More S1 Fun

I am continuing my mini series on reading S1s (IPO documents). We are enjoying an IPO bonanza this year, so we might as well use it for some good and learn something.

When a company files for an IPO, I like to think if there is a publicly traded company that looks a lot like that company and if so, I lik to run some numbers comparing the two.

Well we have that exact situation with Uber filing to go public last week. Here is Uber’s S1.

We can compare Uber’s numbers to recently public Lyft, which I blogged about earlier in this S1 Fun series.

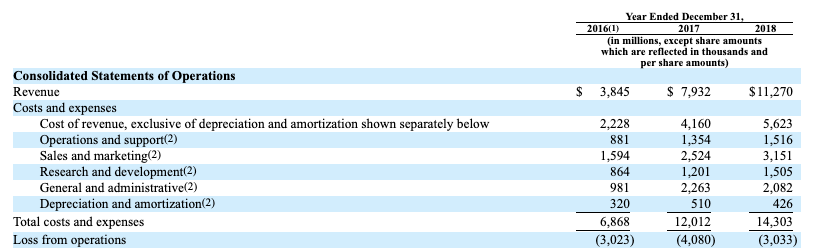

Here are Uber’s profit and loss numbers from their S1:

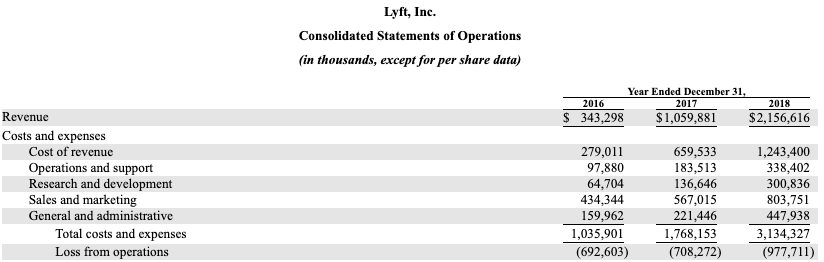

We can compare this to Lyft’s profit and loss from my prior blog post:

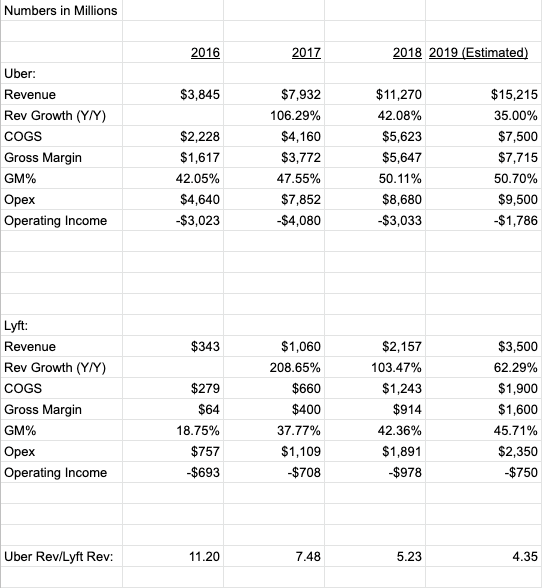

I put all of these numbers into a spreadsheet and added some estimates for 2019 that are nothing more than back of envelope guesstimates.

What you can see from this is that Uber is 4-5x larger than Lyft, growing a lot more slowly, has slightly better gross margins, and both are still losing a lot of money but both are moving towards getting profitable on operations in a few years.

Finally lets look at market valuations. Lyft is currently trading at a market cap of $17bn. If you say that Uber is 4-5x larger than Lyft, then Uber ought to be worth in the range of $70bn to $85bn.

There are other factors that will be in play when Uber eventually prices their IPO and trades. Uber owns minority interests in a number of other ridesharing businesses that could be worth as much as $10bn of additional value. On the other hand, Lyft is growing more quickly than Uber.

Ultimately we will see how the market values Uber. But from this analysis, and the public market comparables from Lyft, we can see that Uber should be worth quite a bit when it goes public.

Comments (Archived):

are VC backed-tech IPOs an anomaly in that the companies they bring to the public are far from profitable and show mounting losses?Does this phenomena happen in companies from other industries too?Seeing this cycle sometimes makes me feel a little uneasy.

Well, they are being compared to each other now, but eventually they’ll be compared to their tech peers.

Hi William. Except the tech peers that can add revenue at zero marginal cost: Facebook/ Google’s next ad sale. Spotify (licensing music), and ride share always have big expenses to pay on the next sale.

Sure, but Google / FB / Spotify weren’t who I was thinking of necessarily. That said, zero marginal cost growth is not so pure even for these companies.Which companies do you think they could be compared to, more appropriately?

I love this series. Would you mind expanding on how operational costs will begin to reduce at greater scale / market expansion? Will marketing go down with increased brand awareness? getting rid of drivers? not quite clear on this.

I use both services often, everywhere.I have zero brand loyalty.They have a mess to figure out with customer acquisition and brand value. The former will continue to be an issue as the latter honestly has no teeth to it in many consumer’s minds.

Hmm thats interesting, I could certainly see Uber becoming the premium brand and leveraging that brand equity into an irrational price premium. I feel like there a many profitable line extensions that fit their vision and user base.

If it is only a price issue, then its a commodity which maybe it is potentially.

reminds me a lot of airlines. network effects, yet very little stickiness and very low margins. uber has the promise of self-driving cars, though i think that is MUCH further away from wide scale deployment in most countries than the hype suggests. i get the case for the believers but personally i see too many reasons to be skeptical, too much risk that hasn’t been removed.

there are similarities for certain.i also think of it as a platform brand perspective.the major platforms we all use–twitter, instagram, facebook, uber, lyft–i care not about them. lots of bad history and zero attempt to make me think differently about them.of the major platforms i use daily, i have some inklings of brand success for prob zoon and wordpress only.

I don’t have huge brand loyalty but Lyft stopped working with iOS Maps ride share feature that used to check fares across services. Also Uber has been discounting credits at 5% for buying ahead which has given me a slight preference for them now.That being said it feels like Uber/Lyft are getting worse in the city. The shared ride experience used to be great but now involves walking, finding the right intersection, and can send you in loops before getting to where you want to be. In many ways it’s not much better than a bus.I am considering picking up one of those electric scooters for my work commute. Increasingly starting to think micro mobility is the future here.

In NY honestly I use them infrequently so grab whichever is faster for a pickup. Use CitiBikes often.In LA where I am often, they are essential and both function well.Though I also use the scooters and bikes in LA all the time.I don’t really have a sense of brand of either of them. No better or worse than an connectivity provider which is low on the list of anyone who gives a shit.

I don’t know much about the mechanics of these businesses but you can see that operational efficiency already showing up in the 2018 numbers (vs 2017 and prior years)

Thanks, Fred.

Saw this breakdown in WSJ of Lyft’s costs per ride. It was making the point that at what point do you start saving? What line items will stop/ or slow growing based on giving more rides?https://uploads.disquscdn.c…

Sounds like just a local, sole, solo taxi driver who gets ride requests via his cell phone could charge $9 a ride and beat the guys who want $14.50.Besides, in all but the busiest parts of the largest cities, a not totally dumb driver will have a brand, that is, customers who like him and give him repeat business.Maybe could do some Monte Carlo evaluation that in some situations there are some efficiencies in the Uber/Lyft sharing idea, but it all looks really thin.Besides, since as we know there is no brand loyalty, the taxi business is still a local business, that is, what state, national, or international connections there are is, for the passenger and driver, just wasteful overhead. For the advantages of sharing, soon enough that will all be an optimized known function, and any city will be able to have their own, just a server with standard software parked somewhere, taking in ride requests, working out the sharing possibilities, and connecting riders and drivers.The one thing I don’t understand is why so many people see so much value in such taxi companies, especially with the big losses.I.e., people are talking market capitalizations of tens of $billions, and that’s not just corn husks.

One of the questions, not yet clear, is how much insider selling is expected. Price range is 48 to 55. It will be interesting to see if they continue to adjust if LYFT gets pounded some more. Either way not much left on the table for the retail side.

That’s the problem with waiting until you have reached peak value before going public. The SEC hates tokens but they should love them because at least token projects are offering investors the opportunity to participate in the Lions share of value capture

From what we have seen from token scams…. as well as the lions share of the losses.Are you also suggestions that tokens lead to earlier ipos?

Or, smooth the path so startup firms can go public earlier. It’s not a problem with technology. It’s certainly a disclosure problem. But, agree with your sentiment about security tokens. I am all for letting the American public for being able to participate and build wealth. We see a lot of people decrying the income inequality in the US-and allowing the masses to have access to startups sooner in the business cycle could change the balance since the IRS has iron gates surrounding the ecosystem now.

Re: SEC – There’s a disparity between the actual value of companies that IPO vs. those that ICO. It’s fascinating that there’s investment in them – until you realize the hype cycles have been perpetuating for a decade now with a growing army of “HODLers” all incentivized to continue to work together (aligned); especially if they have losses.Imagine religions and how powerful their following is: now add the element of money incentivizing them all – it is now religion that’s been indoctrinated being driven by greed – which leads to emotional and irrational behaviour. Of course I can reference your post Orthodoxy post – https://avc.com/2019/04/ort… – to point out you’re aware of the indoctrination – and the ideology/indoctrination that everyone is buying into, all being incentivized by money, shouting down or ignoring those of us, like myself, who see this for what it is without being ignorant to the problems with the Ponzi-Pyramid scheme inherent to these structures – keeping yourselves in a bubble, being ignorantly blissful – likely feeling angry or hurt by my words simply highlighting this; suppressing/repressing thought/logic that wants to unfold in your brain/mind will lead to stronger and stronger negative feelings – the negative feelings being cognitive dissonance, not that something is being said that’s inherently wrong. This is something you can uncover in yoga, or sometimes people need psychotropic experiences in ceremony to open their mind’s block – as the ego mind can have created coping mechanisms, guards from early childhood trauma that blocks you from processing certain logic/emotion that was suppressed/repressed long ago – so that cognitive dissonance is being triggered deeply, yet you’re blocked/prevented from stepping into it to understand it, to allow it to settle and deepen your greater more holistic understanding – seeing the full picture without biases and such.The only reason VC levels of money move into the cryptocurrencies – or that of bad actors – is because they obviously envision the same Ponzi-Pyramid scheme many of us see, and they hope that once society adopts cryptocurrencies – perhaps even forced to adopt them at some point (which is the same problem our current systems have with bad actors trying to change rules to benefit themselves) forcing an unreasonable transfer of wealth from early adopters to late adopters, or they’re gamblers who have excess capital and are just playing with their money and don’t care about taking money from undereducated people buying into the most powerful and dangerous hype machine ever in the history of humankind.

Posts like these really show the value of data and regulations that require public disclosures.

It’s possible that if historical dynamics on multiples hold, Uber should trade at a valuation greater than the ratios of Lyft’s revenues etc. Uber is the market leader by a wide margin and leaders enjoy higher multiples. I speculate that drove the softbank valuation on the company in 2017. Like everyone, I will be watching this one closely.. I think it will tell us if the growth stage Uni’s are being priced correctly by private capital.

This is really good stuff. It seems that someone could make a business out of parsing S1 filings and publishing metrics. I’ll bet 90% of the filing documents never get read. (Except for the firms that produce them.)

I think you mean 90% of investors do not read the S-1 not 90% of S-1s don’t get read.

Yes. To be more precise – out of the total population of investors X the number of public documents filed, there is less than 10% overlap. (Probably closer to 1%). But if we had Fred to summarize them more people would do it!

Between the two…I’d go with Zoom.

Looking at the revenue ratios, really impressive what Lyft has done in the past few years with market share. Thanks for sharing.

being lazy here, how much of Uber overall stock is being made available to the public?

Uber owns 15% of Didi, 23% of Grab and 38% of Yandex. The Didi stake alone should prove to be worth over $20B within 2-3 years. Uber is a closed end fund allowing you to play the global rideshare wave ex-Lyft. Then buy Lyft if you want full exposure.

I drive for both using an app called Mystro to sign in and out of each one as requests come in.I lost out on an estimated $20M payday when I was not selected as employee #34 for the Operations and Logistics Manager in Boston back in 2011.I am down at the Manager level with 0.2–0.33% here (https://www.holloway.com/g/… However I do pickup a $500 bonus on the 4/26 and the opportunity to buy $10K in stock.

I wonder how much brand loyalty there is in this sector or is it becoming more commoditized (driven by price). I’m still scratching my head why neither of these companies has created a compelling loyalty program to increase LTV and retention.

Grab in Southeast Asia (they bought out Uber’s SEA operations) have various loyalty programs (you earn points, there are membership tiers where the higher you are, the more quickly you supposedly get your booking, as well as free rides, etc.), and you can also buy packages (like buy 10 rides upfront and save $4 off each ride). If it isn’t on Uber and Lyft apps already, it might be coming sooner rather than later.

Drivers drive for both services, thereby adding to the industry’s commodity perception. There currently is very little, if any, brand differentiation. Lyft and Uber are competitors but strangely entertwined. It’s like having pilots for United also fly for Delta.

I see a merger in the offing – Lyer.

Any Lyft driver I’ve spoken with greatly prefers Lyft because of the passengers. My thought on this is that Uber’s higher subsidy of rides attracts people who are being price conscious, similarly even if Uber pays drivers more – then they are also attracting drivers who perhaps prefer Uber and probably try to get more rides in, drive faster, etc; of course because many, if not most but definitely not all, drivers work for both services then there will be a distribution that won’t be possible to see unless you can unlock the data vaults of both companies and compare.

May a driver register to work for both companies at the same time?

Yes. You can use the Mystro app to manage incoming requests.

Fred- How much premium do you think Uber should get for its ownership of Uber Eats, and Freight, plus the minority positions you highlighted?

I have a question I checked the S-1 it reads after this initial . This many shares are outstanding and it further reads it excludes this list of shares kept aside for employee stock,incentives, converts etc. and the stocks adds up to 350-450 million common stocks. So how does this affect the market cap once they vest. And what will be the total outstanding stocks left with Uber after the IPO.