More Data On VC's Big Year In 2018

Last week I wrote about and linked to the PWC/CB Insights round up of venture investing in 2018.

Well less than a week later Crunchbase is out with its own data on 2018.

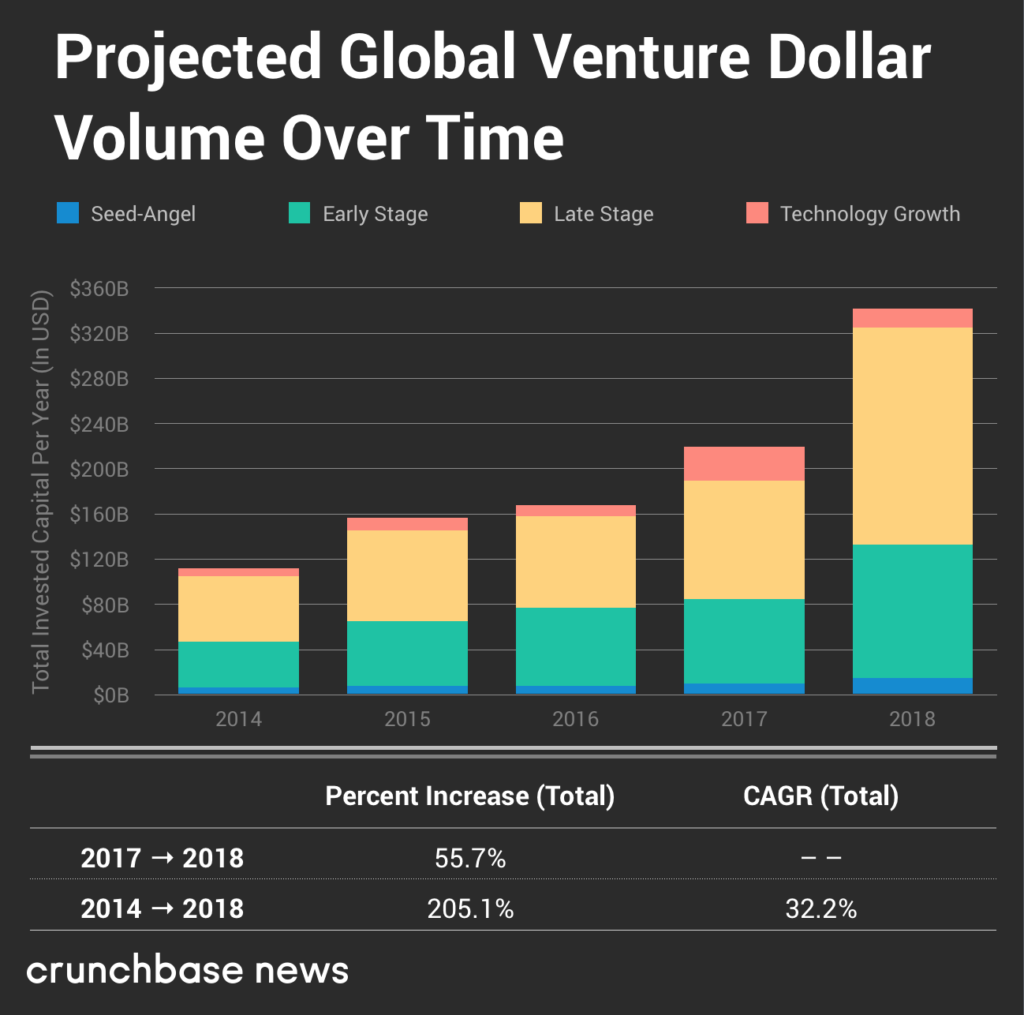

The Crunchbase numbers are much bigger, they report about $330bn of global deal volume.

But otherwise the trends are roughly the same. Flattening deal volumes and amounts raised in the early stage market with massive expansion in the late stage market.

Make no bones about it, there is a lot of money in the venture capital ecosystem right now.

Comments (Archived):

And everyone seems risk averse. So they go late

or there aren’t many early stage opportunities available (not from lack of hard working talent).

The colors represent venture dollars though. In this case, companies in the late stages are likely raising bigger rounds which will make sense.Technically by the late stage phase many companies should have died/failed So it could be the case that there are less opportunities in the late stage but the checks are bigger for sure.

That late stage cash is going to need an IPO run to get out and a less volatile market to make that happen.

Ancient story -Once in the dear dead days beyond recall, an out-of-town visitor was being shown the wonders of the New York financial district. When the party arrived at the Battery, one of his guides indicated some handsome ships riding at anchor. He said – “Look, those are the bankers’ and brokers’ yachts”.”Where are the customers’ yachts ?”asked the naive visitor. – Fred Schwed Jr, Where are the customers’ yachts, 1940.

Asked of Morgan maybe. Looks like good read.

Highly recommend it.

It seems like one of those Purchasing reports that look great until you figure out that its just pulling sales out of the next 2 or 3 quarters.Everyone is nervous, they can tell they are at the end of the cycle.Founders have way too much leverage and retail has no appetite.

I liked this quote from the Crunchbase report.“If deal volume is like a speedometer, dollar volume is better thought of as a pressure gauge.”I wonder when is the pressure too high for a given speed.

It is hard to tell from the graph how much seed-angel grew year over year because it is dwarfed by the other categories. But it looks like deals increased by 50% – with a HUGE amount from the largest accelerators like YC and Techstars.”What angel and seed-stage deals lack in size, they make up for in number. In Q4 2018, angel and seed-stage activity accounted for approximately 59 percent of all deal volume, but just five percent of total dollar volume.”

I would expect that Crunchbase data of Angel deals is probably pretty mediocre at best. For that matter there are even VC deals that don’t make it into Crunchbase. This isn’t RE property tax records with some kind of central recording service that validates and you can audit the data. In a ‘gross’ way of course it’s probably ‘correct enough’ (whatever that is).

With mega rounds it seems that what is being funded here is ability to sustain huge losses (and non profitability) and not companies or ideas.Of course that has always been the case.But I am wondering even how the (eventual) success of Amazon has led more to this thinking. Amazon was derided for years for how much money it lost and how unprofitable it was. The strategy of losing money (once again not new or unique but with Amazon unprecedented) must have shaped attitudes towards investments.Here is an article (random) on Amazon circa 2012:https://slate.com/business/…Investing is emotional and often based on some form of social proof. Again, obviously other factors have greatly contributed to how much money for investment is floating around currently. I just think this is another factor that needs to be considered. Just like it’s a factor that more people are doing startups because they had at one point used a product (Facebook) themselves and were familiar with the person who started it as being a peer (young white guy, not old white guy). [1][1] Not meaning to divert the thread to politics (sorry) but this is happening in politics right now. So many people are running now all based on seeing someone in office who appears to them to not have a clue at all and whose candidacy was an extreme long shot. No way that doesn’t help people who had less self esteem want to enter the game. What’s interesting is that they didn’t know enough to even know this existed before the current candidate. A President or even a Governor or Mayor can surround themselves with dozens of people and in the end can function if they want just as (Bush would say) ‘the decider’.

It is happening in NFL too 🙂 Not sure if you follow NFL but the “in thing” these days is to replace a team’s coach with the next Sean McVay (coach of the LA Rams). With his Ram’s victory over the Cowboys this past weekend, McVay replaced John Madden as the youngest coach ever to win a playoff game (he is 32). A record that was not threatened since 1969.The problem of course is that Sean McVay is not an archetype (or at least hasn’t been proven yet). He is a unique talent and I suspect most of the “Sean McVay” type head coach hires will fall far below the expectations.

I’ve always wondered about how the size of the market affects its own behavior. Does it have a capacity, a saturation point? Is the dream of eternal growth real?

the government’s lack of return on investment for its $ 500 million loan to Tesla seems like a giveaway to the VC community.

No, no, no, no, you totally don’t get it!! You don’t understand!!!!I’ll explain it to you although the NYT’s climate science expert Tom Friedman could do it better: The sky is falling! All of human life, the pure, precious, pristine, sensitive, delicate, vulnerable, 100% all-natural, God given environment, the planet, and all life in the solar system, the cute, cuddly, lovable, pure white baby polar bears, the Australian Great Barrier Reef, all the plants and animals on the land, birds in the air, fish in the sea, lovable, intelligent dolphins, orcas, and whales, lovable, dog like sea lions, and everything else are at severe risk. The cause is human ignorance, greed, and sin, in particular humans belching dangerous, poisonous, toxic CO2 from burning filthy fossil fuels. For a presentation of the concerns, see the two Amherst coeds in:https://www.youtube.com/wat…For people who point out that the polar bears are doing relatively well now and in the past lived through a lot of climate change including some times warmer than now, just ignore those. For the Great Barrier Reef, that has been going without stop likely for millions of years through everything that happened, and just ignore that and hear stories about coral bleaching due to evil humans!So, to solve the problem of the sky is falling, it is essential that the world convert to electric cars. For this, Musk and Tesla are saving the solar system! Then the $500 million is just chump change, trivial, for saving the solar system!!!! Even for just keeping the sky from falling!!!!Now we are beginning to see some of where the big money comes from to keep the propaganda going about human caused global warming. But for the Democrats apparently so concerned, no doubt El Chapo has much more money for his BFFs who don’t want The Wall.