Dronebase Goes Thermal

Our portfolio company Dronebase is announcing some big news today.

They are going to be offering thermal imaging missions in partnership with FLIR, the leading provider of thermal sensors. And FLIR has made a strategic investment in Dronebase.

What is thermal imaging? Thermal imagery, which is also called infrared imagery, is the ability to see a much larger portion of the electromagnetic spectrum than what is visible to the eye. This page from FLIR’s website does a good job of explaining the technology.

If you put a FLIR thermal sensor on a drone, you can learn a lot more about buildings, equipment, terrain, etc, etc. The military sector has been doing this for years and the commercial sector is starting to use the technology a lot now too.

Here is an image of a roof captured with a traditional drone camera:

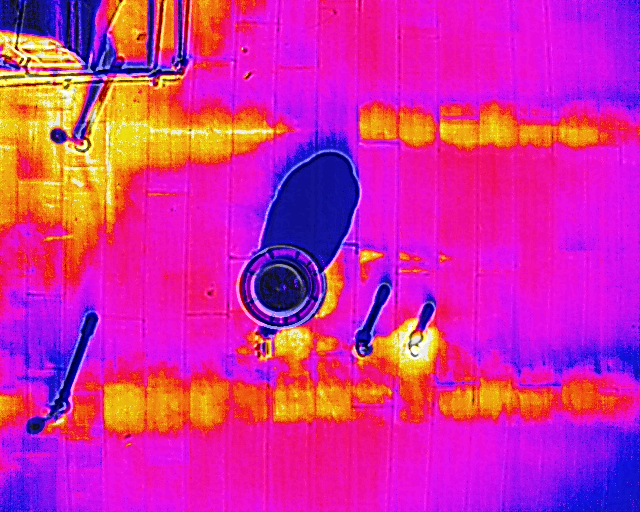

And here is an image of a roof captured with a drone using a FLIR thermal sensor:

This drone mission, recently run by Dronebase, identified water damage and leakage on this roof.

So what is the big deal here?

Dronebase offers the world’s largest drone pilot network. They have pilots all over the world who are skilled at operating commercial drone missions. And they have an API that captures information from drone missions at scale. Now enterprise customers can use their pilot network and API to capture thermal imagery. This will significantly reduce the cost and increase the availability of drone-based thermal imagery to enterprises of all sizes and locations.

If you want to learn more, you can contact Dronebase here and start using thermal imagery to improve your business operations.