Crypto Spring?

On Monday, I wrote:

With the crypto winter seemingly coming to an end and spring on the horizon,

So why do I think winter is behind us and spring is on the horizon?

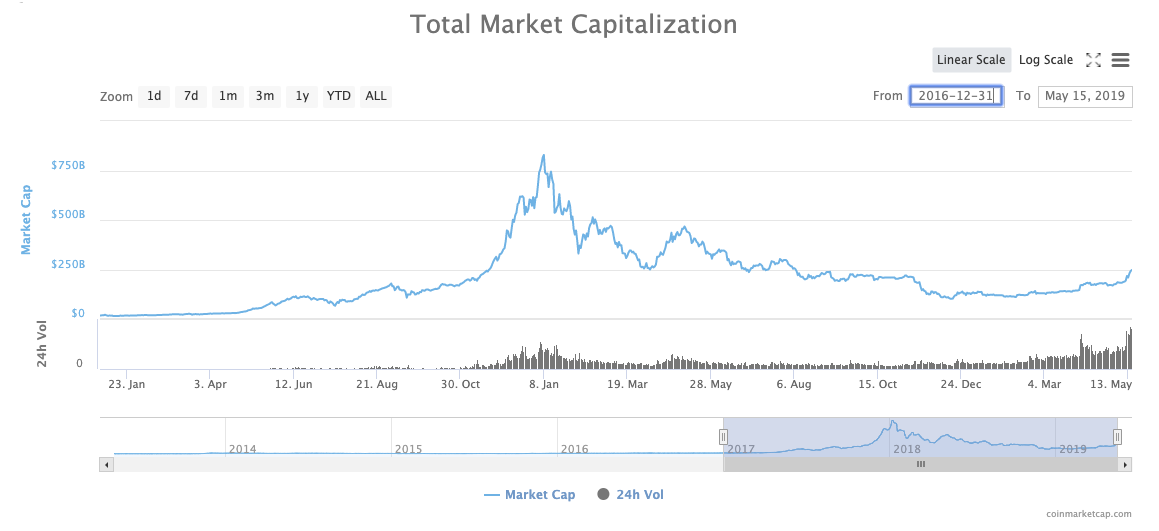

Well you can see in the chart of the entire crypto market that there has been a meaningful move off of the bottom in the last five months.

The entire crypto market hit the low point in mid December at roughly $100bn and has rallied over the winter and spring to almost $250bn. While there is no guarantee that we won’t go back and test those lows, I do think we hit rock bottom in December.

It is also worth noting that the daily trading volumes are now higher (almost double) than they were at the height of the crypto bubble in January 2018. Investors are back in the market and pushing it higher.

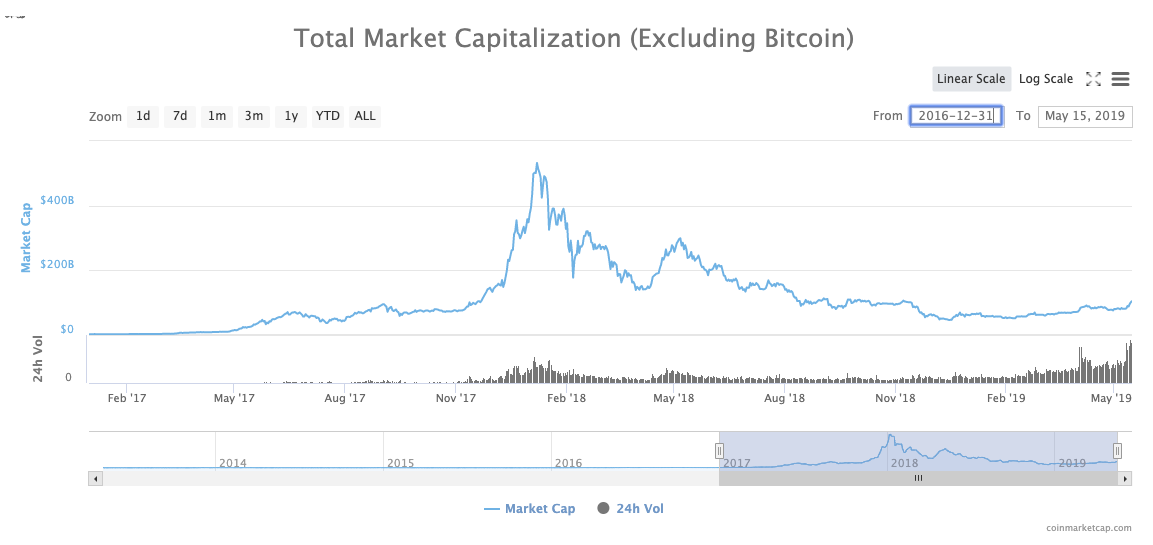

And this is not just about Bitcoin. Here is the total market minus Bitcoin:

It is a very similar chart with very similar volume activity.

The most exciting thing to me is what you don’t see in these charts and that is the fact that many projects have been quietly building out their systems over the last 18 months and we will start to see new public blockchains and protocols go live over the next 6-12 months that will show the power of new ideas and new technologies that are coming to market.

I love spring.

Comments (Archived):

So, let me try to understand: Somewhere, someone, somehow will find a way to make some things about crypto actually make money from paying customers, ones NOT in crypto, and for products/services for those customers.We don’t have any realistic idea just what those products/services will be for paying customers OUTSIDE of crypto, but we suspect that somehow some such will emerge.Net, if stay close to the field, with all its hype, from ICOs, etc., somewhere in there will find some good investment opportunities.

I think the only appropriate response here is – All hail Arya Stark!!!

Agreed but to me even more important is work like Flexa/Spedn moving the ball forward for wider adoption and use – the transformation isn’t just around trading 🙂

What/when is the entry point for the average consumer?

Something that has been recognized since antiquity- https://uploads.disquscdn.c…But if you are not able to tell why something is now in honor that was fallen, then you are basically reading the ticker tape. That’s perfectly fine, fortunes have been made by people who were able to correctly read what the tape was telling them. I know a trader who says – I don’t try to figure out where the market will go, I wait for the tape to tell me.The argument that there are many crypto projects quietly building out that will showcase the power of new ideas and technologies was made in previous years as well.But one has to accept the possibility that maybe this time the quiet, new projects are about real customer value propositions at large scale. And since they are “quiet”, only those who are deeply in the know actually know what the next 12 months will bring. I am the uninformed, wandering in the desert and skeptical of another mirage .Time discovers truth – Seneca the younger.

A new idea is delicate. It can be killed by a sneer or a yawn; it can be stabbed to death by a quip and worried to death by a frown on the right man’s brow. Ovid

“The fact that some geniuses were laughed at does not imply that all who are laughed at are geniuses. They laughed at Columbus, they laughed at Fulton, they laughed at the Wright Brothers. But they also laughed at Bozo the Clown”. – Carl Sagan.What makes life so interesting is that Horace, Ovid and Sagan are all correct.p.s. At what point is a “new” idea no longer new.

Good argument. As Simon Sinek famously says, get to the “why”.What is the relationship between blockchain projects, which are real and a big part of the future, and the price of bitcoin and altcoins. I don’t know.

Is simple price action enough correlation to say there is causation? I’d like to see some adoption of applications outside of just trading and ways to enter orders and keep track of positions. How about some real world stuff that businesses can use to make production and delivery of goods cheaper so people can improve their lives?

Slowly but surely….

Volume does not mean breadth either.Is anything more churnable than an anonymous asset trading platform?I think the likely outcome for Blockchain Bulls is the mainstream adoption of black markets.

CONTRIBUTORS:Juju juice!Gheez!https://tse1.mm.bing.net/th…Captain Obvious!#UNEQUIVOCALLYUNAPOLOGETICALLYINDEPENDENT

Let’s hope the support persists. Technically it looks OK.This is important because it invigorates some projects, and it generates mainstream headlines that raise the awareness and knowledge levels further, and that leads to positive changes, including regulatory ones.Also, there’s been some separation of performance across tokens, so they are not all rising together indiscriminately.

I wonder if some text book Fibonacci would be reassuring on the recent rise and it is good to know that the rise is discriminate.

“the daily trading volumes are now higher (almost double) than they were at the height of the crypto bubble in January 2018.””double” – I would like to see a full spectrum analysis of what’s going here.

what do you think about the fact that Tether has a $2.8B market cap, but has almost 11X in volume, since the start of “spring”?

A major plus point is Microsoft has launched what will emerge as a complete Blockchain based ecosystem through an identity based on the Bitcoin blockchain

Does it have a name, this ecosystem?

We’re involved in the security token space, and have recently seen signs of a thaw from the SEC in the form of comments on some active filings. The tokenizing of securities is, I believe, will be a great example of using blockchain to modernize an existing industry. While the regulations that are still in place will force a somewhat semi-automation (you can’t transfer IBM peer-to-peer), over time I believe that blockchain as an SEC governance vehicle will create a tighter relationship between issuers and investors.

Hey Fred, I think you are one of the smartest and most giving VC’s (this blog as one example) in the industry.Volume is one indicator, but it is possible that there are simply double the speculators than there were before and that this accounts for the increased volume. We need to know what TYPE of volume it is (ie who is the buyer) before we can get excited (and you know that).As far as price rebound, that means nothing. Bitcoin cycles, as you know, in these general price patterns, and on top of that we’re down well over 50% from a year and a half ago.Nothing to be excited about there.

You’re exactly right. I asked Jay Clayton why there was still a transfer agent requirement when cascading smart contracts could do the job of managing KYC/AML and Transfer rules. His reply “I can’t hold a smart contract accountable.” So, for now, there will continue to be intermediaries that push the buttons – same as they do now – to initiate and approve things like transfer on death, divorce, settlement, etc. I hearken back to day trading, when individual investors weren’t allowed to enter their own stock orders. At the time, the software providers instituted the concept of an “execution server” behind which a licensed broker would sit to “enter” all the customer generated orders. This was a big “wink wink” orders flowed through directly – but a nod to the ability manage that process the old way. In my estimation, the accountability issue of the technical aspects of blockchain will get sorted in 3-5 years.

Who are those growing entities? (I am curious)

Wow. That is big.

What’s big? Why are comments being deleted like this?