The Seed Slump

I have written a bit about this topic in recent years, at the end of 2017, and again when the 2018 numbers started showing up.

What has happened over the last five years in venture capital is the seed boom stalled out, the late stage market exploded, and the traditional venture capital business (Series A and Series B) largely remained the same except round sizes, valuations, and fund sizes have all gone up.

Mark Suster posted a great analysis last night of why the seed stage market has stalled out. It comes down to the fact that the traditional venture capital market has not changed much so creating more supply has not resulted in materially more demand.

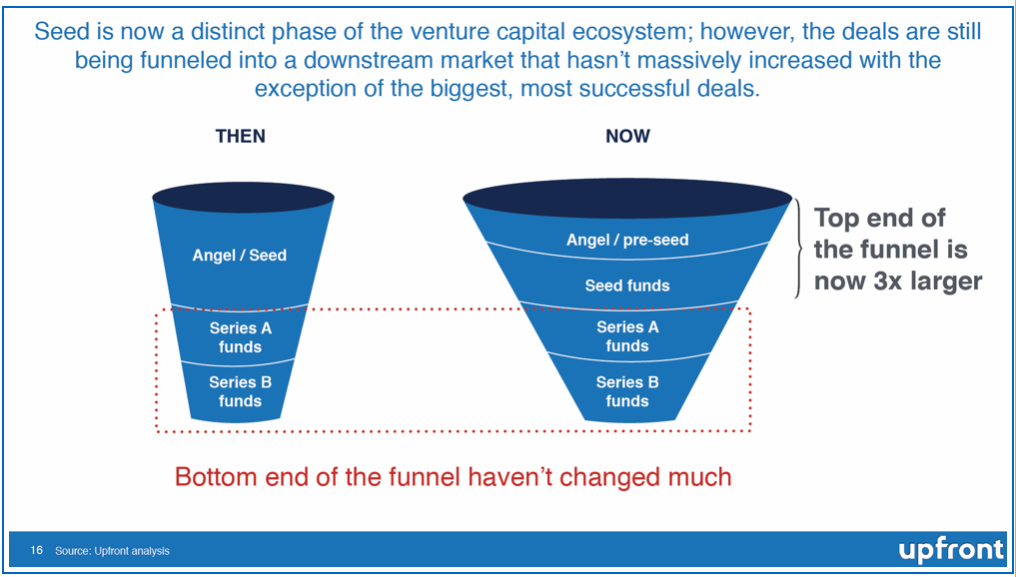

This chart tells the story well:

As Mark explains, the seed market remains alive and well, but it has grown so large that it can’t continue to grow unless the traditional venture capital market grows too and that has not happened, at least not anywhere near the rate that the seed stage market has grown.

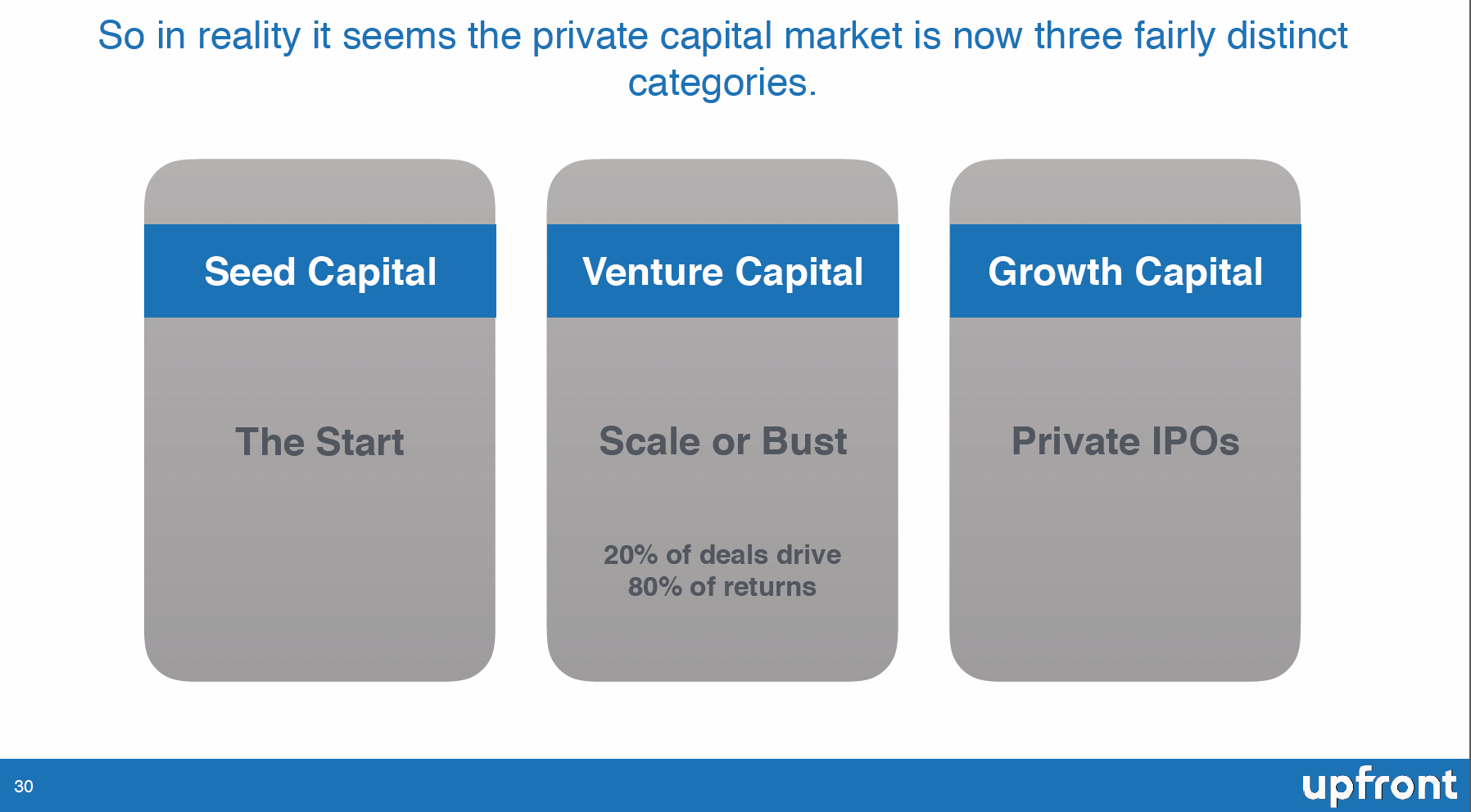

In a companion post, Mark lays out the new architecture of the startup capital markets:

In the first five years of this decade, we saw the seed portion of the market explode. In the last five years of this decade we saw the growth portion of the market explode. But over those last ten years, the middle part, the traditional venture capital market, has not changed much.

That’s an interesting observation in and of itself and something that makes me wonder if that is the next shoe to fall.

Comments (Archived):

So it’s a bottleneck.”Private IPOs” = ‘Private Initial Public Offering’ = a semantic contradiction?n.b. that’s my only comment today, and i will be making no replies.

Wonder what the chart looks like if you add in seed-equivalent ICO funding. Granted, many of those wouldn’t have been able to get venture money, but even if 20% could, that tells a very different story.

I’m not commenting today in protest of the idea that commenting might be removed from AVC…Oh snap!

“You have the right to remain silent……..”

Are you wearing a yellow vest?

Hey Fred – could you make the argument that Series A as defined by round size has grown? Or put differently does the Series A hasn’t grown statement ignore the whole Seed is the new Series A, and Series A is the new Series B phenomenon?

What if you extended the time frame on the dataset to include the effect of crypto/ICO? Gut is that there were a small amount of the total that successfully did an ICO. But, we are hearing that it’s an alternative to VC. It seems like to me the top end, and bottom end of the funnel are a lot more transparent about their metrics for funding a company than the middle as well.

My thoughts exactly. There seemed to be headlines that said “ICO’s passing traditional VC”, .etc. That is a total skip of the seed round.

What the crypto/ico space has taught us is it’s market fit is gambling backed by FOMO. The problem however with all Ponzi / FOMO is it doesn’t scale.

Well, the Growth Stage is only really exploding because institutional (actively managed) fund managers have been caught out as perennial underperformers and now want a piece of the magic sauce that may help their performance… but will most likely only buy them a little extra time to hide while these latest unmarked-to-market bets play out.

I say this with love:The next shoe won’t fall. The other shoe will drop.The sauce isn’t magic. It’s secret.People are entitled to their own opinions, but not their own metaphors ;-P

Thank you. I was wondering if I was the only one who found that dissonant.Origin of “the other shoe to drop” – NYC.https://en.wiktionary.org/w…And may I say this very appreciatively and uncritically – It is an idiom, not a metaphor : ).p.s. There is another problem. The complete phrase is to “wait for the other shoe to drop”. But Fred used the word “wonder” instead of “wait”. And you don’t “wonder” if the other shoe will drop, you “wait” for it to drop. The idiom is about the expected inevitability of the next action.So, if Fred is actually “wondering” (i.e. he does not consider the next step to be inevitable), then the other shoe to drop also does not work perfectly…The next domino to fall ? You could “wonder” if something is the next domino to fall.

I stand corrected and am deeply appreciative of all your research!

for the past 10-12 years, the consensus was a “barbell approach” – go super early or super late. and for seed, it created a dynamic of low barriers to entry and high barriers to exit …

Do you foresee more seed stage funds to emerge as part of that next step?Seed stage maybe is the least sexy of the VC spectrum, but it is where the most exciting variety starts. It does require a large enough portfolio per fund, because you need to place so many bets in order to get at least 1/3 of them to perform well and follow-on.

This year so many late stage startups are going public, which should in theory flood the VC market with liquidity to reinvest, but this sounds like trickle down economics a bit to me where not so much is trickling down to the earlier and most exciting part

Isn’t it legit demand? Regardless of the startup universe size, there are only a small % of legit ideas. These get played out to the max on the private side now.

Tom Labus:Oversaturation of same market, ideas, funding in same category. Softbank imitators.How many bikes, electric people movers, etc can a market consume. There also appears to be funding in competitors, etc (Nothing about that is traditional funding. More a open conflict of interest. Uber & Lyft investors are betting on both. Gheez)Captain Obvious!#UNEQUIVOCALLYUNAPOLOGETICALLYINDEPENDENT

Legit What The Hell Maybe You Have Something = SeedLegit Scaling Big Business = Private IPOThe VC Bottleneck isn’t a Bottleneck, its a Filter.

So is it fair to say that less companies who enter the large funnel at the top will make it to the later stages – hence get “stalled”? It looks the number of deals is actually larger today – while not growing..I am also wondering how much traditional seed money was skipped in place of ICOs for the last 2 years. (PS – sorry for not reading other’s comments who said the same thing.)

some famous academic type has the whole industry lifecycle curve, maybe it is michael porter. anyway i wonder if the rise in late stage/private IPO is indicative of maturation of “centralized SaaS” or as i prefer nation-state software development model. this would dovetail nicely with many crypto views.

Private IPOs are just not letting retail get returns.

Traditional VC is the hard part. It won’t likely change.Seed funds have lower expectation of repeat investors and lower success standards.Growth funds have the same issue but with lower return expectations.In short, there are a limited number of true pros.

hi fred….not sure I understand….what’s tthe next show to fall?

ForThat’s an interesting observation in and of itself and something that makes me wonder if that is the next shoe to fall.Changes should be coming:First cut, the needed changes are already quite well known. There’s no black magic, magic, falling shoes, obscure considerations, unique talents, furrowed brows, deep meditation, cute drawings, data graphs, trend lines, long experience, eureka flashes of brilliance, etc. needed. And nothing will keep the truth from leaking out; it will leak out eventually.The truth is simple, old, rock solid, well practiced, beyond all doubt, with a terrific track record in fraction of wildly successful projects and average ROI, both much better than Sand Hill Road.But the truth is not known by or practiced by commercial bankers, private equity investors, institutional investors, angel investors, or information technology VCs.From all I have read, used to read, from Suster, IMHO he doesn’t know, either. Again, IMHO, neither do Moritz, Doerr, Andreessen, Horowitz or likely anyone on Sand Hill Road. The truth is not known by MBA faculty members (at least not since I was one) or taught to MBA students. The truth is essentially not known anywhere on Wall Street or associated activities — I’m willing to entertain any exceptions for Simons. IMHO the truth is not very well understood in academic computer science (“Any field that calls itself a science isn’t.”).The people who don’t know but should know would get angry if anyone explained.IMHO there are some people who do know in some research universities, the DoD, NSF, NIH, NASA, Department of Energy, etc. Some editors in chief at some of the STEM field journals know.What is needed is, and may I have the envelope, please. Drum roll, please. Thank you. “Rip”. And the answer is, trumpet fanfare, please:https://www.youtube.com/wat…The ability accurately to evaluate new projects. To add a little, the investment “stage” doesn’t matter; essentially only the ability to do accurate evaluations matters.Some of the best examples of accurate evaluations are:(1) The Manhattan Project.Right away, just on paper, there was essentially no doubt in the minds of any of Szilard, Wigner, Teller, Einstein, Fermi, or Oppenheimer. People in Germany and Japan also knew but knew that they didn’t have the electric power or money for the routine parts of the work.Worked fine in the real world: Got an unconditional surrender from Japan in about 4 days.(2) The Transistor.Bell Labs knew, had known, from at least the 1930s, that they needed a solid state amplifier and had good reason to believe they could get one. WWII was a delay, then quickly they had the transistor and knew right away what it would do for Bell and civilization.Has worked fine since 1947 or so just as intended and predicted.(3) Solid State Lasers.Bell Labs knew right away the potential of solid state lasers, e.g., from Ga-Al-As heterojunctions. They were right right away, just from scribbles on paper, for the right reasons and are still right.Those lasers are the crucial key to the Internet.(4) Keyhole.So, could read license plates from orbit. Aim it in the opposite direction and get, presto, bingo, Hubble. No doubt or question. Evaluated just on paper. Successful as planned essentially right away.(5) COBE.COBE, the Cosmic Origin Background Explorer, took pictures from a little after the big bang. Worked great, just as planned, and sent back, e.g.,https://smd-prod.s3.amazona…(6) The SR-71.Planned, evaluated just on paper, with essentially all the math just from slide rules. Worked right away just as planned.http://iliketowastemytime.c…Flew at Mach 2+ at 80,000+ feet for 2000+ miles without refueling.Often shot at; never shot down or even hit.(7) RSA Digital Encryption.Has worked fine for decades just as predicted from the math on paper.(8) The F-117 Stealth.Worked great, right away, as planned:https://i.kinja-img.com/gaw…Flew through all of Saddam’s air defenses, hit the most important targets, never shot down, essentially never even hit.(9) The Porsche 919.New Nurburgring lap record, 5:19:546.IMHO, there was no doubt just during the initial designs just on paper.To be amazed, watchhttps://www.youtube.com/wat…https://www.youtube.com/wat…IIRC, the cornering side forces are several Gs.For making money, amazing technology is not sufficient, even if the technology worked great as intended in scientific or military applications.And technology is not the only way to make money, is not necessary for making money.But apparently nearly sufficient for high ROI in commercial applications is (i) start with a problem so far at best poorly solved where a lot of people want a good solution, (ii) exploit new, powerful technology and deploy it for the first good or a much better solution, (iii) have a good Buffett moat, and (iv) avoid doing anything really stupid.Then it is up to investors to evaluate (i)-(iv).IMHO, technology VCs do not do such evaluations and, instead, consider traction and a few more attributes.IMHO in time VCs, if only from the drop of one more shoe, will learn how accurately to evaluate technology projects and will do so and get much higher ROI. There is just WAY too much money to be had to continue to avoid evaluating projects.

I read Suster’s post and some more that he has posted recently on Medium. It’s all like the AVC post today: The seed investing (1) like looking for ears of corn for the Wal-Mart produce department and (2) not like looking for the best ear of corn in the world to be the basics of the biggest corn crop in the world.All that matters in the seed VC business are the exceptional cases, but all Suster is doing is looking for patterns in the whole collection of mediocre examples. That won’t work very well.Again, over again, once again, yet again, one more time, Suster and Sand Hill Road flatly, feet locked up to their waists in reinforced concrete, just will not, Not, NOT, NOT do anything like evaluating projects looking for unicorns.Instead, as in Suster’s post on “the data room” or some such, they are using techniques good for, say, selling Toyotas to young families instead of looking for some engineering that will set a record at Nurbergring. By analogy, in 1939, looking for a better bomb, they would have looked at the history and current practice of bombs, thought of tweaking the chemistry a little, making the bomb a little bigger, etc. but never but NEVER come up with the Manhattan project. At Bell Labs, they would have looked all over the world at all the copper mines but never but NEVER come up with the idea of a Ga-Al-As heterojunction solid state laser lighting an optical fiber. They just will NOT do things that are really new and especially valuable. With astounding determination, just will NOT do it. As investors, they are thinking mostly like commercial bankers.

I love this and Mark’s post. FWIW – This is from 2013 – https://medium.com/@kteare/…