twenty years from now we will look back and in hindsight it will be easy to see which crypto’s were worth buying and which weren’t.”Isn’t that true of most securities?JLMwww.themusingsofthebigredca…

What happens to this calculation when more of the computing is done with PoS offchain incentivized node work and pulls from the gas cost calculation?

It is not related.PoS is a replacement to PoW which is based on mining rewards vs. staking positions. Gas is spent for running smart contracts to develop decentralized apps. A small portion of gas could be spent on mining contracts or staking contracts but that’s probably a wash in the PoS conversion in terms of relative changes.

Thanks.So there is a connection though not enough to modify the basic correlation as presented.That is useful to me and a project i’m working with.

I love the term “reversing to the mean”. The problem in crypto is that you really don’t know where the “mean” is because there just isn’t enough volume/price data to understand it fully. If you had your pulse on order flow, you could figure it out. The companies that do aren’t going to be transparent about that information.The biggest problem with crypto is there is no killer app. Why should I use it? I don’t have to. As a matter of course, for most people the de facto is fiat currency. It reminds me of the startup where the competitor is Excel. Yes, the solution might be more elegant but the UX and operations to implement the solution are much harder than just using Excel. People forget, Excel has network effects too. So does fiat currency.

Why should I use it? I don’t have to.People always make the mistake of placing themselves at the center of the world. You could say that about anything. Why should you use ByteDance. Or FCStone. Or Coq.It should not matter whether you would use it. Your individual purchasing power and influence is, for all intents and purposes, zero. The question should be, would anyone else?

Yep, talking about reverting to the mean without transforming the time series to one being stationary is just blowing smoke.

If you had your pulse on order flow, you could figure it out. The companies that do aren’t going to be transparent about that information.You have to triangulate it by other methods then. Like flying the airplane over the mall parking lot back in the day.Take a look at the fact that coinbase is adding tokens and infer from that something that is not positive (generally of course that is why it’s an art)https://www.coindesk.com/co…It would not be difficult to figure out what is going on with some of these companies. My possible method (if I needed to do so) would be to try and get setup with a meeting to sell them something that they might need (anything to just get a meeting with them). Then see how they react and what is going on in the office etc (that is not a plan of action but just a general framework for the purpose of this comment).For example if you are a salesman and you are selling a machine and you go to a manufacturer with an unbelievable price and he doesn’t bite at that price (doesn’t have to even be a real deal) then you kind of know things are really dicey. This is an oversimplification of strategy for the purpose of this comment once again.

It reminds me of the startup where the competitor is Excel. Yes, the solution might be more elegant but the UX and operations to implement the solution are much harder than just using Excel.This is so true. This is also why Amazon is the go to place. It totally ‘satisfices’ the need to buy what you need to buy. The price is ‘good enough’, the delivery is ‘good to great’ and the ease of using the website (because you use it so often) is off the charts wow. You can login and re-order some thing you use repeately in less than a minute. How do you beat that? Not by price or by a better UI. And even if you need something new it’s easier than a new vendor and figuring out their web search. Or even google (must sign up for new account forget that on new vendor).The business that I had in the 90’s was built in a similar way. (Still operating today). We did not have the best quality (for sure) and we definitely didn’t have the best prices (for sure; we were high) and our delivery time was ‘ok’. But you know what we had? An unbelievable way whereby ‘miss secretary’ or ‘mr manager’ could pick up the phone, get a person who was glad to hear from herm take her order, answer any questions, and then she could move on to the next 50 things that she had to do. As a result we got paid more than the next guy and locked in accounts. Someone with a better product and price did not stand a chance (unless we failed to deliver etc.). Honestly that was the secret sauce. Slogan was ‘consider it done’.

Ease of doing business is the killer capability for most normal customers. It is the most under-rated and also the most difficult to achieve because you really have to think on the customer’s behalf and look beyond your organization’s own internal silos. Even if each customer value driver is average, but ease of doing business is high >> Some outsize value drivers but without a cohesive experience.

This wasn’t about a new currency, it was and is about distributed computing and distributed networks. The latter don’t exist anywhere in nature and distribued computing has never been sustainable and generative in a technical sense either.

The fact that the lines are diverging is interesting, but does not help you value Ethereum. What happened to date could have been priced massively incorrectly and Ethereum may be moving towards its proper price, however one calculates that. I haven’t looked into the full presentation whence that chart came, but real value must be calculable based on the value inherent in using a smart contract on Ethereum vs the alternative.

The concept of cryptoeconomics that Vitalik explains well is based on strong economic incentives. A higher Ethereum (or Bitcoin) valuation allows these currencies to assert their sovereignty.

Assert their sovereignty ? Fred had another standard for that 5 years ago, highly engaged users growing at 30% per month.

Re: “So, it may be time to start thinking this way in crypto land”.I am going to start calling this the “Narrative-Analogy fallacy” (since Narrative fallacy is a little different).What you said up until the above point about how capital markets behave and overcorrect is absolutely true. What you said about what happened with Amazon, Google etc in 2008 is true – markets absolutely overcorrected then.What follows immediately after that – “it may be time to start thinking this way in crypto land” is not correct. It is not correct for the same reason that I said here last year that calling bitcoin a bubble is not accurate (despite being very skeptical of bitcoin/crypto, both then and now).Because both a “Bubble” and a “Overcorrection” refer to large deviations from a fundamental value – just in opposite directions. And we don’t have a fundamental value for crypto to deviate from.What is being implicity employed in the crypto discussions now that the prices have crashed is “Anchoring”.In his analysis Chris is comparing the drawdowns from Dec 2017 and Jan 2018 for Bitcoin and Ethereum respectively and says that a 65% decline for Bitcoin is justified versus the current 81% decline when considering network transactions. That is simply “anchoring”, based upon the Dec 2017 value for Bitcoin. There is no basis to suggest that Dec 2017 value was justified in the first place.Public Equity Markets are irrational. They go into bubbles and overcorrect. The idea of both a “Bubble” and a “Overcorrection” pre-supposes the idea of some fundamental value.I submit that the fact that Overcorrections are absolutely true of Public equity markets does absolutely nothing to factually characterize the crypto space .Net: There is no Large-scale end user driven legal demand for crypto today. Large-scale + End-User driven + Legal = Killer App. IF large-scale, end user driven legal demand emerges – then fundamental value will also emerge. Until then, talk of an over-correction is interesting but not fact-based.

Correct, this thesis fails from the outside as it assumes that relative valuation factors are known and if known are fixed.

My simplistic homespun theory (no charts, and no economist name dropping) is that the decline in crypto valuations from the ATH was nudged by the beginning of the new tax year in January 2018. Rational capital efficiency behaviour by a few was the first domino falling, the momentum change that clattered through a system that has no circuit breakers. one falls, they all fall. When the SEC finally publishes solid policy proposals we may see a reversal. It depends on the nitty gritty of the policies and how they shape institutional investor behaviour. So far crypto has been largely a retail phenomenon. That will change.

My skepticism about crypto is more fundamental than wondering about what institutional investors will do.But am happy to oblige with said economist name dropping. https://uploads.disquscdn.c… .Institutional investors have much worldly wisdom. They may not jump back into this space anytime soon.p.s. Did you mean simple or simplistic ?

It has to be ‘simplistic’ because great minds are working on how very complex they insist it is. “jump back” – when was the institutional market previously in, unless they were going through on mass throughoffshore entities and OTC? “Character is like a tree and reputation like a shadow. The shadow is what we think of it; the tree is the real thing” – Abraham Lincoln.

Jump in instead of jump back in ? Point is perception risk will be high for institutional investors to get in anytime soon from here.There was the MV=PQ theory of crypto valuation last year.

? – probably, but who knows what positions the smart people have been building this year over the counter and under the radar. Channelling Albert? If you are you are another smarty 🙂

MV=PQ ~ BSWhy? Because PQ is all projections into the future which are really unknown (current actual usage beyond speculation is close to non existent) and velocity is a super tricky variable to account for.There is significant risk in crypto at this stage because there is very little info to go by. An investor with a long term view will be foolish to not have some exposure to crypto. An investor over-exposed to crypto is playing a game of fire.

I was being sarcastic. MV=PQ is a tautology.

First rule – someone out there will gladly take your moneyhttps://uploads.disquscdn.c…

An asset that is down 90% is an asset that was down 80%…and then got cut in half.

Because both a “Bubble” and a “Overcorrection” refer to large deviations from a fundamental value – just in opposite directions. And we don’t have a fundamental value for crypto to deviate from.What was the fundamental value of tulips in the Dutch Tulip Bulb Market Bubble?https://www.investopedia.co…https://www.investopedia.co…Point being that the idea is not that there is not ‘fundamental value’ at all [1] but rather that that there is a ‘large deviation’ from the fundamental value. To be clear doesn’t matter how close to zero the fundamental value approaches.Also generally in any market where there are gamblers (even stock) the price that people will pay is not driven by the fundamental value but the thought that someone will see some value that they will pay you for in the future in particular a ‘greater fool’. Even if I buy a blue chip stock isn’t this what I am betting on? After all there is zero value to me of the blue chip stock if I can’t unload it to someone else. So what really is the difference here? Assume it pays no dividends.What you call ‘fundamental value’ may be better thought of as ‘auction value’. That is the base price that I know I can ‘unload’ and asset for if I have to independent of ever finding a greater fool. Because it earns income in some way.For example if you own a piece of real estate that is earning $10,000 of income per year there is an ‘auction value’ (my words) that you can ‘unload’ it for typically (and ridiculously for this example) $10,000 assuming a 1 year lease with a blue chip tenant. Most likely more (the gamble)[1] You say ‘And we don’t have a fundamental value for crypto to deviate from’

See my previous statement from couple of years back -https://disqus.com/home/dis…”The value of cryptocurrency does not exist the way it does for equities/bonds/housing– there are no futue cash flows (or rental yields) to be discounted.This is true of all money – Money is the ultimate bubble in that sense”.edit/note: all money above meant all fiat money.Edit: Re-reading your comment I am not clear about what you said. I am not saying crypto has zero fundamental value, I don’t know if it does or not. I am saying “we don’t have a fundamental value for crypto to deviate from”. In that case, BTC’s market value is simply what it it is…both at 19K and at 3.5K. The analogy to overcorrection of stocks like Google, Amazon etc is broken. It matters because Fred is using the overcorrection analogy to 2008 to say that “those who bought at those bargain prices were rewarded”.

That’s correct….fiat will continue to be volatile, as long as 1 BTC=1 BTC we’re good!!

Great Comment. The fundamental value of crypto is dependent on future adoption and usage.For example…If BTC becomes one of the default stores of value like Gold or …If ETH blockchain becomes the way to dis-intermediate middlemen and have buyers and sellers engage P2P. Then the gas (ether) paid to execute this will be reflective of the actual adoption of smart contracts in the real world.At this point, we do not know what the adoption will be. it can range from zero to billions of users and zero transactional value to trillions of dollars.So, any crypto investment is a leap of faith into an unknown future. It could work gloriously or devolve into a puff of dust.

Yes. And therefore talk of a overcorrection is misplaced.Same reason why the analogy with Amazon price in 2000 in a recent avc post was misplaced. With the obvious caveat that ANY equity can go down to zero, Amazon in 2000 was not a leap of faith into a unknown future – it was a real business already.Which meant that while you could disagree on valuation in, say, 2008 (the whole point about the existence of markets is that reasonable people disagree on valuation), but you had a framework to value businesses like Amazon or Google within a range in 2008 (it is never exact) and at some point you could point to an overcorrection from that range.

Yes. It is a different probability distribution relative to traditional businesses. The fundamental value based on current levels of actual usage is close to zero, but the expected value is higher because of the probabilities associated with the unknown future.There is a small chance of a massive outlier outcome. Depending on your level of belief in crypto and future adoption, this chance could be <1% to 50%. And thus the wild swing in prices as market moods veer from hype to doldrums.

Tulips went back to being, well, tulips.

The 500K daily ethereum transactions are ETH trades or something business or consumer related?

just noise transactions from apps and stuff. very few actual commercial transactions

Thanks.

I am short ethereum while long bitcoin and ripple and stellar lumens. ETH going to single digits. it’s just an overpriced open source project that is no better than litecoin and others but overpriced. Usage of ETH network does not benefit ETH holders.

I don’t think I go more than a week without thinking about what Albert said last year about always keeping dry powder.60/4040% dry powder.

I don’t know where ETH will be in 10 years but Zcash looks that kind of buy Amazon was back then

disqus_ufgnFC6W5y (:

It will be a better graph if we can distinguish between gas paid for speculative transactions of ether (buy and sell) vs. use of smart contracts to get specific jobs done (i.e. actual users). From what I understand, the latter is a very small % of the total gas paid. If so, the correlation really means nothing and if anything, it is a negative signal.

ETH is Gas in the Ethereum Network. A large portion of ETH was being used as a medium of exchange for capital formation, in 2017. There is not a good reason for this to happen again, as several of the most used Smart Contracts are just parallel assets that maintain a stable value which is better aligned for capital formation. This particular and outsized speculative use case of ETH itself will likely be muted forever now that alternatives are available.There is more bearish news for ETH, while the growth and proliferation of the Ethereum Network maintains:One of the stable value contracts is the MakerDao and DAI system, which uses ETH as collateral exclusively today. Tomorrow ETH won’t be the exclusive collateral, and it will likely be collateralized by a basket of other stable value smart contracts, mitigating the risk of any of the stablecoins.Finally, the Ethereum developers continually talk about keeping transaction fees low, which means keeping ETH in WIDE supply. They are actively developing things to avoid the mass use of ETH as gas.This means a low demand ETH, and in markets built around supply and demand this means low value, while number of transactions and use of this decentralized network can continue to flourish.I would not find it prudent to conclude, with this information, that the market has overcorrected itself. You CAN make this conclusion in a way that I might find it possible to agree with, but a completely different rationale would simply have to be presented to support that.Near term bearish, until native use of gas is much more competitive again.I am excited that gas is cheap and will be cheap. When have you ever heard anyone say otherwise? Maybe you shouldn’t be a gas speculator. But definitely go build or use a nice car.

.In a down market, one can no longer follow the “trend” in the “make the trend your friend” sense. You have to become a stockpicker and find the diamonds.I once liquidated a 100,000 SF warehouse in Dallas which was filled with what I called “Oriental” carpets. Yeah, it was incredible.What I learned was that there were Egyptian, Persian, Turkish, Afghan, Chinese, Pakistani, Tibetan, Indian, and — my favorite — Afghan Refugee Camp rugs.But, to me, the guy with defaulted lease, they were all just Oriental rugs.I then found out some stuff –1. The Egyptian rugs had the most vibrant colors and were prized by American designers for their decorative qualities.2. The Afghan rugs were “authentic” and true to ancient patterns.3. I found out that Turkey has been making rugs for almost 1000 years.4. The Chinese rugs were good construction quality, but there were no authentic Chinese designs.5. Pakistani rugs were better than Afghan rugs until the Afghans who had been weaving in P’stan were able to go home.6. Tibetan rugs were considered to be the best, but they all used Afghan wool.7. The Indian weavers came and went in the market, but their rugs lasted the longest.I’m trying to convert these co-mingled rugs into five years of rent at $600,000/year.I get a bunch of rug professionals to come look at them. Just taking indications of interest.One rug gets a side eye by everybody. They all start chattering in their native language. Turns out I sell this rug to a museum for $150K because it is a castle size, heirloom rug with a particular wear pattern.Everybody recognizes it when they see it, but not mois. I don’t know too much about it.I learn the economics of the balance of the rugs and conduct a successful liquidation to pay the defaulted rent. Had I not taken the time to understand it and to understand what I did not know — way more important — I would have gotten fleeced like a big dog.This is how I see the crypto space. Everybody wants to make it behave like sophisticated, long term capital markets with highly efficient auction pricing and broad ownership when it is just a damn rug market.There is some big winner out there — like my museum rug — but nobody knows who it is.We are a long way from being able to fairly describe crypto as a market which moves within the limits of a stock market because it isn’t an orderly stock market.Can I make you a deal on a nice Afghan Refugee Camp runner?JLMwww.themusingsofthebigredca…

No, you can’t (make me such a deal). But thank you kindly.Can I make you a once-in-a-lifetime not-to-be-missed deal for a cute little seaside cottage in Arizona? Grab it while the grabbing lasts, others are lining up for this amazing offer [1] …[1] #BuildThePeerPressureTom Sawyer’s deal with the neighborhood kids about painting that fence is another never-to-be-seen-again deal.https://www.google.co.in/se…https://en.wikipedia.org/wi…[ The Adventures of Tom Sawyer by Mark Twain is an 1876 novel about a young boy growing up along the Mississippi River. It is set in the 1840s in the fictional town of St. Petersburg, inspired by Hannibal, Missouri, where Twain lived as a boy.[2] In the novel Tom Sawyer has several adventures, often with his friend, Huck. One such adventure, Tom’s whitewashing of a fence, has been adapted into paintings and referenced in other pieces of popular culture. Originally a commercial failure[3] the book ended up being the best selling of any of Twain’s works during his lifetime.[4] ]https://www.shmoop.com/tom-…

Also notable:https://www.google.co.in/se…and from it:https://www.amazon.com/Twis…

I am a blockchain dude (not dev and not a programmer), still having a substantial % of his net-worth in ETH.AMA, I can tell u how this mania evolved, what are the fundamental flaws in some of the metrics people use (including what William Mougayar showed, but obviously he knows much more than the average) and some of the main projects there, what is amazing about ETH, how is different to BTC, what BTC is, what are the risks, what it means to be in charge of your own finance, what is the politics behind my choices, how the rhetoric in crypto has changed, pretty much anything. I can also tell you from the start that everything people write good or wrong about crypto is true, but doesn’t specifically apply to each project out there. That includes Roubini.

It’s nearly impossible to fork Apple or amazon with a 10 person engineering team. Protocols as they exist today have no clients or underlying fundamentals to rely on, only technical or historical analysis. I remain skeptical of the Fat Protocol thesis.