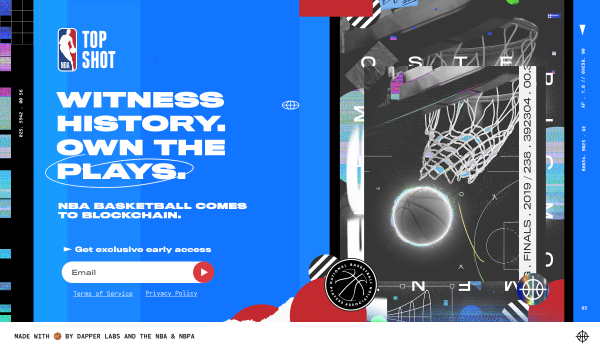

NBA Top Shot

I’ve written on this blog about extensible blockchain games, the ability to own the virtual goods you earn or buy in your games, and the idea that these virtual goods can move from game to game. I think this is a big deal and possibly the thing that brings blockchains and crypto tokens to the mainstream user.

So, here’s an awesome example of that. Our portfolio company Dapper announced today that it is building a blockchain game with the NBA called Top Shot.

Here is the idea behind the game:

NBA Top Shot will feature a social experience built around digital collectibles as well as a complementary head-to-head game designed to create a fun, authentic and accessible fan engagement on blockchain. Like other sports games or fantasy brackets, fans who play the game are tasked with creating their ideal squad, but in this game, their rosters are built by acquiring live in-game moments from the NBA season. These moments, such as a Kevin Durant 3-point shot, or Joel Embiid dunk, which are acquired as digital collectibles or tokens, can then be either owned forever or used to compete against other players in online tournaments and leagues.

NBA Top Shot will start offering crypto-collectibles in the fall, with the game to follow in early 2020. You can get early access by leaving your email address here nbatopshot.com

Comments (Archived):

Any idea if Kevin Durant gets a cut for that 3-pointer? Has the NBA Players Association taken a look at this?

the model is identical to EA Sports videogames.NBA player association gets 10% of revenuesNBA players cut deals directly to be featured in the marketing and promotion of the game. KD would be top of the list if he wasn’t hurt all season

I continue to easily believe that there is a real, big, market opportunity around tokenized fantasy sports.The European companies Stryker and Sorare come to mind, having made some pioneering headway (with soccer, natch).Baseball card collecting was such a huge deal when I was growing up, and I hear still is. Will be interesting to see how this goes digital.

Here’s a good write-up about this today:https://fortune.com/2019/07…

Can i own the ball?

Good!Signed up for early access.Don’t know enough except the direction.Two thoughts.-NFTs collectible market is a true possible future I really believe in and an absolute mess today.Dapper seems to be addressing the need for true emotional value of an NFT but from how CK the game is structured, I don’t know if they have the dna to understand how to present value that is story based not market based. This is key.-Dapper seems to be aspiring to be a studio ala EA or Infogrammes.A good direction but they need to think through this brand now or they will never do it.Start yesterday and be smart if this is what you want.

“an absolute mess” – please say more about this.

I love this space and work around it.Will post on it as it requires some length and nuance to articulate and this is not the right place.Follow me in one of the channels or my blog or send me your email and I’ll send it when done as down with a killer summer cold today.

Thanks.

Can’t this be done with a trusted, non-blockchain centralized source – enforced by a judicial system? If not, why not?

There is no way that I know to mint unique, secure, programmable collectibles in any other way.

The non fungible token/asset idea can only be conceived on a blockchain because it solves the double spend/send problem. You can’t own something digital, then send it to someone and not own it anymore, eg photos you share. You still have a copy after you share it.

Right, but we can have a paper contract that says “you own these digital bits” – and people are going to presumably want to look at, and allow others to look at the digital bits they own – which means sharing the structure of those bits, which then people can copy, share, display however they want – much like today, and then you have the copyright system for any enforcement.

Then you slow down transactions completely and increase their cost as well as compliance checking. The blockchain hits at those inefficiencies squarely.

How exactly does it slow down those transactions? I click “buy” – I now own the copy rights, transfer can happen instantly.

you just enumerated what has to happen in the background to make that possible, and that’s what the blockchain enables. Plus- there’s a settlement layer that built-in. When you click SELL (if you’re a seller), the money doesn’t arrive right away in your bank account.

So what you’re still saying though is you don’t need blockchain to do the same thing? You haven’t said yes/no yet.A system can be programmed where payment is available and expected the moment you hit ‘Send’ – and in fact that already happens, though albeit you only have that money on the platform that is taking on any risk associated with the transaction – before they’ll send it to your bank account directly.Settlement layers and speed of money being transferred into a bank account can all be done with standard, current networks, encryption, and be coded without blockchain or Ethereum contracts – which I presume is what you’re referencing. The speed of transfer depending on processes to determine risk/validity of transaction etc. – currently there is the layer where banks purposefully slow down transactions so they can hold the money longer and make money off of it, however competition will eventually eliminate that behaviour. There are other layers of inefficiency that will fall away once a properly designed system is implemented, and more efficient as it scales.The systems lacking are a lack of greed and regulatory capture allowing that greed, the systems that needs to be strengthened is trust – trusting the platform or network you’re part of, and trusting them and their process for determining trust of others in the network. This is how you reach a fluid state with as little friction as possible – as much efficiency as possible, and less costs overall.

I think this is a really big idea, particularly given the NBA’s youthful demos and the creation of tokens tied to video moments. MLB explored something similar using virtual baseball cards, which are static, and lack the benefits of sight, sound and motion, independent of MLB’s older skewing demos. The NBA game ties right into today’s You Tube, ESPN highlight-driven video generation. Really smart.

Link this with the annual EA sports games and you have something v interesting.

Not sure about the take up of this, but have been hearing some interesting podcasts from people involved in the NBA, including this one from the legendary Cal Fussman. Worth subscribing and listening to his interview last year with Kobe, and a few weeks ago with David Griffin who help the Cavs win a title … https://www.calfussman.com/…

Interesting piece that touches on this.https://nonfungible.com/blo…

Consumer markets are fickle and difficult to predict, but massive with consumer spending accounting for 2/3 of the economy. Building on Cryptokitties, Cheese Wizards and now this, the intersection of blockchain, digital assets and the Gaming & Entertainment industry might be a break out application and sector for blockchain. Who would have predicted? There is much debate about the future role of crypto/blockchain technologies (ecosystems) in currency applications but I think this is a good example of how you never really know where the winners might emerge.Unfortunate that it looks like no one will get to see a Kevin Durant 3-pointer next season.

Be super curious if they address this in their nft design;https://github.com/kauri-io…Super interesting additive.The power stack is:offline value onboarded into NFTERC998Harberger Tax